Infinera Corporation (NASDAQ: INFN), a leading provider of digital

optical communications systems, today released financial results

for the fourth quarter and fiscal year ended December 27, 2008.

GAAP Results for Q4 2008:

-- GAAP revenues for the fourth quarter of 2008 were $99.3 million

compared to $120.5 million in the third quarter of 2008 and $76.1 million

in the fourth quarter of 2007.

-- GAAP gross margins were 38% in the fourth quarter of 2008 compared to

45% in the third quarter of 2008 and 36% in the fourth quarter of 2007.

-- Including non-cash stock-based compensation, the GAAP net loss was

$6.7 million, or $0.07 per share, in the fourth quarter of 2008 compared to

GAAP net income of $14.9 million, or $0.15 per diluted share, in the third

quarter of 2008 and a GAAP net loss of $3.9 million or $0.04 per share in

the fourth quarter of 2007.

Adjusted GAAP / Invoiced Shipment Results for Q4 2008:

-- Adjusted GAAP revenue for the fourth quarter of 2008 was $86.2 million

compared to $80.9 million in the third quarter of 2008 and $93.4 million of

invoiced shipments in the fourth quarter of 2007.

-- Gross margins on an adjusted GAAP basis, excluding non-cash stock-

based compensation, were 36% in the fourth quarter of 2008 compared to 42%

in the third quarter of 2008 and 47% on an invoiced shipment basis in the

fourth quarter of 2007.

-- Excluding non-cash stock-based compensation, the net loss on an

adjusted GAAP basis was $9.0 million, or $0.10 per basic share, for the

fourth quarter of 2008 compared to net income of $0.0 million, or $0.0 per

diluted share in the third quarter of 2008 and net income on an invoiced

shipment basis of $15.9 million or $0.17 per diluted share in the fourth

quarter of 2007.

GAAP Results for Fiscal 2008:

-- GAAP revenues for the year ended December 27, 2008 were $519.2 million

compared to $245.9 million in 2007.

-- GAAP gross margins were 45% in 2008 compared to 31% in 2007.

-- Including non-cash stock-based compensation, GAAP net income was $78.7

million, or $0.81 per diluted share in 2008 compared to a GAAP net loss of

$55.3 million, or $1.09 per share, in 2007.

Adjusted GAAP / Invoiced Shipment Results for Fiscal 2008:

-- Adjusted GAAP revenue for 2008 was $353.4 million compared to $309.3

million of invoiced shipments in 2007.

-- Gross margins on an adjusted GAAP basis, excluding non-cash stock-

based compensation, were 43% in 2008 compared to 41% on an invoiced

shipment basis in 2007.

-- Excluding non-cash stock-based compensation and warrant revaluation

expenses, net income on an adjusted GAAP basis was $14.3 million or $0.15

per diluted share in 2008, compared to $24.1 million, or $0.37 per diluted

share on an invoiced shipment basis in 2007.

Footnote: For an explanation of our use of Adjusted GAAP and

Invoiced Shipments measures and a full reconciliation of these

measures to our GAAP results, please see the section of the

accompanying tables titled "GAAP to Non-GAAP Invoiced Shipment and

Adjusted GAAP Reconciliation."

New Incumbent Carrier win at OTE

In a separate release, the company announced that OTEGLOBE, the

international division of Greek incumbent national carrier OTE, has

selected Infinera as its DWDM supplier for its Pan-European

Network. The win at OTE represents Infinera's fourth win with Tier

1 incumbent carriers, joining Deutsche Telecom and two other

incumbents.

Management Commentary

"In the fourth quarter we saw continued customer win momentum,

with seven new customers added in the quarter, including OTE," said

Jagdeep Singh, president and chief executive officer of Infinera.

"This resulted in strong top-line performance; however the common

equipment associated with these deployments and additional expected

new customer shipments in Q1 put downward pressure on our gross

margins in the quarter.

"We believe our ongoing success at winning new customers

reflects our increasingly strong position as a strategic supplier

of optical transport equipment to a diverse set of customers," said

Singh. "While calendar year 2009 is shaping up as a challenging one

for the optical industry, we believe it will also be a year of

significant long-term business opportunities for Infinera as

carriers grapple with the strategic challenge of scaling their

optical networks. With a strong balance sheet and established

technology lead, we intend to continue our R&D investments to

advance our DWDM leadership position for years to come."

The company also provided the following Q4 highlights regarding

its customer base:

-- The top 10 customers accounted for 72% of total revenue, the lowest

concentration in the history of the company.

-- The largest customer for the fourth quarter was an internet content

provider at 23%.

-- With the seven new customer additions, total customer count for the

company is now at 56.

-- Geographically, new customer wins for the quarter included three

European-based customers including OTE, three from the Americas and one

from Asia Pacific.

-- 24 percent of Q4 revenue came from customers based in the EMEA region.

-- For the first time in a single quarter, the company had an internet

content provider, a wholesale carrier, a cable MSO and a tier one incumbent

all ranked among its top 5 customers.

Conference Call Information:

Infinera will host a conference call for analysts and investors

to discuss its fourth quarter and fiscal year 2008 results today at

6:00 p.m. Eastern Time (3:00 p.m. Pacific Time). A live webcast of

the conference call will also be accessible from the "Investor

Relations" section of the company's website at www.infinera.com.

