0001711754

false

0001711754

2023-08-16

2023-08-16

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

August 16, 2023

| INMUNE BIO INC. |

| (Exact name of registrant as specified in charter) |

| Nevada |

|

001-38793 |

|

47-5205835 |

| (State or other jurisdiction |

|

(Commission File Number) | |

(IRS Employer |

| of incorporation) |

|

|

|

Identification No.) |

225 NE Mizner Bl vd., Suite 640, Boca Raton,

Florida 334327

(Address of Principal Executive Offices) (Zip Code)

(858) 964 3720

(Registrant’s Telephone Number, Including

Area Code)

Not Applicable

(Former Name or Former Address, If Changed Since

Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mart if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act.

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.001 per share |

|

INMB |

|

The NASDAQ Stock Market LLC |

Item 1.01. Entry into a Material Definitive Agreement.

As previously reported on a Current Report on Form 8-K, on March 10,

2021, INmune Bio Inc. (the “Company”), entered into an At-The-Market Sales Agreement (the “Sales Agreement”) with

BTIG, LLC (“BTIG”), pursuant to which the Company may offer and sell, from time to time, through BTIG, as sales agent, shares

of its common stock, par value $0.001 per share (the “Common Stock”), having an aggregate offering price of up to $45,000,000,

subject to certain limitations on the amount of Common Stock that may be offered and sold by the Company set forth in the Sales Agreement.

The Company is not obligated to make any sales of Common Stock under the Sales Agreement and any determination by the Company to do so

will be dependent, among other things, on market conditions and the Company’s capital raising needs.

On August 16, 2023, the Company and BTIG entered into Amendment No.

1 to the Sales Agreement (“Amendment No. 1 to the Sales Agreement”) in order to provide that the offers and sales of Common

Stock by the Company under the Sales Agreement, as amended, if any, will be made through a prospectus supplement to the prospectus forming

a part of the Company’s shelf registration statement on Form S-3 (File No. 333-254221) declared effective by the Securities

and Exchange Commission (the “SEC”) on May 5, 2021 (the “Registration Statement”). The Company filed with the

SEC a prospectus supplement dated August 16, 2023, specifically relating to offers and sales of Common Stock under the Sales Agreement

(the “ATM Prospectus Supplement”), together with the prospectus forming a part of the effective registration statement.

Shares may be sold through the ATM Prospectus Supplement by any method

deemed to be an “at the market offering” as defined in Rule 415(a)(4) under the Securities Act of 1933, as amended, including

sales made through The Nasdaq Capital Market or any other trading market for the common stock, sales made to or through a market maker

other than on an exchange or through an electronic communications network, or in negotiated transactions pursuant to terms set forth in

a placement notice delivered by the Company to BTIG under the Sales Agreement. Upon delivery of a placement notice and subject to the

terms and conditions of the Sales Agreement, BTIG will use commercially reasonable efforts, consistent with its normal trading and sales

practices, applicable state and federal law, rules and regulations, and the rules of The Nasdaq Capital Market, to sell the Shares from

time to time based upon the Company’s instructions, including any price, time or size limits specified by the Company. BTIG is not

obligated to purchase any shares of Common Stock on a principal basis pursuant to the Sales Agreement.

The foregoing description of Amendment No. 1 to the Sales Agreement

does not purport to be complete and is qualified in its entirety by reference to the full text of the Amendment No. 1 to the Sales Agreement.

A copy of the Amendment No. 1 to the Sales Agreement is filed with this Current Report on Form 8-K as Exhibit 1.1 and is incorporated herein by reference.

A copy of the opinion of Sichenzia Ross Ference LLP relating to the

validity of the Shares that may be offered and sold under the ATM Prospectus Supplement, is filed with this Current Report on Form 8-K

as Exhibit 5.1.

This Current Report on Form 8-K does not constitute an offer to

sell or the solicitation of offers to buy any securities of the Company, and shall not constitute an offer, solicitation or sale of any

security in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification

under the securities laws of any such state or jurisdiction.

Item 9.01 Financial statements and Exhibits

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: August 16, 2023 |

INMUNE BIO INC. |

| |

|

| |

By: |

/s/

David Moss |

| |

|

David Moss |

| |

|

Chief Financial Officer |

3

Exhibit 1.1

INMUNE

BIO Inc.

