UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

Report

of Foreign Issuer

Pursuant

to Rule 13a-16 or 15d-16 of

the

Securities Exchange Act of 1934

For

December 5, 2023

Commission

File Number: 001-41335

JE

CLEANTECH HOLDINGS LIMITED

(Exact

name of Registrant as specified in its charter)

Cayman

Islands

(Jurisdiction

of incorporation or organization)

3

Woodlands Sector 1

Singapore

738361

(Address

of principal executive offices)

Bee

Yin Hong, CEO

Tel:

+65 6368 4198

Email:

Elise.hong@jcs-echigo.com.sg

3

Woodlands Sector 1

Singapore

738361

(Name,

Telephone, email and/or fax number and address of Company Contact Person)

Indicate

by check mark whether the Registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Note

: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual

report to security holders.

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Note:

Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that

the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated,

domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on

which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to

be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the

subject of a Form 6-K submission or other Commission filing on EDGAR.

ANNUAL

GENERAL MEETING OF MEMBERS

JE

Cleantech Holdings Limited, a Cayman Islands exempt company (the “Corporation” or “JEC”), held its Annual General

Meeting of Members at 11:00 a.m., local time, on December 5, 2023, at the office of the Corporation located at 3 Woodlands Sector 1,

Singapore 738361 for the following purposes:

| |

(1) |

To

elect the following five (5) persons to serve as directors of the Corporation in their respective capacities until the next annual

general meeting of Shareholders and thereafter until their successors shall have been elected and qualified: Hong Bee Yin, Long Jia

Kwang, Singh Karmjit, Tay Jingyan, Gerald, and Khoo Su Nee, Joanne. |

| |

|

|

| |

(2) |

To

ratify the appointment of WWC, P.C. as the Corporation’s independent registered public accounting firm for the fiscal year

ending December 31, 2023. |

| |

|

|

| |

(3) |

Considering

and acting upon such other business as may properly come before the Meeting or any adjournments thereof. |

Only

Members of record at the close of business on November 3, 2023 were entitled to notice of and to vote at the Meeting.

RESULTS

OF THE ANNUAL GENERAL MEETING OF MEMBERS

On

December 5, 2023, the Corporation’s Annual General Meeting of Members was held at 11:00 a.m., local time, at the office of the

Corporation located at 3 Woodlands Sector 1, Singapore 738361. The results of the Annual Meeting were as follows:

| |

1. |

The

following five (5) persons were elected to serve as directors of the Corporation until the next annual meeting of Shareholders and

thereafter until their successors shall have been elected and qualified: Hong Bee Yin, Long Jia Kwang, Singh Karmjit, Tay Jingyan,

Gerald, and Khoo Su Nee, Joanne; |

| |

|

|

| |

2. |

The

resolution to ratify the appointment of WWC, P.C. as the Corporation’s independent registered public accounting firm for the

fiscal year ending December 31, 2023 was duly adopted. |

Exhibits

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

JE

CLEANTECH HOLDINGS LIMITED |

| |

(Registrant)

|

| |

|

| Date:

December 7, 2023 |

By: |

/s/

LONG Jia Kwang |

| |

|

LONG

Jia Kwang, Chief Financial Officer and Secretary |

EXHIBIT

99.1

JE

CLEANTECH HOLDINGS LIMITED

NOTICE

OF ANNUAL GENERAL MEETING OF MEMBERS

FOR

THE FISCAL YEAR ENDED DECEMBER 31, 2022

TO

BE HELD ON DECEMBER 5, 2023, AT 11:00 AM (SINGAPORE TIME)

Notice

is hereby given (“Notice”) that an annual general meeting of the members (the “Members”) of JE Cleantech Holdings

Limited, a Cayman Islands corporation (the “Corporation” or “JE Cleantech”), for the fiscal year ended December

31, 2022, will be held at 11:00 a.m., local time, on December 5, 2023, at the office of the Corporation located at 3 Woodlands Sector

1, Singapore 738361, and any adjournments or postponements thereof (the “Meeting” or “Annual Meeting”) for the

following purposes:

| |

1.

|

To

elect the following five (5) persons to serve as directors of the Corporation in their respective capacities until the next annual

meeting of Members and thereafter until their successors shall have been elected and qualified: Hong Bee Yin, Executive Director,

Long Jia Kwang, Executive Director, Singh Karmjit, Independent Non-Executive Director, Tay Jingyan, Gerald, Independent Non-Executive

Director, and Khoo Su Nee, Joanne, Independent Non-Executive Director. |

| |

|

|

| |

2.

|

To

ratify the appointment of WWC, P.C. as the Corporation’s independent registered public accounting firm for the fiscal year

ending December 31, 2023. |

| |

|

|

| |

3.

|

To

consider and act upon such other business as may properly come before the Annual Meeting. |

Only

Members of record at the close of business on November 3, 2023, shall be entitled to notice of and to vote at the Annual Meeting. All

Members are cordially invited to attend the Meeting in person. Regardless of your plan to attend/not attend the Annual Meeting, please

vote either over the Internet or by completing the enclosed proxy card and signing, dating, and returning it promptly. Sending in your

proxy will not prevent you from voting in person at the Meeting.

We

have elected to furnish proxy materials to our Members on the Internet. We believe this approach will allow us to provide our Members

with the appropriate information while lowering costs to the Corporation. Accordingly, we are sending a Notice Regarding the Availability

of Proxy Materials (the “Internet Notice”) to our Members of record and beneficial owners. All Members will have the ability

to access the proxy materials on a website referred to in the Internet Notice. Instructions on how to access the proxy materials over

the Internet or to request a printed copy may be found on the Internet Notice.

The

Corporation’s annual report on Form 20-F for the fiscal year ended December 31, 2022, including its complete audited financial

statements, as filed with the United States Securities and Exchange Commission (the “SEC”), is available from the Corporation

without charge upon written request to our Secretary at the corporate office of the Corporation at 3 Woodlands Sector 1, Singapore 738361.

The Corporation’s annual report on Form 20-F and other documents filed or submitted to the SEC are also available from the SEC’s

website at www.sec.gov.

