false

0000712771

0000712771

2023-09-29

2023-09-29

0000712771

cnob:CommonStockCustomMember

2023-09-29

2023-09-29

0000712771

cnob:DepositarySharesCustomMember

2023-09-29

2023-09-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 29, 2023

CONNECTONE BANCORP, INC.

(Exact name of Company as specified in its charter)

|

New Jersey

|

000-11486

|

52-1273725

|

|

(State or other jurisdiction

|

(Commission

|

(IRS Employer

|

|

of incorporation)

|

File Number)

|

Identification No

|

|

|

|

|

|

301 Sylvan Avenue

|

|

|

|

Englewood Cliffs, New Jersey

|

|

07632

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Company's telephone number, including area code (201) 816-8900

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock

|

CNOB

|

NASDAQ

|

|

Depositary Shares (each representing a 1/40th interest in a share of 5.25% Series A Non-Cumulative, perpetual preferred stock)

|

CNOBP

|

NASDAQ

|

|

Item 5.02

|

Departure Of Directors Or Principal Officers; Election Of Directors; Appointment Of Principal Officers; Compensatory Arrangements Of Certain Officers

|

Separation and Release Agreement with Christopher J. Ewing

ConnectOne Bancorp, Inc. (the “Company”) announced that Christopher J. Ewing, who currently serves as the Company’s Chief Operations Officer, will separate employment with the Company effective December 31, 2023 (the “Separation Date”) to pursue other opportunities. In order to ensure an orderly transition, the Company and Mr. Ewing entered into a Separation and Release Agreement (the “Agreement”) as of September 29, 2023, which among other items, provides for the following:

| |

●

|

Mr. Ewing will continue to serve as an executive officer of the Company until the Separation Date and will be entitled to receive such 2023 cash incentive as he is awarded by the Company’s Compensation Committee pursuant to the terms of the Company’s Executive Incentive Plan;

|

| |

●

|

The vesting date of certain equity awards outstanding as of the Separation Date, as specified in the Agreement, will be accelerated;

|

| |

●

|

Mr. Ewing’s departure will be treated as a “termination without cause” under the terms of that certain Employment Agreement dated June 1, 2017 between Mr. Ewing, the Company and ConnectOne Bank (the “Employment Agreement”), entitling Mr. Ewing to a severance payment equal to $450,000 and continuation of certain insurance benefits for a period of eighteen (18) months; and

|

| |

●

|

Effective as of the Separation Date, the Employment Agreement is terminated (except with respect to certain provisions set forth therein with respect to competition, non-solicitation and confidentiality, which shall survive).

|

The foregoing description of the Agreement does not purport to be complete and is qualified in its entirety by reference to the Agreement, which is filed herewith as Exhibit 10.1 and is incorporated herein by reference.

On September 29, 2023, the Company issued a press release announcing that Dana Zeller, a Financial Services Executive with over 20 years of experience, has joined the Company as its Chief Strategic Operations Officer. In that role, Ms. Zeller will oversee the entire operations division of ConnectOne Bank, the Company’s wholly owned subsidiary.

A copy of the September 29, 2023 press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

|

Item 9.01

|

Financial Statements and Exhibits.

|

| |

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Company has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

CONNECTONE BANCORP, INC.

(Registrant)

|

|

| |

|

|

|

Dated: September 29, 2023

|

By:

|

/s/ William S. Burns |

|

|

|

|

WILLIAM S. BURNS |

|

|

|

|

Senior Executive Vice President and Chief Financial Officer |

|

Exhibit 10.1

SEPARATION AND RELEASE AGREEMENT

This Separation and Release Agreement ("Agreement") is made as of this 29th day of September, 2023 by and among Christopher J. Ewing ("Employee"), ConnectOne Bancorp, Inc., a New Jersey corporation (“CNOB”) and ConnectOne Bank, a New Jersey chartered commercial bank (“Bank”, and with CNOB, collectively the "Employer").

