Cipher Mining Inc.

(NASDAQ: CIFR) (“Cipher” or the

“Company”), a leading developer and operator of bitcoin mining data

centers, today announced results for its third quarter 2023, with

an update on its operations and deployment strategy.

“We are pleased to announce that we finalized the build-out of

our Odessa facility and have achieved a self-mining capacity of up

to 7.2 EH/s across our portfolio,” said Tyler Page, CEO of Cipher.

“With this first phase of the Company’s growth now complete, we are

also delighted to announce that we have signed an agreement to

acquire a new Texas-based, ERCOT-approved site, called “Black

Pearl,” with interconnection up to 300 MW.”

Cipher’s obligations under the Black Pearl purchase agreement

are subject to certain conditions precedent that, if satisfied or

waived by Cipher, would result in Cipher taking over a land lease

for up to 50 years for the site itself, as well as the assignment

of certain agreements relating to developing and running the site.

Upon closing, Cipher will pay to the seller $7 million in

consideration, to be paid by delivery of a number of Cipher common

shares to be issued under the Company’s shelf registration

statement previously filed on Form S-3. Cipher anticipates closing

the transaction before the end of the year.

“Now that the first chapter of our growth story is complete, we

are excited to embark on the next major phase of expansion,” said

Mr. Page. “Black Pearl is a front-of-the-meter site that we aim to

bring online in 2025. Having already successfully deployed four

data centers, we are eager to start working on the fifth.”

“We have also purchased ~1.2 EH/s worth of the latest generation

S21 Bitmain mining rigs for $14/TH, using a payment schedule that

extends until one year after the delivery of the last batch of

miners,” continued Mr. Page. “We remain committed to our

disciplined approach to managing growth throughout the cycle.

Whether it is purchasing new mining rigs, expanding our data

centers, or developing a new site, we are proud of the rigorous

approach we consistently apply to developing the Company’s growth

strategy. We believe we are well-positioned to come out a clear

winner on the other side of the halving.”

Finance and Operations Highlights

- Completed the build-out of its Odessa facility and deployed up

to 7.2 EH/s of self-mining capacity across the Company’s four data

centers

- Executed agreement to acquire a new site in Texas with a

conditional ERCOT interconnection approval for up to 300 MW of

energy consumption

- Purchased ~1.2 EH/s worth of Bitmain S21 rigs for $14/TH for

delivery beginning in January 2024

- Produced a third quarter 2023 GAAP diluted net loss of $0.07

per share, and a non-GAAP diluted net income of $0.02 per

share

Business Update Call and Webcast

The live webcast, to be held today at 8:00 a.m. Eastern Time,

and a webcast replay of the conference call can be accessed from

the investor relations section of Cipher’s website at

https://investors.ciphermining.com. To access this conference call

by telephone, register here to receive dial-in numbers and a unique

PIN to join the call.

About Cipher

Cipher is an emerging technology company focused on the

development and operation of bitcoin mining data centers. Cipher is

dedicated to expanding and strengthening the Bitcoin network's

critical infrastructure. Together with its diversely talented team

and strategic partnerships, Cipher aims to be a market leader in

bitcoin mining growth and innovation. To learn more about Cipher,

please visit https://www.ciphermining.com/.

Forward Looking Statements

This press release contains certain forward-looking statements

within the meaning of the federal securities laws of the United

States. The Company intends such forward-looking statements to be

covered by the safe harbor provisions for forward-looking

statements contained in the Private Securities Litigation Reform

Act of 1995 and includes this statement for purposes of complying

with these safe harbor provisions. Any statements made in this

press release that are not statements of historical fact, including

statements about our beliefs and expectations regarding our future

results of operations and financial position, business strategy,

timing and likelihood of success, potential expansion of bitcoin

mining data centers, including the closing of the Black Pearl

purchase agreement and development of the Black Pearl facility,

expectations regarding the operations of mining centers and

delivery of mining rigs, and management plans and objectives, are

forward-looking statements and should be evaluated as such.

