EverQuote, Inc. (“EverQuote” or “the Company”), a leading online

insurance marketplace in the U.S. connecting consumers with

insurance providers, today announced financial results for the

second quarter ended June 30, 2019.

“We are pleased to report a strong second quarter across all our

key financial metrics, including: revenue and variable marketing

margin,” said Seth Birnbaum, CEO and Co-Founder of EverQuote. “In

the second quarter we reported total revenue growth of 35%, driven

by broad based momentum and the strength of our data driven

marketplace. We are laser focused on our mission, key

initiatives and growth levers: expanding consumer demand, growing

provider budget, increasing consumer-provider engagement and adding

new verticals, including the successful launch of renters and

health insurance in the quarter.

“During the quarter, EverQuote benefitted from solid execution

combined with increasing momentum in industry trends, the continued

secular shift of insurance online and strength in the auto

vertical.

“As we look to the remainder of 2019, we are making progress on

our goal to be the largest source of insurance policies online by

expanding the value we deliver to consumers and providers via new

and improved product experiences. Based on our strong second

quarter results and positive momentum, we are increasing our

guidance for the full year 2019,” concluded Mr. Birnbaum.

Second Quarter 2019 Financial Highlights:(All

comparisons are relative to the second quarter of 2018):

- Total revenue of $55.7 million, an increase of 35% driven by

strength in consumer quote request volume.

- Automotive insurance vertical revenue of $49.8 million, an

increase of 40%.

- Revenue from our other insurance verticals, which includes

home, life and our newly launched health and renters insurance,

increased to $5.9 million.

- Variable Marketing Margin of $16.7 million, an increase of

38%.

- GAAP net loss of $2.0 million, compared to a GAAP net loss of

$1.7 million.

- Adjusted EBITDA of $1.6 million, compared to $(0.6)

million.

Second Quarter 2019 Business Highlights:(All

comparisons are relative to the second quarter of 2018):

- The Company successfully launched new health and renters

insurance verticals.

- The Company’s direct business increased to 93% of revenue.

- EverQuote added 11 new and 1 expanded partial technology

integrations with providers.

- The Company’s distribution growth and traffic optimization

initiatives led to a 50% increase in quote requests.

Third Quarter and Full-Year 2019 Guidance:

EverQuote anticipates Revenue, Variable Marketing Margin and

Adjusted EBITDA to be in the following ranges:

Third quarter 2019:

- Revenue of $57.0 - $59.0 million.

- Variable Marketing Margin of $17.0 - $18.0 million.

- Adjusted EBITDA in the range of $1.0 - $2.0 million.

Full year 2019

- Revenue of $215.0 - $219.0 million, an increase from our

previous range of $197.0 - $203.0 million.

- Variable Marketing Margin of $62.5 - $64.5 million, an increase

from our previous range of $55.5 - $58.5 million.

- Adjusted EBITDA in the range of $1.0 - $2.5 million, an

improvement to our previous range of $(3.0) - $(1.0) million.

With respect to the Company’s expectations under "Third Quarter

and Full Year 2019 Guidance" above, the Company has not reconciled

the non-GAAP measure adjusted EBITDA to the GAAP measure net loss

in this press release because the Company does not provide guidance

for stock-based compensation expense, depreciation and

amortization expense, interest income and expense, and the

provision for (benefit from) income taxes on a consistent

basis as the Company is unable to quantify these amounts

without unreasonable efforts, which would be required to include a

reconciliation of adjusted EBITDA to GAAP net loss. In addition,

the Company believes such a reconciliation would imply a degree of

precision that could be confusing or misleading to investors.

Conference Call and Webcast Information

EverQuote will host a conference call and live webcast to

discuss its second quarter 2019 financial results and outlook at

4:30 p.m. Eastern Time today, August 5, 2019. To access the

conference call, dial (877) 273-5005 for the U.S. or Canada, or

(647) 689-5410 for international callers and provide conference ID

4786325. The webcast will be available live on the Investors

section of the Company's website at

https://investors.everquote.com.

An audio replay of the call will also be available to investors

beginning at approximately 6:30 p.m. Eastern Time on August 5,

2019, until 11:59 p.m. Eastern Time on August 12, 2019, by dialing

(800) 585-8367 for the U.S. or Canada, or (416) 621-4642 for

international callers, and entering passcode 4786325. In addition,

an archived webcast will be available on the Investors section of

the Company's website at: https://investors.everquote.com.

