Full Year Net Sales Increased 16% to $795

Million Provides 2020 Outlook

Funko, Inc. ("Funko,” or the “Company”) (Nasdaq: FNKO), a

leading pop culture consumer products company, today reported its

consolidated financial results for the fourth quarter and fiscal

year ended December 31, 2019.

Full Year 2019 Financial Highlights

- Net sales increased 16% to $795.1 million

- Gross profit1 increased 11% to $282.5 million, and gross profit

excluding a one-time charge of $16.8 million related to the

write-down of inventory2 increased 17% to $299.3 million

- Gross margin1 of 35.5% and gross margin excluding the inventory

write-down referenced above2 of 37.6%

- Net income of $27.8 million

- Adjusted EBITDA3 of $123.0 million and Adjusted EBITDA Margin3

of 15.5%

- Cash flow from operations of $90.8 million

Full Year 2019 Operating Highlights

- Completed the strategic acquisition of world-class game design

studio Forrest-Pruzan, creating Funko Games, and successfully

entered the board game category

- Grew sales in the European region approximately 32% on a

year-over-year basis

- Successfully grew sales of Loungefly products more than 60% on

a year-over-year basis

- Unveiled an enhanced mobile app with robust new features and

rolled out a fan loyalty program

- Opened Funko’s second flagship store in Hollywood, CA

- Reinforced Funko’s bench with new hires across the Company in

operations, planning, supply chain and finance

- Strengthened the Company’s balance sheet through the successful

refinancing of Funko’s credit facilities

Brian Mariotti, Chief Executive Officer, stated, “Full year top

line growth of 16% was driven by the underlying strength of Pop!

Vinyl, growth in key geographic markets and the introduction of new

products and categories. Although we closed the year with a

difficult fourth quarter, we remain confident in the underlying

strength of our business model and have a number of initiatives

underway to drive growth in 2020. We have an exceptional line-up of

games, toys and figures coming to market in the second half, unique

evergreen retail programs and new products and partnerships in

underpenetrated genres, including anime, sports and music.”

“Funko’s deep roots and expertise in all things pop culture

provide us with a strong foundation for growth and expansion. As

the proliferation of content continues to occur across pop culture,

we believe Funko will be at the forefront. We are focused on

building for scale – ensuring we have the tools and talent in place

to drive a high level of execution, support our growth and deliver

long-term shareholder value.”

Full Year 2019 Financial Results

Net sales grew 16% to $795.1 million in 2019 compared to $686.1

million in 2018. The year-over-year improvement was primarily

driven by an increase in the number of active properties and

strength in the U.S. and international markets.

In 2019, the number of active properties increased 20% to 804

from 672 in 2018 and net sales per active property decreased 3%. On

a geographical basis, net sales in the United States increased 12%

to $523.9 million and net sales internationally increased 23% to

$271.2 million driven by strong growth in Europe. On a product

category basis, net sales of figures increased 15% to $642.5

million. Net sales of other products increased 21% to $152.6

million, which reflects strong growth in our Loungefly

products.

The tables below show the breakdown of net sales on a

geographical and product category basis (in thousands):

Twelve Months Ended December

31,

Period Over Period

Change

2019

2018

Dollar

Percentage

Net sales by geography: United States

$

523,897

$

466,044

$

57,853

12.4

%

International

271,225

220,029

51,196

23.3

%

Total net sales

$

795,122

$

686,073

$

109,049

15.9

%

Twelve Months Ended December

31,

Period Over Period

Change

2019

2018

Dollar

Percentage

Net sales by product: Figures

$

642,531

$

560,100

$

82,431

14.7

%

Other

152,591

125,973

26,618

21.1

%

Total net sales

$

795,122

$

686,073

$

109,049

15.9

%

Gross margin1 in 2019 decreased 170 basis points to 35.5%

compared to 37.2% in 2018, primarily due to a one-time charge of

$16.8 million related to the write-down of inventory in the fourth

quarter of 2019. Gross margin excluding the one-time inventory

write down2 was 37.6%, an increase of 40 basis points compared to

2018. The year-over-year increase is primarily attributable to

lower product costs as a percentage of net sales due to a mix shift

toward higher margin products as well as a decrease in shipping and

freight costs as a percentage of net sales, which was partially

offset by higher duties as a percentage of net sales related to our

Loungefly products.

SG&A expenses increased 25% to $193.8 million in 2019

compared to $155.3 million in 2018, primarily reflecting increased

headcount, warehouse costs and marketing to support new product

launches as well as new office, retail and warehouse

facilities.