Following the webcast, an archived version will be available on the

website for 30 days. To hear the replay, parties in the United

States and Canada should call 1-866-424-7870. International parties

can access the replay at +1-203-369-0862.

About Infinera

Infinera provides Digital Optical Networking systems to

telecommunications carriers worldwide. Infinera's systems are

unique in their use of a breakthrough semiconductor technology: the

Photonic Integrated Circuit (PIC). Infinera's systems and PIC

technology are designed to provide optical networks with simpler

and more flexible engineering and operations, faster

time-to-service, and the ability to rapidly deliver differentiated

services without reengineering their optical infrastructure. For

more information, please visit www.infinera.com.

Forward-Looking Statements

This press release contains forward-looking statements,

including statements about the strong reception by our installed

base and new customers for our products, our belief that we have

continued customer win momentum, our belief regarding our

increasingly strong position as a strategic supplier, our belief

that our value proposition is resonating with customers and

prospects, our belief that 2009 will be a year of significant

long-term business opportunities for Infinera, and our belief that

we may advance our DWDM leadership role for years to come. These

forward-looking statements involve risks and uncertainties, as well

as assumptions that if they do not fully materialize or prove

incorrect, could cause our results to differ materially from those

expressed or implied by such forward-looking statements. The risks

and uncertainties that could cause our results to differ materially

from those expressed or implied by such forward-looking statements

include our ability to react to trends and challenges in our

business and the markets in which we operate; our ability to

anticipate market needs and develop new or enhanced products to

meet those needs; the adoption rate of our products; our ability to

establish and maintain successful relationships with our customers;

our ability to reduce customer concentration; our ability to

compete in our industry; fluctuations in demand, sales cycles and

prices for our products and services; shortages or price

fluctuations in our supply chain; our ability to protect our

intellectual property rights; general political, economic and

market conditions and events; and other risks and uncertainties

described more fully in our documents filed with or furnished to

the Securities and Exchange Commission (SEC). More information

about these and other risks that may impact Infinera's business are

set forth in our annual report on Form 10-K, which was filed with

the SEC on February 19, 2008, as well as subsequent reports filed

with the SEC. All forward-looking statements in this press release

are based on information available to us as of the date hereof, and

we assume no obligation to update these forward-looking

statements.

Non-GAAP and other Financial Measures

In addition to disclosing financial measures prepared in

accordance with United States Generally Accepted Accounting

Principles (GAAP), this press release and the accompanying tables

contain certain non-GAAP and other financial measures that reflect

invoiced shipments, adjusted GAAP revenue and exclude non-GAAP

non-cash stock-based compensation. For a description of these

non-GAAP financial measures, including the reasons why management

uses each measure, and reconciliations of these non-GAAP financial

measures to the most directly comparable GAAP financial measures,

please see the section of the accompanying tables titled "GAAP to

Non-GAAP Invoiced Shipment and Adjusted GAAP Reconciliation" as

well as the accompanying notes on the use of certain non-GAAP

measures. We anticipate disclosing forward-looking non-GAAP and

other financial information in our conference call to discuss our

fourth quarter of 2008 results, including an estimate of non-GAAP

earnings for the first quarter of 2009 that excludes non-cash

stock-based compensation expenses related to our equity awards and

the right to purchase common stock under our Employee Stock

Purchase Plan in the period.

A copy of this press release can be found on the investor

relations page of Infinera's website at www.infinera.com.

Infinera Corporation and the Infinera logo are trademarks or

registered trademarks of Infinera Corporation. All other trademarks

used or mentioned herein belong to their respective owners.

Infinera Corporation

GAAP Condensed Consolidated Statements of Operations

(In thousands, except per share data)

(Unaudited)

Three Months Ended Twelve Months Ended

-------------------------- --------------------------

December 27, December 29, December 27, December 29,

2008 2007 2008 2007

------------ ------------ ------------ ------------

Revenue:

Product $ 80,045 $ 832 $ 306,808 $ 8,107

Ratable product

and related

support and

services 12,243 75,257 193,705 237,745

Services 7,056 - 18,699 -

------------ ------------ ------------ ------------

Total revenue 99,344 76,089 519,212 245,852

Cost of revenue(1):

Cost of product 52,306 222 184,234 4,091

Cost of ratable

product and

related support

and services 5,088 48,710 91,625 165,172

Cost of services 3,984 - 9,798 -

------------ ------------ ------------ ------------

Total cost

of revenue 61,378 48,932 285,657 169,263

Gross profit 37,966 27,157 233,555 76,589

Operating expenses(1):

Sales and

marketing 10,985 10,689 43,262 32,721

Research and

development 23,256 16,093 80,428 60,851

General and

administrative 10,650 7,981 36,282 25,965

Amortization of

intangible

assets 39 37 150 148

------------ ------------ ------------ ------------

Total

operating

expenses 44,930 34,800 160,122 119,685

------------ ------------ ------------ ------------

Income (loss) from

operations (6,964) (7,643) 73,433 (43,096)

Other income

(expense), net:

Interest income 1,313 3,149 8,549 6,522

Interest expense - (2) (3) (2,251)

Other gain

(loss), net(2) (1,741) 733 (528) (16,249)

