UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT

TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT

OF 1934

For the month of December 2019

Commission File Number: 333-231839

CHINA SXT PHARMACEUTICALS, INC.

(Translation of registrant’s name

into English)

178 Taidong Rd North, Taizhou

Jiangsu, China

(Address of principal executive office)

Indicate by check mark whether the registrant files or will

file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant

is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Note: Regulation S-T Rule 101(b)(1) only permits the submission

in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant

is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Note: Regulation S-T Rule 101(b)(7) only

permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private

issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally

organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s

securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed

to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission

or other Commission filing on EDGAR.

Entry into Material Definitive Agreements

As previously disclosed, on May 2, 2019,

we completed a private placement (the “Private Placement”) with two unaffiliated institutional investors (each

an “Investor”, collectively, the “Investors”) pursuant to certain Securities Purchase Agreement

dated April 16, 2019, as amended on May 2, 2019 (the “Purchase Agreement”). The securities sold by the Company

in the Private Placement consisted of (1) Senior Convertible Notes in the aggregate principal amount of $15 million (each,

a “Note” and collectively, the “Notes”), consisting of (i) Series A Senior Convertible Notes

(“Series A Notes”) in the aggregate principal amount of $10 million, and (ii) Series B Senior Secured Convertible

Notes (“Series B Notes”) in the aggregate principal amount of $5 million and (2) Warrants (“Series

A Warrants”) to purchase 596,658 of the Company’s ordinary shares, par value 0.001 per share (“Ordinary

Shares” equal to 50% of the shares issuable upon conversion of the Series A Notes, exercisable for a period of five years

at an initial exercise price of $8.38, and (3) Warrants (“Series B Warrants”) to purchase 298,330 of the Company’s

ordinary shares equal to 50% of the shares issuable upon conversion of the Series B Notes, exercisable for a period of five years

at an exercise price of $8.38. In exchange for the above securities, the Company received consideration consisting of (i) an aggregate

cash payment of $10,000,000, and (ii) secured promissory notes payable by the Investors to the Company (the “Investor

Notes”) in the aggregate principal amount of $5 million. Pursuant to Purchase Agreement the Company also pre-delivered

four million Ordinary Shares of the Company (“Pre-Delivered Shares”) to the Investors as security for the Company’s

obligations under the transaction documents in the Private Placement.

The Company received from the two Investors

the Event of Default Redemption Notices (“Redemption Notices”) on July 23, 2019 and July 29, 2019 respectively.

The Company was informed by the Investors that certain event of defaults, including the failure to make timely payment on the installment

due on June 28, 2019 and failure to timely convert the shares as required by the Investor, had occurred under the terms of the

Notes and that the Company was required thereby, among other things, to redeem the Series A Notes at certain event of default redemption

price.

Forbearance Agreement

Upon negotiation with the Investors, on

December 13, 2019, (the “Effective Date”) the Company entered into certain Forbearance and Amendment Agreements

(each a “Forbearance Agreement”, collectively, the “Forbearance Agreements”) with each Investor.

Upon the execution of the Forbearance Agreements,

the Investor shall Net (as defined in the Series B Note) all Restricted Principal (as defined in the Series B Note) outstanding

under the Series B Note against the amounts outstanding under the Investor Note (as defined in the Series B Note), after which

the Investor Note, the Series B Note and the Series B Warrant shall no longer remain outstanding.

Pursuant to the Forbearance Agreement,

commencing on the Effective Date till the earlier of (1) 5:00PM, New York city time on October 15, 2020, (or, if earlier, such

date when all the Forbearance Redemption Amounts (as defined therein) are fully paid) and (2) the time of any breach by the Company

of any term or provision of this Agreement or the occurrence of any Event of Default that is not an “Existing Default”

as set forth in the Schedule I of the Forbearance Agreements or an “Additional Forborne Default” as set forth in the

Schedule II of the Forbearance Agreement (such earlier date, the “Forbearance Expiration Date”, such period

from the Effective Date to the Forbearance Expiration Date, the “Forbearance Period”), , the Investors agreed,

among other things, to the following:

(a) to forbear from (i) taking any action

to enforce their Redemption Notice with respect to certain existing defaults (the “Existing Defaults”) including

but not limited to such defaults as described in the Redemption Notices, and (ii) issuing any new demand for redemption of the

Series A Note on the basis of certain additional defaults (the “Additional Forborne Defaults”), including but

not limited to the occurrence of the event that the aggregate daily dollar trading volume of the Company’s ordinary shares

does not exceed $1,500,000, and that the volume weighted average price of the Company’s ordinary shares on any two trading

days during the thirty trading day period ending on the trading day immediately preceding such date of determination fails to exceed

$2.14.

