Crocs, Inc. (NASDAQ: CROX) today reported financial results for

the fourth quarter and fiscal year ended December 31, 2008.

Revenues for the three months ended December 31, 2008 decreased

43.9% to $126.1 million compared to $224.8 million for the three

months ended December 31, 2007. Revenues for the year ended

December 31, 2008 decreased 14.8% to $721.6 million compared to

$847.4 million for the year ended December 31, 2007. For the year

ended December 31, 2008, compared to the year ended December 31,

2007, changes in our regional revenue streams include the

following:

- Revenue in Asia increased 22.4%

to $204.9 million;

- Revenue in Europe decreased

16.2% to $150.7 million; and

- Revenue in the Americas

decreased 26.9% to $366 million.

For the year ended December 31, 2008, changes in our channel

revenue streams include the following:

- Revenues generated from retail

sales increased 68.7% to $125.8 million;

- Revenues generated from internet

sales increased 28.9% to $43.7 million; and

- Revenues generated from

wholesale sales decreased 25.3% to $552.1 million.

The Company reported a net loss of $33.2 million, or ($0.40) per

diluted share for the three months ended December 31, 2008 compared

to net income of $38.3 million, or $0.45 per diluted share for the

three months ended December 31, 2007. The reported net loss of

$33.2 million during the three months ended December 31, 2008

includes approximately $21.1 million in pre-tax foreign currency

exchange rate non cash losses primarily on intercompany balances

and approximately $0.90 million in pre-tax, restructuring charges

primarily related to the shutdown of the Company�s manufacturing

facility in Brazil. Excluding the foreign currency exchange rate

losses, net of tax, during the quarter of $16.1 million, or ($0.20)

per diluted share, the Company�s non-GAAP net loss amounted to

$17.1 million or ($0.20) per diluted share in the three months

ended December 31, 2008.

The Company reported a net loss of $183.6 million or ($2.22) per

diluted share for the year ended December 31, 2008 compared to net

income of $168.2 million or $2.00 per diluted share for the year

ended December 31, 2007. The reported loss of $183.6 million

includes the following pre-tax charges:

- $25.4 million in non-cash

foreign currency exchange rate losses primarily on intercompany

balances;

- $8.6 million in restructuring

charges related to the shutdown of the Company�s manufacturing

facilities in Brazil and in Canada;

- $65.4 million representing the

net non-cash change of inventory write-downs from December 31, 2007

to December 31, 2008

- $45.8 million in non-cash asset

impairment charges related to goodwill, intangible assets and the

write-off of excess equipment and tooling.

Excluding these non-cash charges, non-GAAP net loss for 2008 was

$37.2 million or ($0.44) per diluted share.

Gross profit for the three months ended December 31, 2008 was

$56.0 million or 44.4% of revenues, compared to $125.8 million or

56.0% of revenues for the three months ended December 31, 2007.

Gross profit for the year ended December 31, 2008 was $234.0

million or 32.4% of revenues, compared to $497.6 million or 58.7%

of revenues for the year ended December 31, 2007.

Selling, general and administrative expenses, including foreign

currency exchange rate gains and losses, for the three months ended

December 31, 2008 were $97.6 million or 77.4% of revenues compared

to $71.9 million or 32.0% of revenues in the three months ended

December 31, 2007. Selling, general and administrative expenses,

including foreign currency exchange rate gains and losses, for the

year ended December 31, 2008, were $368.8 million or 51% of

revenues, compared to $260 million or 30.0% of revenues for the

year ended December 31, 2007.

On a non-GAAP basis selling, general and administrative

expenses, excluding foreign currency exchange rate gains and

losses, for the three months ended December 31, 2008 decreased

approximately $13.3 million to $76.5 million from $89.8 million,

excluding foreign currency exchange rate gains and losses, for the

three months ended September 30, 2008 as a result of cost

reductions actions in the following areas:

- Sales and marketing;

- Corporate sponsorships;

- Trade shows;

- Legal expense;

- Consulting and contract

labor;

- Travel expenses;

- Reduction of our global

headcount; and

- Reduction in our capital

expenditures from initial plan levels.