------------ ------------ ------------ ------------

Total other

income

(expense), net (428) 3,880 8,018 (11,978)

Income (loss) before

income taxes (7,392) (3,763) 81,451 (55,074)

Provision for

(benefit from)

income taxes (704) 144 2,723 268

------------ ------------ ------------ ------------

Net income (loss) $ (6,688) $ (3,907) $ 78,728 $ (55,342)

============ ============ ============ ============

Net income (loss)

per common share:

Basic $ (0.07) $ (0.04) $ 0.85 $ (1.09)

============ ============ ============ ============

Diluted $ (0.07) $ (0.04) $ 0.81 $ (1.09)

============ ============ ============ ============

Weighted average

shares used in

computing net

income (loss)

per share:

Basic 93,449 87,672 92,427 50,732

============ ============ ============ ============

Diluted 93,449 87,672 97,088 50,732

============ ============ ============ ============

(1) The following table summarizes the effects of stock-based compensation

related to employees, non-recourse notes and non-employees for the

three and twelve months ended December 27, 2008 and December 29, 2007,

respectively:

Three Months Ended Twelve Months Ended

-------------------------- --------------------------

December 27, December 29, December 27, December 29,

2008 2007 2008 2007

------------ ------------ ------------ ------------

Cost of revenue $ 308 $ 156 $ 1,086 $ 410

Research and

development 1,821 1,315 6,543 3,751

Sales and

marketing 1,176 732 4,440 1,854

General and

administration 1,933 1,282 7,463 3,314

------------ ------------ ------------ ------------

5,238 3,485 19,532 9,329

Cost of revenue

- amortization

from balance

sheet* 738 198 4,287 327

------------ ------------ ------------ ------------

Total

stock-based

compensation

expense $ 5,976 $ 3,683 $ 23,819 $ 9,656

============ ============ ============ ============

* Stock-based compensation expense deferred to inventory and deferred

inventory costs in prior periods and recognized in the current period.

(2) The following table summarizes the remeasurement of our freestanding

preferred stock warrants under FAS 150:

Three Months Ended Twelve Months Ended

-------------------------- --------------------------

December 27, December 29, December 27, December 29,

2008 2007 2008 2007

------------ ------------ ------------ ------------

Other gain (loss) $ - $ - $ - $ (19,761)

Infinera Corporation

GAAP to Non-GAAP Invoiced Shipment and Adjusted GAAP Reconciliation

(In thousands, except per share data)

(Unaudited)

Three Months Ended December 27, 2008

-------------------------------------------------------------

Adjusted

Adjusted GAAP

Adjusted GAAP Excluding

Deferral GAAP Stock Stock

GAAP Adjustments Results Comp Comp

--------- --------- --------- --------- ---------

Revenue

Product

and

ratable

revenue $ 92,288 $ (13,102) (a) $ 79,186 $ - $ 79,186

Services

revenue 7,056 - 7,056 - 7,056

--------- --------- --------- --------- ---------

Total revenue 99,344 (13,102) 86,242 - 86,242

Cost of

revenue 61,378 (4,951) (d) 56,427 (904) (g) 55,523

--------- --------- --------- --------- ---------

Gross profit 37,966 (8,151) 29,815 904 30,719

Gross margin 38% 36%

Operating

expenses 44,930 - 44,930 (4,930) (g) 40,000

--------- --------- --------- --------- ---------

Income (loss)

from

operations (6,964) (8,151) (15,115) 5,834 (9,281)

Other income

(expense),

net (428) - (428) - (428)

--------- --------- --------- --------- ---------

Income (loss)

before

income taxes (7,392) (8,151) (15,543) 5,834 (9,709)

Provision

for (benefit

from) income

taxes (704) - (704) - (704)

--------- --------- --------- --------- ---------

Net income

(loss) $ (6,688) $ (8,151) $ (14,839) $ 5,834 $ (9,005)

========= ========= ========= ========= =========

Net income

(loss) per

common share:

Basic $ (0.07) $ (0.10)

========= =========

Diluted $ (0.07) $ (0.09)*

========= =========

Weighted

average

shares used

in computing

net income

(loss) per

common share:

Basic 93,449 93,449

========= =========

Diluted 93,449 97,167*

========= =========

* Diluted shares used to calculate net loss per share on an Adjusted GAAP

basis provided for informational purposes only.

Three Months Ended September 27, 2008

-------------------------------------------------------------

Adjusted

Adjusted GAAP

Adjusted GAAP Excluding

Deferral GAAP Stock Stock

GAAP Adjustments Results Comp Comp

--------- --------- --------- --------- ---------

Revenue

Product

and

ratable

revenue $ 115,625 $ (39,588) (b) $ 76,037 $ - $ 76,037

Services

revenue 4,881 - 4,881 - 4,881

--------- --------- --------- --------- ---------

Total revenue 120,506 (39,588) 80,918 - 80,918

Cost of

revenue 66,268 (18,338) (e) 47,930 (1,270) (g) 46,660

--------- --------- --------- --------- ---------

Gross profit 54,238 (21,250) 32,988 1,270 34,258

Gross margin 45% 42%

Operating

expenses 41,013 - 41,013 (5,076) (g) 35,937

--------- --------- --------- --------- ---------

Income (loss)

from

operations 13,225 (21,250) (8,025) 6,346 (1,679)

