Flexsteel Industries, Inc. (NASDAQ:FLXS) today reported sales and

earnings for its third quarter and fiscal year-to-date ended March

31, 2008. The Company reported net sales for the quarter ended

March 31, 2008 of $98.1 million compared to the prior year quarter

of $104.1 million, a decrease of 5.7%. Net income for the current

quarter was $0.8 million or $0.13 per share compared to $1.5

million or $0.23 per share in the prior year quarter. The prior

year quarter included an after tax gain of $0.3 million or $0.04

per share from the sale of land. Net sales for the nine months

ended March 31, 2008 were $305.0 million compared to $311.1 million

in the prior year nine-month period, a decrease of 2.0%. Net income

for the nine months ended March 31, 2008 was $3.9 million or $0.59

per share compared to net income of $3.5 million or $0.53 per

share, including the aforementioned $0.3 million or $0.04 per share

after tax gain from the sale of land, for the nine months ended

March 31, 2007. For the quarter ended March 31, 2008, residential

net sales were $60.9 million, compared to $59.5 million, an

increase of 2.5% from the prior year quarter. Recreational vehicle

net sales were $14.0 million for the quarter ended March 31, 2008,

compared to $17.6 million, a decrease of 20.6% from the prior year

quarter. Commercial net sales were $23.2 million for the quarter

ended March 31, 2008, compared to $27.0 million in the prior year

quarter, a decrease of 14.0%. For the nine months ended March 31,

2008, residential net sales were $191.1 million, an increase of

1.6% from the nine months ended March 31, 2007. Recreational

vehicle net sales were $44.5 million for the nine months ended

March 31, 2008, a decrease of 8.0% from the nine months ended March

31, 2007. Commercial net sales were $69.3 million for the nine

months ended March 31, 2008, a decrease of 6.9% from the nine

months ended March 31, 2007. Gross margin for the quarter ended

March 31, 2008 was 18.4% compared to 19.7% in the prior year

quarter. The gross margin percentage decrease is primarily due to

an approximate $1.3 million aggregated impact related to increases

in raw material costs, fuel related transportation costs and under

absorption of fixed manufacturing costs on the lower sales volume

in the current quarter. For the nine months ended March 31, 2008,

the gross margin was 19.6% compared to 18.9% for the prior year

nine-month period. A portion of the gross margin improvements

realized during the first half of the current fiscal year have been

offset by the aforementioned cost increases experienced in our

third fiscal quarter. The Company is committed to adjusting its

selling prices to reflect the additional costs that it has

experienced, however, there will be a time lag in realization of

results. Selling, general and administrative expenses were 16.8%

and 17.6% of net sales for the quarters ended March 31, 2008 and

2007, respectively. The decrease in SG&A expenses for the

current quarter compared to the prior year quarter is primarily due

to lower performance based compensation accruals. For the nine

months ended March 31, 2008 and 2007, selling, general and

administrative expenses were 17.3% and 17.0%, respectively. The

slight percentage increase in SG&A expense for the nine-month

period was primarily a result of a change in revenue on a period

over period basis. Working capital (current assets less current

liabilities) at March 31, 2008 was $103.3 million. Significant

changes in working capital from June 30, 2007 to March 31, 2008

included decreased accounts receivable of $15.7 million, increased

inventory of $5.9 million and decreased accounts payable of $3.9

million. The decrease in receivables is related to lower shipment

volume and improved collections, as well as the timing of shipments

to customers and the related payment terms. The increase in

inventory is due primarily to the timing of purchases of finished

goods to meet our forecasted customer requirements and new product

introductions. The decrease in accounts payable relates to the

timing of purchases and the related payments. Net cash provided by

operating activities was $11.4 million for the nine months ended

March 31, 2008. Cash from operating activities was used to reduce

borrowing by $5.9 million, pay dividends of $2.6 million, increase

cash on hand by $2.2 million and purchase capital assets, primarily

manufacturing equipment, of $1.0 million. Depreciation and

amortization expense was $3.4 million and $4.0 million for the

nine-month periods ended March 31, 2008 and 2007, respectively. The

Company expects that capital expenditures will be less than $1.0

million for the remainder of fiscal year 2008. The Company believes

that existing credit facilities are adequate for its capital

requirements for the remainder of fiscal year 2008. All earnings

per share amounts are on a diluted basis. Outlook Consumers in the

United States are paying higher amounts for food. Fuel prices are

increasing almost on a daily basis. The unemployment level has

increased and in many cases homes have declined in value. Current

events on a national level, including the mortgage credit crisis

and the upcoming presidential election, contribute to uncertainty

for consumers, as well. International events, such as the war in

Iraq, also give consumers pause. As a result, consumer confidence

continues to decline. These events are creating a very challenging

business climate for the products that we sell. In the face of

these challenges, the order rate for our residential products has

declined during our third fiscal quarter. We anticipate that our

fourth fiscal quarter shipments will be lower than the prior year

quarter due to lower order backlogs and declining order rates.

