UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 9, 2023

DISH NETWORK CORPORATION

(Exact name of registrant as specified

in its charter)

Nevada

(State

or other jurisdiction

of incorporation) |

|

001-39144

(Commission

File Number) |

|

88-0336997

(I.R.S Employer

Identification Number) |

9601

South Meridian Boulevard, Englewood, Colorado 80112

(Address

of principal executive offices) (Zip Code)

(303) 723-1000

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| x |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class |

Trading Symbol |

Name of each exchange

on which registered |

| Class A Common Stock, $0.01 par value |

DISH |

The NASDAQ Stock Market L.L.C. |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth

company ¨

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 5.02 Departure

of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On

November 9, 2023, DISH Network Corporation (“DISH”) appointed Mr. Hamid Akhavan, the current Chief Executive Officer and President

of EchoStar Corporation (“EchoStar”), to the additional role of President and Chief Executive Officer of DISH effective as

of November 13, 2023. As previously disclosed, Mr. Carlson notified DISH of his intention to resign as President and Chief Executive Officer

of DISH effective as of November 12, 2023, but will remain on the board of directors of DISH (the “DISH Board”) through the

closing of the previously announced merger between DISH and EchoStar (the “Merger”). The appointment of Mr. Akhavan was approved

by a special committee of independent directors of the DISH Board (the “DISH Special Committee”), subject to the approval

of the DISH Board, and was subsequently approved by the DISH Board. The approval of the DISH Board was

conditioned upon the approval of the board of directors of EchoStar (the “EchoStar Board”) of a compensation sharing agreement

between DISH and EchoStar, which approval was obtained on November 9, 2023.

Mr. Akhavan will retain his current position as

Chief Executive Officer and President of EchoStar. Prior to joining EchoStar on March 31, 2022, Mr. Akhavan served as a Partner at Twin

Point Capital, an investment firm, beginning in April 2018, and from March 2016 to April 2018, he was a Founding Partner of Long Arc Capital

LLC. Prior to March 2016, Mr. Akhavan held a variety of leadership positions, including as Chief Executive Officer of Unify, Inc. (formerly

Siemens Enterprise Communications), and Chief Executive Officer of T-Mobile International, where he also served as a member of the Board

of Management of Deutsche Telekom. Mr. Akhavan has been a member of the Board of Directors of Vonage Holding Corp., a global cloud communications

company, since 2016, and also serves on that Board’s Technology and Transactions Committees. In addition, since 2020, Mr. Akhavan

has served as a member of the Board of Directors of Anterix Inc., a wireless communications company, and is a member of its Compensation

and Nominating and Corporate Governance Committees.

Mr.

Akhavan has no family relationships with any of DISH’s directors or executive officers.

By virtue of his position as President and Chief Executive Officer of EchoStar, Mr. Akhavan may be considered to have an indirect

financial interest in related party transactions between DISH and EchoStar. Information regarding related party transactions between DISH

and EchoStar was provided in DISH’s definitive proxy statement for its 2023 annual meeting of shareholders in the section entitled

“Certain Relationships and Related Party Transactions.” Additionally, during the third quarter of 2023, DISH subsidiaries

ParkerB.com Wireless L.L.C. (“ParkerB”) and Wetterhorn Wireless L.L.C. (“Wetterhorn,” and collectively with ParkerB,

the “Spectrum Subsidiaries”) entered into a Spectrum Manager Lease Agreement (the “Lease”) with Hughes Satellite

Systems Corp., a wholly owned subsidiary of EchoStar (“Hughes”), whereby: (a) ParkerB leased 10 MHz of its 600 MHz spectrum

to Hughes; (b) Wetterhorn leased 10 MHz of its Citizens Broadband Radio Service spectrum to Hughes; and (c) Hughes agreed to pay the Spectrum

Subsidiaries a monthly recurring sum of $18,500 for use of the spectrum. The Lease term expires on August 31, 2024; provided, however,

Hughes may elect to extend the Lease until December 31, 2025. Collectively, the Spectrum Subsidiaries are expected to generate approximately

$198,000 in revenue from the Lease if Hughes elects not to extend the Lease, and approximately $494,000 if Hughes elects to extend the

Lease to December 31, 2025. Hughes may terminate the Lease due to a material default by the Spectrum Subsidiaries following a thirty (30)-day

notice and opportunity to cure period or if the U.S. Department of Defense terminates its relevant contract with Hughes. DISH and EchoStar

also expect to enter into the Compensation Sharing Agreement (as defined below) with respect to Mr. Akhavan’s compensation. Other

than the foregoing, there are no transactions and no proposed transactions between Mr. Akhavan

and DISH that would be required to be disclosed pursuant to Item 404(a) of Regulation

S-K.

