CAUTIONARY NOTE REGARDING FORWARD-LOOKING

STATEMENTS

This prospectus supplement, including the

documents that we incorporate by reference, contains forward-looking statements within the meaning of Section 27A of the Securities

Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended

(the “Exchange Act”). Examples of our forward-looking statements include:

|

|

·

|

our current views with respect to our business strategy, business plan and research and development activities;

|

|

|

·

|

the future impacts of the COVID-19 pandemic on our business, employees, operating results, ability to obtain additional funding, product development programs, research and development programs, suppliers and third-party manufacturers;

|

|

|

·

|

the progress of our product development programs, including clinical testing and the timing of commencement and results thereof;

|

|

|

·

|

our projected operating results, including research and development expenses;

|

|

|

·

|

our ability to continue development plans for CLR 131, CLR 1900 series, CLR 2000 series and CLR 12120;

|

|

|

·

|

our ability to continue development plans for our Phospholipid Drug Conjugates (PDC)™;

|

|

|

·

|

our ability to maintain orphan drug designation in the U.S. for CLR 131 as a therapeutic for the treatment of multiple myeloma, neuroblastoma, osteosarcoma, rhabdomyosarcoma, Ewing’s sarcoma and lymphoplasmacytic lymphoma, and the expected benefits of orphan drug status;

|

|

|

·

|

any disruptions at our sole supplier of CLR 131;

|

|

|

·

|

our ability to pursue strategic alternatives;

|

|

|

·

|

our ability to advance our technologies into product candidates;

|

|

|

·

|

our enhancement and consumption of current resources along with ability to obtain additional funding;

|

|

|

·

|

our current view regarding general economic and market conditions, including our competitive strengths;

|

|

|

·

|

uncertainty and economic instability resulting from conflicts, military actions, terrorist attacks, natural disasters, public health crises, including the occurrence of a contagious disease or illness, including the COVID-19 pandemic, cyber-attacks and general instability;

|

|

|

·

|

assumptions underlying any of the foregoing; and

|

|

|

·

|

any other statements that address events or developments that we intend or believe will or may occur in the future.

|

In some cases, you can identify forward-looking

statements by terminology such as “expects,” “anticipates,” “intends,” “estimates,”

“plans,” “believes,” “seeks,” “may,” “should,” “could”

or the negative of such terms or other similar expressions. Accordingly, these statements involve estimates, assumptions and uncertainties

that could cause actual results to differ materially from those expressed in them. Forward-looking statements also involve risks

and uncertainties, many of which are beyond our control. Any forward-looking statements are qualified in their entirety by reference

to the factors discussed throughout this prospectus supplement.

You should read this prospectus supplement

and the documents that we reference herein and therein and have filed as exhibits to the registration statement, of which this

prospectus is part, completely and with the understanding that our actual future results may be materially different from what

we expect. You should assume that the information appearing in this prospectus supplement is accurate only as of the date on the

front cover of this prospectus supplement. Because the risk factors referred to above could cause actual results or outcomes to

differ materially from those expressed in any forward-looking statements made by us or on our behalf, you should not place undue

reliance on any forward-looking statements. Further, any forward-looking statement speaks only as of the date on which it is made,

and we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which

the statement is made or to reflect the occurrence of unanticipated events. New factors emerge from time to time, and it is not

possible for us to predict which factors will arise. In addition, we cannot assess the impact of each factor on our business or

the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in

any forward-looking statements. We qualify all of the information presented in this prospectus supplement, and particularly our

forward-looking statements, by these cautionary statements.

SUMMARY

This summary highlights information

contained elsewhere in this prospectus supplement and does not contain all of the information that you should consider in making

your investment decision. Before investing in our securities, you should carefully read this entire prospectus, including the documents

to which we have referred you under the headings “Where You Can Find More Information” and “Incorporation of

Documents by Reference” and the information set forth under the headings “Risk Factors” and “Management’s

Discussion and Analysis of Financial Condition and Results of Operations,” in each case, included elsewhere in this prospectus

supplement or incorporated herein by reference.

Overview

We are a late-stage clinical biopharmaceutical

company focused on the discovery, development and commercialization of drugs for the treatment of cancer. Our core objective is

to leverage our proprietary phospholipid drug conjugate™ (PDC™) delivery platform to develop PDCs that are designed

to specifically target cancer cells and deliver improved efficacy and better safety as a result of fewer off-target effects. Our

PDC platform possesses the potential for the discovery and development of the next generation of cancer-targeting treatments, and

we plan to develop PDCs both independently and through research and development collaborations. The COVID-19 pandemic has created

uncertainties in the expected timelines for clinical stage biopharmaceutical companies such as us, and because of such uncertainties,

it is difficult for us to accurately predict expected outcomes at this time. We have not yet experienced any significant impacts

as a result of the pandemic and have continued to enroll patients in our clinical studies. However, COVID-19 may impact our future

ability to recruit patients for clinical studies, obtain adequate supply of CLR 131 and obtain additional financing.

Our lead PDC therapeutic, CLR 131 is a

small-molecule PDC designed to provide targeted delivery of iodine-131 directly to cancer cells, while limiting exposure to healthy

cells. We believe this profile differentiates CLR 131 from many traditional on-market treatment options. CLR 131 is the company’s

lead product candidate and is currently being evaluated in two clinical studies: the CLOVER-1 Phase 2 Adult B-Cell Malignancy study

and the CLOVER-2 Phase 1 pediatric safety study.

The CLOVER-1

study met the primary efficacy endpoints from the Part A dose-finding portion, conducted in relapsed/refractory (r/r) B-cell malignancies,

and is now enrolling in expansion cohorts to evaluate triple class refractory multiple myeloma (MM) and Bruton tyrosine kinase

(BTK) inhibitor failed Waldenstrom’s macroglobulinemia (WM) patients. The dosing regimen is designed to provide the optimal

dose identified in Part A of >60mCi total body dose.

The CLOVER-2

Phase 1 pediatric study is an open-label, sequential-group, dose-escalation study to evaluate the safety and tolerability of CLR

131 in children and adolescents with relapsed or refractory cancers, including malignant brain tumors, neuroblastoma, sarcomas,

and lymphomas (including Hodgkin’s lymphoma). The study is being conducted internationally at seven leading pediatric cancer

centers.

The U.S. Food

and Drug Administration (“FDA”) granted CLR 131 Fast Track Designation for both r/r MM and r/r diffuse large B-cell

lymphoma (DLBCL) and Orphan Drug Designation (ODD) of MM, WM, neuroblastoma, rhabdomyosarcoma, Ewing’s sarcoma and osteosarcoma.

CLR 131 was also granted Rare Pediatric Disease Designation (RPDD) for the treatment of neuroblastoma, rhabdomyosarcoma, Ewing’s

sarcoma and osteosarcoma. Earlier this year, the European Commission granted an ODD for r/r MM and most recently, the FDA

granted Fast Track Designation for CLR 131 in WM patients having received two prior treatment regimens or more.