By

Order of the Board of Directors

Hong

Bee Yin, Chairman

Singapore

November

3, 2023

QUESTIONS

AND ANSWERS

RELATING

TO THE ANNUAL GENERAL MEETING

Why

did I receive these materials?

Our

Members as of the close of business on November 3, 2023, which we refer to as the “Record Date,” are entitled to vote at

our Annual General Meeting, which will be held on December 5, 2023 (“Annual Meeting” or “Meeting”). As a Member,

you are invited to attend the Annual Meeting and are requested to vote on the items of business described in this proxy statement. This

proxy statement provides notice of the Annual Meeting, describes the proposals presented for Shareholder action, and includes other information

about the Corporation. The accompanying proxy card enables Members to vote on the matters without having to attend the Annual Meeting

in person.

The

cost of soliciting these proxies, consisting of the printing, handling, and mailing of the proxy and related material, and the actual

expense incurred by brokerage houses, custodians, nominees, and fiduciaries in forwarding proxy materials to the beneficial owners of

the ordinary shares, will be paid by the Corporation.

In

order to assure that there is a quorum, it may be necessary for certain officers, directors, regular employees, and other representatives

of the Corporation to solicit proxies by telephone, facsimile, or in person. These persons will receive no extra compensation for their

services.

Who

is entitled to vote at the Annual Meeting?

Only

Members of record at the close of business on the Record Date are entitled to receive notice of and to participate in the Annual Meeting.

If you were a Member of record on the Record Date, you would be entitled to vote all of the ordinary shares that you held on that date

at the Annual Meeting, or any postponements or adjournments of the Annual Meeting.

How

many votes do I have?

You

will be entitled to one vote for each outstanding ordinary share of the Corporation you own as of the Record Date. As of the Record Date,

there were 5,006,666 ordinary shares outstanding and eligible to vote.

How

many shares must be present or represented to conduct business at the Annual Meeting?

The

presence, in person or by proxy, of the holders of one-third of the outstanding ordinary shares is necessary to constitute a quorum at

the Annual Meeting. Based on the number of ordinary shares outstanding on the Record Date, the holders of our outstanding shares representing

at least 1,668,887 votes will be required to establish a quorum. Proxies received but marked as abstentions, votes withheld, and broker

“non-votes” will be included in the calculation of the number of votes considered present at the Annual Meeting. Abstentions

and broker “non-votes” are counted as present or represented for purposes of determining the presence or absence of a quorum.

A broker “non-vote” occurs when a broker holding ordinary shares for a beneficial owner votes on one proposal but does not

vote on another proposal because, in respect of such other proposal, the broker does not have discretionary voting power and has not

received instructions from the beneficial owner.

How

can I vote my ordinary shares in person at the Annual Meeting?

Ordinary

shares held in your name as the Member of record may be voted by you in person at the Annual Meeting. Ordinary shares held by you beneficially

in “street name” through a broker, bank, or other nominee may be voted by you in person at the Annual Meeting only if you

obtain a legal proxy from the broker, bank, or other nominee that holds your shares giving you the right to vote the ordinary shares.

How

can I vote my shares without attending the Annual Meeting?

Whether

you hold ordinary shares directly as the Member of record or beneficially in “street name,” you may direct how your ordinary

shares are voted without attending the Annual Meeting. If you are a Member of record (that is if your ordinary shares are registered

directly in your name with our transfer agent), you must complete and properly sign and date the accompanying proxy card and return it

to us and it will be voted as you direct. If you are a Member of record and attend the Annual Meeting, you may deliver your completed

proxy card in person. If you hold ordinary shares beneficially in “street name,” you may vote by submitting voting instructions

to your broker, bank, or other nominee.

Can

I vote by telephone or electronically?

If

you are a Member of record, you may vote electronically through the Internet, by following the instructions included with your proxy

card. If your ordinary shares are held in “street name,” please check your proxy card or contact your broker, bank, or other

nominee concerning voting electronically and the deadline for such voting. You may not vote by telephone.

Can

I change my vote after I return my proxy card?

Yes.

If you are a Member of record, you may revoke or change your vote at any time before the proxy is exercised by delivering a notice of

revocation to our Secretary at 3 Woodlands Sector 1, Singapore 738361, or by signing a proxy card bearing a later date, or by attending

the Annual Meeting and voting in person.

For

ordinary shares you hold beneficially in “street name,” you may change your vote by submitting new voting instructions to

your broker, bank, or other nominee or, if you have obtained a legal proxy from your broker, bank, or other nominee giving you the right

to vote your ordinary shares, by attending the Annual Meeting and voting in person. In either case, the powers of the proxy holder will

be suspended if you attend the Annual Meeting in person and so request, although attendance at the Annual Meeting will not by itself

revoke a previously granted proxy.

Who

counts the votes?

Votes

will be counted by VStock Transfer, LLC (“VStock”), our transfer agent, who will act as master tabulator. However, no representatives

of VStock will attend the Annual Meeting. Henry F. Schlueter, our United States securities counsel, will serve as the Judge of Election.

As the Judge of Election, Mr. Schlueter will certify the final vote count at the Annual Meeting. If you are a Member of record, your

signed proxy card is returned directly to VStock for tabulation. If you hold your ordinary shares in “street name” through

a broker, bank, or other nominee, your broker, bank, or other nominee will return one proxy card to VStock on behalf of its clients.

What

are the Board of Directors’ recommendations?

Unless

you give other instructions on your proxy card, the person named as proxy holder on the proxy card will vote in accordance with the recommendations

of the Board of Directors. The Board of Directors’ recommendation is set forth together with the description of each item in this

proxy statement. In summary, the Board of Directors recommends FOR the election of the directors as named and FOR approval of the ratification

of WWC, P.C. as the independent registered public accountants of the Corporation for the fiscal year ending December 31, 2023.

Ms.

Hong Bee Yin, the Corporation’s Chairman, Executive Director, and Chief Executive Officer, through her direct ownership of 100.00%

of JE Cleantech Global Limited, beneficially owns an aggregate of approximately 63.9% of our issued and outstanding ordinary shares.