Other income

(expense),

net 1,712 - 1,712 - 1,712

--------- --------- --------- --------- ---------

Income (loss)

before

provision

for income

taxes 14,937 (21,250) (6,313) 6,346 33

Provision

for income

taxes - - - - -

--------- --------- --------- --------- ---------

Net income

(loss) $ 14,937 $ (21,250) $ (6,313) $ 6,346 $ 33

========= ========= ========= ========= =========

Net income

(loss) per

common share:

Basic $ 0.16 $ 0.00

========= =========

Diluted $ 0.15 $ 0.00

========= =========

Weighted

average

shares used

in computing

net income

(loss) per

common share:

Basic 92,888 92,888

========= =========

Diluted 97,208 97,208

========= =========

Infinera Corporation

GAAP to Non-GAAP Invoiced Shipment and Adjusted GAAP Reconciliation

(In thousands, except per share data)

(Unaudited)

Three Months Ended December 29, 2007

-------------------------------------------------------------

Non-GAAP

Invoiced

Shipments

Non-GAAP Excluding

Deferral Invoiced Stock Stock

GAAP Adjustments Shipments Comp Comp

--------- --------- --------- --------- ---------

Revenue $ 76,089 $ 17,287 (a) $ 93,376 $ - $ 93,376

Cost of

revenue 48,932 1,735 (d) 50,667 (965) (g) 49,702

--------- --------- --------- --------- ---------

Gross profit 27,157 15,552 42,709 965 43,674

Gross margin 36% 47%

Operating

expenses 34,800 - 34,800 (3,329) (g) 31,471

--------- --------- --------- --------- ---------

Income

(Loss) from

operations (7,643) 15,552 7,909 4,294 12,203

Other income

(expense),

net 3,880 - 3,880 - 3,880

--------- --------- --------- --------- ---------

Income (Loss)

before

provision

for income

taxes (3,763) 15,552 11,789 4,294 16,083

Provision

for income

taxes 144 - 144 - 144

--------- --------- --------- --------- ---------

Net income

(loss) $ (3,907) $ 15,552 $ 11,645 $ 4,294 $ 15,939

========= ========= ========= ========= =========

Net income

(loss) per

common share:

Basic $ (0.04) $ 0.18

========= =========

Diluted $ (0.04) $ 0.17

========= =========

Weighted

average

shares used

in computing

net income

(loss) per

common share:

Basic 87,672 87,672

========= =========

Diluted 87,672 95,317

========= =========

Twelve Months Ended December 27, 2008

-------------------------------------------------------------

Adjusted

Adjusted GAAP

Adjusted GAAP Excluding

Deferral GAAP Stock Stock

GAAP Adjustments Results Comp Comp

--------- --------- --------- --------- ---------

Revenue

Product

and

ratable

revenue $ 500,513 $(165,787) (c) $ 334,726 $ - $ 334,726

Services

revenue 18,699 - 18,699 - 18,699

--------- --------- --------- --------- ---------

Total revenue 519,212 (165,787) 353,425 - 353,425

Cost of

revenue 285,657 (78,401) (f) 207,256 (4,491) (g) 202,765

--------- --------- --------- --------- ---------

Gross profit 233,555 (87,386) 146,169 4,491 150,660

Gross margin 45% 43%

Operating

expenses 160,122 - 160,122 (18,446) (g) 141,676

--------- --------- --------- --------- ---------

Income (loss)

from

operations 73,433 (87,386) (13,953) 22,937 8,984

Other income

(expense),

net 8,018 - 8,018 - 8,018

--------- --------- --------- --------- ---------

Income (loss)

before

provision

for income

taxes 81,451 (87,386) (5,935) 22,937 17,002

Provision

for income

taxes 2,723 - 2,723 - 2,723

--------- --------- --------- --------- ---------

Net income

(loss) $ 78,728 $ (87,386) $ (8,658) $ 22,937 $ 14,279

========= ========= ========= ========= =========

Net income

(loss) per

common share:

Basic $ 0.85 $ 0.15

========= =========

Diluted $ 0.81 $ 0.15

========= =========

Weighted

average

shares used

in computing

net income

(loss) per

common share:

Basic 92,427 92,427

========= =========

Diluted 97,088 97,088

========= =========

Infinera Corporation

GAAP to Non-GAAP Invoiced Shipment and Adjusted GAAP Reconciliation

(In thousands, except per share data)

(Unaudited)

Twelve Months Ended December 29, 2007

-------------------------------------------------------------

Non-GAAP

Invoiced

Shipments

Non-GAAP Excluding

Deferral Invoiced Stock Stock

GAAP Adjustments Shipments Comp Comp

--------- --------- --------- --------- ---------

Revenue $ 245,852 $ 63,484 (c) $ 309,336 $ - $ 309,336

Cost of

revenue 169,263 14,369 (f) 183,632 (1,661) (g) 181,971

--------- --------- --------- --------- ---------

Gross profit 76,589 49,115 125,704 1,661 127,365

Gross margin 31% 41%

Operating

expenses 119,685 - 119,685 (8,919) (g) 110,766

--------- --------- --------- --------- ---------

Income (Loss)

from

operations (43,096) 49,115 6,019 10,580 16,599

Other income

(expense),

net (11,978) - (11,978) 19,761 (h) 7,783

--------- --------- --------- --------- ---------

Income (Loss)

before

provision

for income

taxes (55,074) 49,115 (5,959) 30,341 24,382

Provision

for income

taxes 268 - 268 - 268

--------- --------- --------- --------- ---------

Net income

(loss) $ (55,342) $ 49,115 $ (6,227) $ 30,341 $ 24,114

========= ========= ========= ========= =========

Net income

(loss) per

common share:

