Lakeland Industries, Inc. (NASDAQ: LAKE) today announced

financial results for its first quarter fiscal year 2011 ended

April 30, 2010.

Financial Results Highlights and

Recent Company Developments

- Revenue of $25.4 million in

Q1FY11 at highest level in 6 quarters

- International expansion efforts

drive non-US revenue growth and improved market share

- Revenues from outside the US

were 39% of total in Q1FY11 as compared with 28% for Q1FY10

- International Growth

- Brazil acquisition added:

- $2.9 million of sales in

Q1FY11

- Gross margin of 49.4% for

Q1FY11

- Stage set for further market

expansion with strategically positioned global manufacturing

facilities and enhanced product lines

- Sales of disposable products in

North America declined by 8% in Q1FY11 compared with prior year

periods due to continued depressed economy, particularly in the

automotive supply chain

- Despite weakness in US sales

during Q1FY11, the US Glove Division increased sales by 61.7% over

Q1FY10, driven by Indian glove product finally gaining

traction

- Gross margin improves due to

contributions from international operations

- Operating expenses increased

largely due to:

- Additional SG&A in China

resulting from $1.2 million increase in external sales from

China

- Foreign exchange losses mainly

from unhedged losses against the Euro in China

- Increased operating expenses in

Brazil, largely sales personnel and related staff to support growth

initiatives

- Effective inventory control and

cash management initiatives resulted in $4.6 million reduction of

bank debt at 4/30/10 from 1/31/10

- Cash position increased by 12%

to $5.7 million at end of Q1FY11 from beginning of fiscal year

- New leadership for Brazil

operations; VAT tax issue arises from dispute between two

states

- Charge of $1.6 million has been

taken as a result of VAT tax expense in Brazil relating to periods

prior to the acquisition by Lakeland.

First Quarter Fiscal Year 2011

Financial Results

Net Sales. Net sales increased $1.4 million, or 5.8% to $25.4

million for the three months ended April 30, 2010, from $24.0

million for the three months ended April 30, 2009. The net increase

was due to an increase of $3.1 million in foreign sales, offset by

a $1.7 million decrease in domestic sales. External sales from

China increased by $1.2 million, or 63.6% driven by sales to the

new Australian distributor. Canadian sales increased by $0.5

million, or 37.6%, UK sales increased by $0.4 million or 51.5%,

Chile sales increased by $0.1 million, or 19%. US domestic sales of

disposables decreased by $1.1 million, chemical suit sales

decreased by $0.4 million, wovens increased by $0.1 million,

reflective sales decreased by $0.3 million and glove sales

increased by $0.2 million. Sales in Brazil increased $0.3 million,

an increase of 10.4%.

Gross Profit. Gross profit increased $0.4 million or 6.5% to

$6.4 million for the three months ended April 30, 2010, from $6.0

million for the three months ended April 30, 2009. Gross profit as

a percentage of net sales increased to 25.2% for the three months

ended April 30, 2010, from 25.1% for the three months ended April

30, 2009. Major factors driving the changes in gross margins

were:

- Disposables gross margin

declined by 3.5 percentage points in Q1 this year compared with Q1

last year. This decline was mainly due to higher priced raw

materials and a very competitive pricing environment coupled with

lower volume.

- Brazil’s gross margin was 49.4%

in Q1 this year compared with 46.6% in Q1 last year. This increase

was largely due to the volume provided by a larger bid contract

this year.

- Continued gross losses of $0.1

million from India in Q1 FY11.

- Chemical division gross margin

declined 5.7 percentage points resulting from lower volume and

sales mix

- Canada gross margin increased

6.7 percentage points due to higher volume and favorable exchange

rates.

Operating Expenses. Operating expenses increased $0.8 million,

or 14.7% to $6.1 million for the three months ended April 30, 2010,

from $5.3 million for the three months ended April 30, 2009. As a

percentage of sales, operating expenses increased to 24.1% for the

three months ended April 30, 2010 from 22.2% for the three months

ended April 30, 2009. The $0.8 million increase in operating

expenses in the three months ended April 30, 2010 as compared to

the three months ended April 30, 2009 were comprised of:

- ($0.1) million in reduced

officer salaries resulting from cost cut-backs, along with related

reduction in payroll taxes and employee benefits.

- ($0.1) million reduction in

professional and consulting fees resulting from cost cut

backs.

- ($0.1) million reduction in

equity compensation resulting from the 2009 restricted stock plan

treated at the zero performance level for the time being.

- $0.1 million in increased sales

commissions resulting from higher volume.

- $0.1 million miscellaneous

increases.

- $0.1 million increase in the

self insured medical insurance program resulting from unfavorable

experience in the current year.

