Jowell Global Ltd. (“Jowell” or the “Company”) (NASDAQ: JWEL), one

of the leading cosmetics, health and nutritional supplements, and

household products e-commerce platforms in China, today announced

its financial results for the full year ended December 31, 2021.

Full Year 2021 Financial and Operational

Highlights

- Total revenues were $170.9 million, an

increase of 76.4% from $96.9 million in 2020.

- Net loss was $6.4 million, a decrease of

278.1% compared to net income of $3.6 million in 2020.

- Total VIP members1 as of

December 31, 2021 were approximately 2.2 million, an increase

of 13.6% compared to approximately 2.0 million as of December 31,

2020.

- Total LHH stores2 as of December 31, 2021 were

26,043, an increase of 6.2% compared to 24,513 as of December 31,

2020.

Mr. Zhiwei Xu, Chief Executive Officer and

Chairman of Jowell Global Ltd., commented: “We are very pleased to

report our strong growth in 2021, which was a milestone year for

Jowell. Our initial public offering on the Nasdaq Capital

Market further enhanced our industry leadership and brand

reach. Our total revenue accelerated to a new record, reaching

$170.9 million. Despite the challenges brought by the pandemic and

various uncertainties of macroeconomics, our performance proves

that Jowell’s positioning in the new retail era is satisfying the

needs of the new generation of consumers.”

Mr. Xu continued: “By continuously expanding

partnerships with leading consumer brands and marketing activities,

we are able to bring premium local and international products to

millions of families in China. Additionally, we enhanced customer

loyalty and further expanded our customer base by relentlessly

optimizing both online and offline shopping experiences for our

consumers. By the end of 2021, our VIP members reached 2.2 million,

a new record high.

“Looking ahead to 2022, in spite of the complex

and ever-evolving market environment and the lasting impacts of the

pandemic, we remain confident about the market opportunities in the

new retail market. Our cross-platform online and offline sales and

distribution networks offer convenient shopping and delivery

solutions upon customers’ various needs. Leveraging our expertise

reaching consumers via diversified channels, we are able to provide

efficient sales and marketing solutions for our branded partners.

We will continue to optimize our platforms and product offerings to

meet the increasingly diverse consumer demands.”

Ms. Mei Cai, Chief Financial Officer, added:

“Jowell recorded exceptional revenue growth in 2021, a year over

year increase of 76.4%, and grew LHH stores to 26,043, which

demonstrated our strong execution and successful marketing strategy

to cope with unprecedented challenges in retail market during the

pandemic. During 2021, we made substantial marketing efforts along

with Jowell’s IPO on Nasdaq. Although the effective implementation

of our market strategies and increased marketing expenses resulted

in a net loss in 2021, we are convinced that such investments are

critical to driving our user traffic, increasing our revenues, and

expanding our customer and distributor base. Going forward, we will

remain committed to executing our long term growth strategy.”

Impact of COVID-19 Pandemic

Beginning in late 2019, there was an outbreak of

COVID-19 (coronavirus) which spread quickly across many parts of

China, the U.S. and worldwide. In March 2020, the World Health

Organization declared the COVID-19 a pandemic. With an aim to

contain the COVID-19 outbreak, the Chinese government imposed

various measures across the country that includes, but is not

limited to, travel restrictions, mandatory quarantine requirements,

and postponed resumption of business operations until after the

2020 Chinese New Year holiday. Starting from March 2020, businesses

in China began to reopen and interruptions to businesses were

gradually removed. However, due to the recent outbreak of Omicron

variant in China, many cities in China have imposed new

restrictions and quarantine requirements with office closures,

including Shanghai, the location of our headquarters. Employees of

our VIE in Shanghai office have been working from home since March

30, 2022.

Our operations in 2021 were not significantly

impacted by the pandemic as COVID-19 is considered generally under

control in China in 2021 and Jowell is an online retailer and

retail platform. However, it is not possible to determine the

impact of the COVID-19 pandemic on our business operations and

financial results for 2022, which is highly dependent on numerous

factors beyond our control, such as the duration and spread of the

pandemic, possible COVID-19 resurgence or new variants like

Omicron, COVID-19 vaccine efficacy and distribution, and COVID-19

containment actions implemented by government authorities or other

entities in China and elsewhere, like the current restrictions and

office closures in Shanghai, almost all of which are beyond our

control.

