United States

Securities and Exchange Commission

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of August 2023

Commission File Number 132-02847

INTER & Co, INC.

(Exact name of registrant as specified in its charter)

N/A

(Translation of Registrant’s executive offices)

Av Barbacena, 1.219, 22nd Floor

Belo Horizonte, Brazil, ZIP Code 30 190-131

Telephone: +55 (31) 2138-7978

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes ☐ No ☒

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ☐ No ☒

EXHIBIT INDEX

| | | | | | | | |

| Exhibit No. | | Description of Exhibit |

| | |

| 99.1 | | |

| | |

| | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | | | | |

| | | |

| INTER & Co, INC. |

| By: | /s/ Santiago Horacio Stel |

| | Name: | Santiago Horacio Stel |

| | Title: | Senior Vice President of Finance and Risks |

Date: August 14, 2023

2Q23 Earnings Presentation August 14th, 2023

Disclaimer This report may contain forward-looking statements regarding Inter, anticipated synergies, growth plans, projected results and future strategies. While these forward-looking statements reflect our Management’s good faith beliefs, they involve known and unknown risks and uncertainties that could cause the company’s results or accrued results to differ materially from those anticipated and discussed herein. These statements are not guarantees of future performance. These risks and uncertainties include, but are not limited to, our ability to realize the amount of projected synergies and the projected schedule, in addition to economic, competitive, governmental and technological factors affecting Inter, the markets, products and prices and other factors. In addition, this presentation contains managerial numbers that may differ from those presented in our financial statements. The calculation methodology for these managerial numbers is presented in Inter’s quarterly earnings release. Statements contained in this report that are not facts or historical information may be forward-looking statements under the terms of the Private Securities Litigation Reform Act of 1995. These forward-looking statements may, among other things, beliefs related to the creation of value and any other statements regarding Inter. In some cases, terms such as “estimate”, “project”, “predict”, “plan”, “believe”, “can”, “expectation”, “anticipate”, “intend”, “aimed”, “potential”, “may”, “will/shall” and similar terms, or the negative of these expressions, may identify forward looking statements. These forward-looking statements are based on Inter's expectations and beliefs about future events and involve risks and uncertainties that could cause actual results to differ materially from current ones. Any forward-looking statement made by us in this document is based only on information currently available to us and speaks only as of the date on which it is made. We undertake no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise. For additional information that about factors that may lead to results that are different from our estimates, please refer to sections “Cautionary Statement Concerning Forward-Looking Statements” and “Risk Factors” of Inter&Co Annual Report on Form 20-F. The numbers for our key metrics (Unit Economics), which include active users, as average revenue per active client (ARPAC), cost to serve (CTS), are calculated using Inter’s internal data. Although we believe these metrics are based on reasonable estimates, but there are challenges inherent in measuring the use of our business. In addition, we continually seek to improve our estimates, which may change due to improvements or changes in methodology, in processes for calculating these metrics and, from time to time, we may discover inaccuracies and make adjustments to improve accuracy, including adjustments that may result in recalculating our historical metrics. About Non-IFRS Financial Measures To supplement the financial measures presented in this press release and related conference call, presentation, or webcast in accordance with IFRS, Inter&Co also presents non-IFRS measures of financial performance, as highlighted throughout the documents. The non-IFRS Financial Measures include, among others: Adjusted Net Income, Cost to Serve, Cost of Funding, Efficiency Ratio, Underwriting, NPL > 90 days, NPL 15 to 90 days, NPL and Stage 3 Formation, Cost of Risk, Coverage Ratio, Funding, All-in Cost of Funding, Gross Merchandise Volume (GMV), Premiuns, Net Inflows, Global Services Deposits and Investments, Fee Income Ratio, Client Acquisition Cost, Cards+PIX TPV, Gross ARPAC, Net ARPAC, Marginal NIM 1.0, Marginal NIM 2.0, Net Interest Margin IEP + Non-int. CC Receivables (1.0), Net Interest Margin IEP (2.0), Cost-to-Serve. A “non-IFRS financial measure” refers to a numerical measure of Inter&Co’s historical or financial position that either excludes or includes amounts that are not normally excluded or included in the most directly comparable measure calculated and presented in accordance with IFRS in Inter&Co’s financial statements. Inter&Co provides certain non-IFRS measures as additional information relating to its operating results as a complement to results provided in accordance with IFRS. The non-IFRS financial information presented herein should be considered together with, and not as a substitute for or superior to, the financial information presented in accordance with IFRS. There are significant limitations associated with the use of non-IFRS financial measures. Further, these measures may differ from the non-IFRS information, even where similarly titled, used by other companies and therefore should not be used to compare Inter&Co’s performance to that of other companies.

