UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. ___)

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to §240.14a-12

|

Home Federal Bancorp, Inc. of Louisiana

|

|

(Name of Registrant as Specified In Its Charter)

|

| |

|

(Name of Person(s) Filing Proxy Statement, if other than Registrant)

|

Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

(1) Title of each class of securities to which transaction applies: _____________________________

(2) Aggregate number of securities to which transaction applies: _____________________________

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): _______________

(4) Proposed maximum aggregate value of transaction: ____________________________________

(5) Total fee paid: __________________________________________________________________

☐ Fee paid previously with preliminary materials.

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously.

Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1) Amount Previously Paid: _________________________________________________________________

(2) Form, Schedule or Registration Statement No.: ________________________________________________

(3) Filing Party: ___________________________________________________________

(4) Date Filed: ______________________________________________

October 11, 2024

Dear Shareholder:

You are cordially invited to attend the annual meeting of shareholders of Home Federal Bancorp, Inc. of Louisiana. The meeting will be held at Home Federal Bancorp’s principal office located at 624 Market Street, Shreveport, Louisiana, on Wednesday, November 20, 2024, at 10:00 a.m., Central Time. The matters to be considered by shareholders at the annual meeting are described in the accompanying materials.

It is very important that you be represented at the annual meeting regardless of the number of shares you own or whether you are able to attend the meeting in person. We urge you to mark, sign, date and return your proxy card today in the envelope provided or vote over the Internet or by telephone even if you plan to attend the annual meeting. This will not prevent you from voting in person at the annual meeting but will ensure that your vote is counted if you are unable to attend.

Your continued support of and interest in Home Federal Bancorp, Inc. of Louisiana is sincerely appreciated.

Very truly yours,

James R. Barlow

Chairman of the Board, President and

Chief Executive Officer

|

HOME FEDERAL BANCORP, INC. OF LOUISIANA

624 Market Street

Shreveport, Louisiana 71101

(318) 222-1145

|

|

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

|

|

TIME

|

10:00 a.m., Central Time, Wednesday, November 20, 2024

|

| |

|

|

PLACE

|

Home Federal Bank

624 Market Street

Shreveport, Louisiana

|

| |

|

| ITEMS OF BUSINESS |

(1) To elect two directors for a three-year term expiring in 2027 and until their successors |

| |

are elected and qualified; and |

| |

(2) To ratify the appointment of Carr, Riggs & Ingram, LLC as our independent registered |

|

|

public accounting firm for the fiscal year ending June 30, 2025.

|

| |

|

| |

To transact such other business, as may properly come before the annual meeting or at any adjustment thereof. We are not aware of any other such business.

|

| |

|

|

RECORD DATE

|

Holders of Home Federal Bancorp common stock of record at the close of business on September 23, 2024 are entitled to vote at the meeting.

|

| |

|

|

ANNUAL REPORT

|

Our 2024 Annual Report including our Form 10-K is enclosed but is not a part of the proxy solicitation materials.

|

| |

|

|

PROXY VOTING

|

It is important that your shares be represented and voted at the meeting. You can vote your shares by completing and returning the proxy card sent to you. Most shareholders can also vote their shares over the Internet or by telephone. If Internet or telephone voting is available to you, voting instructions are printed on the proxy card or voting instruction form you received. You can revoke your proxy at any time prior to its exercise at the meeting by following the instructions in the accompanying proxy statement.

|

| |

|

| |

BY ORDER OF THE BOARD OF DIRECTORS

DeNell W. Mitchell

Corporate Secretary

|

|

Shreveport, Louisiana

October 11, 2024

|

| |

|

TABLE OF CONTENTS

|

| |

Page

|

|

About the Annual Meeting of Shareholders

|

1

|

|

Information with Respect to Nominees for Director, Continuing Directors and Executive Officers

|

3

|

|

Election of Directors (Proposal One)

|

3

|

|

Members of the Board of Directors Continuing in Office

|

5

|

|

Director Nominations

|

6

|

|

Director Independence

|

6

|

|

Compensation of Directors

|

6

|

|

Meetings of the Board of Directors

|

7

|

|

Membership on Certain Board Committees

|

7

|

|

Board Leadership Structure

|

8

|

|

Board’s Role in Risk Oversight

|

8

|

|

Directors’ Attendance at Annual Meetings

|

8

|

|

Executive Officers Who Are Not Also Directors

|

9

|

|

Management Compensation

|

10

|

|

Summary Compensation Table

|

10

|

|

Narrative to Summary Compensation Table

|

10

|

|

Pay versus Performance

|

11

|

|

Outstanding Equity Awards at Fiscal Year-End

|

12

|

|

Employment and Change in Control Agreements

|

12

|

|

Supplemental Executive Retirement Agreement

|

13

|

|

Loan Officer Incentive Plan

|

13

|

|

Retirement Benefits

|

14

|

|

Stock Option Plans and Stock Incentive Plans

|

15

|

|

Survivor Benefit Plan

|

15

|

|

Related Party Transactions

|

15

|

|

Beneficial Ownership of Common Stock by Certain Beneficial Owners and Management

|

16

|

|

Section 16(a) Reports

|

17

|

|

Ratification of Appointment of Independent Registered Public Accounting Firm (Proposal Three)

|

18

|

|

Audit Fees

|

18

|

|

Report of the Audit Committee

|

19

|

|

Shareholder Proposals, Nominations and Communications with the Board of Directors

|

20

|

|

Annual Reports

|

20

|

|

Other Matters

|

21

|

PROXY STATEMENT

OF

HOME FEDERAL BANCORP, INC. OF LOUISIANA

|

ABOUT THE ANNUAL MEETING OF SHAREHOLDERS

|

We are furnishing this proxy statement to holders of common stock of Home Federal Bancorp, the holding company of Home Federal Bank. We are soliciting proxies on behalf of our Board of Directors to be used at the annual meeting of shareholders to be held at Home Federal Bancorp’s principal office located at 624 Market Street, Shreveport, Louisiana, on Wednesday, November 20, 2024 at 10:00 a.m., Central Time, and any adjournment thereof, for the purposes set forth in the attached Notice of Annual Meeting of Shareholders. This proxy statement is first being mailed to shareholders on or about October 11, 2024.

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to Be Held on November 20, 2024. This proxy statement and our 2024 Annual Report to Shareholders are available at www.proxyvote.com and on our website at www.hfb.bank/investors.

What is the purpose of the annual meeting?

At our annual meeting, shareholders will act upon the election of directors and the ratification of our independent registered public accounting firm. In addition, management may report on the performance of Home Federal Bancorp and will respond to questions from shareholders.

What are the Board of Directors’ recommendations?

The recommendations of the Board of Directors are set forth under the description of each proposal in this proxy statement. In summary, the Board of Directors recommends that you vote FOR the nominees for director described herein and FOR ratification of our independent registered public accounting firm for fiscal 2025.

The proxy solicited hereby, if properly signed and returned to us or voted over the Internet or by telephone and not revoked prior to its use, will be voted in accordance with your instructions. If no contrary instructions are given, each proxy signed and received will be voted in the manner recommended by the Board of Directors and, upon the transaction of such other business as may properly come before the meeting, in accordance with the best judgment of the persons appointed as proxies. Proxies solicited hereby may be exercised only at the annual meeting and any adjournment of the annual meeting and will not be used for any other meeting.

Who is entitled to vote?

Only our shareholders of record as of the close of business on the record date for the meeting, September 23, 2024, are entitled to vote at the meeting. On the record date, we had 3,131,668 shares of common stock issued and outstanding and no other class of equity securities outstanding. For each issued and outstanding share of common stock you own on the record date, you will be entitled to one vote on each matter to be voted on at the meeting, in person or by proxy.

