Cross Country Healthcare, Inc. (Nasdaq:CCRN) today reported revenue

of $178.1 million in the third quarter ended September 30, 2008, a

4% decrease from revenue of $185.1 million in the prior year

quarter. Net income for the third quarter of 2008 was $6.2 million,

or $0.20 per diluted share, compared to net income of $7.0 million,

or $0.22 per diluted share in the prior year quarter. Cash flow

from operations for the third quarter of 2008 was $13.8 million.

For the nine months ended September 30, 2008, the Company generated

revenue of $528.3 million and net income of $18.4 million, or $0.59

per diluted share. This compares to revenue of $536.6 million and

net income of $17.3 million, or $0.53 per diluted share, in the

first nine months of the prior year. Cash flow from operations for

the first nine months of 2008 was $40.9 million. "While we

generated strong cash flow, improved our gross profit margin and

further diversified our revenue mix with the acquisition of the

locum tenens (temporary physician staffing) business of MDA

Holdings, Inc. (MDA) during the third quarter, the overall

environment in which we operate deteriorated significantly," said

Joseph A. Boshart, President and Chief Executive Officer of Cross

Country Healthcare. "Demand, booking activity and volume in our

travel nurse staffing business weakened, in large part, due to

hospital clients being increasingly reluctant to commit to a

contract nurse most often citing low patient census and budget

reductions for their hesitation. Our other businesses also

experienced similar reluctance on the part of clients to commit.

Nonetheless, our newly acquired temporary physician staffing

business continued its year-over-year growth due to greater demand

for physicians as they are revenue generators for hospitals and

physician practice groups," Mr. Boshart said. "Although our

near-term expectations are disappointing to me, and I'm sure to our

shareholders, Cross Country Healthcare remains on very sound

financial footing with a prudent level of debt and cash flow well

in excess of what is required to operate our business on a

day-to-day basis. Given the general tone and uncertainty of the

economy, including a further weakening of labor markets, our

operations teams will be focused on continuing to provide a

high-level of service to our healthcare facility customers and the

healthcare professionals that look to us for assignment

opportunities. Meanwhile, our management team will be focused on

fundamentals such as cost control and continuing to de-lever our

balance sheet using our strong cash flow. I would like to add that

over our history, we have managed through several industry

down-turns - and we have always generated positive quarterly

earnings. Moreover, consistent with our strategy that we have

communicated for the past several quarters, with the MDA

acquisition we successfully diversified into a sector of our

industry that has shown consistent growth over the past decade,"

added Mr. Boshart. Nurse and Allied Staffing For the third quarter

of 2008, the nurse and allied staffing business segment (travel and

per diem nurse and travel allied staffing) generated revenue of

$128.9 million, a 12% decline from the prior year quarter. The

decrease reflected a 13% decline in staffing volume from the prior

year quarter that was partially offset by a 2.4% year-over-year

increase in the travel nurse staffing hourly bill rate.

Contribution income (defined as income from operations before

depreciation, amortization and corporate expenses not specifically

identified to a reporting segment) was relatively flat at $14.3

million in the third quarters of both 2008 and 2007. For the third

quarter of 2008, the Company experienced continued expansion of the

bill-pay spread and favorable insurance expenses. However, these

improvements were essentially offset by the impact of lower

staffing volume. For the first nine months of 2008, segment revenue

decreased 7% to $402.2 million from $433.5 million in the same

period a year ago, while contribution income increased 4% to $41.1

million from $39.4 million in the prior year period. Physician

Staffing For the third quarter of 2008, physician staffing

generated revenue of $10.8 million and $0.9 million in contribution

income since the Company's acquisition of MDA on September 9, 2008.

Pro-forma for the current quarter, physician staffing days filled

increased 4% from the prior year quarter to 28,190 and revenue per

day filled increased 8% to $1,584. Physician staffing days filled

is derived by dividing the physician staffing hours filled during

the respective period by 8 hours. Revenue per day filled represents

segment revenue divided by the number of days filled for the

respective period. Clinical Trials Services For the third quarter

of 2008, the clinical trials services segment generated revenue of

$25.4 million, a decrease of 3% from the prior year quarter due

primarily to a decline in the drug safety business from the prior

year quarter related to a specific client. Contribution income

decreased 26% in the third quarter of 2008 to $3.8 million from the

same quarter of 2007 primarily due to a reduction in contribution

from the drug safety business. For the first nine months of 2008,

segment revenue increased 15% to $75.2 million from $65.4 million

in the same period a year ago, while contribution income increased

13% to $11.9 million from $10.6 million in the prior year period.