Mr.

Akhavan will continue to be compensated in accordance with his compensation arrangements with EchoStar for his service as President and

Chief Executive Officer of DISH. In connection with the approval of Mr. Akhavan’s appointment, the DISH Special Committee recommended,

and the DISH Board and Audit Committee of the DISH Board each approved, DISH's entry into a compensation sharing agreement with respect

to Mr. Akhavan’s compensation (the “Compensation Sharing Agreement”), with more specific terms to be determined by DISH

management in negotiations with EchoStar. On November 9 and November 10, 2023, respectively,

the special transaction committee of independent directors of the EchoStar Board and the EchoStar Board approved EchoStar’s

entry into the Compensation Sharing Agreement, which provides that, from November 13, 2023 until the completion or termination of the

Merger, EchoStar will pay the full amount of Mr. Akhavan’s current compensation and, upon completion or termination of the Merger,

DISH will reimburse EchoStar for a portion of the cost of Mr. Akhavan’s compensation, in proportion to the percentage of time allocated

to Mr. Akhavan’s service as President and Chief Executive Officer of DISH during such period (as determined in good faith by DISH

and EchoStar, in consultation with Mr. Akhavan). DISH and EchoStar entered into the Compensation Sharing Agreement on November 13, 2023.

Item

7.01 Regulation FD Disclosure.

On November 13, 2023, DISH issued a press release

announcing the appointment of Mr. Akhavan as President and Chief Executive Officer of DISH. A copy of the press release is being furnished

on this Current Report on Form 8-K as Exhibit 99.1 hereto and is incorporated by reference herein.

The information contained in this Item 7.01, including

Exhibit 99.1, is being furnished and shall not be deemed “filed” with the SEC or otherwise incorporated by reference into

any registration statement or other document filed pursuant to the Securities Act or the Exchange Act.

Item

9.01 Financial Statements and Exhibits.

(d) Exhibits

* * *

Forward-Looking Statements

This

document contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, the accuracy

of which are necessarily subject to risks, uncertainties, and assumptions as to future events that may not prove to be accurate. These

statements are neither promises nor guarantees, but are subject to a variety of risks and uncertainties, many of which are beyond

DISH’s and EchoStar’s control, which could cause actual results to differ materially from those contemplated in these forward-looking

statements. Existing and prospective investors are cautioned not to place undue reliance on these forward-looking statements, which speak

only as of the date hereof. Factors that could cause actual results to differ materially from those expressed or implied include the factors

discussed under the section entitled “Risk Factors” of DISH’s Annual Report on Form 10-K for the fiscal year ended December

31, 2022, filed with the SEC, and under the section entitled “Risk Factors” of EchoStar’s Annual Report on Form 10-K

for the fiscal year ended December 31, 2022, filed with the SEC. DISH and EchoStar undertake no obligation to update or supplement any

forward-looking statement, whether as a result of new information, future developments or otherwise, except as required by law. These

factors include, without limitation: the occurrence of any event, change or other circumstance that could give rise to the termination

of the Amended and Restated Agreement and Plan of Merger dated October 2, 2023 by and among DISH Network, EchoStar and EAV Corp.; the

effect of the announcement of the proposed transaction on the ability of DISH and EchoStar to operate their respective businesses and

retain and hire key personnel and to maintain favorable business relationships; the timing of the Merger; the ability to satisfy closing

conditions to the completion of the Merger; DISH’s and EchoStar’s ability to achieve the anticipated benefits from the Merger;

other risks related to the completion of the Merger and actions related thereto; risk factors related to the current economic and business

environment; significant transaction costs and/or unknown liabilities; risk factors related to pandemics or other health crises; risk

factors related to funding strategies and capital structure; and risk factors related to the market price for DISH’s and EchoStar’s

respective common stock.

These

risks, as well as other risks related to the Merger, will be included in the registration statement on Form S-4 that will include as a

prospectus a joint information statement of the type contemplated by Rule 14c-2 of the Exchange Act and be filed with the SEC in connection

with the Merger. While the list of factors presented here is, and the list of factors to be presented in the registration statement on

Form S-4 and the joint information statement are, considered representative, no such list should be considered to be a complete statement

of all potential risks and uncertainties. For additional information about other factors that could cause actual results to differ materially

from those described in the forward-looking statements, please refer to DISH’s and EchoStar’s respective periodic reports

and other filings with the SEC, including the risk factors identified in each of DISH’s and EchoStar’s most recent Quarterly

Reports on Form 10-Q and Annual Reports on Form 10-K. The forward-looking statements included in this communication are made only as of

the date hereof. Neither DISH nor EchoStar undertakes any obligation to update any forward-looking statements to reflect subsequent events

or circumstances, except as required by law.