How do I vote my shares?

After you have carefully read this proxy statement, indicate on your proxy card how you want your shares to be voted, then sign, date and mail your proxy card in the enclosed prepaid return envelope as soon as possible. You may also vote by telephone or the Internet if indicated on your proxy card or voting instruction form. This will enable your shares to be represented and voted at the annual meeting.

Voting instructions from participants in the Home Federal Bank Employees’ Savings and Profit Sharing Plan and the Home Federal Bank Employee Stock Ownership Plan must be received by 11:59 p.m. Eastern Time on November 15, 2024, to be used by the plan Trustees to determine the votes for shares held in the plans.

Can I attend the meeting and vote my shares in person?

Yes. All shareholders are invited to attend the annual meeting. Shareholders of record can vote in person at the annual meeting. If your shares are held in “street name,” then you are not the shareholder of record and you must ask your broker or other nominee how you can vote at the annual meeting.

Can I change my vote or revoke my proxy after I return my proxy card or vote by telephone or the Internet?

Yes. If you are a shareholder of record, there are three ways you can change your vote or revoke your proxy after you have sent in your proxy card or voted by telephone or the Internet.

• First, you may complete and submit a new proxy card or vote by telephone or the Internet again before the deadline printed on the card. Any earlier proxies will be revoked automatically.

• Second, you may send a written notice to our Corporate Secretary, Ms. DeNell W. Mitchell, Home Federal Bancorp, Inc. of Louisiana, 624 Market Street, Shreveport, Louisiana 71101, in advance of the meeting stating that you would like to revoke your proxy.

• Third, you may attend the annual meeting and vote in person. Any earlier proxy will be revoked. However, attending the annual meeting without voting in person will not revoke your proxy.

If your shares are held in “street name” and you have instructed a broker or other nominee to vote your shares, you must follow directions from your broker or other nominee to change your vote.

If my shares are held in “street name” by my broker, could my broker automatically vote my shares?

Your broker may not vote on the election of directors if you do not furnish instructions for such proposal to your broker. You should use the voting instruction form or broker card provided by the institution that holds your shares to instruct your broker to vote your shares on this proposal or else your shares may not be voted or may be considered “broker non-votes.”

Your broker may vote in his or her discretion on the ratification of the appointment of our independent registered public accounting firm if you do not furnish instructions. If your broker votes in his or her discretion on proposal two and you do not provide instructions for proposal one then your shares will be considered “broker non-votes” on proposals one.

What constitutes a quorum?

The presence at the meeting, in person or by proxy, of the holders of a majority of the shares of common stock entitled to vote at the annual meeting will constitute a quorum. Proxies received but marked as abstentions will be included in the calculation of the number of shareholders considered to be present at the meeting.

What vote is required to approve each item?

The election of directors will be determined by a plurality of the votes cast at the annual meeting. The two nominees for director receiving the most “for” votes will be elected. The affirmative vote of a majority of the total votes cast is required for approval of the proposal to ratify the appointment of Carr, Riggs & Ingram, LLC, as our independent registered public accounting firm for the year ending June 30, 2025.

|

INFORMATION WITH RESPECT TO NOMINEES FOR DIRECTOR, CONTINUING

DIRECTORS AND EXECUTIVE OFFICERS

|

Election of Directors (Proposal One)

Our Articles of Incorporation provide that the Board of Directors will be divided into three classes as nearly equal in number as possible. The directors are elected by our shareholders for staggered three year terms and until their successors are elected and qualified.

At this annual meeting, you will be asked to elect one class of directors, consisting of two directors, for a three-year term expiring in 2027 and until their successors are elected and qualified. Shareholders of Home Federal Bancorp are not permitted to use cumulative voting for the election of directors. Our Board of Directors, upon recommendation of the Nominating and Corporate Governance Committee, nominated Messrs. James R. Barlow and Thomas Steen Trawick, Jr. to a three-year term expiring in 2027. No director or nominee for director is related to any other director or executive officer by blood, marriage or adoption.

Unless otherwise directed, each proxy signed and returned by a shareholder will be voted for the election of the nominees for director listed below. If any person named as a nominee should be unable or unwilling to stand for election at the time of the annual meeting, the proxies will nominate and vote for any replacement nominee or nominees recommended by our Board of Directors. At this time, the Board of Directors knows of no reason why any of the nominees listed below may not be able to serve as a director if elected.

The following tables present information concerning the nominees for director and our continuing directors. The indicated period of service as a director is presented on a calendar year basis and includes service for directors of Home Federal Bank prior to our reorganization into the holding company structure in 2005. Ages are reflected as of September 23, 2024.

Nominees for Director for a Three-Year Term Expiring in 2027

|

Name

|

|

Position with Home Federal Bancorp, Age and

Principal Occupation During the Past Five Years

|

|

Director Since

|

|

James R. Barlow

|

|

Chairman of the Board. President and Chief Executive Officer of Home Federal Bancorp and Home Federal Bank since January 2020, January 2016 and 2013, respectively. Prior thereto, Mr. Barlow served as President and Chief Operating Officer of Home Federal Bancorp since November 2009 and Executive Vice President and Chief Operating Officer from November 2009 through December 2012. Mr. Barlow served as President and Chief Operating Officer of Home Federal Bank from February 2009 through December 2012. Previously, Mr. Barlow served as Executive Vice President and Area Manager for the Arkansas-Louisiana-Texas area commercial real estate operations of Regions Bank from August 2006 until February 2009. From 2005 until August 2006, Mr. Barlow was a Regions Bank City President for the Shreveport/Bossier area and from February 2003 to 2005 he served as Commercial Loan Manager for Regions Bank for the Shreveport/Bossier area. Mr. Barlow served in various positions at Regions Bank since 1997.

Mr. Barlow brings substantial managerial, banking and lending experience to the board, as well as significant knowledge of the local commercial real estate market from his years of service as manager and regional President of a regional bank. He served on the Louisiana Banker’s Association Board of Directors from 2015-2018 and is also a member of the Committee of 100 for the betterment of the Shreveport Bossier community by improving regional economic development, education and community relations. Age 56.

|

|

2009

|

|

Thomas Steen Trawick, Jr.

|

|

Private Practice Physician, Sure Access MD, LLC since 2024. Previously, Director, Chief Executive Officer and Chief Medical Officer of CHRISTUS Health Shreveport – Bossier from 2019 to 2023. Former Associate Chief Medical Officer of Sound Inpatient Physicians. Dr. Trawick is a practicing Hospitalist at CHRISTUS Health. He was formerly in Private Practice at Highland Clinic from September 2001 to February 2005 and then a Pediatric and Adult Hospitalist until January 2014.

Dr. Trawick brings management expertise to the board and knowledge of the local medical community as the past President of the Northwest Louisiana Medical Society and serves as Speaker of the House of Delegates for the Louisiana State Medical Society. Age 55.

|

|

2012

|

|

The Board of Directors recommends that you vote FOR election of the

nominees for director.

|

Members of the Board of Directors Continuing in Office

Directors Whose Terms Expire in 2025

|

Name

|

|

Position with Home Federal Bancorp, Age and

Principal Occupation During the Past Five Years

|

|

Director

Since

|

|

Walter T. Colquitt, III

|

|

Director. Retired Dentist, Shreveport, Louisiana.

