Hanmi Financial Corporation (NASDAQ: HAFC) (“we,” “our” or

“Hanmi”), the holding company for Hanmi Bank (the “Bank”), reported

a third-quarter net loss of $59.7 million, or ($1.26) per

share, compared to net income of $4.3 million, or $0.09 per diluted

share, in the third quarter of 2008. During the third quarter, we

incurred tax charges of $38.2 million related to a valuation

allowance of deferred tax assets. Excluding this charge, the net

loss would have been $21.5 million for the third quarter of 2009,

primarily driven by $49.5 million in credit loss provisions.

Hanmi also announced today that Hanmi and the Bank have entered

into a Written Agreement (the “Written Agreement”) with the Federal

Reserve Bank of San Francisco (the “FRB”), effective as of November

2, 2009. In addition, the board of directors of the Bank has

consented to the issuance of a Final Order (the “Final Order”) by

the California Department of Financial Institutions (the “DFI”),

effective as of November 2, 2009. The Written Agreement and the

Final Order provide for certain actions to be taken in cooperation

with the regulatory authorities and are intended to address various

matters including issues related to capital, liquidity and asset

quality.

Jay S. Yoo, President and Chief Executive Officer, commented,

“In the continuing weakness of the credit markets, the

third-quarter provision for loan losses was again a record high,

leading to disappointing operating results. However, we have

continued our business strategies in the third quarter and achieved

meaningful improvements in our core banking foundation. The balance

sheet deleveraging strategy changed our liability profile to

core-deposit based and substantially expanded our net interest

margin. Various asset quality management programs, as well as

higher loan charge-offs and transfers to other real estate owned,

at last reduced delinquent loans and we also took a step forward in

our capital raising efforts by receiving a $6.95 million capital

infusion from Leading Investment & Securities Co. as previously

announced. We are currently in active negotiations with certain

Korean institutional investors relating to a larger capital

infusion sufficient for Hanmi to weather this credit

environment.”

Regulatory Agreements

The Final Order and Written Agreement require the Bank to

prepare and submit written plans to the DFI and the FRB that

address the following items: (i) strengthening board oversight of

the management and operation of the Bank; (ii) strengthening credit

risk management practices; (iii) improving credit administration

policies and procedures; (iv) improving the Bank’s position with

respect to problem assets; (v) improving the capital position of

the Bank and, with respect to the Written Agreement, of Hanmi; (vi)

maintaining adequate reserves for loan and lease losses; (vii)

improving the Bank’s earnings through a strategic plan and a budget

for 2010; (viii) improving the Bank’s liquidity position and funds

management practices; and (ix) contingency funding. In addition,

the Order and the Agreement place restrictions on the Bank’s

lending to borrowers who have adversely classified loans with the

Bank and require the Bank to charge off or collect certain problem

loans. The Final Order and Written Agreement also require the Bank

to review and revise its allowance for loan and lease losses

consistent with relevant supervisory guidance. The Bank is also

prohibited from paying dividends, incurring, increasing or

guaranteeing any debt, or making certain changes to its business

without prior approval from the DFI, and the Bank and Hanmi must

obtain prior approval from the FRB prior to declaring and paying

dividends.

Under the Final Order, the Bank is also required to increase its

capital and maintain certain regulatory capital ratios prior to

certain dates specified therein. By July 31, 2010, the Bank will be

required to increase its contributed equity capital by not less

than an additional $100 million. The Bank will be required to

maintain a ratio of tangible shareholders’ equity to total tangible

assets as follows:

Date

Ratio of Tangible

Shareholders’Equity to Total Tangible

Assets

By December 31, 2009 Not Less Than 7.0 Percent By

July 31, 2010 Not Less Than 9.0 Percent

From December 31, 2010 andUntil

the Order is Terminated

Not Less Than 9.5 Percent

If the Bank is not able to maintain the capital ratios

identified in the Final Order, it must notify the DFI, and Hanmi

and the Bank are required to notify the FRB if their respective

capital ratios fall below those set forth in the capital plan to be

submitted to the FRB.

Results of Operations

The net interest income before provision for credit losses

increased by $3.4 million, or 14.6 percent, to $26.5 million in the

third quarter of 2009 compared to $23.1 million in the prior

quarter. Such increase in net interest income reflects the effects

of our core deposit campaign that was launched in the prior

quarter. Most of our high-cost six-month time deposits that were

offered from December 2008 through March 2009 and matured in the

third quarter of 2009 have been rolled over into lower-cost

deposits and the average cost of interest-bearing deposits

decreased by 67 basis points to 2.70 percent from 3.37 percent in

the second quarter of 2009. On the other hand, our stringent

lending policy allowed us to increase our loan pricing and to

improve the average yield on the loan portfolio to 5.50 percent in

the third quarter of 2009 compared to 5.46 percent in the prior

quarter. The combined result was the increase of net interest

margin by 52 basis points to 3.00 percent in the third quarter

compared to 2.48 percent in the second quarter.

The provision for credit losses in the third quarter of 2009

increased by $25.6 million to $49.5 million compared to $23.9

million in the prior quarter, due mainly to the $16.4 million

additional provision provided to the impaired loans that was part

of our continuing efforts to address the further deteriorating

commercial real estate market. For the first nine months of 2009,

the provision for credit losses more than doubled to $119.4 million

compared to $50.2 million for the prior year’s same period,

reflecting our effort to prepare for the uncertain credit risk in

this weak credit market.

