Check Point� Software Technologies Ltd. (NASDAQ:CHKP), the

worldwide leader in securing the Internet, today announced its

financial results for the fourth quarter and fiscal year ended

December 31, 2007. �Our success in fourth quarter of 2007 is

representative of the entire year, which was one of our best ever,�

said Gil Shwed, chairman and chief executive officer of Check Point

Software. �We believe our performance is a result of the adoption

of our new and existing network security product lines, combined

with the successful expansion into data security earlier in the

year. Our Unified Security Architecture and total security

solutions enabled us to grow market share and deliver excellent

financial results in Q4 2007 and during the entire year.� Financial

Highlights for the Fourth Quarter Ended December 31, 2007: Total

Revenues: $206.7 million, an increase of 29 percent compared to

$160.1 million in the fourth quarter of 2006. Network security

accounted for a record $182.5 million in revenues, representing a

14 percent increase over the fourth quarter of 2006. Data security

contributed $24.2 million in revenues, representing a 17 percent

quarterly sequential increase over the third quarter of 2007. Net

Income � GAAP: $87.9 million, an increase of 11 percent compared to

$79.5 million in the fourth quarter of 2006. Net income in the

fourth quarter of 2007 includes acquisition-related charges of

$10.3 million and equity-based compensation expenses of $8.8

million. Net of taxes, these charges totaled $14.6 million.

Equity-based compensation expenses have been reported since the

beginning of 2006 pursuant to SFAS 123(R). Net Income � Non-GAAP1:

$102.5 million, an increase of 13 percent compared to $90.6 million

in the fourth quarter of 2006. Non-GAAP net income excludes

equity-based compensation expenses and acquisition-related

charges2. Earnings per Diluted Share � GAAP: $0.39, an increase of

11 percent compared to $0.35 in the fourth quarter of 2006. GAAP

earnings per diluted share for the fourth quarter of 2007 included

equity-based compensation expenses of $0.04 and acquisition-related

charges of $0.05. Net of taxes, these charges totaled $0.07.