AMENDMENT

NO. 1 TO

At-the-market

SALES AGREEMENT

August 16, 2023

BTIG, LLC

65 East 55th Street

New York, NY 10022

Ladies and Gentlemen:

Reference is made to the At-The-Market

Sales Agreement, dated March 10, 2021, including the Schedules and Exhibits thereto (the “Sales Agreement”),

between INmune Bio Inc., a Nevada corporation (the “Company”), and BTIG, LLC (“BTIG”

and, together with the Company, the “Parties”), pursuant to which the Company agreed that it may issue and sell

to or through BTIG, as sales agent and/or principal, up to that number of shares of the Company’s common stock, par value $0.001

per share, having an aggregate offering price of $45,000,000, subject to the limitations set forth in Section 5(c) of the Sales

Agreement.

The Parties wish to modify

and amend the Sales Agreement as provided in this Amendment No. 1, dated August 16, 2023, to the Sales Agreement (this “Amendment”).

All capitalized terms used in this Amendment and not otherwise defined herein shall have the respective meanings assigned to such terms

in the Sales Agreement.

BTIG and the Company hereby

agree as follows:

A. Amendments to Sales

Agreement. The Sales Agreement is hereby amended, effective August 16, 2023, as follows:

1. The second paragraph

of Section 1 of the Sales Agreement is hereby deleted in its entirety and replaced with the following:

“The Company

has filed, in accordance with the provisions of the Securities Act of 1933, as amended, and the rules and regulations thereunder (collectively,

the “Securities Act”), with the Commission, not earlier than three years prior to the date hereof, a shelf registration

statement on Form S-3 (File No. 333-254221), including a base prospectus, relating to certain securities, including the Common Stock,

to be issued from time to time by the Company, and which incorporates by reference documents that the Company has filed or will file in

accordance with the provisions of the Securities Exchange Act of 1934, as amended, and the rules and regulations thereunder (collectively,

the “Exchange Act”). The Company has prepared a prospectus supplement to the base prospectus included as part

of such registration statement at the time it became effective specifically relating to the offering of Common Stock pursuant to this

Agreement (the “Prospectus Supplement”). The Company will furnish to BTIG, for use by BTIG, copies of the prospectus

included as part of such registration statement at the time it became effective, as supplemented by the Prospectus Supplement, relating

to the offering of Common Stock pursuant to this Agreement. Except where the context otherwise requires, “Registration Statement,”

as used herein, means such registration statement, as amended at the time of such registration statement’s effectiveness for purposes

of Section 11 of the Securities Act, as well as any new registration statement as may have been filed pursuant to Section 7(aa),

including (1) all documents filed as a part thereof or incorporated or deemed to be incorporated by reference therein, (2) any information

contained or incorporated by reference in a Prospectus (as defined below) subsequently filed with the Commission pursuant to Rule 424(b)

under the Securities Act, to the extent such information is deemed, pursuant to Rule 430B under the Securities Act, to be part of

the registration statement at the effective time, and (3) any abbreviated registration statement filed pursuant to Rule 462(b) under

the Securities Act to register the offer and sale of additional shares of Common Stock pursuant to this Agreement. Except where the context

otherwise requires, “Prospectus,” as used herein, means the base prospectus included in the registration statement

at the time it became effective, including all documents incorporated therein by reference to the extent such information has not been

superseded or modified in accordance with Rule 412 under the Securities Act (as qualified by Rule 430B(g) under the Securities

Act), as it may be supplemented by the Prospectus Supplement, in the form in which such prospectus and/or Prospectus Supplement have most

recently been filed by the Company with the Commission pursuant to Rule 424(b) under the Securities Act, together with any “issuer

free writing prospectus,” as defined in Rule 433 of the Securities Act (“Rule 433”), relating

to the Common Stock that (i) is required to be filed with the Commission by the Company or (ii) is exempt from filing pursuant

to Rule 433(d)(5)(i), in each case in the form filed or required to be filed with the Commission or, if not required to be filed,

in the form retained in the Company’s records pursuant to Rule 433(g). Any reference herein to the Registration Statement,

the Prospectus or any amendment or supplement thereto shall be deemed to refer to and include the documents incorporated by reference

therein, and any reference herein to the terms “amend,” “amendment” or “supplement” with respect to

the Registration Statement or the Prospectus shall be deemed to refer to and include the filing after the execution hereof of any document

with the Commission deemed to be incorporated by reference therein (the “Incorporated Documents”). For purposes

of this Agreement, all references to the Registration Statement, the Prospectus or to any amendment or supplement thereto shall be deemed

to include any copy filed with the Commission pursuant to either the Electronic Data Gathering Analysis and Retrieval System, or if applicable,

the Interactive Data Electronic Applications (collectively “EDGAR”).