Net income in 2019 was $27.8 million compared to net income of

$25.1 million in 2018 and Adjusted Net Income3 (non-GAAP) was $49.9

million in 2019 versus $39.5 million in 2018. Adjusted EBITDA3 in

2019 was $123.0 million and Adjusted EBITDA margin3 was 15.5%,

compared to $113.5 million and 16.5%, respectively, in 2018. A

reconciliation of these non-GAAP measures to GAAP is provided

below.

Fourth Quarter 2019 Financial Results

Net sales decreased 8% to $213.6 million in the fourth quarter

of 2019 compared to $233.2 million in the fourth quarter of 2018.

The year-over-year decline was primarily driven by underperformance

in more mature markets, including the U.S., Australia and Canada,

and reflects three primary factors: softness at retail during the

holiday season which led to a decrease in orders, underperformance

in key tentpole properties, and difficult comparisons from the year

ago period due to the strength of Fortnite which generated 12% of

sales in the fourth quarter of 2018.

In the fourth quarter of 2019, the number of active properties

increased 14% to 667 from 583 in the fourth quarter of 2018 and net

sales per active property decreased 20%. On a geographical basis,

net sales in the United States decreased 9% to $144.9 million and

net sales internationally decreased 8% to $68.6 million due to

declines in Australia and Canada, partially offset by strong growth

in Europe. On a product category basis, net sales of figures

decreased 10% to $170.2 million reflecting the overall softness at

retail in the quarter. Net sales of other products decreased 3% to

$43.3 million versus the fourth quarter of 2018, which reflects

decreased sales in plush and accessories, partially offset by

double digit growth in our Loungefly brand.

The tables below show the breakdown of net sales on a

geographical and product category basis (in thousands):

Three Months Ended December

31,

Period Over Period

Change

2019

2018

Dollar

Percentage

Net sales by geography: United States

$

144,932

$

158,770

$

(13,838

)

-8.7

%

International

68,619

74,454

(5,835

)

-7.8

%

Total net sales

$

213,551

$

233,224

$

(19,673

)

-8.4

%

Three Months Ended December

31,

Period Over Period

Change

2019

2018

Dollar

Percentage

Net sales by product: Figures

$

170,204

$

188,261

$

(18,057

)

-9.6

%

Other

43,347

44,963

(1,616

)

-3.6

%

Total net sales

$

213,551

$

233,224

$

(19,673

)

-8.4

%

Gross margin1 in the fourth quarter of 2019 decreased 680 basis

points to 29.2% compared to 36.0% in the fourth quarter of 2018,

primarily due to a one-time charge of $16.8 million related to the

write-down of inventory in the 2019 quarter. Gross margin excluding

the one-time inventory write down2 was 37.1%, an increase of 110

basis points compared to the fourth quarter of 2018. The

year-over-year increase is primarily attributable to lower product

costs as a percentage of net sales due to a mix shift toward higher

margin products, which was partially offset by higher duties as a

percentage of net sales related to our Loungefly products.

SG&A expenses increased 27% to $57.3 million in the fourth

quarter of 2019 compared to $45.0 million in the fourth quarter of

2018, primarily reflecting increased headcount, marketing spend to

support new product launches, and the addition of new office,

retail and warehouse facilities.

Net loss in the fourth quarter of 2019 was $6.3 million compared

to net income of $15.5 million in the fourth quarter of 2018 and

Adjusted Net Income3 (non-GAAP) was $8.9 million in the fourth

quarter of 2019 versus $21.3 million in the fourth quarter of 2018.

Adjusted EBITDA3 in the fourth quarter of 2019 was $25.7 million

and Adjusted EBITDA margin3 was 12.0%, compared to $43.1 million

and 18.5%, respectively, in the fourth quarter of 2018. A

reconciliation of these non-GAAP measures to GAAP is provided

below.

Balance Sheet Highlights

As of December 31, 2019, the Company had cash and cash

equivalents of $25 million and total debt of $242 million.

Inventories at year-end totaled $62 million, a decrease of 28%

compared to a year ago, primarily reflecting an inventory

write-down in the fourth quarter of 2019.

Jennifer Fall Jung, Chief Financial Officer, stated, “In 2019,

we generated strong operating cash flow and strengthened our

balance sheet, providing us with the financial flexibility to

invest in our infrastructure and strategic growth opportunities.

Looking at 2020, we expect to achieve top line growth in the range

of 6% to 9%, and adjusted EBITDA margins of approximately 14%,

which includes our current assumptions regarding the impact of the

coronavirus crisis. Our adjusted EBITDA outlook reflects strong

gross margin performance, offset by the investments we’re making to

enhance our operations, drive efficiency and build scale in our

model.”