Earnings per Diluted Share � Non-GAAP: $0.46, an increase of 15

percent compared to $0.40 in the fourth quarter of 2006. Non-GAAP

earnings per diluted share exclude equity-based compensation

expenses and acquisition-related charges. Deferred Revenues: $273.7

million, which represented an increase of $69.5 million or 34

percent compared to deferred revenues as of December 31, 2006. Cash

Flow: Cash flow from operations was $91.3 million, an increase of

10 percent compared to the fourth quarter of 2006. Share Repurchase

Program: During the fourth quarter of 2007, Check Point repurchased

2.8 million shares at a total cost of $61.9 million. �Throughout

the year, we experienced healthy growth in all geographies with 34

percent annual revenue growth in our European sales and 24 percent

growth in the Americas,� said Gil Shwed, chairman and chief

executive officer of Check Point Software. �Our new UTM-1 appliance

offerings and high-end integrated solutions have been adopted by

some of the largest corporations in the world and have been key in

driving these results. In addition, our new data security products

delivered 17 percent sequential growth in the fourth quarter of

2007 with increased sales in Europe and broader adoption by the

channel.� Financial Highlights for the Year Ended December 31, 2007

Revenues: $730.9 million, an increase of 27 percent compared to

$575.1 million for the year ended December 31, 2006. Network

security accounted for a record $648.1 million in revenues

representing a 13% increase over 2006. Data security contributed

$82.8 million in revenues for the year. Net Income � GAAP: $281.1

million, an increase of one percent compared to $278.0 million for

2006. Net income for 2007 includes equity-based compensation

expenses in the amount of $34.1 million, and acquisition-related

expenses of $57.0 million, which includes in-process R&D in the

amount of $17.0 million. Net of taxes, these charges totaled $77.7

million. Net Income � Non-GAAP: $358.7 million, an increase of 12

percent compared to $320.3 million for 2006. Non-GAAP net income

excludes equity-based compensation expenses and acquisition-related

charges. Earnings per Diluted Share � GAAP: $1.25, an increase of 7

percent compared to $1.17 for 2006. Net income in 2007 includes

equity-based compensation expenses of $0.15 and acquisition-related

charges of $0.25, which includes in-process R&D in the amount

of $0.07. Net of taxes, these charges totaled $0.34. Earnings per

Diluted Share � Non-GAAP: $1.59, an increase of 18 percent,

compared to $1.35 for 2006. Non-GAAP earnings per diluted share

exclude equity-based compensation expenses and acquisition-related

charges. Cash Flow: Cash flow from operations was $371.6 million,

an increase of 2 percent compared to $363.3 million for 2006. Cash

and Investments Balance: $1.2 billion as of December 31, 2007.

Share Repurchase Program: During 2007, Check Point repurchased 9.0

million shares at a total cost of $209.8 million. There is

approximately $73.2 million remaining of the cumulative $1.2

billion authorized under Check Point�s share repurchase program.

Fourth Quarter and Fiscal Year 2007 Business Highlights: Expanded

Unified Security Architecture into Data Security � In the first

quarter of 2007, we expanded our business into the data security

field with the acquisition Protect Data. The new data security

layer added to our architecture enables customers to keep their

mobile data secure and minimizes the risk of data loss and theft.

Increasing number of large transactions � We continued to see

growth in the number of large transactions originating from a

variety of industries, and across all geographies. During the

fourth quarter, we had 19 customers with transactions greater than

one million dollars. UTM-1 Solutions � In the first quarter of

2007, we introduced the UTM-1 Appliances representing an initial

entry into the mid-range gateway market providing unified threat

management. This was followed in the fourth quarter by the

introduction of the �UTM-1 Total Security Appliances� as we

expanded the product line to include 3-year all-inclusive packages

with messaging security and security updates. CoreXL Acceleration

Technology in VPN-1 Power Achieved Performance Breakthrough �

Leveraging state-of-art multi-core processors, VPN-1 Power with

CoreXL is the first network security gateway that enables security

administrators to gain data center level performance without

compromising on the level of security inspection. ZoneAlarm

ForceField � The first virtualized, on-demand browser security

solution to enable consumers to bank and shop online, or surf

dangerous areas of the Internet. ForceField leverages the power of

Check Point�s Smart Defense Advisor, a hosted service that enables

the company to offer users real-time protection against zero-hour

threats. �We are very pleased with our results for the fourth

quarter and fiscal year 2007. We believe this success is a

reflection of our ability to deliver comprehensive security

solutions to address our customer security needs,� said Gil Shwed,

chairman and chief executive officer of Check Point Software. �In

the coming year we look forward to expanding our product portfolio

and enabling our customers to further increase their level of

security with our solutions.� Conference Call and Webcast

Information Check Point will host a conference call with the

investment community on January 23, 2008 at 8:30 AM ET/5:30 AM PT.

