Kimball Electronics, Inc. (Nasdaq: KE), a leading global

electronics manufacturing services provider of high-quality,

durable electronic products, today announced financial results for

its third quarter ended March 31, 2019.

| |

Three Months Ended |

|

Nine Months Ended |

| |

March 31, |

|

March 31, |

| (Amounts in Thousands, except

EPS) |

2019 (1) |

|

2018 |

|

2019 (1) |

|

2018 |

|

Net Sales |

$ |

313,454 |

|

|

$ |

283,938 |

|

|

$ |

863,223 |

|

|

$ |

795,293 |

|

| Operating Income (2) |

$ |

14,497 |

|

|

$ |

11,130 |

|

|

$ |

31,741 |

|

|

$ |

30,772 |

|

| Adjusted Operating Income

(non-GAAP) (2) (3) |

$ |

14,497 |

|

|

$ |

11,130 |

|

|

$ |

31,649 |

|

|

$ |

30,772 |

|

| Operating Income % |

4.6 |

% |

|

3.9 |

% |

|

3.7 |

% |

|

3.9 |

% |

| Net Income |

$ |

11,849 |

|

|

$ |

10,835 |

|

|

$ |

24,033 |

|

|

$ |

10,968 |

|

| Adjusted Net Income (non-GAAP)

(3) |

$ |

11,849 |

|

|

$ |

10,705 |

|

|

$ |

23,712 |

|

|

$ |

27,418 |

|

| Diluted EPS |

$ |

0.46 |

|

|

$ |

0.40 |

|

|

$ |

0.92 |

|

|

$ |

0.41 |

|

| Adjusted Diluted EPS

(non-GAAP) (3) |

$ |

0.46 |

|

|

$ |

0.40 |

|

|

$ |

0.90 |

|

|

$ |

1.01 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) As of the beginning of fiscal year 2019, the Company

adopted the new accounting standard on Revenue from Contracts with

Customers on a modified retrospective basis. For the three

months ended March 31, 2019, the adoption increased Net Sales $2.6

million, Net Income increased $0.4 million, and Diluted EPS

increased by $0.01. For the nine months ended March 31, 2019,

the adoption increased Net Sales $9.0 million, Net Income increased

$0.6 million, and Diluted EPS increased $0.03. The prior

periods were not restated.(2) Prior period amounts have been

restated to reflect the retrospective adoption of new accounting

guidance on improving the presentation of net periodic pension cost

and net periodic postretirement benefit cost.(3) A

reconciliation of GAAP and non-GAAP financial measures is included

below.

Donald D. Charron, Chairman and Chief Executive Officer, stated,

“We delivered record sales, operating income, net income, and

diluted EPS in our third quarter. Strong double-digit organic

growth in our Medical and Industrial end market verticals helped us

exceed our 8% organic growth goal and set the new quarterly sales

record. New program launches and ramp-ups more than offset

continued softness in certain other programs primarily caused by

global macro-economic conditions and trade uncertainties.”

Mr. Charron continued, “We made excellent progress optimizing

the business as we were successful expanding our operating margin

by 70 basis points when compared to the third quarter of fiscal

year 2018, helping us exceed our goal of 4.5% operating

income. Our acquisition integration work with GES continues

as we remain focused on our strategy to become a multifaceted

manufacturing solutions company. We have good momentum, and

we are cautiously optimistic that we can begin to consistently

achieve our goals of 8% organic growth and 4.5% operating

income.”

Third Quarter Fiscal Year 2019 Overview:

- Consolidated net sales increased 10% compared to the third

quarter of fiscal year 2018. Net sales in the third quarter

were impacted by:○ Unfavorable foreign currency movements

decreased net sales by approximately 3% compared to the prior year

third quarter.○ Net sales during the quarter were up 2% as a

result of the GES acquisition and 1% as a result of the adoption of

new revenue recognition accounting standards.

- Operating income, as a percent of net sales, of 4.6% represents

our best quarter since the second quarter of fiscal year 2017.