Our product pipeline also includes

one preclinical PDC chemotherapeutic program (CLR 1900) and several partnered PDC assets. The CLR 1900 Series is being targeted

for solid tumors with a payload that inhibits mitosis (cell division) a validated pathway for treating cancers.

We have leveraged our PDC platform

to establish four collaborations featuring five unique payloads and mechanisms of action. Through research and development collaborations,

our strategy is to generate near-term capital, supplement internal resources, gain access to novel molecules or payloads, accelerate

product candidate development and broaden our proprietary and partnered product pipelines.

Our PDC platform provides selective

delivery of a diverse range of oncologic payloads to cancerous cells, whether a hematologic cancer or solid tumor, a primary tumor,

or a metastatic tumor and cancer stem cells. The PDC platform’s mechanism of entry does not rely upon specific cell surface

epitopes or antigens as are required by other targeted delivery platforms. Our PDC platform takes advantage of a metabolic pathway

utilized by all tumor cell types in all stages of the tumor cycle. Tumor cells modify specific regions on the cell surface as a

result of the utilization of this metabolic pathway. Our PDCs bind to these regions and directly enter the intracellular compartment.

This mechanism allows the PDC molecules to accumulate over time, which enhances drug efficacy, and to avoid the specialized highly

acidic cellular compartment known as lysosomes, which allows a PDC to deliver molecules that previously could not be delivered.

Additionally, molecules targeting specific cell surface epitopes face challenges in completely eliminating a tumor because the

targeted antigens are limited in the total number on the cell surface, have longer cycling time from internalization to being present

on the cell surface again and available for binding and are not present on all of the tumor cells in any cancer. This means a subpopulation

of tumor cells always exist that cannot be targeted by therapies targeting specific surface epitopes. In addition to the benefits

provided by the mechanism of entry, PDCs offer the ability to conjugate payload molecules in numerous ways, thereby increasing

the types of molecules selectively delivered via the PDC.

The PDC platform features include

the capacity to link with almost any molecule, provide a significant increase in targeted oncologic payload delivery and the ability

to target all types of tumor cells. As a result, we believe that we can generate PDCs to treat a broad range of cancers with the

potential to improve the therapeutic index of oncologic drug payloads, enhance or maintain efficacy while also reducing adverse

events by minimizing drug delivery to healthy cells, and increasing delivery to cancerous cells and cancer stem cells.

We employ a drug discovery and development

approach that allows us to efficiently design, research and advance drug candidates. Our iterative process allows us to rapidly

and systematically produce multiple generations of incrementally improved targeted drug candidates.

In June 2020, the European Medicines

Agency (EMA) granted us Small and Medium-Sized Enterprise status by the EMA’s Micro, Small and Medium-sized Enterprise office.

SME status allows us to participate in significant financial incentives that include a 90% to 100% EMA fee reduction for scientific

advice, clinical study protocol design, endpoints and statistical considerations, quality inspections of facilities and fee waivers

for selective EMA pre and post-authorization regulatory filings, including orphan drug and PRIME designations. We are also eligible

to obtain EMA certification of quality and manufacturing data prior to review of clinical data. Other financial incentives include

EMA-provided translational services of all regulatory documents required for market authorization, further reducing the financial

burden of the market authorization process.

A description of our PDC product

candidates follows:

Clinical Pipeline

Our lead PDC therapeutic,

CLR 131 is a small-molecule, PDC designed to provide targeted delivery of iodine-131 directly to cancer cells, while limiting exposure

to healthy cells. We believe this profile differentiates CLR 131 from many traditional on-market treatments and treatments in development.

CLR 131 is currently being evaluated in two clinical studies: the CLOVER-1 Phase 2 adult B-cell malignancy study and the CLOVER-2

Phase 1 pediatric safety study.

The CLOVER-1

study met the primary efficacy endpoints from the Part A dose-finding portion, conducted in r/r B-cell malignancies, and is now

enrolling in expansion cohorts to evaluate triple class refractory MM and BTK inhibitor failed WM patients. The dosing regimen

is designed to provide the optimal dose of >60mCi total body dose (TBD) identified in Part A. The initial Investigational

New Drug (IND) application was accepted by the FDA in March 2014 with multiple INDs submitted since that time. Initiated in March

2017, the primary goal of the Phase 2A study was to assess the compound’s efficacy in a broad range of hematologic cancers.

In the expansion portion of the study the goal is to confirm the efficacy of the >60mCi TBD in triple class refractory

MM and BTK inhibitor failed WM patients. The Phase 1 study was designed to assess the compound’s safety and tolerability

in patients with r/r MM (to determine maximum tolerated dose (MTD)) and was initiated in April 2015. The study completed enrollment

and the final clinical study report is expected in the first half of 2021.

The CLOVER-2

Phase 1 pediatric study is being conducted internationally at seven leading pediatric cancer centers. The study is an open-label,

sequential-group, dose-escalation study to evaluate the safety and tolerability of CLR 131 in children and adolescents with relapsed

or refractory cancers, including malignant brain tumors, neuroblastoma, sarcomas, and lymphomas (including Hodgkin’s lymphoma).

The FDA previously accepted our IND application for a Phase 1 open-label, dose escalating study to evaluate the safety and tolerability

of a single intravenous administration of CLR 131 in up to 30 children and adolescents with cancers including neuroblastoma, sarcomas,

lymphomas (including Hodgkin’s lymphoma) and malignant brain tumors. This study was initiated during the first quarter of

2019. These cancer types were selected for clinical, regulatory and commercial rationales, including the radiosensitive nature

and continued unmet medical need in the r/r setting, and the rare disease determinations made by the FDA based upon the current

definition within the Orphan Drug Act.

In December

2014, the FDA granted ODD for CLR 131 for the treatment of MM. In 2018, the FDA granted ODD and RPDD for CLR 131 for the treatment

of neuroblastoma, rhabdomyosarcoma, Ewing’s sarcoma and osteosarcoma. In May 2019, the FDA granted Fast Track designation

for CLR 131 for the treatment of MM and in July 2019 for the treatment of DLBCL, in September 2019 CLR 131 received Orphan Drug

Designation from the European Union for Multiple Myeloma, and in January 2020, the FDA granted Orphan Drug Designation for CLR

131 Waldenstrom’s macrogloulinemia. The FDA granted Fast Track designation for CLR 131 for the treatment of WM in May 2020.

The FDA may award priority review

vouchers to sponsors of a RPDD that meet its specified criteria. The key criteria to receiving a priority review voucher (PRV)

is that the disease being treated is life-threatening and that it primarily effects individuals under the age of 18. Under this

program, a sponsor who receives an approval for a drug or biologic for a rare pediatric disease can receive a PRV that can be redeemed

to receive a priority review of a subsequent marketing application for a different product. Additionally, the PRV’s can be

exchanged or sold to other companies so that the receiving company may use the voucher.