Agenda CEO Overview Banking - Credit & Funding Capabilities Transactional Platform Financial Performance

Agenda CEO Overview Banking - Credit & Funding Capabilities Transactional Platform Financial Performance

A quarter of records

The “quarter of records” in Inter’s journey Revenue Quality Operational Leverage Interest Margins Bottom Line Expanding Total Gross Revenue1 R$1.9bn +33% YoY Financials Record low Efficiency Ratio1 53% -9.0 p.p. QoQ Growing NIM 2.01 9.5% Delivering EBT2 +0.9 p.p QoQ R$80mm Vs. 16mm 2Q22 Clients Base Growing Total Clients 28mm +1.5 mm QoQ Activation Rate Increasing Active Clients1 Loyalty Vertical Engagement Activation Monetization Global App Flexible Scalable Seamlessly UX Operational & Innovative Releasing Note 1: Definitions are in the Glossary section of this Earnings Presentation. Note 2: “Profit / (loss) before income tax” in the Income Statements of the IFRS Financial Statements. Launching 52.2% +68 bps QoQ

Introducing our seventh vertical: Inter Loop Integrated business model BANKING & SPENDING CREDIT SHOP INSURANCE INVEST GLOBAL LOYALTY Build Client Base & Funding Grow Monetization & Activation Expand Gaining Market Share

A Quarter of Records Innovative & Profitable Business Model Growth Gaining market share and scale Innovation Enhancing the Super App offer, staying true to our DNA Profitability Monetizing clients in a profitable manner While attracting & engaging a record number of clients

Agenda CEO Overview Banking - Credit & Funding Capabilities Transactional Platform Financial Performance

ROE-driven loan portfolio growth 72.1% 8 .0 0% Credit Cards Annualized Interest Rates 52.8% 14.1% 22.1% 7 .0 0% 20.3% 6 .0 0% 5 .0 0% 16.2% 4 .0 0% 3 .0 0% All-in Loans Yield Payroll + FGTS

SMBs In % 13.3% 13.9% 2 .0 0% Real Estate 11.8% 11.3% 10 .0 % 0.0% 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 10 .0 5 .0 Gross Loan Portfolio In R$ Billion 8.8 4.8 16% 10% 21% 17.5 2% 17.2 27% 4% 17% 24.5 8% 19.9 2% 19.5 30% 2% 15% 1% 21% 25.1 5% 23.8 29% % YoY % Qo + 0.0 2019 2020 2021 2022 2Q22 1Q23 2Q23 Note: All definitions are in the Glossary section of this Earnings Presentation. Note 1: Home Equity includes both business and individuals’ portfolio.