No Offer or Solicitation

This

communication is not intended to and shall not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities,

or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation

or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities

shall be made, except by means of a prospectus meeting the requirements of Section 10 of the Securities Act.

Additional Information about the Transaction and Where to Find It

In connection with the Merger, DISH and EchoStar

have prepared a joint information statement for their respective stockholders containing the information with respect to the Merger contemplated

by Rule 14c-2 of the Exchange Act and describing the Merger. EchoStar has filed with the SEC a registration statement

on Form S-4 that includes the joint information statement, which registration statement was declared effective by the SEC. Each of DISH

and EchoStar have filed and may in the future file other relevant documents with the SEC regarding the Merger. This document is not a

substitute for the registration statement, the joint information statement or any other document that DISH or EchoStar may file with the

SEC. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT, THE JOINT INFORMATION STATEMENT AND ANY OTHER RELEVANT

DOCUMENTS THAT MAY BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY

IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE MERGER. Investors and security

holders may obtain free copies of the registration statement and the joint information statement and other documents containing important

information about DISH, EchoStar and the Merger, once such documents are filed with the SEC through the website maintained by the SEC

at http://www.sec.gov. Copies of the documents filed with the SEC by DISH will be available free of charge on its website at https://ir.dish.com/.

Copies of the documents filed with the SEC by EchoStar will be available free of charge on its website at https://ir.echostar.com/.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

DISH NETWORK CORPORATION |

| |

(Registrant) |

| |

|

|

| November 13, 2023 |

By: |

/s/ Timothy A. Messner |

| |

|

Timothy A. Messner |

| |

|

Executive Vice President, General Counsel and Corporate Secretary |

Exhibit 99.1

Hamid Akhavan Named President and Chief Executive

Officer of DISH Network

ENGLEWOOD, Colo., Nov. 13, 2023

– DISH Network Corporation today announced Hamid Akhavan has joined DISH as president and chief executive officer (CEO), in addition to his current role as CEO and president of EchoStar. Mr.

Akhavan will oversee all aspects of the company’s video services and wireless

businesses, as well as its subsidiaries.

When the merger between DISH and EchoStar was announced, it was also

announced that Mr. Akhavan would become CEO of the combined company. The transaction, which is subject to regulatory approvals and customary

closing conditions, is expected to be completed by year-end.

“Hamid brings a unique set of skills to DISH, building off his

experience in the technology, telecom, private equity and investment sectors,” said Charlie Ergen, co-founder and chairman, DISH

Network. “An engineer by background, he’s financially astute and a seasoned manager. He currently serves EchoStar, DISH’s

sister company, as CEO and will lead both companies in order to hit the ground running, once the merger with EchoStar is complete.”

Before joining DISH and EchoStar, Mr. Akhavan was most recently a partner

at Twin Point Capital, an investment firm, and a founding partner of Long Arc Capital LLC. He held a variety of executive leadership positions

including CEO of Unify Inc. (formerly Siemens Enterprise Communications), Chief Operating Officer at Deutsche Telekom and CEO of T-Mobile

International, where he also served as a member of the Board of Management of Deutsche Telekom.

“There is tremendous opportunity at DISH, and even more so once

it’s combined with EchoStar,” said Mr. Akhavan. “This appointment will enable me and the teams to get a headstart in

preparing to run the combined business of the companies.”

About DISH Network

DISH Network Corporation is a connectivity company. Since 1980, it

has served as a disruptive force, driving innovation and value on behalf of consumers. Through its subsidiaries, the company provides

television entertainment and award-winning technology to millions of customers with its satellite DISH TV and streaming SLING TV services.

In 2020, the company became a nationwide U.S. wireless carrier through the acquisition of Boost Mobile. DISH continues to innovate in

wireless, building the nation's first virtualized, O-RAN 5G broadband network. DISH Network Corporation (NASDAQ: DISH) is a Fortune 200

company.

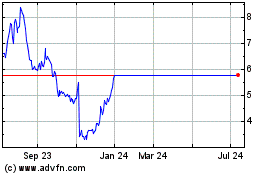

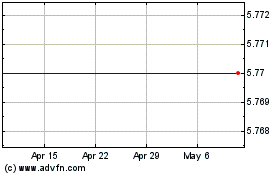

DISH Network (NASDAQ:DISH)

Historical Stock Chart

From Apr 2024 to May 2024

DISH Network (NASDAQ:DISH)

Historical Stock Chart

From May 2023 to May 2024