WHEREAS, Employee has dutifully served as an executive officer of Employer;

WHEREAS, Employer and Employee determined that the parties shall terminate the Employee Agreement, and Employee’s employment with Employer, amicably;

WHEREAS, Employer and Employee wish to ensure an orderly transition of Employee’s position with Employer;

WHEREAS, subject to the terms and conditions hereof, Employee’s last day of employment with Employer will be December 31, 2023 (the “Separation Date”);

WHEREAS, Employee and the Employer desire to enter into this Agreement to set forth their respective agreements regarding Employee’s separation from employment;

NOW, THEREFORE, for good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, Employee and the Employer agree as follows:

1. Employment Until Separation Date. From the date hereof until the Separation Date, Employee will remain employed as an executive officer of Employer on the same terms and conditions, including base salary, as he is employed under as of the date of this Agreement, provided that Employee will at all times continue to comply with all of Employer’s policies, procedures and requirements applicable to employees and the terms of this Agreement as well as the terms of that certain Employment Agreement dated as of June 1, 2017 by and among Employee, CNOB and the Bank (the “Employment Agreement”). Employer and employee agree and understand that Employee’s duties, as defined in the Employment Agreement, shall be reasonably modified to reflect the spirit of this Agreement to effectuate an amicable and orderly transition of Employee’s position with Employer.

2. 2023 Cash Incentive Plan Award. Provided Employee remains employed in good standing by the Employer through the Separation Date, Employee will remain eligible to receive a cash bonus under the Employer’s Executive Incentive Plan for his performance in 2023, despite the fact that the Employee will not be an employee of the Employer on the date the bonus is paid, currently expected to be in the first quarter of 2024. Employee’s performance in 2023 will be evaluated by the Employer’s Board Compensation Committee under the terms of the Executive Incentive Plan, and Employee will be eligible to receive such bonus award as the Compensation Committee shall determine.

3. Payment Under Employment Agreement. For purposes of that certain Employment Agreement dated as of June 1, 2017 by and among Employee, CNOB and the Bank (the “Employment Agreement”), provided Employee remains employed in good standing by the Employer through the Separation Date, the termination of Employee’s employment with Employer on the Separation Date shall be deemed a “termination without cause” under Section 6(d) of the Employment Agreement, and, provided that Employee complies with Section 11(g) of the Employment Agreement in accordance with its terms, Employer shall make the payments, and provide the benefits, provided for under Section 6(d) of the Employment Agreement to Employee under the terms provided for therein.

4. Equity Awards Outstanding as of Separation Date. Employer agrees that, provided Employee remains employed in good standing by the Employer through the Separation Date, those certain equity awards listed on Exhibit A hereto will be deemed vested as of the Separation Date, and Employee shall be entitled to settlement of the Performance Units noted on Exhibit A as and when determined by Employer’s Compensation Committee in accordance with the terms of the Performance Units. Employee acknowledges that all unvested equity awards as of the Separation Date (other than those listed on Exhibit A) will terminate as of the Separation Date and be of no further force or effect.

5. Supplemental Executive Retirement Plan. Provided Employee remains employed in good standing by the Employer through the Separation Date, Employee shall continue to vest in that certain Supplemental Executive Retirement Plan between Employee and Employer and (the “SERP”) until the Separation Date, and Employee’s rights thereunder after the Separation Date shall be as set forth in the SERP.

6. Termination of Existing Agreement; Preservation of Certain Provisions. Effective as of the Separation Date, except as set forth herein, the Employment Agreement shall be deemed terminated, and provided that each party has until such date complied with all of its or his obligations under the Employment Agreement and this Agreement until such date, all obligations of the Employee and the Employer to one another shall be deemed satisfied. Notwithstanding the forgoing, Sections 8, 9, 10 and 11(f) and (g) of the Employment Agreement will remain in full force and effect in accordance with their terms, and are deemed incorporated herein.

7. Employer Property. As of the Separation Date, Employee shall turn over or return to Employer any and all property in Employee’s possession, custody or control that belongs to the Employer.

8. Non-Disparagement. Employee agrees to forever refrain from making any disparaging remarks or other negative or derogatory statements, written or oral, to any third party relating to the Employer, or its parents, subsidiaries, officers, employees, members or agents or customers;. Employer agrees to forever refrain from making any disparaging remarks or other negative or derogatory statements, written or oral, to any third party relating to the Employee; provided, however that the forgoing shall not prohibit Employee or Employer from providing truthful testimony in any judicial or administrative proceeding, if Employee or Employer, as appropriate, is legally compelled to so testify. For purposes hereof, only statements made by the Chief Executive Officer, President, Chief Financial Officer and Director of Human Resources of the Employer shall be deemed statements made by or on behalf of the Employer.