Full Year 2021 Financial Results

Total Revenues

Total revenues were $170.9 million, representing

an increase of 76.4% from $96.9 million in 2020, primarily due to

an increase in our brand reach to distribute more premium branded

products, with an increase in both the units sold and average unit

price. Cosmetics continued to lead the growth, with an increase of

321.6%.

|

Revenues (in thousand) |

|

Full Year Ended December 31 |

|

% |

|

|

2021 |

|

2020 |

|

change |

|

|

US$ |

|

US$ |

|

YoY |

|

Product sales |

|

|

|

|

|

|

|

|

|

|

|

78,841 |

|

18,701 |

|

321.6 |

|

- Health and nutritional supplements

|

|

56,104 |

|

52,372 |

|

7.1 |

|

|

|

|

35,943 |

|

25,733 |

|

39.7 |

|

|

|

|

24 |

|

73 |

|

(67.1 |

) |

|

Total |

|

170,912 |

|

96,879 |

|

76.4 |

|

Total operating expenses were $177.9 million,

an increase of 93.9% from the $91.8 million in 2020.

- Costs of revenues were $159.3

million, an increase of 84.3% from the $86.4 million in 2020. The

increase was primarily due to the increased units sold, as well as

the increased weighted average unit cost as we added more leading

brands into our cosmetic brands portfolio. Cost of sales as a

percentage of total revenues was 93.2%, up from 89.2% in 2020.

- Fulfillment expenses were $3.8

million, an increase of 65.6% from the $2.3 million in 2020. The

increase in our fulfillment expenses is primarily attributable to

the increase in warehouse rent as we rented more spaces in 2021 to

store products. The fulfillment expenses as a percentage of total

revenues was 2.2 %, down from 2.3% in 2020. The decrease was mainly

due to more customers elected to self-pickup products purchased

from the Company’s facilities which reduced outbound freight

costs.

- Sales and marketing expenses were

$9.4 million, an increase of 812.5% from the $1.0 million in 2020.

The increase was primarily due to the increased marketing and

promotion activities and the increased expenditure for further

enhancing brand awareness in strategic geographic areas. Sales and

marketing expense as percentage of total revenues was 5.5%, up from

1.1% in 2020.

- General and administration expenses

were $5.5 million, an increase of 166.8% from $2.1 million in 2020.

The increase was primarily due to an increase in general and

administrative personnel, share-based compensation expenses and

additional expenses related to being a publicly traded company.

General and administration expenses as percentage of total revenues

was 3.2%, up from 2.1% in 2020.

Operating loss

Operating loss was $7.0 million, compared with

the operating income of $5.1 million in 2020, which was mainly

attributable to the implementation of our business expansion with

significant increase in our marketing expenses and general and

administration expenses and cost of revenues.

Net loss

Net loss was $6.4 million, a decrease of 278.1% compared

with net income of $3.6 million in 2020.

Earnings per share

The Company computes earnings per share (“EPS”)

in accordance with ASC 260, “Earnings per Share” (“ASC 260”). The

Company’s each Preferred Share has voting rights equal to two

Ordinary Shares of the Company and each Preferred Share is

convertible into one Ordinary Share at any time. Except for voting

rights and conversion rights, the Ordinary Shares and the Preferred

Shares shall rank pari passu with one another and shall have the

same rights, preferences, privileges and restrictions. For the full

year ended December 31, 2021 and 2020, the Company had no potential

ordinary shares outstanding that could potentially dilute EPS in

the future.

Cash and cash equivalents

As of December 31, 2021, the Company had cash

and cash equivalents and restricted cash of $21.2 million, compared

to the $18.2 million as of December 31, 2020.

About Jowell Global Ltd.

Jowell Global Ltd. (the “Company”) is one of the

leading cosmetics, health and nutritional supplements and household

products e-commerce platforms in China. We offer our own brand

products to customers and also sell and distribute health and

nutritional supplements, cosmetic products and certain household

products from other companies on our platform. In addition, we

allow third parties to open their own stores on our platform for a

service fee based upon sale revenues generated from their online

stores and we provide them with our unique and valuable information

about market needs, enabling them to better manage their sales

effort, as well as an effective platform to promote their brands.

