Kaival Brands Innovations Group, Inc. (NASDAQ: KAVL) ("Kaival

Brands," the "Company," or "we"), the exclusive U.S. distributor of

all products manufactured by Bidi Vapor, LLC ("Bidi Vapor"),

including the BIDI® Stick, which are intended for adults 21 and

over, today announced its financial results for the fiscal 2023

third quarter ended July 31, 2023.

Recent Business Highlights

- Added more than 1,500 store

locations to Circle K rollout bringing the total locations to more

than 2,700 in the South Atlantic and Midwest regions

- Shipped an initial order of BIDI®

Sticks to over 900 Kwik Trip and Mapco locations

- Amended agreement with Phillip

Morris International (PMI) for distribution of Bidi Vapor products

internationally, simplifying payment structure thereby reducing

costs and accelerating royalty payments. On September 8, 2023, the

Company received both a net reconciliation payment from PMI of

approximately $135,000 pursuant to this amendment, and also

received a royalty payment earned from July 1, 2023 through July

31, 2023, in the amount of approximately $121,000

- Appointed Thomas J. Metzler to the

role of Chief Financial Officer

- Promoted Eric Mosser to the role of

Chief Executive Officer

- Promoted Stephen Sheriff to role of

Chief Operating Officer

Management Comments

Eric Mosser, Chief Executive Officer and

President of Kaival Brands, stated, “We are increasingly encouraged

by the renewed BIDI® Stick interest and order flow from our

distribution partners and increased enforcement of compliance

regulations by the U.S. Food and Drug Administration (FDA). Over

the past several months, we have increased placements with several

large-scale C-store brands including Kwik Trip and Circle K, both

of which are focused on ID-verification and youth-access

prevention, and engaged a prominent national broker and one of the

largest retail distributors in the U.S. We are pushing distribution

into more channels and expect the impact will be evident in our

financial results in the coming periods. Sales in September are on

pace to double sales in August, a solid proof point of the momentum

that is building.

“We recently renegotiated the licensing

agreement with PMI in light of regulation changes in international

markets and given the lessons learned during the first year of the

agreement. Importantly, the revised agreement simplifies the

payment terms, provides us with incremental cost savings and

improves visibility into our future revenue and cash flows. We

anticipate an acceleration of royalty payments, which will also

serve as a catalyst for improving financial performance in the

coming periods.”

Financial Results for Fiscal Third

Quarter 2023

Revenues: Revenues for the

third quarter of fiscal year 2023 were $3.6 million, compared to

$3.8 million in the same period of the prior fiscal year. Revenues

were flat in the third quarter of 2023, primarily due to

credits/discounts/rebates issued to customers. The Company does not

anticipate this trend to continue as renewed distribution ramps up

and sales of non-tobacco flavored BIDI® Sticks increase, and even

more so now that the PMTA denial order has been vacated by the 11th

Circuit Court of Appeals, which allows it to continue marketing and

selling BIDI ® Sticks, subject to the FDA’s enforcement

discretion.

Cost of Revenue, Net, and Gross

Profit: Gross profit in the third quarter of fiscal year

2023 was $1.3 million, or 36.3% of revenues, net, compared to

approximately $442,000 gross profit, or 11.5% of revenues, net, for

the third quarter of fiscal year 2022. Total cost of revenue, net

was $2.3 million, or 63.7% of revenue, net for the third quarter of

fiscal year 2023, compared to $3.4 million, or 88.5% of revenue,

net for the third quarter of fiscal year 2022. The increase in

gross profit was primarily driven by improved cost per sticks

during the third quarter of fiscal year 2023.

Operating Expenses: Total

operating expenses were $3.0 million for the third quarter of

fiscal year 2023, compared to $4.3 million for the third quarter of

fiscal year 2022. For the third quarter of fiscal year 2023,

operating expenses consisted of advertising and promotion fees of

$578,000 compared to $658,000 in the prior year quarter, and

general and administrative expenses of $2.4 million compared to

$3.6 million in the prior year quarter. The reduction in general

and administrative expenses was primarily the result of lower stock

option expenses and professional fees, which was partially offset

by an increase in other general and administrative expenses. The

Company expects future operating expenses to increase while it

increases the footprint of its business and generates increased

sales growth.