Other Human Capital Management Services For the third quarter of

2008, the other human capital management services business segment

(education and training and retained search) generated revenue of

$13.0 million, a 2% decrease from the same quarter in the prior

year, reflecting lower revenue generated by the education and

training business that was partially offset by higher revenue in

the retained search business. Segment contribution income decreased

3% to $1.6 million in the third quarter of 2008 from the prior year

quarter, reflecting a decline in contribution from the retained

search business that was mostly offset by an increase in

contribution from the education and training business. For the

first nine months of 2008, segment revenue increased 7% to $40.1

million from $37.6 million in the same period a year ago, while

contribution income increased 6% to $6.1 million from $5.7 million

in the prior year period. Debt Repayments/Borrowings In conjunction

with the MDA acquisition, the Company entered into an amended and

restated $200.0 million syndicated credit facility with Wachovia

Capital Markets, LLC and certain of its affiliates, Banc of America

Securities, LLC, and certain other lenders. Pursuant to this

financing, the Company amended and kept in place its existing $75.0

million revolving credit facility and entered into a new $125.0

million 5-year term loan, from which the proceeds were used to

finance the acquisition and to pay-down approximately $6.8 million

of debt outstanding on the revolving credit facility. During the

third quarter of 2008, the Company repaid a net of $15.0 million of

borrowings under its revolving credit facility. At September 30,

2008, the Company had $144.4 million of total debt on its balance

sheet and a debt, net of unrestricted cash, to total capitalization

ratio of 24%. Stock Repurchase Program Update Cross Country

Healthcare refrained from repurchasing its common stock during the

third quarter of 2008 due to the timing of negotiations and

subsequent completion of the MDA acquisition. As of September 30,

2008, the Company can repurchase up to 1,441,139 shares of its

common stock under the current authorization approved in February

2008. Under this authorization, the shares may be repurchased from

time-to-time in the open market subject to the terms of the

Company's credit agreement. Such repurchases may be discontinued at

any time at the discretion of the Company. Pursuant to the terms of

the Company's credit agreement, as long as its debt leverage ratio

(as defined in the Company's credit agreement) is above 2 to 1 the

Company cannot repurchase shares. As of the end of the third

quarter, the Company's debt leverage ratio was approximately 2.15

to 1. At September 30, 2008, the Company had approximately 30.8

million shares outstanding. Guidance for Fourth Quarter 2008 The

following statements are based on current management expectations.

Such statements are forward-looking and actual results may differ

materially. These statements do not include the potential impact of

any future mergers, acquisitions and other business combinations,

any impairment charges, any significant legal proceedings or any

significant repurchases of our common stock. The Company expects

revenue in the fourth quarter of 2008 to be in the $195 million to

$199 million range and earnings per diluted share to be in the

range of $0.15 to $0.17. For the full-year, the Company expects

2008 revenue to be in the $723 million to $727 million range and

earnings per diluted share to be in the range of $0.74 to $0.76.

Quarterly Conference Call Cross Country Healthcare will hold a

conference call on Monday, November 3rd at 10:00 a.m. Eastern Time

to discuss its third quarter 2008 financial results. This call will

be webcast live by CCBN/Thomson and may be accessed at the

Company's web site at www.crosscountryhealthcare.com or by dialing

877-917-1549 from anywhere in the U.S. or by dialing 312-470-7109

from non-U.S. locations - Passcode: Cross Country. A replay of the

webcast will be available through November 17th. A replay of the

conference call will be available by telephone from approximately

noon on November 3rd until November 17th by calling 800-756-0131

from anywhere in the U.S. or 203-369-3001 from non-U.S. locations.

About Cross Country Healthcare Cross Country Healthcare, Inc. is a

leading provider of nurse and allied staffing services in the

United States, a national provider of multi-specialty locum tenens

(temporary physician staffing) services, a provider of clinical

trials services to global pharmaceutical and biotechnology

customers, as well as a provider of other human capital management

services focused on healthcare. The Company has approximately 5,000

contracts with hospitals, healthcare providers, pharmaceutical and

biotechnology customers, and other healthcare organizations. Copies

of this and other news releases as well as additional information

about Cross Country Healthcare can be obtained online at

www.crosscountryhealthcare.com. Shareholders and prospective

investors can also register at the corporate website to

automatically receive the Company's press releases, SEC filings and

other notices by e-mail. In addition to historical information,

this press release contains statements relating to our future

results (including certain projections and business trends) that

are "forward-looking statements" within the meaning of Section 27A

of the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended (the "Exchange Act"),

and are subject to the "safe harbor" created by those sections.