Forward-looking statements include information concerning possible

or assumed future results of operations, including descriptions of

our business plan and strategies. These forward-looking statements

generally are identified by the words “may,” “will,” “should,”

“expects,” “plans,” “anticipates,” “could,” “seeks,” “intends,”

“targets,” “projects,” “contemplates,” “believes,” “estimates,”

“strategy,” “future,” “forecasts,” “opportunity,” “predicts,”

“potential,” “would,” “will likely result,” “continue,” and similar

expressions (including the negative versions of such words or

expressions).

These forward-looking statements are based upon estimates and

assumptions that, while considered reasonable by Cipher and our

management, are inherently uncertain. Such forward-looking

statements are subject to risks, uncertainties, and other factors

that could cause actual results to differ materially from those

expressed or implied by such forward looking statements. New risks

and uncertainties may emerge from time to time, and it is not

possible to predict all risks and uncertainties. Many factors could

cause actual future events to differ materially from the

forward-looking statements in this press release, including but not

limited to: volatility in the price of Cipher's securities due to a

variety of factors, including changes in the competitive and

regulated industry in which Cipher operates, variations in

performance across competitors, changes in laws and regulations

affecting Cipher's business, and the ability to implement business

plans, forecasts, and other expectations and to identify and

realize additional opportunities. The foregoing list of factors is

not exhaustive. You should carefully consider the foregoing factors

and the other risks and uncertainties described in the "Risk

Factors" section of our Annual Report on Form 10-K filed with the

Securities and Exchange Commission ("SEC") on March 14, 2023, and

in Cipher's subsequent filings with the SEC. These filings identify

and address other important risks and uncertainties that could

cause actual events and results to differ materially from those

contained in the forward-looking statements. Forward-looking

statements speak only as of the date they are made. Readers are

cautioned not to put undue reliance on forward-looking statements,

and Cipher assumes no obligation and, except as required by law,

does not intend to update or revise these forward-looking

statements, whether as a result of new information, future events,

or otherwise.