Net Loss: Net loss for the

third quarter of fiscal year 2023 was $1.8 million, or $0.03 basic

and diluted net loss per share, compared to a net loss of $3.9

million, or $0.09 basic and diluted net loss per share, for the

third quarter of fiscal year 2022. The decrease in the net loss for

the third quarter of fiscal year 2023, as compared to the third

quarter of fiscal year 2022, is primarily attributable to increased

gross margins on sold products and a reduction in general &

administrative expenses.

Cash Position: As of July 31,

2023, the Company had working capital of $2.4 million and total

cash of $1.0 million.

Additional information regarding the Company’s

results of operations for the third quarter ended July 31, 2023 is

available in the Company’s Quarterly Report on Form 10-Q for such

reporting period, which has been filed with the Securities and

Exchange Commission.

ABOUT KAIVAL BRANDS

Based in Grant-Valkaria, Florida, Kaival Brands

is a company focused on incubating innovative and profitable

adult-focused products into mature and dominant brands, with a

current focus on the distribution of electronic nicotine delivery

systems (ENDS) also known as “e-cigarettes” for adult smokers and

tobacco users 21 and over. Our business plan is to seek to

diversify into distributing other nicotine and non-nicotine

delivery system products (including those related to hemp-derived

cannabidiol (known as CBD) products). Kaival Brands and Philip

Morris Products S.A. (via sublicense from Kaival Brands) are the

exclusive global distributors of all products manufactured by Bidi

Vapor.

Learn more about Kaival Brands at

https://ir.kaivalbrands.com/overview/default.aspx.

ABOUT KAIVAL LABS

Based in Grant-Valkaria, Florida, Kaival Labs is

a 100% wholly-owned subsidiary of Kaival Brands focused on

developing new branded and white-label products and services in the

vaporizer and inhalation technology sectors. Kaival Labs’ current

patent portfolio consists of 12 existing and 46 pending with novel

technologies across extrusion dose control, product preservation,

tracking and tracing usage, multiple modalities and child safety.

The patents and patent applications cover territories including the

United States, Australia, Canada, China, the European Patent

Organisation, Israel, Japan, Mexico, New Zealand and South Korea.

The portfolio also includes a fully-functional proprietary mobile

device software application that is used in conjunction with

certain patents in the portfolio.

Learn more about Kaival Labs at

https://kaivallabs.com.

ABOUT BIDI VAPOR

Based in Melbourne, Florida, Bidi Vapor

maintains a commitment to responsible, adult-focused marketing,

supporting age-verification standards and sustainability through

its BIDI ® Cares recycling program. Bidi Vapor’s premier device,

the BIDI ® Stick, is a premium product made with high-quality

components, a UL-certified battery and technology designed to

deliver a consistent vaping experience for adult smokers 21 and

over. Bidi Vapor is also adamant about strict compliance with all

federal, state and local guidelines and regulations. At Bidi Vapor,

innovation is key to its mission, with the BIDI® Stick promoting

environmental sustainability, while providing a unique vaping

experience to adult smokers.

Nirajkumar Patel, the Company’s Chief Science

and Regulatory Officer and director, owns and controls Bidi Vapor.

As a result, Bidi Vapor is considered a related party of the

Company.

For more information, visit

www.bidivapor.com.