To listen to the live webcast, please visit Check Point�s website

at http://www.checkpoint.com/ir. A replay of the conference call

will be available through February 6, 2008 at the company's website

http://www.checkpoint.com/ir or by telephone at +1.706.645.9291,

pass code #29930846. 1 See �Use of Non-GAAP Financial Information�

and �Reconciliation of Supplemental Financial Information� below

for more information regarding Check Point�s use of non-GAAP

measures. 2 �Equity-based compensation expenses� refer to the

amortized fair value of all equity based awards granted to

employees. �Acquisition- related charges� refer to the impact of

the amortization of intangible assets and other acquisition-related

expenses. About Check Point Software Technologies Ltd. Check Point

Software Technologies Ltd. (www.checkpoint.com) is a leader in

securing the Internet. The company is a market leader in the

worldwide enterprise firewall, personal firewall, data security and

VPN markets. Check Point�s PURE focus is on IT security with its

extensive portfolio of network security, data security and security

management solutions. Through its NGX platform, Check Point

delivers a unified security architecture for a broad range of

security solutions to protect business communications and resources

for corporate networks and applications, remote employees, branch

offices and partner extranets. The company also offers market

leading data security solutions through the Pointsec product line,

protecting and encrypting sensitive corporate information stored on

PCs and other mobile computing devices. Check Point's award-winning

ZoneAlarm Internet Security Suite and additional consumer security

solutions protect millions of consumer PCs from hackers, spyware

and data theft. Extending the power of the Check Point solution is

its Open Platform for Security (OPSEC), the industry's framework

and alliance for integration and interoperability with

"best-of-breed" solutions from hundreds of leading companies. Check

Point solutions are sold, integrated and serviced by a network of

Check Point partners around the world and its customers include 100

percent of Fortune 100 companies and tens of thousands of

businesses and organizations of all sizes. �2003�2008 Check Point

Software Technologies Ltd. All rights reserved. Check Point,

AlertAdvisor, Application Intelligence, Check Point Endpoint

Security, Check Point Express, Check Point Express CI, the Check

Point logo, ClusterXL, Confidence Indexing, ConnectControl,

Connectra, Connectra Accelerator Card, Cooperative Enforcement,

Cooperative Security Alliance, CoreXL, CoSa, DefenseNet, Dynamic

Shielding Architecture, Eventia, Eventia Analyzer, Eventia

Reporter, Eventia Suite, FireWall-1, FireWall-1 GX, FireWall-1

SecureServer, FloodGate-1, Hacker ID, Hybrid Detection Engine,

IMsecure, INSPECT, INSPECT XL, Integrity, Integrity Clientless

Security, Integrity SecureClient, InterSpect, IPS-1, IQ Engine,

MailSafe, NG, NGX, Open Security Extension, OPSEC, OSFirewall,

Pointsec, Pointsec Mobile, Pointsec PC, Pointsec Protector, Policy

Lifecycle Management, Provider-1, PureAdvantage, PURE Security, the

puresecurity logo, Safe@Home, Safe@Office, SecureClient,

SecureClient Mobile, SecureKnowledge, SecurePlatform,

SecurePlatform Pro, SecuRemote, SecureServer, SecureUpdate,

SecureXL, SecureXL Turbocard, Security Management Portal,

Sentivist, SiteManager-1, SmartCenter, SmartCenter Express,

SmartCenter Power, SmartCenter Pro, SmartCenter UTM, SmartConsole,

SmartDashboard, SmartDefense, SmartDefense Advisor, Smarter

Security, SmartLSM, SmartMap, SmartPortal, SmartUpdate, SmartView,

SmartView Monitor, SmartView Reporter, SmartView Status,

SmartViewTracker, SMP, SMP On-Demand, SofaWare, SSL Network

Extender, Stateful Clustering, TrueVector, Turbocard, UAM,

UserAuthority, User-to-Address Mapping, UTM-1, UTM-1 Edge, UTM-1

Edge Industrial, UTM-1 Total Security, VPN-1, VPN-1 Accelerator

Card, VPN-1 Edge, VPN-1 Express, VPN-1 Express CI, VPN-1 Power,

VPN-1 Power Multi-core, VPN-1 Power VSX, VPN-1 Pro, VPN-1

SecureClient, VPN-1 SecuRemote, VPN-1 SecureServer, VPN-1 UTM,

VPN-1 UTM Edge, VPN-1 VSX, Web Intelligence, ZoneAlarm, ZoneAlarm

Anti-Spyware, ZoneAlarm Antivirus, ZoneAlarm ForceField, ZoneAlarm

Internet Security Suite, ZoneAlarm Pro, ZoneAlarm Secure Wireless

Router, Zone Labs, and the Zone Labs logo are trademarks or

registered trademarks of Check Point Software Technologies Ltd. or

its affiliates. ZoneAlarm is a Check Point Software Technologies,

Inc. Company. All other product names mentioned herein are

trademarks or registered trademarks of their respective owners. The

products described in this document are protected by U.S. Patent

No. 5,606,668, 5,835,726, 5,987,611, 6,496,935, 6,873,988,

6,850,943, and 7,165,076 and may be protected by other U.S.