Total non-interest income in the third quarter of 2009 was $8.2

million compared to $6.7 million in the prior quarter and $5.3

million in the third quarter of 2008. The sequential increase in

non-interest income reflects an $864,000 net gain on sales of SBA

loans. The second quarter income was also reduced by an impairment

loss of $909,000 on a low income housing investment

Total non-interest expense in the third quarter of 2009 was

$23.7 million compared to $24.7 million in the second quarter, a

decrease of $1.0 million, or 4.1 percent, and an increase of $1.5

million, or 6.5 percent, compared to $22.2 million in the third

quarter of 2008. The decrease from the second quarter of 2009 was

mainly caused by the reduction of deposit insurance premiums and

regulatory assessments. Increased expenses in the second quarter

reflect the one-time FDIC special assessment fees of $1.8 million.

Reflecting a second-quarter out-of-court settlement fee of

$850,000, third-quarter loan-related expenses declined by 84.2

percent to $192,000 from $1.2 million in the second quarter.

Salaries and employee benefits, the biggest single contributor to

total non-interest expense, was essentially unchanged at $8.6

million compared to $8.5 million in the prior quarter. We will

continue to hold down all operating costs for the remainder of

2009; however, further cost control may be offset by

regulatory-related expenses such as professional fees and potential

FDIC assessments. We also expect that expenses to manage our asset

quality in this stressed credit environment continue to be

significant. In the third quarter, expenses in relation with other

real estate owned ("OREO"), such as valuation expenses and

maintenance costs, more than doubled to $3.4 million from the prior

quarter’s $1.5 million.

Due to increased net interest income before provision for credit

losses and increased non-interest income, along with decreased

non-interest expense, the efficiency ratio (non-interest expense

divided by the sum of net interest income before provision for

credit losses and non-interest income) sequentially improved to

68.2 percent compared to 82.9 percent in the second quarter of

2009.

Balance Sheet and Asset Quality

Total assets at September 30, 2009 decreased by $418.3 million,

or 10.8 percent, to $3.46 billion from $3.88 billion at

December 31, 2008, and decreased by $308.5 million, or 8.2 percent,

from $3.77 billion at September 30, 2008, reflecting the Bank’s

ongoing strategy to deleverage the balance sheet.

With our ongoing stringent lending policy to carefully evaluate

all maturing loans and selectively renew our loans based on

quality, gross loans, net of deferred loan fees, decreased by

$384.6 million, or 11.4 percent, to $2.98 billion as of September

30, 2009, compared to $3.36 billion at December 31, 2008, and

decreased by $367.5 million, or 11.0 percent, compared to $3.35

billion at September 30, 2008.

The success of our core deposit campaign together with our

deleveraging strategy substantially changed our liability profile

in the third quarter by increasing our core deposits and decreasing

the brokered deposits and borrowings.

Our total deposits decreased by $78.2 million, or 2.5 percent,

to $2.99 billion at September 30, 2009, compared to $3.07 billion

at December 31, 2008, and increased by $192.5 million, or 6.9

percent, compared to $2.80 billion at September 30, 2008. Such

decrease was carefully designed under our deleveraging strategy

which allows some run off of volatile and expensive time deposits.

For the nine months ended September 30, 2009, time deposits

decreased by $472.1 million and our non-time deposits increased by

$393.9 million. For the same nine month period, FHLB advances also

decreased by $261.4 million, or 61.9 percent, to $160.8 million at

September 30, 2009, compared to $422.2 million at December 31,

2008, At September 30, 2009, brokered deposits, excluding CDARS,

were $365.7 million, a decrease of $508.4 million, or 58.2 percent,

compared to $874.1 million at December 31, 2008.

Third quarter charge-offs, net of recoveries, were $29.9 million

compared to $23.6 million in the prior quarter and $11.8 million in

the third quarter of 2008. Out of the third quarter charge-offs,

$22.8 million was made from unsecured commercial and industrial

(“C&I”) loans, including one large loan in the amount of $7.0

million to an international trading company. Also included were

some commercial real estate and business property loans due to

decreases in hard collateral values, resulted in partial

charge-offs of $4.0 million, with the remaining balance of $3.5

million consisting of consumer and SBA loans.

Delinquent loans were $151.0 million (5.07 percent of total

gross loans) at September 30, 2009, compared to $178.7 million

(5.66 percent of total gross loans) at June 30, 2009, $164.4

million (4.95 percent of total gross loans) at March 31, 2009,

$128.5 million (3.82 percent of total gross loans) at December 31,

2008, and $102.9 million (3.08 percent of total gross loans) at

September 30, 2008. The decrease in delinquencies from the prior

quarter is attributable to diligent collection efforts, which

involve proactive negotiations with borrowers in financial

difficulty, often leading to loan modifications or charge-offs.

Non-performing loans (“NPL”) at September 30, 2009 were $174.4

million (5.85 percent of total gross loans), compared to $167.3

million (5.3 percent of total gross loans) at June 30, 2009, $156.3

million (4.71 percent of total gross loans) at March 31, 2009,

$121.9 million (3.62 percent of total gross loans) at December 31,

2008, and $111.9 million (3.34 percent of total gross loans) at

September 30, 2008. The breakdown in third quarter 2009 NPLs was as

follows: 10.4 percent were construction loans, 47.6 percent were

C&I loans including owner/user business property loans, 30.3

percent were commercial real estate (“CRE”) loans, 9.5 percent were

SBA loans, and 2.2 percent were consumer loans.

As of September 30, 2009, total non-performing assets of $201.6

million included OREO of $27.1 million compared to total

non-performing assets of $201.3 million with OREO of $34.0 million

at June 30, 2009, $157.5 million with OREO of $1.2 million at March

31, 2009, and $122.7 million with OREO of $823,000 at December 31,

2008. At September 30, 2008, total non-performing assets were

$114.9 million, which included OREO of $3.0 million. At September

30, 2009, OREO was $6.9 million lower, when compared to the prior

quarter, mainly due to the sale of a golf course north of San

Diego.