The Company also sells its products through authorized retail

stores all across China, which operate under the brand names of

“Love Home Store” or “LHH Store” and “Juhao Best Choice Store”. For

more information, please visit http://ir.1juhao.com/.

Exchange Rate

The Company’s financial information is presented

in U.S. dollars (“USD”). The functional currency of the Company is

the Chinese Yuan, Renminbi (“RMB”), the currency of the PRC. Any

transactions which are denominated in currencies other than RMB are

translated into RMB at the exchange rate quoted by the People’s

Bank of China prevailing at the dates of the transactions, and

exchange gains and losses are included in the statements of

operations as foreign currency transaction gain or loss. The

consolidated financial statements of the Company have been

translated into U.S. dollars in accordance with ASC 830, “Foreign

Currency Matters”.

This press release contains translations of

certain RMB amounts into U.S. dollars (“USD” or “$”) at specified

rates solely for the convenience of the reader. The exchange rates

in effect as of December 31, 2021 and December 31, 2020 were RMB1

for $0.1572 and $0.1531, respectively. The average exchange rates

for the Full Year ended December 31, 2021 and 2020 were RMB1 for

$0.1550 and $0.1450, respectively.

Safe Harbor Statement

This press release contains forward-looking

statements. These statements are made under the "safe harbor"

provisions of the U.S. Private Securities Litigation Reform Act of

1995. Statements that are not historical facts, including

statements about the Company's beliefs and expectations, are

forward-looking statements. Forward-looking statements involve

inherent risks and uncertainties, and a number of factors could

cause actual results to differ materially from those contained in

any forward-looking statement. In some cases, forward-looking

statements can be identified by words or phrases such as "may,"

"will," "expect," "anticipate," "target," "aim," "estimate,"

"intend," "plan," "believe," "potential," "continue," "is/are

likely to" or other similar expressions. The Company may also make

written or oral forward-looking statements in its reports filed

with, or furnished to, the U.S. Securities and Exchange Commission,

in its annual reports to shareholders, in press releases and other

written materials and in oral statements made by its officers,

directors or employees to third parties. These statements are

subject to uncertainties and risks including, but not limited to,

the following: the Company’s goals and strategies; the Company’s

future business development; financial condition and results of

operations; product and service demand and acceptance; reputation

and brand; the impact of competition and pricing; changes in

technology; government regulations; fluctuations in general

economic and business conditions in China and assumptions

underlying or related to any of the foregoing and other risks

contained in reports filed by the Company with the SEC. For these

reasons, among others, investors are cautioned not to place undue

reliance upon any forward-looking statements in this press release.

Additional factors are discussed in the Company’s filings with the

SEC, which are available for review at www.sec.gov. The Company

undertakes no obligation to publicly revise these forward‐looking

statements to reflect events or circumstances that arise after the

date hereof.

For investor and media inquiries, please

contact:

In China:

Jowell Global Ltd.Ms. Jessie ZhaoEmail: IR@1juhao.com

The Blueshirt GroupMs. Ally WangEmail:

ally@blueshirtgroup.com

In the United States:

The Blueshirt GroupMs. Julia QianEmail:

Julia@blueshirtgroup.com

JOWELL GLOBAL

LTDCONSOLIDATED BALANCE SHEETS

|

|

|

December 31, |

|

|

December 31, |

|

|

|

|

2021 |

|

|

2020 |

|

|

ASSETS |

|

|

|

|

|

|

|

|

|

Current Assets: |

|

|

|

|

|

|

|

|

|

Cash |

|

$ |

18,249,737 |

|

|

$ |

18,244,055 |

|

|

Restricted cash |

|

|

2,999,990 |

|

|

|

- |

|

|

Accounts receivable |

|

|

4,966,226 |

|

|

|

306,450 |

|

|

Accounts receivable - related parties |

|

|

480,111 |

|

|

|

682,315 |

|

|

Advance to suppliers |

|

|

5,211,542 |

|

|

|

2,125,548 |

|

|

Advance to suppliers - related parties |

|

|

- |

|

|

|

583,387 |

|

|

Inventories, net |

|

|

12,316,766 |

|

|

|

7,398,248 |

|

|

Deferred offering costs |

|

|

- |

|

|

|

420,968 |

|

|

Prepaid expenses and other current assets |

|

|

2,082,409 |

|

|

|

253,673 |

|

|

Total current assets |

|

|

46,306,781 |

|

|

|

30,014,644 |

|

|

|

|

|

|

|

|

|

|

|

|

Long-term investment |

|

|

4,861,824 |

|

|

|

- |

|

|

Property and equipment, net |

|

|

524,428 |

|

|

|

12,794 |

|

|

Intangible assets, net |

|

|

386,510 |

|

|

|

34,933 |

|

|

Right of use lease assets, net |

|

|

5,284,379 |

|

|

|

3,674,255 |

|

|

Other non-current asset |

|

|

1,090,471 |

|

|

|

121,848 |

|

|

Deferred tax assets |

|

|

273,525 |

|

|

|

6,380 |

|

|

Total Assets |

|

$ |

58,727,918 |

|

|

$ |

33,864,854 |

|

|

|

|

|

|

|

|

|

|

|

| LIABILITIES AND

STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

Current Liabilities: |

|

|

|

|

|

|

|

|

|

Short-term loan |

|

$ |

2,672,366 |

|

|

$ |

- |

|

|

Accounts payable |

|

|

5,054,867 |

|

|

|

5,688,809 |

|

|

Accounts payable - related parties |

|

|

2,333,455 |

|

|

|

- |

|

|

Trade notes payable |

|

|

- |

|

|

|

580,896 |

|

|

Deferred revenue |

|

|

2,060,872 |

|

|

|

1,701,321 |

|

|

Deferred revenue - related parties |

|

|

93,170 |

|

|

|

- |

|

|

Current portion of operating lease liabilities |

|

|

1,317,006 |

|

|

|

721,003 |

|

|

Accrued expenses and other liabilities |

|

|

1,341,690 |

|

|

|

1,209,105 |

|

|

Due to related parties |

|

|

134,381 |

|

|

|

1,240,008 |

|

|

Taxes payable |

|

|

43,019 |

|

|

|

1,011,775 |

|

|

Total current liabilities |

|

|

15,050,826 |

|

|

|

12,152,917 |

|

|

|

|

|

|

|

|

|

|

|

|

Non-current portion of operating lease liabilities |

|

|

3,993,641 |

|

|

|

2,967,193 |

|

|

Total liabilities |

|

|

19,044,467 |

|

|

|

15,120,110 |

|

|

|

|

|

|

|

|

|

|

|

|

Commitments and contingencies |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders’ Equity |

|

|

|

|

|

|

|

|

|

Common stock, $0.0001 par value, 450,000,000 shares authorized,

25,677,965 and 21,149,425 issued and outstanding at December 31,

2021 and 2020, respectively |

|

|

2,568 |

|

|

|

2,115 |

|

|

Preferred stock, $0.0001 par value, 50,000,000 shares authorized,

750,000 issued and outstanding at December 31, 2021 and 2020,

respectively |

|

|

75 |

|

|

|

75 |

|

|

Additional paid-in capital |

|

|

40,827,231 |

|

|

|

14,171,120 |

|

|

Statutory reserves |

|

|

394,541 |

|

|

|

394,541 |

|

|

Retained earnings (Accumulated deficit) |

|

|

(3,036,045 |

) |

|

|

3,353,031 |

|

|

Accumulated other comprehensive income |

|

|

1,495,081 |

|

|

|

823,862 |

|

|

Total Stockholders’ Equity |

|

|

39,683,451 |

|

|

|

18,744,744 |

|

|

Total Liabilities and Stockholders’ Equity |

|

$ |

58,727,918 |

|

|

$ |

33,864,854 |

|

JOWELL GLOBAL

LTDCONSOLIDATED STATEMENTS OF OPERATIONS AND

COMPREHENSIVE INCOME (LOSS)