2020 Outlook

In 2020, the Company expects the following:

- Net sales of $840.0 million to $865.0 million, representing 6%

to 9% growth compared to 2019, including approximately 2 points of

anticipated impact from the coronavirus;

- Adjusted EBITDA3 of $115.0 million to $125.0 million,

representing Adjusted EBITDA margin of 13.7% to 14.5%;

- Adjusted Net Income3 of $43.3 million to $50.8 million, based

on a blended tax rate of 25%; and

- Adjusted Earnings per Diluted Share3 of $0.85 per share to

$1.00 per share, based on estimated adjusted average diluted shares

outstanding of 51.0 million for the full year.

The Company’s 2020 outlook reflects its current assumptions

regarding any potential effect of the novel coronavirus due to

manufacturing disruptions and delayed shipments resulting from the

crisis. Compared to 2019, the Company anticipates that net sales in

the first quarter of 2020 will decline in the mid-teens and the

first half of the year will decline mid-single digits, which

includes the anticipated impact of manufacturing disruptions and

delayed shipments.

Adjusted EBITDA and Adjusted EPS are non-GAAP measures. A table

at the end of this release reconciles Funko’s outlook for the full

year 2020 Adjusted EBITDA and Adjusted Earnings per Diluted Share

guidance to the most directly comparable U.S. GAAP financial

measures. Please refer to the “Non-GAAP Financial Measures” section

of this press release.

1 Gross profit is calculated as net sales

less cost of sales (exclusive of depreciation and amortization).

Gross margin is calculated as net sales less cost of sales

(exclusive of depreciation and amortization) as a percentage of net

sales.

2 Gross profit excluding the one-time

inventory write-down and gross margin excluding the one-time

inventory write-down are non-GAAP financial measures. Please see

the “Non-GAAP Financial Measures” section for a reconciliation to

the most directly comparable U.S. GAAP measure.

3 Adjusted Net Income, Adjusted Earnings

per Diluted Share, Adjusted EBITDA and Adjusted EBITDA margin are

non-GAAP financial measures. For a reconciliation of Adjusted Net

Income, Adjusted Earnings per Diluted Share and Adjusted EBITDA to

the most directly comparable U.S. GAAP financial measures, please

refer to the “Non-GAAP Financial Measures” section of this press

release.

Conference Call and Webcast

The Company will host a conference call at 4:30 p.m. Eastern

Time (1:30 p.m. Pacific Time) today, March 5, 2020, to further

discuss its fourth quarter results. Investors and analysts can

participate on the conference call by dialing (833) 227-5847 or

(647) 689-4074 and referencing passcode 6565388. Interested parties

can also listen to a live webcast or replay of the conference call

by logging on to the Investor Relations section on the Company’s

website at https://investor.funko.com/. The replay of the webcast

will be available for one year.

About Funko

Headquartered in Everett, Washington, Funko is a leading pop

culture consumer products company. Funko designs, sources and

distributes licensed pop culture products across multiple

categories, including vinyl figures, action toys, plush, apparel,

housewares and accessories for consumers who seek tangible ways to

connect with their favorite pop culture brands and characters.

Learn more at https://funko.com/, and follow us on Twitter

(@OriginalFunko) and Instagram (@OriginalFunko).

Forward Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. All statements contained in this press release that do not

relate to matters of historical fact should be considered

forward-looking statements, including statements regarding our

anticipated financial results, the underlying trends in our

business, the anticipated impact of the novel coronavirus outbreak

on our business, growing demand for our products, our potential for

growth, plans for investments in our business and expected

enhancements to operations. These forward-looking statements are

based on management’s current expectations. These statements are

neither promises nor guarantees, but involve known and unknown

risks, uncertainties and other important factors that may cause our

actual results, performance or achievements to be materially

different from any future results, performance or achievements

expressed or implied by the forward-looking statements, including,

but not limited to, the following: our ability to execute our

business strategy; our ability to maintain and realize the full

value of our license agreements; the ongoing level of popularity of

our products with consumers; changes in the retail industry and

markets for our consumer products; our ability to maintain our

relationships with retail customers and distributors; our ability

to compete effectively; fluctuations in our gross margin; our

dependence on content development and creation by third parties;

our ability to manage our inventories; our ability to develop and

introduce products in a timely and cost-effective manner; our

ability to obtain, maintain and protect our intellectual property

rights or those of our licensors; potential violations of the

intellectual property rights of others; risks associated with

counterfeit versions of our products; our ability to attract and

retain qualified employees and maintain our corporate culture; our

use of third-party manufacturing; risks associated with our

international operations; changes in effective tax rates or tax

law; foreign currency exchange rate exposure; the possibility or

existence of global and regional economic downturns; our dependence

on vendors and outsourcers; risks relating to government

regulation; risks relating to litigation, including products

liability claims and securities class action litigation; any

failure to successfully integrate or realize the anticipated

benefits of acquisitions or investments; reputational risk

resulting from our e-commerce business and social media presence;

risks relating to our indebtedness and our ability to secure

additional financing; the potential for our electronic data or the

electronic data of our customers to be compromised; the influence

of our significant stockholder, ACON, and the possibility that

ACON’s interests may conflict with the interests of our other

stockholders; risks relating to our organizational structure;

volatility in the price of our Class A common stock; and risks

associated with our internal control over financial reporting.