- $0.1 million in inventory

contributions made to the Chilean earthquake relief effort.

- $0.1 million increase in

Delaware Franchise Taxes. This is a result of the increase in total

assets in prior years resulting from prior inventory buildup and

the Brazil acquisition. It is anticipated the cost for this tax

will be greatly reduced going forward.

- $0.2 million increase in foreign

exchange costs resulting from unhedged losses against the Euro in

China.

- $0.2 million in increased

operating costs in China were the result of the large increase in

direct international sales made by China that are now allocated to

SG&A costs although previously allocated to cost of goods

sold.

- $0.2 million of increased

operating expenses in Brazil mainly resulting from increased sales

personnel and support staff due to recent and anticipated

growth.

Operating profit. Operating profit decreased 57% to $0.3 million

for the three months ended April 30, 2010 from $0.7 million for the

three months ended April 30, 2009. Operating margins were 1.1% for

the three months ended April 30, 2010 compared to 2.8% for the

three months ended April 30, 2009. The lower operating profit and

operating margin in the first quarter of fiscal 2011 are the result

of higher gross profits offset by increased operating expenses

which in large part reflect the Company’s international growth

initiatives and foreign currency exchange rate costs.

Interest Expenses. Interest expenses decreased by $0.1 million

for the three months ended April 30, 2010 as compared to the three

months ended April 30, 2009 due to lower borrowing levels

outstanding.

Income Tax Expense. Income tax expenses consist of federal,

state, and foreign income taxes. Income tax expenses decreased $0.4

million, or 105%, to $0.0 million for the three months ended April

30, 2010 from $0.4 million for the three months ended April 30,

2009. The Company’s effective tax rate was 81.5% for the three

months ended April 30 2009. The effective tax rate for Q1FY10 was

affected by a $350,000 allowance against deferred taxes resulting

from the India restructuring, losses in India and UK with no tax

benefit, tax benefits in Brazil resulting from government

incentives and goodwill write-offs, and credits to prior year’s

taxes in the US not previously recorded. The Company’s effective

tax rate for Q1 FY11 reflects goodwill write-offs in Brazil and tax

benefits from India resulting from “check the box” in the U.S., and

a $1.6 million charge for VAT tax expense in Brazil relating to

periods prior to the acquisition by Lakeland in May 2008. It is

important to note that any collections of further escrow monies,

indemnification collections from the selling shareholders and any

potential negligence suits against responsible third parties will

be booked as profits negating this quarter’s write-off of $1.6

million

At the end of the first quarter, the Company recorded

adjustments to its balance sheet relating to a VAT tax issue for

its subsidiary in Brazil. These adjustments pertain to

jurisdictional taxes paid from 2004-2009 occurring primarily prior

to Lakeland’s acquisition of the business which have recently been

audited and put into dispute by local Brazilian authorities.

Through an amnesty payment program, Lakeland believes it will

recoup a significant portion of taxes paid through credits against

future taxes due. The Company also intends to offset taxes paid in

the VAT tax reconciliation with funds set aside in escrow as part

of the acquisition in May 2008 for contingencies such as this. To

date, $0.55 million from the escrow has been released and Lakeland

will file a claim against an additional amount of approximately $1

million. In accordance with GAAP, the Company has reflected the

above items on its balance sheet as follows:

(R$ millions) US$

millions Current assets Prepaid taxes 2.1

1.1 Current assets Escrow received 1.0 0.5

Current liabilities Taxes due 3.5 1.9

Non-current assets Deferred taxes 3.5 1.9

Long-term Liabilities Taxes payable 7.1 3.3

There is an additional exposure for 2007-2009 in the amount of

approximately $3.3 million. Lakeland intends to apply for amnesty

and make any necessary payments upon the forthcoming amnesty

periods imposed by the local Brazilian authorities.

Further to the operations in Brazil, in May 2010 Lakeland

promoted an executive within the subsidiary to replace two leading

members of the management team who had been terminated for cause. A

charge of $200,000 will be taken in the second quarter for expenses

relating to the management terminations, and other separation

actions are being taken by Lakeland. Details of the VAT tax

adjustment and leadership changes are discussed in the Company’s

first quarter fiscal year 2011 filing with the Securities and

Exchange Commission under form 10-Q.

Net Income. Net income decreased to a loss of $1.3 million for

the three months ended April 30, 2010 from net income of $0.1

million for the three months ended April 30, 2009. The decrease in

net income primarily resulted from the $1.6 million charge for VAT

tax expense in Brazil. Excluding the Brazilian VAT tax expense, the

Company would have reported net income of $0.2 million in the first

quarter of fiscal 2011, a 143% increase as compared to the same

period in fiscal 2009. The improved profitability before VAT tax

expense reflects an increase in sales, higher gross margin

contributions from an expanding base of international revenues, and

favorable tax benefits, partially offset by higher operating

expenses which in large part reflect the Company’s international

growth strategy.