At September 30, 2009, the allowance for loan losses was $124.8

million, or 4.19 percent of total gross loans (71.53 percent of

total non-performing loans), compared to $71.0 million, or 2.11

percent of total gross loans (58.23 percent of total non-performing

loans), at December 31, 2008, and $63.9 million, or 1.91 percent of

total gross loans (57.16 percent of total non-performing loans), at

September 30, 2008.

Capital Adequacy

On September 4, 2009, Hanmi received an investment of

$6.95 million from Leading Investment & Securities Co.

Ltd. IWL Partners LLC, an affiliate of Leading, is additionally

preparing a separate definitive agreement that would result in a

larger equity capital infusion. If completed as expected, the

Korean investment will augment Hanmi’s capital reserves and, in

conjunction with our program to deleverage the balance sheet, will

enhance our ability to weather the current recession and emerge

well-positioned to take advantage of opportunities as the economy

recovers.

At September 30, 2009, the Bank’s Tier 1 Leverage, Tier 1

Risk-Based Capital, and Total Risk-Based Capital ratios were 7.05

percent, 8.40 percent and 9.69 percent, respectively, compared to

8.85 percent, 9.44 percent, and 10.71 percent, respectively, at

December 31, 2008. The Bank’s ratio of tangible shareholders’

equity to total tangible assets was 7.57 percent at September 30,

2009.

Deferred Tax Assets

During the third quarter of 2009, Hanmi established a valuation

allowance of $44.9 million against its existing net deferred tax

assets. The Company’s primary deferred tax assets relate to its

allowance for loan losses and impairment charges. Under generally

accepted accounting principles, a valuation allowance must be

recognized if it is “more likely than not” that such deferred tax

assets will not be realized. Appropriate consideration is given to

all available evidence (both positive and negative) related to the

realization of the deferred tax assets on a quarterly basis.

In conducting its regular quarterly evaluation, Hanmi made a

determination to establish a valuation allowance at September 30,

2009 based primarily upon the existence of a three-year cumulative

loss derived by combining the pre-tax income (loss) reported

during the two most recent annual periods with management’s current

projected results for the year ending 2009. This three-year

cumulative loss position is primarily attributable to significant

provisions for credit losses incurred during 2009. Although the

Company’s current financial forecasts indicate that sufficient

taxable income will be generated in the future to ultimately

realize the existing deferred tax benefits, those forecasts were

not considered to constitute sufficient positive evidence to

overcome the observable negative evidence associated with the

three-year cumulative loss position determined at September 30,

2009. Although the creation of the valuation allowance will

increase tax expense for the quarter ended September 30, 2009 and

similarly reduce tangible book value, it will not have an effect on

Hanmi’s cash flows. The remaining net deferred tax assets of $2.5

million will be reversed by NOL carryover during the 4th quarter of

2009.

Forward-Looking Statements

This release contains forward-looking statements, which are

included in accordance with the “safe harbor” provisions of the

Private Securities Litigation Reform Act of 1995. In some cases,

you can identify forward-looking statements by terminology such as

“may,” “will,” “should,” “could,” “expects,” “plans,” “intends,”

“anticipates,” “believes,” “estimates,” “predicts,” “potential,” or

“continue,” or the negative of such terms and other comparable

terminology. Although we believe that the expectations reflected in

the forward-looking statements are reasonable, we cannot guarantee

future results, levels of activity, performance or achievements.

These statements involve known and unknown risks, uncertainties and

other factors that may cause our actual results, levels of

activity, performance or achievements to differ from those

expressed or implied by the forward-looking statements. These

factors include the following: failure to maintain adequate levels

of capital and liquidity to support our operations; the effect of

regulatory orders we have entered into and potential future

supervisory action against us or Hanmi Bank; general economic and

business conditions internationally, nationally and in those areas

in which we operate; volatility and deterioration in the credit and

equity markets; changes in consumer spending, borrowing and savings

habits; availability of capital from private and government

sources; the ability of Leading to complete the transactions

contemplated by the Securities Purchase Agreement; demographic

changes; competition for loans and deposits and failure to attract

or retain loans and deposits; fluctuations in interest rates and a

decline in the level of our interest rate spread; risks of natural

disasters related to our real estate portfolio; risks associated

with Small Business Administration (“SBA”) loans; failure to

attract or retain key employees; changes in governmental

regulation, including, but not limited to, any increase in FDIC

insurance premiums; ability to receive regulatory approval for

Hanmi Bank to declare dividends to Hanmi Financial; adequacy of our

allowance for loan losses, credit quality and the effect of credit

quality on our provision for credit losses and allowance for loan

losses; changes in the financial performance and/or condition of

our borrowers and the ability of our borrowers to perform under the

terms of their loans and other terms of credit agreements; our

ability to successfully integrate acquisitions we may make; our

ability to control expenses; and changes in securities markets. In

addition, we set forth certain risks in our reports filed with the

Securities and Exchange Commission, including our Annual Report on

Form 10-K for the fiscal year ended December 31, 2008 and current

and periodic reports filed with the Securities and Exchange

Commission thereafter, which could cause actual results to differ

from those projected. You should understand that it is not possible

to predict or identify all such risks. Consequently, you should not

consider such disclosures to be a complete discussion of all

potential risks or uncertainties. We undertake no obligation to

update such forward-looking statements except as required by

law.

