Additional Proxy Soliciting Materials (definitive) (defa14a)

May 06 2020 - 8:36AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

proxy statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the

Registrant ☒ Filed by a Party other than

the Registrant ☐

Check the appropriate box:

|

|

|

|

|

☐

|

|

Preliminary proxy statement

|

|

|

|

|

☐

|

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

|

|

☐

|

|

Definitive proxy statement

|

|

|

|

|

☒

|

|

Definitive Additional Materials

|

|

|

|

|

☐

|

|

Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12

|

DENTSPLY SIRONA Inc.

(Name of Registrant as Specified

In Its Charter)

(Name of Person(s) Filing proxy

statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

|

|

☒

|

|

No fee required.

|

|

|

|

|

☐

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

|

|

|

(1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

|

(2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

|

(3)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the

filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

|

(4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

|

(5)

|

|

Total fee paid:

|

|

|

|

|

☐

|

|

Fee paid previously with preliminary materials.

|

|

|

|

|

☐

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement

number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

|

|

(1)

|

|

Amount Previously Paid:

|

|

|

|

|

|

|

|

(2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

|

(3)

|

|

Filing Party:

|

|

|

|

|

|

|

|

(4)

|

|

Date Filed:

|

|

Re:

|

DENTSPLY SIRONA Inc. 2020 Annual Meeting of Stockholders

|

Supplemental Information Regarding Proposal #3 – Advisory Vote to Approve Our Named

Executive Officer Compensation, or “Say on Pay”

Dear Stockholder,

At our 2020 Annual Meeting of Stockholders,

you will once again be asked to cast an advisory vote to approve our named executive officer (“NEO”) compensation, or “Say on Pay”. Our Board of Directors has recommended that you cast your vote in favor of this proposal.

As we are all well aware, the novel coronavirus (COVID-19) outbreak has had a significant impact on millions of people

worldwide and continues to pose significant challenges to the world economy. At Dentsply Sirona, we remain accountable to our stockholders, customers and partners, colleagues and communities throughout these uncertain conditions and we are taking

appropriate steps to respond quickly to maintain the health and safety of our employees, ensure business continuity, maintain our supply chain and support our customers. We have committed to communicate clearly, be transparent and to go the extra

mile for our customers, while protecting the health and safety of our employees. Once these temporary challenges subside, we are confident that we will emerge from this rapidly evolving situation in a stronger position for the future.

During this time of unprecedent challenges, we have taken prudent steps to protect and secure the cash flows and financial position of the Company. For

example, as the Company previously announced, each member of the Company’s senior management team, including each of the Company’s named executive officers, took a temporary reduction in base salary for 90 days. The base salary of our

Chief Executive Officer, Mr. Casey, was reduced to the amount necessary to fund, on an after-tax basis, his contributions to continue to participate in the Company’s health benefit plan and meet

certain other legal requirements. The base salaries of our other named executive officers and members of our senior management team were reduced 25% for the same 90-day period, and each member of our Board of

Directors agreed to waive one quarter of his or her annual cash retainer for 2020.

Although the world has changed since the end of our most recent fiscal

year, we would like to reflect on our journey over the past 18 months. I highlight this journey to provide you with what I believe to be critical context for our compensation actions during 2019.

OUR JOURNEY

Following the approval of the Company’s

transformation plan in late 2018, we then needed to act on it. Our leaders, many of whom were new to the organization, needed to accomplish the enormous objectives of both simultaneously running our existing businesses and taking the

transformational steps necessary to deliver on what we had promised to you, our shareholders. To ensure our success, the Board and our management team implemented a wide range of initiatives and supporting programs.

|

|

•

|

|

We announced that we would be focusing on establishing consistent internal revenue growth and aggressively

improving our adjusted income operating margins.

|

|

|

•

|

|

We committed to achieving annualized internal revenue growth of 3-4% on a

consistent basis and an adjusted operating income margin of 22% by 2022.

|

|

|

•

|

|

We dedicated ourselves to simplifying the organization through supply chain integration and optimization and the

evaluation of non-core and underperforming businesses.

|

|

|

•

|

|

We outlined the operating principles that would be necessary to execute this strategy and to build a world-class

organization, including refocusing our customer efforts and taking responsibility for demand creation, delivering innovation that is substantial and supported, leading in clinical education and taking advantage of our scale.

|

Page 2/7

We determined that these major steps were necessary to transform our business in order to deliver on the

promise of our portfolio and to deliver sustainable long-term value to our stockholders.