Consumer demand for recreational vehicles continues to be weak,

creating lower order and production levels by most of the Original

Equipment Manufacturers that we provide product to, and as a result

the demand for our products is lower than in the prior year. We

expect that this reduced demand for residential and recreational

vehicle products will continue through the balance of calendar year

2008. Orders and shipments of our commercial office and hospitality

products have slowed along with the overall commercial market from

the relatively high levels experienced in the prior year. We expect

shipments to be lower than the prior year through the balance of

the fiscal year. The Company continues to focus on the processes

that it can control regardless of the level of consumer confidence

and national and international macroeconomic circumstances that we

face. We will continue to review our allocation of capital

resources in relation to business conditions and to explore cost

control opportunities in all facets of our business. The Company

believes it has the necessary inventories, product offerings and

marketing strategies in place to take advantage of opportunities

for expansion of market share, especially for our residential

products. We believe that consumers will continue to value a broad

selection of designs, as well as a wide range of fabrics and

leathers. Based on this, the Company anticipates continuing its

strategy of providing furniture from a wide selection of

domestically manufactured and imported products. Analysts

Conference Call We will host a conference call for analysts

Tuesday, April 22, 2008, at 10:30 a.m. Central Time. To access the

call, please dial 1-888-275-4480 and provide the operator with ID#

35843799. A replay will be available for two weeks beginning

approximately two hours after the conclusion of the call by dialing

1-800-642-1687 and entering ID# 35843799. Forward-Looking

Statements Statements, including those in this release, which are

not historical or current facts, are �forward-looking statements�

made pursuant to the safe harbor provisions of the Private

Securities Litigation Reform Act of 1995. There are certain

important factors that could cause our results to differ materially

from those anticipated by some of the statements made in this press

release. Investors are cautioned that all forward-looking

statements involve risk and uncertainty. Some of the factors that

could affect results are the cyclical nature of the furniture

industry, the effectiveness of new product introductions and

distribution channels, the product mix of sales, pricing pressures,

the cost of raw materials and fuel, foreign currency valuations,

actions by governments including taxes and tariffs, the amount of

sales generated and the profit margins thereon, competition (both

foreign and domestic), changes in interest rates, credit exposure

with customers and general economic conditions. Any forward-looking

statement speaks only as of the date of this press release. We

specifically decline to undertake any obligation to publicly revise

any forward-looking statements that have been made to reflect

events or circumstances after the date of such statements or to

reflect the occurrence of anticipated or unanticipated events.