- The Romania facility continued its progress with achieving the

milestone of generating net income for the quarter.

- Interest expense was $1.2 million in the current year quarter

compared to $0.1 million in the prior year quarter as a result of

increased borrowings on the credit facilities and is included in

Other Income (Expense), net on the Condensed Consolidated

Statements of Income.

- Operating activities used cash of $14.6 million during the

quarter largely related to increased accounts receivable on the

higher sales volumes, which compares to cash provided by operating

activities of $9.5 million in the third quarter of fiscal year

2018.

- Cash conversion days (“CCD”) for the quarter ended

March 31, 2019 were 75 days, up from 62 days in the same

quarter last year primarily related to an increase in raw material

inventories to maintain appropriate buffer stock levels in the

current tight supply environment. CCD is calculated as the

sum of days sales outstanding plus contract asset days plus

production days supply on hand less accounts payable days.

- $4.7 million was returned to Share Owners during the quarter in

the form of common stock repurchases.

- Investments in capital expenditures were $6.9 million during

the quarter.

- Cash and cash equivalents were $47.2 million and borrowings

outstanding on credit facilities were $127.0 million at

March 31, 2019, including $91.5 million classified as

long-term.

- Return on invested capital (“ROIC”), calculated for the

trailing twelve months, was 9.0% and 10.0% for the twelve months

ended March 31, 2019 and 2018, respectively (see

reconciliation of non-GAAP financial measures for ROIC

calculation).

Net Sales by Vertical Market:

| |

Three Months Ended |

|

|

| |

March 31, |

|

|

| (Amounts in Millions) |

2019 |

|

2018 |

|

PercentChange |

|

Automotive |

$ |

127.3 |

|

|

$ |

136.2 |

|

|

(7 |

)% |

| Medical |

99.1 |

|

|

77.8 |

|

|

27 |

% |

| Industrial |

68.0 |

|

|

53.3 |

|

|

27 |

% |

| Public Safety |

15.1 |

|

|

14.3 |

|

|

5 |

% |

| Other |

4.0 |

|

|

2.3 |

|

|

74 |

% |

|

Total Net Sales |

$ |

313.5 |

|

|

$ |

283.9 |

|

|

10 |

% |

| |

|

|

|

|

|

|

|

|

|

|

Forward-Looking StatementsCertain statements

contained within this release are considered forward-looking under

the Private Securities Litigation Reform Act of 1995 and are

subject to risks and uncertainties including, but not limited to,

successful integration of acquisitions, ramp up of new operations,

global economic conditions, geopolitical environment, significant

volume reductions from key contract customers, loss of key

customers or suppliers, financial stability of key customers and

suppliers, availability or cost of raw materials, impact related to

tariffs and other trade barriers, and increased competitive pricing

pressures reflecting excess industry capacities. Additional

cautionary statements regarding other risk factors that could have

an effect on the future performance of the Company are contained in

its Annual Report on Form 10-K for the year ended June 30,

2018.

Non-GAAP Financial MeasuresThis press release

contains non-GAAP financial measures. A non-GAAP financial

measure is a numerical measure of a company’s financial performance

that excludes or includes amounts so as to be different than the

most directly comparable measure calculated and presented in

accordance with Generally Accepted Accounting Principles (“GAAP”)

in the United States in the statement of income, statement of

comprehensive income, balance sheet, statement of cash flows, or

statement of share owners’ equity of the Company. The

non-GAAP financial measures contained herein include adjusted

operating income, adjusted net income, adjusted diluted EPS, and

ROIC. These measures include adjustments in the nine months

ended March 31, 2019 and in the three and nine months ended

March 31, 2018 related to adjustments to the provision for

income taxes resulting from the U.S. Tax Cuts and Jobs Act (“Tax

Reform”), and for the nine months ended March 31, 2019, for

proceeds from a lawsuit settlement. Reconciliations of the

reported GAAP numbers to these non-GAAP financial measures are

included in the financial highlights table below. Management

believes it is useful for investors to understand how its core

operations performed without the effects of the provisional tax

adjustments resulting from Tax Reform and proceeds from the lawsuit

settlement. Excluding these amounts allows investors to

meaningfully trend, analyze, and benchmark the performance of the

Company’s core operations. Many of the Company’s internal

performance measures that management uses to make certain operating

decisions excludes these items to enable meaningful trending of

core operating metrics.