Basic $ (1.09) $ 0.48

========= =========

Diluted $ (1.09) $ 0.37

========= =========

Weighted

average

shares used

in computing

net income

(loss) per

common share:

Basic 50,732 50,732

========= =========

Diluted 50,732 64,785

========= =========

Use of Non-GAAP Invoiced Shipments / Adjusted GAAP

Information:

Prior to the second quarter of 2008, in order to supplement our

condensed consolidated financial statements presented on a GAAP

basis, Infinera used invoiced shipment measures of operating

results, net income and net income per share, which are adjusted to

reflect invoiced shipments and exclude non-GAAP stock-based

compensation and warrant revaluation expenses. Invoiced shipment

measures reflected GAAP results adjusted for changes in our

deferred revenue and deferred cost of inventory balances from the

prior period. We further presented non-GAAP measures of operating

results, net income and net income per share, which included

invoiced shipments and excluded non-GAAP stock-based compensation

expense. These adjustments to our GAAP results were made to provide

both management and investors with an understanding of Infinera's

underlying operating results and trends as they would have been

reflected had we established vendor specific objective evidence

(VSOE) of fair value for our service offerings and not been

required to recognize revenue ratably.

Effective April 2008, we had established VSOE of fair value for

most of our service offerings. Therefore beginning in the second

quarter of 2008, we have used adjusted GAAP measures of operating

results and net income. Adjusted GAAP results reflect our GAAP

results reduced for amounts released from deferred revenue and

deferred cost of inventory balances recorded prior to the second

quarter of 2008 and previously reported in our invoiced shipment

results. Deferred services and deferred ratable and product revenue

and cost amounts recorded after March 29, 2008 have not been

adjusted and are recognized on a GAAP basis in arriving at the

adjusted GAAP results. We have continued to present non-GAAP

measures of operating results, net income and net income per share,

which include adjusted GAAP results and exclude non-GAAP

stock-based compensation expense.

We believe these adjustments are appropriate to enhance an

overall understanding of our underlying financial performance and

also our prospects for the future and are considered by management

for the purpose of making operational decisions. In addition, these

results are the primary indicators management uses as a basis for

our planning and forecasting of future periods. The presentation of

this additional information is not meant to be considered in

isolation or as a substitute for net income or basic and diluted

net income per share prepared in accordance with GAAP. Non-GAAP

financial measures are not based on a comprehensive set of

accounting rules or principles and are subject to limitations.

(a) Adjustment amount represents the release of ratable and

product deferred revenue amounts related to periods prior to March

29, 2008 as these amounts have been previously reported as invoiced

shipments. No adjustment has been made for changes in services

deferred revenue as these amounts relate to future service

deliverables and are appropriately deferred. Deferred ratable and

product amounts recorded after March 29, 2008 have not been

adjusted as these amounts are recognized on a GAAP basis in

arriving at the adjusted GAAP results.

The deferred revenue adjustments recorded above are reconciled

to the deferred revenue balance on our balance sheet in the table

below:

Three

Months

Ended

December

Three Months Ended December 27, 2008 29, 2007

---------------------------------------------- ---------

Pre Mar 29, Post Mar 29,

2008 2008

Ratable and Ratable and

Deferred Product Product

Revenue Revenue Revenue Services Total Total

----------- ----------- --------- ---------- ---------

(In thousands)

Beginning

balance $ 21,752 $ 4,296 $ 6,408 $ 32,456 $ 157,150

Additions to

deferred

revenue - 1,086 7,577 8,663 92,544

Amortization

to revenue (13,102) (1,205) (4,405) (18,712) (75,257)

----------- ----------- --------- ---------- ---------

Ending balance $ 8,650 $ 4,177 $ 9,580 $ 22,407 $ 174,437

=========== =========== ========= ========== =========

Change in

deferred

revenue

balance $ (13,102) $ (119) $ 3,172 $ (10,049) $ 17,287

=========== =========== ========= ========== =========

(b) Adjustment amount represents the release of ratable and

product deferred revenue amounts related to periods prior to March

29, 2008 as these amounts have been previously reported as invoiced

shipments. No adjustment has been made for changes in services

deferred revenue as these amounts relate to future service

deliverables and are appropriately deferred. Deferred ratable and

product amounts recorded after March 29, 2008 have not been

adjusted as these amounts are recognized on a GAAP basis in

arriving at the adjusted GAAP results.