About Hanmi Financial Corporation

Headquartered in Los Angeles, Hanmi Bank, a wholly owned

subsidiary of Hanmi Financial Corporation, provides services to the

multi-ethnic communities of California, with 27 full-service

offices in Los Angeles, Orange, San Bernardino, San Francisco,

Santa Clara and San Diego counties, and two loan production offices

in Virginia and Washington State. Hanmi Bank specializes in

commercial, SBA and trade finance lending, and is a recognized

community leader. Hanmi Bank’s mission is to provide a full range

of quality products and premier services to its customers and to

maximize shareholder value. Additional information is available at

www.hanmi.com.

HANMI FINANCIAL CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE

SHEETS (UNAUDITED)

(Dollars in Thousands)

September 30, December

31, %

September 30, %

2009

2008 Change

2008 Change

ASSETS

Cash and Due from Banks $ 57,727 $ 83,933 (31.2 )% $ 81,640

(29.3 )% Interest-Bearing Deposits in Other Banks 155,607 2,014

7,626.3 % 755 20,510.2 % Federal Funds Sold and Securities

Purchased Under Resale Agreements

—

130,000 (100.0

)% 5,000

(100.0 )% Cash and Cash

Equivalents

213,334

215,947 (1.2 )%

87,395 144.1 %

Investment Securities 205,901 197,117 4.5 % 221,714 (7.1 )%

Loans: Gross Loans, Net of Deferred Loan Fees 2,977,504

3,362,111 (11.4 )% 3,345,049 (11.0 )% Allowance for Loan Losses

(124,768 )

(70,986 ) 75.8

% (63,948 )

95.1 % Loans Receivable, Net

2,852,736 3,291,125

(13.3 )%

3,281,101 (13.1 )%

Due from Customers on Acceptances 1,859 4,295 (56.7 )% 7,382

(74.8 )% Premises and Equipment, Net 19,302 20,279 (4.8 )% 20,703

(6.8 )% Accrued Interest Receivable 11,389 12,347 (7.8 )% 13,801

(17.5 )% Other Real Estate Owned, Net 27,140 823 3,197.7 % 2,988

808.3 % Deferred Income Taxes, Net 2,464 29,456 (91.6 )% 18,682

(86.8 )% Servicing Assets 3,957 3,791 4.4 % 4,018 (1.5 )% Other

Intangible Assets, Net 3,736 4,950 (24.5 )% 5,404 (30.9 )%

Investment in Federal Home Loan Bank Stock, at Cost 30,697 30,697 —

30,424 0.9 % Investment in Federal Reserve Bank Stock, at Cost

10,053 10,228 (1.7 )% 11,733 (14.3 )% Bank-Owned Life Insurance

26,171 25,476 2.7 % 25,239 3.7 % Income Taxes Receivable 34,908

11,712 198.1 % 17,785 96.3 % Other Assets

13,843 17,573

(21.2 )% 17,622

(21.4 )% TOTAL

ASSETS $ 3,457,490

$ 3,875,816

(10.8 )% $

3,765,991 (8.2

)%

LIABILITIES AND STOCKHOLDERS’

EQUITY

Liabilities: Deposits: Noninterest-Bearing $ 561,548 $

536,944 4.6 % $ 634,593 (11.5 )% Interest-Bearing

2,430,312 2,533,136

(4.1 )% 2,164,784

12.3 % Total Deposits

2,991,860 3,070,080 (2.5 )% 2,799,377 6.9 % Accrued Interest

Payable 19,730 18,539 6.4 % 11,344 73.9 % Bank Acceptances

Outstanding 1,859 4,295 (56.7 )% 7,382 (74.8 )% Federal Home Loan

Bank Advances 160,828 422,196 (61.9 )% 583,315 (72.4 )% Other

Borrowings 1,496 787 90.1 % 1,657 (9.7 )% Junior Subordinated

Debentures 82,406 82,406 — 82,406 — Accrued Expenses and Other

Liabilities

12,191

13,598 (10.3 )%

13,314 (8.4 )%

Total Liabilities 3,270,370 3,611,901 (9.5 )% 3,498,795 (6.5

)% Stockholders’ Equity

187,120

263,915 (29.1

)% 267,196

(30.0 )% TOTAL LIABILITIES AND

STOCKHOLDERS’ EQUITY $

3,457,490 $

3,875,816 (10.8

)% $ 3,765,991

(8.2 )%

HANMI FINANCIAL CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

OPERATIONS (UNAUDITED)

(Dollars in Thousands, Except Per Share Data)

Three Months

Ended Nine Months Ended Sept.