Balance Sheet

The Company increased its cash and cash equivalents to $51.7

million as of December 31, 2008, from $36.3 million as of December

31, 2007. Borrowings under the Company�s credit facility were $22.4

million at December 31, 2008 compared to $7.1 million at December

31, 2007. The Company extended the term of its bank credit facility

through April 2, 2009 and is currently in discussions with other

lending institutions to arrange an asset-backed borrowing

facility.

The Company had accounts receivable of $35.3 million as of

December 31, 2008 compared to $153.0 million as of December 31,

2007. This reduction is due to our accounts receivable collections

improving as days sales outstanding decreased from 63 days for the

three months ended December 31, 2007 to 26 days for the three

months ended December 31, 2008.

Inventories decreased $105.2 million to $143.2 million compared

to $248.4 million as of December 31, 2007, primarily as a result of

inventory write-downs during the three months ended September 30,

2008.

Ron Snyder, President and Chief Executive Officer of Crocs, Inc.

commented: �While our fourth quarter results were better than

expectations, our year-over-year comparisons reflect the ongoing

global economic slowdown that began approximately 12-months ago.

Throughout 2008, we took several important steps to address the

decline in consumer spending which we believe will better position

our Company in this challenging environment. This included

rationalizing our manufacturing base, consolidating our

distribution centers and warehouse space, and lowering our

worldwide headcount. We also continue to reduce major categories of

our SG&A including marketing, legal and headcount, somewhat

offset by increases in our retail and internet division rollouts.

We are disappointed with our full year operating results; however,

we are pleased by our improved cash, accounts receivable, and

inventory positions versus a year ago. Importantly, we believe that

the right sizing of our infrastructure combined with our enhanced

balance sheet will allow us to internally fund our working capital

requirements in 2009.�

Guidance

For the first quarter ending March 31, 2009, the Company expects

to generate revenues of between $110 to $135 million and a diluted

loss per share of approximately $(0.32) to $(0.17). Our guidance

includes an estimated non-cash foreign currency exchange loss of

$10 million. Due to global market uncertainty, we are not giving

annual guidance at this time.

Mr. Snyder concluded, �We are confident that our global brand

equity remains strong and we continue to be optimistic about the

long-term potential of our business. We begin 2009 focused on

leveraging our core competencies in order to provide consumers with

new and compelling products that broaden our global market share

and help diversify our operations. At the same time our entire

organization is committed to improving productivity in order to

generate cash and drive profitability going forward.�

Conference Call Information

A conference call to discuss fourth quarter and fiscal 2008

year-end financial results is scheduled for today (February 19,

2009) at 5:00 PM Eastern Time. A webcast of the call will take

place simultaneously and can be accessed by clicking the �Investor

Relations� link under the Company section on www.crocs.com or at

www.earnings.com. To listen to the broadcast, your computer must

have Windows Media Player installed. If you do not have Windows

Media Player, go to the latter site prior to the call, where you

can download the software for free.

About Crocs, Inc.

Crocs, Inc. is a designer, manufacturer and retailer of footwear

for men, women and children under the Crocs� brand.

All Crocs� brand shoes feature Crocs� proprietary closed-cell

resin, Croslite�, which represents a substantial innovation in

footwear. The Croslite� material enables Crocs to produce soft,

comfortable, lightweight, superior-gripping, non-marking and

odor-resistant shoes. These unique elements make Crocs� footwear

ideal for casual wear, as well as for professional and recreational

uses such as boating, hiking, hospitality and gardening. The

versatile use of the material has enabled Crocs to successfully

market its products to a broad range of consumers.

Crocs� shoes are sold in 100 countries and come in a wide array

of colors and styles. Please visit www.crocs.com for additional

information.

Forward-looking statements

The matters regarding the future discussed in this news release

include �forward-looking statements� within the meaning of the

Private Securities Litigation Reform Act of 1995. These statements

involve known and unknown risks, uncertainties and other factors

which may cause our actual results, performance or achievements to

be materially different from any future results, performances, or

achievements expressed or implied by the forward-looking

statements. These risks and uncertainties include, but are not

limited to, the following: macroeconomic issues, including, but not

limited to, the current global financial crisis; our ability to

obtain adequate financing; our significant recent expansion; our

ability to manage our future growth effectively; changing fashion

trends; our defense and the ultimate outcome of a pending class

action lawsuit; our ability to accurately anticipate and respond to

seasonal or quarterly fluctuations in our operating results; our

management and information systems infrastructure; our ability to

obtain and protect intellectual property rights; our reliance on

third party manufacturing and logistics providers for the

production and distribution of products; our limited manufacturing

capacity and distribution channels; our reliance on a single source

supply for certain raw materials; inherent risks associated with

the manufacture, distribution and sale of our products overseas;

