0000799233FALSE319626-360000007992332024-01-312024-01-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

--------------------------------------------------------------

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

January 31, 2024

----------------------------------------------------------------

HEARTLAND EXPRESS, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Nevada | 000-15087 | 93-0926999 |

| (State of other Jurisdiction | (Commission | (IRS Employer |

| of Incorporation) | File Number) | Identification No.) |

| | | | | |

901 HEARTLAND WAY, NORTH LIBERTY, IA | 52317 |

| (Address of Principal Executive Offices) | (Zip Code) |

| | |

319 626-3600 |

| Registrant's Telephone Number (including area code): |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.01 par value | HTLD | NASDAQ |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On January 31, 2024, Heartland Express, Inc. announced its unaudited financial results for the quarter and year ended December 31, 2023. The press release is attached as Exhibit 99.1 to this Form 8-K and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

| | | | | |

| EXHIBIT | |

| NUMBER | EXHIBIT DESCRIPTION |

| | |

| Heartland Express, Inc. press release dated January 31, 2024 with |

| | respect to the Company's unaudited financial results for the quarter and year ended |

| | December 31, 2023 |

The information contained in Items 2.02 and 9.01 of this report and the exhibit hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act:”), or incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

The information in this report and the exhibit hereto may contain “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. Such statements are made based on the current beliefs and expectations of the Company's management and are subject to significant risks and uncertainties. Actual results or events may differ from those anticipated by forward-looking statements. Please refer to the paragraph following the financial and operating information in the attached press release and various disclosures by the Company in its press releases, stockholder reports, and filings with the Securities and Exchange Commission for information concerning risk, uncertainties, and other factors that may affect future results.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on behalf by the undersigned thereunto duly authorized.

| | | | | | | | | | | | | | |

| | | HEARTLAND EXPRESS, INC. | |

| | | | |

| Date: | February 2, 2024 | | By:/s/Christopher A. Strain | |

| | | Christopher A. Strain | |

| | | Vice President-Finance, | |

| | | Treasurer and Chief Financial Officer | |

EXHIBIT INDEX

| | | | | |

| EXHIBIT | |

| NUMBER | EXHIBIT DESCRIPTION |

| | |

| Heartland Express, Inc. press release dated January 31, 2024 with |

| | respect to the Company's unaudited financial results for the quarter and year ended |

| | December 31, 2023 |

| |

| 104 | Cover Page Interactive Data File |

January 31, 2024 For Immediate Release

Press Release

Heartland Express, Inc. Reports Fourth Quarter and Annual Financial Results which includes All-Time Record High Annual Operating Revenue

NORTH LIBERTY, IOWA - January 31, 2024 - Heartland Express, Inc. (Nasdaq: HTLD) announced today financial results for the quarter and year ended December 31, 2023.

Three months ended December 31, 2023:

•Net Income of $5.1 million and Basic Earnings per Share of $0.06,

•Operating Revenue of $275.3 million,

•Operating Income of $10.7 million,

•Operating Ratio of 96.1% and 94.9% Non-GAAP Adjusted Operating Ratio(1),

•Total Assets of $1.5 billion,

•Stockholders' Equity of $865.3 million.

Twelve months ended December 31, 2023:

•Net Income of $14.8 million, Basic Earnings per Share of $0.19,

•Operating Revenue of $1.2 billion (All-time record),

•Operating Income of $42.4 million,

•Operating Ratio of 96.5% and 95.4% Non-GAAP Adjusted Operating Ratio(1),

•$114.1 million paid for debt reductions in 2023 ($195.6 million paid since acquisition in 2022).