Patents, foreign patents, or pending applications. Use of Non-GAAP

Financial Information In addition to reporting financial results in

accordance with generally accepted accounting principles, or GAAP,

Check Point uses non-GAAP measures of net income, operating income

and earnings per share, which are adjustments from results based on

GAAP to exclude non-cash equity-based compensation charges in

accordance with SFAS 123R and acquisition related charges. Check

Point�s management believes the non-GAAP financial information

provided in this release is useful to investors� understanding and

assessment of Check Point�s on-going core operations and prospects

for the future. The presentation of this non-GAAP financial

information is not intended to be considered in isolation or as a

substitute for results prepared in accordance with GAAP. Management

uses both GAAP and non-GAAP information in evaluating and operating

business internally and as such has determined that it is important

to provide this information to investors. Safe Harbor Regarding

Forward Looking Statements This press release contains

forward-looking statements within the meaning of Section�27A of the

Securities Act of 1933 and Section�21E of the Securities Exchange

Act of 1934, including, but not limited to, statements related to

Check Point�s expectations that it will continue to deliver

comprehensive security solutions that address their customer

security needs and their ability to expand their product portfolio.

Because these statements pertain to future events they are subject

to various risks and uncertainties, actual results could differ

materially from Check Point's current expectations and beliefs.

Factors that could cause or contribute to such differences include,

but are not limited to: general market conditions in the Check

Point�s industry; economic and political uncertainties; the impact

of political changes and weaknesses in various regions of the

world, including hostilities or acts of terrorism�in Israel,

where�Check Point�s international headquarters are based; inclusion

of network security functionality in third-party hardware or system

software; any foreseen and unforeseen developmental or

technological difficulties with regard to Check Point's products;

changes in the competitive landscape, including new competitors or

the impact of competitive pricing and products; rapid technological

advances and changes in customer requirements to which Check Point

is unable to respond expeditiously, if at all; a shift in demand

for products such as Check Point's; factors affecting third parties

with which Check Point has formed business alliances; timely

availability and customer acceptance of Check Point's new and

existing products; the amount of equity based compensation charges

and other factors and risks discussed in Check Point's Annual

Report on Form 20-F for the year ended December 31, 2006, which is

on file with the Securities and Exchange Commission. Check Point

assumes no obligation to update information concerning its

expectations or beliefs. CHECK POINT SOFTWARE TECHNOLOGIES LTD.

CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS �(In thousands,

except per share amounts) � � Three Months Ended Year Ended

December 31, December 31, 2007 � 2006 2007 � 2006 (unaudited)

(unaudited) (unaudited) (unaudited) Revenues: Products and licenses

$93,529 $69,863 $309,785 $241,961 Software updates, maintenance and

services 113,175 90,232 421,092 333,180 Total revenues 206,704

160,095 730,877 575,141 � Operating expenses: Cost of products and

licenses 9,778 3,978 30,276 13,378 Cost of software updates,

maintenance and services 6,695 4,728 24,301 17,639 Amortization of

technology 7,154 1,353 27,724 5,414 Total cost of revenues 23,627

10,059 82,301 36,431 � Research and development 21,454 15,750

80,982 62,210 Selling and marketing 57,638 43,022 217,491 157,114

General and administrative 15,768 10,566 53,527 43,503 Acquired in

process research and development - 1,060 17,000 1,060 Total

operating expenses 118,487 80,457 451,301 300,318 � Operating

income 88,217 79,638 279,576 274,823 Financial income, net 13,443

16,326 49,725 63,647 Income before income taxes 101,660 95,964

329,301 338,470 Taxes on income 13,743 16,423 48,237 60,443 Net

income 87,917 79,541 281,064 278,027 Earnings per share (basic)