CEO Overview Banking Transactional Platform Financial Performance Closing Remarks Appendix

1100

Asset quality following macro trends NPL 15 to 90 days In % 4.6% 4.6% 4.5% 4.5% 4.6% 4.4% NPL > 90 days In % 3.5% 3.9% 4.0% 4.4% 4.7% 4.9% 4.7% 4.5% 4.5% 4.3% 4.1%

4.3% 4.2% 3.4% 3.8% 3.8% 4.1% 4.4% 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23

NPL 15-90 days NPL 15-90 days (Excl. Antic. of CC Receivables) Credit Cards NPL > 90 days per cohort1 In % 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 NPL > 90 days NPL > 90 days (Excl. Antic. of CC Receivables) NPL and Stage 3 Formation2 In % 1Q23 1.0% 1.0% 1.1% 1.3% 1.1% 1.3%

1.5% 1.5% 1.5% 1.6% 1.6% 1.5% 1Q21 3 4 5 6 7 8 9 10 11 12 Quarters of relationship 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 NPL Formation Stage 3 Formation Note 1: Cohorts defined as the first date when the client has his limit available. NPL per cohort = NPL > 90 days balance of the cohort divided by total credit card portfolio of the same cohort. Note 2: NPL formation is calculated considering: (overdue balance higher than 90 days in the current quarter – overdue balance higher than 90 days in the previous quarter + write-off change in the current quarter) ÷ Credit Portfolio Balance in the previous quarter. Stage 3 Formation = ( Δ Stage 3 Balance + Write-Offs of the period ) ÷ Total Credit Balance of previous period. From 1Q23 onwards IFRS and BACEN GAAP write-off methodology converged.

CEO Overview Banking Transactional Platform Financial Performance Closing Remarks Appendix

Provisioning level maintaining stable coverage ratio Cost of Risk1 In % Coverage Ratio In % 126% 129% 141% 132% 131% 130% 4.9% 5.2% 5.2% 4.8% 4.8% 5.1% 5.0% 4.5% 6.5%

6.0% 5.6% 6.2% 2.1% 1.1% 1.9% 1.0% 1.1% 1.1% 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 Cost of Risk (Excl. Antic. of CC Receiva bles) Cost of Risk Cost of risk (Excluding CC) Note: All definitions are in the Glossary section of this Earnings Presentation. Note 1: 1Q22: managerial number, excluding non-recurrent provision. CEO Overview Banking Transactional Platform Financial Performance Closing Remarks Appendix

Continued success in attracting retail deposits Funding In R$ Billion 67.2% 64.5% 67.5% 61.9% 61.2% 65.0% 63.3% % YoY % QoQ -2.1 p.p. -1.7 p.p. All-In Cost of

Funding as % of CDI 29.8 30.8 33.3 5%; 1.6 +45 29% +8% +14% +6% Total Other1

+13.2 million clients 6.4 6%; 0.4 27%; 1.7 14.2 21.9 25.9 +15% +6% +52% +11% +20% +6%

Securities Issued Time Deposits2 Transactional Accounts Balance3 trusting Inter with their deposits

2019 2020 2021 2022 2Q22 1Q23 2Q23 Note 1: Includes saving deposits and creditors by resources to release. Note 2: Excluding Conta com Pontos correspondent balance. Note 3: Includes Conta com Pontos correspondent balance and demand deposits.

CEO Overview Banking Transactional Platform Financial Performance Closing Remarks Appendix

1133

Agenda CEO Overview Banking - Credit & Funding Capabilities Transactional Platform Financial Performance

Strong adoption combining higher activation with low CAC Total Number of Clients In Million

+ 2.0 mm +2.2 mm 20.7 22.8 + 1.9 mm + 1.6 mm 24.7 + 1.5 mm 26.3 27.8 Client Acquisition Cost In R$, quarterly 32.1 29.0 28.3 -16% YoY 30.4 29.8 27.1 18.6 1 mm + 0.9 m 10.7 .9 mm + 1.0 mm

12.6 + 1.0 mm 14.5 13.5 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 Active Clients 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 Marketing Costs Operational Costs CEO Overview Banking Transactional Platform Financial Performance Closing Remarks Appendix