|

|

|

For the Years Ended December 31, |

|

|

|

|

|

2021 |

|

|

2020 |

|

|

|

Net Revenues |

|

|

|

|

|

|

|

|

|

|

Revenues - third party |

|

$ |

169,390,433 |

|

|

$ |

95,356,627 |

|

|

|

Revenues - related party |

|

|

1,521,566 |

|

|

|

1,522,546 |

|

|

|

Total Net Revenues |

|

|

170,911,999 |

|

|

|

96,879,173 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Expenses: |

|

|

|

|

|

|

|

|

|

|

Cost of revenues |

|

|

(159,259,496 |

) |

|

|

(86,404,697 |

) |

|

|

Fulfillment expenses |

|

|

(3,757,991 |

) |

|

|

(2,269,768 |

) |

|

|

Marketing expenses |

|

|

(9,380,401 |

) |

|

|

(1,027,895 |

) |

|

|

General and administrative expenses |

|

|

(5,506,614 |

) |

|

|

(2,063,997 |

) |

|

|

Total operating expenses |

|

|

(177,904,502 |

) |

|

|

(91,766,357 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (Loss) From Operations |

|

|

(6,992,503 |

) |

|

|

5,112,816 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Income (Expenses), net |

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

|

(92,257 |

) |

|

|

- |

|

|

|

Investment income |

|

|

301,778 |

|

|

|

- |

|

|

|

Government subsidy income |

|

|

318,783 |

|

|

|

- |

|

|

|

Other income (expense), net |

|

|

(115,393 |

) |

|

|

6,106 |

|

|

|

Other Income, net |

|

|

412,911 |

|

|

|

6,106 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income (Loss) Before

Income Taxes |

|

|

(6,579,592 |

) |

|

|

5,118,922 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Provision (Benefit)

for Income Taxes |

|

|

(190,516 |

) |

|

|

1,532,230 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Income

(loss) |

|

$ |

(6,389,076 |

) |

|

$ |

3,586,692 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings Per

share – Basic and Diluted |

|

$ |

(0.26 |

) |

|

$ |

0.18 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted Average

Shares Outstanding – Basic and diluted |

|

|

24,562,248 |

|

|

|

20,222,976 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Income

(loss) |

|

$ |

(6,389,076 |

) |

|

$ |

3,586,692 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other Comprehensive

income, net of tax |

|

|

|

|

|

|

|

|

|

|

Foreign currency translation gain |

|

|

671,219 |

|

|

|

783,406 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Comprehensive Income