To support these critical efforts, we reviewed the fundamentals

of our management compensation programs, including both short- and long-term incentives. As a result of such review, the Human Resources Committee and the full Board determined that our existing incentive programs, with modest modifications, were

able to support the majority of our initiatives. However, it also became clear that a key aspect of our transformation, securing substantial improvements in operating margins, was not able to be sufficiently supported within the framework of our

existing incentive plans. Additionally, based on conversations with shareholders leading up to the transformation program, most shareholders were supportive of the current incentive programs for ongoing operations. There was, however, also a

sentiment that favored increased accountability for meaningful transformation and saw returning the company to historical operating margins as critical. The Board concurred and, to address this gap, in late 2018, we reviewed alternative incentive

designs and implemented our Operating Margin Transformation Incentive Plan with the following desirable characteristics:

|

|

•

|

|

One Time Award: the Board deemed that ensuring a successful transformation was sufficiently unique and

critical to warrant a special award;

|

|

|

•

|

|

100% Performance-Based Design with Stretch Goals: no shares under this plan will be earned for operating

margins below 18%, representing a 250 basis point improvement over our operating margins prior to undertaking our transformation. Maximum awards can be earned for operating margins up to 23% (a 750 basis point increase over 2018 levels and a full

100 basis points higher than our 22% 2022 goal);

|

|

|

•

|

|

Focused: only the group of leaders who are most responsible for and able to influence our operating

margins were invited to participate;

|

|

|

•

|

|

Long-Term in Nature: the performance cycle spans 4 years, acknowledging that the desired operating margin

improvements will take time but must be achieved quickly;

|

|

|

•

|

|

Sustained Performance: the incentive plan requires that operating margin performance levels, once

achieved, must be sustained over an additional period or awards are not earned; the rolling nature of this plan ensures that participants are engaged and focused on achieving the desired goals throughout the entire

4-year performance period;

|

|

|

•

|

|

Supplemental to Existing Incentive Awards: while the use of supplemental awards is not favored by proxy

advisors, who suggest that the need for these programs suggests a flaw in the underlying compensation system, we believe that the use of this strategic, customized tool is perfectly suited to support our needs – our standard annual program has

been tailored to support running our existing businesses and achieving most restructuring goals, while the Operating Margin Transformation Plan focuses on that critical objective;

|

|

|

•

|

|

Meaningful Rewards: the target value of the incentive opportunity for participants ranged between 1x and

2x their normal annual equity award opportunity with maximum payout opportunity (for 23% operating margin) set at 3x target. The HRC and Board viewed target opportunities of this magnitude and the above-normal maximum opportunity, as appropriate

given the 100% performance-based nature of the plan, the exceptional stretch built into the goals and the criticality of achieving the objective; and

|

|

|

•

|

|

Share-Based: awards, if they vest, are delivered in company shares that further align our leaders with

you, our shareholders.

|

This Operating Margin Transformation Plan is an integral part of ensuring that our leadership team is focused on

the objectives of our transformation and that they are rewarded for its achievement.

Page 3/7

2019 TRANSFORMATION PROGRESS

Since late 2018, from both strategic and financial perspectives, it is clear that our portfolio of incentives and strategy have been successful. In 2019, we

executed across our business and we are excited with the progress that our team has made.