Contact:Brett Maas, Managing

PartnerHayden IR(646) 536-7331brett@haydenir.com

Kaival Brands Media & Press

Relations:Stephen Sheriff, COO and Investor Relations

OfficerKaival Brands (646) 572-7086investors@kaivalbrands.com

-- Tables Follow –

|

Kaival Brands Innovations Group, Inc. |

|

Consolidated Balance Sheets |

|

(Unaudited) |

| |

| |

| |

|

|

July 31, 2023 |

|

October 31, 2022 |

|

ASSETS |

| |

CURRENT

ASSETS: |

|

|

|

|

|

|

Cash |

$ |

1,003,212 |

|

|

$ |

3,685,893 |

|

| |

|

Accounts receivable, net |

|

710,608 |

|

|

|

574,606 |

|

| |

|

Other receivable - related

party - short term |

|

1,136,452 |

|

|

|

1,539,486 |

|

| |

|

Inventories |

|

3,591,991 |

|

|

|

1,239,725 |

|

| |

|

Prepaid expenses |

|

172,601 |

|

|

|

426,407 |

|

| |

|

Income tax receivable |

|

- |

|

|

|

1,607,302 |

|

| |

Total current

assets |

|

6,614,864 |

|

|

|

9,073,419 |

|

| |

Fixed assets,

net |

|

3,016 |

|

|

|

- |

|

| |

Intangible assets,

net |

|

11,664,909 |

|

|

|

- |

|

| |

Other receivable -

related party - net of current portion |

|

1,840,475 |

|

|

|

2,164,646 |

|

| |

Right of use asset

- operating lease |

|

1,056,767 |

|

|

|

1,198,969 |

|

| TOTAL

ASSETS |

$ |

21,180,031 |

|

|

$ |

12,437,034 |

|

| |

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDER EQUITY |

|

|

|

| |

CURRENT

LIABILITIES: |

|

|

|

| |

|

Accounts payable |

$ |

125,011 |

|

|

$ |

40,023 |

|

| |

|

Accounts payable - related

party |

|

2,308,373 |

|

|

|

- |

|

| |

|

Accrued expenses |

|

540,516 |

|

|

|

1,099,157 |

|

| |

|

Customer deposits |

|

- |

|

|

|

44,973 |

|

| |

|

Customer refund due |

|

618,403 |

|

|

|

- |

|

| |

|

Deferred revenue |

|

- |

|

|

|

235,274 |

|

| |

|

Loans payable, net |

|

483,078 |

|

|

|

- |

|

| |

|

Operating lease obligation -

short term |

|

179,861 |

|

|

|

166,051 |

|

| |

Total current

liabilities |

|

4,255,242 |

|

|

|

1,585,478 |

|

| |

|

|

|

|

|

| |

LONG TERM

LIABILITIES: |

|

|

|

| |

|

|

|

|

| |

|

Operating lease obligation,

net of current portion |

|

914,761 |

|

|

|

1,050,776 |

|

| |

|

|

|

|

|

| TOTAL

LIABILITIES |

|

5,170,003 |

|

|

|

2,636,254 |

|

| |

|

|

|

|

|

| |

STOCKHOLDERS'

EQUITY: |

|

|

|

| |

|

|

|

|

|

| |

|

Preferred stock;