30, June 30, %

Sept. 30, %

Sept. 30,

Sept. 30, %

2009

2009 Change

2008 Change

2009 2008

Change INTEREST AND DIVIDEND INCOME: Interest and Fees

on Loans $ 42,705 $ 44,718 (4.5 )% $ 56,134 (23.9 )% $ 132,508 $

172,637 (23.2 )% Taxable Interest on Investment Securities 1,541

1,370 12.5 % 2,049 (24.8 )% 4,261 7,743 (45.0 )% Tax-Exempt

Interest on Investment Securities 607 621 (2.3 )% 650 (6.6 )% 1,871

2,071 (9.7 )% Interest on Term Federal Funds Sold 293 695 (57.8 )%

— — 1,688 — — Dividends on Federal Reserve Bank Stock 150 153 (2.0

)% 176 (14.8 )% 456 528 (13.6 )% Interest on Federal Funds Sold and

Securities Purchased Under Resale Agreements 67 112 (40.2 )% 23

191.3 % 261 137 90.5 % Interest on Interest-Bearing Deposits in

Other Banks 68 11 518.2 % 4 1,600.0 % 81 5 1,520.0 % Dividends on

Federal Home Loan Bank Stock

64

— — 405

(84.2 )% 64

953 (93.3

)% Total Interest and Dividend Income

45,495 47,680

(4.6 )% 59,441

(23.5 )% 141,190

184,074 (23.3

)% INTEREST EXPENSE: Interest on Deposits

17,365 22,686 (23.5 )% 19,365 (10.3 )% 62,836 64,699 (2.9 )%

Interest on Federal Home Loan Bank Advances 865 1,010 (14.4 )%

3,324 (74.0 )% 2,987 11,406 (73.8 )% Interest on Junior

Subordinated Debentures 747 846 (11.7 )% 1,150 (35.0 )% 2,581 3,763

(31.4 )% Interest on Other Borrowings

—

2 (100.0 )%

5 (100.0 )%

2 344

(99.4 )% Total Interest Expense

18,977 24,544

(22.7 )% 23,844

(20.4 )%

68,406 80,212

(14.7 )% NET INTEREST INCOME

BEFORE PROVISION FOR CREDIT LOSSES 26,518 23,136 14.6 % 35,597

(25.5 )% 72,784 103,862 (29.9 )% — — — Provision for Credit Losses

49,500 23,934

106.8 % 13,176

275.7 % 119,387

50,226 137.7

% NET INTEREST INCOME (LOSS) AFTER PROVISION

FOR CREDIT LOSSES

(22,982 )

(798 ) 2,779.9

% 22,421

(202.5 )% (46,603

) 53,636

(186.9 )% NON-INTEREST INCOME:

Service Charges on Deposit Accounts 4,275 4,442 (3.8 )% 4,648 (8.0

)% 13,032 13,904 (6.3 )% Insurance Commissions 1,063 1,185 (10.3 )%

1,194 (11.0 )% 3,430 3,893 (11.9 )% Remittance Fees 511 545 (6.2 )%

499 2.4 % 1,579 1,543 2.3 % Trade Finance Fees 512 499 2.6 % 784

(34.7 )% 1,517 2,474 (38.7 )% Other Service Charges and Fees 489

467 4.7 % 433 12.9 % 1,439 1,852 (22.3 )% Net Gain on Sales of

Loans 864 — — — — 866 765 13.2 % Bank-Owned Life Insurance Income

234 227 3.1 % 241 (2.9 )% 695 715 (2.8 )% Gain on Sales of

Investment Securities — 1 (100.0 )% — — 1,277 618 106.6 % Loss on

Sales of Investment Securities — — — (483 ) (100.0 )% (109 ) (483 )

(77.4 )% Other-Than-Temporary Impairment Loss on Investment

Securities — — — (2,410 ) (100.0 )% — (2,410 ) (100.0 )% Other

Operating Income (Loss)

265

(695 ) (138.1

)% 422 (37.2

)% (462 )

1,874 (124.7 )% Total

Non-Interest Income

8,213

6,671 23.1 %

5,328 54.1 %

23,264 24,745

(6.0 )% NON-INTEREST EXPENSE:

Salaries and Employee Benefits 8,648 8,508 1.6 % 10,782 (19.8 )%

24,659 33,363 (26.1 )% Occupancy and Equipment 2,834 2,788 1.6 %

2,786 1.7 % 8,506 8,360 1.7 % Deposit Insurance Premiums and

Regulatory Assessments 2,001 3,929 (49.1 )% 780 156.5 % 7,420 2,098

253.7 % Other Real Estate Owned Expense 3,372 1,502 124.5 % 2 N/M

5,017 141 3,458.2 % Data Processing 1,608 1,547 3.9 % 1,498 7.3 %

4,691 4,730 (0.8 )% Professional Fees 1,239 890 39.2 % 647 91.5 %

2,745 2,627 4.5 % Supplies and Communications 603 599 0.7 % 681

(11.5 )% 1,772 2,008 (11.8 )% Advertising and Promotion 447 624

(28.4 )% 914 (51.1 )% 1,640 2,614 (37.3 )% Loan-Related Expense 192

1,217 (84.2 )% 170 12.9 % 1,590 569 179.4 % Amortization of Other

Intangible Assets 379 406 (6.7 )% 478 (20.7 )% 1,214 1,504 (19.3 )%

Other Operating Expenses 2,366 2,686 (11.9 )% 3,497 (32.3 )% 7,383

7,859 (6.1 )% Impairment Loss on Goodwill

—

— —

— — —

107,393 (100.0

)% Total Non-Interest Expense

23,689 24,696

(4.1 )% 22,235

6.5 % 66,637

173,266 (61.5

)% INCOME (LOSS) BEFORE PROVISION (BENEFIT) FOR

INCOME TAXES (38,458 ) (18,823 ) 104.3 % 5,514 (797.5 )% (89,976 )

(94,885 ) (5.2 )% Provision (Benefit) for Income Taxes

21,207 (9,288

) (328.3 )%

1,166 1,718.8 %

(3,580 ) 3,393

(205.5 )% NET INCOME

(LOSS) $ (59,665

) $

(9,535 ) 525.7

% $ 4,348

(1,472.2 )% $

(86,396 )

$ (98,278

) (12.1 )%

EARNINGS (LOSS) PER SHARE: Basic $ (1.26 ) $ (0.21 ) 500.0 %

$ 0.09 (1,500.0 )% $ (1.86 ) $ (2.14 ) (13.1 )% Diluted $ (1.26 ) $

(0.21 ) 500.0 % $ 0.09 (1,500.0 )% $ (1.86 ) $ (2.14 ) (13.1 )%

WEIGHTED-AVERAGE SHARES OUTSTANDING: Basic 47,413,141

45,924,767 45,881,549 46,415,225 45,869,069 Diluted 47,413,141

45,924,767 45,933,043 46,415,225 45,869,069

SHARES

OUTSTANDING AT PERIOD-END 51,201,390 46,130,967 45,905,549

51,201,390 45,905,549

HANMI FINANCIAL

CORPORATION AND SUBSIDIARIES SELECTED FINANCIAL DATA

(UNAUDITED) (Dollars in Thousands)

Three Months Ended

Nine Months Ended Sept. 30,

June 30, %

Sept. 30, %

Sept.