Dr. Colquitt brings extensive knowledge to the board of the local professional community through his dental practice in Shreveport, Louisiana. Age 79.

|

|

1993

|

| |

|

|

|

|

|

Scott D. Lawrence

|

|

Director. President of Southwestern Wholesale Co., Inc., Shreveport, Louisiana since 1980.

Mr. Lawrence brings significant business enterprise and managerial oversight skills as President and owner of a dry goods wholesale supplier in Shreveport, Louisiana. Age 78.

|

|

1994

|

Directors Whose Terms Expire in 2026

|

Name

|

|

Position with Home Federal Bancorp, Age and

Principal Occupation During the Past Five Years

|

|

Director

Since

|

|

Mark M. Harrison

|

|

Director. Owner of House of Carpets and Lighting, a floor coverings and lighting fixtures business in Shreveport, Louisiana, since September 2007.

Mr. Harrison brings substantial business and entrepreneurial experience to the board as owner of a local carpet and lighting business in Shreveport, Louisiana and as a director of Home Builders Association of Northwest Louisiana. Age 65.

|

|

2007

|

|

Timothy W. Wilhite

|

|

Director. CFO/General Counsel of Wilhite Electric Co., Inc. since June 2001. Mr. Wilhite remains Of Counsel of the law firm Downer, Jones, Marino & Wilhite. Serves on the Executive Committee and Board Member of the Greater Bossier Economic Development Foundation and Co-Chair of the Bossier Industrial Park Committee. Serves as President of the Ark-La-Tex Regional Air Service Alliance (RASA), a 501(c)4. Serves on the Executive Board of Raffles, Ltd., a captive insurance program.

Mr. Wilhite brings knowledge of the local business and legal community to the Board through his community involvement and thru the GBEDA and RASA. Age 55.

|

|

2010

|

Director Nominations

Nominations for director of Home Federal Bancorp are made by the Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee considers candidates for director suggested by other directors, as well as our management and shareholders. A shareholder who desires to recommend a prospective nominee for the Board should notify our Secretary in writing with whatever supporting material the shareholder considers appropriate. In addition, any shareholder wishing to make a nomination must follow our procedures for shareholder nominations, which are described under “Shareholder Proposals, Nominations and Communications with the Board of Directors.”

The charter of the Nominating and Corporate Governance Committee sets forth certain criteria the committee may consider when recommending individuals for nomination as director including: (a) ensuring that the Board of Directors, as a whole, is diverse and consists of individuals with various and relevant career experience, relevant technical skills, industry knowledge and experience, financial expertise (including expertise that could qualify a director as a “financial expert,” as that term is defined by the rules of the SEC), local or community ties and (b) minimum individual qualifications, including strength of character, mature judgment, familiarity with our business and industry, independence of thought and an ability to work collegially. The committee also may consider the extent to which the candidate would fill a present need on the Board of Directors.

Director Independence

A majority of Home Federal Bancorp’s directors are independent directors as defined in the rules of the Nasdaq Stock Market. The Board of Directors has determined that Drs. Colquitt and Trawick and Messrs. Harrison, Lawrence and Wilhite are independent directors.

Compensation of Directors

Director Compensation Table. The table below summarizes the total compensation paid to each of our non-employee directors for the fiscal year ended June 30, 2024. The primary elements of Home Federal Bank’s non-employee director compensation program consist of cash and equity compensation. Compensation for Mr. Barlow is included in the Summary Compensation Table.

|

Name

|

|

Fees Earned or

Paid in Cash

|

|

|

Stock

Awards(1)

|

|

|

Option

Awards(1)

|

|

|

Total

|

|

|

Walter T. Colquitt, III

|

|

$ |

24,300 |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

24,300 |

|

|

Mark M. Harrison

|

|

|

25,800 |

|

|

|

- |

|

|

|

- |

|

|

|

25,800 |

|

|

Scott D. Lawrence

|

|

|

24,900 |

|

|

|

- |

|

|

|

- |

|

|

|

24,900 |

|

|

Thomas Steen Trawick, Jr.

|

|

|

24,300 |

|

|

|

- |

|

|

|

- |

|

|

|

24,300 |

|

|

Timothy W. Wilhite, Esq.

|

|

|

25,800 |

|

|

|

- |

|

|

|

- |

|

|

|

25,800 |

|

(1) As of June 30, 2024, each of our non-employee directors held the following aggregate number of unvested stock awards and outstanding options:

| |

|

Aggregate Number of Equity Awards Outstanding at Fiscal Year End

|

|

|

Name

|

|

Stock Awards

|

|

|

Option Awards

|

|

|

Walter T. Colquitt, III

|

|

|

1,600 |

|

|

|

27,000 |

|

|

Mark M. Harrison

|

|

|

1,600 |

|

|

|

31,000 |

|

|

Scott D. Lawrence

|

|

|

1,600 |

|

|

|

10,800 |

|

|

Thomas Steen Trawick, Jr.

|

|

|

1,600 |

|

|

|

31,000 |

|

|

Timothy W. Wilhite, Esq.

|

|

|

1,600 |

|

|

|

18,000 |

|

Narrative to Director Compensation Table. During 2024, members of the Board of Directors received a fee of $2,400 for regular meetings of the Board regardless of meeting attendance. We do not pay fees for special meetings of the Board or separate compensation to directors for their attendance at meetings of the Board of Directors of Home Federal Bancorp. During 2024, members of Home Federal Bancorp’s Audit Committee and Compensation Committee received $150 per meeting attended and members of Home Federal Bank’s ALCO committee received $150 meeting attended. Board fees are subject to periodic adjustment by the Board of Directors.

Meetings of the Board of Directors

During the fiscal year ended June 30, 2024, the Board of Directors of Home Federal Bancorp met 10 times. No director of Home Federal Bancorp attended fewer than 75% of the aggregate of the total number of Board meetings held during the period for which he has been a director, and the total number of meetings held by all committees of the Board on which he served, other than Dr. Colquitt who attended 56.25%.

Membership on Certain Board Committees

The Board of Directors of Home Federal Bancorp has established an Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee. All of the members of these committees are independent directors as defined in the listing standards of The Nasdaq Stock Market. The committees operate in accordance with written charters which are available on our website at www.hfbla.com. The following table sets forth the membership of the committees as of the date of this proxy statement.

|

Directors

|

|

Audit

|

|

Compensation

|

|

Nominating

and Corporate

Governance

|

|

Walter T. Colquitt III

|

|

|

|

*

|

|

|

|

Mark M. Harrison

|

|

*

|

|

**

|

|

|

|

Scott D. Lawrence

|

|

**

|

|

|

|

*

|

|

Thomas Steen Trawick, Jr.

|

|

|

|

|

|

*

|

|

Timothy W. Wilhite, Esq.

|

|

*

|

|

*

|

|

**

|

* Member

** Chairman

Audit Committee. The Audit Committee reviews with management and the independent registered public accounting firm the systems of internal control, reviews the annual financial statements, including the Annual Report on Form 10-K and monitors Home Federal Bancorp’s adherence in accounting and financial reporting to generally accepted accounting principles. The Audit Committee is comprised of three directors who are independent directors as defined in the Nasdaq listing standards and the rules and regulations of the Securities and Exchange Commission. The Board of Directors has determined that no members of the Audit Committee meet the qualifications established for an Audit Committee financial expert in the regulations of the Securities and Exchange Commission; however, the members have the requisite financial and accounting background to meet the Nasdaq listing standards. The Audit Committee met six times in fiscal 2024 and informally reviews our financial results on a quarterly basis.

