Form 8-K - Current report

February 02 2024 - 4:02PM

Edgar (US Regulatory)

false

0001856948

0001856948

2024-02-02

2024-02-02

0001856948

chea:UnitsEachConsistingOfOneClassOrdinaryShare0.0001ParValueAndOnehalfOfOneRedeemableWarrantMember

2024-02-02

2024-02-02

0001856948

us-gaap:CommonClassAMember

2024-02-02

2024-02-02

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section

13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported):

February 2, 2024

(February 2, 2024)

Chenghe

Acquisition Co.

(Exact Name of Registrant as Specified in its Charter)

| Cayman Islands |

|

001-41366 |

|

98-1598077 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

38 Beach Road #29-11

South Beach Tower

Singapore |

|

189767 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

| Registrant’s telephone number, including area code: (+65) 9851 8611 |

| Not Applicable |

| (Former name or former address, if changed since last report) |

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which

registered |

| Units, each consisting of one Class A ordinary share, $0.0001 par value, and one-half of one redeemable warrant |

|

CHEAU |

|

The Nasdaq Stock Market LLC |

| Class A ordinary shares, par value $0.0001 per share |

|

CHEA |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act.

Item 5.07 Submission of Matters to a

Vote of Security Holders.

On February 2, 2024,

Chenghe Acquisition Co. (the “Company” or “Chenghe”) held an extraordinary general meeting of shareholders

(the “Extraordinary Meeting”), at which, holders of 9,664,189 of the Company’s ordinary shares, which represents

approximately 85.43 % of the ordinary shares issued and outstanding and entitled to vote as of the record date of December 20, 2023, were

represented in person or by proxy.

Set

forth below are the proposals voted upon at the Extraordinary Meeting, which are described in more detail in the definitive proxy statement/prospectus

filed with the Securities Exchange Commission on January 12, 2024 (the “Proxy Statement/Prospectus”), and the final

voting results.

| 1. |

Proposal No. 1 — The Business Combination Proposal. To consider and vote upon, as an ordinary resolution, a proposal to approve and adopt the business combination agreement dated as of July 21, 2023 (as it may be amended, supplemented or otherwise modified from time to time, the “Business Combination Agreement”), by and among Chenghe, Semilux International Ltd., a Cayman Islands exempted company with limited liability (“CayCo”), SEMILUX LTD., a Cayman Islands exempted company with limited liability and a direct wholly owned subsidiary of CayCo (“Merger Sub”), and Taiwan Color Optics, Inc. (“TCO” and together with CayCo and Merger Sub, the “TCO Parties”), a company incorporated and in existence under the laws of Taiwan with uniform commercial number of 25052644, and approve the transactions contemplated thereby, pursuant to which, among other things, Merger Sub shall be merged with and into Chenghe with Chenghe being the surviving company and as a direct, wholly owned subsidiary of CayCo (the “Merger”), and Chenghe will change its name to “SEMILUX LTD.” (the “Business Combination”). |

| |

FOR |

|

|

|

AGAINST |

|

|

|

ABSTAIN |

|

| |

9,139,144 |

|

|

|

525,045 |

|

|

|

0 |

|

| 2. |

Proposal No. 2 — The Merger Proposal. To consider and vote upon, as a special resolution, a proposal to approve and adopt the plan of merger to be filed with the Registrar of Companies of the Cayman Islands (the “Plan of Merger”) and approve the transactions contemplated thereby, including, without limitation the Merger. |

| |

FOR |

|

|

|

AGAINST |

|

|

|

ABSTAIN |

|

| |

9,139,144 |

|

|

|

525,045 |

|

|

|

0 |

|

| 3. |

Proposal No. 3 — The Authorized Share Capital Amendment Proposal. To consider and vote upon, as an ordinary resolution, a proposal to approve, with effect from the effective time of the Merger, the reclassification and re-designation of (a) 500,000,000 issued and unissued Class A ordinary shares of a par value of $0.0001 each to 500,000,000 issued and unissued ordinary shares of a par value of $0.0001 each; (b) 50,000,000 issued and unissued Class B ordinary shares of a par value of $0.0001 each to 50,000,000 issued and unissued ordinary shares of a par value of $0.0001 each; and (c) 5,000,000 authorized but unissued preference shares of a par value of $0.0001 each to 5,000,000 authorized but unissued ordinary shares of a par value of $0.0001 each (the “Re-designation”) so that following such Re-designation, the authorized share capital of Chenghe shall be $55,500 divided into 555,000,000 ordinary shares of a par value of $0.0001 each, and immediately after the Re-designation, the authorized share capital of Chenghe be amended from $55,500 divided into 555,000,000 ordinary shares of a par value of $0.0001 each to $50,000 divided into 500,000,000 ordinary shares of a par value of $0.0001 each by the cancellation of 55,000,000 authorized but unissued ordinary shares of a par value of $0.0001 each. |