Forward-looking statements consist of statements that are

predictive in nature, depend upon or refer to future events. Words

such as "expects", "anticipates", "intends", "plans", "believes",

"estimates", "suggests", "seeks", "will" and variations of such

words and similar expressions intended to identify forward-looking

statements. Forward-looking statements involve known and unknown

risks, uncertainties and other factors that may cause our actual

results and performance to be materially different from any future

results or performance expressed or implied by these

forward-looking statements. These factors include, without

limitation, the following: our ability to attract and retain

qualified nurses, physicians and other healthcare personnel, costs

and availability of short-term housing for our travel nurses and

physicians, demand for the healthcare services we provide, both

nationally and in the regions in which we operate, the functioning

of our information systems, the effect of existing or future

government regulation and federal and state legislative and

enforcement initiatives on our business, our clients' ability to

pay us for our services, our ability to successfully implement our

acquisition and development strategies, the effect of liabilities

and other claims asserted against us, the effect of competition in

the markets we serve, our ability to successfully defend the

Company, its subsidiaries, and its officers and directors on the

merits of any lawsuit or determine its potential liability, if any,

and other factors set forth in Item 1A. "Risk Factors" in the

Company's Annual Report on Form 10-K for the year ended December

31, 2007, and our other Securities and Exchange Commission filings

made during 2008. Although we believe that these statements are

based upon reasonable assumptions, we cannot guarantee future

results and readers are cautioned not to place undue reliance on

these forward-looking statements, which reflect management's

opinions only as of the date of this press release. There can be no

assurance that (i) we have correctly measured or identified all of

the factors affecting our business or the extent of these factors'

likely impact, (ii) the available information with respect to these

factors on which such analysis is based is complete or accurate,

(iii) such analysis is correct or (iv) our strategy, which is based

in part on this analysis, will be successful. The Company

undertakes no obligation to update or revise forward-looking

statements. All references to "we," "us," "our," or "Cross Country"

in this press release mean Cross Country Healthcare, Inc., its

subsidiaries and affiliates. -0- *T Cross Country Healthcare, Inc.

Consolidated Statements of Income (Unaudited, amounts in thousands,

except per share data) Three Months Ended Nine Months Ended

September 30, September 30, ------------------ ------------------ %

% 2008 2007 Change 2008 2007 Change --------- -------- ------

--------- -------- ------ Revenue from services $178,134 $185,124

(4%) $528,336 536,556 (2%) Operating expenses: Direct operating

expenses 130,696 139,266 (6%) 390,081 408,606 (5%) Selling, general

and administrative expenses 33,475 31,486 6% 97,763 90,927 8% Bad

debt expense 203 - ND 687 1,265 (46%) Depreciation 1,789 1,370 31%

5,352 4,359 23% Amortization 713 622 15% 2,029 1,361 49% Legal

settlement charge - - - - 34 ND --------- -------- ---------

-------- Total operating expenses 166,876 172,744 (3%) 495,912

506,552 (2%) --------- -------- --------- -------- Income from

operations 11,258 12,380 (9%) 32,424 30,004 8% Other expenses:

Foreign exchange loss (gain) (79) 59 (234%) (119) 59 (302%)

Interest expense, net 788 808 (2%) 1,960 1,823 8% ---------

-------- --------- -------- Income before income taxes 10,549

11,513 (8%) 30,583 28,122 9% Income tax expense 4,378 4,464 (2%)

12,191 10,810 13% --------- -------- --------- -------- Net income

$ 6,171 $ 7,049 (12%) $ 18,392 17,312 6% ========= ========

========= ======== Net income per common share: Basic $ 0.20 $ 0.22

(9%) $ 0.60 $ 0.54 11% ========= ======== ========= ========

Diluted $ 0.20 $ 0.22 (9%) $ 0.59 $ 0.53 11% ========= ========

========= ======== Weighted average common shares outstanding:

Basic 30,710 31,954 30,842 32,041 Diluted 30,911 32,433 31,032

32,631 ND - Not determinable *T -0- *T Cross Country Healthcare,

Inc. Condensed Consolidated Balance Sheets (Unaudited, amounts in

thousands) September 30, December 31, 2008 2007 -------------

------------ Assets Current assets: Cash and cash equivalents $

12,637 $ 9,066 Restricted cash 5,000 - Accounts receivable, net

126,380 116,133 Deferred tax assets 6,472 6,172 Other current

assets 18,962 17,768 ------------ ------------ Total current assets

169,451 149,139 Property and equipment, net 25,639 23,460

Trademarks, net 64,815 19,153 Goodwill, net 366,340 326,119 Other

identifiable intangible assets, net 36,933 15,996 Debt issuance

costs, net 2,910 424 Other long-term assets 1,254 1,017

------------ ------------ Total assets $ 667,342 $ 535,308

============ ============ Liabilities and Stockholders' Equity

Current liabilities: Accounts payable and accrued expenses 12,885

10,203 Accrued employee compensation and benefits 39,015 26,102

Current portion of long-term debt 9,214 5,067 Income taxes payable

5,041 1,222 Other current liabilities 8,357 7,815 ------------

------------ Total current liabilities 74,512 50,409 Long-term debt

135,194 34,385 Non-current deferred tax liabilities 49,767 49,547

Other long-term liabilities 9,117 10,530 ------------ ------------

Total liabilities 268,590 144,871 Commitments and contingencies

Stockholders' equity: Common stock 3 3 Additional paid-in capital

237,093 245,844 Other stockholders' equity 161,656 144,590

------------ ------------ Total stockholders' equity 398,752

390,437 ------------ ------------ Total liabilities and

stockholders' equity $ 667,342 $ 535,308 ============ ============

*T -0- *T Cross Country Healthcare, Inc. Segment Data (a)

(Unaudited, amounts in thousands) Three Months Ended Nine Months

Ended September 30, September 30, ------------------

----------------- 2008 2007 % Change 2008 2007 % Change ---------

-------- -------- -------- -------- -------- Revenues: Nurse and

allied staffing $ 128,910 $145,780 (12%) $402,241 $433,497 (7%)

Physician staffing 10,831 - ND 10,831 - ND Clinical trials services

25,414 26,164 (3%) 75,181 65,444 15% Other human capital management

services 12,979 13,180 (2%) 40,083 37,615 7% --------- --------

-------- -------- $ 178,134 $185,124 (4%) $528,336 $536,556 (2%)

========= ======== ======== ======== Contribution income (b) Nurse

and allied staffing $ 14,332 $ 14,329 0% $ 41,132 $ 39,385 4%

Physician staffing 928 - ND 928 - ND Clinical trials services 3,755

5,064 (26%) 11,937 10,597 13% Other human capital management

services 1,589 1,639 (3%) 6,092 5,728 6% --------- --------

-------- -------- 20,604 21,032 (2%) 60,089 55,710 8% Unallocated

corporate overhead 6,844 6,660 3% 20,284 19,952 2% Depreciation

1,789 1,370 31% 5,352 4,359 23% Amortization 713 622 15% 2,029

1,361 49% Legal settlement charge - - ND - 34 (100%) ---------

-------- -------- -------- Income from operations $ 11,258 $ 12,380

$ 32,424 $ 30,004 ========= ======== ======== ======== *T -0- *T

Cross Country Healthcare , Inc. Other Financial Data (Unaudited)

Three Months Ended Nine Months Ended September 30, September 30,

------------------ ----------------- 2008 2007 2008 2007 ---------

-------- -------- -------- Net cash provided by operating

activities (in thousands) $ 13,760 $ 8,611 $ 40,932 $ 15,966 Nurse

and allied staffing statistical data: --------------------- FTEs

(c) 4,335 4,999 4,566 5,067 Weeks worked (d) 56,355 64,987 178,074

197,613 Average nurse and allied staffing revenue per FTE per week

(e) $ 2,287 $ 2,243 $ 2,259 $ 2,194 *T -0- *T (a) Segment data

provided is in accordance with FASB Statement 131. (b) Defined as

income from operations before depreciation, amortization, and

corporate expenses not specifically identified to a reporting

segment. Contribution income is a financial measure used by

management when assessing segment performance. (c) FTEs represent

the average number of nurse and allied contract staffing personnel

on a full-time equivalent basis. (d) Weeks worked is calculated by

multiplying the FTEs by the number of weeks during the respective

period. (e) Average nurse and allied staffing revenue per FTE per

week is calculated by dividing the nurse and allied staffing

revenue by the number of week worked in the respective periods.

Nurse and allied staffing revenue includes revenue from permanent

placement of nurses. *T Cross Country Healthcare, Inc.

