DMC Global Inc. (Nasdaq: BOOM) today reported financial results for

its third quarter ended September 30, 2019.

Consolidated sales were $100.1 million, up 14%

versus the third quarter of 2018 and down 10% sequentially. The

sequential decline principally was due to an anticipated slowdown

in well completion activity within North America’s unconventional

oil and gas industry.

Third quarter gross margin was 36% versus 34% in

the 2018 third quarter and 38% in the 2019 second quarter. Adjusted

gross margin* was 37%, and excludes a write down of inventory at

DynaEnergetics, DMC’s oilfield products business. The write

down is related to the previously announced closure of

DynaEnergetics’ manufacturing facility in Tyumen,

Siberia.

Operating income was $12.8 million, up 45% from

$8.8 million in the 2018 third quarter. Net income was $6.9

million, or $0.46 per diluted share, versus $4.9 million, or $0.33

per diluted share, in last year’s third quarter.

Adjusted operating income* was $19.3 million,

and excludes $6.5 million in special items related to the Tyumen

plant closure. Adjusted net income was $13.4 million, or $0.90 per

diluted share.

Third quarter adjusted EBITDA was $23.2 million,

up 35% from $17.2 million in the 2018 third quarter, and down 20%

sequentially versus the $29.0 million reported in the second

quarter.

Net debt* (total debt less cash and cash

equivalents) at September 30, 2019, was $16.0 million, down from

$21.0 million at June 30, 2019, and $28.0 million at December 31,

2018.

DynaEnergetics Third quarter sales at

DynaEnergetics were $77.4 million, up 17% from the 2018 third

quarter and down 13% sequentially. Gross margin was 39%, up from

37% in last year’s third quarter and down from 41% in the second

quarter. Excluding inventory write downs associated with the

Tyumen, Siberia, plant closure, adjusted gross margin was 40%.

Operating income was $14.9 million versus $9.9 million in the

comparable year-ago quarter. Excluding restructuring related

charges in 2019 and anti-dumping duty penalties in 2018, adjusted

operating income was $21.4 million versus $14.8 million in the 2018

third quarter. Adjusted EBITDA was $23.2 million versus $16.4

million in last year’s third quarter.

NobelClad Third quarter sales at NobelClad,

DMC’s composite metals business, were $22.7 million, up 5% versus

the 2018 third quarter and up 2% sequentially. Gross margin was

26%, up from 25% in the 2018 third quarter and flat versus the

second quarter. Operating income was $2.2 million versus $2.1

million in the year-ago third quarter. Excluding restructuring

charges related to NobelClad’s European consolidation, adjusted

operating income was $2.2 million versus $2.3 million in the

year-ago third quarter. Adjusted EBITDA was $3.1 million, flat

versus last year’s third quarter.

NobelClad’s trailing 12-month book-to-bill ratio

at the end of the third quarter was 0.97. Order backlog was $33.2

million versus $38.8 million at the end of the second quarter.

Nine-month resultsConsolidated

sales for the nine-month period were $311.2 million,

up 32% versus the same period a year ago. Gross

margin was 37% versus 34% in the 2018

nine-month period. Operating income was $57.9 million

versus $24.4 million in last year’s nine-month period, which

included $8.0 million in accrued anti-dumping penalties. Net income

was $39.3 million, or $2.64 per diluted share,

versus $15.2 million, or $1.02 per diluted share, in the

nine-month period a year ago.

Nine-month adjusted operating income was $64.9

million and adjusted net income was $46.2 million, or $3.10 per

diluted share. Adjusted EBITDA was $76.1

million versus $42.7 million in last year’s

nine-month period.

DynaEnergeticsNine-month sales at DynaEnergetics

were $245.8 million, up 41% from $174.3 million

in last year’s nine-month period. Operating income was $64.8

million versus $30.8 million in the comparable

year-ago period. Adjusted EBITDA was $76.2

million versus $43.5 million in last year’s

nine-month period.

NobelCladNine-month sales at NobelClad

were $65.4 million, up 6% from $61.8

million at the nine-month mark last year. Operating income

was $6.0 million versus $3.8 million in the

comparable year-ago period, while adjusted EBITDA was $8.9

million versus $6.8 million in the year-ago period.

Management Commentary Kevin

Longe, president and CEO, said, “DynaEnergetics and NobelClad

executed very well during a quarter in which market conditions grew

increasingly challenging. I am particularly encouraged by the

margin performance of both businesses, which illustrates that

customers continue to recognize the value of our differentiated

products and services.

“DynaEnergetics is taking an opportunistic

approach to the slowdown in onshore well completion activity,”

Longe added. “The sales team is onboarding new customers for

DynaEnergetics’ IS2™ intrinsically safe initiating systems and

DynaStage DS Factory-Assembled, Performance-Assured™ perforating

systems; and several existing customers are deploying these

products more broadly across their service fleets. We

also are working more closely with exploration and production

companies to demonstrate the safety, efficiency and reliability of

the DynaStage DS product line. Several of these operators

have begun to specify the DynaStage DS systems to their service

companies as they prepare for upcoming well completion

programs.

“DynaEnergetics announced during the third

quarter that sales of its DynaStage DS systems had exceeded one

million units. The milestone was the result of a widespread

transition by operators and service companies to our

Factory-Assembled, Performance-Assured perforating systems.

The two newest DS models – DS Trinity™ 3.5. and DS NLine™ – are now

fully commercialized and are enabling DynaEnergetics to extend its

lead at the premium end of the perforating market.

Field trials of the ultra-compact DS Trinity

3.5, which features three charges on a single radial plane, were

completed earlier this month. Customer response was very positive,

and commercial shipments are underway. DS NLine, which

enables the user to align the charges at surface and then orient

the gun in the wellbore, has been adopted by several operators and

service companies, and we expect sales volumes will continue

increasing as more completion engineers incorporate the system into

their well designs.”

“Our NobelClad business is reporting solid

demand from the downstream energy sector, and also is bidding on a

number of international upstream projects that are expected to be

awarded in the coming months. New composite-metal

applications also are generating increased customer interest within

a variety of industrial processing sectors. With NobelClad’s

sales team pursuing a growing number of large project opportunities

in both new and traditional end markets, we believe 2020 could be a

year of meaningful growth for the business.”

Longe continued, “We ended the third quarter

with a trailing 12-month return on invested capital of 30%, and a

net debt position that has improved 43% since the end of last

year. As a result of our financial strength and commitment to

delivering value to our stakeholders, we recently increased our

annual dividend to $0.50 from $0.08.

“Despite the anticipated slowdown in North

American well-completion activity, we are maintaining our full-year

2019 guidance for sales, and now expect adjusted EPS will be in a

range of $3.65 to $3.80, up from a previously forecasted range of

$3.55 to $3.70. We expect to end 2019 with record revenue,

income and returns on invested capital, as well as a clean balance

sheet. We also anticipate our markets will begin to recover next

year, and believe 2020 will bring continued financial growth for

DMC.

“I sincerely appreciate the commitment and

consistent effort of DMC’s employees around the world,” Longe

added. “Our continued success would not be possible without

them. I also want to thank our customers for their loyalty

and ongoing support of our businesses.”

GuidanceMichael Kuta, CFO, said

fourth quarter sales are expected in a range of $92 million to $97

million versus the $90.3 million in the 2018 fourth quarter. At the

business level, DynaEnergetics is expected to report sales in a

range of $72 million to $75 million versus the $63.2 million

reported in last year’s fourth quarter. NobelClad’s sales are

expected to be in the range of $20 million to $22 million versus

the $27.1 million reported in the 2018 fourth quarter.