Contacts:Investor Contact:Josh

KaneHead of Investor Relations at Cipher

Miningjosh.kane@ciphermining.com

Media Contact:Ryan Dicovitsky / Kendal

TillDukas Linden Public RelationsCipherMining@DLPR.com

|

CIPHER MINING INC. |

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

|

(in thousands, except for share and per share amounts) |

| |

| |

| |

September 30, 2023 |

|

|

December 31, 2022 |

|

| |

(unaudited) |

|

|

|

|

| ASSETS |

|

|

|

|

|

| Current assets |

|

|

|

|

|

|

Cash and cash equivalents |

$ |

3,342 |

|

|

$ |

11,927 |

|

|

Accounts receivable |

|

360 |

|

|

|

98 |

|

|

Receivables, related party |

|

- |

|

|

|

1,102 |

|

|

Prepaid expenses and other current assets |

|

3,962 |

|

|

|

7,254 |

|

|

Bitcoin |

|

13,667 |

|

|

|

6,283 |

|

|

Derivative asset |

|

33,087 |

|

|

|

21,071 |

|

|

Total current assets |

|

54,418 |

|

|

|

47,735 |

|

| Property and equipment,

net |

|

258,295 |

|

|

|

191,784 |

|

| Deposits on equipment |

|

1,220 |

|

|

|

73,018 |

|

| Investment in equity

investees |

|

33,609 |

|

|

|

37,478 |

|

| Derivative asset |

|

46,963 |

|

|

|

45,631 |

|

| Operating lease right-of-use

asset |

|

4,399 |

|

|

|

5,087 |

|

| Security deposits |

|

17,586 |

|

|

|

17,730 |

|

|

Total assets |

$ |

416,490 |

|

|

$ |

418,463 |

|

| LIABILITIES AND

STOCKHOLDERS’ EQUITY |

|

|

|

|

|

| Current liabilities |

|

|

|

|

|

|

Accounts payable |

$ |

4,604 |

|

|

$ |

14,286 |

|

|

Accounts payable, related party |

|

1,554 |

|

|

|

3,083 |

|

|

Accrued expenses and other current liabilities |

|

24,813 |

|

|

|

19,353 |

|

|

Finance lease liability, current portion |

|

6,749 |

|

|

|

2,567 |

|

|

Operating lease liability, current portion |

|

1,117 |

|

|

|

1,030 |

|

|

Warrant liability |

|

56 |

|

|

|

7 |

|

|

Total current liabilities |

|

38,893 |

|

|

|

40,326 |

|

| Asset retirement

obligation |

|

17,966 |

|

|

|

16,682 |

|

| Finance lease liability |

|

12,014 |

|

|

|

12,229 |

|

| Operating lease liability |

|

3,645 |

|

|

|

4,494 |

|

| Deferred tax liability |

|

1,285 |

|

|

|

1,840 |

|

|

Total liabilities |

|

73,803 |

|

|

|

75,571 |

|

| Commitments and contingencies

(Note 12) |

|

|

|

|

|

| Stockholders’ equity |

|

|

|

|

|

|

Preferred stock, $0.001 par value; 10,000,000 shares authorized,

none issued and outstanding as of September 30, 2023 and December

31, 2022 |

|

- |

|

|

|

- |

|

|

Common stock, $0.001 par value, 500,000,000 shares authorized,

259,682,742 and 251,095,305 shares issued as of September 30, 2023

and December 31, 2022, respectively, and 254,558,178 and

247,551,958 shares outstanding as of September 30, 2023 and

December 31, 2022, respectively |

|

259 |

|

|

|

251 |

|

|

Additional paid-in capital |

|

490,655 |

|

|

|

453,854 |

|

|

Accumulated deficit |

|

(148,222 |

) |

|

|

(111,209 |

) |

|

Treasury stock, at par, 5,124,564 and 3,543,347 shares at September

30, 2023 and December 31, 2022, respectively |

|

(5 |

) |

|

|

(4 |

) |

|

Total stockholders’ equity |

|

342,687 |

|

|

|

342,892 |

|

|

Total liabilities and stockholders’ equity |

$ |

416,490 |

|

|

$ |

418,463 |

|

|

CIPHER MINING INC. |

|

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS |

|

(in thousands, except for share and per share amounts) |

|

(unaudited) |

| |

| |

| |

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

| |

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

Revenue - bitcoin mining |

$ |

30,304 |

|

|

$ |

- |

|

|

$ |

83,423 |

|

|

$ |

- |

|

| Costs and operating expenses

(income) |

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenue |

|

13,008 |

|

|

|

- |

|

|

|

37,017 |

|

|

|

- |

|

|

General and administrative |

|

23,898 |

|

|