0.40 0.35 1.26 1.18 Number of shares used in computing earnings per

share (basic) 220,132 226,471 222,548 235,519 Earnings per share

(diluted) 0.39 0.35 1.25 1.17 Number of shares used in computing

earnings per share (diluted) 222,993 228,865 225,442 236,769 CHECK

POINT SOFTWARE TECHNOLOGIES LTD. RECONCILIATION OF SUPPLEMENTAL

FINANCIAL INFORMATION �(In thousands, except per share amounts) � �

� Three Months Ended Year Ended December 31, December 31, 2007 �

2006 2007 2006 (unaudited) (unaudited) (unaudited) (unaudited) �

GAAP operating income $88,217 $79,638 $279,576 $274,823 Stock-based

compensation (1) 8,827 9,004 34,052 36,392 Amortization of

intangible assets and acquisition related expenses (2) 10,338 1,504

39,977 6,945 Acquired in process research and development - 1,060

17,000 1,060 Non-GAAP operating income 107,382 91,206 370,605

319,220 � GAAP net income 87,917 79,541 281,064 278,027 Stock-based

compensation (1) 8,827 9,004 34,052 36,392 Amortization of

intangible assets and acquisition related expenses (2) 10,338 1,504

39,977 6,945 Acquired in process research and development - 1,060

17,000 1,060 Taxes on stock-based compensation and amortization of

intangible assets and acquisition related expenses (3) (4,576)

(542) (13,358) (2,166) Non-GAAP net income 102,506 90,567 358,735

320,258 � GAAP Earnings per share (diluted) 0.39 0.35 1.25 1.17

Stock-based compensation (1) 0.04 0.04 0.15 0.16 Amortization of

intangible assets and acquisition related expenses (2) 0.05 0.01

0.18 0.03 Acquired in process research and development 0.00 0.00

0.07 0.00 Taxes on stock-based compensation and amortization of

intangible assets and acquisition related expenses (3) (0.02) 0.00

(0.06) (0.01) Non-GAAP Earnings per share (diluted) 0.46 0.40 1.59

1.35 � Number of shares used in computing Non-GAAP earnings per

share (diluted) 222,993 228,865 225,442 236,769 � (1) Stock-based

compensation: Cost of products and licenses 14 5 65 39 Cost of

software updates, maintenance and services 197 247 668 470 Research

and development 1,014 1,945 4,309 9,371 Selling and marketing 1,973

2,214 8,780 7,997 General and administrative 5,629 4,593 20,230

18,515 Total before taxes 8,827 9,004 34,052 36,392 � (2)

Amortization of intangible assets and acquisition related expenses:

Cost of products and licenses 7,154 1,353 27,724 5,414 Selling and

marketing 3,184 151 12,253 604 General and administrative - - - 927

Total before taxes 10,338 1,504 39,977 6,945 � (3) Taxes on

stock-based compensation and amortization of intangible assets and

acquisition related expenses (4,576) (542) (13,358) (2,166) Total,

net 14,589 9,966 60,671 41,171 CHECK POINT SOFTWARE TECHNOLOGIES

LTD. CONDENSED CONSOLIDATED BALANCE SHEET DATA (In thousands)

ASSETS � � December 31, December 31, 2007 2006 (unaudited)

(unaudited) Current assets: Cash and cash equivalents $509,664

$519,443 Marketable securities 387,878 571,621 Trade receivables,

net 201,515 141,881 Other receivables and prepaid expenses 24,353

22,408 Total current assets 1,123,410 1,255,353 � Long-term assets:

Marketable securities 343,967 558,874 Property, plant and

equipment, net 56,947 47,192 Severance pay fund 9,302 6,631

Intangible assets, net 160,133 23,117 Goodwill 664,910 182,115

Deferred income taxes, net 14,950 6,977 Other assets 636 534 Total

long-term assets 1,250,845 825,440 � Total assets 2,374,255

2,080,793 � � � LIABILITIES AND SHAREHOLDERS� EQUITY � Current

liabilities: Deferred revenues $273,693 $204,149 Trade payables and

other accrued liabilities 197,739 153,900 Total current liabilities

471,432 358,049 � Deferred tax liability, net 31,465 - Accrued

severance pay 14,403 11,211 � Total liabilities 517,300 369,260 � �

Shareholders� equity: Share capital 774 774 Additional paid-in

capital 464,330 422,381 Treasury shares at cost (907,022) (728,909)

Accumulated other comprehensive income (loss) 1,233 (6,293)

Retained earnings 2,297,640 2,023,580 Total shareholders� equity

1,856,955 1,711,533 Total liabilities and shareholders� equity

2,374,255 2,080,793 Total cash and cash equivalents and marketable

1,241,509 1,649,938 CHECK POINT SOFTWARE TECHNOLOGIES LTD. SELECTED

CONSOLIDATED CASH FLOW DATA (In thousands) � � Three Months Ended

Year Ended December 31, December 31, 2007 � 2006 2007 � 2006

(unaudited) (unaudited) (unaudited) (unaudited) Cash flow from

operating activities: Net income $87,917 $79,541 $281,064 $278,027

Adjustments to reconcile net income to net cash provided by

operating activities: � Depreciation and amortization of property,

plant and equipment 3,995 1,461 8,541 5,707 Increase in trade and

other receivables, net (68,080) (47,582) (24,235) (10,296) Increase

in deferred revenues, trade payables and other accrued liabilities

65,467 43,722 48,246 51,826 Acquisition of in process research and

development - 1,060 17,000 1,060 Amortization of intangible assets

10,338 1,504 39,977 6,018 Stock-based compensation 8,827 9,004

34,052 36,392 Excess tax benefit from stock-based compensation

(6,828) 1,159 (6,828) (2,291) Deferred income taxes, net (10,359)

(7,130) (26,222) (3,150) Net cash provided by operating activities

91,277 82,739 371,595 363,293 � Cash flow from investing

activities: Cash paid in conjunction with the acquisition of NFR -

(14,371) - (14,371) Cash paid in conjunction with the acquisition

of Protect Data, net (456) - (594,964) - Investment in property,

plant and equipment (4,089) (2,975) (16,727) (44,890) Net cash used

in investing activities (4,545) (17,346) (611,691) (59,261) � Cash

flow from financing activities: Proceeds from issuance of shares

upon exercise of options 1,751 5,375 24,640 51,934 Purchase of

treasury shares (61,858) (31,693) (209,757) (435,491) Excess tax

benefit from stock-based compensation 6,828 (1,159) 6,828 2,291

Repayment of loans related to NFR - (1,833) - (1,833) Net cash used

in financing activities (53,279) (29,310) (178,289) (383,099) �

Unrealized gain on marketable securities, net 3,227 1,805 9,956

3,662 � Increase (decrease) in cash and cash equivalents and

marketable securities 36,680 37,888 (408,429) (75,405) � Cash and

cash equivalents and marketable securities at the beginning of the

period 1,204,829 1,612,050 1,649,938 1,725,343 � Cash and cash

equivalents and marketable securities at the end of the period

1,241,509 1,649,938 1,241,509 1,649,938

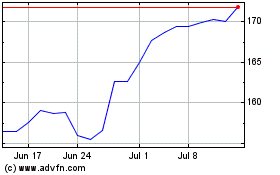

Check Point Software Tec... (NASDAQ:CHKP)

Historical Stock Chart

From May 2024 to Jun 2024

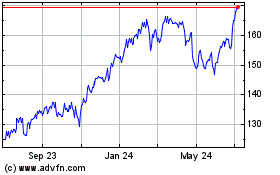

Check Point Software Tec... (NASDAQ:CHKP)

Historical Stock Chart

From Jun 2023 to Jun 2024