2. Section 6(a)

of the Sales Agreement is hereby deleted in its entirety and replaced with the following:

“Registration

Statement and Prospectus. The Registration Statement was declared effective under the Securities Act by the Commission on May 5, 2021,

and any post-effective amendment thereto and any Rule 462(b) Registration Statement have also been declared effective by the Commission

or became effective upon filing under the Securities Act. The Company has not received from the Commission any notice pursuant to Rule 401(g)(1)

under the Securities Act objecting to the use of the shelf registration statement form. At the time of the initial filing of the Registration

Statement, the Company paid the required Commission filing fees relating to the Shares in accordance with Rules 456(a) and 457(o)

under the Securities Act. The Company has complied to the Commission’s satisfaction with all requests of the Commission for additional

or supplemental information. No stop order suspending the effectiveness of the Registration Statement or any Rule 462(b) Registration

Statement is in effect and no proceedings for such purpose have been instituted or are pending or, to the best knowledge of the Company,

are contemplated or threatened by the Commission. At the time of (i) the initial filing of the Registration Statement with the Commission

and (ii) the most recent amendment thereto for the purposes of complying with Section 10(a)(3) of the Securities Act (whether such amendment

was by post-effective amendment, incorporated report filed pursuant to Section 13 or 15(d) of the Exchange Act or form of prospectus),

the Company met the then applicable requirements for use of Form S-3 under the Securities Act. The Registration Statement and the offer

and sale of the Shares as contemplated hereby meet the requirements of Rule 415 under the Securities Act and comply in all material

respects with said Rule. In the section entitled “Plan of Distribution” in the Prospectus Supplement, the Company has named

BTIG, LLC as an agent that the Company has engaged in connection with the transactions contemplated by this Agreement. The Company was

not and is not an “ineligible issuer” as defined in Rule 405 under the Securities Act..”

3. Section 6(ll)

of the Sales Agreement is hereby deleted in its entirety and replaced with the following:

“Market

Capitalization. As of the close of trading on the Exchange on August 14, 2023, the aggregate market value of the outstanding voting

and non-voting common equity (as defined in Rule 405) of the Company held by persons other than affiliates of the Company (pursuant

to Rule 144 of the Securities Act, those that directly, or indirectly through one or more intermediaries, control, or are controlled

by, or are under common control with, the Company) (the “Non-Affiliate Shares”), was approximately $96,376,755

(calculated by multiplying (x) the price at which the common equity of the Company was last sold on the Exchange on August 14, 2023

by (y) the number of Non-Affiliate Shares outstanding on August 14, 2023). The Company is not a shell company (as defined in Rule

405 under the Securities Act) and has not been a shell company for at least 12 calendar months previously and if it has been a shell company

at any time previously, has filed current “Form 10 information” (as defined in Instruction 4 to General Instruction I.B.6.

of Form S-3) with the Commission at least 12 calendar months previously reflecting its status as an entity that is not a shell company.”

4. Section 13

of the Sales Agreement is hereby deleted in its entirety and replaced with the following:

“All notices or other communications required or permitted to

be given by any party to any other party pursuant to the terms of this Agreement shall be in writing, unless otherwise specified, and

if sent to BTIG, shall be delivered to:

BTIG, LLC

65 E 55th Street

New York, NY 10022

Attention: Equity Capital Markets

Email: BTIGUSATMTrading@btig.com

with copies (which shall not

constitute notice) to:

BTIG, LLC

600 Montgomery Street, 6th Floor

San Francisco, CA 94111

Attention: General Counsel and Chief Compliance Officer

Email: BTIGcompliance@btig.com

legal@btig.com

and:

Lowenstein Sandler LLP

1251 Avenue of the Americas

New York, NY 10020

Telephone: (212) 262-6700

Facsimile: (212) 262-7402

Attention: Steven M. Skolnick

Email: sskolnick@lowenstein.com

and if to the Company, shall be delivered

to:

INmune Bio Inc.

225 NE Mizner Blvd., Suite 640

Boca Raton, FL 33432

Attention: David J. Moss, CFO

Email: dmoss@inmunebio.com

with a copy (which shall not constitute notice)

to:

Sichenzia Ross Ference LLP

1185 Avenue of the Americas, 31st Floor

New York, NY 10036

Attention: Marc Ross, Esq.