Nominating and Corporate Governance Committee. It is the responsibility of the Nominating and Corporate Governance Committee in accordance with its charter to, among other functions, review the qualifications of director nominees. The Committee approves nominees for consideration by the full Board of Directors to fill vacancies on the Board or for election at the annual meeting. The Nominating and Corporate Governance Committee met once during fiscal 2024.

Compensation Committee. It is the responsibility of the Compensation Committee of Home Federal Bancorp to set the compensation of Home Federal Bancorp’s Chief Executive Officer and Chief Financial Officer as well as the other members of senior management and administer our stock and incentive compensation plans. The Compensation Committee of Home Federal Bancorp met six times in fiscal 2024.

Board Leadership Structure

Our Board of Directors is led by a Chairman selected by the Board from time to time. Presently, Mr. Barlow, our President and Chief Executive Officer also serves as Chairman of the Board. Other than Mr. Barlow, all of our directors are independent. The Board determined that selecting our Chief Executive Officer as Chairman is in our best interests because it promotes unity of vision for the leadership of Home Federal Bancorp and avoids potential conflicts among directors. In addition, as the Chief Executive Officer, Mr. Barlow is the director most familiar with our business and operations and is best situated to lead discussions on important matters affecting the business of Home Federal Bancorp. By combining the Chief Executive Officer and Chairman positions there is a firm link between management and the Board which promotes the development and implementation of our corporate strategy.

The Board of Directors is aware of the potential conflicts that may arise when an insider chairs the Board but believes these are limited by existing safeguards which include the fact that as a financial institution holding company, much of our operations are highly regulated.

Board’s Role in Risk Oversight

Risk is inherent with every business, particularly financial institutions. We face a number of risks, including credit risk, interest rate risk, liquidity risk, operational risk, strategic risk and reputational risk. Management is responsible for the day-to-day management of the risks Home Federal Bancorp faces, while the Board, as a whole and through its committees, has responsibility for the oversight of risk management. In its risk oversight role, the Board of Directors ensures that the risk management processes designed and implemented by management are adequate and functioning as designed.

Members of senior management regularly attend meetings of the Board of Directors and address any questions or concerns raised by the Board on risk management or other matters. The Board’s risk oversight function is carried out through, among other factors, its review and approval of various policies and procedures, such as Home Federal Bank’s lending and investment policies, ratification or approval of investments and loans exceeding certain thresholds, and regular review of risk elements such as interest rate risk exposure, liquidity and problem assets.

Directors’ Attendance at Annual Meetings

Directors are expected to attend the annual meeting absent a valid reason for not doing so. All of our directors attended, in person or by telephone, our last annual meeting of shareholders held on November 15, 2023.

Executive Officers Who Are Not Also Directors

The following individuals who do not also serve on the Board of Directors serve as executive officers of Home Federal Bancorp. Ages are reflected as of September 23, 2024.

|

David S. Barber, age 55, has served as Senior Vice President Mortgage Lending of Home Federal Bank since June 2009. Prior thereto, Mr. Barber served as Vice President, Director of Branch Operations, First Family Mortgage, Inc. from July 2004 to May 2009.

|

|

Glen W. Brown, CPA, age 67, has served as Senior Vice President and Chief Financial Officer of Home Federal Bank since July 2014. Previously, Mr. Brown served as Vice President/Controller, Teche Federal Bank, New Iberia, Louisiana, the wholly owned subsidiary of Teche Holding Company, from November 1997 to June 2014.

|

|

Adalberto Cantu, Jr., age 74, has served as Senior Vice President and Senior Credit Officer of Home Federal Bank since February 2013. Prior thereto, Mr. Cantu served as Senior Vice President of Business Banking at Progressive Bank from July 2010 to October 2011. Previously, Mr. Cantu served as Senior Vice President of Business Banking at Regions Bank from July 1987 to July 2010.

|

|

Mary L. Jones, age 71, has served as Chief Operations Officer, Senior Vice President Retail and Deposit Operations of Home Federal Bank since January 2015. Prior thereto, Ms. Jones served as Senior Vice President Retail and Deposit Operations of Home Federal Bank from July 2011 to January 2015, and previously Ms. Jones served as Vice President of Operations since January 2009. Previously, Ms. Jones served as Assistant Vice President and BSA Officer of Home Federal Bank from January 1985 to January 2009 and January 2013, respectively.

|

|

Donna (Delayne) C. Lewis, age 61, has served as Senior Vice President, Chief Risk Officer and BSA Officer of Home Federal Bank since March 2022. Previously, Ms. Lewis served as Senior Vice President, BSA Officer and Risk Officer of Home Federal Bank from January 2018 to March 2022, and served as Vice President, BSA Officer and Risk Officer of Home Federal Bank from January 2013 to January 2018. Prior thereto, Ms. Lewis served as Vice President/Compliance of Community Trust Bank (now known as Origin Bank) from 2010 to 2013. Ms. Lewis served as Vice President, Compliance/BSA Officer/Internal Auditor of First Louisiana Bank from 1998 to 2010. Ms. Lewis served as Assistant Vice President/Branch Manager from 1987 to 1998 and Loan Operations from 1982 to 1987 of City Bank and Trust. Ms. Lewis holds a Certified Regulatory Compliance Manager (CRCM) certification and graduated from Louisiana State University Graduate School of Banking.

|

|

K. Matthew Sawrie, age 49, has served as Senior Vice President Commercial Lending of Home Federal Bank since February 2009. Prior thereto, Mr. Sawrie served as Vice President Commercial Real Estate, Regions Bank from 2006 to 2009, and previously, Assistant Vice President Business Banking Relationship Manager, Regions Bank from 2003 to 2006.

|

|

In accordance with our Bylaws, our executive officers are elected annually and hold office until their respective successors have been elected and qualified or until death, resignation or removal by the Board of Directors.

|

Summary Compensation Table

The following table sets forth a summary of certain information concerning the compensation earned during the fiscal years ended June 30, 2024 and 2023 by our principal executive officer, Mr. Barlow, and the two other executive officers serving at the end of fiscal 2024 who were the most highly compensated executive officers in fiscal 2024. These three officers are referred to as the “named executive officers” in this proxy statement.

|

Name and Principal Position

|

|

Fiscal

Year

|

|

|

Salary

|

|

|

Bonus

|

|

|

Nonequity

Incentive Plan

Compensation

|

|

|

Stock

Awards

|

|

|

Option

Awards

|

|

|

All Other

Compen-

sation(1)

|

|

|

Total

|

|

| James R. Barlow |

|

|

2024 |

|

|

$ |

312,469 |

|

|

$ |

165,672 |

|

|

$ |

-- |

|

|

$ |

-- |

|

|

$ |

-- |

|

|

$ |

161,124 |

|

|

$ |

639,265 |

|

| Chairman of the Board, |

|

|

2023 |

|

|

|

301,175 |

|

|

|

164,563 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

118,707 |

|

|

|

584,445 |

|

| President and |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Chief Executive Officer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| David S. Barber |

|

|

2024 |

|

|

|

156,847 |

|

|

|

-- |

|

|

|

158,733 |

|

|

|

-- |

|

|

|

-- |

|

|

|

31,452 |

|

|

|

347,032 |

|

| Senior Vice President – |

|

|

2023 |

|

|

|

150,017 |

|

|

|

|

|

|

|

132,288 |

|

|

|

|

|

|

|

|

|

|

|

34,307 |

|

|

|

316,774 |

|

| Mortgage Lending |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| K. Matthew Sawrie |

|

|

2024 |

|

|

|

188,181 |

|

|

|

-- |

|

|

|

126,570 |

|

|

|

-- |

|

|

|

-- |

|

|

|

35,524 |

|

|

|

361,851 |

|

| Senior Vice President – |

|

|

2023 |

|

|

|

170,172 |

|

|

|

|

|

|

|

186,088 |

|

|

|

|

|

|

|

|

|

|

|

49,065 |

|

|

|

405,477 |

|

| Commercial Lending |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

______________________

(1) All other compensation does not include amounts attributable to other miscellaneous benefits the costs of which to Home Federal Bancorp of providing such benefits during the fiscal year did not exceed $10,000 other than club dues, the provision of an automobile and phone allowance for Mr. Sawrie. Includes for fiscal 2024, matching contributions under the Home Federal Bank 401(k) Plan, allocations of cash dividends and shares under the employee stock ownership plan based on a closing price of $14.34 on December 31, 2023, life insurance premiums, $24,130 in directors’ fees paid to Mr. Barlow, $54,751 accrued for his benefit under Mr. Barlow’s Supplemental Executive Retirement Plan, a phone allowance and the incremental cost to Home Federal Bank of providing an automobile to Mr. Barlow.

