Comcast's Earnings Rise 26%, Lifted by Broadband Growth -- Update

January 23 2020 - 12:23PM

Dow Jones News

By Lillian Rizzo

Cable giant Comcast Corp.'s net profit rose 26% in the fourth

quarter, once again riding on the back of internet subscriber

growth amid continued pay-TV customer losses.

The Philadelphia company reported a profit of $3.16 billion for

the fourth quarter, or 68 cents a share, meeting FactSet analysts'

estimates. This is up from $2.51 billion, or 55 cents a share, in

the same period last year.

Revenue rose 2% to $28.4 billion, and Comcast said it would

increase its dividend by 10% to 92 cents a share this year. It is

the second year in a row the company raised its dividend by 10%,

and the 12th consecutive annual increase.

Comcast's stock was trading down 3.2% at $45.91 by late morning

on Thursday.

The company added 442,000 high-speed internet customers in the

quarter, and lost 149,000 pay-TV customers -- marking the 11th

consecutive quarter of pay-TV customer erosion.

Comcast is bracing for higher pay-TV customer losses in 2020,

Chief Financial Officer Michael Cavanagh said during Thursday's

earnings call.

Company executives have previously said Comcast won't chase

cable customers defecting to streaming apps. Instead, Comcast's

focus will remain on its broadband business and its investment in

its streaming service, Peacock, on which it plans to spend $2

billion over the next two years.

The U.K.-based Sky performed well, more than a year since being

acquired by Comcast. Sky reported a 10% revenue increase to more

than $5 billion during the quarter.

This summer, Comcast will launch NBC Sky World News, a

24-hour-a-day news channel across cable and satellite providers.

The news service, meant to compete globally with the likes of CNN,

will also be available on Peacock and other direct-to-consumer

apps. The company plans to add 10 more bureaus to its news

operations, and hire about 100 more employees.

Comcast's broadband business generated $4.8 billion in revenue,

while its traditional pay-TV unit brought in about $5.5

billion.

Revenue at Comcast's NBCUniversal unit fell 2.6% to $9.15

billion, owing in part to the poor performance of its

filmed-entertainment division, which was affected by the weak

release of "Cats," in comparison to the same period last year when

it had stronger releases with "The Grinch" and "Halloween."

Last week, NBCUniversal unveiled its streaming platform as the

company embraced the proliferation of people cutting the cord in

favor of direct-to-consumer apps such as Netflix Inc. and Walt

Disney Co.'s Hulu.

Unlike Netflix, Hulu and many of its other competitors, Peacock

is banking on an ad-supported business model that will allow it to

offer a limited version of the app free, and an ad-supported

version for $4.99 a month. A no-commercials version will be

available for $9.99.

Comcast's pay-TV and broadband customers will receive

ad-supported Peacock free beginning in April.

By 2024, Comcast expects to have between 30 million and 35

million active Peacock subscribers, resulting in annual revenue of

$2.5 billion.

Comcast's Xfinity Mobile, which launched more than two years

ago, added another 261,000 customers in the fourth quarter, a 15%

increase from the same quarter in 2018. In total, Comcast has more

than 2 million mobile customers as it continues to view the

business as a way to hold on to existing customers. The unit

generated $372 million in revenue.

Comcast had 55.5 million Comcast Cable and Sky subscribers at

the end of the fourth quarter.

Write to Lillian Rizzo at Lillian.Rizzo@wsj.com

(END) Dow Jones Newswires

January 23, 2020 12:08 ET (17:08 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

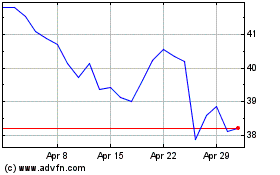

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Aug 2024 to Sep 2024

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Sep 2023 to Sep 2024