Today's Logistics Report: China Bites Apple; Cargo Lost at Sea; Leasing into Freighters

January 04 2019 - 11:30AM

Dow Jones News

By Erica E. Phillips

Sign up: With one click, get this newsletter delivered to your

inbox.

China's economic stumbles are reverberating more strongly across

global supply chains. Consumers in the world's second-largest

economy are spending less on discretionary goods and big-ticket

items, the WSJ reports, as costs for basic necessities are soaring.

That's hitting global behemoths like Apple Inc., which roiled

markets this week with word that declining smartphone sales in

China contributed to a sharp falloff in revenue. China's e-commerce

titans Alibaba Group Holding Ltd. and JD.com Inc. are hitting speed

bumps as consumer spending drops. Apple's components suppliers have

already been reporting weaker results as demand has tapered off,

and the company's warning suggests orders may pull back even

further. And that signals other companies focused on selling and

moving goods in China may also start feeling financial pain.

Sometimes those container imports just can't wait to get ashore.

A Mediterranean Shipping Co. vessel lost 270 boxes in rough waters

in the North Sea, the WSJ Logistics Report's Costas Paris writes,

highlighting a rare but nagging side effect of the world's big

ocean trade flows. Geneva-based MSC hired a salvage company to

handle the spill, retrieving cargo from the sea and on Dutch island

beaches where many of the containers made landfall. Container

spills are quite rare in the ocean shipping business, with less

than 1,600 containers lost at sea annually on average, of more than

130 million shipped -- about one thousandth of 1%, according to the

World Shipping Council. Still, the industry is working on safety

measures to reduce losses further, such as verifying container

weights and establishing standard practices for loading containers

onto ships.

TRANSPORTATION

Private-equity investors are gliding into the airfreight

business. KKR & Co. is buying six widebody freighters for $1

billion, the WSJ's Doug Cameron reports, to launch a joint-venture

aircraft leasing business with Seattle-based Altavair LP. KKR is

entering the cargo segment as e-commerce companies including

Amazon.com Inc. are building out their airfreight operations -- a

move that has drawn the attention of other investors, too. KKR said

it's taking a 50% stake in Altavair and may acquire additional

assets beyond the initial six freighters, and may even even splurge

on new planes. The firm is jumping into the business amid signs

that a boom in airfreight demand appears to be tapering off.

Research group WorldACD says November global air cargo volume fell

1.4% from a year ago, and broke from usual patterns by declining 2%

from October to November.

The U.S. auto industry is showing signs of stalling. General

Motors Co.'s U.S. sales fell nearly 3% in the fourth quarter, the

WSJ's Adrienne Roberts writes, as weak business in sedans offset

GM's gains in the SUV market. U.S. automakers sold a total of about

17.2 million vehicles in 2018, defying earlier predictions of a

downturn, but the outlook for 2019 isn't optimistic as interest

rates rise and more consumers are looking to used cars. Escalating

trade tensions with China, which imported $13 billion in vehicles

from the U.S. in 2017, could also drive down U.S. vehicle

production. GM said closing several North American factories and

laying off thousands of workers, and automotive supply chains

already look to be thinning: The Association of American Railroads

says U.S. and Canadian automotive rail shipments fell 4.5% in

November.

The U.S. factory sector is signaling far fewer goods are heading

into distribution channels. The Institute for Supply Management's

manufacturing index declined last month at its steepest rate since

2008, the WSJ's Sharon Nunn and Nick Timiraos write, indicating

manufacturing expansion is coming at a slower rate heading into

2019. Growth of new orders and production also slowed sharply,

while inventories and imports declined, signaling that U.S.

companies are through with their pre-tariff stockpiling. U.S.

imports from China hit record levels last year as many companies

pulled forward orders to get ahead of impending levies on those

goods. "Inventories, rather than foreign trade (imports and

exports), were the trigger for these less-buoyant readings," IHS

Markit economist Michael Montgomery said.

QUOTABLE

IN OTHER NEWS

The U.S. private sector added 271,000 jobs last month. (WSJ)

The number of Americans filing new applications for unemployment

benefits rose by 10,000 last week. (WSJ)

A measure of factory activity in China's manufacturing sector

hit its lowest level in three years. (WSJ)

Copper prices are sliding on worries over economic growth in

China. (WSJ)

General Motors Co. and DoorDash Inc. are partnering on a food

delivery service using autonomous vehicles. (WSJ)

Retailer FullBeauty Brands Inc. is filing for bankruptcy.

(WSJ)

Edward Lampert's ESL Investments Inc. has offered $1.8 billion

for Sears Holdings Corp.'s real estate. (WSJ)

Bristol-Myers Squibb Co. is acquiring cancer-drug maker Celgene

Corp. for about $74 billion. (WSJ)

The American Trucking Associations says the driver turnover rate

tumbled 11 percentage points in the third quarter. (Logistics

Management)

The Teamsters appealed a federal ruling that U.S. law preempts

California's meal-and-break rules for truckers. (Commercial Carrier

Journal)

California officials warned warehouse operators against

contracting with trucking firms that have violated state wage laws.

(The Press-Enterprise)

Patrick Fuchs and Martin Oberman were confirmed to the U.S.

Surface Transportation Board. (Progressive Railroading)

A shortage of railcars led to a decline in shipments last month

at state-owned Coal India. (Nikkei Asian Review).

Norfolk Southern Corp. is adding automated equipment at its

terminals in Chicago and Memphis. (Container News)

A.P. Moeller-Maersk A/S container maker Maersk Container

Industry will shut down a China factory as it focuses on

refrigerated equipment. (Shipping Watch)

The U.S. Coast Guard doubled the number of workers that maritime

companies will have to submit to random drug tests. (Lloyd's

List)

Ocean container shipping rates from China to the U.S. West Coast

have fallen for seven straight weeks. (Lloyd's Loading List)

Russia granted control over the Arctic Northern Shipping Route

to state-run nuclear group Rosatom. (Splash 247)

Extreme weather in the Arctic brought about by climate change

has made shipping conditions there more dangerous. (Financial

Post)

ABOUT US

Paul Page is deputy editor of WSJ Logistics Report. Follow him

at @PaulPage, and follow the entire WSJ Logistics Report team:

@brianjbaskin , @jensmithWSJ and @EEPhillips_WSJ. Follow the WSJ

Logistics Report on Twitter at @WSJLogistics.

Write to Erica E. Phillips at erica.phillips@wsj.com

(END) Dow Jones Newswires

January 04, 2019 11:15 ET (16:15 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

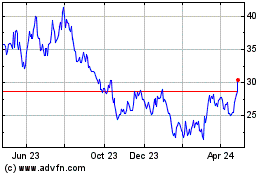

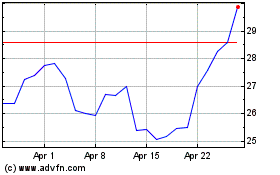

JD com (NASDAQ:JD)

Historical Stock Chart

From Mar 2024 to Apr 2024

JD com (NASDAQ:JD)

Historical Stock Chart

From Apr 2023 to Apr 2024