Email: mross@srf.law

Each party may change

such address for notices by sending to the other party to this Agreement written notice of a new address for such purpose. Each such notice

or other communication shall be deemed given (i) when delivered personally or by verifiable facsimile transmission (with an original to

follow) on or before 4:30 p.m., New York City time, on a Business Day or, if such day is not a Business Day, on the next succeeding Business

Day, (ii) on the next Business Day after timely delivery to a nationally-recognized overnight courier and (iii) on the Business Day actually

received if deposited in the U.S. mail (certified or registered mail, return receipt requested, postage prepaid). For purposes of this

Agreement, “Business Day” shall mean any day on which the Exchange and commercial banks in the City of New York

are open for business.

An electronic communication

(“Electronic Notice”) shall be deemed written notice for purposes of this Section 13 if sent to the electronic

mail address specified by the receiving party under separate cover. Electronic Notice shall be deemed received at the time the party sending

Electronic Notice receives confirmation of receipt by the receiving party (other than pursuant to auto-reply). Any party receiving Electronic

Notice may request and shall be entitled to receive the notice on paper, in a nonelectronic form (“Nonelectronic Notice”)

which shall be sent to the requesting party within ten (10) days of receipt of the written request for Nonelectronic Notice.”

5. Schedule

1 is hereby amended by adding the words “as amended on August 16, 2023” immediately after “March 10, 2021”

in such Schedule.

6. The first sentence

of the Form of Officer’s Certificate attached as Exhibit 7(m) is hereby amended by adding the words “as amended on

August 16, 2023” immediately after “March 10, 2021” in such sentence.

7. The first sentence

of the Form of Certificate of Chief Scientific Officer attached as Exhibit 7(p) is hereby amended by adding the words “as

amended on August 16, 2023” immediately after “March 10, 2021” in such sentence.

B. No Other Amendments.

Except as amended as set forth in Part A above, all of the terms and provisions of the Sales Agreement shall continue in full force

and effect and shall not be in any way changed, modified or superseded by this Amendment.

C. Counterparts. This

Amendment may be executed in two or more counterparts, each of which shall be deemed an original, but all of which together shall constitute

one and the same instrument. Delivery of an executed Amendment by one party to the other may be made by facsimile or email transmission.

D. Governing Law. This

Amendment shall be governed by, and construed in accordance with, the internal laws of the State of New York without regard to the principles

of conflicts of laws.

[Remainder of page intentionally left blank.]

If the foregoing correctly

sets forth the understanding between us, please so indicate in the space provided below for that purpose.

| |

Very truly yours, |

| |

|

| |

INMUNE BIO INC. |

| |

|

| |

By: |

/s/ David Moss |

| |

Name: |

David Moss |

| |

Title: |

Chief Financial Officer |

| |

|

| |

ACCEPTED as of the date first-above written: |

| |

|

| |

BTIG, LLC |

| |

|

| |

By: |

/s/ KC Stone |

| |

Name: |

KC Stone |

| |

Title: |

Managing Director |

[Signature Page to Amendment No. 1 to Sales

Agreement]

5

Exhibit 5.1

August

16, 2023

INmune Bio Inc.

225 ne Mizner Blvd., Suite 640

Boca Raton, Florida 33432

Re: Securities Registered

under Registration Statement on Form S-3 (File No. 333-254221)

Ladies and Gentlemen:

You have requested our

opinion with respect to certain matters in connection with the proposed offer and sale by INmune Bio Inc., a Nevada corporation (the “Company”),

of up to an aggregate of $28,701,161.61 INmune Bio, Inc. of shares of the Company’s common stock (the “Placement Shares”),

pursuant to a Registration Statement on Form S-3 (File No. 333-254221) (the “Registration Statement”), which was originally

filed under the Securities Act of 1933, as amended (the “Securities Act”) with the Securities and Exchange Commission (“SEC”)

on March 12, 2021 and declared effective by the SEC on May 5, 2021, the base prospectus contained in the Registration Statement (the “Base

Prospectus”), and the prospectus supplement relating to the proposed offer and sale of the Placement Shares filed with the SEC on

August 16, 2023 pursuant to Rule 424(b) of the rules and regulations under the Securities Act (the “Prospectus Supplement”,

and together with the Base Prospectus, the “Prospectus”). We understand that the Placement Shares are proposed to be offered

and sold by the Company through BTIG, LLC. (the “Agent”) pursuant to an At-the-Market Sales Agreement by and between the Company

and the Agent (the “At-the-Market Sales Agreement”) as amended by Amendment No.1 to the At-the-Market Sales Agreement.

In connection with the

preparation of this opinion, we have examined such documents and considered such questions of law as we have deemed necessary or appropriate.

