Kaival Brands Innovations Group, Inc. (NASDAQ:

KAVL) ("Kaival Brands," the "Company" or "we,” “our” or

similar terms), a company focused on incubating and commercializing

innovative products into mature and dominant brands, with a current

focus on the distribution of electronic nicotine delivery systems

(ENDS) intended for adults 21 and over, today announced that the

NASDAQ Stock Market (“Nasdaq”) has granted Kaival Brands an

additional 180 days to regain compliance with Nasdaq’s $1.00

minimum bid price rule requirement under Nasdaq Listing Rule

5550(a)(2) (the “Bid Price Rule”), following the expiration of the

initial 180 days period to regain compliance on July 31, 2023.

Nasdaq’s action follows the submission by Kaival

Brands to Nasdaq of a plan for regaining compliance with the Bid

Price Rule.

As a result of the extension, Kaival Brands now

has until January 29, 2024 to regain compliance with the $1.00

minimum bid price rule requirement. If at any time before January

29, 2024, the bid price of Kaival Brands’ common stock closes at or

above $1.00 per share for a minimum of 10 consecutive business

days, Nasdaq will provide written notification to Kaival Brands

that it has achieved compliance with the bid price requirement. If

Kaival Brands chooses to implement a reverse stock split to regain

compliance with the Bid Price Rule, it must complete the reverse

split no later than 10 business days prior to the expiration of the

additional 180 calendar day period in order to timely regain

compliance.

If Kaival Brands does not regain compliance with

the bid price requirement by January 29, 2024, Nasdaq will provide

written notification to Kaival Brands that its common stock will be

subject to delisting. At such time, Kaival Brands may appeal the

delisting determination to a Nasdaq Hearings Panel. There can be no

assurance that, if Kaival Brands does appeal a subsequent delisting

determination, such appeal would be successful. Kaival Brands’

common stock would remain listed pending the Panel’s decision.

The current notification from Nasdaq has no

immediate effect on the listing or trading of the Kaival Brands’

common stock, which will continue to trade on the Nasdaq Capital

Market under the symbol “KAVL”.

ABOUT KAIVAL BRANDS

Based in Grant-Valkaria, Florida, Kaival Brands

is a company focused on incubating and commercializing innovative

products into mature and dominant brands, with a current focus on

the distribution of electronic nicotine delivery systems (ENDS)

also known as “e-cigarettes” for use by customers 21 years and

older. Our business plan is to seek to diversify into distributing

other nicotine and non-nicotine delivery system products (including

those related to hemp-derived cannabidiol (known as CBD) products).

Kaival Brands and Philip Morris Products S.A. (via sublicense from

Kaival Brands) are the exclusive global distributors of all

products manufactured by Bidi Vapor.

Learn more about Kaival Brands at

https://ir.kaivalbrands.com/overview/default.aspx.

ABOUT KAIVAL LABS

Based in Grant-Valkaria, Florida, Kaival Labs,

Inc. is wholly-owned subsidiary of Kaival Brands focused on

developing new branded and white-label products and services in the

vaporizer and inhalation technology sectors. Kaival Labs’ current

patent portfolio consists of 12 existing and 46 pending with novel

technologies across extrusion dose control, product preservation,

tracking and tracing usage, multiple modalities and child safety.

The patents and patent applications cover territories including the

United States, Australia, Canada, China, the European Patent

Organisation, Israel, Japan, Mexico, New Zealand and South Korea.

The portfolio also includes a fully-functional proprietary mobile

device software application that is used in conjunction with

certain patents in the portfolio.

Learn more about Kaival Labs at

https://kaivallabs.com.Cautionary Note Regarding

Forward-Looking Statements

This press release and the statements of the

Company’s management and partners included herein and related to

the subject matter herein includes statements that constitute

“forward-looking statements” (as defined in Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended), which are statements

other than historical facts. You can identify forward-looking

statements by words such as “anticipate,” “believe,” “continue,”

“could,” “estimate,” “expect,” “forecast,” “intend,” “may,” “plan,”

“position,” “should,” “strategy,” “target,” “will,” and similar

words. All forward-looking statements speak only as of the date of

this press release. Although we believe that the plans, intentions,

and expectations reflected in or suggested by the forward-looking

statements are reasonable, there is no assurance that these plans,

intentions, or expectations will be achieved. Therefore, actual

outcomes and results (including, without limitation, the results of

the Company’s efforts to regain compliance with the Nasdaq’s Bid

Price Rule) could materially and adversely differ from what is

expressed, implied, or forecasted in such statements. Our business

may be influenced by many factors that are difficult to predict,

involve uncertainties that may materially affect results, and are

often beyond our control. Factors that could cause or contribute to

such differences include, but are not limited to: (i) future

actions by the FDA in response to the 11th Circuit Court’s decision

that could impact our business and prospects, (ii) the outcome of

FDA’s scientific review of Bidi Vapor’s pending FDA Premarket

Tobacco Product Applications, (iii) the results of international

marketing and sales efforts by Philip Morris International, the

Company’s international distribution partner, (iv) how quickly

domestic and international markets adopt our products, (v) the

scope of future FDA enforcement of regulations in the ENDS

industry, (vi) the FDA’s approach to the regulation of synthetic

nicotine and its impact on our business, (vii) potential federal

and state flavor bans and other restrictions on ENDS products,

(viii) the duration and scope of the COVID-19 pandemic and impact

on the demand for the products we distribute, (ix) general economic

uncertainty in key global markets and a worsening of global

economic conditions or low levels of economic growth, (x) the

effects of steps that we could take to reduce operating costs, (xi)

our inability to generate and sustain profitable sales growth,

including sales growth in U.S. and international markets, (xii)

circumstances or developments that may make us unable to implement

or realize anticipated benefits, or that may increase the costs, of

our current and planned business initiatives, (xiii) significant

changes in our relationships with our distributors or

sub-distributors and (xiv) other factors detailed by us in our

public filings with the Securities and Exchange Commission,

including the disclosures under the heading “Risk Factors” in our

Annual Report on Form 10-K for the fiscal year ended October 31,

2022, filed with the Securities and Exchange Commission on January

27, 2023 and accessible at www.sec.gov. All forward-looking

statements included in this press release are expressly qualified

in their entirety by such cautionary statements. Except as required

under the federal securities laws and the Securities and Exchange

Commission’s rules and regulations, we do not have any intention or

obligation to update any forward-looking statements publicly,

whether as a result of new information, future events, or

otherwise.

All Press Inquiries and Kaival Brands Investor

Relations:Stephen Sheriff, Director of Communications and

AdministrationIr.kaivalbrands.cominvestors@kaivalbrands.com

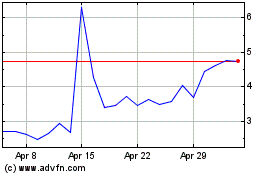

Kaival Brands Innovations (NASDAQ:KAVL)

Historical Stock Chart

From Mar 2024 to Apr 2024

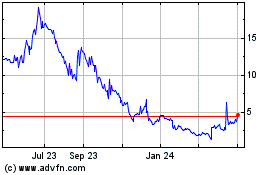

Kaival Brands Innovations (NASDAQ:KAVL)

Historical Stock Chart

From Apr 2023 to Apr 2024