These and other important factors discussed under the caption “Risk

Factors” in our annual report on Form 10-K for the year ended

December 31, 2019 and our other filings with the Securities and

Exchange Commission could cause actual results to differ materially

from those indicated by the forward-looking statements made in this

press release. Any such forward-looking statements represent

management’s estimates as of the date of this press release. While

we may elect to update such forward-looking statements at some

point in the future, we disclaim any obligation to do so, even if

subsequent events cause our views to change. These forward-looking

statements should not be relied upon as representing our views as

of any date subsequent to the date of this press release.

Funko, Inc. and

Subsidiaries

Condensed Consolidated

Statements of Operations

(Unaudited)

Three Months Ended December

31,

Twelve Months Ended December

31,

2019

2018

2019

2018

(In thousands, except per

share data)

Net sales

$

213,551

$

233,224

$

795,122

$

686,073

Cost of sales (exclusive of depreciation and amortization shown

separately below)

151,125

149,172

512,580

430,746

Selling, general, and administrative expenses

57,264

45,015

193,803

155,321

Acquisition transaction costs

—

—

—

28

Depreciation and amortization

10,999

10,204

42,126

39,116

Total operating expenses

219,388

204,391

748,509

625,211

Income (loss) from operations

(5,837

)

28,833

46,613

60,862

Interest expense, net

2,887

4,509

14,342

21,739

Loss on extinguishment of debt

—

4,547

—

4,547

Other (income) expense, net

(448

)

1,488

(25

)

4,082

Income (loss) before income taxes

(8,276

)

18,289

32,296

30,494

Income tax (benefit) expense

(1,988

)

2,770

4,476

5,432

Net income (loss)

(6,288

)

15,519

27,820

25,062

Less: net income (loss) attributable to non-controlling interests

(2,047

)

10,292

16,095

17,599

Net income (loss) attributable to Funko, Inc.

$

(4,241

)

$

5,227

$

11,725

$

7,463

Earnings (loss) per share of Class A common stock: Basic

$

(0.12

)

$

0.21

$

0.38

$

0.31

Diluted

$

(0.12

)

$

0.20

$

0.36

$

0.29

Weighted average shares of Class A common stock outstanding: Basic

34,883

24,821

30,898

23,821

Diluted

34,883

26,607

32,926

25,560

Funko, Inc. and

Subsidiaries

Condensed Consolidated Balance

Sheets

December 31,

December 31,

2019

2018

(In thousands, except per

share amounts)

Assets Current assets: Cash and cash equivalents

$

25,229

$

13,486

Accounts receivable, net

151,564

148,627

Inventory

62,124

86,622

Prepaid expenses and other current assets

20,280

11,904

Total current assets

259,197

260,639

Property and equipment, net

65,712

44,296

Operating lease right-of-use assets

62,901

—

Goodwill

124,835

116,078

Intangible assets, net

221,492

233,645

Deferred tax asset

57,547

7,407

Other assets

4,783

4,275

Total assets

$

796,467

$

666,340

Liabilities and Stockholders' Equity Current

liabilities: Line of credit

$

25,822

$

20,000

Current portion long-term debt, net of unamortized discount

13,685

10,593

Current portion of operating lease liability

11,314

—

Accounts payable

42,531

36,130

Income taxes payable

637

4,492

Accrued royalties

34,625

39,020

Accrued expenses and other current liabilities

28,955

33,015

Total current liabilities

157,569

143,250

Long-term debt, net of unamortized discount

202,816

216,704

Operating lease liabilities, net of current portion

61,622

—

Deferred tax liability

341

5

Liabilities under tax receivable agreement, net of current portion

61,554

6,504

Deferred rent and other long-term liabilities

7,421

6,623

Commitments and contingencies

Stockholders'

equity: Class A common stock, par value $0.0001 per share,

200,000 shares authorized; 34,918 shares and 24,960 shares issued

and outstanding as of December 31, 2019 and 2018, respectively

3

2

Class B common stock, par value $0.0001 per share, 50,000 shares

authorized; 14,515 shares and 23,584 shares issued and outstanding

as of December 31, 2019 and 2018, respectively

1

2

Additional paid-in-capital

204,174

146,154

Accumulated other comprehensive loss

791

(167

)

Retained earnings

20,442

8,717

Total stockholders' equity attributable to Funko, Inc.