Heartland Express Chief Executive Officer Mike Gerdin commented on the quarterly operating results and ongoing initiatives of the Company, "Our consolidated operating results for the three and twelve months ended December 31, 2023 reflect the continued weak freight environment combined with excess industry capacity throughout the year. This challenging freight environment combined with two acquisitions in the prior year, have pressured our financial results to a level below our historical results and management expectations. However, these recent acquisitions have also allowed us to deliver $1.2 billion of operating revenues, an all-time record for our organization. We believe this enhanced scale provides a better strategic position given the cyclical nature of the industry we operate in. This enhanced scale has allowed us to increase capacity, enhance our customer offerings, and further diversify our customer base. The 2022 acquisitions have also allowed us the opportunity to upgrade our real estate portfolio of terminal locations. During the fourth quarter, the Company strategically divested certain real estate assets that no longer fit the Company’s freight pattern or were concentrated in markets where multiple properties existed. The Company will continue to evaluate its real estate portfolio for strategic opportunities and better alignment with our model of maintaining our fleet of revenue equipment in conjunction with the needs of our customers and lanes of freight."

Mr. Gerdin continued, "Even in a challenging operating environment, we remain committed to paying down the debt resulting from the acquisitions of Smith Transport and Contract Freighter's, Inc. ("CFI"). During 2023, we reduced our debt levels to $300 million following $114.1 million in debt payments during the year and $195.6 million since the acquisitions of Smith and CFI were completed in 2022. We expect the strategic changes that we have implemented during 2023 will improve our operational readiness ahead of future expected freight demand growth. Heartland Express and Millis Transfer combined had an operating ratio of 86.9%, during 2023 which included legacy Heartland Express operating ratio of 85.1%. In contrast, Smith Transport and CFI combined for an operating ratio of 103.8% during 2023. We expect to continue on our path for future operational improvements and cost reduction measures at all four operating brands. We project we can improve our consolidated operating results, within three to four years following the 2022 acquisitions to align with our historical operational results. We continue to be extremely proud of our professional drivers, our team that works hard to support our drivers, and the outstanding service provided to our customers."

Financial Results

Heartland Express ended the fourth quarter of 2023 with operating revenues of $275.3 million ($235.6 million excluding fuel surcharge revenue), compared to $354.9 million ($293.6 million excluding fuel surcharge revenue) in the fourth quarter of 2022. Operating revenues for the quarter included fuel surcharge revenues of $39.7 million compared to $61.4 million in the same period of 2022. The weak freight environment continued to present challenges on our financial results during the quarter. Lower freight volumes, freight rate mix, and an increase in empty miles compared to the same quarter a year ago were products of the continued freight environment weakness. During the three months ended December 31, 2023, we benefited from an aggregate gain of $25.6 million from the sale of three terminal properties. Net income was $5.1 million, compared to $15.5 million in the fourth quarter of 2022, and basic earnings per share were $0.06 during the quarter compared to $0.20 basic earnings per share in the fourth quarter of 2022. The Company posted an operating ratio of 96.1%, non-GAAP adjusted operating ratio(1) of 94.9%, and a 1.9% net margin (net income as a percentage of operating revenues) in the fourth quarter of 2023 compared to 92.6%, 90.6% and 4.4%, respectively in the fourth quarter of 2022.

For the twelve month period ended December 31, 2023, operating revenues were $1.2 billion, compared to $968.0 million in the same period of 2022, an increase of 24.7% and the best annual period of operating revenues in our Company's 45-year history. Operating revenues included fuel surcharge revenues of $173.8 million compared to $169.2 million in the same period of 2022, a $4.6 million increase. Net income was $14.8 million, compared to $133.6 million in 2022. Basic earnings per share were $0.19 compared to $1.69 basic earnings per share in 2022. The 2022 results included Smith Transport starting June 1, 2022 and CFI starting September 1, 2022 and the sale of a terminal property for an unusually large gain during the second quarter. The Company posted an operating ratio of 96.5%, non-GAAP adjusted operating ratio(1) of 95.4% and a 1.2% net margin (net income as a percentage of operating revenues) in the twelve months ended December 31, 2023 compared to 80.5%, 84.8% and 13.8%, respectively in 2022.