|

17,755 |

|

|

|

62,653 |

|

|

|

51,849 |

|

|

Depreciation |

|

16,217 |

|

|

|

11 |

|

|

|

42,284 |

|

|

|

26 |

|

|

Change in fair value of derivative asset |

|

(4,744 |

) |

|

|

(85,658 |

) |

|

|

(13,294 |

) |

|

|

(85,658 |

) |

|

Power sales |

|

(2,720 |

) |

|

|

- |

|

|

|

(8,469 |

) |

|

|

- |

|

|

Equity in losses of equity investees |

|

1,998 |

|

|

|

8,345 |

|

|

|

4,179 |

|

|

|

20,577 |

|

|

Realized gain on sale of bitcoin |

|

(2,505 |

) |

|

|

(6 |

) |

|

|

(10,711 |

) |

|

|

(6 |

) |

|

Impairment of bitcoin |

|

3,443 |

|

|

|

320 |

|

|

|

8,076 |

|

|

|

859 |

|

|

Other gains |

|

(95 |

) |

|

|

- |

|

|

|

(2,355 |

) |

|

|

- |

|

|

Total costs and operating expenses (income) |

|

48,500 |

|

|

|

(59,233 |

) |

|

|

119,380 |

|

|

|

(12,353 |

) |

| Operating (loss) income |

|

(18,196 |

) |

|

|

59,233 |

|

|

|

(35,957 |

) |

|

|

12,353 |

|

| Other income (expense) |

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

11 |

|

|

|

55 |

|

|

|

112 |

|

|

|

106 |

|

|

Interest expense |

|

(627 |

) |

|

|

- |

|

|

|

(1,513 |

) |

|

|

- |

|

|

Change in fair value of warrant liability |

|

10 |

|

|

|

4 |

|

|

|

(49 |

) |

|

|

115 |

|

|

Other expense |

|

(6 |

) |

|

|

- |

|

|

|

(18 |

) |

|

|

- |

|

|

Total other (expense) income |

|

(612 |

) |

|

|

59 |

|

|

|

(1,468 |

) |

|

|

221 |

|

| (Loss) income before

taxes |

|

(18,808 |

) |

|

|

59,292 |

|

|

|

(37,425 |

) |

|

|

12,574 |

|

| Current income tax

expense |

|

(95 |

) |

|

|

- |

|

|

|

(143 |

) |

|

|

- |

|

| Deferred income tax

benefit |

|

1,192 |

|

|

|

- |

|

|

|

555 |

|

|

|

- |

|

|

Total income tax benefit |

|

1,097 |

|

|

|

- |

|

|

|

412 |

|

|

|

- |

|

| Net (loss) income |

$ |

(17,711 |

) |

|

$ |

59,292 |

|

|

$ |

(37,013 |

) |

|

$ |

12,574 |

|

| Net (loss) income per share -

basic |

$ |

(0.07 |

) |

|

$ |

0.24 |

|

|

$ |

(0.15 |

) |

|

$ |

0.05 |

|

| Net (loss) income per share -

diluted |

$ |

(0.07 |

) |

|

$ |

0.24 |

|

|

$ |

(0.15 |

) |

|

$ |

0.05 |

|

| Weighted average shares

outstanding - basic |

|

251,789,350 |

|

|

|

247,508,745 |

|

|

|

249,858,033 |

|

|

|

248,461,373 |

|

| Weighted average shares

outstanding - diluted |

|

251,789,350 |

|

|

|

248,342,200 |

|

|

|

249,858,033 |

|

|

|

248,782,665 |

|

|

CIPHER MINING INC. |

|

CONDENSED CONSOLIDATED STATEMENT OF CASH

FLOWS |

|

(in thousands) |

|

(unaudited) |

| |

| |

Nine Months Ended September 30, |

|

| |

2023 |

|

|

2022 |

|

| Cash flows from

operating activities |

|

|

|

|

|

|

Net (loss) income |

$ |

(37,013 |

) |

|

$ |

12,574 |

|

| Adjustments to reconcile net

loss to net cash provided by (used in) operating activities: |

|

|

|

|

|

|

Depreciation |

|

42,284 |

|

|

|

26 |

|

|

Amortization of operating right-of-use asset |

|

688 |

|

|

|

556 |

|

|

Share-based compensation |

|

28,687 |

|

|

|

30,072 |

|

|

Equity in losses of equity investees |

|

4,179 |

|

|

|

20,577 |

|

|

Impairment of bitcoin |

|

8,076 |

|

|

|

859 |

|

|

Non-cash lease expense |

|

1,477 |

|

|

|

- |

|

|

Deferred income taxes |

|

(555 |

) |

|

|

- |

|

|

Bitcoin received as payment for services |

|

(83,161 |

) |

|

|

- |

|

|

Change in fair value of derivative asset |

|

(13,294 |

) |

|

|

(85,658 |

) |

|

Change in fair value of warrant liability |

|

49 |

|

|

|

(115 |

) |

|

Realized gain on sale of bitcoin |

|

(10,711 |

) |

|

|

(6 |

) |

|

Changes in assets and liabilities: |

|

|

|

|

|

|

Proceeds from sale of bitcoin |

|

78,729 |

|

|

|

23 |

|

|

Proceeds from power sales |

|

- |

|

|

|

1,722 |

|

|

Proceeds from reduction of scheduled power |