Phase 2 Study in Patients with r/r select B-cell Malignancies

In

February 2020, we announced positive data from our Phase 2 CLOVER-1 study in patients with relapsed/refractory B-cell lymphomas.

Relapsed/Refractory MM and non-Hodgkin lymphoma (NHL) patients were treated with three different doses (<50mCi,

~50mCi and >60mCi total body dose (TBD). The <50mCi total body dose was a deliberately planned sub-therapeutic

dose. CLR 131 achieved the primary endpoint for the study. Patients with r/r MM who received the >60mCi TBD of CLR

131 showed a 42.8% overall response rate (ORR). Those who received ~50mCi TBD had a 26.3% ORR with a combined rate of 34.5% ORR

(n=33) while maintaining a well-tolerated safety profile. Patients in the studies were elderly with a median age of 70, and heavily

pre-treated, with a median of five prior lines of treatment (range: 3 to 17), which included immunomodulatory drugs, proteasome

inhibitors and CD38 antibodies for the majority of patients. Additionally, a majority of the patients (53%) were quad refractory

or greater and 44% of all treated multiple myeloma patients were triple class refractory. 100% of all evaluable patients (n=43)

achieved clinical benefit (primary outcome measure) as defined by having stable disease or better. 85.7% of multiple myeloma patients

receiving the higher total body dose levels of CLR 131 experienced tumor reduction. The >60mCi TBD demonstrated

positive activity in both high-risk patients and triple class refractory patients with a 50% and 33% ORR, respectively.

Patients

with r/r NHL who received <60mCi TBD and the >60mCi TBD had a 42% and 43% ORR, respectively and a combined rate

of 42%. These patients were also heavily pre-treated, having a median of three prior lines of treatment (range, 1 to

9) with the majority of patients being refractory to rituximab and/or ibrutinib. The patients had a median age of 70 with a range

of 51 to 86. All patients had bone marrow involvement with an average of 23%. In addition to these findings, subtype assessments

were completed in the r/r B-cell NHL patients. Patients with DLBCL demonstrated a 30% ORR with one patient achieving a complete

response (CR), which continues at nearly 24 months post-treatment. The ORR for CLL/SLL/MZL patients was 33%. Current data from

our Phase 2 CLOVER-1 clinical study show that four LPL/WM patients demonstrated 100% ORR with one patient achieving a CR which

continues at nearly 35 months post-treatment. This may represent an important improvement in the treatment of relapsed/refractory

LPL/WM as we believe no approved or late-stage development treatments for second- and third-line patients have reported a CR. LPL/WM

is a rare, indolent and incurable form of NHL that is composed of a patient population in need of new and better treatment options.

Based upon

the dose response observed in Part A patients receiving total body doses of 60mCi or greater, we determined that patient dosing

of CLR 131 would be >60mCi TBD. Therefore, patients are now grouped as receiving <60mCi or >60mCi

TBD. In September 2020, we announced that a clinically meaningful 40% ORR was observed in the subset of refractory multiple myeloma

patients deemed triple class refractory who received 60 mCi or greater TBD. Triple class refractory is defined as patients that

are refractory to immunomodulatory, proteasome inhibitors and anti-CD38 antibody drug classes. The 40% ORR (6/15 patients) represents

triple class refractory patients enrolled in Part A of Cellectar’s CLOVER-1 study and additional patients enrolled in Part

B from March through May 2020 and received >60mCi TBD. All MM patients enrolled in the expansion cohort are required

to be triple class refractory. The additional six patients were heavily pre-treated with an average of nine prior multi-drug regimens.

Three patients received a total body dose of > 60 mCi and three received less than 60 mCi. Consistent with

the data released in February 2020, patients receiving > 60 mCi typically exhibit greater responses. Based

on study results to date, patients continue to tolerate CLR 131 well, with the most common and almost exclusive treatment emergent

adverse events being cytopenias.

We recently

held FDA Type B guidance meeting to define the registrational pathway for our priority adult hematology oncology indications and

planned initiation of the pivotal study for our lead indication in the fourth quarter

The

most frequently reported adverse events in r/r MM patients were cytopenias, which followed a predictable course and timeline. The

frequency of adverse events have not increased as doses were increased and the profile of cytopenias remains consistent. Importantly,

these cytopenias have had a predictable pattern to initiation, nadir and recovery and are treatable. The most common grade ≥3

events at the highest dose (75mCi TBD) were hematologic toxicities including thrombocytopenia (65%), neutropenia (41%), leukopenia

(30%), anemia (24%) and lymphopenia (35%). No patients experienced cardiotoxicities, neurological toxicities, infusion site reactions,

peripheral neuropathy, allergic reactions, cytokine release syndrome, keratopathy, renal toxicities, or changes in liver enzymes.

The safety and tolerability profile in patients with r/r NHL was similar to r/r MM patients except for fewer cytopenias of any

grade. Based upon CLR 131 being well tolerated across all dose groups and the observed response rate, especially in difficult to

treat patients such as high risk and triple class refractory or penta-refractory, and corroborating data showing the potential

to further improve upon current ORRs and durability of those responses, the study has been expanded to test a two-cycle dosing

optimization regimen with a target total body dose >60 mCi/m2 of CLR 131.

In July 2016, we were awarded a $2,000,000

National Cancer Institute (NCI) Fast-Track Small Business Innovation Research grant to further advance the clinical development

of CLR 131. The funds are supporting the Phase 2 study initiated in March 2017 to define the clinical benefits of CLR 131 in r/r

MM and other niche hematologic malignancies with unmet clinical need. These niche hematologic malignancies include Chronic Lymphocytic

Leukemia, Small Lymphocytic Lymphoma, Marginal Zone Lymphoma, Lymphoplasmacytic Lymphoma/WM and DLBCL. The study is being conducted

in approximately 10 U.S. cancer centers in patients with orphan-designated relapse or refractory hematologic cancers. The study’s

primary endpoint is clinical benefit response (CBR), with secondary endpoints of ORR, progression free survival (PFS,) median Overall

Survival (mOS) and other markers of efficacy following patients receiving one of three TBDs of CLR 131 (<50mCi, ~50mCi and >60mCi),

with the option for a second cycle approximately 75-180 days later. Dosages were provided either as single bolus or fractionated

(the assigned dose level split into two doses) given day 1 and day 15.

In May 2020, we announced that the

FDA granted Fast Track Designation for CLR 131 in WM in patients having received two prior treatment regimens or more.