(Nasdaq:CCRN) today reported revenue of $178.1 million in the third

quarter ended September 30, 2008, a 4% decrease from revenue of

$185.1 million in the prior year quarter. Net income for the third

quarter of 2008 was $6.2 million, or $0.20 per diluted share,

compared to net income of $7.0 million, or $0.22 per diluted share

in the prior year quarter. Cash flow from operations for the third

quarter of 2008 was $13.8 million. For the nine months ended

September 30, 2008, the Company generated revenue of $528.3 million

and net income of $18.4 million, or $0.59 per diluted share. This

compares to revenue of $536.6 million and net income of $17.3

million, or $0.53 per diluted share, in the first nine months of

the prior year. Cash flow from operations for the first nine months

of 2008 was $40.9 million. �While we generated strong cash flow,

improved our gross profit margin and further diversified our

revenue mix with the acquisition of the locum tenens (temporary

physician staffing) business of MDA Holdings, Inc. (MDA) during the

third quarter, the overall environment in which we operate

deteriorated significantly,� said Joseph A. Boshart, President and

Chief Executive Officer of Cross Country Healthcare. �Demand,

booking activity and volume in our travel nurse staffing business

weakened, in large part, due to hospital clients being increasingly

reluctant to commit to a contract nurse most often citing low

patient census and budget reductions for their hesitation. Our

other businesses also experienced similar reluctance on the part of

clients to commit. Nonetheless, our newly acquired temporary

physician staffing business continued its year-over-year growth due

to greater demand for physicians as they are revenue generators for

hospitals and physician practice groups,� Mr. Boshart said.

�Although our near-term expectations are disappointing to me, and

I�m sure to our shareholders, Cross Country Healthcare remains on

very sound financial footing with a prudent level of debt and cash

flow well in excess of what is required to operate our business on

a day-to-day basis. Given the general tone and uncertainty of the

economy, including a further weakening of labor markets, our

operations teams will be focused on continuing to provide a

high-level of service to our healthcare facility customers and the

healthcare professionals that look to us for assignment

opportunities. Meanwhile, our management team will be focused on

fundamentals such as cost control and continuing to de-lever our

balance sheet using our strong cash flow. I would like to add that

over our history, we have managed through several industry

down-turns � and we have always generated positive quarterly

earnings. Moreover, consistent with our strategy that we have

communicated for the past several quarters, with the MDA

acquisition we successfully diversified into a sector of our

industry that has shown consistent growth over the past decade,�

added Mr. Boshart. Nurse and Allied Staffing For the third quarter

of 2008, the nurse and allied staffing business segment (travel and

per diem nurse and travel allied staffing) generated revenue of

$128.9 million, a 12% decline from the prior year quarter. The

decrease reflected a 13% decline in staffing volume from the prior

year quarter that was partially offset by a 2.4% year-over-year

increase in the travel nurse staffing hourly bill rate.

Contribution income (defined as income from operations before

depreciation, amortization and corporate expenses not specifically

identified to a reporting segment) was relatively flat at $14.3

million in the third quarters of both 2008 and 2007. For the third

quarter of 2008, the Company experienced continued expansion of the

bill-pay spread and favorable insurance expenses. However, these

improvements were essentially offset by the impact of lower

staffing volume. For the first nine months of 2008, segment revenue

decreased 7% to $402.2 million from $433.5 million in the same

period a year ago, while contribution income increased 4% to $41.1

million from $39.4 million in the prior year period. Physician

Staffing For the third quarter of 2008, physician staffing

generated revenue of $10.8 million and $0.9 million in contribution

income since the Company�s acquisition of MDA on September 9, 2008.

Pro-forma for the current quarter, physician staffing days filled

increased 4% from the prior year quarter to 28,190 and revenue per

day filled increased 8% to $1,584. Physician staffing days filled

is derived by dividing the physician staffing hours filled during

the respective period by 8 hours. Revenue per day filled represents

segment revenue divided by the number of days filled for the

respective period. Clinical Trials Services For the third quarter

of 2008, the clinical trials services segment generated revenue of

$25.4 million, a decrease of 3% from the prior year quarter due

primarily to a decline in the drug safety business from the prior

year quarter related to a specific client. Contribution income

decreased 26% in the third quarter of 2008 to $3.8 million from the

same quarter of 2007 primarily due to a reduction in contribution

from the drug safety business. For the first nine months of 2008,

segment revenue increased 15% to $75.2 million from $65.4 million

in the same period a year ago, while contribution income increased

13% to $11.9 million from $10.6 million in the prior year period.