(b) not to effect any conversions of the

Series A Note or Alternate Conversions except for conversions or Alternate Conversions of the Series A Note and/or exercises of

the Series A Warrant, in each case, on any Trading Day where the trading price of the Ordinary Shares is at least $2.50 (as adjusted

for share splits, share dividends, share combinations, recapitalizations and similar events on or after the date hereof) (such

price, a “Forbearance Conversion Floor” and each such conversion, a “Permitted Transaction”);

provided, that any Ordinary Shares issued in a Permitted Transaction (other than Applied Pre-Delivery Shares or any Ordinary Shares

issued upon conversion of any Forbearance Redemption Amount that the Company has failed to pay in cash either prior to, or during,

the applicable Payment Grace Period (as defined in Schedule II of the Forbearance Agreement) with respect thereto)(collectively,

the “Excluded Leak-Out Shares”)) shall be subject to the Leak-Out Agreement. If the Company or its agents do

not deliver conversion shares pursuant to such aforementioned conversion, the Investor may apply any remaining Pre-Delivered Shares

to satisfy such obligations (on a share-for-share basis, against the Ordinary Shares not timely delivered in such aforementioned

conversion)

(c) not to effect any Installment Conversion,

Installment Redemption, Disclosure Delay Payments or Event of Default Redemption (as defined in the Notes, solely with respect

to the Existing Defaults and Additional Forborne Defaults) prior to the Forbearance Expiration Date other than as permitted under

this Agreement

(d) not to exercise the Series A Warrant

during the Forbearance Period (other than exercises of the Series A Warrant in Permitted Transactions);

(e) to return the original share certificate

representing the Pre-Delivered Shares (other than Applied Pre-Delivery Shares (as defined below)) to the Company for cancellation

upon the Company’s payment of the full Forbearance Redemption Amounts (as defined below),

(f) to execute and deliver to the Company

certain lock-up agreements with respect to the Pre-Delivered Shares (each a “Lock-Up Agreement”, collectively

“Lock-Up Agreements”) , certain mutual release (each a “Mutual Release”, collectively, the

“Mutual Releases”) and to execute and deliver to the Company the Leak-Out Agreement (as defined below)

In consideration for the above, the Company

agreed to the followings:

(a) in lieu of the payment of the redemption

price as stated in each Redemption Notices respectively, the Company shall (I) pay to each Investor $500,000 (the “Initial

Forbearance Fee”) on or prior to December 16, 2019, and (II) commencing on January 24th 2020, redeem the Series A Notes

for an aggregate redemption price of $10,939,410.21 (the “Forbearance Redemption Price”), in accordance

with Section 8 of the Series A Note, but replacing the applicable Installment Dates and Installment Amounts (including, Principal

Amounts, Interest and Make-Whole Amounts with respect thereto) with the dates (each a “New Installment Date”)

and amounts (each, a “New Installment Amount”), respectively and (III) pay the aggregate amount of any payment

obligations of the Company arising after the date hereof pursuant to the Sections 3(c)(ii), 20 or 24(c) of the Series A Note, 9(k)

of the Securities Purchase Agreement, and/or Sections 2(e), 6 and 7 of the Registration Rights Agreement, (each such amounts, an

“Ancillary Redemption Amount”, and together with the New Installment Amounts, each an “Additional Forbearance

Redemption Amount”, and together with the Initial Forbearance Fee, each a “Forbearance Redemption Amount”)

(b) If the Company fails to pay any New

Installment Amount within 5 days of the applicable New Installment Date pursuant to the Installment Notice (as defined in Section

8 of the Series A Note), the Investor may convert the applicable New Installment Amount in one or multiple conversion notices as

an Alternate Conversion pursuant to Section 3(e) of the Series A Note with the Forbearance Conversion Floor and the Leak-Out Agreement

being disregarded for such conversions and such conversions deemed a Permitted Transaction for the purposes of this Agreement and

any sales of such Ordinary Shares shall not be included in the applicable Daily Limit (as defined in the Leak-Out Agreement) with

respect thereto. In the event that the Company or its agents do not deliver applicable Conversion Shares pursuant to any conversion

in accordance with Section 3 of the Series A Note, the Investor may apply any remaining Pre-Delivered Shares to satisfy such obligations

(on a share-for-share basis, against the Ordinary Shares not timely delivered in such aforementioned conversion) (each an “Applied

Pre-Delivery Share”).

(b) the Company shall cause all restrictive

legends on the Pre-Delivered Shares to be removed and delivery of un-legended Pre-Delivery Shares into the Investor’s custodian’s

account pursuant to the DWAC instructions set forth therein; and

Concurrently with the execution of the

Forbearance Agreement, the Investors and the Company have entered into the Lock-Up Agreements, Leak-Out Agreements and Mutual Releases.