Ms. Hong has advised the Corporation that she intends to vote her 3,200,000 ordinary shares representing approximately 63.9% of the outstanding

ordinary shares as of November 3, 2023, in favor of the proposals above. Accordingly, each of the proposals will be approved.

Will

Members be asked to vote on any other matters?

To

the knowledge of the Corporation and its management, Members will vote only on the matters described in this proxy statement. However,

if any other matters properly come before the Annual Meeting, the persons named as proxies for Members will vote on those matters in

the manner they consider appropriate.

What

vote is required to approve each of the items?

Election

of Directors

The

affirmative vote of a plurality of the votes cast at the Annual Meeting is required for the election of directors (Proposal 1). A properly

executed proxy marked “withhold authority” with respect to the election of one or more directors will not be voted with respect

to the director or directors indicated, although it will be counted for purposes of determining whether there is a quorum.

Ratification

of WWC, P.C. as the independent registered public accountants for the Corporation for the fiscal year ending December 31, 2023

The

affirmative vote of the holders of a majority of the votes cast in person or represented by proxy and entitled to vote is required for

the ratification of WWC, P.C. as the independent registered public accountants for the Corporation for the fiscal year ending December

31, 2023 (Proposal 2).

A

properly executed proxy marked “abstain” with respect to any matter will not be voted, although it will be counted for purposes

of determining whether there is a quorum. Accordingly, an abstention will have the effect of a negative vote.

How

are votes counted?

In

the election of directors, you may vote “FOR” all or some of the nominees or your vote may “WITHHOLD AUTHORITY FOR”

with respect to one or more of the nominees. You may not cumulate your votes for the election of directors.

In

the ratification of the appointment of WWC, P.C. as the Corporation’s independent registered public accountants and other items

of business, you may vote “FOR,” “AGAINST,” or “ABSTAIN.” If you elect to “ABSTAIN,”

the abstention has the same effect as a vote “AGAINST.” If you provide specific instructions with regard to certain items,

your shares will be voted as you instruct on such items.

If

you hold your shares in “street name” through a broker, bank, or other nominee rather than directly in your own name, then

your broker, bank, or other nominee is considered the Member of record, and you are considered the beneficial owner of your ordinary

shares. We have supplied copies of our proxy statement to the broker, bank, or other nominee holding your ordinary shares of record,

and they have the responsibility to send it to you. As the beneficial owner, you have the right to direct your broker, bank, or other

nominee on how to vote your ordinary shares at the Annual Meeting. The broker, bank, or other nominee that is the Member of record for

your ordinary shares is obligated to provide you with a voting instruction card for you to use for this purpose. If you hold your ordinary

shares in a brokerage account but you fail to return your voting instruction card to your broker, your ordinary shares may constitute

“broker non-votes.”

Brokerage

firms generally have the authority to vote customers’ un-voted shares on certain “routine” matters. No matters submitted

for Members’ approval herein are “routine” matters. When a brokerage firm votes its customers’ un-voted shares,

these shares are counted for purposes of establishing a quorum.

PROPOSAL

1

ELECTION

OF FIVE (5) PERSONS TO SERVE AS DIRECTORS OF THE CORPORATION

The

Corporation’s directors are elected annually to serve until the next Annual Meeting of Members and thereafter until their successors

shall have been elected and qualified. The number of directors presently authorized by the Articles of Association of the Corporation

shall be not less than two (2). There shall be no maximum number of directors unless otherwise determined from time to time by the Board.

Unless

otherwise directed by Members, the proxy holder named in the accompanying proxy will vote all shares represented by proxies held by him

for the election of the following nominees, all of whom are now members and constitute the Corporation’s Board of Directors. The

Corporation is advised that all nominees have indicated their availability and willingness to serve if elected. In the event that any

nominee becomes unavailable or unable to serve as a director of the Corporation prior to the voting, the proxy holder will vote for a

substitute nominee in the exercise of his best judgment.

The

election of the slate of directors proposed is assured, because the management of the Corporation’s controlling shareholder has

advised that the shares it holds will be voted for the election of the directors nominated herein.

Information

Concerning Nominees

Executive

Directors

Ms.

Hong Bee Yin (age 51) is the founder of our Group (the “Group,” including the Corporation and all of its subsidiaries),

having incorporated JCS-Echigo Pte Ltd., a company incorporated in Singapore with limited liability and an indirect wholly owned subsidiary

of the Corporation (“JCS”), on November 25, 1999. Ms. Hong is currently our Chairman, Executive Director, and Chief Executive

Officer. She was appointed as our Executive Director on January 29, 2019 and re-designated as our Executive Director on March 5, 2020.

Ms. Hong is primarily responsible for planning and execution of our Group’s strategies including product innovation and customization,

as well as managing our Group’s relationship with major customers and suppliers. She is also responsible for overseeing all day-to-day

aspects of our Group’s operation including production, inventory, and material control.

Ms.

Hong commenced her start-up business in November 1999 by incorporating JCS and since then has accumulated more than 23 years of operational

experience in providing cleaning solutions for the cleaning industry. Prior to forming our Group, Ms. Hong worked at JLW Property Consultants

Pte Ltd. from June 1993 to June 1998 with her last position as assistant manager (Industrial Department). From June 1998 to around September

1999, she worked at JCS Automation Pte Ltd. (now known as JCS Biotech Pte. Ltd.) as marketing manager.

Ms.

Hong obtained a Diploma in Electronic and Computer Engineering from Ngee Ann Polytechnic, Singapore in August 1993. She also completed

the Tsinghua SEM Indonesia-Singapore Executive Program and SPRING CEO Leadership Circle Program in May 2014 and November 2016, respectively.

Ms. Hong has been appointed as the deputy chairman of Singapore Precision Engineering and Technology Association from April 2017 to April

2019.

Mr.

Long Jia Kwang (age 45) joined our Group as financial controller in December 2014 and was appointed as our Executive Director and

Chief Financial Officer on March 5, 2020. Mr. Long is primarily responsible for managing accounting and finance, human resources, and

administrative functions of our Group.

Mr.