Balance Sheet and Liquidity

At December 31, 2023, the Company had $28.1 million in cash balances, a decrease of $21.3 million since December 31, 2022. Debt and financing lease obligations of $300.0 million remain at December 31, 2023 ($275 million of CFI acquisition debt and $25 million of Smith Transport acquired equipment financing). These amounts are down from the initial $447.3 million borrowings less associated fees for the CFI acquisition in August 2022 and $46.8 million debt and finance lease obligations assumed from the Smith acquisition in May 2022. During 2023, the Company made $114.1 million debt payments. There were no borrowings under the Company's unsecured line of credit at December 31, 2023. The Company had $88.0 million in available borrowing capacity on the line of credit as of December 31, 2023 after consideration of $12.0 million of outstanding letters of credit. The Company continues to be in compliance with associated financial covenants. The Company ended the year with total assets of $1.5 billion and stockholders' equity of $865.3 million.

Net cash flows from operations for the twelve month period ended December 31, 2023 were $165.3 million, 13.7% of operating revenues. The primary use of cash during the twelve month period ended December 31, 2023 were $114.1 million repayments of debt and financing leases, $6.3 million for regular dividends, and $71.3 million for net property and equipment transactions.

The average age of the Company's tractor fleet was 2.2 years as of December 31, 2023 compared to 2.0 years at December 31, 2022. The average age of the Company's trailer fleet was 6.4 years at December 31, 2023 compared to 6.3 years at December 31, 2022.

The Company continued its commitment to shareholders through the payment of cash dividends. Regular dividends of $0.02 per share were declared and paid during each quarter of 2023. The Company has now paid cumulative cash dividends of $548.9 million, including four special dividends, ($2.00 in 2007, $1.00 in 2010, $1.00 in 2012, and $0.50 in 2021) over the past eighty-two consecutive quarters since 2003. Our outstanding shares at December 31, 2023 were 79.0 million. A total of 3.3 million shares of common stock have been repurchased for $57.7 million over the past five years. The Company has the ability to repurchase an additional 6.6 million shares under the current authorization which would result in 72.4 million outstanding shares if fully executed.

Other Information

Historical commitment to customer service has allowed us to build solid, long-term relationships and brand ourselves as an industry leader for on-time service. This past year we once again were recognized for customer service by our customers. These awards received include:

•FedEx Express National Carrier of the Year (12 years in a row)

•FedEx Express Platinum Award (99.98% On-Time Delivery)

•Lowe’s One-Way Outbound Carrier of the Year

•United Sugar Producers & Refiners Carrier of the Year

•Mark Anthony Carrier of the Year

•PepsiCo/Gatorade SW Carrier of the Year

•DHL/Tempur Pedic Carrier of the Year

•Uber Freight Carrier of the Year

•Henkel Carrier Base Logistics Award – Asset Excellence

During 2023, we were also recognized with the following environmental, operational, industry, and community service awards:

•Smartway – High Performer Award

•Logistics Management Quest for Quality Award (our 19th award in 21 years)

•CFI Driver Zach Yeakley TCA’s Highway Angel of the Year

•CFI Driver Endrea Davisson – Women in Trucking Association – 2023 Top Women to Watch in Transportation

•Wreaths Across America Honor Fleet (our 9th year)

•Pepsi Co “Rolling Remembrance” Participant

These awards are hard-earned and are a direct reflection upon our outstanding group of employees and our focus on excellence in all areas of our business.

Operating revenue excluding fuel surcharge revenue, adjusted operating income, and adjusted operating ratio are non-GAAP financial measures and are not intended to replace financial measures calculated in accordance with GAAP. These non-GAAP financial measures supplement our GAAP results. We believe that using these measures affords a more consistent basis for comparing our results of operations from period to period. The information required by Item 10(e) of Regulation S-K under the Securities Act of 1933 and the Securities Exchange Act of 1934 and Regulation G under the Securities Exchange Act of 1934, including a reconciliation to the most directly comparable financial measure calculated in accordance with GAAP, is included in the table at the end of this press release.

