Current Report Filing (8-k)

August 15 2022 - 4:32PM

Edgar (US Regulatory)

0000712515FALSE3/3100007125152022-08-112022-08-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) August 11, 2022

ELECTRONIC ARTS INC.

(Exact Name of Registrant as Specified in Its Charter)

| | | | | | | | | | | | | | | | | | | | |

| Delaware | | 0-17948 | | 94-2838567 | |

| (State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) | |

| | | | | | | | | | | | | | | | | | | | |

| 209 Redwood Shores Parkway, | Redwood City, | California | 94065-1175 | |

| (Address of Principal Executive Offices) | (Zip Code) | |

| | | | | | | | | | | |

| (650) | 628-1500 | |

| (Registrant’s Telephone Number, Including Area Code) |

|

|

| Former Name or Former Address, if Changed Since Last Report) |

| | | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below): | | | | | | | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | | | | |

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933(17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). |

| | | |

Emerging growth company | ☐ |

| | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ |

| | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| | | | |

| Title of Each Class | | Trading Symbol | | Name of Each Exchange on Which Registered |

| Common Stock, $0.01 par value | | EA | | NASDAQ Global Select Market |

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

On August 11, 2022, at Electronic Arts Inc.'s (the "Company") annual meeting of stockholders (the "Annual Meeting"), the Company's stockholders approved an amendment and restatement of the Electronic Arts Inc. 2019 Equity Incentive Plan (the "Amended 2019 EIP"), as described in the Company's Definitive Proxy Statement, filed with the Securities and Exchange Commission on June 24, 2022 (the "Proxy Statement"), effective as of the date of stockholder approval. The primary purpose of the amendment is to authorize an increase in the overall limit on the number of shares of Company common stock ("Common Stock") that may be issued under the Amended 2019 EIP by an additional 16,000,000 shares. The Amended 2019 EIP, which was previously approved, subject to stockholder approval, by the Board of Directors of the Company (the "Board"), permits the Company to grant equity awards with respect to a maximum of (i) 29,500,000 shares of Company Common Stock (which represents the 13,500,000 shares initially reserved for issuance and approved by our stockholders on August 8, 2019, plus the additional 16,000,000 shares reserved for issuance and approved by stockholders on August 11, 2022), plus (ii) any shares authorized for grant or subject to awards under the Electronic Arts Inc. 2000 Equity Incentive Plan, as amended (which plan terminated on August 8, 2019) that are not delivered to participants for any reason. The Company's directors, executive officers and employees are currently eligible to receive equity awards under the Amended 2019 EIP.

A summary of the Amended 2019 EIP is set forth in the Proxy Statement. That summary and the foregoing description of the Amended 2019 EIP is qualified in its entirety by reference to the text of the Amended 2019 EIP, a copy of which is attached hereto as Exhibit 10.1 and is incorporated herein by reference.

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year

On August 11, 2022, at the Annual Meeting, the stockholders of the Company approved an amendment to the Company's Amended and Restated Certificate of Incorporation (the “COI Amendment”) to reduce the threshold for stockholders to call special meetings from 25% to 15%. Following the Annual Meeting, on August 11, 2022, the Company filed the COI Amendment with the Secretary of State of the State of Delaware, at which time the COI Amendment became effective. The foregoing description of the COI Amendment is qualified in its entirety by reference to the full text of the Certificate of Amendment to Amended and Restated Certificate of Incorporation, a copy of which is attached hereto as Exhibit 3.1 and is incorporated herein by reference.

On August 11, 2022, the Company's Amended and Restated Bylaws (the "A&R Bylaws"), as approved by the Board, became effective to (i) amend Section 1.3 to reflect the reduced threshold for stockholders to call special meetings from 25% to 15%, and (ii) make an administrative change to Section 1.6. The foregoing description of the changes contained in the Company's A&R Bylaws is qualified in its entirety by reference to the full text of the A&R Bylaws, a copy of which is attached hereto as Exhibit 3.2 and is incorporated herein by reference.

Item 5.07 Submission of Matters to a Vote of Security Holders.