Safe Harbor Statement

Any statements in this press release about future expectations,

plans and prospects for EverQuote, Inc. (“EverQuote” or the

“Company”), including statements about future results of operations

or the future financial position of the Company, including

financial targets, business strategy, plans and objectives for

future operations and other statements containing the words

“anticipates,” “believes,” “expects,” “plans,” and similar

expressions, constitute forward-looking statements within the

meaning of The Private Securities Litigation Reform Act of

1995. Actual results may differ materially from those

indicated by such forward-looking statements as a result of various

important factors, including: (1) the Company’s ability to

attract and retain consumers and insurance providers using the

Company’s marketplace; (2) the Company’s ability to maintain or

increase the amount providers spend per quote request; (3) the

effectiveness of the Company’s growth strategies and its ability to

effectively manage growth; (4) the Company’s ability to maintain

and build its brand; (5) the Company’s reliance on its third-party

service providers; (6) the Company’s ability to develop new and

enhanced products and services to attract and retain consumers and

insurance providers, and the Company’s ability to successfully

monetize them; (7) the impact of competition in the Company’s

industry and innovation by the Company’s competitors; (8) the

Company’s expected use of proceeds from its initial public

offering; and (9) other factors discussed in the “Risk Factors”

section of the Company’s most recent Quarterly Report on Form 10-Q,

which is on file with the Securities and Exchange Commission.

In addition, the forward-looking statements included in this press

release represent the Company’s views as of the date of this press

release. The Company anticipates that subsequent events and

developments will cause the Company’s views to change.

However, while the Company may elect to update these

forward-looking statements at some point in the future, the Company

specifically disclaims any obligation to do so. These

forward-looking statements should not be relied upon as

representing the Company’s views as of any date subsequent to the

date of this press release.

About EverQuote

EverQuote operates a leading online insurance marketplace in the

U.S., connecting consumers with insurance providers. The company's

data & technology platform matches and connects consumers

seeking to purchase insurance with relevant options from the

company's broad direct network of insurance providers, saving

consumers and providers time and money. EverQuote was founded with

the vision of applying a scientific, data-driven approach to help

consumers find the best price and coverage for their individual

insurance needs.

EVERQUOTE, INC.STATEMENTS OF OPERATIONS

| |

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

| |

|

2019 |

|

|

2018 |

|

|

2019 |

|

|

2018 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

(in thousands except per share) |

|

|

Revenue |

|

$ |

55,667 |

|

|

$ |

41,092 |

|

|

$ |

107,900 |

|

|

$ |

81,822 |

|

|

Cost and operating expenses(1): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenue |

|

|

3,504 |

|

|

|

2,873 |

|

|

|

7,170 |

|

|

|

5,488 |

|

|

Sales and marketing |

|

|

45,524 |

|

|

|

34,932 |

|

|

|

90,146 |

|

|

|

69,955 |

|

|

Research and development |

|

|

4,404 |

|

|

|

3,181 |

|

|

|

9,089 |

|

|

|

5,795 |

|

|

General and administrative |

|

|

4,481 |

|

|

|

1,733 |

|

|

|

8,307 |

|

|

|

3,446 |

|

|

Total cost and operating expenses |

|

|

57,913 |

|

|

|

42,719 |

|

|

|

114,712 |

|

|

|

84,684 |

|

|

Loss from operations |

|

|

(2,246 |

) |

|

|

(1,627 |

) |

|

|

(6,812 |

) |

|

|

(2,862 |

) |

|

Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income (expense), net |

|

|

184 |

|

|

|

(103 |

) |

|

|

368 |

|

|

|

(196 |

) |

|

Other income |

|

|

88 |

|

|

|

— |

|

|

|

88 |

|

|

|

— |

|

|

Total other income (expense), net |

|

|

272 |

|

|

|

(103 |

) |

|

|

456 |

|

|

|

(196 |

) |

|

Net loss |

|

|

(1,974 |

) |

|

|

(1,730 |

) |

|

|

(6,356 |

) |

|

|

(3,058 |

) |

|

Accretion of redeemable convertible preferred stock to

redemption value |

|

|

— |

|

|

|

(26,402 |

) |

|

|

— |

|

|

|

(37,415 |

) |

|

Net loss attributable to common stockholders |

|

$ |

(1,974 |

) |

|

$ |

(28,132 |

) |

|

$ |

(6,356 |

) |

|

$ |

(40,473 |

) |

|

Net loss per share attributable to common stockholders, basic

and diluted |

|

$ |

(0.08 |

) |

|

$ |

(3.10 |

) |

|

$ |

(0.25 |

) |

|

$ |

(4.55 |

) |

|

Weighted average common shares outstanding, basic and

diluted |

|

|

25,579 |

|

|

|

9,085 |

|

|

|

25,437 |

|

|

|

8,897 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Amounts include stock-based compensation expense, as

follows: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

| |

|

2019 |

|

|

2018 |

|

|

2019 |

|

|

2018 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

(in thousands) |

|

| Cost of revenue |

|

$ |

87 |

|

|

$ |

10 |

|

|

$ |

87 |

|

|

$ |

17 |

|

| Sales and marketing |

|

|

891 |

|

|

|

400 |

|

|

|

1,685 |

|

|

|

670 |

|

| Research and development |

|

|

979 |

|

|

|

168 |

|

|

|

1,853 |

|

|

|

292 |

|

| General and administrative |

|

|

1,281 |

|

|

|

145 |

|

|

|

2,363 |

|

|

|

311 |

|

| |

|

$ |

3,238 |

|

|

$ |

723 |

|

|

$ |

5,988 |

|

|

$ |

1,290 |

|

|

EVERQUOTE, INC. |

|

BALANCE SHEET DATA |

| |

|

June 30, |

|

|

December 31, |

| |

|

2019 |

|

|

2018 |

| |

|

|

|

|

|

| |

|

(in thousands) |

|

Cash and cash equivalents |

|

$ |

37,123 |

|

|

$ |

41,634 |

| Working capital |

|

|

39,131 |

|

|

|

39,185 |

| Total assets |

|

|

68,442 |

|

|

|

65,746 |

| Total liabilities |

|

|

24,743 |

|

|

|

22,562 |

| Total stockholders'