Phase 1 Study in Patients with

r/r Multiple Myeloma

In February 2020, we announced the

successful completion of our Phase 1 dose escalation study. Data from the study demonstrated that CLR 131 was safe and tolerated

at total body dose of approximately 90mCi in r/r MM. The Phase 1 multicenter, open-label, dose-escalation study was designed to

evaluate the safety and tolerability of CLR 131 administered as a 30-minute I.V. infusion, either as a single bolus dose or as

fractionated doses. The r/r multiple myeloma patients in this study received single cycle doses ranging from approximately 20mCi

to 90mCi total body dose. An independent Data Monitoring Committee determined that all doses have been safe and well-tolerated

by patients.

CLR 131 in combination with

dexamethasone is currently under investigation in adult patients with r/r MM. Patients must have been refractory to or relapsed

from at least one proteasome inhibitor and at least one immunomodulatory agent. The clinical study is a standard three-plus-three

dose escalation safety study to determine the maximum tolerable dose. Multiple myeloma is an incurable cancer of the plasma cells

and is the second most common form of hematologic cancers. Secondary objectives include the evaluation of therapeutic activity

by assessing surrogate efficacy markers, which include M protein, free light chain (FLC), PFS and OS. All patients have been heavily

pretreated with an average of five prior lines of therapy. CLR 131 was deemed by an Independent Data Monitoring Committee (IDMC)

to be safe and tolerable up to its planned maximum single, bolus dose of 31.25 mCi/m2. The four single dose cohorts

examined were: 12.5 mCi/m2 (~25mCi TBD), 18.75 mCi/m2 (~37.5mCi TBD), 25 mCi/m2(~50mCi

TBD), and 31.25 mCi/m2(~62.5mCi TBD), all in combination with low dose dexamethasone (40 mg weekly). Of the five patients

in the first cohort, four achieved stable disease and one patient progressed at Day 15 after administration and was taken off the

study. Of the five patients admitted to the second cohort, all five achieved stable disease however one patient progressed at Day

41 after administration and was taken off the study. Four patients were enrolled to the third cohort and all achieved stable disease.

In September 2017, we announced results for cohort 4, showing that a single infusion up to 30-minutes of 31.25mCi/m2 of

CLR 131 was safe and tolerated by the three patients in the cohort. Additionally, all three patients experienced CBR with one patient

achieving a partial response (PR). We use the International Myeloma Working Group (IMWG) definitions of response, which involve

monitoring the surrogate markers of efficacy, M protein and FLC. The IMWG defines a PR as a greater than or equal to 50% decrease

in FLC levels (for patients in whom M protein is unmeasurable) or 50% or greater decrease in M protein. The patient experiencing

a PR had an 82% reduction in FLC. This patient did not produce M protein, had received seven prior lines of treatment including

radiation, stem cell transplantation and multiple triple combination treatments including one with daratumumab that was not tolerated.

One patient experiencing stable disease attained a 44% reduction in M protein. In January 2019, we announced that the pooled mOS

data from the first four cohorts was 22.0 months. In late 2018, we modified this study to evaluate a fractionated dosing strategy

to potentially increase efficacy and decrease adverse events.

Cohort 5 and 6 were fractionated

cohorts of 31.25 mCi/m2(~62.5mCi TBD) and 37.5 mCi/m2(~75mCi TBD), each administered on day 1 and on day

8. Following the determination that all prior dosing cohorts were safe and tolerated, we initiated a cohort 7 utilizing a 40mCi/m2

(~80mCi TBD) fractionated dose administered 20mCi/m2 (~40mCi TBD) on days 1 and day 8. Cohort 7 was the highest pre-planned dose

cohort and subjects have completed the evaluation period. The study completed enrollment and the final clinical study report is

expected in the first half of 2021.

In May 2019,

we announced that the FDA granted Fast Track Designation for CLR 131 in fourth line or later r/r MM. CLR 131 is our small molecule

radiotherapeutic PDC designed to deliver cytotoxic radiation directly and selectively to cancer cells and cancer stem cells. It

is currently being evaluated in our ongoing CLOVER-1 Phase 2 clinical study in patients with relapsed or refractory multiple myeloma

and other select B-cell lymphomas.

Phase 1 Study in r/r

Pediatric Patients with select Solid tumors, Lymphomas and Malignant Brain Tumors

In December 2017 the Division of

Oncology at the FDA accepted our IND and study design for the Phase 1 study of CLR 131 in children and adolescents with select

rare and orphan designated cancers. This study was initiated during the first quarter of 2019. In December 2017, we filed an IND

application for r/r pediatric patients with select solid tumors, lymphomas and malignant brain tumors. The Phase 1 clinical study

of CLR 131 is an open-label, sequential-group, dose-escalation study evaluating the safety and tolerability of intravenous administration

of CLR 131 in children and adolescents with cancers including neuroblastoma, sarcomas, lymphomas (including Hodgkin’s lymphoma)

and malignant brain tumors. Secondary objectives of the study are to identify the recommended efficacious dose of CLR 131 and to

determine preliminary antitumor activity (treatment response) of CLR 131 in children and adolescents. In August 2020, it was announced

that four dose levels 15mCi/m2 up to 60mCi/m2 were deemed safe and tolerable by an independent

Data Monitoring Committee and evaluation of the next higher dose cohort, 75mCi/m2 was to initiate. In 2018, the

FDA granted OD and RPDD for CLR 131 for the treatment of neuroblastoma, rhabdomyosarcoma, Ewing’s sarcoma and osteosarcoma.

Should any of these indications reach approval, the RPDD would enable us to receive a priority review voucher. Priority review

vouchers can be used by the sponsor to receive priority review for a future New Drug Application (“NDA”) or Biologic

License Application (“BLA”) submission, which would reduce the FDA review time from 12 months to six months. Currently,

these vouchers can also be transferred or sold to another entity. This Priority Review Voucher Program is currently under

evaluation for renewal.

Phase 1 Study in r/r Head and Neck Cancer

In August 2016, the University

of Wisconsin Carbone Cancer Center (“UWCCC”) was awarded a five-year Specialized Programs of Research Excellence (“SPORE”)

grant of $12,000,000 from the National Cancer Institute and the National Institute of Dental and Craniofacial Research to improve

treatments and outcomes for head and neck cancer, HNC, patients. HNC is the sixth most common cancer across the world with approximately

56,000 new patients diagnosed every year in the U.S. As a key component of this grant, the UWCCC researchers completed testing

of CLR 131 in various animal HNC models and initiated the first human clinical study enrolling up to 30 patients combining CLR

131 and external beam radiation with recurrent HNC in Q4 2019. This clinical study was suspended due to the COVID-19 pandemic but

has now been reopened for enrollment.