Lock-Up Agreement

Pursuant to the Lock-Up Agreement, except

that investors may pledge the Pre-Delivered Shares in connection with a bona fide margin account or other loan or financing arrangement

secured by the Pre-Delivered Shares, the Investors agreed not to make any hedge, swap or other agreement that transfers, in whole

or in part, any of the economic consequences of ownership of the Pre-Delivered Shares (excluding the Applied Pre-Delivery Shares,

the “Locked Shares”). The investor also agreed to provide, up to three (3) times during the forbearance period,

evidence reasonably satisfactory to the Company within two (2) Business Days after receipt of the Company’s written request,

showing that the Locked Shares remain in the account of the Investor. In the event that prior to the expiration of the Forbearance

Period, the aggregate number of Ordinary Shares held in the brokerage account of such Investor is less than the Locked Shares,

the undersigned shall within one (1) Business Day of the Company’s written request, return the Locked Shares to the Company

for cancellation by directing the Investors’ broker to initiate a DWAC withdrawal of the Pre-Delivered Shares and delivering

duly executed cancellation instructions along with the original certificates (if any) evidencing the Pre-Delivered Shares, original

stock power with medallion guaranteed and corporate resolution approving such cancellation to the Company’s transfer agent.

Leak-Out Agreement

Pursuant to the Leak-Out Agreements, each

investor (together with certain of its affiliates) has agreed to not sell, dispose or otherwise transfer, directly or indirectly

(including, without limitation, any sales, short sales, swaps or any derivative transactions that would be equivalent to any sales

or short positions) any Ordinary Shares issued in any Permitted Transaction (collectively, the “Restricted Securities”),

on any Trading Day (as defined in Series A Notes) (each date of determination, each a “Measuring Date”), if

such sale, together with all prior sales of Restricted Securities by the Investor on such Measuring Date, exceed 20% of the daily

composite trading volume of the Ordinary Shares (as reported by Bloomberg, LP for such Measuring Date) (the “Daily Limit”);

provided that any other sales of Restricted Shares on such Measuring Date (excluding any sales of Restricted Securities) shall

not be included in the Daily Limit calculation above.

Further, this restriction will not apply

to sales or transfers of any such shares of Restricted Shares in transactions with any Person (an “Assignee”);

provided, that as a condition to any such sale or transfer an authorized signatory of the Company and such Assignee duly execute

and deliver a leak-out agreement in the form of this Leak-Out Agreement with respect to such transferred Restricted Securities

(or such securities convertible or exercisable into Restricted Securities, as applicable) (an “Assignee Agreement”)

and sales of the Investor and all Assignees shall be aggregated for all purposes of this Leak-Out Agreement and all Assignee Agreements.

Mutual Release

In accordance with the Mutual Release,

both parties agree not to bring any and all charges, complaints, liabilities, claims and demands of any nature whatsoever solely

with respect to the Notes and the Warrants against each other effective upon the full payment of the forbearance redemption amounts.

A copy of the forms of Forbearance Agreement, Lock-Up Agreement,

Leak-Out Agreement and Mutual Release are attached hereto as exhibits 10.1, 10.2, 10.3 and 10.4.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENT

This Current Report contains forward-looking

statements. All statements contained in this Current Report other than statements of historical fact are forward-looking statements.

The words “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,”

“intend,” “expect,” “seek” and similar expressions are intended to identify forward-looking

statements. We have based these forward-looking statements largely on our current expectations and projections about future events

and trends that we believe may affect our financial condition, results of operations, business strategy, short-term and long-term

business operations and objectives, and financial needs. These forward-looking statements are subject to a number of risks, uncertainties

and assumptions. In light of these risks, uncertainties and assumptions, the future events and trends discussed in this Current

Report may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking

statements.

You should not rely upon forward-looking

statements as predictions of future events. The events and circumstances reflected in the forward-looking statements may not be

achieved or occur. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot

guarantee future results, levels of activity, performance, or achievements. Except as required by applicable law, we undertake

no duty to update any of these forward-looking statements after the date of this Current Report or to conform these statements

to actual results or revised expectations.

Exhibits

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

10.1

|

|

Form of Forbearance Agreement, dated December [13], 2019, by and between China SXT Pharmaceutical, Inc. and the investor thereto.

|

|

10.2

|

|

Form of Lock-Up Agreement, dated December [13], 2019, by and between China SXT Pharmaceutical, Inc. and the investor thereto.

|

|

10.3

|

|

Form of Leak-Out dated December [13], 2019, by and among Mr. Feng Zhou, Mr. Jianping Zhou. and the investor thereto.

|

|

10.4

|

|

Form of Mutual Release, dated December [13], 2019, by and between China SXT Pharmaceuticals, Inc. and the investor thereto.

|

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

CHINA SXT PHARMACEUTICAL, INC.

|

|

|

|

|

|

|

By:

|

/s/ Feng Zhou

|

|

|

|

Feng Zhou

|

|

|

|

Chief Executive Officer

|

Date: December 16, 2019

5

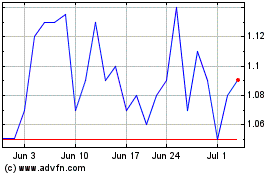

China SXT Pharmaceuticals (NASDAQ:SXTC)

Historical Stock Chart

From Mar 2024 to Apr 2024

China SXT Pharmaceuticals (NASDAQ:SXTC)

Historical Stock Chart

From Apr 2023 to Apr 2024