Long has over 23 years of experience in auditing, accounting, and financial management. Prior to joining our Group, Mr. Long worked at

KPMG in Johor Bahru, Malaysia from February 2000 to September 2007 with his last position as deputy audit manager. From October 2007

to October 2014, he worked at KPMG Services Pte. Ltd. in Singapore where his last position was as senior manager.

Mr.

Long obtained a Bachelor of Commerce degree from the University of Adelaide, Australia in December 1999. Mr. Long was a certified practicing

accountant of CPA Australia from November 2004 to April 2015, a chartered accountant of the Malaysian Institute of Accountants from September

2006 to February 2010, and has been a member of the Institute of Singapore Chartered Accountants (formerly known as Institute of Certified

Public Accountants of Singapore) since April 2013.

Independent

Non-Executive Directors

Mr.

Karmjit Singh (age 76) was appointed as a Non-Executive Director of the Corporation on March 5, 2020, and re-designated as an Independent

Non-Executive Director on November 12, 2021. Mr. Singh serves as the chairman of the nomination committee and as a member of the audit

and compensation committees. Mr. Singh is primarily responsible for providing guidance to the management team on corporate strategies

and governance matters.

Mr.

Singh has over 48 years of experience in business management. From 1974 to 1998, Mr. Singh worked at Singapore Airlines Limited serving

in a variety of managerial capacities covering corporate affairs, planning, aviation fuel, and administrative services. Mr. Singh joined

SATS Ltd. in July 1998 as the chief executive of SATS Airport Services Pte Ltd. and then became the chief operating officer of SATS Ltd.

in July 2004 overseeing the ground handling and inflight catering operation of the SATS group of companies until his retirement in September

2009. He then became the consultant to the president and chief executive officer of SATS Ltd. from October 2009 until September 2010.

Mr.

Singh has been an independent director of Keppel Telecommunications & Transportation Ltd. since October 2020, chairman of that company’s

nominating committee from October 2012 to July 2019, a member of its audit committee from January 2011 to July 2019, and a member of

its board safety committee since July 2019. Keppel Telecommunications & Transportation Ltd. was listed on Singapore Exchange Limited

(stock code: K11) and subsequently delisted on May 8, 2019.

Mr.

Singh obtained a Bachelor of Arts degree in Geography from the National University of Singapore in June 1970. Mr. Singh has been actively

engaged in prominent civil and industry affairs in Singapore. Mr. Singh has served as the chairman of Chartered Institute of Logistics

and Transport Singapore since 1994. Mr. Singh was a council member of the Public Transport Council, Singapore from August 2005 to May

2019.

Mr.

Tay Jingyan, Gerald (age 35) was appointed as an independent Non-Executive Director of the Corporation on January 19, 2022. Mr. Tay

serves as chairman of the compensation committee and as a member of the audit and nomination committees.

Mr.

Tay has over 19 years of experience in business management and financial advisory services. Since January 2005 until his promotion in

October 2014, Mr. Tay was an associate of TPS Group Alliance, an alliance of companies offering a variety of professional services including

corporate services, statutory compliance, accounting, corporate advisory, real estate, and family office services. In October 2014, Mr.

Tay was promoted as the group chief executive officer of TPS Group Alliance and, as of the date of this Proxy Statement, remains as group

chief executive of TPS Group Alliance. From August 2013 to January 2014 and from May 2014 to the present, Mr. Tay was and has also been

a director of Capilion Corporation Pte. Ltd., a company together with companies within its group engaging in private equity, corporate

services, real estate, and financial securities. Mr. Tay also founded and has acted as the director of Excelsus Tech Pte Ltd. (formerly

known as Excelsus Capital Pte. Ltd.), a holding company for technology-related businesses and projects, since February 2014, and Galacthor

International Pte Ltd, a company for general physical commodities trading, since December 2011.

Mr.

Tay obtained a Bachelor of Arts degree in Communication from the University at Buffalo, The State University of New York in February

2012.

Ms.

Khoo Su Nee, Joanne (age 49) was appointed as an Independent Non-Executive Director of the Corporation on January 19, 2022. Ms. Khoo

serves as the Chairman of the audit committee and as a member of the compensation and nomination committees.

Ms.

Khoo has over 26 years of experience in corporate finance and business advisory services. Ms. Khoo started her career at PricewaterhouseCoopers

in January 1997 and her last position was senior associate in February 2000. From May 2000 to August 2004, she worked at Stone Forest

Consulting Pte Ltd., a business advisory company, and her last position was as assistant manager. She was responsible for providing consultancy

services including IPO advisory, working capital consulting, business turnaround, and profit improvement. Ms. Khoo worked in the corporate

finance industry at several companies, which include (i) Hong Leong Finance Limited from September 2004 to November 2005 as an assistant

vice president; (ii) Phillip Securities Pte Ltd. from November 2005 to January 2008 as an assistant vice president; and (iii) Canaccord

Genuity Singapore Pte. Ltd. (formerly known as Collins Stewart Pte. Limited) from February 2008 to October 2012 with her last position

as a director. She founded and has acted as an executive director of Bowmen Capital Private Limited, a management consultancy company,

since February 2013. From October 2019 to April 2020, she also served as a director of PayLinks Pte. Ltd., a financial service company.

Ms.

Khoo served as an independent director of Kitchen Culture Holdings Limited (a company listed on the Catalist of the Singapore Exchange

Limited (stock code: SGX:5TI)) from October 2012 to February 2019. Since January 2014, she has served as an independent director of Teho

International Inc Ltd. (a company listed on the Catalist of the Singapore Exchange Limited (stock code: SGX:5OQ)). Ms. Khoo served as

an independent director of Excelpoint Technology Ltd. (a company listed on the main board of the Singapore Exchange Limited (stock code:

SGX: BDF)) from September 2016 to April 2022. She has also served as an independent non-executive director of Netccentric Limited (a

company listed on The Australian Securities Exchange (stock code: ASX: NCL)) since July 2017. Since June 2020, she has also served as

an independent non-executive director of ES Group (Holdings) Limited (a company listed on the Catalist of the Singapore Exchange Limited

(stock code: SGX:5RC).

Ms.