(Loss) |

|

$ |

(5,717,857 |

) |

|

$ |

4,370,098 |

|

|

JOWELL GLOBAL

LTDCONSOLIDATED STATEMENTS OF CASH

FLOWS

| |

|

For the Years Ended December 31, |

|

|

| |

|

2021 |

|

|

2020 |

|

|

| Cash flows from

operating activities: |

|

|

|

|

|

|

|

|

Net income (loss) |

|

$ |

(6,389,076 |

) |

|

$ |

3,586,692 |

|

|

|

Adjustments to reconcile net income (loss) to net cash provided by

(used in) operating activities: |

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

185,484 |

|

|

|

25,926 |

|

|

|

Income from long-term investment |

|

|

(143,849 |

) |

|

|

- |

|

|

|

Allowance for doubtful accounts |

|

|

451,127 |

|

|

|

- |

|

|

|

Amortization of operating lease right-of-use assets |

|

|

880,551 |

|

|

|

156,543 |

|

|

|

Inventory reserve |

|

|

329,639 |

|

|

|

24,172 |

|

|

|

Deferred income taxes |

|

|

(263,249 |

) |

|

|

(6,044 |

) |

|

|

Share-based compensation |

|

|

971,200 |

|

|

|

- |

|

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

|

Accounts receivables |

|

|

- |

|

|

|

|

|

|

|

Accounts receivables |

|

|

(4,688,990 |

) |

|

|

(289,767 |

) |

|

|

Accounts receivable - related Parties |

|

|

217,500 |

|

|

|

(646,285 |

) |

|

|

Inventories |

|

|

(4,983,104 |

) |

|

|

(4,518,720 |

) |

|

|

Advance to suppliers |

|

|

(3,335,276 |

) |

|

|

(1,861,778 |

) |

|

|

Advance to suppliers - related parties |

|

|

590,738 |

|

|

|

7,583,425 |

|

|

|

Prepaid expenses and other current assets |

|

|

(1,375,344 |

) |

|

|

218,550 |

|

|

|

Accounts payables |

|

|

(776,146 |

) |

|

|

2,445,100 |

|

|

|

Accounts payables - related parties |

|

|

2,234,057 |

|

|

|

- |

|

|

|

Trade notes payable |

|

|

(588,215 |

) |

|

|

550,221 |

|

|

|

Deferred revenue |

|

|

401,233 |

|

|

|

(396,109 |

) |

|

|

Operating lease liabilities |

|

|

(868,766 |

) |

|

|

(143,339 |

) |

|

|

Taxes payable |

|

|

(982,105 |

) |

|

|

830,726 |

|

|

|

Accrued expenses and other liabilities |

|

|

98,632 |

|

|

|

(669,939 |

) |

|

|

Net cash provided by (used in) operating

activities |

|

|

(18,033,959 |

) |

|

|

6,889,374 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash flows from investing activities: |

|

|

|

|

|

|

|

|

|

|

Long-term investment |

|

|

(4,650,150 |

) |

|

|

- |

|

|

|

Advance for purchase of fixed assets |

|

|

(951,874 |

) |

|

|

(115,414 |

) |

|

|

Purchase of intangible assets |

|

|

(426,370 |

) |

|

|

- |

|

|

|

Purchase of equipment |

|

|

(609,014 |

) |

|

|

(1,332 |

) |

|

|

Net cash used in investing activities |

|

|

(6,637,408 |

) |

|

|

(116,746 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash flows from financing activities: |

|

|

|

|

|

|

|

|

|

|

Issuance of Ordinary Shares |

|

|

- |

|

|

|

10,000,000 |

|

|

|

Deferred offering costs |

|

|

- |

|

|

|

(379,961 |

) |

|

|

Net proceeds from the Initial Public Offering |

|

|

25,685,364 |

|

|

|

- |

|

|

|

Proceeds from short-term loans |

|

|

2,635,085 |

|

|

|

- |

|

|

|

Capital injection |

|

|

- |

|

|

|

- |

|

|

|

Dividend paid |

|

|

- |

|

|

|

- |

|

|

|

Repayment of related party loans |

|

|

(1,108,311 |

) |

|

|

1,174,546 |

|

|

|

Net cash provided by financing activities |

|

|

27,212,138 |

|

|

|

10,794,585 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Effect of exchange rate changes on cash and restricted

cash |

|

|

464,900 |

|

|

|

665,331 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net increase in cash and restricted cash |

|

|

3,005,672 |

|

|

|

18,232,544 |

|

|

|

Cash and restricted cash, beginning of year |

|

|

18,244,055 |

|

|

|

11,511 |

|

|

|

Cash and restricted cash, end of year |

|

$ |

21,249,727 |

|

|

$ |

18,244,055 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental disclosure information: |

|

|

|

|

|

|

|

|

|

|

Cash paid for income tax |

|

$ |

988,445 |

|

|

$ |

839,325 |

|

|

|

Cash paid for interest |

|

$ |

92,257 |

|

|

$ |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental non-cash activities: |

|

|

|

|

|

|

|

|

|

|

Cash paid in prior year for purchase of fixed assets |

|

$ |

123,384 |

|

|

$ |

- |

|

|

|

Right of use assets obtained in exchange for operating lease

obligations |

|

$ |

2,370,655 |

|

|

$ |

3,480,231 |

|

|

____________________________________________________1 “Total VIP

members refers to the total number of members registered on

Jowell’s platform as of December 31, 2021.2 LHH stores: the brand

name of “Love Home Store”. Authorized retailers may operate as

independent stores or store-in-shop (an integrated store), selling

products they purchased through Jowell’s online platform LHH Mall

under their retailer accounts which provides them with major

discounts.

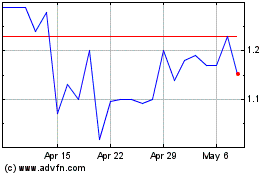

Jowell Global (NASDAQ:JWEL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Jowell Global (NASDAQ:JWEL)

Historical Stock Chart

From Apr 2023 to Apr 2024