30, Sept. 30, %

2009

2009 Change

2008 Change

2009 2008

Change AVERAGE BALANCES: Average Gross

Loans, Net of Deferred Loan Fees $ 3,078,104 $ 3,282,152 (6.2 )% $

3,341,250 (7.9 )% $ 3,235,455 $ 3,320,559 (2.6 )% Average

Investment Securities 209,021 179,129 16.7 % 244,027 (14.3 )%

190,243 294,130 (35.3 )% Average Interest-Earning Assets 3,552,698

3,796,039 (6.4 )% 3,630,755 (2.1 )% 3,718,837 3,659,255 1.6 %

Average Total Assets 3,672,253 3,897,158 (5.8 )% 3,789,614 (3.1 )%

3,842,266 3,892,197 (1.3 )% Average Deposits 3,100,419 3,223,309

(3.8 )% 2,895,746 7.1 % 3,174,880 2,924,416 8.6 % Average

Borrowings 297,455 386,477 (23.0 )% 590,401 (49.6 )% 374,139

588,267 (36.4 )% Average Interest-Bearing Liabilities 2,844,821

3,083,774 (7.7 )% 2,835,917 0.3 % 3,013,651 2,861,288 5.3 % Average

Stockholders’ Equity 232,136 240,207 (3.4 )% 267,433 (13.2 )%

249,742 340,894 (26.7 )% Average Tangible Equity 228,169 235,850

(3.3 )% 261,751 (12.8 )% 245,377 263,870 (7.0 )%

PERFORMANCE RATIOS (Annualized): Return on Average Assets

(6.45 )% (0.98 )% 0.46 % (3.01 )% (3.37 )% Return on Average

Stockholders’ Equity (101.97 )% (15.92 )% 6.47 % (46.25 )% (38.51

)% Return on Average Tangible Equity (103.75 )% (16.22 )% 6.61 %

(47.08 )% (49.75 )% Efficiency Ratio 68.21 % 82.85 % 54.33 % 69.38

% 134.73 % Net Interest Spread (1) 2.47 % 1.88 % 3.21 % 2.08 % 3.02

% Net Interest Margin (1) 3.00 % 2.48 % 3.94 % 2.65 % 3.83 %

ALLOWANCE FOR LOAN LOSSES: Balance at Beginning of

Period $ 105,268 $ 104,943 0.3 % $ 62,977 67.2 % $ 70,986 $ 43,611

62.8 % Provision Charged to Operating Expense 49,375 23,922 106.4 %

12,802 285.7 % 119,067 47,685 149.7 % Charge-Offs, Net of

Recoveries

(29,875 )

(23,597 ) 26.6

% (11,831 )

152.5 % (65,285

) (27,348 )

138.7 % Balance at End of Period

$ 124,768 $

105,268 18.5 %

$ 63,948 95.1

% $ 124,768

$ 63,948 95.1

% Allowance for Loan Losses to Total Gross

Loans 4.19 % 3.33 % 1.91 % 4.19 % 1.91 % Allowance for Loan Losses

to Total Non-Performing Loans 71.53 % 62.92 % 57.16 % 71.53 % 57.16

%

ALLOWANCE FOR OFF-BALANCE SHEET ITEMS:

Balance at Beginning of Period $ 4,291 $ 4,279 0.3 % $ 3,932 9.1 %

$ 4,096 $ 1,765 132.1 % Provision Charged to Operating Expense

125 12

941.7 % 374

151.8 % 320

2,541 (87.4 )%

Balance at End of Period

$ 4,416

$ 4,291 2.9

% $ 4,306

2.6 % $ 4,416

$ 4,306 2.6

% (1) Amounts calculated on a fully taxable

equivalent basis using the current statutory federal tax rate.

HANMI FINANCIAL

CORPORATION AND SUBSIDIARIES SELECTED FINANCIAL DATA

(UNAUDITED) (Continued) (Dollars in Thousands)