Consolidated gross margin is expected to be in a

range of 34% to 35% versus 35% reported in the year-ago fourth

quarter. The anticipated sequential decline versus this year’s

third quarter is due to lower fixed overhead absorption on lower

expected sales at DynaEnergetics, and a less favorable project mix

at NobelClad.

Fourth quarter selling, general and

administrative (SG&A) expense is expected to be approximately

$17 million versus SG&A of $17.2 million in last year’s fourth

quarter. Amortization expense is expected to be approximately

$400,000 versus $579,000 in the fourth quarter last year, while

interest expense is expected to be approximately $400,000.

Adjusted EBITDA is expected in a range of $17.5

million to $20 million versus $16.9 million in last year’s fourth

quarter.

Full-year adjusted earnings per share are

expected in a range of $3.65 to $3.80, up from the $2.07 reported

in fiscal 2018, and above a previously forecasted range of $3.55 to

$3.70.

DMC expects to record an additional charge

related to the winddown of operations in Tyumen, Siberia. The

charge primarily is associated with the write off of cumulative

foreign currency translation losses incurred since the plant

commenced operations in 2011. These losses, which had a

carrying value of approximately $8.0 million as of September 30,

2019, will be fully written off once the assets in Tyumen have been

substantially liquidated.

Conference call

informationManagement will hold a conference call to

discuss these results today at 5:00 p.m. Eastern (3:00 p.m.

Mountain). The call is available live via the Internet at:

https://www.investornetwork.com/event/presentation/54704, or by

dialing 844-369-8770 (862-298-0840 for international callers). No

passcode is necessary. Webcast participants should access the

website at least 15 minutes early to register and download any

necessary audio software. A replay of the webcast will be available

for 90 days and a telephonic replay will be available until October

31, 2019, by calling 877-481-4010 (919-882-2331 for international

callers) and entering the Conference ID #54704.

*Use of Non-GAAP Financial Measures

Adjusted EBITDA, adjusted operating income,

adjusted net income, adjusted gross margin, adjusted diluted

earnings per share, net debt, and return on invested capital (ROIC)

are non-GAAP (generally accepted accounting principles) financial

measures used by management to measure operating performance and

liquidity. Non-GAAP results are presented only as a supplement to

the financial statements based on U.S. generally accepted

accounting principles (GAAP). The non-GAAP financial information is

provided to enhance the reader’s understanding of DMC’s financial

performance, but no non-GAAP measure should be considered in

isolation or as a substitute for financial measures calculated in

accordance with GAAP. Reconciliations of the most directly

comparable GAAP measures to non-GAAP measures are provided within

the schedules attached to this release.

EBITDA is defined as net income plus or minus

net interest plus taxes, depreciation and amortization. Adjusted

EBITDA excludes from EBITDA stock-based compensation, restructuring

and impairment charges and, when appropriate, other items that

management does not utilize in assessing DMC’s operating

performance (as further described in the attached financial

schedules). Adjusted operating income is defined as operating

income plus restructuring and impairment charges and, when

appropriate, other items that management does not utilize in

assessing DMC’s operating performance. Adjusted net income is

defined as net income plus restructuring and impairment charges

and, when appropriate, other items that management does not utilize

in assessing DMC’s operating performance. Adjusted gross margin is

defined as gross margin plus inventory write downs associated with

restructuring. Adjusted diluted earnings per share is defined

as diluted earnings per share plus restructuring and impairment

charges and, when appropriate, other items that management does not

utilize in assessing DMC’s operating performance. Net debt is

defined as total debt less cash and cash equivalents. ROIC is based

on Bloomberg Finance's most recent calculation methodology and is

computed as trailing 12-month net operating profit after tax

divided by average invested capital, where average of invested

capital is calculated based on the average of invested capital for

the current period and invested capital for the same period a year

ago. None of these non-GAAP financial measures are recognized terms

under GAAP and do not purport to be an alternative to net income as

an indicator of operating performance or any other GAAP

measure.

Management uses adjusted EBITDA in its

operational and financial decision-making, believing that it is

useful to eliminate certain items in order to focus on what it

deems to be a more reliable indicator of ongoing operating

performance. As a result, internal management reports used during

monthly operating reviews feature adjusted EBITDA measures.

Management believes that investors may find this non-GAAP financial

measure useful for similar reasons, although investors are

cautioned that non-GAAP financial measures are not a substitute for

GAAP disclosures. In addition, management incentive awards are

based, in part, on the amount of adjusted EBITDA achieved during

relevant periods. EBITDA and adjusted EBITDA are also used by

research analysts, investment bankers and lenders to assess

operating performance. For example, a measure similar to adjusted

EBITDA is required by the lenders under DMC’s credit facility.

Net debt is used by management to supplement

GAAP financial information and evaluate DMC’s performance, and

management believes this information may be similarly useful to

investors. Adjusted operating income, adjusted net income, adjusted

gross margin and adjusted diluted earnings per share are presented

because management believes these measures are useful to understand

the effects of restructuring and impairment charges on DMC’s

operating income, net income and diluted earnings per share,

respectively. ROIC is used by management as one measure of the

effectiveness of DMC’s use of capital in its operations, and

management believes it may be of similar usefulness to

investors.

Because not all companies use identical

calculations, DMC’s presentation of non-GAAP financial measures may

not be comparable to other similarly titled measures of other

companies. However, these measures can still be useful in

evaluating the company’s performance against its peer companies

because management believes the measures provide users with

valuable insight into key components of GAAP financial disclosures.

For example, a company with greater GAAP net income may not be as

appealing to investors if its net income is more heavily comprised

of gains on asset sales. Likewise, eliminating the effects of

interest income and expense moderates the impact of a company’s

capital structure on its performance.

All of the items included in the reconciliation

from net income to EBITDA and adjusted EBITDA are either (i)

non-cash items (e.g., depreciation, amortization of purchased

intangibles and stock-based compensation) or (ii) items that

management does not consider to be useful in assessing DMC’s

operating performance (e.g., income taxes, restructuring and

impairment charges). In the case of the non-cash items, management

believes that investors can better assess the company’s operating

performance if the measures are presented without such items

because, unlike cash expenses, these adjustments do not affect

DMC’s ability to generate free cash flow or invest in its business.

For example, by adjusting for depreciation and amortization in

computing EBITDA, users can compare operating performance without

regard to different accounting determinations such as useful life.

In the case of the other items, management believes that investors

can better assess operating performance if the measures are

presented without these items because their financial impact does

not reflect ongoing operating performance.

About DMCDMC Global is a

diversified holding company. Our innovative businesses

provide differentiated products and services to niche

industrial and commercial markets around the world. DMC’s

objective is to identify well-run businesses and strong management

teams and support them with long-term capital and strategic, legal,

technology and operating resources. Our approach helps our

portfolio companies grow core businesses, launch new initiatives,

upgrade technologies and systems to support their long-term

strategy, and make acquisitions that improve their competitive

positions and expand their markets. DMC’s culture is to

foster local innovation versus centralized control, and stand

behind our businesses in ways that truly add value. Today,

DMC’s portfolio consists of DynaEnergetics and NobelClad, which

collectively address the energy, industrial processing and

transportation markets. Based in Broomfield, Colorado, DMC

trades on Nasdaq under the symbol “BOOM.” For more

information, visit the Company’s website at:

http://www.dmcglobal.com.