|

|

|

Conference Call / Webcast |

|

|

|

|

Date: |

May 8, 2019 |

|

Time: |

10:00 AM Eastern Time |

|

Dial-In #: |

800-992-4934 (International Calls - 937-502-2251) |

|

Conference ID: |

3073689 |

|

|

|

The live webcast of the conference call can be accessed at

investors.kimballelectronics.com. For those unable to

participate in the live webcast, the call will be archived at

investors.kimballelectronics.com.

About Kimball Electronics, Inc.WHO WE

ARE Kimball Electronics is a leading contract manufacturer

of durable electronics serving a variety of industries on a global

scale. The customer is the focus of everything we do and our

touch is felt throughout daily life via the markets we serve:

Automotive, Industrial, Medical, and Public Safety.

Recognized for a reputation of excellence, we are committed to a

high-performance culture that values personal and organizational

commitment to quality, reliability, value, speed, and ethical

behavior. Our employees know they are part of a company

culture that is committed to doing the right thing. We build

lasting relationships and global success for customers while

enabling employees to share in the Company’s success through

personal, professional, and financial growth.

WHAT WE DO Kimball Electronics trades under the

symbol “KE” on The NASDAQ Stock Market. Kimball Electronics

is a preeminent Electronics Manufacturing Services (“EMS”) provider

serving customers around the world and further offers diversified

contract manufacturing services (“DCMS”) for non-electronic

components, medical disposables, and plastics. GES, a Kimball

Electronics Company, specializes in design, production and

servicing of automation, test, and inspection equipment for the

semiconductor, electronics, and life sciences industries.

From our operations in the United States, China, India, Japan,

Mexico, Poland, Romania, Thailand, and Vietnam, our teams are proud

to provide manufacturing services for a variety of industries

globally. Kimball Electronics is headquartered in Jasper,

Indiana.

To learn more about Kimball Electronics, visit:

www.kimballelectronics.com.

Lasting relationships. Global

success.

Financial highlights for the third quarter ended March 31,

2019 are as follows:

| |

|

|

|

|

|

|

| Condensed

Consolidated Statements of Income |

|

|

|

|

|

|

| (Unaudited) |

Three Months Ended |

| (Amounts in Thousands, except

Per Share Data) |

March 31, 2019 (1) |

|

March 31, 2018 |

|

Net Sales |

$ |

313,454 |

|

|

100.0 |

% |

|

$ |

283,938 |

|

|

100.0 |

% |

| Cost of Sales (2) |

286,900 |

|

|

91.5 |

% |

|

261,057 |

|

|

91.9 |

% |

| Gross Profit (2) |

26,554 |

|

|

8.5 |

% |

|

22,881 |

|

|

8.1 |

% |

| Selling and Administrative

Expenses (2) |

12,057 |

|

|

3.9 |

% |

|

11,751 |

|

|

4.2 |

% |

| Operating Income (2) |

14,497 |

|

|

4.6 |

% |

|

11,130 |

|

|

3.9 |

% |

| Other Income (Expense), net

(2) |

177 |

|

|

0.1 |

% |

|

1,999 |

|

|

0.7 |

% |

| Income Before Taxes on

Income |

14,674 |

|

|

4.7 |

% |

|

13,129 |

|

|

4.6 |

% |

| Provision for Income

Taxes |

2,825 |

|

|

0.9 |

% |

|

2,294 |

|

|

0.8 |

% |

| Net Income |

$ |

11,849 |

|

|

3.8 |

% |

|

$ |

10,835 |

|

|

3.8 |

% |

| |

|

|

|

|

|

|

|

| Earnings Per Share of Common

Stock: |

|

|

|

|

|

|

|

|

Basic |

$ |

0.46 |

|

|

|

|

$ |

0.41 |

|

|

|

|

Diluted |

$ |

0.46 |

|

|

|

|

$ |

0.40 |

|

|

|

| |

|

|

|

|

|

|

|

| Average Number of Shares

Outstanding: |

|

|

|

|

|

|

|

|

Basic |

25,479 |

|

|

|

|

26,714 |

|

|

|

|

Diluted |

25,568 |

|

|

|

|

26,846 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| (Unaudited) |

Nine Months Ended |

| (Amounts in Thousands, except

Per Share Data) |

March 31, 2019 (1) |

|

March 31, 2018 |

|

Net Sales |

$ |

863,223 |

|

|

100.0 |

% |

|

$ |

795,293 |

|

|

100.0 |

% |

| Cost of Sales (2) |

798,039 |

|

|

92.4 |

% |

|

732,038 |

|

|

92.0 |

% |

| Gross Profit (2) |

65,184 |

|

|

7.6 |

% |

|

63,255 |

|

|

8.0 |

% |

| Selling and Administrative

Expenses (2) |

33,535 |

|

|

3.9 |

% |

|

32,483 |

|

|

4.1 |

% |

| Other General Income |

(92 |

) |

|

— |

% |

|

— |

|

|

— |

% |

| Operating Income (2) |

31,741 |

|

|

3.7 |

% |

|

30,772 |

|

|

3.9 |

% |

| Other Income (Expense), net

(2) |

(1,970 |

) |

|

(0.3 |

)% |

|

3,778 |

|

|

0.4 |

% |

| Income Before Taxes on

Income |

29,771 |

|

|

3.4 |

% |

|

34,550 |

|

|

4.3 |

% |

| Provision for Income

Taxes |

5,738 |

|

|

0.6 |

% |

|

23,582 |

|

|

2.9 |

% |

| Net Income |

$ |

24,033 |

|

|

2.8 |

% |

|

$ |

10,968 |

|

|

1.4 |

% |

| |

|

|

|

|

|

|

|

| Earnings Per Share of Common

Stock: |

|

|

|

|

|

|

|

|

Basic |

$ |

0.92 |

|

|

|

|

$ |

0.41 |

|

|

|

|

Diluted |

$ |

0.92 |

|

|

|

|

$ |

0.41 |

|

|

|

| |

|

|

|

|

|

|

|

| Average Number of Shares

Outstanding: |

|

|

|

|

|

|

|

|

Basic |

25,993 |

|

|

|

|

26,779 |

|

|

|

|

Diluted |

26,181 |

|

|

|

|

27,006 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

(1) As of July 1, 2018, the Company adopted the new

accounting standard on Revenue from Contracts with Customers on a

modified retrospective basis. For the three months ended

March 31, 2019, the adoption increased Net Sales $2.6 million, Net

Income increased $0.4 million, and Diluted EPS increased by

$0.01. For the nine months ended March 31, 2019, the adoption

increased Net Sales $9.0 million, Net Income increased $0.6

million, and Diluted EPS increased $0.03. The prior periods

were not restated.(2) The Condensed Consolidated Statements

of Income for the three and nine months ended March 31, 2018 have

been retrospectively restated for the adoption of new accounting

guidance on improving the presentation of net periodic pension cost

and net periodic postretirement benefit cost.