Preclinical Pipeline

We believe our PDC platform has potential

to provide targeted delivery of a diverse range of oncologic payloads, as exemplified by the product candidates listed below, that

may result in improvements upon current standard of care (“SOC”) for the treatment of a broad range of human cancers:

|

|

·

|

CLR 1900 Series is an internally developed proprietary PDC program leveraging a novel small molecule cytotoxic compound as

the payload. The payload inhibits mitosis (cell division) and targets a key pathway required to inhibit rapidly dividing cells

that results in apoptosis. We believe that this program could produce a product candidate targeted to select solid tumors. Currently,

the program is in early preclinical development and if we elect to progress any molecules further, we will select preferred candidates.

|

|

|

·

|

CLR 2000 Series is a collaborative PDC program with Avicenna Oncology, or Avicenna, that we entered into in July 2017. Avicenna

is a developer of antibody drug conjugates (“ADCs”). The objective of the research collaboration is to design and develop

a series of PDCs utilizing Avicenna’s proprietary cytotoxic payload. Although Avicenna is a developer of ADCs, this collaboration

was sought as a means to overcome many of the challenges associated with ADCs, including those associated with the targeting of

specific cell surface epitopes. The CLR 2000 Series has demonstrated improved safety, efficacy and tissue distribution with the

cytotoxic payload in animal models. A candidate molecule and a back-up have been selected for further advancement at a future time.

|

|

|

·

|

CLR 12120 Series is a collaborative PDC program with Orano Med for the development of novel PDCs utilizing Orano Med’s

unique alpha emitter, lead 212 conjugated to our phospholipid ether; the companies intend to evaluate the new PDCs in up to three

oncology indications. Currently this series has shown efficacy in the first two animal models tested.

|

Key Risks and Uncertainties

We are subject to numerous risks and uncertainties,

including the following:

|

|

·

|

Our operations and financial condition may be adversely impacted by the COVID-19 pandemic.

|

|

|

·

|

We will require additional capital in order to continue our operations and may have difficulty raising additional capital.

|

|

|

·

|

We are a clinical-stage company with a going concern qualification to our financial statements and a history of losses, and

we can provide no assurance as to our future operating results.

|

|

|

·

|

We rely on a collaborative outsourced business model, and disruptions with these third-party collaborators may impede our ability

to gain FDA approval and delay or impair commercialization of any products.

|

|

|

·

|

We will require additional capital in order to continue our operations and may have difficulty raising additional capital.

|

|

|

·

|

We rely on a small number of key personnel who may terminate their employment with us at any time, and our success will depend

on our ability to hire additional qualified personnel.

|

|

|

·

|

We cannot assure the successful development and commercialization of our compounds in development.

|

|

|

·

|

Our proposed products and their potential applications are in an early stage of clinical and manufacturing/process development

and face a variety of risks and uncertainties.

|

|

|

·

|

Failure to complete the development of our technologies, to obtain government approvals, including required FDA approvals,

or comply with ongoing governmental regulations could prevent, delay or limit introduction or sale of proposed products and result

in failure to achieve revenues or maintain our ongoing business.

|

|

|

·

|

Clinical studies involve a lengthy and expensive process with an uncertain outcome, and results of earlier studies and trials

may not be predictive of future trial results.

|

|

|

·

|

We may be required to suspend or discontinue clinical studies due to unexpected side effects or other safety risks that could

preclude approval of our product candidates.

|

|

|

·

|

Controls we or our third-party collaborators have in place to ensure compliance with all applicable laws and regulations may

not be effective.

|

|

|

·

|

We expect to rely on our patents as well as specialized regulatory designations such as orphan drug classification for our

product candidates, but regulatory drug designations may not confer marketing exclusivity or other expected commercial benefits.

|

|

|

·

|

The FDA has granted rare pediatric disease designation, RPDD, to CLR 131 for treatment of neuroblastoma and rhabdomyosarcoma;

however, we may not be able to realize any value from such designation.

|

|

|

·

|

We are exposed to product, clinical and preclinical liability risks that could create a substantial financial burden should

we be sued.

|

|

|

·

|

Acceptance of our products in the marketplace is uncertain and failure to achieve market acceptance will prevent or delay our

ability to generate revenues.

|

|

|

·

|

The market for our proposed products is rapidly changing and competitive, and new therapeutics, drugs and treatments that may

be developed by others could impair our ability to develop our business or become competitive.

|

|

|

·

|

We may face litigation from third parties claiming that our products infringe on their intellectual property rights, particularly

because there is often substantial uncertainty about the validity and breadth of medical patents.

|

|

|

·

|

If we are unable to adequately protect or enforce our rights to intellectual property or to secure rights to third-party patents,

we may lose valuable rights, experience reduced market share, assuming any, or incur costly litigation to protect our intellectual

property rights.

|

|

|

·

|

Conflicts, military actions, terrorist attacks, natural disasters. public health crises, including the occurrence of a contagious

disease or illness, such as the COVID-19 coronavirus, cyber-attacks and general instability could adversely affect our business.

|

|

|

·

|

Confidentiality agreements with employees and others may not adequately prevent disclosure of our trade secrets and other proprietary

information and may not adequately protect our intellectual property, which could limit our ability to compete.

|

|

|

·

|

We may be subject to claims that our employees have wrongfully used or disclosed alleged trade secrets of their former employers.

|

|

|

·

|

Due to continued changes in marketing, sales and distribution, we may be unsuccessful in our efforts to sell our proposed products,

develop a direct sales organization, or enter into relationships with third parties.

|

|

|

·

|

If we are unable to convince physicians of the benefits of our intended products, we may incur delays or additional expense

in our attempt to establish market acceptance.

|

|

|

·

|

If users of our products are unable to obtain adequate reimbursement from third-party payors, or if additional healthcare reform

measures are adopted, it could hinder or prevent the commercial success of our product candidates.

|

|

|

·

|

Our business and operations may be materially, adversely affected in the event of computer system failures or security breaches.

|

|

|

·

|

Failure to maintain effective internal controls could adversely affect our ability to meet our reporting requirements.

|

|

|

·

|

We have in the past received notices from Nasdaq of noncompliance with its listing rules, and delisting with Nasdaq could impact

the price of our common stock and our ability to raise funds.

|

|

|

·

|

Our stock price has experienced price fluctuations.

|

|

|

·

|

Our common stock could be further diluted as the result of the issuance of additional shares of common stock, convertible securities,

warrants or options.

|

|

|

·

|

Provisions of our certificate of incorporation, by-laws, and Delaware law may make an acquisition of us or a change in our

management more difficult.

|

|

|

·

|

We have not paid dividends in the past and do not expect to pay dividends for the foreseeable future. Any return on investment

may be limited to the value of our common stock.

|

|

|

·

|

Our management team will have immediate and broad discretion over the use of the net proceeds from this offering, and you may

not agree with our use of the net proceeds.

|

|

|

·

|

You will experience immediate and substantial dilution as a result of this offering and may experience additional dilution

in the future.

|

|

|

·

|

A pre-funded warrant does not entitle the holder to any rights as common stockholders until the holder exercises the warrant

for shares of our common stock.

|

|

|

·

|

There is no public market for the pre-funded warrants being offered by us in this offering.

|

|

|

·

|

You may experience future dilution as a result of future equity offerings.

|

For more information regarding the material

risks and uncertainties we face, please see “Risk Factors” beginning on page S-16 of this prospectus supplement.