Khoo obtained a Bachelor of Business degree in Accountancy from Royal Melbourne Institute of Technology in November 1997. She was admitted

as a Certified Practicing Accountant of the CPA Australia in October 1999 and a Chartered Accountant of the Malaysian Institute of Accountants

in July 2000. Ms. Khoo was a member of the Women Corporate Directors from September 2018 to June 2019.

There

are no family relationships among the directors or executive officers of either the Corporation or its subsidiaries.

No

arrangement or understanding exists between any such director or officer and any other persons pursuant to which any director or executive

officer was elected as a director or executive officer. Our directors are elected annually and serve until their successors take office

or until their death, resignation, or removal. The executive officers serve at the pleasure of the Board of Directors.

Board

Recommendation

The

Board of Directors recommends a vote FOR the election of each of the five (5) nominees named above as directors of the Corporation.

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The

following table shows the number of ordinary shares beneficially owned by our directors and executive officers as of November 3, 2023.

Except as indicated below, the stockholders listed possess sole voting and investment power with respect to their ordinary shares.

| Name of Beneficial Owner | |

Ordinary

Shares

Beneficially

Owned |

| |

Percent

of Class | |

| Named Executive Officers and Directors: | |

| |

| |

| | |

| Hong Bee Yin | |

| 3,200,000 |

(1) | |

| 63.9 | %(2) |

| Long Jia Kwang | |

| - |

| |

| - | |

| Karmjit Singh | |

| - |

| |

| - | |

| Tay Jingyan, Gerald | |

| - |

| |

| - | |

| Khoo Su Nee, Joanne | |

| - |

| |

| - | |

| | |

| |

| |

| | |

| All executive officers and Directors as a group (5 persons) | |

| 3,200,000 |

(1) | |

| 63.9 | %(2) |

| | |

| |

| |

| | |

| 5% Members: | |

| |

| |

| | |

| JE Cleantech Global Limited | |

| 3,200,000 |

| |

| 63.9 | %(2) |

Note:

As a result of a one for three (1:3) share consolidation effected on October 13, 2023, the number of ordinary shares issued and outstanding

is 5,006,666. The calculations above are based upon the number of ordinary shares outstanding of 5,006,666.

|

(1) |

Represents

ordinary shares held by JE Cleantech Global Limited, a company directly owned as to 100.0% by Ms. Hong. |

| |

|

|

| |

(2) |

Based

on 5,006,666 ordinary shares outstanding as of the date of this Proxy Statement. |

There

are no arrangements known to the Corporation the operation of which may at a subsequent date result in a change in control of the Corporation.

NASDAQ

EXEMPTIONS AND

HOME

COUNTRY PRACTICES

Our

ordinary shares are listed on the Nasdaq Capital Market under the symbol “JEC.” We make no representation that our ordinary

shares will continue to trade in the future.

The

Nasdaq Capital Market listing rules include certain accommodations in the corporate governance requirements that allow foreign private

issuers, such as us, to follow “home country” corporate governance practices in lieu of the otherwise applicable corporate

governance standards of the Nasdaq Capital Market. In our listing application, we indicated that we would be following Cayman Islands

corporate governance practices. The application of such exceptions requires that we disclose each Nasdaq corporate governance standard

that we do not follow and describe the Cayman Islands corporate governance practices we do follow in lieu of the relevant Nasdaq corporate

governance standard. Although we are not required to do so under Cayman Islands corporate governance practices, we are following the

Nasdaq corporate governance standards in the following respects.

| |

● |

The

majority independent director requirement under Section 5605(b)(1) of the Nasdaq listing rules; |

| |

|

|

| |

● |

under

Section 5605(d) of the Nasdaq listing rules our compensation committee is comprised solely of independent directors governed by a

compensation committee charter who oversee executive compensation; |

| |

|

|

| |

● |

under

Section 5605(e) of the Nasdaq listing rules director nominees are to be selected or recommended for selection by either a majority

of the independent directors or a nomination committee comprised solely of independent directors, and our nomination committee is

composed entirely of independent directors; |

In

lieu of the Nasdaq corporate governance standards we are following Cayman Island corporate governance standards in respect of the following:

| |

● |

The

Shareholder Approval Requirements under Section 5635 of the Nasdaq listing rules; and |

| |

|

|

| |

● |

The

requirement under Section 5605(b)(2) of the Nasdaq listing rules that the independent directors have regularly scheduled meetings

with only the independent directors present. |

BOARD

COMMITTEES

Committees

of the Board of Directors

Our

Board of Directors has established an audit committee, a compensation committee, and a nomination committee, each of which will operate

pursuant to a charter adopted by our Board of Directors. The Board of Directors may also establish other committees from time to time

to assist our Corporation and the Board of Directors. The composition and functioning of all of our committees are intended to comply

with all applicable requirements of the Sarbanes-Oxley Act of 2002 and with Nasdaq and SEC rules and regulations, if applicable. Each

committee’s charter is available on our website at http://www.jecleantech.sg. The reference to our website address does not constitute

incorporation by reference of the information contained at or available through our website, and you should not consider it to be part

of this Proxy Statement.

Audit

committee

Ms.

Khoo, Mr. Singh, and Mr. Tay currently serve on the audit committee, which is chaired by Ms. Khoo. Our Board of Directors determined

that each is “independent” for audit committee purposes as that term is defined by the rules of the SEC and Nasdaq, and that

each has sufficient knowledge in financial and auditing matters to serve on the audit committee. Our Board of Directors designated Ms.

Khoo as an “audit committee financial expert,” as defined under the applicable rules of the SEC. The audit committee’s

responsibilities include:

| |

● |

Pre-approving

audit and permissible non-audit services, and the terms of such services, to be provided by our independent registered public accounting

firm; |

| |

|

|

| |

● |

Reviewing

the overall audit plan with our independent registered public accounting firm and members of management responsible for preparing

our financial statements; |

| |

|

|

| |

● |

Reviewing

and discussing with management and our independent registered public accounting firm our annual and quarterly/semi-annual financial

statements and related disclosures as well as critical accounting policies and practices used by us; |

| |

|

|

| |

● |

Coordinating

the oversight and reviewing the adequacy of our internal control over financial reporting; |

| |

|

|

| |

● |

Establishing

policies and procedures for the receipt and retention of accounting-related complaints and concerns; recommending, based upon the

audit committee’s review and discussions with management and our independent registered public accounting firm, whether our

audited financial statements shall be included in our Annual Report on Form 20-F; |

| |

|

|

| |

● |

Monitoring

the integrity of our financial statements and our compliance with legal and regulatory requirements as they relate to our financial

statements and accounting matters; |

| |

|

|

| |

● |

Preparing

the audit committee report required by SEC rules, if and when required; and |

| |

|

|

| |

● |

Reviewing

all related party transactions for potential conflict of interest situations and approving all such transactions. |

Compensation

committee

Mr.