Narrative to Summary Compensation Table

Base salaries for our named executive officers are approved by the Compensation Committee. Base salaries as of the end of fiscal 2024 established by the Compensation Committee were $312,469 $156,847 and $188,181 for Messrs. Barlow, Barber and Sawrie, respectively. Mr. Barlow received a discretionary bonus of $165,672 equal to approximately 53.0% of his then current base salary, in January 2024, based on Home Federal Bancorp’s results of operations through the second quarter ended December 31, 2023. Mr. Barber receives incentive compensation based on a matrix that includes total mortgage loan originations and average basis points earned by Home Federal Bank, with adjustments for early payoffs and defaults. Mr. Sawrie received incentive compensation within 45 days of the end of each quarter as a participant in our Loan Officer Incentive Plan, the terms of which are described below under “-Loan Officer Incentive Plan.” Messrs. Barlow, Barber and Sawrie received 20,000, 4,000 and 14,000 stock options, respectively, and Messrs. Barlow and Sawrie, received 30,000 and 2,000 stock awards, respectively, on November 11, 2020, all which are vesting over five years at 20% per year.

At the annual meeting of shareholders of Home Federal Bancorp held on November 13, 2019, the shareholders recommended, on an advisory basis, that future advisory votes on executive compensation should be held every three years. Consistent with the shareholder recommendation, the Board of Directors of Home Federal Bancorp determined that it will hold an advisory vote on executive compensation every three years. The next advisory vote on the compensation of our named executive officers will be presented at the 2025 annual meeting.

Pay versus Performance

The following table sets forth information concerning the compensation of our named executive officers for the fiscal years ended June 30, 2024 and 2023 and certain measures of our financial performance for those years.

|

Year

|

|

Summary Compensation Table Total for PEO (1)

|

|

|

Compensation Actually Paid to PEO (2)

|

|

|

Average Summary Compensation Table Total for Non-PEO Named Executive Officers (3)

|

|

|

Average Compensation Actually Paid to Non-PEO Named Executive Officers (2)

|

|

|

Value of Initial Fixed $100 Investment Based on:

Total Shareholder Return (4)

|

|

|

Net Income (5) (in thousands)

|

|

|

2024

|

|

$ |

639,265 |

|

|

$ |

589,725 |

|

|

$ |

354,442 |

|

|

$ |

345,064 |

|

|

$ |

84.88 |

|

|

$ |

3,593 |

|

|

2023

|

|

|

584,445 |

|

|

|

551,145 |

|

|

|

361,126 |

|

|

|

362,366 |

|

|

|

73.27 |

|

|

|

5,704 |

|

__________________

(1) Represents the total compensation of our principal executive officer (“PEO”), Mr. Barlow, as reported in the Summary Compensation Table for each year indicated. Mr. Barlow was the only person who served as our PEO during those years.

(2) Represents the “compensation actually paid” to Mr. Barlow and to our non-PEO named executive officers, as calculated in accordance with Item 402(v) of Regulation S-K. The following table presents the adjustments made to Mr. Barlow’s and the non-PEO named executive officers’ Summary Compensation Table total for each year to determine their average compensation actually paid.

| |

|

Adjustments to Determine Compensation Actually Paid to

|

|

| |

|

PEO

|

|

|

Non-PEO Named Executive Officers

|

|

| |

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

|

Summary Compensation Table total

|

|

$ |

639,265 |

|

|

$ |

584,445 |

|

|

$ |

354,442 |

|

|

$ |

361,126 |

|

|

Decrease for the change in fair value from the prior year-end to the end of the covered year of awards granted prior to the covered year that were outstanding and unvested as of the end of the covered year

|

|

|

(51,400 |

) |

|

|

(21,300 |

) |

|

|

(8,224 |

) |

|

|

(3,550 |

) |

|

Increase (decrease) for the change in fair value from the prior year-end to the vesting date of awards granted prior to the covered year that vested during the covered year

|

|

|

1,860 |

|

|

|

(12,000 |

) |

|

|

(1,154 |

) |

|

|

4,790 |

|

|

Total Adjustments

|

|

$ |

589,725 |

|

|

$ |

551,145 |

|

|

$ |

345,064 |

|

|

$ |

362,366 |

|

__________________

(3) Represents the average of the total compensation of each of our non-PEO named executive officers (Messrs. Barber and Sawrie), as reported in the Summary Compensation Table for each year indicated. Messrs. Barber and Sawrie were our only non-PEO named executive officers for those years.

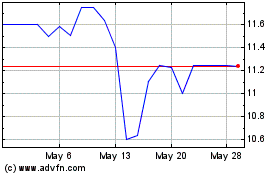

(4) Represents the total return to shareholders of our common stock and assumes that the value of the investment was $100 on June 30, 2023 and 2022, respectively, and that the subsequent dividends were reinvested. The stock price performance included in this column is not necessarily indicative of future stock price performance.

(5) Represents our reported net income for each year indicated.

Relationship Between Compensation Actually Paid to our PEO and the Average of the Compensation Actually Paid to the Other NEOs and the Company's Cumulative Total Shareholder Return (TSR) and the Company’s Net Income. From 2023 to 2024, the compensation actually paid to our PEO and the average of the compensation actually paid to the Other NEOs increased by 7.0% and decreased by 4.8%, respectively, compared to a 15.9% increase in our TSR over the same time period and 37.0% decrease in our Net Income over the same time period.

Outstanding Equity Awards at Fiscal Year-End

The table below sets forth outstanding equity awards to our named executive officers under our 2014 Stock Incentive Plan and 2019 Stock Incentive Plan at June 30, 2024. We have not made any equity incentive plan awards that are subject to performance conditions.