Strategic Success in FY 2019

|

|

•

|

|

Enhanced Demand Creation: a central objective of our transformation was to accelerate growth through

enhanced demand creation. To support this goal, we moved our R&D approach from a decentralized, complex process that consisted of too many small projects. We created a comprehensive R&D program that prioritizes spending across our entire

portfolio rather than relying on individual business units to drive their own innovation plans, allowing bigger ideas and higher return on investment projects to develop more efficiently. Our recent successful launches of Primescan®—a key driver of the strong sales we posted in 2019—and Primemill® demonstrated the positive impacts of this focused mindset

across our Company.

|

|

|

•

|

|

Streamlined Commercial Organization: another critical aspect of our transformation was to create a

simplified but unified commercial organization. During the year, we overhauled our U.S. demand creation capabilities in a significant way. Starting with a single view of the customer, we changed our structure, moved our U.S. operations to a single

CRM system, created a single, cross-company loyalty program for our U.S. market. From the recent improvements we have seen under the simplified structure, we started rolling that model out to other geographies.

|

|

|

•

|

|

Scaling of Critical Functions: we executed a plan to scale critical functions, consolidating our supply

chain into a single organization, centralizing procurement, logistics, demand planning and manufacturing. These efforts contributed to our margin expansion in 2019, a core aspect of our business that we focused on improving.

|

|

|

•

|

|

Asset Rationalization: we also executed our strategy to shed noncore assets that were dilutive from a

growth or a margin perspective. We acted thoughtfully and efficiently to either sell them or close them down. Collectively, these actions have helped to improve our margin profile and free up management capacity to focus on more profitable

activities going forward.

|

|

|

•

|

|

Streamlined Business Structure: we centralized our strategic business unit structure, enabling us to drive

costs down and scale operations. This simplification process has enabled us to reduce costs and, because we have scaled operations, we’ve been able to bring in world-class talent that will help us operate at scale.

|

Financial Progress in FY 20191

|

|

•

|

|

We generated revenues of $4 billion, which represents an annual internal growth rate of 5.7% from 2018;

|

|

|

•

|

|

We made significant progress in driving cash flow, achieving operating cash flow of $633 million, up 27%

compared to 2018, and free cash flow of $510 million, up 61% versus 2018;

|

|

|

•

|

|

Our strong sales growth, driven by our enhanced demand creation initiatives and a sharp focus on operational

discipline around expenses and headcount management, contributed to a 2019 adjusted income operating margin of 18.6%, which represents a 310 basis point expansion of our operating margin versus prior year; and

|

|

|

•

|

|

This resulted in 2019 earnings per diluted common share of $1.17 compared to a loss per diluted common share of

$4.51 in 2018, or 2019 adjusted earnings per share of $2.45 compared to 2018 adjusted earnings per share of $2.01.

|

|

1

|

Please refer to the tables in Exhibit A for a reconciliation between GAAP and non-GAAP measures.

|

Page 4/7

From the above discussion, I trust it is clear that our Board recognized the Company’s historical

challenges and has undertaken a comprehensive approach to improving our performance; performance that clearly started to materialize in 2019. We have historically set compensation opportunities consistent with our market median philosophy. However,

this perspective reflects assumed target performance. As discussed in our 2020 proxy statement on page 61, the compensation actually received by our executives over the past 3 years is substantially below the compensation opportunity for

those same years based on performance and vesting during that period. This analysis and result demonstrate pay for performance in action and shows that it is indeed working here at Dentsply Sirona.

Because of the myriad of transformational and performance-improvement initiatives and supporting compensation programs that we have implemented across our

Company, I truly believe Dentsply Sirona is uniquely positioned to continue the success we drove in 2019 and to weather the current market challenges; we have a flexible global footprint, marquee brands with loyal followings, and a dedicated,

passionate, focused and incentivized workforce.

In the Board’s view, our suite of compensation and incentive programs, including the Operating

Margin Transformation Plan, are integral to our transformation and ultimately in achieving our strategy. While the reward opportunities are substantial and aligned with market, the performance goals are equally challenging and ensure actual pay

received by our leaders is appropriate and commensurate.

Our stockholders have overwhelmingly supported the structure of our executive compensation

program in the past. At each of the 2018 and 2019 annual meetings of stockholders, our say-on-pay proposal was approved by more than 91% of the votes cast.