The deferred revenue adjustments recorded above are reconciled

to the deferred revenue balance on our balance sheet in the table

below:

Three Months Ended September 27, 2008

----------------------------------------------

Pre Mar 29, Post Mar 29,

2008 2008

Ratable and Ratable and

Deferred Product Product

Revenue Revenue Revenue Services Total

----------- ----------- --------- ----------

(In thousands)

Beginning

balance $ 61,340 $ 3,113 $ 5,456 $ 69,909

Additions to

deferred

revenue - 2,075 3,567 5,642

Amortization

to revenue (39,588) (891) (2,616) (43,095)

----------- ----------- --------- ----------

Ending balance $ 21,752 $ 4,297 $ 6,407 $ 32,456

=========== =========== ========= ==========

Change in

deferred

revenue

balance $ (39,588) $ 1,184 $ 951 $ (37,453)

=========== =========== ========= ==========

(c) Adjustment amount represents the release of ratable and

product deferred revenue amounts related to periods prior to March

29, 2008 as these amounts have been previously reported as invoiced

shipments. No adjustment has been made for changes in services

deferred revenue as these amounts relate to future service

deliverables and are appropriately deferred. Deferred ratable and

product amounts recorded after March 29, 2008 have not been

adjusted as these amounts are recognized on a GAAP basis in

arriving at the adjusted GAAP results.

The deferred revenue adjustments recorded above are reconciled

to the deferred revenue balance on our balance sheet in the table

below:

Twelve

Months

Ended

December

Twelve Months Ended December 27, 2008 29, 2007

----------------------------------------------- ---------

Pre Mar 29, Post Mar 29,

2008 2008

Ratable and Ratable and

Deferred Product Product

Revenue Revenue Revenue Services Total Total

----------- ----------- --------- ---------- ---------

(In thousands)

Beginning

balance $ 174,437 $ - $ - $ 174,437 $ 110,953

Additions to

deferred

revenue 29,639 8,140 19,356 57,135 301,229

Amortization

to revenue (195,426) (3,963) (9,776) (209,165) (237,745)

----------- ----------- --------- ---------- ---------

Ending balance $ 8,650 $ 4,177 $ 9,580 $ 22,407 $ 174,437

=========== =========== ========= ========== =========

Change in

deferred

revenue

balance $ (165,787) $ 4,177 $ 9,580 $ (152,030) $ 63,484

=========== =========== ========= ========== =========

(d) Adjustment amount represents the release of ratable and

product deferred cost amounts related to periods prior to March 29,

2008 as these amounts have been previously included as invoiced

shipments. Deferred ratable and product amounts recorded after

March 29, 2008 have not been adjusted as these amounts are

recognized on a GAAP basis in arriving at the adjusted GAAP

results.

The deferred cost of inventory adjustments recorded above are

reconciled to the deferred cost of inventory balance on our balance

sheet in the table below:

Three

Months

Ended

Three Months Ended December 27, December

2008 29, 2007

----------------------------------- ----------

Pre Mar 29, Post Mar 29,

2008 2008

Ratable and Ratable and

Deferred Product Product

Inventory Cost Cost Cost Total Total

----------- ----------- --------- ----------

(In thousands)

Beginning

balance $ 8,172 $ 1,120 $ 9,292 $ 79,887

Additions to

deferred cost

of revenue - 32 32 39,580

Amortized to

cost of

revenue (4,951) (136) (5,087) (37,845)

----------- ----------- --------- ----------

Ending balance $ 3,221 $ 1,016 $ 4,237 $ 81,622

=========== =========== ========= ==========

Change in

deferred

inventory cost

balance $ (4,951) $ (104) $ (5,055) $ 1,735

=========== =========== ========= ==========

(e) Adjustment amount represents the release of ratable and

product deferred cost amounts related to periods prior to March 29,

2008 as these amounts have been previously included as invoiced

shipments. Deferred ratable and product amounts recorded after

March 29, 2008 have not been adjusted as these amounts are

recognized on a GAAP basis in arriving at the adjusted GAAP

results.

The deferred cost of inventory adjustments recorded above are

reconciled to the deferred cost of inventory balance on our balance

sheet in the table below:

Three Months Ended September 27,

2008

-----------------------------------

Pre Mar 29, Post Mar 29,

2008 2008

Ratable and Ratable and

Deferred Product Product

Inventory Cost Cost Cost Total

----------- ----------- ---------

(In thousands)

Beginning

balance $ 26,510 $ 450 $ 26,960

Additions to

deferred cost

of revenue - 710 710

Amortized to

cost of

revenue (18,338) (40) (18,378)

----------- ----------- ---------

Ending balance $ 8,172 $ 1,120 $ 9,292

=========== =========== =========

Change in

deferred

inventory cost

balance $ (18,338) $ 670 $ (17,668)

=========== =========== =========

(f) Adjustment amount represents the release of ratable and

product deferred cost amounts related to periods prior to March 29,

2008 as these amounts have been previously included as invoiced

shipments. Deferred ratable and product amounts recorded after

March 29, 2008 have not been adjusted as these amounts are

recognized on a GAAP basis in arriving at the adjusted GAAP

results.