|

- |

|

|

|

5,056 |

|

|

Accounts receivable |

|

(262 |

) |

|

|

- |

|

|

Receivables, related party |

|

(958 |

) |

|

|

(731 |

) |

|

Prepaid expenses and other current assets |

|

3,238 |

|

|

|

5,412 |

|

|

Security deposits |

|

144 |

|

|

|

(1,103 |

) |

|

Accounts payable |

|

2,366 |

|

|

|

400 |

|

|

Accounts payable, related party |

|

(1,529 |

) |

|

|

- |

|

|

Accrued expenses and other current liabilities |

|

10,732 |

|

|

|

1,408 |

|

|

Lease liabilities |

|

(762 |

) |

|

|

37 |

|

|

Net cash provided by (used in) operating activities |

|

32,404 |

|

|

|

(8,891 |

) |

| Cash flows from

investing activities |

|

|

|

|

|

| Deposits on equipment |

|

(4,533 |

) |

|

|

(184,095 |

) |

| Purchases of property and

equipment |

|

(32,980 |

) |

|

|

(28,958 |

) |

| Capital distributions from

equity investees |

|

3,807 |

|

|

|

43,291 |

|

| Investment in equity

investees |

|

(3,545 |

) |

|

|

- |

|

| Prepayments on financing

lease |

|

(3,676 |

) |

|

|

- |

|

|

Net cash used in investing activities |

|

(40,927 |

) |

|

|

(169,762 |

) |

| Cash flows from

financing activities |

|

|

|

|

|

| Proceeds from the issuance of

common stock |

|

11,644 |

|

|

|

- |

|

| Offering costs paid for the

issuance of common stock |

|

(298 |

) |

|

|

- |

|

| Repurchase of common shares to

pay employee withholding taxes |

|

(3,224 |

) |

|

|

(3,077 |

) |

| Principal payments on

financing lease |

|

(8,184 |

) |

|

|

- |

|

|

Net cash used in financing activities |

|

(62 |

) |

|

|

(3,077 |

) |

| Net decrease in cash and cash

equivalents |

|

(8,585 |

) |

|

|

(181,730 |

) |

| Cash and cash equivalents,

beginning of the period |

|

11,927 |

|

|

|

209,841 |

|

| Cash and cash equivalents, end

of the period |

$ |

3,342 |

|

|

$ |

28,111 |

|

| Supplemental

disclosure of noncash investing and financing

activities |

|

|

|

|

|

|

Reclassification of deposits on equipment to property and

equipment |

$ |

74,186 |

|

|

$ |

- |

|

|

Right-of-use asset obtained in exchange for finance lease

liability |

$ |

14,212 |

|

|

$ |

- |

|

|

Reclassification of receivables, related party to investment in

equity investees |

$ |

2,060 |

|

|

$ |

- |

|

|

Equity method investment acquired for non-cash consideration |

$ |

1,926 |

|

|

$ |

93,208 |

|

|

Sales tax accruals reversed due to exemption |

$ |

1,837 |

|

|

$ |

- |

|

|

Bitcoin received from equity investees |

$ |

317 |

|

|

$ |

3,139 |

|

|

Common stock cancelled |

$ |

- |

|

|

$ |

10,000 |

|

|

Property and equipment purchases in accounts payable, accounts

payable, related party and accrued expenses |

$ |

- |

|

|

$ |

6,695 |

|

|

Right-of-use asset obtained in exchange for operating lease

liability |

$ |

- |

|

|

$ |

5,859 |

|

|

Investment in equity investees in accrued expenses |

$ |

- |

|

|

$ |

5,316 |

|

|

Deposits on equipment in accounts payable, accounts payable,

related party and accrued expenses |

$ |

- |

|

|

$ |

4,289 |

|

|

Reclassification of deferred investment costs to investment in

equity investees |

$ |

- |

|

|

$ |

174 |

|

|

|

Non-GAAP Financial Measures

The following is a reconciliation of our non-GAAP income (loss)

from operations, which excludes the impact of (i) depreciation and

amortization, (ii) the non-cash change in the fair value of our

derivative asset (iii) share-based compensation expense and (iv)

nonrecurring gains, to its most directly comparable GAAP measure

for the periods indicated (in thousands):

| |

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

| |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| Reconciliation of

non-GAAP income (loss) from operations: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating (loss) income |