We have assumed the authenticity of all documents submitted to us as originals, the conformity to originals of all documents submitted

to us as copies thereof and the genuineness of all signatures. As to questions of fact material to our opinions, we have relied upon the

certificates of certain officers of the Company without independent investigation or verification.

Further, in connection

with our opinions expressed below, we have assumed that, (i) at or prior to the time of the delivery of any of the Placement Shares,

there will not have occurred any change in the law or the facts affecting the validity of the Placement Shares, (ii) at the time

of the offer, issuance and sale of any Placement Shares, no stop order suspending the Registration Statement’s effectiveness will

have been issued and remain in effect, (iii) no future amendments will be made to the company’s Articles of Incorporation that

would be in conflict with or inconsistent with the Company’s right and ability to issue the Placement Shares, (iv) at the time

of each offer, issuance and sale of any Placement Shares, the Company will have a sufficient number of authorized and unissued and unreserved

shares of the applicable class or series of its capital stock included in (or purchasable upon exercise or conversion of) the Placement

Shares so issued and sold (after taking into account all other outstanding securities of the Company which may require the Company to

issue shares of such applicable class or series) to be able to issue all such shares, and (v) all purchasers of the Placement Shares

will timely pay in full to the Company all amounts they have agreed to pay to purchase such Placement Shares, as approved by the Board

of Directors of the Company or a duly authorized committee thereof, and that the purchase price of any Placement Shares will not be less

than the par value thereof.

1185 Avenue of the Americas | 31st Floor

| New York, NY | 10036

T (212) 930 9700 | F (212) 930 9725 | WWW.SRF.LAW

We express no opinion

regarding the effectiveness of any waiver or stay, extension or of unknown future rights. Further, we express no opinion regarding the

effect of provisions relating to indemnification, exculpation or contribution to the extent such provisions may be held unenforceable

as contrary to federal or state securities laws or public policy.

With respect to our opinion

expressed below, we have assumed that, upon the issuance of any of the Placement Shares, the total number of shares of Common Stock issued

and outstanding and reserved for future issuance will not exceed the total number of shares of Common Stock that the Company is then authorized

to issue under its Articles of Incorporation as then in effect.

Based on the foregoing,

we are of the opinion that the Placement Shares have been duly authorized and, when issued and sold in the manner described in the Registration

Statement, the Prospectus and the At-the-Market Sales Agreement, as amended by Amendment No.1 to the At-the-market Sales Agreement, will

be validly issued, fully paid and non-assessable.

We are members of the

bar of the State of New York. We express no opinion as to the laws of any jurisdiction other than the laws of the State of New York, and

the federal laws of the United States of America. Insofar as the matters covered by this opinion may be governed by the laws of

other states we have assumed that such laws are identical in all respects to the laws of the State of New York.

We hereby consent to the

use of this opinion as Exhibit 5.1 to the Company’s Current Report on Form 8-K filed with the SEC on the date hereof, which is incorporated

by reference into the Registration Statement, and further consent to the reference to us in the Registration Statement and any amendments

thereto. In giving such consent, we do not hereby admit that we are within the category of persons whose consent is required under Section

7 of the Securities Act or the rules and regulations thereunder.

This opinion is intended

solely for use in connection with the offer and sale of the Placement Shares pursuant to the Registration Statement and is not to be relied

upon for any other purpose or delivered to or relied upon by any other person without our prior written consent. This opinion is rendered

as of the date hereof and based solely on our understanding of facts in existence as of such date after the examination described in this

opinion. We assume no obligation to advise you of any fact, circumstance, event or change in the law or the facts that may hereafter be

brought to our attention whether or not such occurrence would affect or modify the opinions expressed herein.

| |

Very truly yours, |

| |

|

| |

/s/ Sichenzia Ross Ference LLP |

| |

|

| |

SICHENZIA ROSS FERENCE LLP |

1185 Avenue of the Americas | 31st Floor

| New York, NY | 10036

T (212) 930 9700 | F (212) 930 9725 | WWW.SRF.LAW

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

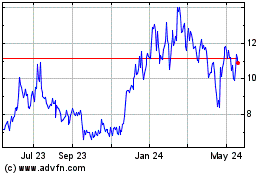

INmune Bio (NASDAQ:INMB)

Historical Stock Chart

From Mar 2024 to Apr 2024

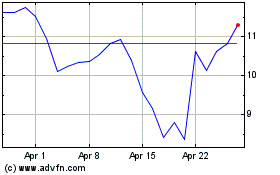

INmune Bio (NASDAQ:INMB)

Historical Stock Chart

From Apr 2023 to Apr 2024