9. Resignation From All Employer Positions; No Obligation to Re-Hire.

(a) By executing this Agreement, Employee is resigning from any and all additional positions Employee may hold with Employer, its affiliates or subsidiaries, including but not limited to (i) any positions with any compensation or benefit plans for the benefit of employees or directors of the Employer or (ii) any positions with any subsidiary or joint venture of the Employer, effective as of the Separation Date, or, with regard to positions with affiliates or subsidiaries of Employer, sooner if requested by Employer.

(b) Employee agrees that the Employer shall have no obligation, contractual or otherwise to hire, re-hire or re-employ Employee in the future.

10. Employee's Release. Upon the Separation Date, as a condition to receiving the payments under Section 6(d) of the Employment Agreement, as well as the benefits provided for hereunder, Employee shall provide Employer with a general release as required by section 11(g) of the Employment Agreement.

11. Equitable and other Remedies. Employee agrees that the Employer will suffer irreparable harm in the event that Employee breaches any of Employee’s obligations under this Agreement, and that it is impossible to measure in money the damages that will accrue to the Employer in the event of such a breach or threatened breach. Accordingly, if any action or proceeding is commenced by or on behalf of the Employer to enforce any of the provisions contained in this Agreement, Employee hereby waives the claim or defense that the Employer has an adequate remedy at law or has not been or is not being irreparably injured by such breach or threatened breach, and Employee agrees to not raise such claim or defense in any such action or proceeding. Employee further agrees that the Employer shall be entitled to temporary and permanent injunctive relief to restrain any breaches or further violations of this Agreement, without the posting of any bond, and that this right to injunctive relief shall be in addition to any and all of the Employer's other remedies and damages, including, but not limited to, costs and reasonable attorney's fees incurred as a result of said breach or threatened breach.

(a) The Employer, to the full extent permitted by law, shall indemnify Employee for any claims arising out of related to Employee’s employment as an officer of Employer. Expenses (including reasonable attorneys’ fees) incurred by Employee in defending any civil, criminal, administrative, or investigative action, suit or proceeding for which Employee may be entitled to indemnification shall be paid by the Employer in advance of the final disposition of such action, suit or proceeding (directly to counsel retained by Employer to represent Employee) provided that Employee has provided an undertaking to repay such amount if it shall ultimately be determined that he is not entitled to indemnification under the New Jersey Business Corporation Act or the New Jersey Banking Act if 1948, as amended.

12. Entire Agreement. This Agreement and the exhibits hereto are the complete agreement of the parties with respect to the subject matter herein, and, except as otherwise provided for herein, supersedes all agreements previously made between the parties relating to its subject matter. This Agreement may not be amended or modified except by an agreement in writing signed by both parties.

13. Liability for Breach of Agreement. Any party found by a court of competent jurisdiction to be in breach of this Agreement shall be liable for all reasonable attorneys' fees and costs incurred by the non-breaching party in connection with any efforts to enforce this Agreement against the party found to be in breach.

14. Voluntary Nature of Agreement. Employee warrants, represents and acknowledges that this Agreement is entered into by Employee knowingly and voluntarily as an act of Employee’s own free will; that Employee is of sound mind; and that Employee is laboring under no physical or mental infirmity that would affect either Employee’s capacity to understand the terms of this Agreement or to freely enter into and be bound by the provisions of this Agreement. Employee has been advised that Employee should have this Agreement reviewed by a legal representative of Employee’s choice.

15. Governing Law/Forum Selection. This Agreement shall be governed by the laws of the State of New Jersey. The parties agree that all disputes arising under this Agreement shall be resolved in the courts of the state of New Jersey sitting in Bergen County, or the federal district court for the District of New Jersey sitting on Newark, New Jersey.

16. Counterparts. This Agreement may be executed in one or more counterparts, each of which shall be considered an original and together which shall constitute one and the same instrument.

