Mutual Fund Summary Prospectus (497k)

March 01 2013 - 8:24AM

Edgar (US Regulatory)

High Yield Fund

|

|

|

|

|

|

|

Institutional

|

|

Ticker Symbol(s)

|

PHYTX

|

Principal Funds, Inc. Summary Prospectus March 1, 2013

Before you invest, you may want to review the Fund's prospectus, which contains more information about the Fund and its risks. You can find the Fund's prospectus and other information about the Fund online at www.principalfunds.com/prospectus. You can also get this information at no cost by calling 1-800-222-5852 or by sending an email request to prospectus@principalfunds.com.

This Summary Prospectus incorporates by reference the Statutory Prospectus for Classes R-1, R-2, R-3, R-4, R-5, Institutional shares dated March 1, 2013 and the Statement of Additional Information dated March 1, 2013 (which may be obtained in the same manner as the Prospectus).

|

|

|

|

Objective:

|

The Fund seeks to provide a relatively high level of current income.

|

Fees and Expenses of the Fund

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund.

Shareholder Fees (fees paid directly from your investment):

None

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment)

|

|

|

|

|

|

|

Institutional Class

|

|

Management Fees

|

0.51%

|

|

Other Expenses

|

0.08%

|

|

Total Annual Fund Operating Expenses

|

0.59%

|

|

Expense Reimbursement

(1)

|

—

|

|

Total Annual Fund Operating Expense after Expense Reimbursement

|

0.59%

|

|

|

|

|

(1)

|

Principal Management Corporation ("Principal"), the investment advisor, has contractually agreed to limit the Fund’s expenses attributable to Institutional class shares by paying, if necessary, expenses normally payable by the Fund, excluding interest expense, through the period ending February 28, 2014. The expense limit will maintain a total level of operating expenses (expressed as a percent of average net assets on an annualized basis) not to exceed 0.61% for Institutional class shares, excluding interest expense. It is expected that the expense limit will continue through the period disclosed; however, Principal Funds, Inc. and Principal, the parties to the agreement, may agree to terminate the expense limit prior to the end of the period.

|

Example

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds.

The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 year

|

3 years

|

5 years

|

10 years

|

|

Institutional Class

|

$

|

60

|

|

$

|

189

|

|

$

|

329

|

|

$

|

738

|

|

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 82.6% of the average value of its portfolio.

Principal Investment Strategies

Under normal circumstances, the Fund invests at least 80% of its net assets, plus any borrowings for investment purposes, in below investment grade bonds (sometimes called “high yield bonds” or "junk bonds") which are rated at the time of purchase Ba1 or lower by Moody's and BB+ or lower by S&P (if the bond has been rated by only one of those agencies, that rating will determine whether the bond is below investment grade; if the bond has not been rated by either of those agencies, the Sub-Advisor will determine whether the bond is of a quality comparable to those rated below investment grade). The Fund also invests in bank loans (also known as senior floating rate interests) and securities of foreign issuers, including those located in developing or emerging countries. Under normal circumstances, the Fund maintains an average portfolio duration that is within ±20% of the duration of the Barclays US High Yield 2% Issuer Capped Index, which as of December 31, 2012 was 4.12 years.

During the fiscal year ended October 31, 2012, the average ratings of the Fund’s fixed-income assets, based on market value at each month-end, were as follows (all ratings are by Moody’s):

|

|

|

|

|

|

|

2.10% in securities rated Aaa

|

39.50% in securities rated Ba

|

0.00% in securities rated C

|

|

0.11% in securities rated Aa

|

37.53% in securities rated B

|

0.00% in securities rated D

|

|

0.31% in securities rated A

|

9.48% in securities rated Caa

|

5.19% in securities not rated

|

|

5.73% in securities rated Baa

|

0.05% in securities rated Ca

|

|

Principal Risks

The Fund may be an appropriate investment for investors seeking diversification by investing in a fixed-income mutual fund, and who are willing to accept the risks associated with investing in "junk bonds," foreign securities and emerging markets.

The value of your investment in the Fund changes with the value of the Fund's investments. Many factors affect that value, and it is possible to lose money by investing in the Fund. An investment in the Fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The principal risks of investing in the Fund, in alphabetical order, are:

Bank Loans Risk.

Changes in economic conditions are likely to cause issuers of bank loans (also known as senior floating rate interests) to be unable to meet their obligations. In addition, the value of the collateral securing the loan may decline, causing a loan to be substantially unsecured. Underlying credit agreements governing the bank loans, reliance on market makers, priority of repayment and overall market volatility may harm the liquidity of loans.

Currency Risk.

Risks of investing in securities denominated in, or that trade in, foreign (non-U.S.) currencies include changes in foreign exchange rates and foreign exchange restrictions.

Emerging Market Risk.

Investments in emerging market countries may have more risk than those in developed market countries because the emerging markets are less developed and more illiquid. Emerging market countries can also be subject to increased social, economic, regulatory, and political uncertainties and can be extremely volatile.

Fixed-Income Securities Risk.