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock Awards |

|

| |

|

Option Awards |

|

Number of |

|

|

Market Value |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares or |

|

|

of Shares or |

|

| |

|

Number of Securities Underlying |

|

|

Option |

|

Option |

|

Units of Stock |

|

|

Units of Stock |

|

| |

|

Unexercised Options |

|

|

Exercise |

|

Expiration |

|

That Have |

|

|

That Have |

|

| Name |

|

Exercisable |

|

Unexercisable |

|

|

Price |

|

Date |

|

Not Vested |

|

|

Not Vested(2) |

|

|

James R. Barlow

|

|

|

20,000 |

|

|

-- |

|

|

$ |

11.50 |

|

10/26/2025

|

|

|

12,000 |

(1) |

|

$ |

137,640 |

|

| |

|

|

12,000 |

|

|

8,000 |

(1) |

|

|

11.86 |

|

11/11/2030

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

David S. Barber

|

|

|

4,000 |

|

|

-- |

|

|

|

11.50 |

|

10/26/2025

|

|

|

|

|

|

|

|

|

| |

|

|

9,000 |

|

|

-- |

|

|

|

15.63 |

|

2/5/2029

|

|

|

|

|

|

|

|

|

| |

|

|

2,400 |

|

|

1,600 |

(1) |

|

|

11.86 |

|

11/11/2030

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

K. Matthew Sawrie

|

|

|

14,000 |

|

|

-- |

|

|

|

11.50 |

|

10/26/2025

|

|

|

800 |

(1) |

|

$ |

9,176 |

|

| |

|

|

8,400 |

|

|

5,600 |

(1) |

|

|

11.86 |

|

11/11/2030

|

|

|

|

|

|

|

|

|

___________________

(1) The unexercisable stock options and unvested restricted stock awards are vesting at a rate of 20% per year commencing on November 11, 2021.

(2) Market value calculated by multiplying the closing market price of our common stock on June 30, 2024, which was $11.47, by the applicable number of shares of common stock underlying the unvested stock awards.

Employment and Change in Control Agreements

Home Federal Bank has entered into an amended and restated employment agreement with Mr. James R. Barlow effective as of January 1, 2013. The employment agreement amended and restated the prior employment agreement between Home Federal Bank and the executive. Pursuant to his employment agreement, Mr. Barlow serves as President and Chief Executive Officer of Home Federal Bank for an initial term of three years commencing on the effective date, provided that the term of Mr. Barlow’s agreement will be extended for an additional year on each January 1 during the term of the agreement, unless Home Federal Bank or Mr. Barlow gives notice to the other party of its or his intent not to extend the term of the agreement. The agreement provided for an initial base salary of $193,950 per year for Mr. Barlow. Mr. Barlow’s base salary may be increased at the discretion of the Board of Directors of Home Federal Bank but may not be decreased during the term of the agreement without the prior written consent of the executive. Home Federal Bank also agreed to provide Mr. Barlow with an automobile during the term of the agreement.

The employment agreement with Mr. Barlow is terminable with or without cause by Home Federal Bank. The employment agreement provides that in the event of (y) termination of employment by Home Federal Bank other than for cause, disability, retirement or death, or (z) termination by the executive for "good reason," as defined, in each case before or after a change in control, the executive would be entitled to (1) an amount of cash severance which is equal to three times his average annual compensation and (2) continued participation in certain employee benefit plans of Home Federal Bank until the earlier of 36 months or the date the executive receives substantially similar benefits from full-time employment with another employer. The employment agreement with Home Federal Bank provides that in the event any of the payments to be made thereunder or otherwise upon termination of employment are deemed to constitute "parachute payments" within the meaning of Section 280G of the Internal Revenue Code, then such payments and benefits received thereunder shall be reduced by the minimum amount necessary to result in no portion of the payments and benefits being non-deductible by Home Federal Bank for federal income tax purposes.

Home Federal Bancorp entered into an employment agreement with Mr. Barlow to serve as President and Chief Operating Officer of Home Federal Bancorp, effective as of January 1, 2013, which is on terms substantially similar to the amended and restated employment agreement with Home Federal, except as follows. The agreement with Home Federal Bancorp provides that severance payments payable to Mr. Barlow by Home Federal Bancorp shall include the amount by which the severance benefits payable by Home Federal are reduced as a result of Section 280G of the Internal Revenue Code, if the parachute payments exceed 105% of three times the executive's "base amount" as defined in Section 280G of the Internal Revenue Code. If the parachute payments are not more than 105% of the amount equal to three times the base amount, the severance benefits payable by Home Federal Bancorp will be reduced so they do not constitute "parachute payments" under Section 280G of the Internal Revenue Code. In addition, the agreement with Home Federal Bancorp provides that Home Federal Bancorp shall reimburse Mr. Barlow for any resulting excise taxes payable by him, plus such additional amount as may be necessary to compensate him for the payment of state and federal income, excise and other employment-related taxes on the excise tax reimbursement. Under the agreements with Home Federal Bancorp and Home Federal Bank, Mr. Barlow's compensation, benefits and expenses will be paid by Home Federal Bancorp and Home Federal Bank in the same proportion as the time and services actually expended by Mr. Barlow on behalf of each of Home Federal Bancorp and Home Federal Bank.

Supplemental Executive Retirement Agreement

Home Federal Bank adopted a Supplemental Executive Retirement Agreement on December 13, 2017 for the benefit of Mr. Barlow as President and Chief Executive Officer of Home Federal Bancorp and Home Federal Bank effective as of January 1, 2018. Under the terms of the agreement, after the target retirement date of December 31, 2033, Mr. Barlow will receive annual retirement benefits of $120,000, payable in equal annual installments over ten years. In the event of a separation from service prior to December 31, 2033, other than as a result of death and without cause, Mr. Barlow would receive his accrued benefits through such date payable in a lump sum. If Mr. Barlow has a separation from service either concurrently with or within two years following a change in control, he will be credited with five additional years of service following the date of his separation from service for purposes of calculating his accrued amount. In the event of death while in active service, his designated beneficiaries would receive a lump sum payment of the full retirement benefit. In the event of death after retirement, but before all payments have been made, any remaining benefits will be paid to the designated beneficiaries until all the annual installments have been paid. The retirement benefits are vesting ratably at 6.25% per year for sixteen years beginning with the calendar year ending December 31, 2018.

Loan Officer Incentive Plan

The Loan Officer Incentive Plan is an annual incentive compensation plan intended to reward participating commercial loan officers with variable cash awards that are contingent upon the net interest income produced from the loan officer’s identified loan portfolio, and in the case of the Commercial Sales Manager, all loans originated by commercial loan officers, and net income from new loans originated during the performance period plus commercial deposit fee income, multiplied by a portfolio rating based on the performance measures. Participants in the Loan Officer Incentive Plan are selected by the President and Chief Executive Officer and recommended for approval by the Compensation Committee of the Board of Directors which administers the plan. Mr. Sawrie is our only named executive officer who participates in the plan as Commercial Sales Manager.

During fiscal 2023, Level I and Level II participants in the Loan Officer Incentive Plan received a cash incentive award equal to 2.0% and 3.0%, respectively, of the net interest income from loans originated by the particular loan officer prior to the beginning of the fiscal year and a cash incentive award equal to 15.0% and 10.0%, respectively, of the net income from the loan officer’s loan originations during the performance period plus year to date commercial deposit fee income, in each case multiplied by a portfolio rating based on the five performance measures. The Commercial Sales Manager received a cash incentive award equal to 1.0% of the net interest income from loans originated by all the commercial loan officers prior to the beginning of the fiscal year and a cash incentive award equal to 5.0% of the net income from all of the loans originated by the commercial loan officers during the performance period plus year to date commercial deposit fee income, in each case multiplied by a portfolio rating based on the five performance measures. The cash incentive awards are paid to the Commercial Sales Manager on a quarterly basis.

Retirement Benefits

Retirement benefits are an important element of a competitive compensation program for attracting senior executives, especially in the financial services industry. Our executive compensation program currently includes (i) a 401(k) profit sharing plan which enables our employees to supplement their retirement savings with elective deferral contributions and with matching and discretionary contributions by us, and (ii) an employee stock ownership plan that allows participants to accumulate retirement benefits in the form of employer stock at no current cost to the participant.