Corporate Information

Our principal executive offices are located

at 100 Campus Drive, Florham Park, New Jersey 07932 and the telephone number of our principal executive offices is (608) 441-8120.

We maintain a website at www.cellectar.com. The information included or referred to on, or accessible through, our website does

not constitute part of, and is not incorporated by reference into, this prospectus supplement.

The Offering

The following is a brief summary of some

of the terms of the offering and is qualified in its entirety by reference to the more detailed information appearing elsewhere

in this prospectus supplement. For a more complete description of the terms of our common stock, see the “Description of

the Securities We Are Offering” section in this prospectus supplement.

|

Common stock offered by us:

|

|

shares.

|

|

Pre-funded warrants offered by us:

|

|

We are also offering to certain purchasers whose purchase of shares of common stock in this offering would otherwise result in the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding common stock immediately following the consummation of this offering, the opportunity to purchase, if such purchasers so choose, pre-funded warrants, in lieu of shares of common stock that would otherwise result in any such purchaser’s beneficial ownership exceeding 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding common stock. Each pre-funded warrant will be exercisable for one share of our common stock. The purchase price of each pre-funded warrant will equal the price at which a share of common stock is being sold to the public in this offering, minus $0.00001, and the exercise price of each pre-funded warrant will be $0.00001 per share. The pre-funded warrants will be exercisable immediately and may be exercised at any time until all of the pre-funded warrants are exercised in full. This offering also relates to the shares of common stock issuable upon exercise of any pre-funded warrants sold in this offering. For each pre-funded warrant we sell, the number of shares of common stock we are offering will be decreased on a one-for-one basis. For additional information, see “Description of Securities—Pre-Funded Warrants to be Issued as Part of this Offering” on page 19 of this prospectus supplement.

|

|

Shares of common stock outstanding before this offering:

|

|

27,260,968 shares

|

|

Use of Proceeds:

|

|

We expect to use the net proceeds received from this offering to fund our research and development activities and for general corporate purposes. For a more complete description of our anticipated use of proceeds from this offering, see “Use of Proceeds.”

|

|

Risk Factors:

|

|

See “Risk Factors” beginning on page S-16 and the other information included in this prospectus supplement for a discussion of factors you should carefully consider before deciding whether to purchase our securities.

|

|

Nasdaq symbol for our common stock:

|

|

CLRB

|

|

Concurrent Private Placement:

|

|

In a separate concurrent PIPE transaction, we are selling shares of common stock at a purchase price of $ per share and shares of Series D Preferred Stock convertible into a number of shares of common stock equal to $ divided by the Conversion Price (or shares of common stock for each share of Series D Preferred Stock converted), at a price of $ per share of Series D Preferred Stock. The Series D Preferred Stock will only be convertible into common stock upon receipt of stockholder approval of the issuance of the shares of common stock as required by Nasdaq Marketplace Rule 5635(d) at a special stockholder meeting to be called for that purpose. The shares of common stock, Series D Preferred Stock and the shares of our common stock issuable upon the exercise of the Series D Preferred Stock, are not being offered pursuant to this prospectus supplement and the accompanying prospectus and are being offered pursuant to the exemption provided in Section 4(a)(2) under the Securities Act and Rule 506(b) promulgated thereunder. See “Private Placement Transaction.”

|

|

Shares of common stock to be outstanding after this offering:

|

|

shares

|

|

Shares of Series D Preferred Stock to be outstanding after this offering:

|

|

shares

|

|

No listing of Pre-Funded Warrants or Series D Preferred Stock:

|

|

We do not intend to apply for listing of the pre-funded warrants or shares of Series D Preferred Stock on any securities exchange or trading system

|

|

Unless we specifically state otherwise,

the share information in this prospectus, including the number of shares of common stock outstanding before this offering, is as

of December 21, 2020.

The number of shares of our common stock

outstanding before and after this offering is based on 27,260,968 shares of common stock outstanding as of December 21, 2020 and

excludes, as of that date:

·

an aggregate of 1,184,464 shares of common stock issuable upon the exercise of outstanding stock options issued to employees,

directors and consultants;

·

an aggregate of 537,500 shares of common stock issuable upon the conversion of outstanding shares of Series C preferred

stock

·

an aggregate of 17,489,891 additional shares of common stock reserved for issuance under outstanding warrants having

expiration dates between April 1, 2021, and June 5, 2025, and exercise prices ranging from $1.21 to $30.40 per share; and

·

shares of our common stock that may be issued upon the exercise of pre-funded warrants issued in this offering and

[_] shares of our common stock that may be issued upon the conversion of the Series D Preferred Stock issued in the PIPE.

Unless otherwise noted, the information in this prospectus supplement

reflects and assumes no exercise of outstanding options and warrants.

|

RISK FACTORS

An investment in our securities involves

a high degree of risk. Prior to making a decision about investing in our securities, prospective investors should consider carefully

all of the information included and incorporated by reference or deemed to be incorporated by reference in this prospectus supplement,

including the risk factors incorporated by reference herein from our Annual Report on Form 10-K for the fiscal year ended December 31, 2019, as updated by annual, quarterly and other reports and documents we file with the SEC after the date of this prospectus

supplement and that are incorporated by reference herein. Each of these risk factors could have a material adverse effect on our

business, results of operations, financial position or cash flows, which may result in the loss of all or part of your investment.

For more information, see “Where You Can Find Additional Information” and “Incorporation of Certain Information

by Reference.”

In addition, you should carefully consider

the following risks related to this offering, together with the other information about these risks contained in this prospectus

supplement, as well as the other information contained in this prospectus generally, before deciding to buy our securities. Any

of the risks we describe below could adversely affect our business, financial condition, operating results, or prospects. The market

price for our securities could decline if one or more of these risks and uncertainties develop into actual events and you could

lose all or part of your investment. Additional risks and uncertainties that we do not yet know of, or that we currently think

are immaterial, may also impair our business operations.

RISKS RELATED TO THIS OFFERING

We have broad discretion to determine

how to use the proceeds raised in this offering, and we may not use the proceeds effectively.

The net proceeds from this offering will

be immediately available to our management to use at its discretion. We currently intend to use the net proceeds from this offering

to fund our research and development activities, general corporate purposes, and possibly for acquisitions of other companies,

products or technologies, although no such acquisitions are currently contemplated. See “Use of Proceeds.” We have

not allocated specific amounts of the net proceeds from this offering for any of the foregoing purposes. Accordingly, our management

will have significant discretion and flexibility in applying the net proceeds of this offering. You will be relying on the judgment

of our management with regard to the use of these net proceeds, and you will not have the opportunity, as part of your investment

decision, to assess whether the proceeds are being used appropriately. It is possible that the net proceeds will be invested in

a way that does not yield a favorable, or any, return for us or our stockholders. The failure of our management to use such funds

effectively could have a material adverse effect on our business, prospects, financial condition and results of operation.