Other Human Capital Management Services For the third quarter of

2008, the other human capital management services business segment

(education and training and retained search) generated revenue of

$13.0 million, a 2% decrease from the same quarter in the prior

year, reflecting lower revenue generated by the education and

training business that was partially offset by higher revenue in

the retained search business. Segment contribution income decreased

3% to $1.6 million in the third quarter of 2008 from the prior year

quarter, reflecting a decline in contribution from the retained

search business that was mostly offset by an increase in

contribution from the education and training business. For the

first nine months of 2008, segment revenue increased 7% to $40.1

million from $37.6 million in the same period a year ago, while

contribution income increased 6% to $6.1 million from $5.7 million

in the prior year period. Debt Repayments/Borrowings In conjunction

with the MDA acquisition, the Company entered into an amended and

restated $200.0 million syndicated credit facility with Wachovia

Capital Markets, LLC�and certain of its affiliates, Banc of America

Securities, LLC, and certain other lenders. Pursuant to this

financing, the Company amended and kept in place its existing $75.0

million revolving credit facility and entered into a new $125.0

million 5-year term loan, from which the proceeds were used to

finance the acquisition and to pay-down approximately $6.8 million

of debt outstanding on the revolving credit facility. During the

third quarter of 2008, the Company repaid a net of $15.0 million of

borrowings under its revolving credit facility. At September 30,

2008, the Company had $144.4 million of total debt on its balance

sheet and a debt, net of unrestricted cash, to total capitalization

ratio of 24%. Stock Repurchase Program Update Cross Country

Healthcare refrained from repurchasing its common stock during the

third quarter of 2008 due to the timing of negotiations and

subsequent completion of the MDA acquisition. As of September 30,

2008, the Company can repurchase up to 1,441,139 shares of its

common stock under the current authorization approved in February

2008. Under this authorization, the shares may be repurchased from

time-to-time in the open market subject to the terms of the

Company�s credit agreement. Such repurchases may be discontinued at

any time at the discretion of the Company. Pursuant to the terms of

the Company�s credit agreement, as long as its debt leverage ratio

(as defined in the Company�s credit agreement) is above 2 to 1 the

Company cannot repurchase shares. As of the end of the third

quarter, the Company's debt leverage ratio was approximately 2.15

to 1. At September 30, 2008, the Company had approximately 30.8

million shares outstanding. Guidance for Fourth Quarter 2008 The

following statements are based on current management expectations.

Such statements are forward-looking and actual results may differ

materially. These statements do not include the potential impact of

any future mergers, acquisitions and other business combinations,

any impairment charges, any significant legal proceedings or any

significant repurchases of our common stock. The Company expects

revenue in the fourth quarter of 2008 to be in the $195 million to

$199 million range and earnings per diluted share to be in the

range of $0.15 to $0.17. For the full-year, the Company expects

2008 revenue to be in the $723 million to $727 million range and

earnings per diluted share to be in the range of $0.74 to $0.76.

Quarterly Conference Call Cross Country Healthcare will hold a

conference call on Monday, November 3rd at 10:00 a.m. Eastern Time

to discuss its third quarter 2008 financial results. This call will

be webcast live by CCBN/Thomson and may be accessed at the

Company's web site at www.crosscountryhealthcare.com or by dialing

877-917-1549 from anywhere in the U.S. or by dialing 312-470-7109

from non-U.S. locations � Passcode: Cross Country. A replay of the

webcast will be available through November 17th. A replay of the

conference call will be available by telephone from approximately

noon on November 3rd until November 17th by calling 800-756-0131

from anywhere in the U.S. or 203-369-3001 from non-U.S. locations.

About Cross Country Healthcare Cross Country Healthcare, Inc. is a

leading provider of nurse and allied staffing services in the

United States, a national provider of multi-specialty locum tenens

(temporary physician staffing) services, a provider of clinical

trials services to global pharmaceutical and biotechnology

customers, as well as a provider of other human capital management

services focused on healthcare. The Company has approximately 5,000

contracts with hospitals, healthcare providers, pharmaceutical and

biotechnology customers, and other healthcare organizations. Copies

of this and other news releases as well as additional information

about Cross Country Healthcare can be obtained online at

www.crosscountryhealthcare.com. Shareholders and prospective

investors can also register at the corporate website to

automatically receive the Company's press releases, SEC filings and

other notices by e-mail. In addition to historical information,

this press release contains statements relating to our future

results (including certain projections and business trends) that

are �forward-looking statements� within the meaning of Section�27A

of the Securities Act of 1933, as amended, and Section�21E of the

Securities Exchange Act of 1934, as amended (the �Exchange Act�),

and are subject to the �safe harbor� created by those sections.