Transactional banking continues its path of strong growth Cards + PIX TPV1 In R$ Million 92 80 109 111 94 97 134 118 155 138 178 181 158 163 197 177 % YoY +47% +50% % QoQ +9% +9% Cards + PIX TPV per Active Client In R$, monthly 10 9 8 7 6 5 67 44 58 37 12 14 14 16 46% 17 46% 19 45%

18 46% 20 47% +22% +26% +6% 4 +8% 3 2Q23 8 38% 62% 9 38% 62% 39% 61% 42% 58% 45% 55% 54%

54% 55% 54% 53% +20% 2 +5% 1 1Q18 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 Debit Credit PIX 0 1 4 7 10 13 16 19 22

Quarters of relationship Note 1: Height of PIX volume was reduced to fit on page. CEO Overview Banking Transactional Platform Financial Performance Closing Remarks Appendix

Enhancing performance across all business verticals Enhancing performance across all business verticals Active Clients In Million é 35% 2.0 2.7 Active Clients In Million é 46% 1.5 Active Clients In Million 1.0 9mm Transactions1 2Q23 é 24% YoY 2Q22 2Q23 +R$756 million GMV x 8.9% Net Take Rate 344k Total sales 2Q23 é 26% YoY 2Q22 2Q23 +R$48 million Premium High margin business R$77bn AuC 2Q23 é 41% YoY 2Q22 2Q23 Strong AuC growth R$7.5bn 3rd Party Fixed Income Note 1: Number of transactions through Inter Shop during the quarter. CEO Overview Banking Transactional Platform Financial Performance Closing Remarks Appendix 1177

New rewards program to drive synergies across business verticals Introducing our New Rewards Program

More Options for Clients Earn points: Credit Card Bills “Conta com Pontos” Missions Accomplishments

+ 3 Million clients in 2 months Burn points: Cashback Extra Cashback in Inter Shop Credit Card Bill Discount Airline Miles Investments Connecting all verticals Before Only Cashback Now Cashback + Multiple Options Unlocking Significant Results for Inter CEO Overview Banking Transactional Platform Financial Performance Closing Remarks Appendix 18

Keeping our innovative DNA with a prudent approach in the US Product Rollout Remittances Gift Cards Pipeline Global Services Clients1 In Thousand + 335 AuC & Deposits in US Dollars In USD Million More than 710k Brazilian travelled to US from Jan to Jun in 20232 + 91 + 360 + 625 501

+ 320 1,127 1,447 1,782 é 30 8 20x 84 56 26 142 20 41 68 221 20 66 115 Real estate fund Deposit balance3 Assets under Custody4 50 141 11 4 42 49 Securities5 2 10 26

6 9 14 20 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 - -

1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 Note 1: Includes Brazilian Global Account clients, US clients and International Investors. Note 2: Source: Panrotas.com.br. Note 3: Amount included in Demand Deposit balance on IFRS Financial Statement. Note 4: Assets under APEX Custody. Note 5: Securities under APEX Custody. CEO Overview Banking Transactional Platform Financial Performance Closing Remarks Appendix 1199

Agenda CEO Overview Banking - Credit & Funding Capabilities Transactional Platform Financial Performance

Accelerating revenues with balanced mix of NII and fees Revenue In R$ Million 636 544 837 607 1,100

731 25% 1,540 1,461 1,281 834 877 850 35% 36% 35% 1,800 1,704 1,002 1,024 33% 31%

1,939 1,150 30% % YoY +33% +31% +10% • Reacceleration of fee revenue across business lines

• Strong NII growth given repricing and better loan mix 467 417 30% 35% 70% 65%

26% 74% 75% 65% 64% 65% 67% 69% 70% +43% Acceleration 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23

Engagement and activation drives higher ARPAC across cohorts Gross ARPAC By Cohort In R$, monthly

90 75 60 45 30 15 R$87 Mature ARPAC ARPAC In R$, monthly 43.7 45.6 47.3 45.9 46.9