Tay, Ms. Khoo, and Mr. Singh currently serve on the compensation committee, which is chaired by Mr. Tay. Our Board of Directors determined

that each such member satisfies the “independence” requirements of Rule 5605(a)(2) of the Listing Rules of the Nasdaq Stock

Market. The compensation committee’s responsibilities include:

| |

● |

Evaluating

the performance of our Chief Executive Officer in light of our Corporation’s corporate goals and objectives and based on such

evaluation: (i) recommending to the Board of Directors the cash compensation of our Chief Executive Officer, and (ii) reviewing and

approving grants and awards to our Chief Executive Officer under equity-based plans; |

| |

|

|

| |

● |

Reviewing

and recommending to the Board of Directors the cash compensation of our other executive officers and the members of our Board of

Directors; |

| |

|

|

| |

● |

Reviewing

and establishing our overall management compensation, philosophy, and policy, and overseeing and administering our compensation and

similar plans; |

| |

|

|

| |

● |

Reviewing

and approving the retention or termination of any consulting firm or outside advisor to assist in the evaluation of compensation

matters and evaluating and assessing potential and current compensation advisors in accordance with the independence standards identified

in the applicable Nasdaq rules; |

| |

|

|

| |

● |

Retaining

and approving the compensation of any compensation advisors; |

| |

|

|

| |

|

Reviewing

and approving our policies and procedures for the grant of equity-based awards; and |

| |

|

|

| |

● |

Preparing

the compensation committee report required by SEC rules, if and when required. |

Nomination

committee

Mr.

Singh, Ms. Khoo, and Mr. Tay currently serve on the nomination committee, which is chaired by Mr. Singh. Our Board of Directors determined

that each member of the nomination committee is “independent” as defined in the applicable Nasdaq rules. The nomination committee’s

responsibilities include:

|

● |

Developing

and recommending to the Board of Directors criteria for Board and committee membership, including establishing procedures for identifying

and evaluating director candidates and nominees recommended by Members; |

| |

|

|

| |

● |

Reviewing

the composition of the Board of Directors to ensure that it is composed of members containing the appropriate skills and expertise

to advise us. |

While

we do not have a formal policy regarding Board diversity, our nomination committee and Board of Directors will consider a broad range

of factors relating to the qualifications and background of nominees, which may include diversity (not limited to race, gender, or national

origin). Our nomination committee’s and Board of Directors’ priority in selecting Board members is identification of persons

who will further the interests of our Members through their established record of professional accomplishment, the ability to contribute

positively to the collaborative culture among Board members, knowledge of our business, understanding of the competitive landscape, and

professional and personal experience and expertise relevant to our growth strategy.

COMPENSATION

OF

OFFICERS

AND DIRECTORS

Compensation

For

the financial years ended December 31, 2021 and 2022, we paid an aggregate of S$766,000 and S$956,000, respectively, as compensation

to our directors, our executive officers, and our key employees.

We

did not set aside or accrue any amounts to provide pension, retirement or similar benefits for directors and officers for the financial

year ended December 31, 2021 and 2022 other than contributions to our Provident Fund Plan as social insurances and housing provident

fund, which aggregated S$62,000 and S$63,000 for officers and directors.

Employment

Agreements with Directors

Employment

Agreement with Hong Bee Yin

Effective

as of January 1, 2014, we entered into an employment agreement with Hong Bee Yin pursuant to which she was employed as executive director

of JCS-Echigo Pte Ltd. The agreement provides for an annual base salary of S$330,000, which amount may be adjusted from time to time

in the discretion of the Corporation. Under the terms of the agreement, Ms. Hong is entitled to receive an annual cash bonus in the amount

of S$500,000 for any year in which the Corporation’s net profit, after tax, (inclusive of any amounts payable or to be set aside

for all bonuses) equals at least S$5 million, together with such additional bonus as may be agreed from time to time with the Corporation.

Ms. Hong’s employment will continue indefinitely, subject to termination by either party to the agreement upon 6 months’

prior written notice or the equivalent salary in lieu of such notice. The agreement also contains non-compete and non-disclosure provisions

and restrictions against the unauthorized use of the Corporation’s intellectual property. Effective as of March 5, 2020, we entered

into an employment agreement with Hong Bee Yin pursuant to which she was employed as the Executive Director, Chairman, and Chief Executive

Officer of JE Cleantech Holdings Limited. The agreement provides for a monthly base director fee of US$6,000. The other terms of the

prior agreement remain unchanged.

Employment

Agreement with Long Jia Kwang

We

entered into an employment agreement dated September 5, 2014 with Long Jia Kwang pursuant to which he was employed as Financial Controller

for JCS-Echigo Pte Ltd. The agreement provides for a monthly base salary of S$9,750, plus a transportation allowance of S$750 per month.

These amounts may be adjusted from time to time. The agreement provides that the Corporation may, in its discretion, transfer or assign

Mr. Long to any position compatible with that of Financial Controller or to any of the companies in our Group. Under the terms of the

agreement, Mr. Long’s employment will continue indefinitely, subject to termination by either party to the agreement upon 1 month’s

written notice or the equivalent salary in lieu of such notice. Effective as of March 5, 2020, we entered into an employment agreement

with Long Jia Kwang pursuant to which he was employed as the Executive Director and Chief Financial Officer of JE Cleantech Holdings

Limited. The agreement provides for a monthly base director fee of US$4,000. The other terms stated herein remain unchanged.