Forward-looking statements consist of statements that are

predictive in nature, depend upon or refer to future events. Words

such as �expects�, �anticipates�, �intends�, �plans�, �believes�,

�estimates�, �suggests�, �seeks�, �will� and variations of such

words and similar expressions intended to identify forward-looking

statements. Forward-looking statements involve known and unknown

risks, uncertainties and other factors that may cause our actual

results and performance to be materially different from any future

results or performance expressed or implied by these

forward-looking statements. These factors include, without

limitation, the following: our ability to attract and retain

qualified nurses, physicians and other healthcare personnel, costs

and availability of short-term housing for our travel nurses and

physicians, demand for the healthcare services we provide, both

nationally and in the regions in which we operate, the functioning

of our information systems, the effect of existing or future

government regulation and federal and state legislative and

enforcement initiatives on our business, our clients� ability to

pay us for our services, our ability to successfully implement our

acquisition and development strategies, the effect of liabilities

and other claims asserted against us, the effect of competition in

the markets we serve, our ability to successfully defend the

Company, its subsidiaries, and its officers and directors on the

merits of any lawsuit or determine its potential liability, if any,

and other factors set forth in Item 1A. �Risk Factors� in the

Company�s Annual Report on Form�10-K for the year ended

December�31, 2007, and our other Securities and Exchange Commission

filings made during 2008. Although we believe that these statements

are based upon reasonable assumptions, we cannot guarantee future

results and readers are cautioned not to place undue reliance on

these forward-looking statements, which reflect management�s

opinions only as of the date of this press release. There can be no

assurance that (i)�we have correctly measured or identified all of

the factors affecting our business or the extent of these factors�

likely impact, (ii)�the available information with respect to these

factors on which such analysis is based is complete or accurate,

(iii)�such analysis is correct or (iv)�our strategy, which is based

in part on this analysis, will be successful. The Company

undertakes no obligation to update or revise forward-looking

statements. All references to �we,� �us,� �our,� or �Cross Country�

in this press release mean Cross Country Healthcare, Inc., its

subsidiaries and affiliates. Cross Country Healthcare, Inc.

Consolidated Statements of Income (Unaudited, amounts in thousands,

except per share data) � � � � � � Three Months Ended Nine Months

Ended September 30, September 30, 2008 2007 %Change 2008 2007

%Change � � Revenue from services $ 178,134 $ 185,124 (4 %) $

528,336 536,556 (2 %) Operating expenses: Direct operating expenses

130,696 139,266 (6 %) 390,081 408,606 (5 %) Selling, general and

administrative expenses 33,475 31,486 6 % 97,763 90,927 8 % Bad

debt expense 203 - ND 687 1,265 (46 %) Depreciation 1,789 1,370 31

% 5,352 4,359 23 % Amortization 713 622 15 % 2,029 1,361 49 % Legal

settlement charge � - � � - - � - � � 34 ND Total operating

expenses � 166,876 � � 172,744 (3 %) � 495,912 � � 506,552 (2 %)

Income from operations 11,258 12,380 (9 %) 32,424 30,004 8 % Other

expenses: Foreign exchange loss (gain) (79 ) 59 (234 %) (119 ) 59

(302 %) Interest expense, net � 788 � � 808 (2 %) � 1,960 � � 1,823

8 % Income before income taxes 10,549 11,513 (8 %) 30,583 28,122 9

% Income tax expense � 4,378 � � 4,464 (2 %) � 12,191 � � 10,810 13

% Net income $ 6,171 � $ 7,049 (12 %) $ 18,392 � � 17,312 6 % � Net

income per common share: Basic $ 0.20 � $ 0.22 (9 %) $ 0.60 � $

0.54 11 % Diluted $ 0.20 � $ 0.22 (9 %) $ 0.59 � $ 0.53 11 % �

Weighted average common shares outstanding: � Basic 30,710 31,954

30,842 32,041 Diluted 30,911 32,433 31,032 32,631 � ND - Not

determinable Cross Country Healthcare, Inc. Condensed Consolidated

Balance Sheets (Unaudited, amounts in thousands) � � September 30,

December 31, 2008 2007 Assets Current assets: Cash and cash

equivalents $ 12,637 $ 9,066 Restricted cash 5,000 - Accounts

receivable, net 126,380 116,133 Deferred tax assets 6,472 6,172

Other current assets � 18,962 � 17,768 Total current assets 169,451

149,139 Property and equipment, net 25,639 23,460 Trademarks, net

64,815 19,153 Goodwill, net 366,340 326,119 Other identifiable

intangible assets, net 36,933 15,996 Debt issuance costs, net 2,910

424 Other long-term assets � 1,254 � 1,017 Total assets $ 667,342 $

535,308 � Liabilities and Stockholders' Equity Current liabilities:

Accounts payable and accrued expenses 12,885 10,203 Accrued

employee compensation and benefits 39,015 26,102 Current portion of

long-term debt 9,214 5,067 Income taxes payable 5,041 1,222 Other

current liabilities � 8,357 � 7,815 Total current liabilities

74,512 50,409 � Long-term debt 135,194 34,385 Non-current deferred

tax liabilities 49,767 49,547 Other long-term liabilities � 9,117 �

10,530 Total liabilities 268,590 144,871 � Commitments and

contingencies � Stockholders' equity: Common stock 3 3 Additional

paid-in capital 237,093 245,844 Other stockholders' equity �

161,656 � 144,590 Total stockholders' equity 398,752 390,437 � �

Total liabilities and stockholders' equity $ 667,342 $ 535,308

Cross Country Healthcare, Inc. Segment Data (a) (Unaudited, amounts

in thousands) � � � � � � Three Months Ended Nine Months Ended

September 30, September 30, 2008 2007 % Change 2008 2007 % Change �

Revenues: Nurse and allied staffing $ 128,910 $ 145,780 (12 %) $

402,241 $ 433,497 (7 %) Physician staffing 10,831 - ND 10,831 - ND

Clinical trials services 25,414 26,164 (3 %) 75,181 65,444 15 %

Other human capital management services � 12,979 � 13,180 (2 %) �

40,083 � 37,615 7 % $ 178,134 $ 185,124 (4 %) $ 528,336 $ 536,556

(2 %) � Contribution income (b) Nurse and allied staffing $ 14,332

$ 14,329 0 % $ 41,132 $ 39,385 4 % Physician staffing 928 - ND 928

- ND Clinical trials services 3,755 5,064 (26 %) 11,937 10,597 13 %

Other human capital management services � 1,589 � 1,639 (3 %) �

6,092 � 5,728 6 % 20,604 21,032 (2 %) 60,089 55,710 8 % �

Unallocated corporate overhead 6,844 6,660 3 % 20,284 19,952 2 %

Depreciation 1,789 1,370 31 % 5,352 4,359 23 % Amortization 713 622

15 % 2,029 1,361 49 % Legal settlement charge � - � - ND � - � 34

(100 %) Income from operations $ 11,258 $ 12,380 $ 32,424 $ 30,004

Cross Country Healthcare , Inc. Other Financial Data (Unaudited) �

� � � � � � � � � � � � � � � Three Months Ended Nine Months Ended

September 30, � September 30, 2008 2007 2008 2007 Net cash provided

by operating activities (in thousands) $ 13,760 $ 8,611 $ 40,932 $

15,966 � Nurse and allied staffing statistical data: FTEs (c) 4,335

4,999 4,566 5,067 Weeks worked (d) 56,355 64,987 178,074 197,613

Average nurse and allied staffing revenue per FTE per week (e) $

2,287 $ 2,243 $ 2,259 $ 2,194 (a) Segment data provided is in

accordance with FASB Statement 131. (b) Defined as income from

operations before depreciation, amortization, and corporate

expenses not specifically identified to a reporting segment.

Contribution income is a financial measure used by management when

assessing segment performance. (c) FTEs represent the average

number of nurse and allied contract staffing personnel on a

full-time equivalent basis. (d) Weeks worked is calculated by

multiplying the FTEs by the number of weeks during the respective

period. (e) Average nurse and allied staffing revenue per FTE per

week is calculated by dividing the nurse and allied staffing

revenue by the number of week worked in the respective periods.

Nurse and allied staffing revenue includes revenue from permanent

placement of nurses.

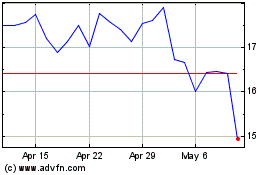

Cross Country Health (NASDAQ:CCRN)

Historical Stock Chart

From May 2024 to Jun 2024

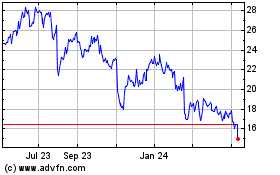

Cross Country Health (NASDAQ:CCRN)

Historical Stock Chart

From Jun 2023 to Jun 2024