45.9 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 Quarters of relationship 37.1 Net ARPAC By Cohort In R$, monthly 60 50 R$56 Mature ARPAC 31.9 32.1

40 Avg. ARPAC 2Q23 30 20 10 1Q18 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 Quarters of relationship 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 Net ARPAC Gross ARPAC CEO Overview Banking Transactional Platform Financial Performance Closing Remarks Appendix 2222

Strong NIM expansion, reaching highest levels in multiple years

1 Conversion to Market 2 Ongoing Repricing 3 Loan Mix Change

4 Evolution into 2H23 10. 0% 9. 0% 8. 0% 7. 0% 6.4% 7.3% 8.1% 8.3% 8.0% 8.1%

7.2% 7.3% 6.9% 7.0% 6.4% 7.4% 7.2% 8.4% 8.7% 7.4% 9.5% 8.1% Conta com Pontos

full implementation 6. 0% 5. 0% Scale New Products Overdraft, BNPL, Auto 4. 0% 3. 0% 2. 0% SELIC decrease downward trend 1.0 % 0. 0% 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 NIM 1.0 - IEP + Non-int. CC Receivables (%) NIM 2. 0 - IEP Only (%) CEO Overview Banking Transactional Platform Financial Performance Closing Remarks Appendix 23

Expense control strategies proving successful Expenses Breakdown1 In R$ Million 603 685 8 43 % YoY % QoQ +3% -3% Total Expenses 1 592 634 596 575 -49% -41% Share-based comp.2

602 558 557 8 8 10 6 6 10 -10% +64% M&A2 4 12 12 576 579 555 533

171 559 +5% -4% Expenses Excl. M&A & SBC 202 175 148 166 189 157 127 -14% -19% Other3 146

19 141 36 149 36 160 36 56 156 38 170 41 +14% +9% Personnel4 +16% +9% D&A 45 190 43 159 32

169 23 190 40 178 20 209 21 200 -35% +18% +5% -4% Advertising & marketing Data processing5

5 0 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 - 5 Strong opportunity to continue delivering operating leverage Note 1: IFRS Financial Statements lines: “Personnel expenses”, “Depreciation and Amortization”, “Administrative Expenses”. Note 2: Share-based and M&A Expenses are included in Personnel Expenses in the Income Statement. Note 3: Others = third party services; rent, condominium fee and property maintenance; provisions for contingencies and Financial System services. Note 4: Personnel Expenses excluding Share-based and M&A Expenses. Salaries and benefits (including Board). Note 5: Data processing and information technology. CEO Overview Banking Transactional Platform Financial Performance Closing Remarks Appendix 224

Boosting employee productivity to improve efficiency Active Clients per Employee1 In Thousand

+ 0.7 4.2 Cost-to-Serve In R$, monthly Headcount optimization from 4.1k in December to 3.4k in June

+ 0.2 2.3 + 0.1 2.5 2.6 + 0.3 2.9 + 0.2 + 0.4 3.1 3.5 21.2 17.5 -20% YoY 17.1 15.7 15.8

13.8 12.5 0. 5 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 Note 1: Including interns. CEO Overview Banking Transactional Platform Financial Performance Closing Remarks Appendix 225

Meaningful improvements in operational leverage Revenue vs. Expenses In %, index in a 100 basis

Efficiency Ratio In % 88% 114 119 117 120 115 163 137 140 117 108 158 127 Net revenue1 Personnel Expenses 64% 72% 49% 68% 43% 75% 73% 48% 42% 62% 40% 53% Total 10 00 99 95 89 89 96 91

Personnel + Administrative Expenses 22% 21% 22% 26% 32% Administrative Eff. Ratio

86 87 89 88 80 Administrative Expenses 80 19% 18% 17% Personnel Eff. Ratio

7 0 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 Record low efficiency ratio proving that we are doing more with less Note: All definitions are in the Glossary section of this Earnings Presentation. Note 1: Net revenue = net revenue - tax expenses. CEO Overview Banking Transactional Platform Financial Performance Closing Remarks Appendix 26