5,000,000 shares authorized |

|

|

|

| |

|

Series A Convertible Preferred

stock ($0.001 par value, 3,000,000 shares

authorized, |

|

|

|

| |

|

none issued and outstanding as

of July 31, 2023, and October 31, 2022, respectively) |

|

- |

|

|

|

- |

|

| |

|

Series B Convertible Preferred

stock ($0.001 par value, 900,000 shares

authorized, |

|

|

|

| |

|

900,000 and none issued and

outstanding as of July 31, 2023, and October 31, 2022,

respectively) |

|

900 |

|

|

|

- |

|

| |

|

|

|

|

|

| |

|

Common stock |

|

|

|

| |

|

($.001 par value,

1,000,000,000 shares authorized, 58,261,090 and 56,169,090

shares |

|

|

|

| |

|

issued and outstanding as of

July 31, 2023, and October 31, 2022, respectively) |

|

58,261 |

|

|

|

56,169 |

|

| |

|

|

|

|

|

| |

|

Additional paid-in

capital |

|

44,339,243 |

|

|

|

29,375,787 |

|

| |

|

|

|

|

|

| |

|

Accumulated deficit |

|

(28,388,376 |

) |

|

|

(19,631,176 |

) |

| |

Total

Stockholders' Equity |

|

16,010,028 |

|

|

|

9,800,780 |

|

| TOTAL

LIABILITIES & EQUITY |

$ |

21,180,031 |

|

|

$ |

12,437,034 |

|

| |

|

|

|

|

|

|

|

|

Kaival Brands Innovations Group, Inc. |

|

Consolidated Statements of Operations |

|

(Unaudited) |

| |

| |

|

For the Three Months Ended July

31, |

|

For the Nine Months Ended July

31, |

|

|

|

2023 |

|

2022 |

|

2023 |

|

2022 |

|

Revenues |

|

|

|

|

|

|

|

|

|

Revenues, net |

$ |

3,228,099 |

|

|

$ |

3,854,012 |

|

|

$ |

8,710,591 |

|

|

$ |

9,788,368 |

|

| |

Revenues - related party |

|

1,165 |

|

|

|

29,319 |

|

|

|

7,878 |

|

|

|

60,469 |

|

| |

Royalty revenue |

|

385,685 |

|

|

|

- |

|

|

|

491,257 |

|

|

|

- |

|

| |

Excise tax on products |

|

(31,356 |

) |

|

|

(36,070 |

) |

|

|

(79,913 |

) |

|

|

(99,669 |

) |

| Total

revenues, net |

|

3,583,593 |

|

|

|

3,847,261 |

|

|

|

9,129,813 |

|

|

|

9,749,168 |

|

| |

|

|

|

|

|

|

|

|

| Cost of

revenues |

|

|

|

|

|

|

|

| |

Cost of revenue - related

party |

|

2,282,601 |

|

|

|

3,365,010 |

|

|

|

7,414,053 |

|

|

|

9,477,060 |

|

| |

Cost of revenue - other |

|

- |

|

|

|

40,186 |

|

|

|

- |

|

|

|

133,283 |

|

| Total cost

of revenue |

|

2,282,601 |

|

|

|

3,405,196 |

|

|

|

7,414,053 |

|

|

|

9,610,343 |

|

| |

|

|

|

|

|

|

|

|

| Gross

profit |

|

1,300,992 |

|

|

|

442,065 |

|

|

|

1,715,760 |

|

|

|

138,825 |

|

| |

|

|

|

|

|

|

|

|

| Operating

expenses |

|

|

|

|

|

|

|

| |

Advertising and promotion |

|

577,991 |

|

|

|

657,561 |

|

|

|

1,827,033 |

|

|

|

2,011,131 |

|

| |

General and administrative

expenses |

|

2,376,057 |

|

|

|

3,641,495 |

|

|

|

8,510,792 |

|

|

|

9,784,616 |

|

| Total

operating expenses |

|

2,954,048 |

|

|

|

4,299,056 |

|

|

|

10,337,825 |

|

|

|

11,795,747 |

|

| |

|

|

|

|

|

|

|

|

| Other

income (expense) |

|

|

|

|

|

|

|

| Interest expense,

net |

|

(147,087 |

) |

|

|

- |

|

|

|

(135,135 |

) |

|

|

- |

|

| Total

other expense |

|

(147,087 |

) |

|

|

- |

|

|

|

(135,135 |

) |

|

|

- |

|

| |

|

|

|

|

|

|

|

|

| Loss

before income taxes provision |

|

(1,800,143 |

|

|

|

(3,856,991 |

) |

|

|

(8,757,200 |

) |

|

|

(11,656,922 |

) |

| |

|

|

|

|

|

|

|

|

| Provision for

income taxes |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

5,807 |

|

| |

|

|

|

|

|

|

|

|

| Net

loss |

|

(1,800,143 |

) |

|

|

(3,856,991 |

) |

|

$ |

(8,757,200 |

) |

|

|

(11,651,115 |

) |

| Preferred stock

dividend |

|

(45,000 |

) |

|

|

- |

|

|

|

(45,000 |

) |

|

|

- |

|

| Net loss

attributable to common shareholders |

$ |

(1,845,143 |

) |

|

$ |

(3,856,991 |

) |

|

$ |

(8,802,200 |

) |

|

$ |

(11,651,115 |

) |

| |

|

|

|

|

|

|

|

|

| Net loss

per common share - basic and diluted |

$ |

(0.03 |

) |

|

$ |

(0.09 |

) |

|

$ |

(0.16 |

) |

|

$ |

(0.34 |

) |

| |

|

|

|

|

|

|

|

|

| Weighted

average number of common shares outstanding - basic and

diluted |

|

57,578,916 |

|

|

|

41,493,644 |

|

|

|

56,645,943 |

|

|

|

34,259,009 |

|

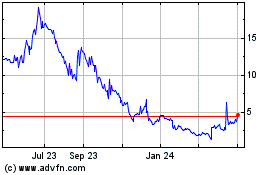

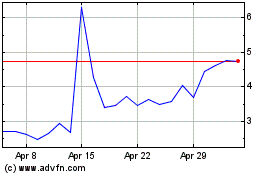

Kaival Brands Innovations (NASDAQ:KAVL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Kaival Brands Innovations (NASDAQ:KAVL)

Historical Stock Chart

From Apr 2023 to Apr 2024