| |

|

| Condensed Consolidated

Statements of Cash Flows |

Nine Months Ended |

| (Unaudited) |

March 31, |

| (Amounts in Thousands) |

2019 |

|

2018 |

|

Net Cash Flow (used for) provided by Operating Activities |

$ |

(18,980 |

) |

|

$ |

20,888 |

|

| Net Cash Flow used for

Investing Activities |

(59,464 |

) |

|

(21,823 |

) |

| Net Cash Flow provided by

(used for) Financing Activities |

80,315 |

|

|

(1,718 |

) |

| Effect of Exchange Rate Change

on Cash and Cash Equivalents |

(1,149 |

) |

|

2,342 |

|

| Net Increase (Decrease) in

Cash and Cash Equivalents |

722 |

|

|

(311 |

) |

| Cash and Cash Equivalents at

Beginning of Period |

46,428 |

|

|

44,555 |

|

| Cash and Cash Equivalents at

End of Period |

$ |

47,150 |

|

|

$ |

44,244 |

|

| |

|

|

|

|

|

|

|

| |

|

|

|

| |

(Unaudited) |

|

|

| Condensed Consolidated

Balance Sheets |

March 31, |

|

June 30, |

| (Amounts in Thousands) |

2019 |

|

2018 |

| ASSETS |

|

|

|

|

Cash and cash equivalents |

$ |

47,150 |

|

|

$ |

46,428 |

|

|

Receivables, net |

225,775 |

|

|

173,559 |

|

|

Contract assets (1) |

52,222 |

|

|

— |

|

|

Inventories (1) |

213,200 |

|

|

201,596 |

|

|

Prepaid expenses and other current assets |

23,893 |

|

|

15,405 |

|

|

Property and Equipment, net |

140,560 |

|

|

137,210 |

|

|

Goodwill |

11,409 |

|

|

6,191 |

|

|

Other Intangible Assets, net |

23,038 |

|

|

4,375 |

|

|

Other Assets (1) |

24,633 |

|

|

23,994 |

|

|

Total Assets |

$ |

761,880 |

|

|

$ |

608,758 |

|

| |

|

|

|

| LIABILITIES AND SHARE

OWNERS’ EQUITY |

|

|

|

|

Current portion of borrowings under credit facilities |

$ |

35,544 |

|

|

$ |

8,337 |

|

|

Accounts payable |

209,819 |

|

|

187,788 |

|

|

Accrued expenses (1) |

39,385 |

|

|

32,446 |

|

|

Long-term debt under credit facilities, less current portion |

91,500 |

|

|

— |

|

|

Long-term income taxes payable |

10,937 |

|

|

12,361 |

|

|

Other |

15,220 |

|

|

12,299 |

|

|

Share Owners’ Equity (1) |

359,475 |

|

|

355,527 |

|

|

Total Liabilities and Share Owners’ Equity |

$ |

761,880 |

|

|

$ |

608,758 |

|

| |

|

|

|

|

|

|

|

(1) The Company adopted new accounting guidance for the

recognition of revenue from contracts with customers on a modified

retrospective basis as of July 1, 2018. As a result of the

adoption of this new guidance, on July 1, 2018, the Company

recognized Contract assets of $43.2 million, reduced Inventories by

$39.2 million, reduced Other Assets by $0.9 million, increased

Accrued expenses by $0.2 million, and increased retained earnings

in Share Owners’ Equity by $3.1 million.