equity |

|

|

43,699 |

|

|

|

43,184 |

EVERQUOTE, INC.STATEMENTS OF CASH FLOWS

| |

|

Six Months Ended June 30, |

|

| |

|

2019 |

|

|

2018 |

|

| |

|

|

|

|

|

|

| |

|

(in thousands) |

|

|

Cash flows from operating activities: |

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(6,356 |

) |

|

$ |

(3,058 |

) |

|

Adjustments to reconcile net loss to net cash used in operating

activities: |

|

|

|

|

|

|

|

|

|

Depreciation and amortization expense |

|

|

1,005 |

|

|

|

612 |

|

|

Stock-based compensation expense |

|

|

5,988 |

|

|

|

1,290 |

|

|

Noncash interest expense |

|

|

— |

|

|

|

14 |

|

|

Provision for bad debt |

|

|

422 |

|

|

|

— |

|

|

Deferred rent |

|

|

(22 |

) |

|

|

325 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

(7,109 |

) |

|

|

(3,025 |

) |

|

Prepaid expenses and other current assets |

|

|

27 |

|

|

|

(1,379 |

) |

|

Accounts payable |

|

|

1,529 |

|

|

|

3,193 |

|

|

Accrued expenses and other current liabilities |

|

|

353 |

|

|

|

863 |

|

|

Deferred revenue |

|

|

321 |

|

|

|

166 |

|

|

Net cash used in operating activities |

|

|

(3,842 |

) |

|

|

(999 |

) |

|

Cash flows from investing activities: |

|

|

|

|

|

|

|

|

|

Acquisition of property and equipment, including costs

capitalized for development of internal-use software |

|

|

(1,552 |

) |

|

|

(1,395 |

) |

|

Net cash used in investing activities |

|

|

(1,552 |

) |

|

|

(1,395 |

) |

|

Cash flows from financing activities: |

|

|

|

|

|

|

|

|

|

Proceeds from exercise of stock options |

|

|

883 |

|

|

|

577 |

|

|

Proceeds from borrowings on line of credit |

|

|

— |

|

|

|

22,729 |

|

|

Repayments of borrowings on line of credit |

|

|

— |

|

|

|

(17,746 |

) |

|

Repayments of term loan |

|

|

— |

|

|

|

(2,625 |

) |

|

Payments of initial public offering costs |

|

|

— |

|

|

|

(522 |

) |

|

Net cash provided by financing activities |

|

|

883 |

|

|

|

2,413 |

|

|

Net increase (decrease) in cash, cash equivalents and

restricted cash |

|

|

(4,511 |

) |

|

|

19 |

|

|

Cash, cash equivalents and restricted cash at beginning of

period |

|

|

41,884 |

|

|

|

2,613 |

|

|

Cash, cash equivalents and restricted cash at end of period |

|

$ |

37,373 |

|

|

$ |

2,632 |

|

EVERQUOTE, INC.FINANCIAL AND OPERATING

METRICS

Revenue by vertical:

| |

|

Three Months Ended June 30, |

|

|

Change |

|

| |

|

2019 |

|

|

2018 |

|

|

% |

|

| |

|

|

|

|

|

|

|

|

|

| |

|

(in thousands) |

|

|

|

|

|

|

Automotive |

|

$ |

49,788 |

|

|

$ |

35,509 |

|

|

|

40.2 |

% |

|

Other |

|

|

5,879 |

|

|

|

5,583 |

|

|

|

5.3 |

% |

| Total Revenue |

|

$ |

55,667 |

|

|

$ |

41,092 |

|

|

|

35.5 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Six Months Ended June 30, |

|

|

Change |

|

| |

|

2019 |

|

|

2018 |

|

|

% |

|

| |

|

|

|

|

|

|

|

|

|

| |

|

(in thousands) |

|

|

|

|

|

|

Automotive |

|

$ |

94,802 |

|

|

$ |

71,434 |

|

|

|

32.7 |

% |

|

Other |

|

|

13,098 |

|

|

|

10,388 |

|

|

|

26.1 |

% |

| Total Revenue |

|

$ |

107,900 |

|

|

$ |

81,822 |

|

|

|

31.9 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

Other

financial and non-financial metrics:

| |

|

Three Months Ended June 30, |

|

|

Change |

|

| |

|

2019 |

|

|

2018 |

|

|

% |

|

| |

|

|

|

|

|

|

|

|

|

| |

|

(in thousands) |

|

|

|

|

|

|

Loss from operations |

|

$ |

(2,246 |

) |

|

$ |

(1,627 |

) |

|

|

38.0 |

% |

| Net loss |

|

$ |

(1,974 |

) |

|

$ |

(1,730 |

) |

|

|

14.1 |

% |

| Quote requests |

|

|

4,519 |

|

|

|

3,018 |

|

|

|

49.7 |

% |

| Variable Marketing Margin(1) |

|

$ |

16,702 |

|

|

$ |

12,146 |

|

|

|

37.5 |

% |

| Adjusted EBITDA(2) |

|

$ |

1,604 |

|

|

$ |

(586 |

) |

|

|

-373.7 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Six Months Ended June 30, |

|

|

Change |

|

| |

|

2019 |

|

|

2018 |

|

|

% |

|

| |

|

|

|

|

|

|

|

|

|

| |

|

(in thousands) |

|

|

|

|

|

| Loss from operations |

|

$ |

(6,812 |

) |

|

$ |

(2,862 |

) |

|

|

138.0 |

% |

| Net loss |

|

$ |

(6,356 |

) |

|

$ |

(3,058 |

) |

|

|

107.8 |

% |

| Quote requests |

|

|

8,632 |

|

|

|

6,475 |

|

|

|

33.3 |

% |

| Variable Marketing Margin(1) |

|

$ |

30,568 |

|

|

$ |

23,284 |

|

|

|

31.3 |

% |

| Adjusted EBITDA(2) |

|

$ |

269 |

|

|

$ |

(960 |

) |

|

|

-128.0 |

% |

|

(1 |

) |

Beginning in the first quarter of

2019, we revised our definition of variable marketing margin, or

VMM, as revenue, as reported in our statements of operations and

comprehensive loss, less advertising costs (a component of sales

and marketing expense, as reported in our statements of operations

and comprehensive loss). We use VMM to measure the efficiency of

individual advertising and consumer acquisition sources and to

make trade-off decisions to manage our return on

advertising. Under our previous definition of VMM, our VMM for the

three months and six months ended June 30, 2018 was $12.8 million

and $24.5 million, respectively, as advertising costs used in our

previously defined VMM calculation excluded advertising costs

related to our EverDrive app and advertising costs not related to

obtaining quote requests. |

|

(2 |

) |

Adjusted EBITDA is

a non-GAAP measure. Please see “EverQuote, Inc.