For these reasons, we strongly encourage you to vote “FOR” our compensation of the Company’s Named Executive Officers as disclosed in our

2020 Proxy Statement as a critical part of our transformation.

We appreciate your continued support.

Sincerely,

/s/ Willie

Deese

Willie Deese

Chairman of the Human Resources Committee

of the Board of

Directors of Dentsply Sirona

Page 5/7

EXHIBIT A

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended

December 31, 2019

|

|

|

2019

Growth

|

|

|

Year Ended

December 31, 2018

|

|

|

(in millions, except percentages)

|

|

Total

|

|

|

Total

|

|

|

Total

|

|

|

Net sales

|

|

$

|

4,029.2

|

|

|

|

1.1

|

%

|

|

$

|

3,986.3

|

|

|

Less: precious metal content of sales

|

|

|

41.1

|

|

|

|

|

|

|

|

37.2

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales, excluding precious metal content

|

|

|

3,988.1

|

|

|

|

1.0

|

%

|

|

|

3,949.1

|

|

|

Acquisition related adjustments(a)

|

|

|

—

|

|

|

|

|

|

|

|

6.4

|

|

|

Non-GAAP, net sales, excluding precious metal

content

|

|

$

|

3,988.1

|

|

|

|

0.8

|

%

|

|

$

|

3,955.5

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign exchange impact

|

|

|

|

|

|

|

(3.3

|

%)

|

|

|

|

|

|

Constant currency growth

|

|

|

|

|

|

|

4.1

|

%

|

|

|

|

|

|

Acquisitions

|

|

|

|

|

|

|

(0.6

|

%)

|

|

|

|

|

|

Discontinued Products

|

|

|

|

|

|

|

(1.0

|

%)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Internal sales growth

|

|

|

|

|

|

|

5.7

|

%

|

|

|

|

|

|

(a)

|

Represents an adjustment to reflect deferred revenue that was eliminated under business combination accounting

standards.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended

December 31, 2019

|

|

|

Year Ended

December 31, 2018

|

|

|

% Change

|

|

|

Cash provided by Operations

|

|

$

|

633

|

|

|

$

|

500

|

|

|

|

27

|

%

|

|

Less: Capital Expenditures

|

|

$

|

123

|

|

|

$

|

183

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Free cash flow

|

|

$

|

510

|

|

|

$

|

317

|

|

|

|

61

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended

December 31, 2019

|

|

|

(in millions, except per share amounts)

|

|

Operating Income

|

|

|

Percentage of

Net Sales

|

|

|

Operating income

|

|

$

|

360.9

|

|

|

|

9.0

|

%

|

|

Amortization of purchased intangible assets

|

|

|

189.6

|

|

|

|

4.7

|

%

|

|

Restructuring program related costs and other costs

|

|

|

184.5

|

|

|

|

4.6

|

%

|

|

Business combination related costs and fair value adjustments

|

|

|

7.1

|

|

|

|

0.2

|

%

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted Non-GAAP Operating Income

|

|

$

|

742.1

|

|

|

|

18.4

|

%

|

|

|

|

|

|

|

|

|

|

|

Page 6/7

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended

December 31, 2018

|

|

|

(in millions, except per share amounts)

|

|

Operating (Loss)

Income

|

|

|

Percentage of

Net Sales

|

|

|

Operating loss

|

|

$

|

(958.1

|

)

|

|

|

(24.0

|

%)

|

|

Restructuring program related costs and other costs

|

|

|

1,353.1

|

|

|

|

33.9

|

%

|

|

Amortization of purchased intangible assets

|

|

|

197.9

|

|

|

|

5.0

|

%

|

|

Business combination related costs and fair value adjustments

|

|

|

21.3

|

|

|

|

0.5

|

%

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted Non-GAAP Operating Income

|

|

$

|

614.2

|

|

|

|

15.4

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended

December 31, 2019

|

|

|

(in millions, except per share amounts)