This press release may contain statements that might be considered as forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. Such statements may be identified by their use of terms or phrases such as “seek,” “expects,” “estimates,” “anticipates,” “projects,” “believes,” “hopes,” “plans,” “goals,” “intends,” “may,” “might,” “likely,” “will,” “should,” “would,” “could,” “potential,” “predict,” “continue,” “strategy,” “future,” “ensure,” “outlook,” and similar terms and

phrases. In this press release, the statements relating to freight supply and demand, our ability to react to and capitalize on changing market conditions, the expected impact of operational improvements, strategic changes, enhanced scale, and cost reductions, evaluation of real estate opportunities, progress toward our goals, deployment of cash reserves, future dispositions of revenue equipment and real estate and gains therefrom, future operating ratio, future stock repurchases, dividends, acquisitions, and debt repayment, and results of the foregoing are forward-looking statements. Such statements are based on management's belief or interpretation of information currently available. These statements and assumptions involve certain risks and uncertainties, and undue reliance should not be placed on such statements. Actual events may differ materially from those set forth in, contemplated by, or underlying such statements as a result of numerous factors, including, without limitation, those specified in the Company's Annual Report on Form 10-K for the year ended December 31, 2022 and Quarterly Report on Form 10-Q for the quarter ended March 31, 2023. The Company assumes no obligation to update any forward-looking statements, which speak as of their respective dates.

| | |

Contact: Heartland Express, Inc. (319-645-7060)

Mike Gerdin, Chief Executive Officer

Chris Strain, Chief Financial Officer |

HEARTLAND EXPRESS, INC.

AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME

(In thousands, except per share amounts)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Twelve Months Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| OPERATING REVENUE | $ | 275,347 | | | $ | 354,923 | | | $ | 1,207,458 | | | $ | 967,996 | |

| | | | | | | |

| OPERATING EXPENSES: | | | | | | | |

| Salaries, wages, and benefits | $ | 112,237 | | | $ | 124,336 | | | $ | 474,803 | | | $ | 346,271 | |

| Rent and purchased transportation | 24,464 | | | 33,368 | | | 112,749 | | | 54,288 | |

| Fuel | 49,023 | | | 69,438 | | | 212,228 | | | 194,608 | |

| Operations and maintenance | 15,688 | | | 15,673 | | | 63,358 | | | 39,092 | |

| Operating taxes and licenses | 5,404 | | | 5,482 | | | 21,804 | | | 16,387 | |

| Insurance and claims | 14,512 | | | 11,737 | | | 45,278 | | | 34,436 | |

| Communications and utilities | 2,458 | | | 2,915 | | | 10,508 | | | 6,995 | |

| Depreciation and amortization | 51,120 | | | 50,639 | | | 199,039 | | | 133,047 | |

| Other operating expenses | 14,950 | | | 19,269 | | | 66,393 | | | 51,420 | |

| Gain on disposal of property and equipment | (25,214) | | | (4,100) | | | (41,087) | | | (96,906) | |

| | | | | | | |

| 264,642 | | | 328,757 | | | 1,165,073 | | | 779,638 | |

| | | | | | | |

| Operating income | 10,705 | | | 26,166 | | | 42,385 | | | 188,358 | |

| | | | | | | |

| Interest income | 304 | | | 345 | | | 1,655 | | | 1,288 | |

| Interest expense | (5,934) | | | (6,036) | | | (24,187) | | | (8,555) | |

| | | | | | | |

| Income before income taxes | 5,075 | | | 20,475 | | | 19,853 | | | 181,091 | |

| | | | | | | |

| Federal and state income taxes | (20) | | | 4,987 | | | 5,078 | | | 47,507 | |

| | | | | | | |

| Net income | $ | 5,095 | | | $ | 15,488 | | | $ | 14,775 | | | $ | 133,584 | |

| | | | | | | |

| Earnings per share | | | | | | | |

| Basic | $ | 0.06 | | | $ | 0.20 | | | $ | 0.19 | | | $ | 1.69 | |

| Diluted | $ | 0.06 | | | $ | 0.20 | | | $ | 0.19 | | | $ | 1.69 | |

| | | | | | | |

| Weighted average shares outstanding | | | | | | | |

| Basic | 79,030 | | | 78,964 | | | 79,010 | | | 78,941 | |

| Diluted | 79,110 | | | 79,010 | | | 79,079 | | | 78,974 | |

| | | | | | | |

| Dividends declared per share | $ | 0.02 | | | $ | 0.02 | | | $ | 0.08 | | | $ | 0.08 | |