| FOR |

|

|

|

AGAINST |

|

|

|

ABSTAIN |

|

| 9,139,134 |

|

|

|

525,055 |

|

|

|

0 |

|

| 4. |

Proposal No. 4 — The Articles Amendment Proposals. To consider and vote upon, as special resolutions, two separate proposals to approve, with effect from the effective time of the Merger: |

| |

(a) |

the change of name of Chenghe from “Chenghe Acquisition Co.” to “SEMILUX LTD.”; and |

| |

FOR |

|

|

|

AGAINST |

|

|

|

ABSTAIN |

|

| |

9,139,144 |

|

|

|

525,045 |

|

|

|

0 |

|

| |

(b) |

the amended and restated memorandum and articles of association of SPAC currently in effect be amended and restated by the deletion in their entirety and the substitution in their place of the proposed second amended and restated memorandum and articles of association of Chenghe (the “Restated M&A”). |

| |

FOR |

|

|

|

AGAINST |

|

|

|

ABSTAIN |

|

| |

9,139,144 |

|

|

|

525,045 |

|

|

|

0 |

|

As there were sufficient

votes to approve the above proposals, the “Adjournment Proposal” described in the Proxy Statement/Prospectus was not presented

to the shareholders.

Item 8.01 Other Events.

On February 1, 2024, Chenghe and the TCO parties agreed that (i) the

Sponsor will not execute (and Chenghe will accordingly not provide) the Lock-Up Agreement at the Closing, pursuant to section 4.2(b)(iii)

of the Business Combination Agreement, and the TCO Parties agree to waive any rights in respect of the forgoing and release the Sponsor

and Chenghe from their respective obligations thereunder), and (ii) waive the closing condition that the Company Acquisition Percentage

shall be at least 90.1% at the Closing pursuant to section 8.2(c) of the Business Combination Agreement.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| Exhibit No. |

|

Description |

| |

|

|

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly

authorized.

| |

Chenghe Acquisition Co. |

| |

|

| |

By: |

/s/ Shibin Wang |

| |

Name: |

Shibin Wang |

| |

Title: |

Chief Executive Officer |

Date: February 2, 2024

v3.24.0.1

Cover

|

Feb. 02, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 02, 2024

|

| Entity File Number |

001-41366

|

| Entity Registrant Name |

Chenghe

Acquisition Co.

|

| Entity Central Index Key |

0001856948

|

| Entity Tax Identification Number |

98-1598077

|

| Entity Incorporation, State or Country Code |

E9

|

| Entity Address, Address Line One |

38 Beach Road #29-11

|

| Entity Address, City or Town |

South Beach Tower

|

| Entity Address, Country |

SG

|

| Entity Address, Postal Zip Code |

189767

|

| City Area Code |

65

|

| Local Phone Number |

9851 8611

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Units, each consisting of one Class A ordinary share, $0.0001 par value, and one-half of one redeemable warrant |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Units, each consisting of one Class A ordinary share, $0.0001 par value, and one-half of one redeemable warrant

|

| Trading Symbol |

CHEAU

|

| Security Exchange Name |

NASDAQ

|

| Common Class A [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Class A ordinary shares, par value $0.0001 per share

|

| Trading Symbol |

CHEA

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=chea_UnitsEachConsistingOfOneClassOrdinaryShare0.0001ParValueAndOnehalfOfOneRedeemableWarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonClassAMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

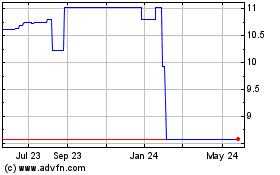

Chenghe Acquisition (NASDAQ:CHEAU)

Historical Stock Chart

From Apr 2024 to May 2024

Chenghe Acquisition (NASDAQ:CHEAU)

Historical Stock Chart

From May 2023 to May 2024