You will experience immediate and

substantial dilution as a result of this offering and may experience additional dilution in the future.

You will incur immediate and substantial

dilution as a result of this offering. After giving effect to the sale by of the securities offered in this offering, at a public

offering price of $ per share, and after deducting the underwriter’s discounts and commissions and other estimated offering

expenses payable by us, investors in this offering can expect an immediate dilution of $0. per share, or %, assuming no exercise

of the warrants. In addition, in the past, we have issued preferred stock, options and warrants to acquire shares of common stock.

To the extent these options are ultimately exercised, you will sustain future dilution.

You may experience future dilution as a result

of future equity offerings.

In order to raise additional capital, in

the future we may offer additional shares of our common stock or other securities convertible into or exchangeable for our common

stock at prices that may not be the same as the price in this offering. We may sell shares or other securities in any other offering

at a price that is less than the price paid by investors in this offering, and investors purchasing shares or other securities

in the future could have rights superior to existing stockholders. The price at which we sell additional shares of our common stock,

or securities convertible or exchangeable into common stock, in future transactions may be higher or lower than the price paid

by investors in this offering.

There is no public market for the

warrants or the pre-funded warrants being offered by us in this offering.

There is no established public trading

market for the pre-funded warrants being offered in this offering, and we do not expect a market to develop. In addition, we do

not intend to apply to list the pre-funded warrants on any national securities exchange or other nationally recognized trading

system, including The Nasdaq Capital Market. Without an active market, the liquidity of the pre-funded warrants will be limited.

USE OF PROCEEDS

We estimate that the net proceeds to us

from the sale of the securities that we are offering will be approximately $ million, after deducting underwriting discounts

and commissions and estimated offering expenses.

We expect to use any proceeds received

from this offering as follows:

|

|

·

|

research and development activities, including the further development of CLR 131, and the research advancement of our PDC platform, including product candidates, CLR 1900, CLR 2000 and CLR 12120.

|

|

|

·

|

general corporate purposes, such as human resource acquisition to support organizational priorities, general and administrative expenses, capital expenditures, working capital, repayment of debt, prosecution and maintenance of our intellectual property, and the potential investment in technologies, products or collaborations that complement our business.

|

Even if we sell all of the securities subject

to this offering, we will still need to obtain additional financing in the future in order to fully fund these product candidates

through the regulatory approval process. We may seek such additional financing through public or private equity or debt offerings

or other sources, including collaborative or other arrangements with corporate partners, and through government grants and contracts.

There can be no assurance we will be able to obtain additional financing. Although we currently anticipate that we will use the

net proceeds of this offering as described above, there may be circumstances when a reallocation of funds is necessary. The amounts

and timing of our actual expenditures will depend upon numerous factors, including the progress of our development and commercialization

efforts, the progress of our clinical studies, whether or not we enter into strategic collaborations or partnerships, and our operating

costs and expenditures. Accordingly, our management will have significant flexibility in applying the net proceeds of this offering.

The costs and timing of drug development

and regulatory approval, particularly conducting clinical studies, are highly uncertain, subject to substantial risks, and can

often change. Accordingly, we may change the allocation of use of these proceeds as a result of contingencies such as the progress

and results of our clinical studies and other development activities, the establishment of collaborations, our manufacturing requirements,

and regulatory or competitive developments.

Pending the application of the net proceeds

as described above or otherwise, we may invest the proceeds in short-term, investment-grade, interest-bearing securities or guaranteed

obligations of the U.S. government or other securities.

DILUTION

Our net tangible book value as of September

30, 2020, was approximately $16.2 million, or $0.61 per share of common stock, based upon 26,813,593 shares outstanding. Net tangible

book value per share is determined by dividing such number of outstanding shares of common stock into our net tangible book value,

which is our total tangible assets, less total liabilities.

After

giving effect to the sale of an estimated shares of our common stock

and pre-funded warrants in this offering, and assuming issuance of all shares of common stock underlying the pre-funded warrants,

and shares of common stock and Series D Preferred Stock to be sold in the concurrent PIPE, and assuming the issuance of all of

the shares of common stock underlying the Series D Preferred Stock, each at the offering price of $ per

share, gross proceeds will be approximately $ million. After deducting the underwriting commission and our

estimated offering expenses, our as-adjusted net tangible book value as of September 30, 2020 would have been $ per share.

This represents an immediate increase in net tangible book value of approximately $ per share to our existing stockholders,

and an immediate dilution of $ per share to investors purchasing securities in the offering.

The following table illustrates the per

share dilution to investors purchasing securities in the offering:

|

Public offering price per share of common stock

|

|

|

|

|

|

$

|

|

|

|

Net tangible book value per share as of September 30, 2020

|

|

$

|

0.61

|

|

|

|

|

|

|

Increase per share attributable to the sale of securities to investors

|

|

$

|

|

|

|

|

|

|

|

Adjusted net tangible book value per share after the offering

|

|

|

|

|

|

$

|

|

|

|

Dilution per share to investors in this offering

|

|

|

|

|

|

$

|

|

|

The foregoing illustration does not reflect

potential dilution from the exercise of outstanding options or warrants to purchase shares of our common stock. The dilution information

set forth in the table above is illustrative only and will be adjusted based on the actual sales made during this offering. The

information set forth above is based on shares of common stock outstanding as of September 30, 2020 and excludes, as of December

21, 2020:

|

|

·

|

an aggregate of 447,500 shares of common stock issued upon the exercise of outstanding warrants issued and an aggregate of

125 shares of common stock that were surrendered since September 30, 2020;

|

|

|

·

|

an aggregate of 1,184,464 shares of common stock issuable upon the exercise of outstanding stock options issued to employees,

directors and consultants;

|

|

|

·

|

an aggregate of 537,500 shares of common stock issuable upon the conversion of outstanding shares of Series C preferred stock;

|

|

|

·

|

an aggregate of 17,489,891 additional shares of common stock reserved for issuance under outstanding warrants having expiration

dates between April 1, 2021, and June 5, 2025, and exercise prices ranging from $1.21 to $30.40 per share; and

|

|

|

·

|

shares of our common stock that may be issued upon the exercise of pre-funded warrants issued in this offering and

shares of our common stock that may be issued upon the conversion of the Series D Preferred Stock issued in the PIPE.

|

DESCRIPTION OF THE SECURITIES WE ARE

OFFERING

The following summary description of

our common stock is based on the provisions of our Second Amended and Restated Certificate of Incorporation, as amended, which

we refer to as our certificate of incorporation or charter, our by-laws, and the applicable provisions of the Delaware General

Corporation Law, which we refer to as the DGCL. This description may not contain all of the information that is important to you

and is subject to, and is qualified in its entirety by reference to, our certificate of incorporation, our by-laws and the applicable

provisions of the DGCL. For information on how to obtain copies of our certificate of incorporation and by-laws, see “Where

You Can Find More Information.”