Employment

Agreement with Wui Chin Hou

We

entered into an employment agreement dated July 21, 2016 with Wui Chin Hou pursuant to which he was employed as Field Operations Manager

for Hygieia Warewashing Pte Ltd. The agreement provides for a monthly base salary of S$4,150, plus a transportation allowance of S$750

per month. Effective October 1, 2022, the monthly base salary was revised to S$4,475. These amounts may be adjusted from time to time.

The agreement provides that the Corporation may, in its discretion, transfer or assign Mr. Wui to any position compatible with that of

Field Operations Manager or to any of the companies in our Group. Under the terms of the agreement, Mr. Wui’s employment will continue

indefinitely, subject to termination by either party to the agreement upon one month’s written notice or the equivalent salary

in lieu of such notice.

Employment

Agreement with Zhao Liang

We

entered into an employment agreement dated October 1, 2010 with Zhao Liang pursuant to which he was employed as Departmental Head of

Designing for JCS-Echigo Pte Ltd. The agreement provides for a monthly base salary of S$3,400, which amount may be adjusted from time

to time in the discretion of the Corporation. Effective January 1, 2022, the monthly base salary was revised to S$5,400. The agreement

provides that the Corporation may, in its discretion, transfer or assign Mr. Zhao to any position compatible with that of Departmental

Head of Design or to any of the companies in our Group. Under the terms of the agreement, Mr. Zhao’s employment will continue indefinitely,

subject to termination by either party to the agreement upon one month’s written notice or the equivalent salary in lieu of such

notice.

Directors’

Agreements

Each

of our directors has entered into a Director’s Agreement with the Corporation. The terms and conditions of such Directors’

Agreements are similar in all material aspects. Each Director’s Agreement is for an initial term of one year and will continue

until the director’s successor is duly elected and qualified. Each director will be up for re-election each year at the annual

Members’ meeting and, upon re-election, the terms and provisions of his or her Director’s Agreement will remain in full force

and effect. Any Director’s Agreement may be terminated for any or no reason by the director or at a meeting called expressly for

that purpose by a vote of the Members holding more than 50% of the Corporation’s issued and outstanding ordinary shares entitled

to vote.

Under

the Directors’ Agreements, the initial annual salary that is payable to each of our directors is as follows:

| Ms. Hong Bee Yin | |

US$ | 72,000 | |

| Mr. Long Jia Kwang | |

US$ | 48,000 | |

| Mr. Karmjit Singh | |

US$ | 18,000 | |

| Mr. Tay Jingyan | |

US$ | 18,000 | |

| Ms. Khoo Su Nee, Joanne | |

US$ | 24,000 | |

In

addition, our directors will be entitled to participate in the JE Cleantech Holdings Limited 2022 Equity Incentive Plan or such other

share option scheme as may be adopted by the Corporation, as amended from time to time. The number of options granted and the terms of

those options will be determined from time to time by a vote of the Board of Directors; provided that each director shall abstain from

voting on any such resolution or resolutions relating to the grant of options to that director.

Other

than as disclosed above, none of our directors has entered into a service agreement with our Corporation or any of our subsidiaries that

provides for benefits upon termination of employment.

RELATED

PARTY TRANSACTIONS

We

have adopted an audit committee charter, which requires the committee to review all related-party transactions on an ongoing basis and

all such transactions to be approved by the committee.

Set

forth below are related party transactions of our Corporation for the fiscal years ended December 31, 2020, 2021, and 2022, which are

identified in accordance with the rules prescribed under Form F-1 and Form 20-F and may not be considered as related party transactions

under Singapore law.

There

were no related party transactions or amounts due to/from related parties during the year ended December 31, 2020.

On

September 24, 2021, prior to the reorganization and the Corporation’s Initial Public Offering, the Corporation declared a dividend

of S$2.9 million (approximately US$2.1 million) payable in cash to its shareholders-JE Cleantech Global Limited, which is wholly-owned

by Ms. Hong Bee Yin, the Corporation’s Chief Executive Officer, and Triple Business Limited. The dividend was subsequently paid

in full. Of this amount, S$2.5 million (approximately US$1.9 million) was paid to JE Cleantech Global Limited and S$406,000 (approximately

US$0.3 million) was paid to Triple Business Limited. On October 5, 2021, the Corporation entered into a loan facility agreement with

Ms. Hong Bee Yin for a revolving loan facility of up to US$1.1 million for general working capital and general corporate purposes, including

the payment of expenses related to the Corporation’s initiative to raise capital through an initial public offering and simultaneous

listing of the Corporation’s ordinary shares on a globally recognized stock exchange. Ms. Hong and the Corporation entered into

a subsequent revolving loan facility on October 6, 2021 in the amount of US$0.7 million to be used for the same purposes. The total amount

of the revolving loan facility of approximately US$1.8 million from Ms. Hong Bee Yin, the Corporation’s controlling shareholder,

is non-trade, unsecured, interest-free, and payable on demand.

During

the years ended December 31, 2021 and 2022, an amount of US$1.2 million and US$0.5 million, respectively, were drawn down from the original

revolving loan facility made available by Ms. Hong Bee Yin to the Corporation in 2021. In the year ended December 31, 2022, the Corporation

made a repayment of US$1.1 million to Ms. Hong Bee Yin. As of December 31, 2022, the amount of outstanding loan owed to Ms. Hong Bee

Yin stood at US$0.6 million.

Other

than as disclosed above, there were no significant related party transactions conducted during the fiscal years ended December 31, 2020,

2021, and 2022.

PROPOSAL

2

RATIFICATION

OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS

The

Audit Committee has selected WWC, P.C. to serve as the independent registered public accounting firm of the Corporation for the fiscal

year ending December 31, 2023. We are asking our Members to ratify the selection of WWC, P.C. as our independent registered public accounting

firm. In the event our Members fail to ratify the appointment, the Audit Committee may reconsider this appointment.

We

have been advised by WWC, P.C. that neither the firm nor any of its associates had any relationship during the last fiscal year with

our Corporation other than the usual relationship that exists between independent registered public accounting firms and their clients.

Representatives of WWC, P.C. are not expected to attend the Annual Meeting in person and therefore are not expected to be available to

respond to any questions. As a result, representatives of WWC, P.C. will not make a statement at the Annual Meeting.