Strongly capitalized balance sheet structure Tier I Ratio In % 32.9% 29.8% - 0.2 p.p. • Capital ratio purely comprised of high-quality core Tier I capital • Several opportunities to continue redeploying capital into loan growth • Approximately 2x Brazil 5 largest banks capital base

Tier-I Ratio In % 24.1% 23.0% 22.8% 22.8% ~2x 14.9% 14.7% 13.5% 12.6% 11.8%

2Q22 3Q22 4Q22 1Q23 2Q23 Inter Bank 1 Bank 2 Bank 3 Bank 4 Bank 5

Source: 2Q23 Banco Inter Bacen GAAP Financial Statements and Companies Financial Statements.

Latest Tier-I of Brazil’s 5 Largest Banks CEO Overview Banking Transactional Platform Financial Performance Closing Remarks Appendix 2277

Record profitability since IPO Speeding up our path to profitability Earnings Before Tax & Net Income In R$ Million | Inter&Co 12 Δ YoY 80 +7x 6 Δ QoQ +14x Pre-tax Income -20 64 +4x +3x

Net Income -111 -100 -70 16 29 24 (29) (30) (56) 4Q21 1Q22 2Q22 3Q221 4Q22 1Q23 2Q23

Note 1: Adjusted Net Income for the third quarter of 2022 is presented for illustrative purposes only and does not reflect our actual results. ‘3Q22 Adjusted’ (non-IFRS measure) excludes the non-recurring effects of deflation in 3Q22 and assumes the inflation projected for 2023 from the Focus Report of Brazilian Central Bank, divided by four. The unadjusted figure for deflation was R$ (30).

CEO Overview Banking Transactional Platform Financial Performance Closing Remarks Appendix

2288

Closing Remarks

“A quarter of records Total Gross Revenue R$1.9bn NIM 2.0 9.5% Total Clients 28mm Rewards Launch

Efficiency Ratio 53% Earnings Before Tax R$80mm Active Clients 52.2% Global App Launch

Q&A

Appendix

Balance Sheet (In R$ Million) Income Statement (In R$ Million) Variation % 06/30/2023 06/30/2022 ∆YoY Variation % 2Q23 2Q22 ∆YoY CEO Overview Banking Transactional Platform Financial Performance Closing Remarks Appendix Balance Sheet Assets Cash and cash equivalents 3,672 1,549 137% Amounts due from financial institutions 2,557 1,825 40% Compulsory deposits 1,704 2,581 -34% Securities 14,170 12,710 11% Derivative financial instruments 4 3 13% Net loans and advances to customers 23,524 18,510 27% Non-current assets held-for-sale 177 161 10% Equity accounted investees 72 81 -11% Property and equipment 179 201 -11% Intangible assets 1,303 1,190 10% Deferred tax assets 940 932 1% Other assets 1,701 1,191 43% Total assets 50,003 40,934 22% Liabilities Liabilities with financial institutions 8,024 6,945 16% Liabilities with clients 26,299 19,746 33% Securities issued 7,006 6,104 15% Derivative financial liabilities 28 66 -58%

Other liabilities 1,328 957 39% Total Liabilities Equity 42,686 33,818 26%

Total shareholder's equity of controlling shareholders 7,204 7,034 2% Non-controlling interest 114 81 40% Total shareholder's equity 7,318 7,115 3% Total liabilities and shareholder's equity 50,003 40,934 22% Income Statement (In R$ Million) Income Statement

Interest income from loans 1,151 622 85% Interest expenses (692) (465) 49%

Income from securities and derivatives 343 404 -15% Net interest income 802 561 43% Revenues from services and commissions 299 239 25% Expenses from services and commissions (32) (34) -7% Other revenues 81 111 -27% Revenue 1,150 877 31% Impairment losses on financial assets (399) (242) 64% Net result of losses 751 635 18% Administrative expenses (348) (349) 0% Personnel expenses (186) (172) 8%