About Flexsteel Flexsteel Industries, Inc. is headquartered in

Dubuque, Iowa, and was incorporated in 1929. Flexsteel is a

designer, manufacturer, importer and marketer of quality

upholstered and wood furniture for residential, recreational

vehicle, office, hospitality and healthcare markets. All products

are distributed nationally. For more information, visit our web

site at http://www.flexsteel.com. FLEXSTEEL INDUSTRIES, INC. AND

SUBSIDIARIES CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED) � �

� March 31, June 30, ASSETS 2008 2007 CURRENT ASSETS: Cash and cash

equivalents $ 3,087,008 $ 900,326 Investments 1,042,782 976,180

Trade receivables, net 40,600,882 56,273,874 Inventories 84,623,719

78,756,985 Other 6,003,921 5,609,045 Total current assets

135,358,312 142,516,410 � NONCURRENT ASSETS: Property, plant, and

equipment, net 25,919,618 28,168,244 Other assets 13,489,182

13,479,528 � TOTAL $ 174,767,112 $ 184,164,182 � LIABILITIES AND

SHAREHOLDERS� EQUITY � CURRENT LIABILITIES: Accounts payable �

trade $ 9,672,054 $ 13,607,485 Notes payable and current maturities

of long-term debt 1,519,845 7,030,059 Accrued liabilities

20,818,262 22,540,063 Total current liabilities 32,010,161

43,177,607 � LONG-TERM LIABILITIES: Long-term debt 20,944,500

21,336,352 Other long-term liabilities 6,715,258 5,535,113 Total

liabilities 59,669,919 70,049,072 � SHAREHOLDERS� EQUITY

115,097,193 114,115,110 � TOTAL $ 174,767,112 $ 184,164,182

FLEXSTEEL INDUSTRIES, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS

OF INCOME (UNAUDITED) � � Three Months Ended Nine Months Ended

March 31, March 31, 2008 � � 2007 � 2008 � � 2007 � NET SALES $

98,138,372 $ 104,071,451 $ 305,024,720 $ 311,110,666 COST OF GOODS

SOLD (80,119,291 ) (83,593,396 ) (245,172,530 ) (252,453,428 )

GROSS MARGIN 18,019,081 20,478,055 59,852,190 58,657,238 SELLING,

GENERAL AND�ADMINISTRATIVE (16,486,183 ) (18,277,812 ) (52,867,477

) (52,885,603 ) GAIN ON SALE OF CAPITAL�ASSETS --� 392,685 � --�

392,685 � OPERATING INCOME 1,532,898 � 2,592,928 � 6,984,713 �

6,164,320 � OTHER�INCOME (EXPENSE): Interest and other income

108,361 128,356 329,323 459,363 Interest expense (341,728 )

(329,682 ) (1,183,678 ) (1,110,298 ) Total (233,367 ) (201,326 )

(854,355 ) (650,935 ) INCOME BEFORE INCOME TAXES 1,299,531

2,391,602 6,130,358 5,513,385 PROVISION FOR INCOME TAXES (450,000 )

(870,000 ) (2,230,000 ) (2,020,000 ) NET INCOME $ 849,531 � $

1,521,602 � $ 3,900,358 � $ 3,493,385 � AVERAGE NUMBER OF

COMMON�SHARES OUTSTANDING: Basic 6,575,633 � 6,568,251 6,573,454 �

6,566,396 � Diluted 6,615,678 � 6,586,488 6,612,010 � 6,578,661 �

EARNINGS PER SHARE OF�COMMON STOCK: Basic $ 0.13 � $ 0.23 $ 0.59 �

$ 0.53 � Diluted $ 0.13 � $ 0.23 $ 0.59 � $ 0.53 � FLEXSTEEL

INDUSTRIES, INC. AND SUBSIDIARIES � CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS (UNAUDITED) � Nine Months Ended March 31,

2008 � � 2007 � OPERATING ACTIVITIES: Net income $ 3,900,358 $

3,493,385 Adjustments to reconcile net income to net cash provided

by (used in) operating activities: Depreciation and amortization

3,404,290 3,989,813 Gain on disposition of capital assets (43,301 )

(473,060 ) Stock-based compensation expense 186,000 274,000 Changes

in operating assets and liabilities 3,966,860 � 9,676,238 � Net

cash provided by operating activities 11,414,207 � 16,960,376 � �

INVESTING ACTIVITIES: Net sales of investments 111,754 (152,551 )

Proceeds from sale of capital assets 63,022 637,466 Capital

expenditures (998,895 ) (10,196,972 ) Net cash used in investing

activities (824,119 ) (9,712,057 ) � FINANCING ACTIVITIES: Net

proceeds (payment) of borrowings (5,902,066 ) (4,456,132 )

Dividends paid (2,563,046 ) (2,560,361 ) Proceeds from issuance of

common stock 61,706 � 64,238 � Net cash used in financing

activities (8,403,406 ) (6,952,255 ) � Increase in cash and cash

equivalents 2,186,682 296,064 Cash and cash equivalents at

beginning of period 900,326 � 1,985,768 � Cash and cash equivalents

at end of period $ 3,087,008 � $ 2,281,832 �

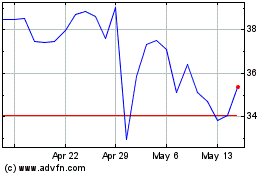

Flexsteel Industries (NASDAQ:FLXS)

Historical Stock Chart

From May 2024 to Jun 2024

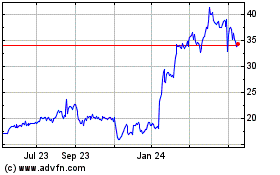

Flexsteel Industries (NASDAQ:FLXS)

Historical Stock Chart

From Jun 2023 to Jun 2024