Sept. 30, Dec. 31, %

Sept. 30, %

2009 2008

Change 2008 Change

NON-PERFORMING ASSETS: Non-Accrual Loans $ 174,363 $ 120,823

44.3 % $ 111,335 56.6 % Loans 90 Days or More Past Due and Still

Accruing

64 1,075

(94.0 )% 535

(88.0 )% Total Non-Performing

Loans 174,427 121,898 43.1 % 111,870 55.9 % Other Real Estate

Owned, Net

27,140

823 3,197.7 %

2,988 808.3 % Total

Non-Performing Assets

$ 201,567

$ 122,721 64.2

% $ 114,858

75.5 % Total Non-Performing

Loans/Total Gross Loans 5.85 % 3.62 % 3.34 % Total Non-Performing

Assets/Total Assets 5.83 % 3.17 % 3.05 % Total Non-Performing

Assets/Allowance for Loan Losses 161.6 % 172.9 % 179.6 %

DELINQUENT LOANS $ 151,047

$ 128,469 17.6

% $ 102,917

46.8 % Delinquent Loans/Total

Gross Loans 5.07 % 3.82 % 3.08 %

LOAN PORTFOLIO: Real

Estate Loans $ 1,086,735 $ 1,180,114 (7.9 )% $ 1,166,436 (6.8 )%

Commercial and Industrial Loans 1,824,042 2,099,732 (13.1 )%

2,096,222 (13.0 )% Consumer Loans

68,537

83,525 (17.9

)% 84,031

(18.4 )% Total Gross Loans 2,979,314

3,363,371 (11.4 )% 3,346,689 (11.0 )% Deferred Loan Fees

(1,810 ) (1,260

) 43.7 %

(1,640 ) 10.4 %

Gross Loans, Net of Deferred Loan Fees 2,977,504 3,362,111 (11.4 )%

3,345,049 (11.0 )% Allowance for Loan Losses

(124,768 ) (70,986

) 75.8 %

(63,948 ) 95.1

% Loans Receivable, Net

$

2,852,736 $ 3,291,125

(13.3 )% $

3,281,101 (13.1 )%

LOAN MIX: Real Estate Loans 36.5 % 35.1 % 34.9 %

Commercial and Industrial Loans 61.2 % 62.4 % 62.6 % Consumer Loans

2.3 % 2.5

% 2.5 % Total Gross

Loans

100.0 %

100.0 % 100.0

% DEPOSIT PORTFOLIO: Demand -

Noninterest-Bearing $ 561,548 $ 536,944 4.6 % $ 634,593 (11.5 )%

Savings 98,019 81,869 19.7 % 86,157 13.8 % Money Market Checking

and NOW Accounts 723,585 370,401 95.4 % 597,065 21.2 % Time

Deposits of $100,000 or More 845,318 849,800 (0.5 )% 863,034 (2.1

)% Other Time Deposits

763,390

1,231,066 (38.0 )%

618,528 23.4 %

Total Deposits

$ 2,991,860

$ 3,070,080 (2.5

)% $ 2,799,377

6.9 % DEPOSIT MIX: Demand -

Noninterest-Bearing 18.8 % 17.5 % 22.7 % Savings 3.3 % 2.7 % 3.1 %

Money Market Checking and NOW Accounts 24.2 % 12.1 % 21.3 % Time

Deposits of $100,000 or More 28.3 % 27.7 % 30.8 % Other Time

Deposits

25.4 %

40.0 % 22.1

% Total Deposits

100.0

% 100.0 %

100.0 % CAPITAL RATIOS (Bank

Only): Total Risk-Based 9.69 % 10.71 % 10.84 % Tier 1

Risk-Based 8.40 % 9.44 % 9.57 % Tier 1 Leverage 7.05 % 8.85 % 8.94

%

HANMI FINANCIAL

CORPORATION AND SUBSIDIARIES AVERAGE BALANCES, AVERAGE

YIELDS EARNED AND AVERAGE RATES PAID (UNAUDITED) (Dollars in

Thousands)

Three Months Ended

Nine Months Ended September 30,

2009 June 30, 2009

September 30, 2008 September 30,

2009 September 30, 2008

AverageBalance

InterestIncome/Expense

AverageYield/Rate

AverageBalance

InterestIncome/Expense

AverageYield/Rate

AverageBalance

InterestIncome/Expense

AverageYield/Rate

AverageBalance

InterestIncome/Expense

AverageYield/Rate

AverageBalance

InterestIncome/Expense

AverageYield/Rate

INTEREST-EARNING ASSETS Loans: Real Estate

Loans: Commercial Property $ 887,028 $ 12,051 5.39 % $ 914,802 $

13,041 5.72 % $ 867,684 $ 14,604 6.70 % $ 905,386 $ 38,029 5.62 % $

821,097 $ 42,894 6.98 % Construction 138,340 1,464 4.20 % 178,456

1,594 3.58 % 199,969 2,539 5.05 % 165,455 4,605 3.72 % 208,519

8,081 5.18 % Residential Property

83,387

1,050 5.00 %

86,913 1,119

5.16 % 90,739

1,209 5.30 %

86,904 3,332

5.13 % 90,069

3,584 5.32 % Total

Real Estate Loans 1,108,755 14,565 5.21 % 1,180,171 15,754 5.35 %

1,158,392 18,352 6.30 % 1,157,745 45,966 5.31 % 1,119,685 54,559

6.51 % Commercial and Industrial Loans 1,897,321 26,863 5.62 %

2,025,414 27,774 5.50 % 2,099,708 36,128 6.85 % 2,001,546 82,874

5.54 % 2,114,974 112,416 7.10 % Consumer Loans

73,670 1,084

5.84 % 77,989

1,108 5.70 %

85,021 1,495

7.00 % 77,606

3,345 5.76 %

87,920 4,789

7.28 % Total Gross Loans 3,079,746 42,512

5.48 % 3,283,574 44,636 5.45 % 3,343,121 55,975 6.66 % 3,236,897

132,185 5.46 % 3,322,579 171,764 6.91 % Prepayment Penalty Income —

193 — — 82 — — 159 — — 323 — — 873 — Unearned Income on Loans, Net

of Costs

(1,642 )

— — (1,422

) — —

(1,871 ) —

— (1,442 )

— —

(2,020 ) —

— Gross Loans, Net

3,078,104

42,705 5.50

% 3,282,152

44,718 5.46

% 3,341,250

56,134 6.68

% 3,235,455

132,508 5.48

% 3,320,559

172,637 6.94

% Investment Securities:

Municipal Bonds (1) 58,179 933 6.41 % 59,222 956 6.46 % 60,979

1,000 6.56 % 58,760 2,878 6.53 % 65,329 3,186 6.50 % U.S.