our reliance on market acceptance of the small number of products

we sell; our ability to develop and sell new products; our limited

operating history; our ability to accurately forecast consumer

demand for our products; our ability to maintain effective internal

controls; our ability to attract, assimilate and retain management

talent; retail environment; our ability to effectively market and

maintain a positive brand image; the effect of competition in our

industry; the effect of potential adverse currency exchange rate

fluctuations; and other factors described in our annual report on

Form 10-K under the heading �Risk Factors� and our subsequent

filings with the Securities and Exchange Commission. Readers are

encouraged to review that section and all other disclosures

appearing in our filings with the Securities and Exchange

Commission. We do not undertake any obligation to update publicly

any forward-looking statements, including, without limitation, any

estimate regarding revenues or earnings, whether as a result of the

receipt of new information, future events, or otherwise.

� Crocs, Inc. Consolidated Statements of Operations (In thousands,

except share and per share data) (unaudited) � � � � THREE MONTHS

ENDED TWELVE MONTHS ENDED December 31, December 31, 2008 2007 2008

2007

�

Revenues

$

126,092

$

224,800

�

$

721,589

�

$

847,350

Cost of sales 70,049 98,973 486,722 349,701 Restructuring Charges

901 Gross profit 56,043 125,827 233,966 497,649 � � Selling,

general and administrative expenses 76,484 75,307 343,361 269,937

Foreign Exchange (gain)/loss

21,091

(3,381)

�

25,439

�

(10,055)

Impairment Charges

483

-

�

45,784

�

-

Restructuring Charges

895

-

�

7,664

�

-

� Income (loss) from operations (42,910) 53,901 (188,282) 237,767 �

Interest expense

408

132 1,793 438 Other expense (income), net

217

(923) (565) (2,997) Income (loss) before taxes (43,535) 54,692

(189,510) 240,326 � Income tax expense (benefit)

(10,286)

16,408

�

(5,886)

�

72,098

� Net income (loss)

$

(33,249)

$

38,284

�

$

(183,624)

�

$

168,228

� Net income (loss) per share: Basic

$

(0.40)

$

0.47

�

$

(2.22)

�

$

2.08

Diluted

$

(0.40)

$

0.45

�

$

(2.22)

�

$

2.00

� Weighted average common shares: Basic

83,004,845

81,937,028

82,767,540

�

80,759,077 Diluted

83,004,845

85,240,020

82,767,540

�

84,194,883 � Crocs, Inc. Consolidated Balance Sheets (In thousands,

except share and per share data) (unaudited) � � December 31, �

December 31, 2008 2007

ASSETS Current assets: Cash and cash

equivalents

$

51,665

�

$

36,335

Restricted cash

0

�

300

Accounts receivable, net

35,305

�

152,919

Inventories, net of obsolescence

143,205

�

248,391

Deferred tax assets, net

12,729

�

12,140

Income tax receivable

18,858

�

-

Prepaid expenses and other current assets 13,415 17,865 �

Total

current assets 275,177 467,950 � Property and equipment, net

95,892 88,184 Restricted cash 2,922 1,014 Goodwill - 23,759 Other

intangibles, net 40,892 31,634 Deferred tax assets, net

18,130

�

8,051

Other assets

15,691

�

6,833

Total assets

$

448,704

�

$

627,425

�

LIABILITIES AND STOCKHOLDERS' EQUITY � Current

liabilities: Accounts payable

$

35,137

�

$

82,979

Accrued expenses and other liabilities

50,652

�

57,246

Accrued restructuring charges

1,439

�

-

Deferred tax liabilities, net

124

�

265

Income taxes payable

14,586

�

19,851

Notes payable and current installments of long-term debt

22,430

�

7,107

�

Total current liabilities 124,368 167,448 � Long-term

debt, net of current portion - 9 Deferred tax liabilities, net

4,809 1,858 Long term restructuring

959

�

-

Other liabilities 26,461 13,997 �

Total liabilities 156,597

183,312 � � Stockholders' equity: Common shares, par value $0.001

per share; 250,000,000 authorized, 83,543,501 and 82,198,426 shares

issued and outstanding in 2008 and 2007

84

�

83

Treasury Stock, 524,000 shares, at cost

(25,022)