Audit

Fees

The

following are the fees billed to us by our auditors during the fiscal years ended December 31, 2021 and 2022:

| | |

Fiscal Year Ended

December 31, 2021 | | |

Fiscal Year Ended

December 31, 2022 | |

| Audit Fees | |

$ | 100,000 | | |

$ | 100,000 | |

| Audit Related Fees | |

| - | | |

| - | |

| Tax Fees | |

| - | | |

| - | |

| All Other Fees | |

| - | | |

| - | |

| Total | |

$ | 100,000 | | |

$ | 100,000 | |

Audit

Fees consist of the aggregate fees billed for professional services rendered for the audit of our annual financial statements

and the reviews of the financial statements included in our Forms 6-K and for any other services that were normally provided by our independent

auditor in connection with our statutory and regulatory filings or engagements.

Audit

Related Fees consist of the aggregate fees billed for professional services rendered for assurance and related services that

were reasonably related to the performance of the audit or review of our financial statements and were not otherwise included in Audit

Fees.

Tax

Fees consist of the aggregate fees billed for professional services rendered for tax compliance, tax advice, and tax planning.

Included in such Tax Fees are fees for preparation of our tax returns and consultancy and advice on other tax planning matters.

All

Other Fees consist of the aggregate fees billed for products and services provided by our independent auditor and not otherwise

included in Audit Fees, Audit Related Fees, or Tax Fees. Included in such Other Fees would be fees for services rendered by our independent

auditor in connection with any private and public offerings conducted during such periods.

Vote

Required and Board Recommendation

Approval

of this proposal requires the affirmative vote of a majority of the ordinary shares entitled to vote and present at the Annual Meeting,

and are voted in person or by proxy. Our Board unanimously recommends a vote “FOR” the approval of this proposal to ratify

the appointment of WWC., P.C. as the Corporation’s independent public accounting firm for the fiscal year ending December 31, 2023.

GENERAL

Other

Matters

The

Board of Directors does not know of any matters that are to be presented at the Annual Meeting other than those stated in the Notice

of Annual Meeting and referred to in this Proxy Statement. If any other matters should properly come before the Annual Meeting, it is

the intention of the proxy holder named in the accompanying proxy to vote the ordinary shares he represents as the Board of Directors

may recommend. Discretionary authority with respect to such other matters is expressly granted by the execution of the enclosed proxy.

By

Order of the Board of Directors

Hong

Bee Yin, Chairman of the Board of Directors

November

3, 2023

Exhibit

99.2

JE

Cleantech (JCSE) Announces Annual General Meeting Results

Singapore,

06 December 2023 - JE Cleantech Holdings Limited (Nasdaq: JCSE), (“the Company”) a Singapore-based cleantech company,

today announced the results of the Company’s Annual General Meeting of Members (the “AGM”) held on December 5, 2023,

at the Company’s office located at 3 Woodlands Sector 1, Singapore 738361.

Appointment

of Board of Directors

At

the AGM, the members of the Company approved and ratified the appointment of Hong Bee Yin, Long Jia Kwang, Singh Karmjit, Tay Jingyan,

Gerald and Khoo Su Nee, Joanne as members of the Board of Directors to serve for the ensuing year.

Ratification

of Appointment of WWC, P.C.

At

the AGM, the Company’s members also approved a resolution to ratify the appointment of WWC, P.C. as the Company’s independent

registered public accounting firm for the fiscal year ending December 31, 2023.

About

JE Cleantech Holdings Limited

JE

Cleantech Holdings Limited is based in Singapore and is principally engaged in (i) the sale of cleaning systems and other equipment;

and (ii) the provision of centralized dishwashing and ancillary services. Through its subsidiary, JCS-Echigo Pte Ltd, the Company designs,

develops, manufactures, and sells cleaning systems for various industrial end-use applications, primarily to customers in Singapore and

Malaysia. Its cleaning systems are mainly designed for precision cleaning, with features such as particle filtration, ultrasonic or megasonic

rinses with a wide range of frequencies, high-pressure drying technology, high flow rate spray, and deionized water rinses, which are

designed for effective removal of contaminants and to minimize particle generation and entrapment. The Company also has provided centralized

dishwashing services through its subsidiary, Hygieia Warewashing Pte Ltd, since 2013 and general cleaning services since 2015, both mainly

for food and beverage establishments in Singapore. For more information about JE Cleantech, please visit our website: www.jecleantech.sg.

Disclaimer:

Forward looking statements

This

news release includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities and Exchange Act of 1934, as amended. Forward-looking statements may be identified by such words or phrases as

“should,” “intends,” “is subject to,” “expects,” “will,” “continue,”

“anticipate,” “estimated,” “projected,” “may,” “I or we believe,” “future

prospects,” “our strategy,” or similar expressions. Forward-looking statements involve known and unknown risks and

uncertainties that may cause the actual results to differ materially from those expected and stated in this announcement. Forward-looking

statements speak only as of the date they are made, and JCSE is not under any obligation and expressly disclaims any obligation to update,

alter, or otherwise revise any forward-looking statement, whether as a result of new information, future events, or otherwise, except

as required by law.

Readers

should carefully review the statements set forth in the reports which JCSE has filed or will file from time to time with the Securities

and Exchange Commission (the “SEC”).The documents filed by JCSE with the SEC may be obtained free of charge at the SEC’s

website at www.sec.gov.

Contact:

Jason

Long

Email

address: enquiry@jecleantech.sg

Phone

number: +65 63684198

Other

number: +65 66029468

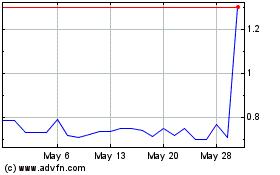

JE Cleantech (NASDAQ:JCSE)

Historical Stock Chart

From Apr 2024 to May 2024

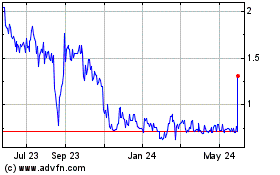

JE Cleantech (NASDAQ:JCSE)

Historical Stock Chart

From May 2023 to May 2024