Safe Harbor Language Except for

the historical information contained herein, this news release

contains forward-looking statements within the meaning of Section

27A of the Securities Act of 1933, as amended, and Section 21E of

the Securities Exchange Act of 1934, as amended, including fourth

quarter and full-year 2019 guidance on sales, gross margin,

adjusted gross margin, SG&A, amortization expenses, adjusted

earnings per share, adjusted EBITDA and interest expense; as well

as our belief that sales volumes of DS NLine will continue

increasing as more completion engineers incorporate the system into

their well designs; our belief that a number of international

upstream projects in NobelClad’s markets will be awarded in the

coming months; our belief that 2020 could be year of meaningful

growth for NobelClad; our expectation that our markets will begin

to recover next year and that 2020 will bring continued financial

growth for DMC; and our expectation that losses associated with the

winddown of operations in Tyumen, Siberia, will result in a charge

in the range of $8 million associated primarily with the write off

of cumulative foreign currency translation losses. Such statements

and information are based on numerous assumptions regarding present

and future business strategies, the markets in which we operate,

anticipated costs and ability to achieve goals. Forward-looking

information and statements are subject to known and unknown risks,

uncertainties and other important factors that may cause actual

results and performance to be materially different from those

expressed or implied by such forward-looking information and

statements, including but not limited to: our ability to realize

sales from our backlog; our ability to obtain new contracts at

attractive prices; the execution of purchase commitments by our

customers, and our ability to successfully deliver on those

purchase commitments; the size and timing of customer orders and

shipments; changes to customer orders; product pricing and margins,

fluctuations in customer demand; our ability to successfully

execute and capitalize upon growth opportunities; the success of

DynaEnergetics’ product and technology development initiatives;

fluctuations in foreign currencies; fluctuations in tariffs and

quotas; the cyclicality of our business; competitive factors; the

timely completion of contracts; the timing and size of

expenditures; the timing and price of metal and other raw material;

the adequacy of local labor supplies at our facilities; current or

future limits on manufacturing capacity at our various operations;

the availability and cost of funds; and general economic

conditions, both domestic and foreign, impacting our business and

the business of the end-market users we serve; as well as the other

risks detailed from time to time in our SEC reports, including the

annual report on Form 10-K for the year ended December 31,

2018. We do not undertake any obligation to release public

revisions to any forward-looking statement, including, without

limitation, to reflect events or circumstances after the date of

this news release, or to reflect the occurrence of unanticipated

events, except as may be required under applicable securities

laws.

| |

|

| |

CONTACT: |

| |

Geoff High, Vice President of Investor Relations |

| |

303-604-3924 |

DMC GLOBAL INC.CONDENSED CONSOLIDATED STATEMENTS

OF OPERATIONS(Amounts in Thousands, Except Share and Per Share

Data)(unaudited)

| |

Three months ended |

|

Change |

| |

Sep 30, 2019 |

|

Jun 30, 2019 |

|

Sep 30, 2018 |

|

Sequential |

|

Year-on-year |

|

NET SALES |

$ |

100,094 |

|

|

$ |

110,954 |

|

|

$ |

87,883 |

|

|

-10 |

% |

|

14 |

% |

| COST OF PRODUCTS SOLD |

63,870 |

|

|

68,881 |

|

|

58,155 |

|

|

-7 |

% |

|

10 |

% |

|

Gross profit |

36,224 |

|

|

42,073 |

|

|

29,728 |

|

|

-14 |

% |

|

22 |

% |

|

Gross profit percentage |

|

36.2 |

% |

|

|

37.9 |

% |

|

|

33.8 |

% |

|

|

|

|

| COSTS AND EXPENSES: |

|

|

|

|

|

|

|

|

|

|

General and administrative expenses |

10,128 |

|

|

9,460 |

|

|

9,630 |

|

|

7 |

% |

|

5 |

% |

|

Selling and distribution expenses |

6,983 |

|

|

7,239 |

|

|

5,420 |

|

|

-4 |

% |

|

29 |

% |

|

Amortization of purchased intangible assets |

394 |

|

|

397 |

|

|

769 |

|

|

-1 |

% |

|

-49 |

% |

|

Restructuring expenses, net |

5,898 |

|

|

324 |

|

|

192 |

|

|

1,720 |

% |

|

2,972 |

% |

|

Anti-dumping duty penalties |

— |

|

|

— |

|

|

4,897 |

|

|

n/a |

|

|

-100 |

% |

|

Total costs and expenses |

23,403 |

|

|

17,420 |

|

|

20,908 |

|

|

34 |

% |

|

12 |

% |

| OPERATING INCOME |

12,821 |

|

|

24,653 |

|

|

8,820 |

|

|

-48 |

% |

|

45 |

% |

| OTHER INCOME (EXPENSE): |

|

|

|

|

|

|

|

|

|

|

Other income (expense), net |

170 |

|

|

343 |

|

|

(335 |

) |

|

-50 |

% |

|

151 |

% |

|

Interest expense, net |

(387 |

) |

|

(409 |

) |

|

(495 |

) |

|

5 |

% |

|

22 |

% |

| INCOME BEFORE INCOME

TAXES |

12,604 |

|

|

24,587 |

|

|

7,990 |

|

|

-49 |

% |

|

58 |

% |

| INCOME TAX PROVISION |

5,689 |

|

|

7,343 |

|

|

3,080 |

|

|

-23 |

% |

|

85 |

% |

| NET INCOME |

6,915 |

|

|

17,244 |

|

|

4,910 |

|

|

-60 |

% |

|

41 |

% |

| NET INCOME PER SHARE |

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

0.47 |

|

|

$ |

1.17 |

|

|

$ |

0.33 |

|

|

-60 |

% |

|

42 |

% |

|

Diluted |

$ |

0.46 |

|

|

$ |

1.15 |

|

|

$ |

0.33 |

|

|

-60 |

% |

|

39 |

% |

| WEIGHTED AVERAGE NUMBER OF

SHARES OUTSTANDING: |

|

|

|

|

|

|

|

|

|

|

Basic |

14,632,276 |

|

|

14,647,019 |

|

|

14,571,155 |

|

|

— |

% |

|

— |

% |

|

Diluted |

14,851,166 |

|

|

14,899,987 |

|

|

14,571,155 |

|

|

— |

% |

|

2 |

% |

| DIVIDENDS DECLARED PER COMMON

SHARE |

$ |

0.125 |

|

|

$ |

0.020 |

|

|

$ |

0.020 |

|

|

|

|

|

DMC GLOBAL INC.CONDENSED CONSOLIDATED STATEMENTS

OF OPERATIONS(Amounts in Thousands, Except Share and Per Share

Data)(unaudited)