Tax expenses (72) (62) 18% Depreciation and amortization (41) (36) 16%

Income from equity interests in affiliates (23) (4) N/M Profit / (loss) before income tax 80 12 N/M Income tax and social contribution (16) 4 N/M Profit / (loss) 64 16 N/M

Glossary of operational definitions Active clients: We define an active client as a customer at any given date that was the source of any amount of revenue for us in the preceding three months, or/and a customer that used products in the preceding three months. For Inter insurance, we calculate the number of active clients for our insurance brokerage vertical as the number of beneficiaries of insurance policies effective as of a particular date. For Inter Invest, we calculate the number of active clients as the number of individual accounts that have invested on our platform over the applicable period. Active clients per employee: Number of active clients at the end of the quarter

Total number of employees at the end of the quarter, including interns Client acquisition cost (CAC): The average cost to add a client to the platform, considering operating expenses for opening an account, such as onboarding personnel, embossing and sending cards and digital marketing expenses with a focus on client acquisition, divided by the number of accounts opened in the quarter. Gross merchandise volume (GMV): Gross merchandise value, or GMV, for a given period as the total value of all sales made or initiated through our Inter Shop & Commerce Plus platform managed by Inter Shop & Commerce Plus. Activity Rate: Number of active clients at the end of the quarter Total number of clients at the end of the quarter Gross take rate: Inter Shop gross revenue GMV Card+PIX TPV:

PIX, debit and credit cards and withdrawal transacted volumes of a given period. PIX is a Central Bank of Brazil solution to bring instant payments among banks and financial institutions in Brazil.

Net take rate: Inter Shop net revenue GMV Card+PIX TPV per active client: Card+PIX TPV for a given period divided by the number of active clients as of the last day of the period. Primary Banking Relationship: A client who has 50% or more of their income after tax for that period flowing to their bank account with us during the month. CEO Overview Banking Transactional Platform Financial Performance Closing Remarks Appendix 3344

Glossary of financial measures reconciliation Administrative efficiency ratio: (Administrative expenses+Depreciation and amortization)/(Net Interest Income+Net result from services and comissions+Other revenue−Tax expense) Annualized interest rates: Yearly rate calculated by multiplying the quarterly interest by four, over the average portfolio of the last two quarters. All-in loans rate considers Real Estate, Payroll +FGTS, SMBs, Credit Card, excluding non-interest earnings credit card receivables, and Anticipation of Credit Card Receivables. Anticipation of credit card receivables: Disclosed in note 9.a of the Financial Statements, line " "Loans to financial institutions”. ARPAC gross of interest expenses: (Interest income + (Revenue from services and comissions − Cashback − Inter rewards) + Income from securities and derivarives + Other revenue) ÷ 3 Average of the last 2 quarters Active Clients ARPAC net of interest expenses: (Revenue − Interest expenses) ÷ 3 Average of the last 2 quarters Active Clients ARPAC per quarterly cohort: Total Gross revenue net of interest expenses in a given cohort divided by the average number of active clients in the current and previous periods1. Cohort is defined as the period in which the client started his relationship with Inter. 1 - Average number of active clients in the current and previous periods: For the first period, is used the total number of active clients in the end of the period. Card fee revenue: It is part of the “Revenue from services and commission” and “Other revenue” on IFRS Income Statement. Cost of funding: Interest expenses × 4 Average of last 2 quarters Interest bearing liabilities (demand deposits, time deposits, savings deposits, creditors by resources to release and securities issued) Cost of risk: Impairment losses on Kinancial assets × 4 Average of last 2 quarters of Loans and advances to customers Cost of risk excluding anticipation of credit card receivables: Impairment losses on Kinancial assets × 4 Average of last 2 quarters of Loans and advances to customers excluding anticipation of credit card receivables Cost of risk excluding credit card: Impairment losses on Kinancial assets × 4 Average of last 2 quarters of Loans and advances to customers excluding credit card Cost-to-serve (CTS): Assets under custody (AuC): We calculate assets under custody, or AUC, at a given date as the market value of all retail clients’ assets invested through our investment platform as of that same date. We believe that AUC, as it reflects the total volume of assets invested in our investment platform without accounting for our operational efficiency, provides us useful insight on the appeal of our platform. We use this metric to monitor the size of our investment platform. CEO Overview Banking Transactional Platform (Personnel Expense + Administrative Expenses − Total CAC) ÷ 3 Average of the last 2 quarters Active Clients Financial Performance Closing Remarks Appendix 3355

