Filed Pursuant to Rule 424(b)(3)

Registration No. 333-258340

PROSPECTUS SUPPLEMENT NO. 58

(to prospectus dated August 10, 2021)

Up to 19,300,751 Shares of Class A Common Stock Issuable Upon the Exercise of Warrants Up to 77,272,414 Shares of Class A Common Stock Up to 8,014,500 Warrants to Purchase Class A Common Stock

This prospectus supplement is being filed to update and supplement the information contained in the prospectus dated August 10, 2021 (as supplemented or amended from time to time, the “Prospectus”), with the information contained in our Current Report on Form 8-K, filed with the Securities and Exchange Commission (“SEC”) on November 27, 2023 (the “Current Report”). Accordingly, we have attached the Current Report to this prospectus supplement.

The Prospectus and this prospectus supplement relate to the issuance by us of up to an aggregate of 19,300,751 shares of Class A Common Stock, par value $0.0001 per share (“Class A Common Stock”), which consists of (i) up to 8,014,500 shares of Class A Common Stock that are issuable upon the exercise of 8,014,500 warrants (the “private placement warrants”) issued in a private placement in connection with the initial public offering of Decarbonization Plus Acquisition Corporation (“DCRB”) and upon the conversion of a working capital loan by the Sponsor (as defined in the Prospectus) to DCRB and (ii) up to 11,286,251 shares of Class A Common Stock that are issuable upon the exercise of 11,286,251 warrants originally issued in DCRB’s initial public offering. The Prospectus and this prospectus supplement also relate to the offer and sale from time to time by the selling securityholders named in the Prospectus, or their permitted transferees, of (i) up to 77,272,414 shares of Class A Common Stock (including up to 5,293,958 shares of Class A Common Stock issuable upon the satisfaction of certain triggering events (as described in the Prospectus) and up to 326,048 shares of Class A Common Stock that may be issued upon exercise of the Ardour Warrants (as defined in the Prospectus)) and (ii) up to 8,014,500 private placement warrants.

This prospectus supplement updates and supplements the information in the Prospectus and is not complete without, and may not be delivered or utilized except in combination with, the Prospectus, including any amendments or supplements thereto. This prospectus supplement should be read in conjunction with the Prospectus and if there is any inconsistency between the information in the Prospectus and this prospectus supplement, you should rely on the information in this prospectus supplement.

Our Class A Common Stock and warrants are traded on the Nasdaq Global Select Market under the symbols “HYZN” and “HYZNW,” respectively. On November 27, 2023 the closing price of our Class A Common Stock was $1.18 and the closing price for our public warrants was $0.04.

Investing in our securities involves risks that are described in the “Risk Factors” section beginning on page 7 of the Prospectus.

Neither the SEC nor any state securities commission has approved or disapproved of the securities to be issued under the Prospectus or determined if the Prospectus or this prospectus supplement is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is November 27, 2023.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________

FORM 8-K

___________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 27, 2023

___________________________________

Hyzon Motors Inc.

(Exact name of registrant as specified in its charter)

___________________________________

| | | | | | | | |

| Delaware | 001-3962 | 82-2726724 |

(State or other jurisdiction of incorporation or organization) | (Commission File Number) | (I.R.S. Employer Identification Number) |

475 Quaker Meeting House Road Honeoye Falls, NY | | 14472 |

| (Address of principal executive offices) | | (Zip Code) |

(585)-484-9337 |

(Registrant's telephone number, including area code) |

| Not Applicable |

| (Former name or former address, if changed since last report) |

___________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | |

Securities registered pursuant to Section 12(b) of the Act: |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A common stock, par value $0.0001 per share | HYZN | NASDAQ Capital Market |

| Warrants, each whole warrant exercisable for one share of Class A common stock at an exercise price of $11.50 per share | HYZNW | NASDAQ Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Agreement.

On November 20, 2023, Hyzon Motors Inc. (the “Company”) entered into a Purchase and Sale Agreement (the “Agreement”) with Fulcrum Holdings LLC (the “Buyer”).

Under the terms of the Agreement, the Buyer will purchase the Company’s property located at 475 Quaker Meeting House Road, Honeoye Falls, New York 14472 (the “Property”) for $3,125,000.

Under the terms of the Agreement, (i) within five days after the execution of the Agreement, the Buyer must deposit with the Agreement’s third-party escrow agent $93,750 (the “Initial Deposit”), and (ii) five days after the expiration of the Due Diligence Period (as hereafter defined), the Buyer must deposit with the Agreement’s third-party escrow agent a second $93,750 (the “Additional Deposit” and together with the Initial Deposit, the “Deposit”).

The Buyer will have until the date which is 45 days after execution of the Agreement (the “Due Diligence Period”), to conduct its due diligence on the Property at its own cost and expense. If the Buyer does not terminate the Agreement by the expiration of the Due Diligence Period, then the Due Diligence Period will expire and the Deposit will be nonrefundable and credited to the purchase price at closing. If Buyer elects to terminate the Agreement prior to the expiration of the Due Diligence Period, the Deposit is returned to the Buyer. After the expiration of the Due Diligence Period, if the Buyer does not terminate the Agreement and thereafter fails to close the transaction, the Deposit will be non-refundable and will be released to the Company as liquidated damages. The Due Diligence Period is subject to a 15 day extension (the “Extension Period”) by the Buyer if the Buyer has not received written reports from its environmental consultants as to the condition of the Property during the Due Diligence Period. However, during the Extension Period, the Buyer’s right to terminate the Agreement is limited to the reasons relating to the results of such written reports.

The closing of this sale will occur on or prior to April 30, 2024, or such earlier or later date as the Company and the Buyer mutually agree in writing.

The foregoing summary of the terms and conditions of the Agreement does not purport to be complete and is qualified in its entirety by reference to the complete text of the Agreement, a copy of which is filed as Exhibit 10.1 hereto and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits:

| | | | | | | | |

| Exhibit Number | | Description |

| 10.1 | | |

| | |

| 104 | | Cover Page Interactive Data File (formatted as inline XBRL and contained in Exhibit 101) |

| | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| HYZON MOTORS INC. |

| | |

| Date: November 27, 2023 | By: | /s/ Parker Meeks |

| Name: | Parker Meeks |

| Title: | Chief Executive Officer |

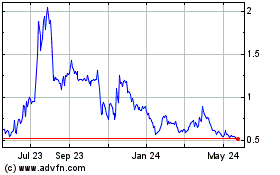

Hyzon Motors (NASDAQ:HYZN)

Historical Stock Chart

From Apr 2024 to May 2024

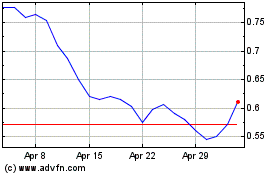

Hyzon Motors (NASDAQ:HYZN)

Historical Stock Chart

From May 2023 to May 2024