| |

Nine months ended |

|

Change |

| |

Sep 30, 2019 |

|

Sep 30, 2018 |

|

Year-on-year |

|

NET SALES |

$ |

311,183 |

|

|

$ |

236,111 |

|

|

32 |

% |

| COST OF PRODUCTS SOLD |

196,481 |

|

|

156,855 |

|

|

25 |

% |

|

Gross profit |

114,702 |

|

|

79,256 |

|

|

45 |

% |

|

Gross profit percentage |

|

36.9 |

% |

|

|

33.6 |

% |

|

|

| COSTS AND EXPENSES: |

|

|

|

|

|

|

General and administrative expenses |

28,756 |

|

|

27,550 |

|

|

4 |

% |

|

Selling and distribution expenses |

20,531 |

|

|

16,427 |

|

|

25 |

% |

|

Amortization of purchased intangible assets |

1,189 |

|

|

2,365 |

|

|

-50 |

% |

|

Restructuring expenses, net |

6,300 |

|

|

553 |

|

|

1,039 |

% |

|

Anti-dumping duty penalties |

— |

|

|

8,000 |

|

|

-100 |

% |

|

Total costs and expenses |

56,776 |

|

|

54,895 |

|

|

3 |

% |

| OPERATING INCOME |

57,926 |

|

|

24,361 |

|

|

138 |

% |

| OTHER INCOME (EXPENSE): |

|

|

|

|

|

|

Other income (expense), net |

492 |

|

|

(1,039 |

) |

|

147 |

% |

|

Interest expense, net |

(1,169 |

) |

|

(1,096 |

) |

|

-7 |

% |

| INCOME BEFORE INCOME

TAXES |

57,249 |

|

|

22,226 |

|

|

158 |

% |

| INCOME TAX PROVISION |

17,920 |

|

|

7,024 |

|

|

155 |

% |

| NET INCOME |

39,329 |

|

|

15,202 |

|

|

159 |

% |

| NET INCOME PER SHARE |

|

|

|

|

|

|

Basic |

$ |

2.67 |

|

|

$ |

1.02 |

|

|

162 |

% |

|

Diluted |

$ |

2.64 |

|

|

$ |

1.02 |

|

|

159 |

% |

| WEIGHTED AVERAGE NUMBER OF

SHARES OUTSTANDING: |

|

|

|

|

|

|

Basic |

14,589,655 |

|

|

14,518,765 |

|

|

— |

% |

|

Diluted |

14,800,132 |

|

|

14,518,765 |

|

|

2 |

% |

| DIVIDENDS DECLARED PER COMMON

SHARE |

$ |

0.165 |

|

|

$ |

0.060 |

|

|

|

DMC GLOBAL INC.SEGMENT STATEMENTS OF

OPERATIONS(Amounts in Thousands)(unaudited)

DynaEnergetics

| |

Three months ended |

|

Change |

| |

Sep 30, 2019 |

|

Jun 30, 2019 |

|

Sep 30, 2018 |

|

Sequential |

|

Year-on-year |

|

Net sales |

$ |

77,356 |

|

|

$ |

88,628 |

|

|

$ |

66,250 |

|

|

-13 |

% |

|

17 |

% |

| Gross profit |

30,543 |

|

|

36,341 |

|

|

24,505 |

|

|

-16 |

% |

|

25 |

% |

| Gross profit percentage |

|

39.5 |

% |

|

|

41.0 |

% |

|

|

37.0 |

% |

|

|

|

|

| COSTS AND EXPENSES: |

|

|

|

|

|

|

|

|

|

|

|

|

|

General and administrative expenses |

5,048 |

|

|

4,591 |

|

|

5,556 |

|

|

10 |

% |

|

-9 |

% |

|

Selling and distribution expenses |

4,405 |

|

|

4,637 |

|

|

3,522 |

|

|

-5 |

% |

|

25 |

% |

|

Amortization of purchased intangible assets |

299 |

|

|

300 |

|

|

670 |

|

|

— |

% |

|

-55 |

% |

|

Restructuring expenses |

5,880 |

|

|

— |

|

|

— |

|

|

n/a |

|

|

n/a |

|

|

Anti-dumping duty penalties |

— |

|

|

— |

|

|

4,897 |

|

|

n/a |

|

|

-100 |

% |

| Operating income |

14,911 |

|

|

26,813 |

|

|

9,860 |

|

|

-44 |

% |

|

51 |

% |

| Adjusted EBITDA |

$ |

23,193 |

|

|

$ |

28,532 |

|

|

$ |

16,352 |

|

|

-19 |

% |

|

42 |

% |

| |

Nine months ended |

|

Change |

| |

Sep 30, 2019 |

|

Sep 30, 2018 |

|

Year-on-year |

|

Net sales |

$ |

245,820 |

|

|

$ |

174,270 |

|

|

41 |

% |

| Gross profit |

98,116 |

|

|

65,879 |

|

|

49 |

% |

| Gross profit percentage |

|

39.9 |

% |

|

|

37.8 |

% |

|

|

| COSTS AND EXPENSES: |

|

|

|

|

|

|

|

|

General and administrative expenses |

13,360 |

|

|

14,526 |

|

|

-8 |

% |

|

Selling and distribution expenses |

13,142 |

|

|

10,493 |

|

|

25 |

% |

|

Amortization of purchased intangible assets |

900 |

|

|

2,059 |

|

|

-56 |

% |

|

Restructuring expenses |

5,880 |

|

|

— |

|

|

n/a |

|

|

Anti-dumping duty penalties |

— |

|

|

8,000 |

|

|

-100 |

% |

| Operating income |

64,834 |

|

|

30,801 |

|

|

110 |

% |

| Adjusted EBITDA |

$ |

76,234 |

|

|

$ |

43,530 |

|

|

75 |

% |

DMC GLOBAL INC.SEGMENT STATEMENTS OF

OPERATIONS(Amounts in Thousands)(unaudited)

NobelClad

| |

Three months ended |

|

Change |

| |

Sep 30, 2019 |

|

Jun 30, 2019 |

|

Sep 30, 2018 |

|

Sequential |

|

Year-on-year |

|

Net sales |

$ |

22,738 |

|

|

$ |

22,326 |

|

|

$ |

21,633 |

|

|

2 |

% |

|

5 |

% |

| Gross profit |

5,811 |

|

|

5,884 |

|

|

5,302 |

|

|

-1 |

% |

|

10 |

% |

| Gross profit percentage |

|

25.6 |

% |

|

|

26.4 |

% |

|

|

24.5 |

% |

|

|

|

|

| COSTS AND EXPENSES: |

|

|

|

|

|

|

|

|

|

|

|

|

|

General and administrative expenses |

1,032 |

|

|

1,102 |

|

|

1,090 |

|

|

-6 |

% |

|

-5 |

% |

|

Selling and distribution expenses |

2,447 |

|

|

2,438 |

|

|

1,822 |

|

|

— |

% |

|

34 |

% |

|

Amortization of purchased intangible assets |

95 |

|

|

97 |

|

|

99 |

|

|

-2 |

% |

|

-4 |

% |

|

Restructuring expenses, net |

17 |

|

|

324 |

|

|

192 |

|

|

-95 |

% |

|

-91 |

% |

| Operating income |

2,219 |

|

|

1,923 |

|

|

2,099 |

|

|

15 |

% |

|

6 |

% |

| Adjusted EBITDA |

$ |

3,082 |

|

|

$ |

3,082 |

|

|

$ |

3,093 |

|

|

— |

% |

|

— |

% |

| |

Nine months ended |

|

Change |

| |

Sep 30, 2019 |

|

Sep 30, 2018 |

|

Year-on-year |

|

Net sales |

$ |

65,363 |

|

|

$ |

61,841 |

|

|

6 |

% |

| Gross profit |

17,055 |

|

|

13,615 |

|

|

25 |

% |

| Gross profit percentage |

|

26.1 |

% |

|

|

22.0 |

% |

|

|

| COSTS AND EXPENSES: |

|

|

|

|

|

|

|

|

General and administrative expenses |

3,378 |

|

|

3,305 |

|

|

2 |

% |

|

Selling and distribution expenses |

6,996 |

|

|

5,660 |

|

|

24 |

% |

|

Amortization of purchased intangible assets |

289 |

|

|

306 |

|

|

-6 |

% |

|

Restructuring expenses, net |

420 |

|

|

553 |

|

|

-24 |

% |

| Operating income |

5,972 |

|

|

3,791 |

|

|

58 |

% |

| Adjusted EBITDA |

$ |

8,869 |

|

|

$ |

6,779 |

|

|

31 |

% |

DMC GLOBAL INC.CONDENSED CONSOLIDATED BALANCE

SHEETS(Amounts in Thousands)