225,411

154,708

Non-controlling interests

79,733

138,546

Total stockholders' equity

305,144

293,254

Total liabilities and stockholders' equity

$

796,467

$

666,340

Funko, Inc. and

Subsidiaries

Condensed Consolidated

Statements of Cash Flows

Twelve Months Ended December

31,

2019

2018

(In thousands) Operating Activities Net income

$

27,820

$

25,062

Adjustments to reconcile net income to net cash provided by

operating activities: Depreciation, amortization and other

44,518

39,116

Equity-based compensation

13,044

9,140

Accretion of discount on long-term debt

952

1,414

Amortization of debt issuance costs

258

709

Loss on debt extinguishment

—

4,547

Deferred tax benefit

(2,293

)

(964

)

Other

635

4,288

Changes in operating assets and liabilities: Accounts receivable,

net

(3,969

)

(36,139

)

Inventory

25,372

(8,886

)

Prepaid expenses and other assets

(5,824

)

8,736

Accounts payable

4,629

(16,375

)

Income taxes payable

(3,618

)

2,177

Accrued royalties

(4,403

)

13,495

Accrued expenses and other liabilities

(6,356

)

3,671

Net cash provided by operating activities

90,765

49,991

Investing Activities Purchase of property and

equipment

(42,264

)

(26,866

)

Acquisitions of businesses and related intangible assets, net of

cash

(6,369

)

(635

)

Net cash used in investing activities

(48,633

)

(27,501

)

Financing Activities Borrowings on line of credit

42,083

316,390

Payments on line of credit

(36,383

)

(307,191

)

Debt issuance costs

(411

)

—

Proceeds from long-term debt

—

230,011

Payment of long-term debt

(11,750

)

(231,338

)

Contingent consideration

—

(2,500

)

Distribution to continuing equity owners

(23,923

)

(20,441

)

Payments under tax receivable agreement

(173

)

—

Proceeds from exercise of equity-based options

2,217

23

Net cash used in financing activities

(28,340

)

(15,046

)

Effect of exchange rates on cash and cash equivalents

(2,049

)

(1,686

)

Net increase in cash and cash equivalents

11,743

5,758

Cash and cash equivalents at beginning of period

13,486

7,728

Cash and cash equivalents at end of period

$

25,229

$

13,486

Funko, Inc. and Subsidiaries Non-GAAP

Financial Measures

Adjusted Net Income, Adjusted Earnings per Diluted Share,

EBITDA, Adjusted EBITDA and Adjusted EBITDA margin are supplemental

measures of our performance that are not required by, or presented

in accordance with, U.S. GAAP. Adjusted Net Income, Adjusted

Earnings per Diluted Share, EBITDA, Adjusted EBITDA and Adjusted

EBITDA margin are not measurements of our financial performance

under U.S. GAAP and should not be considered as an alternative to

net income (loss), earnings per share or any other performance

measure derived in accordance with U.S. GAAP. We define Adjusted

Net Income as net income attributable to Funko, Inc. adjusted for

the reallocation of income attributable to non-controlling

interests from the assumed exchange of all outstanding common units

and options in FAH, LLC for newly issued-shares of Class A common

stock of Funko, Inc. and further adjusted for the impact of certain

non-cash charges and other items that we do not consider in our

evaluation of ongoing operating performance. These items include,

among other things, non-cash charges related to equity-based

compensation programs, loss on extinguishment of debt, acquisition

transaction costs and other expenses, foreign currency transaction

gains and losses, the Loungefly customs investigation and related

costs, certain severance, relocation and related costs, tax

receivable agreement liability adjustments, and other unusual or

one-time items, and the income tax expense (benefit) effect of

these adjustments. We define Adjusted Earnings per Diluted Share as

Adjusted Net Income divided by the weighted-average shares of Class

A common stock outstanding, assuming (1) the full exchange of all

outstanding common units and options in FAH, LLC for newly

issued-shares of Class A common stock of Funko, Inc. and (2) the

dilutive effect of stock options and unvested common units, if any.

We define EBITDA as net income (loss) before interest expense, net,

income tax expense (benefit), depreciation and amortization. We

define Adjusted EBITDA as EBITDA further adjusted for non-cash

charges related to equity-based compensation programs, loss on

extinguishment of debt, acquisition transaction costs and other

expenses, the Loungefly customs investigation and related costs,

certain severance, relocation and related costs, foreign currency

transaction gains and losses, tax receivable agreement liability

adjustments and other unusual or one-time items. Adjusted EBITDA

margin is calculated as Adjusted EBITDA as a percentage of net

sales We caution investors that amounts presented in accordance

with our definitions of Adjusted Net Income, Adjusted Earnings per

Diluted Share, EBITDA, Adjusted EBITDA and Adjusted EBITDA margin

may not be comparable to similar measures disclosed by our

competitors, because not all companies and analysts calculate these

measures in the same manner. We present Adjusted Net Income,

Adjusted Earnings per Diluted Share, EBITDA, Adjusted EBITDA and

Adjusted EBITDA margin because we consider them to be important

supplemental measures of our performance and believe they are

frequently used by securities analysts, investors, and other

interested parties in the evaluation of companies in our industry.

