Integra's New Extremity Offering - Analyst Blog

February 10 2012 - 12:08PM

Zacks

In an attempt to consolidate its position in the Extremity

Reconstruction business, which has witnessed disappointing sales

performance in the recent past, medical products company

Integra LifeSciences Holdings Corporation (IART)

recently launched its new Allograft Wedge System.

Developed from human cancellous bone, the Integra Allograft

Wedge is sterilized through the BioCleanse Tissue Sterilization

Process. This is also terminally sterilized using a validated

method to attain a Sterility Assurance Level (SAL) of

10-6. This system comprises simple pre-cut allograft

wedges for both Evans and Cotton osteotomies and a set of

instruments designed to provide a method of assessing osteotomy

space to aid in the selection of the appropriate Integra Allograft

Wedge implant.

Integra’s Extremity Reconstruction sales organization, which

works on lower extremity fixation, upper extremity fixation, tendon

protection, peripheral nerve repair/protection and wound repair,

distributes this Allograft Wedge System in four sizes (6, 8, 10 and

12mm). The company claims that this variation in size will help the

surgeons limit the uncertainty by accommodating a patient's unique

surgical needs.

For the past few quarters, Integra has been witnessing several

headwinds in the form of weakness in the extremities and spine

markets leading to softer procedural volume and

tough competitive environment. The company is facing stiff

competition from large-cap players like Medtronic

(MDT) and Stryker Corp. (SYK) in the extremities

fixation market. Additionally, the challenging macroeconomic

environment in Europe and continued softness in the US is leading

to lower sales in Spine and Orthobiologics.

Earlier this month, while reporting preliminary results for the

fourth quarter and full year 2011, the company estimated quarterly

revenues in the range of $202–$203 million (way below the

previously announced guidance of $208.5–223.5 million). The company

believes the poor performance is primarily due to the disappointing

sales of Extremity Reconstruction products in the domestic

market.

To worsen the situation, Integra recently received a warning

letter from the US Food and Drug Administration (FDA) pertaining to

quality systems and compliance issues at its collagen manufacturing

facility in Plainsboro, New Jersey. Earlier in August, the company

received a Form 483 observation from the FDA regarding

manufacturing concerns at this collagen manufacturing facility.

Collagen products currently represent roughly 23% of total sales

and are manufactured at two facilities (the second in Puerto Rico).

We remain apprehensive regarding the FDA warning letter as it may

weigh down the stock further.

Although the company is taking several steps like planned

product launches and acquisition strategy to navigate through these

difficulties, the challenging macroeconomic environment remains a

headwind for the turnaround. Currently, Integra retains a Zacks #4

Rank (Short-term Sell). Considering the company’s business model

and fundamentals, we have a long-term Neutral recommendation on the

stock.

INTEGRA LIFESCI (IART): Free Stock Analysis Report

MEDTRONIC (MDT): Free Stock Analysis Report

STRYKER CORP (SYK): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

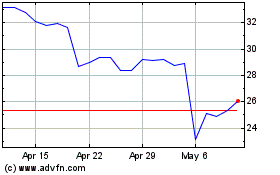

Integra LifeSciences (NASDAQ:IART)

Historical Stock Chart

From Aug 2024 to Sep 2024

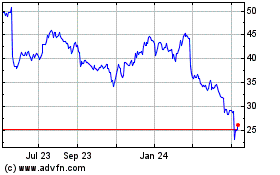

Integra LifeSciences (NASDAQ:IART)

Historical Stock Chart

From Sep 2023 to Sep 2024