| |

|

|

|

|

|

|

Change |

| |

Sep 30, 2019 |

|

Jun 30, 2019 |

|

Dec 31, 2018 |

|

Sequential |

|

From year-end |

| |

(unaudited) |

|

(unaudited) |

|

|

|

|

|

|

| ASSETS |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

$ |

12,183 |

|

$ |

14,881 |

|

$ |

13,375 |

|

-18 |

% |

|

-9 |

% |

|

Accounts receivable, net |

71,689 |

|

76,800 |

|

59,709 |

|

-7 |

% |

|

20 |

% |

|

Inventory, net |

58,923 |

|

59,980 |

|

51,074 |

|

-2 |

% |

|

15 |

% |

|

Other current assets |

9,206 |

|

6,650 |

|

8,058 |

|

38 |

% |

|

14 |

% |

| |

|

|

|

|

|

|

|

|

|

|

Total current assets |

152,001 |

|

158,311 |

|

132,216 |

|

-4 |

% |

|

15 |

% |

| |

|

|

|

|

|

|

|

|

|

| Property, plant and equipment,

net |

103,670 |

|

105,232 |

|

95,140 |

|

-1 |

% |

|

9 |

% |

| Purchased intangible assets,

net |

6,251 |

|

7,375 |

|

8,589 |

|

-15 |

% |

|

-27 |

% |

| Other long-term assets |

13,893 |

|

14,266 |

|

4,473 |

|

-3 |

% |

|

211 |

% |

| |

|

|

|

|

|

|

|

|

|

| Total assets |

$ |

275,815 |

|

$ |

285,184 |

|

$ |

240,418 |

|

-3 |

% |

|

15 |

% |

| |

|

|

|

|

|

|

|

|

|

| LIABILITIES AND

STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Accounts payable |

$ |

24,306 |

|

$ |

36,179 |

|

$ |

24,243 |

|

-33 |

% |

|

— |

% |

| Accrued anti-dumping

penalties |

— |

|

— |

|

8,000 |

|

n/a |

|

|

-100 |

% |

| Contract liabilities |

2,563 |

|

2,076 |

|

1,140 |

|

23 |

% |

|

125 |

% |

| Dividend payable |

1,866 |

|

299 |

|

295 |

|

524 |

% |

|

533 |

% |

| Accrued income taxes |

10,427 |

|

9,419 |

|

9,545 |

|

11 |

% |

|

9 |

% |

| Current portion of long-term

debt |

3,125 |

|

3,125 |

|

3,125 |

|

— |

% |

|

— |

% |

| Other current liabilities |

21,671 |

|

19,234 |

|

18,217 |

|

13 |

% |

|

19 |

% |

| |

|

|

|

|

|

|

|

|

|

|

Total current liabilities |

63,958 |

|

70,332 |

|

64,565 |

|

-9 |

% |

|

-1 |

% |

| |

|

|

|

|

|

|

|

|

|

| Long-term debt |

25,010 |

|

32,744 |

|

38,230 |

|

-24 |

% |

|

-35 |

% |

| Deferred tax liabilities |

1,469 |

|

458 |

|

379 |

|

221 |

% |

|

288 |

% |

| Other long-term

liabilities |

18,302 |

|

18,149 |

|

2,958 |

|

1 |

% |

|

519 |

% |

| Stockholders’ equity |

167,076 |

|

163,501 |

|

134,286 |

|

2 |

% |

|

24 |

% |

| |

|

|

|

|

|

|

|

|

|

| Total liabilities and

stockholders’ equity |

$ |

275,815 |

|

$ |

285,184 |

|

$ |

240,418 |

|

-3 |

% |

|

15 |

% |

DMC GLOBAL INC.CONDENSED CONSOLIDATED STATEMENTS

OF CASH FLOWS(Amounts in Thousands)(unaudited)

| |

Three months ended |

| |

Sep 30, 2019 |

|

Jun 30, 2019 |

|

Sep 30, 2018 |

| CASH FLOWS FROM OPERATING

ACTIVITIES: |

|

|

|

|

|

|

Net income |

$ |

6,915 |

|

|

$ |

17,244 |

|

|

$ |

4,910 |

|

|

Adjustments to reconcile net income to net cash provided by

operating activities: |

|

|

|

|

|

|

Depreciation |

2,223 |

|

|

2,157 |

|

|

1,628 |

|

|

Amortization of purchased intangible assets |

394 |

|

|

397 |

|

|

769 |

|

|

Amortization of deferred debt issuance costs |

47 |

|

|

36 |

|

|

44 |

|

|

Stock-based compensation |

1,242 |

|

|

1,495 |

|

|

870 |

|

|

Deferred income taxes |

1,236 |

|

|

81 |

|

|

243 |

|

|

Loss on disposal of property, plant and equipment |

26 |

|

|

317 |

|

|

4 |

|

|

Restructuring expenses, net |

5,898 |

|

|

324 |

|

|

192 |

|

|

Transition tax liability |

— |

|

|

— |

|

|

(411 |

) |

|

Change in working capital, net |

(6,187 |

) |

|

(5,746 |

) |

|

(125 |

) |

|

Net cash provided by operating activities |

11,794 |

|

|

16,305 |

|

|

8,124 |

|

| CASH FLOWS FROM INVESTING

ACTIVITIES: |

|

|

|

|

|

|

Acquisition of property, plant and equipment |

(6,094 |

) |

|

(9,682 |

) |

|

(10,373 |

) |

|

Proceeds on sale of property, plant and equipment |

— |

|

|

1,054 |

|

|

— |

|

|

Net cash used in investing activities |

(6,094 |

) |

|

(8,628 |

) |

|

(10,373 |

) |

| CASH FLOWS FROM FINANCING

ACTIVITIES: |

|

|

|

|

|

|

Repayments on revolving loans, net |

(7,000 |

) |

|

(6,749 |

) |

|

(300 |

) |

|

(Repayments) borrowings on capital expenditure facility |

(782 |

) |

|

(781 |

) |

|

7,187 |

|

|

Payment of dividends |

(298 |

) |

|

(300 |

) |

|

(298 |

) |

|

Payment of deferred debt issuance costs |

— |

|

|

— |

|

|

(179 |

) |

|

Net proceeds from issuance of common stock |

— |

|

|

358 |

|

|

2 |

|

|

Treasury stock purchases |

(123 |

) |

|

(103 |

) |

|

(70 |

) |

|

Net cash provided by (used in) financing activities |

(8,203 |

) |

|

(7,575 |

) |

|

6,342 |

|

| EFFECTS OF EXCHANGE RATES ON

CASH |

(195 |

) |

|

(95 |

) |

|

376 |

|

| |

|

|

|

|

|

| NET (DECREASE) INCREASE IN

CASH AND CASH EQUIVALENTS |

(2,698 |

) |

|

7 |

|

|

4,469 |

|

| CASH AND CASH EQUIVALENTS,

beginning of the period |

14,881 |

|

|

14,874 |

|

|

6,629 |

|

| CASH AND CASH EQUIVALENTS, end

of the period |

$ |

12,183 |

|

|

$ |

14,881 |

|

|

$ |

11,098 |

|

DMC GLOBAL INC.CONDENSED CONSOLIDATED STATEMENTS

OF CASH FLOWS(Amounts in Thousands)(unaudited)