17. 409A. The payments and benefits described herein are intended to either comply with, or be exempt from, the requirements of Section 409A of the Internal Revenue Code of 1986, as amended and the parties intend that this Agreement will be administered and interpreted consistent with that intention.

I have read the foregoing Agreement and I accept and agree to its provisions and hereby execute it voluntarily with full understanding of its consequences.

[Signatures on Next Page]

[Signature Page to Separation and Release Agreement]

| CONNECTONE BANCORP, INC. |

|

| |

|

| By: |

/s/ Frank Sorrentino III |

|

| |

Name: Frank Sorrentino III

Title: Chairman & CEO

|

|

| |

|

| CONNECTONE BANK |

|

| |

|

| By: |

/s/ Frank Sorrentino III |

|

| |

Name: Frank Sorrentino III

Title: Chairman & CEO

|

|

| |

|

| /s/ Christopher J. Ewing |

|

| Christopher J. Ewing |

|

EXHIBIT A

6,356 Deferred Stock Units

4,457 Performance Units

Exhibit 99.1

DANA ZELLER, STRATEGIC AND INNOVATIVE OPERATIONS

EXECUTIVE, JOINS CONNECTONE

Englewood Cliffs, NJ: ConnectOne Bancorp (NASDAQ “CNOB”), the holding company for ConnectOne Bank, an industry leading commercial bank, announced today the hiring of Dana Zeller, a leading Financial Services Executive as Chief Strategic Operations Officer.

With over 20 years of experience at both banks and fintechs, Ms. Zeller brings with her an impressive track record in organizational leadership and infrastructure development, as well as a deep understanding of transformational financial services. In her position, Ms. Zeller will play a pivotal role in supporting ConnectOne Bank’s strategic priorities, prudent growth, and people-first mission as she oversees the entire operations division of the bank.

“We are thrilled to welcome Dana Zeller to the ConnectOne team. Her extensive background and passion for innovation aligns with ConnectOne’s commitment to building a people-first modern financial services company,” said Elizabeth Magennis, President of ConnectOne Bank. “With the rapid evolution of the banking landscape, the intersection of strategy and operations has become increasingly critical, and Ms. Zeller brings a wealth of expertise to lead the bank's efforts as we position ConnectOne for the future.”

Ms. Zeller’s appointment comes on the heels of the addition of Ali Mattera as Chief Digital Officer, underscoring the company’s dedication to growth and innovation.

Separately, the Company, announced that Christopher Ewing, Chief Operations Officer, will be leaving the Company effective December 31, 2023, to pursue other personal and professional interests.

Investor Contact:

William S. Burns

Senior Executive VP & CFO

201.816.4474; bburns@cnob.com

Media Contact:

Shannan Weeks, MWW

732.299.7890; sweeks@mww.com

v3.23.3

Document And Entity Information

|

Sep. 29, 2023 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

CONNECTONE BANCORP, INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Sep. 29, 2023

|

| Entity, Incorporation, State or Country Code |

NJ

|

| Entity, File Number |

000-11486

|

| Entity, Tax Identification Number |

52-1273725

|

| Entity, Address, Address Line One |

301 Sylvan Avenue

|

| Entity, Address, City or Town |

Englewood Cliffs

|

| Entity, Address, State or Province |

NJ

|

| Entity, Address, Postal Zip Code |

07632

|

| City Area Code |

201

|

| Local Phone Number |

816-8900

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000712771

|

| CommonStock Custom [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

CNOB

|

| Security Exchange Name |

NASDAQ

|

| DepositaryShares Custom [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Depositary Shares

|

| Trading Symbol |

CNOBP

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=cnob_CommonStockCustomMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=cnob_DepositarySharesCustomMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

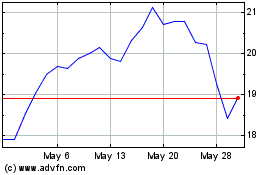

ConnectOne Bancorp (NASDAQ:CNOB)

Historical Stock Chart

From Apr 2024 to May 2024

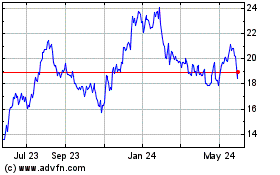

ConnectOne Bancorp (NASDAQ:CNOB)

Historical Stock Chart

From May 2023 to May 2024