| |

|

|

|

|

|

|

|

Reconciliation of Non-GAAP Financial Measures |

|

|

|

|

|

|

| (Unaudited) |

|

|

|

|

|

|

|

| (Amounts in Thousands, except

Per Share Data) |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Operating

Income excluding Lawsuit Proceeds |

| |

Three Months Ended |

|

Nine Months Ended |

| |

March 31, |

|

March 31, |

| |

2019 |

|

2018 |

|

2019 |

|

2018 |

|

Operating Income, as reported (1) |

$ |

14,497 |

|

|

$ |

11,130 |

|

|

$ |

31,741 |

|

|

$ |

30,772 |

|

| Less: Pre-tax Settlement

Proceeds from Lawsuit |

— |

|

|

— |

|

|

92 |

|

|

— |

|

| Adjusted Operating Income

(1) |

$ |

14,497 |

|

|

$ |

11,130 |

|

|

$ |

31,649 |

|

|

$ |

30,772 |

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Net

Income excluding Tax Reform and Lawsuit Proceeds |

| |

Three Months Ended |

|

Nine Months Ended |

| |

March 31, |

|

March 31, |

| |

2019 |

|

2018 |

|

2019 |

|

2018 |

| Net Income, as reported |

$ |

11,849 |

|

|

$ |

10,835 |

|

|

$ |

24,033 |

|

|

$ |

10,968 |

|

| Add: Adjustments to Provision

for Income Taxes from Tax Reform during measurement period |

— |

|

|

(130 |

) |

|

(251 |

) |

|

16,450 |

|

| Less: After-tax Settlement

Proceeds from Lawsuit |

— |

|

|

— |

|

|

70 |

|

|

— |

|

| Adjusted Net Income |

$ |

11,849 |

|

|

$ |

10,705 |

|

|

$ |

23,712 |

|

|

$ |

27,418 |

|

| |

|

|

|

|

|

|

|

| Diluted

Earnings per Share excluding Tax Reform and Lawsuit

Proceeds |

| |

Three Months Ended |

|

Nine Months Ended |

| |

March 31, |

|

March 31, |

| |

2019 |

|

2018 |

|

2019 |

|

2018 |

| Diluted Earnings per Share, as

reported |

$ |

0.46 |

|

|

$ |

0.40 |

|

|

$ |

0.92 |

|

|

$ |

0.41 |

|

| Add: Adjustments to Provision

for Income Taxes from Tax Reform during measurement period |

— |

|

|

— |

|

|

(0.01 |

) |

|

0.60 |

|

| Less: Impact of Settlement

Proceeds from Lawsuits |

— |

|

|

— |

|

|

0.01 |

|

|

— |

|

| Adjusted Diluted Earnings per

Share |

$ |

0.46 |

|

|

$ |

0.40 |

|

|

$ |

0.90 |

|

|

$ |

1.01 |

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Return on Invested

Capital (ROIC) |

|

|

|

|

|

|

|

| |

|

|

Twelve Months Ended |

| |

|

|

March 31, |

| |

|

|

|

|

2019 |

|

2018 |

| Operating Income (GAAP)

(1) |

|

|

|

|

$ |

43,007 |

|

|

$ |

39,177 |

|

| Less: Pre-tax Settlement

Proceeds from Lawsuit |

|

|

|

|

$ |

92 |

|

|

$ |

— |

|

| Adjusted Operating Income

(non-GAAP) (1) |

|

|

|

|

$ |

42,915 |

|

|

$ |

39,177 |

|

| Tax Effect (2) |

|

|

|

|

$ |

9,718 |

|

|

$ |

7,642 |

|

| After Tax Adjusted Operating

Income |

|

|

|

|

$ |

33,197 |

|

|

$ |

31,535 |

|

| Average Invested Capital

(3) |

|

|

|

|

$ |

366,995 |

|

|

$ |

315,751 |

|

| ROIC |

|

|

|

|

9.0 |

% |

|

10.0 |

% |

| |

|

|

|

|

|

|

|

|

|

(1) Prior period Operating Income has been retrospectively

restated for the adoption of new accounting guidance on improving

the presentation of net periodic pension cost and net periodic

postretirement benefit cost.(2) Accumulated tax effect

utilizing the applicable quarterly effective tax rates, excludes

adjustments to provision for income taxes related to the U.S. Tax

Cuts and Jobs Act.(3) Average Invested Capital is computed

using Share Owners’ equity plus current and non-current debt less

cash and cash equivalents averaged for the last five quarters.

CONTACT:Adam W. SmithTreasurerTelephone: 812.634.4000E-mail:

Investor.Relations@kimballelectronics.com

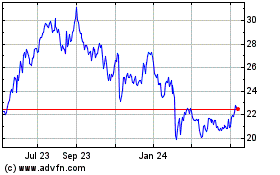

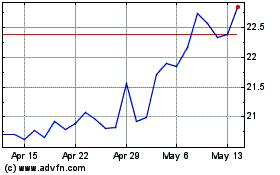

Kimball Electronics (NASDAQ:KE)

Historical Stock Chart

From Jun 2024 to Jul 2024

Kimball Electronics (NASDAQ:KE)

Historical Stock Chart

From Jul 2023 to Jul 2024