Fixed-income securities are subject to interest rate risk and credit quality risk. The market value of fixed-income securities generally declines when interest rates rise, and an issuer of fixed-income securities could default on its payment obligations.

Foreign Securities Risk.

The risks of foreign securities include loss of value as a result of: political or economic instability; nationalization, expropriation or confiscatory taxation; settlement delays; and limited government regulation (including less stringent reporting, accounting, and disclosure standards than are required of U.S. companies).

High Yield Securities Risk.

High yield fixed-income securities (commonly referred to as "junk bonds") are subject to greater credit quality risk than higher rated fixed-income securities and should be considered speculative.

Portfolio Duration Risk.

Portfolio duration is a measure of the expected life of a fixed-income security and its sensitivity to changes in interest rates. The longer a fund's average portfolio duration, the more sensitive the fund will be to changes in interest rates.

Risk of Being an Underlying Fund.

A fund is subject to the risk of being an underlying fund to the extent that a fund of funds invests in the fund. An underlying fund of a fund of funds may experience relatively large redemptions or investments as the fund of funds periodically reallocates or rebalances its assets. These transactions may cause the underlying fund to sell portfolio securities to meet such redemptions, or to invest cash from such investments, at times it would not otherwise do so, and may as a result increase transaction costs and adversely affect underlying fund performance.

Performance

The following information provides an indication of the risks of investing in the Fund. The bar chart shows the investment returns of the Fund’s Institutional Class shares for each full calendar year of operations for 10 years (or, if shorter, the life of the Fund). The table shows, for Institutional Class shares of the Fund and for the last one, five, and ten calendar year periods (or, if shorter, the life of the Fund), how the Fund’s average annual total returns compare to the returns of one or more broad-based market indices. Past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. You may get updated performance information online at www.principal.com or by calling 1-800-222-5852.

The Fund commenced operations after succeeding to the operations of another fund on January 12, 2007. Performance for periods prior to that date is based on the performance of the predecessor fund which commenced operations on April 8, 1998.

Total Returns as of December 31 each year (Institutional Class shares)

|

|

|

|

|

|

|

|

Highest return for a quarter during the period of the bar chart above:

|

Q2 ‘09

|

18.85

|

%

|

|

Lowest return for a quarter during the period of the bar chart above:

|

Q4 ‘08

|

-11.84

|

%

|

|

|

|

|

|

|

|

|

Average Annual Total Returns

|

|

For the periods ended December 31, 2012

|

1 Year

|

5 Years

|

10 Years

|

|

Institutional Class Return Before Taxes

|

15.86%

|

9.06%

|

11.18%

|

|

Institutional Class Return After Taxes on Distributions

|

12.61%

|

5.63%

|

7.83%

|

|

Institutional Class Return After Taxes on Distribution and Sale of Fund Shares

|

10.24%

|

5.72%

|

7.73%

|

|

Barclays U.S. Corporate High Yield 2% Issuer Capped Index (reflects no deduction for fees, expenses, or taxes)

|

15.78%

|

10.45%

|

10.60%

|

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. The after-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts.

Management

Investment Advisor:

Principal Management Corporation

Sub-Advisor(s) and Portfolio Manager(s):

Principal Global Investors, LLC

|

|

|

|

•

|

Mark P. Denkinger (since 2009), Portfolio Manager

|

|

|

|

|

•

|

Darrin E. Smith (since 2009), Portfolio Manager

|

Purchase and Sale of Fund Shares

There are no restrictions on amounts to be invested in shares of the Fund for an eligible purchaser. You may purchase or redeem shares on any business day (normally any day when the New York Stock Exchange is open for regular trading) through your plan or intermediary; by sending a written request to Principal Funds at P.O. Box 8024, Boston, MA 02266-8024 (regular mail) or 30 Dan Road, Canton, MA 02021-2809 (overnight mail); calling us at 1-800-222-5852; or accessing our website (www.principalfunds.com).

Tax Information

The Fund’s distributions you receive are generally subject to federal income tax as ordinary income or capital gain and may also be subject to state and local taxes, unless you are tax-exempt or your account is tax-deferred in which case your distributions would be taxed when withdrawn from the tax-deferred account.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase the Fund through a broker-dealer or other financial intermediary (such as a bank, insurance company, investment adviser, etc.), the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment, or to recommend one share class of the Fund over another share class. Ask your salesperson or visit your financial intermediary's website for more information.

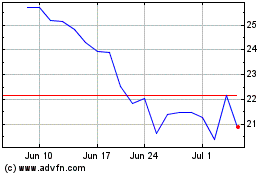

L B Foster (NASDAQ:FSTR)

Historical Stock Chart

From Jun 2024 to Jul 2024

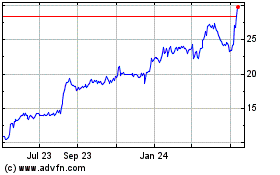

L B Foster (NASDAQ:FSTR)

Historical Stock Chart

From Jul 2023 to Jul 2024