The deferred cost of inventory adjustments recorded above are

reconciled to the deferred cost of inventory balance on our balance

sheet in the table below:

Twelve

Months

Ended

Twelve Months Ended December 27, December

2008 29, 2007

----------------------------------- ----------

Pre Mar 29, Post Mar 29,

2008 2008

Ratable and Ratable and

Deferred Product Product

Inventory Cost Cost Cost Total Total

----------- ----------- --------- ----------

(In thousands)

Beginning

balance $ 81,622 $ - $ 81,622 $ 67,253

Additions to

deferred cost

of revenue 11,162 1,202 12,364 144,374

Amortized to

cost of

revenue (89,563) (186) (89,749) (130,005)

----------- ----------- --------- ----------

Ending balance $ 3,221 $ 1,016 $ 4,237 $ 81,622

=========== =========== ========= ==========

Change in

deferred

inventory cost

balance $ (78,401) $ 1,016 $ (77,385) $ 14,369

=========== =========== ========= ==========

(g) Excluded amount represents stock-based compensation expense

on a non-GAAP basis. Stock-based compensation is a non-cash expense

accounted for in accordance with the fair value recognition

provisions of Statement of Financial Accounting Standards No.

123(R). While this is a large component of our expense, we believe

investors want to evaluate our financial results both including and

excluding the effects of stock-based compensation expense in order

to compare our financial performance with that of other companies

and between time periods.

The stock-based compensation expense excluded from cost of

revenue is a non-GAAP financial measure and is reconciled to the

corresponding GAAP amount in the table below:

Three Months Ended Twelve Months Ended

------------------------------- --------------------

December September December December December

27, 27, 29, 27, 29,

2008 2008 2007 2008 2007

--------- --------- --------- --------- ---------

(In thousands)

GAAP stock-based

compensation in

cost of revenue $ 308 $ 299 $ 156 $ 1,086 $ 410

GAAP stock-based

compensation in

cost of revenue -

amortization from

balance sheet 739 1,180 198 4,288 327

Stock-based

compensation not

deferred to

deferred inventory

cost - - 797 215 1,213

Stock-based

compensation

previously

recognized on

invoiced shipment

basis (143) (209) (186) (1,098) (289)

--------- --------- --------- --------- ---------

Non-GAAP stock-based

compensation in

cost of revenue $ 904 $ 1,270 $ 965 $ 4,491 $ 1,661

========= ========= ========= ========= =========

(h) The following table summarizes the re-measurement of our

freestanding preferred stock warrants under FAS 150:

Twelve Months Ended

---------------------

December December

27, 29,

2008 2007

---------- ---------

Other gain (loss) $ - $ (19,761)

========== =========

Infinera Corporation

Condensed Consolidated Balance Sheets

(In thousands)

(Unaudited)

December 27, December 29,

2008 2007

------------ ------------

ASSETS

Current assets:

Cash and cash equivalents $ 166,770 $ 91,209

Short-term investments 68,232 181,168

Short-term restricted cash 720 743

Accounts receivable, net of allowance for

doubtful accounts of $1,700 in 2008 and

$0 in 2007 69,354 39,216

Other receivables 1,085 1,127

Inventory 58,986 58,579

Deferred inventory costs 1,744 78,362

Prepaid expenses and other current assets 6,311 3,941

------------ ------------

Total current assets 373,202 454,345

Property, plant and equipment, net 46,820 36,973

Intangible assets 1,276 1,541

Deferred inventory costs, non-current 2,493 3,260

Long-term investments 74,684 30,116

Long-term restricted cash 2,179 2,594

Other non-current assets 6,413 359

------------ ------------

Total assets $ 507,067 $ 529,188

============ ============

LIABILITIES AND STOCKHOLDERS' EQUITY

Current liabilities:

Accounts payable $ 34,048 $ 17,504

Accrued expenses 16,092 9,497

Accrued compensation and related benefits 13,472 17,749

Accrued warranty 5,205 4,974

Deferred revenue 14,683 167,031

------------ ------------

Total current liabilities 83,500 216,755

Accrued warranty, non-current 4,735 5,018

Deferred revenue, non-current 7,724 7,406

Long-term exercised unvested options 221 825

Other long-term liabilities 5,424 4,610

Commitments and contingencies

Stockholders' equity:

Preferred stock, $0.001 par value

Authorized shares - 25,000 and no shares

issued and outstanding - -

Common stock, $0.001 par value

Authorized shares - 500,000 as of

December 27, 2008 and December 29, 2007

Issued and outstanding shares - 94,163

as of December 27, 2008 and 91,580 as of

December 29, 2007 94 92

Additional paid-in capital 699,705 663,870

Accumulated other comprehensive income

(loss) (3,598) 78

Accumulated deficit (290,738) (369,466)

------------ ------------

Total stockholders' equity 405,463 294,574

------------ ------------

Total liabilities and stockholders' equity $ 507,067 $ 529,188

============ ============

Infinera Corporation

Condensed Consolidated Statements of Cash Flows

(In thousands)

(Unaudited)

Twelve Months Ended

---------------------------

December 27, December 29,

2008 2007

------------ ------------

Cash Flows from Operating Activities:

Net income (loss) $ 78,728 $ (55,342)

Adjustments to reconcile net income (loss)

to net cash provided by (used in)

operating activities:

Depreciation and amortization 12,975 9,824

Provision for doubtful accounts 1,700 -

Amortization of debt discount - 282

Accretion of investment discount (893) (572)