401(k) and Profit Sharing Plan. We adopted the Home Federal Bank Employees’ Savings and Profit Sharing Plan and Trust (“401(k) Plan”) effective November 15, 2004. To participate in the 401(k) Plan, eligible employees must have completed three months of full-time service and attained age 21. Participating employees may make elective salary reduction contributions of up to $23,000 of their eligible compensation for 2024. Home Federal Bank will contribute a basic “safe harbor” contribution of 100% of the first 6% of plan salary elective deferrals. We are also permitted to make discretionary contributions to be allocated to participant accounts.

Employee Stock Ownership Plan. We established an employee stock ownership plan for our employees in connection with our mutual to stock conversion in 2005. We acquired additional shares in connection with our second-step conversion in 2010. The shares were purchased by the employee stock ownership plan with funds borrowed from Home Federal Bancorp and are held in a suspense account and released for allocation as debt service payments are made. Additional discretionary contributions may be made to the plan in either cash or shares of common stock, although we have no plans to do so at this time. Shares released from the suspense account are allocated to each eligible participant’s plan account pro rata based on compensation. Forfeitures may be used for the payment of expenses or be reallocated among the remaining participants. Employees who have been credited with at least 1,000 hours of service during a 12-month period and who have attained age 21 are eligible to participate in the employee stock ownership plan. Participants become 100% vested after three years of service. Participants also become fully vested in their account balances upon a change in control (as defined), death, disability or retirement. Benefits may be payable upon retirement or separation from service.

Stock Option Plans and Stock Incentive Plans

Home Federal Bancorp maintains our 2005 Stock Option Plan and our 2011 Stock Option Plan. The 2005 Stock Option Plan terminated on June 8, 2015, however the 4,266 outstanding stock options as of September 23, 2024 will remain in effect until exercised for the remainder of their original ten year terms. The 2011 Option Plan terminated on December 23, 2021, however, the 37,350 outstanding options as of September 23, 2024 will remain in effect for the remainder of their original ten year term.

In November 2014, shareholders approved the 2014 Stock Incentive Plan which provides for a total of 300,000 shares (split adjusted) reserved for future issuance as stock awards or stock options. No more than 75,000 shares, or 25%, may be granted as stock awards. On October 26, 2015, we granted a total of 69,000 plan share awards and 207,000 stock options to directors, officers, and other key employees vesting ratably over five years. On February 5, 2019, we granted the remaining 6,000 plan share awards and 27,000 stock options to key employees vesting ratably over five years. As of September 23, 2024, there were 24,600 stock options and share awards forfeited and available for grant under the 2014 Stock Incentive Plan. The 2014 Stock Incentive Plan cost is being recognized over the five-year vesting period.

In November 2019, shareholders approved the 2019 Stock Incentive Plan which provides for a total of 250,000 shares (split adjusted) reserved for future issuance as stock awards or stock options. No more than 62,500 shares, or 25%, may be granted as stock awards. On November 11, 2020, we granted a total of 62,500 plan share awards and 187,500 stock options to directors, officers and other key employees. Under all of our stock benefit plans, awards may vest no faster than 20% per year, beginning one year from the date of grant. However, under the plans, vesting of any award is accelerated upon the death or disability of a recipient or upon a change-in-control of Home Federal Bancorp. Outstanding stock awards and stock options as of June 30, 2023, for our non-employee directors are reflected in footnote one to the “Director Compensation Table” and for our named executive officers in the table “Outstanding Equity Awards at Fiscal Year-End.”

Survivor Benefit Plan

In June 2011, Home Federal Bank purchased bank owned life insurance on the lives of its employees. In consideration for entering into consent to insurance agreements, on July 13, 2011, Home Federal Bank entered into Survivor Benefit Plan Participation Agreements with employees including our named executive officers. The agreements provide that the officer’s beneficiary will receive three times the officer’s base salary if serving as an officer of Home Federal Bank at the date of death. The agreements may be amended or terminated at any time by Home Federal Bank as long as it does not reduce or delay any benefit payable to a participant whose death has already occurred.

Related Party Transactions

Home Federal Bank offers extensions of credit to its directors, officers and employees as well as members of their immediate families for the financing of their primary residences and other purposes. These loans are made in the ordinary course of business, on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable loans with persons not related to Home Federal Bank and none of such loans involve more than the normal risk of collectability or present other unfavorable features.

Under Home Federal Bancorp’s Audit Committee Charter, the Audit Committee is required to review and approve all related party transactions, as described in Item 404 of Regulation S-K promulgated by the Securities and Exchange Commission.

|

BENEFICIAL OWNERSHIP OF COMMON STOCK BY CERTAIN BENEFICIAL OWNERS

AND MANAGEMENT

|

The following table sets forth as of September 23, 2024, the voting record date for the annual meeting, certain information as to the common stock beneficially owned by (1) each person or entity, including any “group” as that term is used in Section 13(d)(3) of the Securities Exchange Act of 1934, who or which was known to us to be the beneficial owner of more than 5% of the issued and outstanding common stock, (2) our directors, (3) the other named executive officers and (4) all directors and executive officers of Home Federal Bancorp as a group.

|

Name of Beneficial Owner or Number of Persons in Group

|

|

Amount and Nature of Beneficial Ownership as of September 23, 2024(1)

|

|

|

Percent of Common Stock(2)

|

|

|

5% Shareholders: (3)

|

|

|

|

|

|

|

|

|

|

Home Federal Bank Employee Savings & Profit Sharing Plan and Trust

c/o Home Federal Bank

624 Market Street

Shreveport, Louisiana 71101

|

|

|

243,811 |

(3) |

|

|

7.8 |

% |

| |

|

|

|

|

|

|

|

|

|

Home Federal Bank Employee Stock Ownership Plan

c/o Home Federal Bank

624 Market Street

Shreveport, Louisiana 71101

|

|

|

391,292 |

(4) |

|

|

12.5 |

|

| |

|

|

|

|

|

|

|

|

|

Daniel R. Herndon and Lola W. Herndon

6425 Youree Drive, Suite 260

Shreveport, Louisiana 71105

|

|

|

200,902 |

(5) |

|

|

6.4 |

|

| |

|

|

|

|

|

|

|

|

|

Directors:

|

|

|

|

|

|

|

|

|

|

James R. Barlow

|

|

|

231,865 |

(6)(7) |

|

|

7.3 |

% |

|

Walter T. Colquitt, III

|

|

|

53,566 |

(6)(8) |

|

|

1.7 |

|

|

Mark M. Harrison

|

|

|

75,899 |

(6)(9) |

|

|

2.4 |

|

|

Scott D. Lawrence

|

|

|

85,802 |

(6)(10) |

|

|

2.7 |

|

|

Thomas Steen Trawick, Jr.

|

|

|

50,808 |

(6) |

|

|

1.6 |

|

|

Timothy W. Wilhite, Esq.

|

|

|

51,496 |

(6)(11) |

|

|

1.6 |

|

|

Other Named Executive Officers:

|

|

|

|

|

|

|

|

|

|

David S. Barber

|

|

|

47,098 |

(6)(12) |

|

|

1.5 |

|

|

K. Matthew Sawrie

|

|

|

129,748 |

(6)(13) |

|

|

4.1 |

|

| |

|

|

|

|

|

|

|

|

|

All Directors and Executive Officers as a Group (12 persons)

|

|

|

857,635 |

(6)(14) |

|

|

25.6 |

% |

___________________

* Represents less than 1% of our outstanding common stock.