|

|

Net Income

|

|

|

Per Diluted

Common Share

|

|

|

Net income attributable to Dentsply Sirona

|

|

$

|

262.9

|

|

|

$

|

1.17

|

|

|

|

|

|

|

|

|

|

|

|

|

Pre-tax Non-GAAP

adjustments:

|

|

|

|

|

|

|

|

|

|

Amortization of purchased intangible assets

|

|

|

189.6

|

|

|

|

|

|

|

Restructuring program related costs and other costs

|

|

|

183.3

|

|

|

|

|

|

|

Business combination related costs and fair value adjustments

|

|

|

9.5

|

|

|

|

|

|

|

Credit risk and fair value adjustments

|

|

|

5.3

|

|

|

|

|

|

|

Tax impact of the pre-tax

Non-GAAP adjustments (a)

|

|

|

(101.7

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Subtotal Non-GAAP adjustments

|

|

$

|

286.0

|

|

|

$

|

1.28

|

|

|

Income tax related adjustments

|

|

|

1.0

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted Non-GAAP net income

|

|

$

|

549.9

|

|

|

$

|

2.45

|

|

|

|

|

|

|

|

|

|

|

|

|

(a)

|

The tax amount was calculated using the applicable statutory tax rate in the tax jurisdiction where the Non-GAAP adjustments were generated.

|

Page 7/7

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended

December 31, 2018

|

|

|

(in millions, except per share amounts)

|

|

Net (Loss) Income

|

|

|

Per Diluted

Common

Share

|

|

|

Net loss attributable to Dentsply Sirona

|

|

$

|

(1,011.0

|

)

|

|

$

|

(4.51

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Pre-tax Non-GAAP

adjustments:

|

|

|

|

|

|

|

|

|

|

Restructuring program related costs and other costs

|

|

|

1,353.1

|

|

|

|

|

|

|

Amortization of purchased intangible assets

|

|

|

197.9

|

|

|

|

|

|

|

Business combination related costs and fair value adjustments

|

|

|

22.8

|

|

|

|

|

|

|

Credit risk and fair value adjustments

|

|

|

14.5

|

|

|

|

|

|

|

Gain on sale of marketable securities

|

|

|

(44.1

|

)

|

|

|

|

|

|

Tax impact of the pre-tax

Non-GAAP adjustments (a)

|

|

|

(130.2

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Subtotal Non-GAAP adjustments

|

|

$

|

1,414.0

|

|

|

$

|

6.26

|

|

|

Adjustment for calculating Non-GAAP net income per diluted

common share (b)

|

|

|

|

|

|

|

0.23

|

|

|

Income tax related adjustments

|

|

|

51.5

|

|

|

|

0.03

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted Non-GAAP net income

|

|

$

|

454.5

|

|

|

$

|

2.01

|

|

|

|

|

|

|

|

|

|

|

|

|

(a)

|

The tax amount was calculated using the applicable statutory tax rate in the tax jurisdiction where the Non-GAAP adjustments were generated.

|

|

(b)

|

The Company had a net loss for the year ended December 31, 2018, but had net income on a Non-GAAP basis. The weighted average common shares outstanding used in calculating diluted Non-GAAP net income per common share includes the dilutive effect of common stock.

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding used in calculating diluted GAAP net loss

per common share

|

|

|

224.3

|

|

|

Weighted average common shares outstanding used in calculating diluted Non-GAAP net income per common share

|

|

|

26.0

|

|

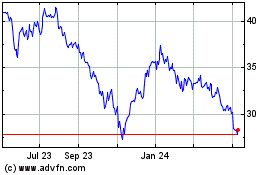

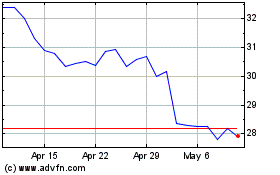

DENTSPLY SIRONA (NASDAQ:XRAY)

Historical Stock Chart

From Aug 2024 to Sep 2024

DENTSPLY SIRONA (NASDAQ:XRAY)

Historical Stock Chart

From Sep 2023 to Sep 2024