| | | | | | | | | | | | | | |

HEARTLAND EXPRESS, INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED BALANCE SHEETS (in thousands, except per share amounts) (unaudited) |

| | December 31, | | December 31, |

| ASSETS | | 2023 | | 2022 |

| CURRENT ASSETS | | | | |

| Cash and cash equivalents | | $ | 28,123 | | | $ | 49,462 | |

| Trade receivables, net | | 102,740 | | | 139,819 | |

| Prepaid tires | | 10,650 | | | 11,293 | |

| Other current assets | | 17,602 | | | 26,069 | |

| Income tax receivable | | 10,157 | | | 3,139 | |

| Total current assets | | 169,272 | | | 229,782 | |

| | | | |

| PROPERTY AND EQUIPMENT | | 1,319,909 | | | 1,282,194 | |

| Less accumulated depreciation | | 434,558 | | | 308,936 | |

| | 885,351 | | | 973,258 | |

| GOODWILL | | 322,597 | | | 320,675 | |

| OTHER INTANGIBLES, NET | | 98,537 | | | 103,701 | |

| OTHER ASSETS | | 14,953 | | | 19,894 | |

| DEFERRED INCOME TAXES, NET | | 1,494 | | | 1,224 | |

| OPERATING LEASE RIGHT OF USE ASSETS | | 17,442 | | | 20,954 | |

| | | $ | 1,509,646 | | | $ | 1,669,488 | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | | | | |

| CURRENT LIABILITIES | | | | |

| Accounts payable and accrued liabilities | | $ | 37,777 | | | $ | 62,712 | |

| Compensation and benefits | | 28,492 | | | 30,972 | |

| Insurance accruals | | 21,507 | | | 18,490 | |

| Long-term debt and finance lease liabilities - current portion | | 9,303 | | | 13,946 | |

| Operating lease liabilities - current portion | | 9,259 | | | 12,001 | |

| Other accruals | | 17,138 | | | 18,636 | |

| Total current liabilities | | 123,476 | | | 156,757 | |

| LONG-TERM LIABILITIES | | | | |

| Income taxes payable | | 6,270 | | | 6,466 | |

| Long-term debt and finance lease liabilities less current portion | | 290,696 | | | 399,062 | |

| Operating lease liabilities less current portion | | 8,183 | | | 8,953 | |

| Deferred income taxes, net | | 189,121 | | | 207,516 | |

| Insurance accruals less current portion | | 26,640 | | | 35,257 | |

| Total long-term liabilities | | 520,910 | | | 657,254 | |

| COMMITMENTS AND CONTINGENCIES | | | | |

| | | | |

| STOCKHOLDERS' EQUITY | | | | |

| Capital stock, common, $.01 par value; authorized 395,000 shares; issued 90,689 in 2023 and 2022; outstanding 79,039 and 78,984 in 2023 and 2022, respectively | | $ | 907 | | | $ | 907 | |

| Additional paid-in capital | | 4,527 | | | 4,165 | |

| Retained earnings | | 1,060,094 | | | 1,051,641 | |

| Treasury stock, at cost; 11,650 and 11,705 shares in 2023 and 2022, respectively | | (200,268) | | | (201,236) | |

| | | 865,260 | | | 855,477 | |

| | | $ | 1,509,646 | | | $ | 1,669,488 | |

(1)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| GAAP to Non-GAAP Reconciliation Schedule: | | | | |

| Operating revenue excluding fuel surcharge revenue, adjusted operating income, and adjusted operating ratio reconciliation (a) |

| | | | | | | | |

| | | | | | | | |

| | Three Months Ended December 31, | | Twelve Months Ended December 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| | (Unaudited, in thousands) | | (Unaudited, in thousands) |

| | | | | | | | |

| Operating revenue | | $ | 275,347 | | | $ | 354,923 | | | $ | 1,207,458 | | | $ | 967,996 | |

| Less: Fuel surcharge revenue | | 39,740 | | | 61,358 | | | 173,817 | | | 169,173 | |