�

(25,022)

Additional paid-in-capital

232,038

�

211,936

Deferred compensation

(246)

�

(2,402)

Retained earnings 65,685 249,309 Accumulated other comprehensive

income

19,568

�

10,209

Total stockholders' equity 292,107 444,113 �

Total

liabilities and stockholders' equity

$

448,704

�

$

627,425

Crocs, Inc. Reconciliation of GAAP Measures to Non-GAAP

Measures (In thousands, except share and per share data)

(Unaudited) � �

The Company prepares and reports

its financial statements in accordance with U.S. Generally Accepted

Accounting Principles ("GAAP"). Internally, management monitors the

operating performance of its business using non-GAAP metrics

similar to those below. These non-GAAP measures exclude the effects

of foreign exchange rate loss, restructuring activities, inventory

write-down, and asset impairment charges. In management's opinion,

these non-GAAP measures are important indicators of the continuing

operations of our business and provide better comparability between

reporting periods because they exclude items that may not be

indicative of current period results and provide a better baseline

for analyzing trends in our operations. The Company does not, nor

does it suggest that investors should, consider such non-GAAP

financial measures in isolation from, or as a substitute for,

financial information prepared in accordance with GAAP. The Company

believes the disclosure of the effects of these items increases the

reader's understanding of the underlying performance of the

business and that such non-GAAP financial measures provide

investors with an additional tool to evaluate our financial results

and assess our prospects for future performance.

� � � � �

Three months ended Three months ended

December 31, 2008 September 30, 2008 � GAAP selling,

general and administrative expense $ 97,575 $ 104,391 Foreign

currency loss � 21,091 �

(1

)

� 14,609

(1

)

Non-GAAP selling, general and administrative expense $ 76,484 � $

89,782 �

Three months ended December 31, 2008 GAAP

net loss $ (33,249 ) Foreign currency loss, net of tax � 16,108 �

(1

)

Non-GAAP net loss $ (17,141 ) � Non-GAAP net loss per diluted share

$ (0.20 )

(2

)

� � �

Year ended December 31, 2008 GAAP net loss

before income taxes $ (183,624 ) Foreign currency exchange losses

25,438 Restructuring charges 8,565 Inventory write-down charges

65,424 Asset impairment charges � 45,784 � Non-GAAP net loss before

income taxes � (38,413 ) Estimated income tax benefit � 1,191 �

(3

)

Non-GAAP net loss $ (37,222 ) � Non-GAAP net loss per diluted share

$ (0.44 )

(2

)

(1) In the three months ended December 31, 2008, the Company

experienced significant non-cash foreign currency exchange rate

loss. The proforma adjustments in the GAAP to non-GAAP

reconciliation above represent the add back of GAAP charges taken

in connection with our fourth quarter foreign currency exchange

rate loss, net of tax calculated based on our fourth quarter

effective tax rate of 23.6%

(2) As the Company reported a GAAP net loss for the quarter

ended December 31, 2008, the dilutive effect of stock options and

awards were not included in the computation of diluted earnings per

share because their inclusion would have been anti-dilutive.

(3) Income tax benefit estimated based on the full year

effective tax rate of 3.1% applied to non-GAAP net loss before

income taxes and quarterly effective tax rate of 23.6% for the

three months ended December 31, 2008

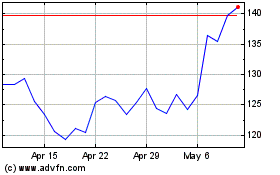

Crocs (NASDAQ:CROX)

Historical Stock Chart

From May 2024 to Jun 2024

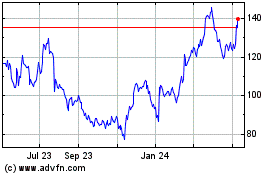

Crocs (NASDAQ:CROX)

Historical Stock Chart

From Jun 2023 to Jun 2024