(1) Based upon filings made pursuant to the Securities Exchange Act of 1934 and information furnished by the respective individuals. Under regulations promulgated pursuant to the Securities Exchange Act of 1934, shares of common stock are deemed to be beneficially owned by a person if he or she directly or indirectly has or shares (i) voting power, which includes the power to vote or to direct the voting of the shares, or (ii) investment power, which includes the power to dispose or to direct the disposition of the shares. Unless otherwise indicated, the named beneficial owner has sole voting and dispositive power with respect to the shares. None of the shares reflected as being beneficially owned by executive officers and directors are pledged as security.

(2) Each beneficial owner’s percentage ownership is determined by assuming that options held by such person (but not those held by any other person) and that are exercisable within 60 days of the voting record date have been exercised.

(Footnotes continued on next page)

___________________

(3) Under the terms of the Home Federal Bak Employees’ Savings & Profit Sharing Plan and Trust (“401(k) Plan”, the trustees vote the plans held in participant accounts in accordance with their instructions. Shares held in the 401(k) Plan for which no instructions are given are generally not voted.

(4) As of September 23, 2024, 299,217 shares held in the Home Federal Bank Employee Stock Ownership Plan trust had been allocated to the accounts of participating employees. Amounts held by the plan trustee, Mr. Barlow, reflect shares allocated to their individual accounts and exclude all other shares held in the trust. Under the terms of the plan, the trustee votes all allocated shares in accordance with the instructions of the participating employees. Any unallocated shares are generally required to be voted by the plan trustee in the same ratio on any matter as to those shares for which instructions are given by the participants.

(5) Includes 22,524 shares held by Mr. Herndon, 99,456 shares held by Mr. Herndon in his individual retirement account and 78,922 shares held jointly. Based on Amendment No. 2 to a Schedule 13D filed with the SEC on December 31, 2021.

(6) Includes options to acquire shares of Home Federal Bancorp common stock that were exercisable within 60 days of September 23, 2024, under our 2014 and 2019 Stock Incentive Plans and plan share awards under our 2014 and 2019 Stock Incentive Plans that will vest within 60 days of September 23, 2024, over which the directors and executive officers do not have current voting or investment powers as follows:

|

Name

|

|

Stock Awards

|

|

|

Stock Options

|

|

|

James R. Barlow

|

|

|

6,000 |

|

|

|

36,000 |

|

|

Walter T. Colquitt, III

|

|

|

800 |

|

|

|

23,400 |

|

|

Mark M. Harrison

|

|

|

800 |

|

|

|

27,400 |

|

|

Scott D. Lawrence

|

|

|

800 |

|

|

|

7,200 |

|

|

Thomas Steen Trawick, Jr.

|

|

|

800 |

|

|

|

27,400 |

|

|

Timothy W. Wilhite, Esq.

|

|

|

800 |

|

|

|

14,400 |

|

|

David S. Barber

|

|

|

-- |

|

|

|

16,200 |

|

|

K. Matthew Sawrie

|

|

|

400 |

|

|

|

25,200 |

|

|

All directors and executive officers as a group (12 persons)

|

|

|

11,520 |

|

|

|

212,000 |

|

(7) Includes 1,550 shares held by Mr. Barlow’s spouse, 88,483 shares held jointly with the reporting person’s spouse, 88,483 of which are pledged, 28,590 shares held in Mr. Barlow’s individual retirement account, 45,358.6068 shares held in Home Federal Bank’s 401(k) Plan and 25,883.6849 shares allocated to Mr. Barlow’s account in the Home Federal Bank employee stock ownership plan.

(8) Includes 25,058 shares held jointly with Dr. Colquitt’s spouse.

(9) Includes 1,822 shares held by Mr. Harrison’s spouse and 5,466 shares held in his individual retirement account.

(10) Includes 9,110 shares held in Mr. Lawrence’s individual retirement account and 9,110 shares held jointly with Mr. Lawrence’s spouse.

(11) Includes 36,296 shares held jointly with Mr. Wilhite’s spouse.

(12) Includes 4,970.6196 shares held in Home Federal Bank’s 401(k) Plan and 20,070.4835 shares allocated to Mr. Barber’s account in the Home Federal Bank employee stock ownership plan.

(13) Includes two shares held jointly with Mr. Sawrie’s daughter, 10,728.7254 shares held in Mr. Sawrie’s individual retirement account, 6,587.4341 shares held in Home Federal Bank’s 401(k) Plan and 20,879.7049 shares allocated to Mr. Sawrie in the Home Federal Bank employee stock ownership plan.

(14) Includes an aggregate of 96,719.4146 shares of common stock held in Home Federal Bank’s 401(k) Plan and 108,878.208 shares of common stock which are held by Home Federal Bank’s employee stock ownership plan on behalf of our executive officers as a group.

Section 16(a) Reports

General. Section 16(a) of the Securities Exchange Act of 1934, as amended, requires the officers and directors, and persons who own more than 10% of Home Federal Bancorp’s common stock to file reports of ownership and changes in ownership with the Securities and Exchange Commission. Officers, directors and greater than 10% shareholders are required by regulation to furnish Home Federal Bancorp with copies of all Section 16(a) forms they file. We know of no person who owns 10% or more of our common stock.

Delinquent Section 16(a) Reports. Based solely on our review of the copies of such forms furnished to us, or written representations from our officers and directors, we believe that during, and with respect to, the fiscal year ended June 30, 2024, all of our officers and directors complied in all respects with the reporting requirements promulgated under Section 16(a) of the Securities Exchange Act of 1934, with the exception of Messrs. Barber, Brown and Trawick and Ms. Jones who were each late filing one transaction on Form 4.

|

RATIFICATION OF APPOINTMENT OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM (Proposal Two)

|

The Audit Committee of the Board of Directors of Home Federal Bancorp has appointed Carr, Riggs & Ingram, LLC, to perform the audit of our financial statements for the year ending June 30, 2025, and further directed that the selection of auditors be submitted for ratification by the shareholders at the annual meeting.

We have been advised by Carr, Riggs & Ingram, LLC that neither that firm nor any of its associates has any relationship with Home Federal Bancorp or its subsidiaries other than the usual relationship that exists between an independent registered public accounting firm and its clients. Carr, Riggs & Ingram, LLC will have one or more representatives at the annual meeting who will have an opportunity to make a statement, if they so desire, and will be available to respond to appropriate questions.

FORVIS, LLP performed the audits of our financial statements for the year ended June 30, 2023. On February 2, 2024, Home Federal Bancorp notified FORVIS, LLP that it had been dismissed as Home Federal Bancorp’s independent registered public accounting firm and notified Carr, Riggs & Ingram, LLC, that it had been selected by the Audit Committee as the independent registered public accounting firm for the fiscal year ended June 30, 2024. In connection with their audit for the year ended June 30, 2023 and during the subsequent interim period until the engagement of Carr, Riggs & Ingram, LLC, there were no disagreements with FORVIS, LLP on any matter of accounting principles or practices, financial statement disclosures, or auditing scope or procedure. The report on the financial statements for fiscal 2023 of FORVIS, LLP did not contain an adverse opinion or disclaimer of opinion and was not qualified or modified as to uncertainty, audit scope or accounting principles. During fiscal 2023, Carr, Riggs & Ingram, LLC did not advise, and has not indicated to Home Federal Bancorp that it had reason to advise, Home Federal Bancorp of any “reportable event,” as defined in Item 304(a) of Regulation S-K of the Exchange Act. During fiscal 2023, Home Federal Bancorp had not consulted Carr, Riggs & Ingram, LLC regarding the application of accounting principles, either contemplated or proposed, the type of audit opinion that might be rendered on Home Federal Bancorp’s financial statements or any other matters of a “reportable event.”

Audit Fees