| |

Nine months ended |

| |

Sep 30, 2019 |

|

Sep 30, 2018 |

| CASH FLOWS FROM OPERATING

ACTIVITIES: |

|

|

|

|

Net income |

$ |

39,329 |

|

|

$ |

15,202 |

|

|

Adjustments to reconcile net income to net cash provided by

operating activities: |

|

|

|

|

Depreciation |

6,178 |

|

|

4,799 |

|

|

Amortization of purchased intangible assets |

1,189 |

|

|

2,365 |

|

|

Amortization of deferred debt issuance costs |

130 |

|

|

268 |

|

|

Stock-based compensation |

3,908 |

|

|

2,662 |

|

|

Deferred income taxes |

1,660 |

|

|

276 |

|

|

Loss on disposal of property, plant and equipment |

343 |

|

|

30 |

|

|

Restructuring expenses, net |

6,300 |

|

|

553 |

|

|

Transition tax liability |

— |

|

|

(679 |

) |

|

Change in working capital, net |

(23,941 |

) |

|

(18,931 |

) |

|

Net cash provided by operating activities |

35,096 |

|

|

6,545 |

|

| CASH FLOWS FROM INVESTING

ACTIVITIES: |

|

|

|

|

Acquisition of property, plant and equipment |

(22,377 |

) |

|

(26,574 |

) |

|

Proceeds on sale of property, plant and equipment |

1,258 |

|

|

— |

|

|

Net cash used in investing activities |

(21,119 |

) |

|

(26,574 |

) |

| CASH FLOWS FROM FINANCING

ACTIVITIES: |

|

|

|

|

(Repayments) borrowings on revolving loans, net |

(10,999 |

) |

|

4,522 |

|

|

(Repayments) borrowings on capital expenditure facility |

(2,344 |

) |

|

18,990 |

|

|

Payment of dividends |

(896 |

) |

|

(891 |

) |

|

Payment of deferred debt issuance costs |

— |

|

|

(310 |

) |

|

Net proceeds from issuance of common stock |

358 |

|

|

232 |

|

|

Treasury stock purchases |

(1,079 |

) |

|

(453 |

) |

|

Net cash (used in) provided by financing activities |

(14,960 |

) |

|

22,090 |

|

| EFFECTS OF EXCHANGE RATES ON

CASH |

(209 |

) |

|

54 |

|

| |

|

|

|

| NET (DECREASE) INCREASE IN

CASH AND CASH EQUIVALENTS |

(1,192 |

) |

|

2,115 |

|

| CASH AND CASH EQUIVALENTS,

beginning of the period |

13,375 |

|

|

8,983 |

|

| CASH AND CASH EQUIVALENTS, end

of the period |

$ |

12,183 |

|

|

$ |

11,098 |

|

DMC GLOBAL INC.RECONCILIATIONS OF NON-GAAP

FINANCIAL MEASUREMENTS TO MOSTDIRECTLY COMPARABLE GAAP FINANCIAL

MEASUREMENTS(Amounts in Thousands)(unaudited)

DMC Global

EBITDA and Adjusted EBITDA

| |

Three months ended |

|

Change |

| |

Sep 30, 2019 |

|

Jun 30, 2019 |

|

Sep 30, 2018 |

|

Sequential |

|

Year-on-year |

|

Net income |

$ |

6,915 |

|

|

$ |

17,244 |

|

|

$ |

4,910 |

|

-60 |

% |

|

41 |

% |

| Interest expense, net |

387 |

|

|

409 |

|

|

495 |

|

-5 |

% |

|

-22 |

% |

| Income tax provision |

5,689 |

|

|

7,343 |

|

|

3,080 |

|

-23 |

% |

|

85 |

% |

| Depreciation |

2,223 |

|

|

2,157 |

|

|

1,628 |

|

3 |

% |

|

37 |

% |

| Amortization of purchased

intangible assets |

394 |

|

|

397 |

|

|

769 |

|

-1 |

% |

|

-49 |

% |

| |

|

|

|

|

|

|

|

|

|

| EBITDA |

15,608 |

|

|

27,550 |

|

|

10,882 |

|

-43 |

% |

|

43 |

% |

| Restructuring expenses,

net |

5,898 |

|

|

324 |

|

|

192 |

|

1,720 |

% |

|

2,972 |

% |

| Restructuring related

inventory write down |

630 |

|

|

— |

|

|

— |

|

n/a |

|

|

n/a |

|

| Accrued anti-dumping

penalties |

— |

|

|

— |

|

|

4,897 |

|

n/a |

|

|

-100 |

% |

| Stock-based compensation |

1,242 |

|

|

1,495 |

|

|

870 |

|

-17 |

% |

|

43 |

% |

| Other (income) expense,

net |

(170 |

) |

|

(343 |

) |

|

335 |

|

50 |

% |

|

-151 |

% |

| Adjusted EBITDA |

$ |

23,208 |

|

|

$ |

29,026 |

|

|

$ |

17,176 |

|

-20 |

% |

|

35 |

% |

| |

Nine months ended |

|

|

| |

Sep 30, 2019 |

|

Sep 30, 2018 |

|

Year-on-year |

|

Net income |

$ |

39,329 |

|

|

$ |

15,202 |

|

159 |

% |

| Interest expense, net |

1,169 |

|

|

1,096 |

|

7 |

% |

| Income tax provision |

17,920 |

|

|

7,024 |

|

155 |

% |

| Depreciation |

6,178 |

|

|

4,799 |

|

29 |

% |

| Amortization of purchased

intangible assets |

1,189 |

|

|

2,365 |

|

-50 |

% |

| |

|

|

|

|

|

| EBITDA |

65,785 |

|

|

30,486 |

|

116 |

% |

| Restructuring expenses,

net |

6,300 |

|

|

553 |

|

1,039 |

% |

| Restructuring related

inventory write down |

630 |

|

|

— |

|

n/a |

|

| Accrued anti-dumping

penalties |

— |

|

|

8,000 |

|

-100 |

% |

| Stock-based compensation |

3,908 |

|

|

2,662 |

|

47 |

% |

| Other (income) expense,

net |

(492 |

) |

|

1,039 |

|

-147 |

% |

| Adjusted EBITDA |

$ |

76,131 |

|

|

$ |

42,740 |

|

78 |

% |

Adjusted gross margin

| |

Three months ended |

| |

Sep 30, 2019 |

|

Jun 30, 2019 |

|

Sep 30, 2018 |

| Gross margin, as

reported |

36.2 |

% |

|

37.9 |

% |

|

33.8 |

% |

| Restructuring

related inventory write down |

0.6 |

% |

|

— |

% |

|

— |

% |

| Adjusted gross

margin |

36.8 |

% |

|

37.9 |

% |

|

33.8 |

% |

| |

Nine months ended |

| |

Sep 30, 2019 |

|

Sep 30, 2018 |

| Gross margin, as

reported |

36.9 |

% |

|

33.6 |

% |

| Restructuring

related inventory write down |

0.2 |

% |

|

— |

| Adjusted gross

margin |

37.1 |

% |

|

33.6 |

% |

DMC GLOBAL INC.RECONCILIATIONS OF NON-GAAP

FINANCIAL MEASUREMENTS TO MOSTDIRECTLY COMPARABLE GAAP FINANCIAL

MEASUREMENTS(Amounts in Thousands)(unaudited)