Asset impairment charges - 393

Stock-based compensation expense 23,819 9,656

Put Rights gain (15,866) -

Mark-to-market, trading 16,762 -

Excess tax benefit from stock option

transactions (248) -

Tax benefit from stock option transactions 593 -

Revaluation of warrant liabilities - 19,761

Gain on disposal of fixed assets (1,107) (2,776)

Other (gain) loss 7 (73)

Changes in assets and liabilities:

Accounts receivable (31,796) 2,054

Inventory (821) 2,515

Prepaid expenses and other current assets (2,463) (770)

Deferred inventory costs 76,538 (14,696)

Other non-current assets (6,081) 706

Accounts payable 16,767 (24,220)

Accrued liabilities and other expenses 3,387 5,557

Deferred revenue (152,030) 63,484

Accrued warranty (53) 7,275

------------ ------------

Net cash provided by operating

activities 19,918 23,058

Cash Flows from Investing Activities:

Purchases of available-for-sale investments (226,014) (299,159)

Proceeds from sale of investments 108,190 57,200

Proceeds from maturities of investments and

restricted cash 183,778 28,620

Proceeds from disposal of assets 1,192 3,286

Purchase of property and equipment (22,941) (20,215)

------------ ------------

Net cash provided by (used in)

investing activities 44,205 (230,268)

Cash Flows from Financing Activities:

Principal payments on loan obligations - (35,401)

Proceeds from loans - 7,119

Proceeds from initial public offering,

net of issuance costs - 190,078

Proceeds from follow-on offering, net of

issuance costs - 104,016

Proceeds from issuance of common stock 11,482 3,535

Proceeds from exercise of warrants - 45

Proceeds from repayment of non-recourse

notes - 145

Excess tax benefit from stock option

transactions 248 -

Repurchase of common stock (29) (59)

------------ ------------

Net cash provided by financing

activities 11,701 269,478

Effect of exchange rate changes (263) 57

Net change in cash and cash equivalents 75,561 62,325

Cash and cash equivalents at beginning of

period 91,209 28,884

------------ ------------

Cash and cash equivalents at end of period $ 166,770 $ 91,209

============ ============

Supplemental disclosures of cash flow

information:

Cash paid for interest $ 3 $ 2,497

Cash paid for income taxes $ 1,036 $ 121

Infinera Corporation

Supplemental Financial Information

Q1'07 Q2'07 Q3'07 Q4'07 Q1'08 Q2'08 Q3'08 Q4'08

----- ----- ----- ----- ----- ----- ----- -----

Invoiced Shipments $66.7 $69.0 $80.4 $93.4 $95.5 $90.8 $80.9 $86.2

Gross Margin % 35% 37% 43% 47% 45% 47% 42% 36%

----- ----- ----- ----- ----- ----- ----- -----

Invoiced Shipment

Composition:

Domestic % 89% 84% 81% 81% 82% 78% 81% 73%

International % 11% 16% 19% 19% 18% 22% 19% 27%

Largest Customer % 57% 48% 28% 18% 31% 21% 27% 23%

----- ----- ----- ----- ----- ----- ----- -----

Cash Related

Information:

Cash from

Operations $ 6.9 $(0.8) $(2.0) $18.9 $ 9.8 $ 5.6 $ 9.9 $(5.4)

Capital

Expenditures $ 5.2 $ 3.6 $ 3.0 $ 8.5 $ 4.5 $ 4.8 $ 5.9 $ 7.8

Depreciation &

Amortization $ 2.1 $ 2.0 $ 2.7 $ 2.7 $ 2.6 $ 2.9 $ 3.4 $ 4.1

DSO's 27 36 47 39 42 57 55 74

----- ----- ----- ----- ----- ----- ----- -----

Inventory Metrics:

Raw Materials $ 7.4 $ 8.8 $ 7.5 $10.5 $ 7.9 $ 9.2 $10.0 $ 9.1

Work in Process $31.6 $36.0 $34.8 $35.1 $40.6 $34.6 $35.8 $37.9

Finished Goods $18.4 $13.7 $14.8 $13.0 $10.7 $13.8 $12.8 $12.0

----- ----- ----- ----- ----- ----- ----- -----

Total Inventory $57.3 $58.5 $57.1 $58.6 $59.2 $57.6 $58.6 $59.0

Inventory Turns 3.0 3.0 3.2 3.4 3.5 3.3 3.2 3.8

----- ----- ----- ----- ----- ----- ----- -----

Worldwide Headcount 617 646 668 711 799 853 889 937

----- ----- ----- ----- ----- ----- ----- -----

Contacts: Press: Jeff Ferry jferry@infinera.com Infinera

Corporation 408-572-5213 Investors/Analysts: Bob Blair

bblair@infinera.com Infinera Corporation 408-716-4879

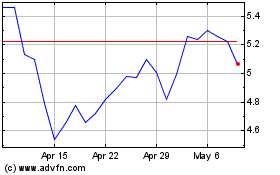

Infinera (NASDAQ:INFN)

Historical Stock Chart

From May 2024 to Jun 2024

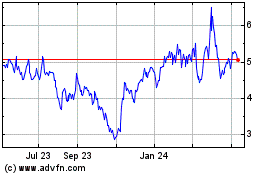

Infinera (NASDAQ:INFN)

Historical Stock Chart

From Jun 2023 to Jun 2024