Glossary of financial measures reconciliation Coverage ratio: Provision for expected credit loss Overdue higher than 90 days Net interest income: Interest Income + Interest Expenses + Income from securities and derivatives Earning portfolio (IEP): Earnings Portfolio includes “Amounts due from financial institutions” + “Loans and advances to customers” + “Securities” + “Derivatives” from the IFRS Balance Sheet. Efficiency ratio: Personnel expense + Administrative expenses + Depreciation and amortization Net Interest Income + Net result from services and comissions + Other revenue − Tax expense Net revenue: Net interest income + Net result from services and commissions + Other revenue

NIM 1.0 – IEP + Non-interest Credit Cards Receivables: Net interest income x 4 Average of 2 Last Quarters Earning Portfolio (Loans to Minancial institutions + Securities + Derivatives + Net loans and advances to customers Fee income ratio: Net result from services and commissions + Other revenue

NIM 2.0 – IEP Only: Net Interest Income + Net result from services and comissions + Other revenue − Tax expense Funding: Demand Deposits + Time Deposits + Securities Issued + Savings Deposits + Creditors by Resources to Release Gross loan portfolio: Net interest income x 4 Average of 2 Last Quarters Earning Portfolio − Non − interest − Bearing Credit Cards Receivables (Amounts due from Minancial institutions + Securities + Derivatives + Net loans and advances to customers – Credit card transactor portfolio) NPL 15 to 90 days: Loans and Advance to Customers + Loans to financial institutions Overdue 15 to 90 days Loans and Advance to Costumers + Loans to Minancial institutions

Net fee income: Net result from services and commissions + Other Revenue NPL > 90 days: Overdue higher than 90 days Loans and Advance to Costumers + Loans to Minancial institutions CEO Overview Banking Transactional Platform Financial Performance Closing Remarks Appendix 3366

Glossary of financial measures reconciliation NPL formation: Overdue balance higher than 90 days in the current quarter – Overdue balance higher than 90 days inthe previous quarter + Write − off change in the current quarter Total loans and advance to customers in the previous quarter Personal efficiency ratio: Personnel expense Net Interest Income + Net result from services and comissions + Other revenue − Tax expense Return on average equity (ROE): (ProMit / (loss) for the quarter)× 4 Average of last 2 quarters of total shareholder`s equity Stage 3 formation: Stage 3 balance in the current quarter – Stage 3 balance in the previous quarter + Write − off change in the current quarter Total loans and advance to customers in the previous quarter Tier I ratio: Tier I referential equity Risk weighted assets Total gross revenue: Interest income + Revenue from services and commissions − Cashback expenses − Inter rewards + Income from securities and derivatives + Other revenue CEO Overview Banking Transactional Platform Financial Performance Closing Remarks Appendix 3377

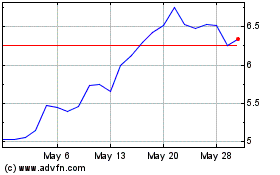

Inter (NASDAQ:INTR)

Historical Stock Chart

From Apr 2024 to May 2024

Inter (NASDAQ:INTR)

Historical Stock Chart

From May 2023 to May 2024