Adjusted operating income

| |

Three months ended |

|

Change |

| |

Sep 30, 2019 |

|

Jun 30, 2019 |

|

Sep 30, 2018 |

|

Sequential |

|

Year-on-year |

|

Operating income, as reported |

$ |

12,821 |

|

$ |

24,653 |

|

$ |

8,820 |

|

-48 |

% |

|

45 |

% |

| Restructuring programs: |

|

|

|

|

|

|

|

|

|

|

NobelClad |

18 |

|

324 |

|

192 |

|

-94 |

% |

|

-91 |

% |

|

DynaEnergetics |

5,880 |

|

— |

|

— |

|

n/a |

|

|

n/a |

|

| Restructuring related

inventory write down |

630 |

|

— |

|

— |

|

n/a |

|

|

n/a |

|

| Accrued anti-dumping

penalties |

— |

|

— |

|

4,897 |

|

n/a |

|

|

-100 |

% |

| Adjusted operating income |

$ |

19,349 |

|

$ |

24,977 |

|

$ |

13,909 |

|

-23 |

% |

|

39 |

% |

| |

Nine months ended |

|

|

| |

Sep 30, 2019 |

|

Sep 30, 2018 |

|

Year-on-year |

|

Operating income, as reported |

$ |

57,926 |

|

$ |

24,361 |

|

138 |

% |

| Restructuring programs: |

|

|

|

|

|

|

NobelClad |

420 |

|

553 |

|

-24 |

% |

|

DynaEnergetics |

5,880 |

|

— |

|

n/a |

|

| Restructuring related

inventory write down |

630 |

|

— |

|

n/a |

|

| Accrued anti-dumping

penalties |

— |

|

8,000 |

|

-100 |

% |

| Adjusted operating income |

$ |

64,856 |

|

$ |

32,914 |

|

97 |

% |

Adjusted Net Income and Adjusted Diluted Earnings per Share

| |

Three months ended September 30, 2019 |

| |

Pretax |

|

Tax |

|

Net |

|

Diluted EPS |

|

Net income, as reported |

$ |

12,604 |

|

$ |

5,689 |

|

$ |

6,915 |

|

$ |

0.46 |

| Restructuring programs: |

|

|

|

|

|

|

|

|

NobelClad |

18 |

|

— |

|

18 |

|

— |

|

DynaEnergetics |

5,880 |

|

77 |

|

5,803 |

|

0.40 |

| Restructuring related

inventory write down |

630 |

|

— |

|

630 |

|

0.04 |

| Adjusted net income |

$ |

19,132 |

|

$ |

5,766 |

|

$ |

13,366 |

|

$ |

0.90 |

| |

Three months ended June 30, 2019 |

| |

Pretax |

|

Tax |

|

Net |

|

Diluted EPS |

|

Net income, as reported |

$ |

24,587 |

|

$ |

7,343 |

|

$ |

17,244 |

|

$ |

1.15 |

| Restructuring programs: |

|

|

|

|

|

|

|

|

NobelClad |

324 |

|

— |

|

324 |

|

0.02 |

| Adjusted net income |

$ |

24,911 |

|

$ |

7,343 |

|

$ |

17,568 |

|

$ |

1.17 |

DMC GLOBAL INC.RECONCILIATIONS OF NON-GAAP

FINANCIAL MEASUREMENTS TO MOSTDIRECTLY COMPARABLE GAAP FINANCIAL

MEASUREMENTS(Amounts in Thousands)(unaudited)

| |

Three months ended September 30, 2018 |

| |

Pretax |

|

Tax |

|

Net |

|

Diluted EPS |

|

Net income, as reported |

$ |

7,990 |

|

$ |

3,080 |

|

$ |

4,910 |

|

$ |

0.33 |

| Restructuring programs: |

|

|

|

|

|

|

|

|

NobelClad |

192 |

|

— |

|

192 |

|

0.01 |

| Accrued anti-dumping

duties |

4,897 |

|

— |

|

4,897 |

|

0.34 |

| Adjusted net income |

$ |

13,079 |

|

$ |

3,080 |

|

$ |

9,999 |

|

$ |

0.68 |

| |

Nine months ended September 30, 2019 |

| |

Pretax |

|

Tax |

|

Net |

|

Diluted EPS |

|

Net income, as reported |

$ |

57,249 |

|

$ |

17,920 |

|

$ |

39,329 |

|

$ |

2.64 |

| Restructuring programs: |

|

|

|

|

|

|

|

|

NobelClad |

420 |

|

— |

|

420 |

|

0.03 |

|

DynaEnergetics |

5,880 |

|

77 |

|

5,803 |

|

0.39 |

| Restructuring related

inventory write down |

630 |

|

— |

|

630 |

|

0.04 |

| Adjusted net income |

$ |

64,179 |

|

$ |

17,997 |

|

$ |

46,182 |

|

$ |

3.10 |

| |

Nine months ended September 30, 2018 |

| |

Pretax |

|

Tax |

|

Net |

|

Diluted EPS |

|

Net income, as reported |

$ |

22,226 |

|

$ |

7,024 |

|

$ |

15,202 |

|

$ |

1.02 |

| Restructuring programs: |

|

|

|

|

|

|

|

|

NobelClad |

553 |

|

— |

|

553 |

|

0.04 |

| Accrued anti-dumping

duties |

8,000 |

|

— |

|

8,000 |

|

0.55 |

| Adjusted net income |

$ |

30,779 |

|

$ |

7,024 |

|

$ |

23,755 |

|

$ |

1.61 |

DMC GLOBAL INC.RECONCILIATIONS OF NON-GAAP

FINANCIAL MEASUREMENTS TO MOSTDIRECTLY COMPARABLE GAAP FINANCIAL

MEASUREMENTS(Amounts in Thousands)(unaudited)

Return on Invested Capital

| |

|

|

Three months ended |

| |

|

|

Sep 30, 2018 |

|

Dec 31, 2018 |

|

Mar 31, 2019 |

|

Jun 30, 2019 |

|

Sep 30, 2019 |

|

Operating income |

|

|

8,820 |

|

$ |

13,063 |

|

|

$ |

20,452 |

|

|

$ |

24,653 |

|

|

$ |

12,821 |

|

| Income tax provision (benefit)