Management believes that investors’ understanding of our

performance is enhanced by including these non-GAAP financial

measures as a reasonable basis for comparing our ongoing results of

operations. Management uses Adjusted Net Income, Adjusted Earnings

per Diluted Share, EBITDA, Adjusted EBITDA and Adjusted EBITDA

margin as a measurement of operating performance because they

assist us in comparing the operating performance of our business on

a consistent basis, as they remove the impact of items not directly

resulting from our core operations; for planning purposes,

including the preparation of our internal annual operating budget

and financial projections; as a consideration to assess incentive

compensation for our employees; to evaluate the performance and

effectiveness of our operational strategies; and to evaluate our

capacity to expand our business.

By providing these non-GAAP financial measures, together with

reconciliations, we believe we are enhancing investors’

understanding of our business and our results of operations, as

well as assisting investors in evaluating how well we are executing

our strategic initiatives. In addition, our senior secured credit

facilities use Adjusted EBITDA to measure our compliance with

covenants such as senior leverage ratio. Adjusted Net Income,

Adjusted Earnings per Diluted Share, EBITDA, Adjusted EBITDA and

Adjusted EBITDA margin have limitations as analytical tools, and

should not be considered in isolation, or as an alternative to, or

a substitute for net income (loss) or other financial statement

data presented in this press release as indicators of financial

performance. Some of the limitations are:

- such measures do not reflect our cash expenditures, or future

requirements for capital expenditures or contractual

commitments;

- such measures do not reflect changes in, or cash requirements

for, our working capital needs;

- such measures do not reflect the interest expense, or the cash

requirements necessary to service interest or principal payments on

our debt;

- although depreciation and amortization are non-cash charges,

the assets being depreciated and amortized will often have to be

replaced in the future and such measures do not reflect any cash

requirements for such replacements; and

- other companies in our industry may calculate such measures

differently than we do, limiting their usefulness as comparative

measures.

Due to these limitations, Adjusted Net Income, Adjusted Earnings

per Diluted Share, EBITDA, Adjusted EBITDA and Adjusted EBITDA

margin should not be considered as measures of discretionary cash

available to us to invest in the growth of our business. We

compensate for these limitations by relying primarily on our GAAP

results and using these non-GAAP measures only supplementally. As

noted in the table below, Adjusted Net Income, Adjusted Earnings

per Diluted Share, Adjusted EBITDA and Adjusted EBITDA margin

include adjustments for non-cash charges related to equity-based

compensation programs, loss on extinguishment of debt, acquisition

transaction costs and other expenses, the Loungefly customs

investigation and related costs, certain severance, relocation and

related costs, foreign currency transaction gains and losses, tax

receivable agreement liability adjustments and other unusual or

one-time items. It is reasonable to expect that these items will

occur in future periods. However, we believe these adjustments are

appropriate because the amounts recognized can vary significantly

from period to period, do not directly relate to the ongoing

operations of our business and complicate comparisons of our

internal operating results and operating results of other companies

over time. Each of the normal recurring adjustments and other

adjustments described herein and in the reconciliation table below

help management with a measure of our core operating performance

over time by removing items that are not related to day-to-day

operations.

In addition, this press release refers to the non-GAAP financial

measures gross profit excluding the one-time inventory write-down

and gross margin excluding the one-time inventory write-down. Gross

profit excluding the one-time inventory write-down is calculated as

net sales less cost of goods sold (exclusive of depreciation and

amortization) less the $16.8 million charge related to the one-time

inventory write-down in the fourth quarter of 2019. Gross margin

excluding the one-time inventory write-down is calculated as net

sales less cost of goods sold (exclusive of depreciation and

amortization) less the $16.8 million charge related to the one-time

inventory write-down as a percentage of net sales. Management

believes that gross profit excluding the one-time inventory

write-down and gross margin excluding the one-time inventory

write-down provides useful information to investors because it

assists investors in comparing our ongoing operating performance

between periods.

The following table reconciles gross profit excluding the

one-time inventory write-down and gross margin excluding the

one-time inventory write-down to the most directly comparable U.S.