| Operating revenue, excluding fuel surcharge revenue | | 235,607 | | | 293,565 | | | 1,033,641 | | | 798,823 | |

| | | | | | | | |

| Operating expenses | | 264,642 | | | 328,757 | | | 1,165,073 | | | 779,638 | |

| Less: Fuel surcharge revenue | | 39,740 | | | 61,358 | | | 173,817 | | | 169,173 | |

| Less: Amortization of intangibles | | 1,262 | | | 1,432 | | | 5,164 | | | 3,653 | |

| Less: Acquisition-related costs | | — | | | — | | | — | | | 2,254 | |

| Less: Gain on sale of a terminal property | | — | | | — | | | — | | | (73,175) | |

| Adjusted operating expenses | | 223,640 | | | 265,967 | | | 986,092 | | | 677,733 | |

| | | | | | | | |

| Operating income | | 10,705 | | | 26,166 | | | 42,385 | | | 188,358 | |

| Adjusted operating income | | $ | 11,967 | | | $ | 27,598 | | | $ | 47,549 | | | $ | 121,090 | |

| | | | | | | | |

| Operating ratio | | 96.1 | % | | 92.6 | % | | 96.5 | % | | 80.5 | % |

| Adjusted operating ratio | | 94.9 | % | | 90.6 | % | | 95.4 | % | | 84.8 | % |

(a) Operating revenue excluding fuel surcharge revenue, as reported in this press release is based upon operating revenue minus fuel surcharge revenue. Adjusted operating income as reported in this press release is based upon operating revenue excluding fuel surcharge revenue, less operating expenses, net of fuel surcharge revenue, non-cash amortization expense related to intangible assets, acquisition-related legal and professional fees, and the gain on sale of a terminal property. Adjusted operating ratio as reported in this press release is based upon operating expenses, net of fuel surcharge revenue, amortization of intangibles, acquisition-related costs, and the gain on sale of terminal property, as a percentage of operating revenue excluding fuel surcharge revenue. We believe that operating revenue excluding fuel surcharge revenue, adjusted operating income, and adjusted operating ratio are more representative of our underlying operations by excluding the volatility of fuel prices, which we cannot control, and removes items resulting from acquisitions or one-time transactions that do not reflect our core operating performance. Operating revenue excluding fuel surcharge revenue, adjusted operating income, and adjusted operating ratio are not substitutes for operating revenue, operating income, or operating ratio measured in accordance with GAAP. There are limitations to using non-GAAP financial measures. Although we believe that operating revenue excluding fuel surcharge revenue, adjusted operating income, and adjusted operating ratio improve comparability in analyzing our period-to-period performance, they could limit comparability to other companies in our industry if those companies define such measures differently. Because of these limitations, operating revenue excluding fuel surcharge revenue, adjusted operating income, and adjusted operating ratio should not be considered measures of income generated by our business or discretionary cash available to us to invest in the growth of our business. Management compensates for these limitations by primarily relying on GAAP results and using non-GAAP financial measures on a supplemental basis.

v3.24.0.1

Cover

|

Jan. 31, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jan. 31, 2024

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity File Number |

000-15087

|

| Entity Tax Identification Number |

93-0926999

|

| Entity Address, Address Line One |

901 HEARTLAND WAY,

|

| Entity Address, City or Town |

NORTH LIBERTY,

|

| Entity Address, State or Province |

IA

|

| Entity Address, Postal Zip Code |

52317

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.01 par value

|

| Trading Symbol |

HTLD

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Registrant Name |

HEARTLAND EXPRESS, INC.

|

| Entity Central Index Key |

0000799233

|

| Amendment Flag |

false

|

| City Area Code |

319

|

| Local Phone Number |

626-3600

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

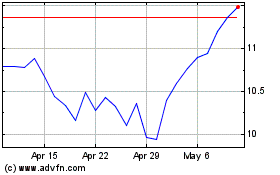

Heartland Express (NASDAQ:HTLD)

Historical Stock Chart

From Apr 2024 to May 2024

Heartland Express (NASDAQ:HTLD)

Historical Stock Chart

From May 2023 to May 2024