Management’s Comments

Commenting on the financial results, Lakeland Industries

President and Chief Executive Officer Christopher J. Ryan said, “We

are pleased to report an improvement in consolidated revenues and

gross margin for the first quarter of fiscal 2011. Upon reporting

our year end results, we had anticipated a softer first quarter due

to several larger contracts and certain seasonality issues. The

improved performance was driven by continued growth from our

international operations which generally deliver higher margins

than our domestic sales.

“Since the end of the first quarter, a few events have occurred

which we believe bode well for Lakeland Industries for the

immediate and longer terms. The first event is the Gulf of Mexico

oil spill. There appears to be minimal if any progress being made

to contain the spill. As we have stated, in times of natural

disaster, there typically is large and urgent need for the

environmental, protective and safety apparel which we manufacture

and distribute globally. Although we have increased production of

these types of products at our facilities around the world to meet

the substantial increase in demand for oil spill containment and

remediation purposes, we are presently capacity constrained and the

back orders are mounting. We are also experiencing severe stockout

conditions as a result of our winding down inventory levels in

anticipation of the EI DuPont de Nemours & Co. (“DuPont”)

transition.

“Reflecting the pick up in demand globally as the recession had

abated with economic and industrial growth returning in many

corners of the world, during the first quarter we had already begun

to see our manufacturing capacity become challenged. As a result,

we had anticipated sales growth in the second quarter and

thereafter. The requirements pertaining to the Gulf of Mexico oil

spill are incremental to this anticipated growth.

“Later in the year, we expect our manufacturing capacity to be

realigned as a result of a second event. In May we disclosed a new

agreement with DuPont relating to our licensing and production of

garments using their material. Lakeland Industries was recently

named one of what is expected to be a limited number of wholesale

distributors for the sale of DuPont garments in the United States.

To this end, we will remain a supplier to our existing customers

and we will have additional marketing opportunities domestically.

DuPont will supply us with finished goods, which means that, except

for custom orders, we will no longer be purchasing from DuPont the

raw materials that are made into the garments, nor will we be

required to hold such large quantities of raw materials, work in

progress and finished goods in our inventory. A substantial portion

of shipping costs and related logistics and support personnel

expenses also will be eliminated. This agreement is being phased in

as we work through our remaining inventory and certain

modifications are anticipated. However, we expect that upon full

implementation as the year progresses we will significantly reduce

our annual expenses.

“Consistent with our strategy for the past few quarters and in

light of the new agreement with DuPont, we have systematically been

reducing our inventory levels. Against a backdrop of increasing

sales -- with the first quarter of fiscal 2011 at the highest level

in a year and a half – we have seen an improvement in our working

capital, inventory turns, cash generation, cash position and debt

level. At April 30, 2010, we had reduced our inventory by nearly $5

million from the beginning of the fiscal year three months earlier,

reduced the borrowings under our credit facility by nearly half to

$5 million, and increased our cash balance nearly 12% since January

31, 2010 to $5.7 million. We have sufficient cash flow and balance

sheet strength to accommodate the unanticipated Brazilian tax

issue, and are well positioned for continued performance

improvements with a markedly enhanced financial condition as well

as to capitalize on the many growth opportunities we have

identified within our global operating footprint.”

Financial Results Conference

Call

Lakeland will host a conference call at 04:30 PM (EDT) on June

14, 2010, to discuss the Company’s first quarter fiscal year 2011

financial results. The conference call will be hosted by

Christopher J. Ryan, Lakeland’s President and CEO. Investors can

listen to the call by dialing 888-510-1768(domestic) or

719-457-2683(international), code 9229477.

A conference call replay will be available by dialing

888-203-1112 (domestic) or 719-457-0820 (international), code

9229477.

About Lakeland Industries, Inc.:

Lakeland Industries, Inc. (NASDAQ: LAKE) manufactures and sells

a comprehensive line of safety garments and accessories for the

industrial protective clothing market. The Company’s products are

sold by a direct sales force and through independent sales

representatives to a network of over 1,000 safety and mill supply

distributors. These distributors in turn supply end user industrial

customers such as chemical/petrochemical, automobile, steel, glass,

construction, smelting, janitorial, pharmaceutical, and high

technology electronics manufacturers, as well as hospitals and

laboratories. In addition, Lakeland supplies federal, state, and

local government agencies, fire and police departments, airport

crash rescue units, the Department of Defense, the Centers for

Disease Control and Prevention, and may other federal and state

agencies. For more information concerning Lakeland, please visit

the Company online at www.lakeland.com.