|

$ |

(18,196 |

) |

|

$ |

59,233 |

|

|

$ |

(35,957 |

) |

|

$ |

12,353 |

|

| Depreciation and

amortization |

|

|

16,453 |

|

|

|

11 |

|

|

|

42,972 |

|

|

|

26 |

|

| Change in fair value of

derivative asset |

|

|

(4,744 |

) |

|

|

(85,658 |

) |

|

|

(13,294 |

) |

|

|

(85,658 |

) |

| Share-based compensation

expense |

|

|

10,699 |

|

|

|

10,494 |

|

|

|

28,687 |

|

|

|

30,072 |

|

| Other gains -

nonrecurring |

|

|

- |

|

|

|

- |

|

|

|

(2,349 |

) |

|

|

- |

|

|

Non-GAAP income (loss) from operations |

|

$ |

4,212 |

|

|

$ |

(15,920 |

) |

|

$ |

20,059 |

|

|

$ |

(43,207 |

) |

| |

The following are reconciliations of our non-GAAP net income

(loss) and non-GAAP basic and diluted net income (loss) per share,

in each case excluding the impact of (i) depreciation and

amortization (ii) the non-cash change in the fair value of our

derivative asset, (iii) share-based compensation expense, (iv)

nonrecurring gains, (v) the non-cash change in the fair value of

our warrant liability and (vi) deferred income tax expense, to the

most directly comparable GAAP measures for the periods indicated

(in thousands, except for per share amounts):

| |

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

| |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| Reconciliation of

non-GAAP net income (loss): |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss) income |

|

$ |

(17,711 |

) |

|

$ |

59,292 |

|

|

$ |

(37,013 |

) |

|

$ |

12,574 |

|

| Non-cash adjustments to net

(loss) income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

16,453 |

|

|

|

11 |

|

|

|

42,972 |

|

|

|

26 |

|

|

Change in fair value of derivative asset |

|

|

(4,744 |

) |

|

|

(85,658 |

) |

|

|

(13,294 |

) |

|

|

(85,658 |

) |

|

Share-based compensation expense |

|

|

10,699 |

|

|

|

10,494 |

|

|

|

28,687 |

|

|

|

30,072 |

|

|

Other gains - nonrecurring |

|

|

- |

|

|

|

- |

|

|

|

(2,349 |

) |

|

|

- |

|

|

Change in fair value of warrant liability |

|

|

10 |

|

|

|

4 |

|

|

|

(49 |

) |

|

|

115 |

|

|

Deferred income tax expense |

|

|

1,192 |

|

|

|

- |

|

|

|

555 |

|

|

|

- |

|

|

Total non-cash adjustments to net (loss) income |

|

|

23,610 |

|

|

|

(75,149 |

) |

|

|

56,522 |

|

|

|

(55,445 |

) |

|

Non-GAAP net income (loss) |

|

$ |

5,899 |

|

|

$ |

(15,857 |

) |

|

$ |

19,509 |

|

|

$ |

(42,871 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Reconciliation of

non-GAAP basic and diluted net income (loss) per

share: |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and diluted net (loss)

income per share |

|

$ |

(0.07 |

) |

|

$ |

0.24 |

|

|

$ |

(0.15 |

) |

|

$ |

0.05 |

|

| Depreciation and amortization

(per share) |

|

|

0.07 |

|

|

|

- |

|

|

|

0.17 |

|

|

|

- |

|

| Change in fair value of

derivative asset (per share) |

|

|

(0.02 |

) |

|

|

(0.35 |

) |

|

|

(0.05 |

) |

|

|

(0.35 |

) |

| Share-based compensation

expense (per share) |

|

|

0.04 |

|

|

|

0.04 |

|

|

|

0.11 |

|

|

|

0.12 |

|

| Other gains - nonrecurring

(per share) |

|

|

- |

|

|

|

- |

|

|

|

(0.01 |

) |

|

|

- |

|

| Change in fair value of

warrant liability (per share) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| Deferred income tax expense

(per share) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Non-GAAP basic and diluted net income (loss) per share |

|

$ |

0.02 |

|

|

$ |

(0.07 |

) |

|

$ |

0.07 |

|

|

$ |

(0.18 |

) |

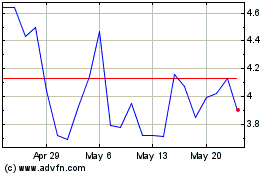

Cipher Mining (NASDAQ:CIFR)

Historical Stock Chart

From Apr 2024 to May 2024

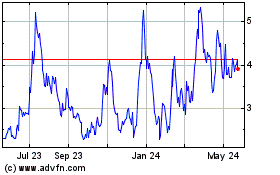

Cipher Mining (NASDAQ:CIFR)

Historical Stock Chart

From May 2023 to May 2024