Government Agency Securities 37,969 431 4.54 % 13,177 144 4.37 %

46,777 483 4.13 % 20,345 671 4.40 % 80,120 2,612 4.35 %

Mortgage-Backed Securities 82,429 807 3.92 % 74,939 880 4.70 %

83,460 994 4.76 % 77,720 2,582 4.43 % 90,652 3,246 4.77 %

Collateralized Mortgage Obligations 17,066 173 4.05 % 20,713 215

4.15 % 41,266 441 4.27 % 23,742 736 4.13 % 45,853 1,462 4.25 %

Corporate Bonds 401 — 0.00 % 233 22 37.77 % 7,751 89 4.59 % 265 —

0.00 % 8,344 287 4.59 % Other Securities

12,977

130 4.01 %

10,845 109

4.02 % 3,794

42 4.43 %

9,411 272 3.85

% 3,832

136 4.73 % Total

Investment Securities (1)

209,021

2,474 4.73

% 179,129

2,326 5.19

% 244,027

3,049 5.00

% 190,243

7,139 5.00

% 294,130

10,929 4.95

% Other Interest-Earning Assets:

Equity Securities 41,741 214 2.05 % 41,532 153 1.47 % 39,929 581

5.82 % 41,667 520 1.66 % 37,160 1,481 5.31 %

Federal Funds Sold and Securities

Purchased Under Resale Agreements

56,568 67 0.47 % 135,362 112 0.33 % 4,797 23 1.92 % 95,365 261 0.36

% 7,096 137 2.57 % Term Federal Funds Sold 90,239 293 1.30 %

147,692 695 1.88 % — — — 125,249 1,688 1.80 % — — —

Interest-Earning Deposits

77,025

68 0.35 %

10,172 11 0.43

% 752 4

2.13 % 30,858

81 0.35 %

310 5 2.15

% Total Other Interest-Earning Assets

265,573 642

0.97 %

334,758 971

1.16 %

45,478 608

5.35 %

293,139 2,550

1.16 %

44,566 1,623

4.86 % TOTAL

INTEREST-EARNING ASSETS (1)

$

3,552,698 $

45,821 5.12

% $

3,796,039 $

48,015 5.07

% $

3,630,755 $

59,791 6.55

% $

3,718,837 $

142,197 5.11

% $

3,659,255 $

185,189 6.76

% INTEREST-BEARING LIABILITIES

Interest-Bearing Deposits: Savings $ 93,404 $ 585

2.48 % $ 84,588 $ 527 2.50 % $ 91,465 $ 533 2.32 % $ 86,715 $ 1,617

2.49 % $ 91,910 $ 1,587 2.31 % Money Market Checking and NOW

Accounts 629,124 2,998 1.89 % 319,319 1,426 1.79 % 693,718 5,579

3.20 % 431,646 6,278 1.94 % 656,625 15,946 3.24 % Time Deposits of

$100,000 or More 983,341 7,447 3.00 % 1,313,683 12,108 3.70 %

973,752 8,709 3.56 % 1,124,876 29,877 3.55 % 1,143,975 35,436 4.14

% Other Time Deposits

841,497

6,335 2.99 %

979,707 8,625

3.53 % 486,581

4,544 3.72 %

996,275 25,064

3.36 % 380,511

11,730 4.12 %

Total Interest-Bearing Deposits

2,547,366

17,365 2.70

% 2,697,297

22,686 3.37

% 2,245,516

19,365 3.43

% 2,639,512

62,836 3.18

% 2,273,021

64,699 3.80

% Borrowings: FHLB Advances

213,583 865 1.61 % 302,220 1,010 1.34 % 506,981 3,324 2.61 %

290,142 2,987 1.38 % 492,434 11,406 3.09 % Other Borrowings 1,466 —

0.00 % 1,851 2 0.43 % 1,014 5 1.96 % 1,591 2 0.17 % 13,427 344 3.42

% Junior Subordinated Debentures

82,406

747 3.60 %

82,406 846

4.12 % 82,406

1,150 5.55 %

82,406 2,581

4.19 % 82,406

3,763 6.10 % Total

Borrowings 297,455

1,612 2.15

% 386,477

1,858 1.93

% 590,401

4,479 3.02

% 374,139

5,570 1.99

% 588,267

15,513 3.52

% TOTAL INTEREST-BEARING

LIABILITIES $ 2,844,821

$ 18,977

2.65 %

$ 3,083,774

$ 24,544

3.19 %

$ 2,835,917

$ 23,844

3.34 %

$ 3,013,651

$ 68,406

3.03 %

$ 2,861,288

$ 80,212

3.74 % NET

INTEREST INCOME (1)

$

26,844 $

23,471 $

35,947 $

73,791 $

104,977 NET INTEREST SPREAD (1)

2.47 %

1.88 %

3.21 %

2.08 %

3.02 % NET

INTEREST MARGIN (1)

3.00

% 2.48

% 3.94

% 2.65

% 3.79

%

(1) Amounts calculated on a fully

taxable equivalent basis using the current statutory federal tax

rate.

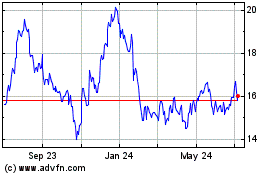

Hanmi Financial (NASDAQ:HAFC)

Historical Stock Chart

From May 2024 to Jun 2024

Hanmi Financial (NASDAQ:HAFC)

Historical Stock Chart

From Jun 2023 to Jun 2024