GAAP financial performance measure:

Three Months Ended December

31,

Twelve Months Ended December

31,

2019

2018

2019

2018

(amounts in thousands) Net sales

$

213,551

$

233,224

$

795,122

$

686,073

Cost of sales (exclusive of depreciation and amortization)

151,125

149,172

512,580

430,746

Gross profit (1)

$

62,426

$

84,052

$

282,542

$

255,327

Gross margin (1)

29.2

%

36.0

%

35.5

%

37.2

%

Adjustments: One-time inventory write-down (2)

16,775

—

16,775

—

Gross profit excluding the one-time inventory write-down

$

79,201

$

84,052

$

299,317

$

255,327

Gross margin excluding the one-time inventory write-down

37.1

%

36.0

%

37.6

%

37.2

%

(1)

Gross profit is calculated as net sales

less cost of sales (exclusive of depreciation and amortization).

Gross margin is calculated as net sales less cost of sales

(exclusive of depreciation and amortization) as a percentage of net

sales.

(2)

Represents a one-time $16.8 million charge

for the three and twelve months ended December 31, 2019 to cost of

goods sold for additional inventory reserves to dispose of certain

inventory items. This charge is incremental to normal course

inventory reserves and was recorded as a result of the Company’s

decision to dispose of slower moving inventory to increase

operational capacity.

The following tables reconcile Adjusted Net Income, Adjusted

Earnings per Diluted Share, EBITDA and Adjusted EBITDA to the most

directly comparable U.S. GAAP financial performance measure:

Three Months Ended December

31,

Twelve Months Ended December

31,

2019

2018

2019

2018

(In thousands, except per

share data)

Net income (loss) attributable to Funko, Inc.

$

(4,241

)

$

5,227

$

11,725

$

7,463

Reallocation of net income (loss) attributable to non-controlling

interests from the assumed exchange of common units of FAH, LLC for

Class A common stock (1)

(2,047

)

10,292

16,095

17,599

Equity-based compensation (2)

3,214

3,390

13,044

9,140

Loss on extinguishment of debt

—

4,547

—

4,547

Acquisition transaction costs and other expenses (3)

—

700

383

3,391

Customs investigation and related costs (4)

—

—

3,357

—

Certain severance, relocation and related costs (5)

559

—

739

1,031

Foreign currency transaction (gain) loss (6)

(600

)

1,488

(177

)

4,082

Tax receivable agreement liability adjustments

152

—

152

—

One-time inventory write-down (7)

16,775

—

16,775

—

Income tax expense (benefit) (8)

(4,944

)

(4,334

)

(12,166

)

(7,739

)

Adjusted net income

8,868

21,310

49,927

39,514

Adjusted net income margin (9)

4.2

%

9.1

%

6.3

%

5.8

%

Weighted-average shares of Class A common stock outstanding

- basic

34,883

24,821

30,898

23,821

Equity-based compensation awards and common units of FAH, LLC that

are convertible into Class A common stock

15,403

26,054

21,167

26,858

Adjusted weighted-average shares of Class A stock outstanding -

diluted

50,286

50,875

52,065

50,679

Adjusted earnings per diluted share

$

0.18

$

0.42

$

0.96

$

0.78

Three Months Ended December

31,

Twelve Months Ended December

31,

2019

2018

2019

2018

(amounts in thousands)

Net income (loss)

$

(6,288

)

$

15,519

$

27,820

$

25,062

Interest expense, net

2,887

4,509

14,342

21,739

Income tax (benefit) expense

(1,988

)

2,770

4,476

5,432

Depreciation and amortization

10,999

10,204

42,126

39,116

EBITDA

$

5,610

$

33,002

$

88,764

$

91,349

Adjustments: Equity-based compensation (2)

3,214

3,390

13,044

9,140

Loss on extinguishment of debt

—

4,547

—

4,547

Acquisition transaction costs and other expenses (3)

—

700

383

3,391

Customs investigation and related costs (4)

—

—

3,357

—

Certain severance, relocation and related costs (5)

559

—

739

1,031

Foreign currency transaction (gain) loss (6)

(600

)

1,488

(177

)

4,082

One-time inventory write-down (7)

16,775

—

16,775

—

Tax receivable agreement liability adjustments

152

—

152

—

Adjusted EBITDA

$

25,710

$

43,127

$

123,037

$

113,540

Adjusted EBITDA margin (10)

12.0

%

18.5

%

15.5

%

16.5

%

(1)

Represents the reallocation of net income

attributable to non-controlling interests from the assumed exchange

of common units of FAH, LLC for Class A common stock in periods in

which income was attributable to non-controlling interests.

(2)

Represents non-cash charges related to

equity-based compensation programs, which vary from period to

period depending on timing of awards.

(3)

Represents legal, accounting, and other

related costs incurred in connection with acquisitions and other

potential transactions. Included for the twelve months ended

December 31, 2018 is a one-time $2.0 million consent fee related to

certain existing license agreements and $0.7 million for the

recognition of a pre-acquisition contingency related to our

Loungefly acquisition.