At the Annual Meeting, held on August 11, 2022, the stockholders of the Company voted on the following proposals and cast their votes as described below:

1. Election of Directors. The individuals listed below were elected to serve on the Board until the next annual meeting of stockholders or until his or her successor is elected and qualified.

| | | | | | | | | | | | | | | | | | | | | | | |

| For | | Against | | Abstain | | Broker Non-Vote |

| Kofi A. Bruce | 217,613,881 | | 1,362,945 | | 125,540 | | 13,955,736 |

| Rachel A. Gonzalez | 218,746,469 | | 240,821 | | 115,076 | | 13,955,736 |

Jeffrey T. Huber | 206,951,793 | | 12,027,507 | | 123,066 | | 13,955,736 |

Talbott Roche | 212,542,465 | | 6,438,351 | | 121,550 | | 13,955,736 |

Richard A. Simonson | 203,315,805 | | 15,663,531 | | 123,030 | | 13,955,736 |

Luis A. Ubiñas | 205,458,151 | | 8,368,754 | | 5,275,461 | | 13,955,736 |

Heidi J. Ueberroth | 216,369,938 | | 2,571,420 | | 161,008 | | 13,955,736 |

Andrew Wilson | 205,490,349 | | 12,371,275 | | 1,240,742 | | 13,955,736 |

2. Advisory vote to approve named executive officer compensation.

| | | | | | | | | | | | | | | | | | | | |

| For | | Against | | Abstain | | Broker Non-Vote |

| 202,357,812 | | 16,571,144 | | 173,410 | | 13,955,736 |

3. Ratify the appointment of KPMG LLP as the Company's independent registered public accounting firm for the fiscal year ending March 31, 2023.

| | | | | | | | | | | | | | |

| For | | Against | | Abstain |

| 213,575,605 | | 19,392,000 | | 90,497 |

4. Approve the Company's amended 2019 Equity Incentive Plan.

| | | | | | | | | | | | | | | | | | | | |

| For | | Against | | Abstain | | Broker Non-Vote |

| 195,197,790 | | 23,808,571 | | 96,005 | | 13,955,736 |

5. Approve an amendment to the Company's Certificate of Incorporation to reduce the threshold for stockholders to call special meetings from 25% to 15%.

| | | | | | | | | | | | | | | | | | | | |

| For | | Against | | Abstain | | Broker Non-Vote |

| 218,415,968 | | 588,439 | | 97,959 | | 13,955,736 |

6. Consider and vote upon a stockholder proposal on termination pay.

| | | | | | | | | | | | | | | | | | | | |

| For | | Against | | Abstain | | Broker Non-Vote |

| 103,152,334 | | 114,841,426 | | 1,108,606 | | 13,955,736 |

Item 8.01 Other Events.

On August 11, 2022, the Company’s Board authorized a new program to repurchase up to $2.6 billion of the Company’s common stock. Repurchases under this new share repurchase authorization will begin upon the completion of repurchases under the Company's current share repurchase authorization, which is expected in late September or early October 2022. This new stock repurchase program expires on November 4, 2024. Under this program, the Company may purchase stock in the open market or through privately-negotiated transactions in accordance with applicable securities laws, including pursuant to pre-arranged stock trading plans. The timing and actual amount of the stock repurchases will depend on several factors including price, capital availability, regulatory requirements, alternative investment opportunities and other market conditions. The Company is not obligated to repurchase any specific number of shares under this program and it may be modified, suspended or discontinued at any time.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| 3.1 | | Certificate of Amendment to Amended and Restated Certificate of Incorporation. |

| 3.2 | | Amended and Restated Bylaws |

| 10.1 | | Amended and Restated 2019 Equity Incentive Plan* |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

*Management contract or compensatory plan or arrangement.

INDEX TO EXHIBITS

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

*Management contract or compensatory plan or arrangement.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | ELECTRONIC ARTS INC. |

| | | |

| Dated: | August 15, 2022 | By: | /s/ Jacob J. Schatz |

| | | Jacob J. Schatz |

| | | Chief Legal Officer and Corporate Secretary |

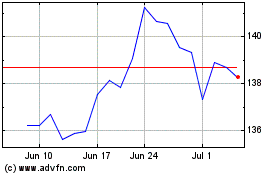

Electronic Arts (NASDAQ:EA)

Historical Stock Chart

From Jun 2024 to Jul 2024

Electronic Arts (NASDAQ:EA)

Historical Stock Chart

From Jul 2023 to Jul 2024