Integra's Prelim Results Disappoint - Analyst Blog

January 06 2012 - 5:00AM

Zacks

Integra LifeSciences

Holdings Corporation (IART) reported disappointing

preliminary results for the fourth quarter and full year 2011.

Integra expects to report total

revenue in the range of $202–$203 million, way below the previously

announced guidance of $208.5–223.5 million. Sluggish sales during

the quarter resulted from the inventory reduction initiatives by

the company’s instrument distributors, worldwide weaker economy and

disappointing sales of Extremity Reconstruction products in the

domestic market. Based on this initial guidance, the company’s

fiscal 2011 revenues are expected to be around $778.5–779.5 million

(lower than the guided range of $785–$800 million).

Adjusted EPS in the fourth quarter

is expected in the range of 65–70 cents, lagging considerably from

the previously stated range of 75–83 cents. Fiscal 2011 adjusted

EPS of $2.74–$2.79 also compared unfavorably with the previously

announced adjusted EPS outlook of $2.88–$2.96. Earlier, while

reporting the third quarter result, Integra anticipated the

acquisition of Ascension Orthopedics (acquired in October 2011) to

dilute its adjusted EPS by 5–6 cents in the fourth quarter.

The company also lowered its 2012

revenue guidance. Integra currently expects 2012 sales to increase

roughly 8% on a constant currency basis, and 7% on a reported basis

over 2011 revenues, which is well below than the earlier provided

guidance of 10%. This was in the wake of weak fourth quarter result

combined with stronger domestic currency compared to Euro, volatile

international economy and lower growth expectations for the

domestic extremity product lines.

For the past few quarters, Integra

has been witnessing several headwinds in the form of weakness in

the extremities and spine markets leading to softer procedural

volume, tough competitive environment in global knee and hip

replacement market, challenging macroeconomic environment in Europe

and continued softness in the US leading to lower sales in Spine

and Orthobiologics.

To worsen the situation, Integra

recently received a warning letter from the US Food and Drug

Administration (FDA) pertaining to quality systems and compliance

issues at its collagen manufacturing facility in Plainsboro, New

Jersey. Earlier in August, the company received a Form 483

observation from the FDA regarding manufacturing concerns at this

collagen manufacturing facility. Collagen products currently

represent roughly 23% of total sales and are manufactured at two

facilities (the second in Puerto Rico). We are anxious regarding

the FDA warning letter as it may weigh down the stock further.

However, the company is taking

several steps to navigate through these difficulties. Earlier in

December, the company saw a change at its helm with the appointment

of Mr. Peter Arduini as the new President and Chief Executive

Officer. Mr. Arduini was earlier the President of Medication

Delivery at Baxter Healthcare, a $4.8 billion global business of

Baxter International (BAX).

Integra faces direct competition in

the medical instruments & supplies industry from major players

like Medtronic (MDT) and Stryker

Corp. (SYK). Currently, the company retains a Zacks #3

Rank (Short-term ‘Hold’). Considering the company’s business

model and fundamentals, we have a long-term ‘Neutral’

recommendation on the stock.

BAXTER INTL (BAX): Free Stock Analysis Report

INTEGRA LIFESCI (IART): Free Stock Analysis Report

MEDTRONIC (MDT): Free Stock Analysis Report

STRYKER CORP (SYK): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

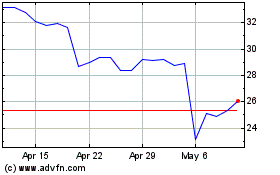

Integra LifeSciences (NASDAQ:IART)

Historical Stock Chart

From May 2024 to Jun 2024

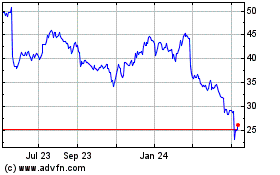

Integra LifeSciences (NASDAQ:IART)

Historical Stock Chart

From Jun 2023 to Jun 2024