Reconciliation of Non-GAAP Measures to GAAP” below

for more information. |

EVERQUOTE, INC.NON-GAAP FINANCIAL MEASURES

To supplement the Company’s financial statements presented in

accordance with GAAP and to provide investors with additional

information regarding EverQuote’s financial results, the Company

has presented adjusted EBITDA as a non-GAAP financial measure. This

non-GAAP financial measure is not based on any standardized

methodology prescribed by GAAP and is not necessarily comparable to

similarly titled measures presented by other companies.

The Company defines adjusted EBITDA as net income (loss),

excluding the impact of stock-based compensation expense;

depreciation and amortization expense; interest income and interest

expense; and the provision for (benefit from) income taxes. The

most directly comparable GAAP measure is net income (loss). The

Company monitors and presents adjusted EBITDA because it is a key

measure used by management and the board of directors to understand

and evaluate operating performance, to establish budgets and to

develop operational goals for managing EverQuote’s business. In

particular, the Company believes that excluding the impact of these

items in calculating adjusted EBITDA can provide a useful measure

for period-to-period comparisons of EverQuote’s core operating

performance.

The Company uses adjusted EBITDA to evaluate EverQuote’s

operating performance and trends and make planning decisions. The

Company believes that this non-GAAP financial measure helps

identify underlying trends in EverQuote’s business that could

otherwise be masked by the effect of the items that the Company

excludes in the calculations of adjusted EBITDA. Accordingly, the

Company believes that this financial measure provides useful

information to investors and others in understanding and evaluating

EverQuote’s operating results, enhancing the overall understanding

of the Company’s past performance and future prospects.

The Company’s non-GAAP financial measures are not prepared in

accordance with GAAP and should not be considered in isolation of,

or as an alternative to, measures prepared in accordance with GAAP.

There are a number of limitations related to the use of adjusted

EBITDA rather than net income (loss), which is the most directly

comparable financial measure calculated and presented in accordance

with GAAP. In addition, other companies may use other measures to

evaluate their performance, which could reduce the usefulness of

the Company’s non-GAAP financial measures as tools for

comparison.

The following table reconciles adjusted EBITDA to net loss, the

most directly comparable financial measure calculated and presented

in accordance with GAAP.

EVERQUOTE, INC.RECONCILIATION OF NON-GAAP

MEASURES TO GAAP

| |

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

| |

|

2019 |

|

|

2018 |

|

|

2019 |

|

|

2018 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

(in thousands) |

|

|

Net loss |

|

$ |

(1,974 |

) |

|

$ |

(1,730 |

) |

|

$ |

(6,356 |

) |

|

$ |

(3,058 |

) |

|

Stock-based compensation |

|

|

3,238 |

|

|

|

723 |

|

|

|

5,988 |

|

|

|

1,290 |

|

|

Depreciation and amortization |

|

|

524 |

|

|

|

318 |

|

|

|

1,005 |

|

|

|

612 |

|

|

Interest (income) expense, net |

|

|

(184 |

) |

|

|

103 |

|

|

|

(368 |

) |

|

|

196 |

|

| Adjusted EBITDA |

|

$ |

1,604 |

|

|

$ |

(586 |

) |

|

$ |

269 |

|

|

$ |

(960 |

) |

Investor Relations Contact: Allise FurlaniThe Blueshirt Group

212-331-8433allise@blueshirtgroup.com

SOURCE: EverQuote, Inc.

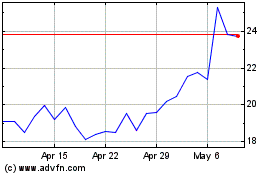

EverQuote (NASDAQ:EVER)

Historical Stock Chart

From Oct 2024 to Nov 2024

EverQuote (NASDAQ:EVER)

Historical Stock Chart

From Nov 2023 to Nov 2024