(4)

Represents legal, accounting and other

related costs incurred in connection with the Company's

investigation of the underpayment of customs duties at Loungefly.

For the twelve months ended December 31, 2019, includes the accrual

of a contingent liability of $0.5 million related to potential

penalties that may be assessed by U.S. Customs in connection with

the underpayment of customs duties at Loungefly.

(5)

Represents certain severance, relocation

and related costs. For the three months and twelve months ended

December 31, 2019, includes $0.4 million of severance costs

incurred in connection with the departure of our former Chief

Financial Officer as well as severance, relocation and related

costs associated with the consolidation of our warehouse facilities

in the United Kingdom. For the twelve months ended December 31,

2018, includes severance costs incurred in connection with the

departure of certain members of senior management, including the

founders of Loungefly.

(6)

Represents both unrealized and realized

foreign currency losses on transactions other than in U.S.

dollars.

(7)

Represents a one-time $16.8 million charge

for the three and twelve months ended December 31, 2019 to cost of

goods sold for additional inventory reserves to dispose of certain

inventory items. This charge is incremental to normal course

inventory reserves and was recorded as a result of the Company’s

decision to dispose of slower moving inventory to increase

operational capacity.

(8)

Represents the income tax expense effect

of the above adjustments. This adjustment uses an effective tax

rate of 25% for all periods presented.

(9)

Adjusted net income margin is calculated

as Adjusted net income as a percentage of net sales.

(10)

Adjusted EBITDA margin is calculated as

Adjusted EBITDA as a percentage of net sales.

Guidance Reconciliation of Net

Income to EBITDA, Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted

Net Income and Adjusted Earnings per Diluted Share

Estimated Range for the Year EndingDecember 31, 2020

(In millions, except per share amounts) Net Sales

$

840.0

$

865.0

Net income

$

34.1

$

41.9

Interest expense, net

11.5

11.5

Income tax expense

9.6

11.8

Depreciation and amortization

45.8

45.8

EBITDA

$

101.0

$

111.0

Adjustments: Equity-based compensation (1)

13.3

13.3

Certain severance, relocation and related costs (2)

0.7

0.7

Adjusted EBITDA

$

115.0

$

125.0

Adjusted EBITDA Margin(3)

13.7

%

14.5

%

Net income

$

34.1

$

41.9

Equity-based compensation (1)

13.3

13.3

Certain severance, relocation and related costs (2)

0.7

0.7

Income tax expense (4)

(4.8

)

(5.1

)

Adjusted net income

$

43.3

$

50.8

Weighted-average shares of Class A common stock outstanding

35.6

35.6

Equity-based compensation awards and common units of FAH, LLC that

are convertible into Class A common stock

15.4

15.4

Adjusted weighted-average shares of Class A stock outstanding -

diluted

51.0

51.0

Adjusted earnings per diluted share

$

0.85

$

1.00

(1)

Represents non-cash charges related to

equity-based compensation programs, which vary from period to

period depending on timing of awards.

(2)

Represents severance, relocation and

related costs associated with the consolidation of our new

warehouse facilities in the United Kingdom.

(3)

Adjusted EBITDA Margin is calculated as

Adjusted EBITDA as a percentage of net sales.

(4)

Represents the income tax expense effect

of the above adjustments. This adjustment uses an effective tax

rate of 25% for the year ending December 31, 2020.

Note: The Company is not able to provide the expected impact of

unrealized and realized foreign currency gains and losses for the

year ending December 31, 2020 on transactions without unreasonable

efforts because the calculation for that change is primarily driven

by changes in foreign currency exchange rates, principally British

pounds and euros. Additionally, the impacts are also driven by

fluctuations in product sales and operating expenses in each of

those local currencies, which can fluctuate month to month.

Therefore, the Company’s Adjusted EBITDA, Adjusted Net Income and

Adjusted Earnings per Diluted Share for the year ending December

31, 2020, including the above adjustments, may differ materially

from that forecasted in the table above.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200305005837/en/

Investor Relations: Andrew Harless Funko Investor

Relations investorrelations@funko.com

Media: Jessica Piha-Grafstein Funko Public Relations

jessicap@funko.com

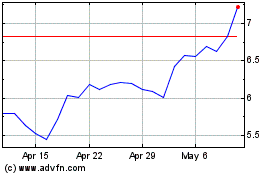

Funko (NASDAQ:FNKO)

Historical Stock Chart

From Mar 2024 to Apr 2024

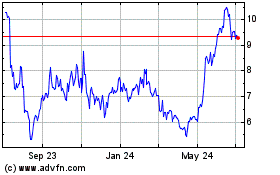

Funko (NASDAQ:FNKO)

Historical Stock Chart

From Apr 2023 to Apr 2024