(1) |

|

|

3,396 |

|

(2,809 |

) |

|

4,990 |

|

|

7,371 |

|

|

5,782 |

|

| Net operating profit after

taxes (NOPAT) |

|

|

5,424 |

|

15,872 |

|

|

15,462 |

|

|

17,282 |

|

|

7,039 |

|

| Trailing Twelve Months

NOPAT |

|

|

|

|

|

|

|

|

54,040 |

|

|

55,655 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Balances as of |

| |

June 30, 2018 |

|

Sep 30, 2018 |

|

Dec 31, 2018 |

|

Mar 31, 2019 |

|

Jun 30, 2019 |

|

Sep 30, 2019 |

| Allowance for doubtful

accounts |

572 |

|

490 |

|

513 |

|

|

574 |

|

|

428 |

|

|

405 |

|

| Deferred tax assets |

— |

|

— |

|

(4,001 |

) |

|

(3,843 |

) |

|

(3,656 |

) |

|

(3,431 |

) |

| Deferred tax liabilities |

606 |

|

849 |

|

379 |

|

|

880 |

|

|

458 |

|

|

1,469 |

|

| Accrued income taxes |

6,557 |

|

9,299 |

|

9,545 |

|

|

5,367 |

|

|

9,419 |

|

|

10,427 |

|

| Current portion of long-term

debt |

— |

|

— |

|

3,125 |

|

|

3,125 |

|

|

3,125 |

|

|

3,125 |

|

| Long-term debt |

34,611 |

|

41,454 |

|

38,230 |

|

|

40,239 |

|

|

32,744 |

|

|

25,010 |

|

| Total stockholders'

equity |

114,229 |

|

119,390 |

|

134,286 |

|

|

148,911 |

|

|

163,501 |

|

|

167,076 |

|

| Total invested capital |

156,575 |

|

171,482 |

|

182,077 |

|

|

195,253 |

|

|

206,019 |

|

|

204,081 |

|

| Average invested capital |

|

|

|

|

|

|

171,049 |

|

|

181,297 |

|

|

187,782 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Trailing Twelve Months Return on Invested Capital (ROIC) |

|

|

|

|

|

|

|

25 |

% |

|

|

|

30 |

% |

|

|

|

30 |

% |

| (1) Tax

calculation for NOPAT: |

| |

Three months ended |

|

Twelve months ended |

|

Three months ended |

| |

Sep 30, 2018 |

|

Dec 31, 2018 |

|

Dec 31, 2018 |

|

Mar 31, 2019 |

|

June 30, 2019 |

|

Sep 30, 2019 |

|

Income before income taxes |

7,990 |

|

|

12,381 |

|

|

34,607 |

|

|

20,058 |

|

|

24,587 |

|

|

12,604 |

|

| Income tax provision

(benefit) |

3,080 |

|

|

(2,890 |

) |

|

4,134 |

|

|

4,888 |

|

|

7,343 |

|

|

5,689 |

|

| Effective tax rate |

38.5 |

% |

|

(23.3 |

)% |

|

11.9 |

% |

|

24.4 |

% |

|

29.9 |

% |

|

45.1 |

% |

DMC GLOBAL INC.RECONCILIATIONS OF NON-GAAP

FINANCIAL MEASUREMENTS TO MOSTDIRECTLY COMPARABLE GAAP FINANCIAL

MEASUREMENTS(Amounts in Thousands)(unaudited)

DynaEnergetics

| |

Three months ended |

|

Change |

| |

Sep 30, 2019 |

|

Jun 30, 2019 |

|

Sep 30, 2018 |

|

Sequential |

|

Year-on-year |

| Operating income |

$ |

14,911 |

|

$ |

26,813 |

|

$ |

9,860 |

|

-44 |

% |

|

51 |

% |

| Adjustments: |

|

|

|

|

|

|

|

|

|

|

Restructuring |

5,880 |

|

— |

|

— |

|

n/a |

|

|

n/a |

|

|

Restructuring related inventory write down |

630 |

|

— |

|

— |

|

n/a |

|

|

n/a |

|

|

Accrued anti-dumping penalties |

— |

|

— |

|

4,897 |

|

n/a |

|

|

-100 |

% |

|

Depreciation |

1,473 |

|

1,419 |

|

925 |

|

4 |

% |

|

59 |

% |

|

Amortization of purchased intangibles |

299 |

|

300 |

|

670 |

|

— |

% |

|

-55 |

% |

| Adjusted EBITDA |

$ |

23,193 |

|

$ |

28,532 |

|

$ |

16,352 |

|

-19 |

% |

|

42 |

% |

| |

Nine months ended |

|

Change |

| |

Sep 30, 2019 |

|

Sep 30, 2018 |

|

Year-on-year |

| Operating income |

$ |

64,834 |

|

$ |

30,801 |

|

110 |

% |

| Adjustments: |

|

|

|

|

|

|

Restructuring |

5,880 |

|

— |

|

n/a |

|

|

Restructuring related inventory write down |

630 |

|

— |

|

n/a |

|

|

Accrued anti-dumping penalties |

— |

|

8,000 |

|

-100 |

% |

|

Depreciation |

3,990 |

|

2,670 |

|

49 |

% |

|

Amortization of purchased intangibles |

900 |

|

2,059 |

|

-56 |

% |

| Adjusted EBITDA |

$ |

76,234 |

|

$ |

43,530 |

|

75 |

% |

Adjusted gross margin

| |

Three months ended |

| |

Sep 30, 2019 |

|

Jun 30, 2019 |

|

Sep 30, 2018 |

| Gross margin, as

reported |

39.5 |

% |

|

41.0 |

% |

|

37.0 |

% |

| Restructuring

related inventory write down |

0.8 |

% |

|

— |

% |

|

— |

% |

| Adjusted gross

margin |

40.3 |

% |

|

41.0 |

% |

|

37.0 |

% |

| |

Nine months ended |

| |

Sep 30, 2019 |

|

Sep 30, 2018 |

| Gross margin, as

reported |

39.9 |

% |

|

37.8 |

% |

| Restructuring

related inventory write down |

0.3 |

% |

|

— |

|

| Adjusted gross

margin |

40.2 |

% |

|

37.8 |

% |

NobelClad

| |

Three months ended |

|

Change |

| |

Sep 30, 2019 |

|

Jun 30, 2019 |

|

Sep 30, 2018 |

|

Sequential |

|

Year-on-year |

| Operating income |

$ |

2,219 |

|

$ |

1,923 |

|

$ |

2,099 |

|

15 |

% |

|

6 |

% |

| Adjustments: |

|

|

|

|

|

|

|

|

|

|

Restructuring expenses, net |

18 |

|

324 |

|

192 |

|

-94 |

% |

|

-91 |

% |

|

Depreciation |

750 |

|

738 |

|

703 |

|

2 |

% |

|

7 |

% |

|

Amortization of purchased intangibles |

95 |

|

97 |

|

99 |

|

-2 |

% |

|

-4 |

% |

| Adjusted EBITDA |

$ |

3,082 |

|

$ |

3,082 |

|

$ |

3,093 |

|

— |

% |

|

— |

% |

| |

Nine months ended |

|

|

| |

Sep 30, 2019 |

|

Sep 30, 2018 |

|

Year-on-year |

| Operating income |

$ |

5,972 |

|

$ |

3,791 |

|

58 |

% |

| Adjustments: |

|

|

|

|

|

|

Restructuring expenses, net |

420 |

|

553 |

|

-24 |

% |

|

Depreciation |

2,188 |

|

2,129 |

|

3 |

% |

|

Amortization of purchased intangibles |

289 |

|

306 |

|

-6 |

% |

| Adjusted EBITDA |

$ |

8,869 |

|

$ |

6,779 |

|

31 |

% |

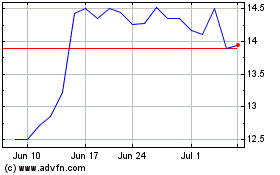

DMC Global (NASDAQ:BOOM)

Historical Stock Chart

From Mar 2024 to Apr 2024

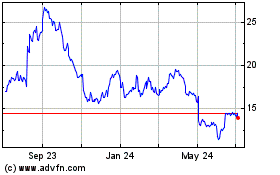

DMC Global (NASDAQ:BOOM)

Historical Stock Chart

From Apr 2023 to Apr 2024