“Safe Harbor” Statement under the Private Securities Litigation

Reform Act of 1995: Forward-looking statements involve risks,

uncertainties and assumptions as described from time to time in

Press Releases and 8-K(s), registration statements, annual reports

and other periodic reports and filings filed with the Securities

and Exchange Commission or made by management. All statements,

other than statements of historical facts, which address Lakeland’s

expectations of sources or uses for capital or which express the

Company’s expectation for the future with respect to financial

performance or operating strategies can be identified as

forward-looking statements. As a result, there can be no assurance

that Lakeland’s future results will not be materially different

from those described herein as “believed,” “projected,” “planned,”

“intended,” “anticipated,” “estimated” or “expected,” which words

reflect the current view of the Company with respect to future

events. We caution readers that these forward-looking statements

speak only as of the date hereof. The Company hereby expressly

disclaims any obligation or undertaking to release publicly any

updates or revisions to any such statements to reflect any change

in the Company’s expectations or any change in events conditions or

circumstances on which such statement is based.

LAKELAND INDUSTRIES, INC. AND

SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE

SHEETS

(In thousands except share

data)

April 30,

January 31,

ASSETS

2010

2010

(Unaudited)

Current assets: Cash and cash equivalents $5,690 $5,093

Accounts receivable, net 17,278 15,809 Inventories, net 33,697

38,576 Deferred income taxes 1,261 1,261 Prepaid income and VAT tax

2,772 1,732 Escrow receivable 550 ----- Other current assets

2,966

2,356

Total current assets 64,214 64,827 Property and equipment,

net 13,665 13,742 Deferred tax asset, noncurrent 1,917 -----

Intangibles and other assets, net 6,121 5,622 Goodwill

6,154

5,829

Total assets

$92,071

$90,020 LIABILITIES AND STOCKHOLDERS’ EQUITY

Current liabilities: Accounts payable $5,218 $3,883 Accrued

compensation and benefits 1,575 1,289 Other accrued expenses 971

1,139 Current VAT taxes payable 1,909 ----- Borrowing under

revolving credit facility 4,953 9,518 Current maturity of long term

debt

99

94

Total current liabilities 14,725 15,921 Construction loan payable,

net of current maturity 1,644 1,583 VAT taxes payable long-term

3,270 ----- Other liabilities

100

92

Total liabilities 19,739 17,597 Commitments and

contingencies Stockholders’ equity:

Preferred stock, $0.01 par;

authorized 1,500,000 shares

(none issued)

----- ----- Common Stock, $0.01 par; authorized 10,000,000 shares

issued and outstanding 5,564,732 shares at April 30, 2010 and at

January 31, 2010 56 56 Less treasury stock at cost 125,322 shares

at April 30, 2010 and January 31, 2010 (1,353) (1,353) Additional

paid-in capital 49,640 49,623 Retained earnings

23,875

25,221

Other comprehensive income (loss) 113 (1,122) Total stockholders’

equity

72,331

72,424

Total liabilities and stockholders’ equity

$92,071

$90,020 LAKELAND INDUSTRIES, INC. AND

SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(In thousands, except share and per share data)

(Unaudited) Three Months Ended April 30,

2010

2009

Net sales $ 25,363 $ 23,976 Cost of goods sold 18,959

17,965 Gross profit 6,404 6,010 Operating

expenses 6,114 5,332 Operating profit

290 679 VAT tax charge-Brazil from prior periods (1,583 ) -----

Interest and other income, net 13 40 Interest expense (86 )

(193 ) Income before income taxes (1,366 ) 525 Provision

(benefit) for income taxes (20 ) 428 Net

(loss) income

$ (1,346 )

$ 97 Net income per common share:

Basic

$ (0.25 )

$ 0.02 Diluted

$

(0.25 ) $ 0.02

Weighted average common shares outstanding: Basic

5,439,410 5,406,291

Diluted

5,465,594

5,468,616

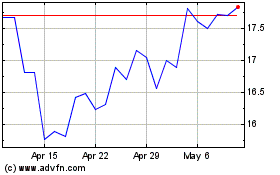

Lakeland Industries (NASDAQ:LAKE)

Historical Stock Chart

From Jun 2024 to Jul 2024

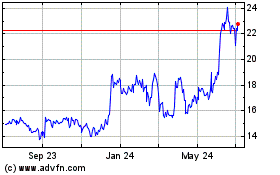

Lakeland Industries (NASDAQ:LAKE)

Historical Stock Chart

From Jul 2023 to Jul 2024