Authorized and Outstanding Capital Stock

Our authorized capital stock consists of

80,000,000 shares of common stock, $0.00001 par value per share and 7,000 shares of preferred stock, $0.00001 par value per share.

Our certificate of incorporation, as amended, authorizes us to issue shares of our preferred stock from time to time in one or

more series without stockholder approval, each such series to have rights and preferences, including voting rights, dividend rights,

conversion rights, redemption privileges and liquidation preferences, as our Board may determine. The rights of the holders of

common stock will be subject to, and may be adversely affected by, the rights of holders of any preferred stock that we may issue

in the future. The issuance of preferred stock, while providing desirable flexibility in connection with possible acquisitions

and other corporate purposes, could have the effect of making it more difficult for others to acquire, or of discouraging others

from attempting to acquire, a majority of our outstanding voting stock.

As of December 21, 2020, there were 27,260,968

shares of common stock outstanding and 215 shares of preferred stock outstanding. All outstanding shares of our common stock and

preferred stock are duly authorized, validly issued, fully paid and nonassessable.

Common Stock

Voting. Holders

of our common stock are entitled to one vote per share held of record on all matters to be voted upon by our stockholders. Our

common stock does not have cumulative voting rights. Persons who hold a majority of the outstanding common stock entitled to vote

on the election of directors can elect all of the directors who are eligible for election.

Dividends. Subject

to preferences that may be applicable to the holders of any outstanding shares of our preferred stock, the holders of our common

stock are entitled to receive such lawful dividends as may be declared by our Board.

Liquidation and Dissolution. In

the event of our liquidation, dissolution or winding up, and subject to the rights of the holders of any outstanding shares of

our preferred stock, the holders of shares of our common stock will be entitled to receive pro rata all of our remaining assets

available for distribution to our stockholders.

Other Rights and Restrictions. Our

charter prohibits us from granting preemptive rights to any of our stockholders.

Pre-Funded Warrants to be Issued as Part of this Offering

Duration and Exercise Price. Each

pre-funded warrant offered hereby will have an initial exercise price per share equal to $0.00001. The pre-funded warrants will

be immediately exercisable and may be exercised at any time until the pre-funded warrants are exercised in full. The exercise price

and number of shares of common stock issuable upon exercise is subject to appropriate adjustment in the event of stock dividends,

stock splits, reorganizations or similar events affecting our common stock and the exercise price. The pre-funded warrants will

be issued separately from the accompanying common warrants, and may be transferred separately immediately thereafter.

Exercisability. The

pre-funded warrants will be exercisable, at the option of each holder, in whole or in part, by delivering to us a duly executed

exercise notice accompanied by payment in full for the number of shares of our common stock purchased upon such exercise (except

in the case of a cashless exercise as discussed below). Purchasers of the pre-funded warrants in this offering may elect to deliver

their exercise notice following the pricing of the offering and prior to the issuance of the pre-funded warrants at closing to

have their pre-funded warrants exercised immediately upon issuance and receive shares of common stock underlying the pre-funded

warrants upon closing of this offering. A holder (together with its affiliates) may not exercise any portion of the pre-funded

warrant to the extent that the holder would own more than 4.99% of the outstanding common stock immediately after exercise, except

that upon at least 61 days’ prior notice from the holder to us, the holder may increase the amount of ownership of outstanding

stock after exercising the holder’s pre-funded warrants up to 9.99% of the number of shares of our common stock outstanding

immediately after giving effect to the exercise, as such percentage ownership is determined in accordance with the terms of the

pre-funded warrants. Purchasers of pre-funded warrants in this offering may also elect prior to the issuance of the pre-funded

warrants to have the initial exercise limitation set at 9.99% of our outstanding common stock. No fractional shares of common stock

will be issued in connection with the exercise of a pre-funded warrant. In lieu of fractional shares, we will round down to the

next whole share.

Cashless Exercise. If,

at the time a holder exercises its pre-funded warrants, a registration statement registering the issuance of the shares of common

stock underlying the pre-funded warrants under the Securities Act is not then effective or available, then in lieu of making the

cash payment otherwise contemplated to be made to us upon such exercise in payment of the aggregate exercise price, the holder

may elect instead to receive upon such exercise (either in whole or in part) the net number of shares of common stock determined

according to a formula set forth in the pre-funded warrants.

Transferability. Subject

to applicable laws, a pre-funded warrant may be transferred at the option of the holder upon surrender of the pre-funded warrant

to us together with the appropriate instruments of transfer.

Exchange Listing. There

is no trading market available for the pre-funded warrants on any securities exchange or nationally recognized trading system.

We do not intend to list the pre-funded warrants on any securities exchange or nationally recognized trading system.

Right as a Stockholder. Except

as otherwise provided in the pre-funded warrants or by virtue of such holder’s ownership of shares of our common stock, the

holders of the pre-funded warrants do not have the rights or privileges of holders of our common stock, including any voting rights,

until they exercise their pre-funded warrants.

Fundamental Transaction. In

the event of a fundamental transaction, as described in the pre-funded warrants and generally including any reorganization, recapitalization

or reclassification of our common stock, the sale, transfer or other disposition of all or substantially all of our properties

or assets, our consolidation or merger with or into another person, the acquisition of more than 50% of our outstanding common

stock, or any person or group becoming the beneficial owner of 50% of the voting power represented by our outstanding common stock,

the holders of the pre-funded warrants will be entitled to receive upon exercise of the pre-funded warrants the kind and amount

of securities, cash or other property that the holders would have received had they exercised the pre-funded warrants immediately

prior to such fundamental transaction.

PRIVATE PLACEMENT TRANSACTION

In the separate PIPE, we are selling

shares of common stock and shares of Series D Preferred Stock. The shares of common stock were priced at $ per share and

the Series D Preferred Stock are convertible into a number of shares of common at the Conversion Price (or shares of common

stock for each share of Series D Preferred Stock converted), at a price of $ per share of Series D Preferred Stock.

The offering and sale of the shares of

comment stock, the Series D Preferred Stock and the shares of our common stock issuable upon the conversion of the Series D Preferred

Stock are not being registered under the Securities Act, are not being offered pursuant to this prospectus supplement and the accompanying

prospectus and are being offered pursuant to the exemption provided in Section 4(a)(2) under the Securities Act and Rule 506(b)

promulgated thereunder. Accordingly, purchasers may only sell shares acquired in the PIPE pursuant to an effective registration

statement under the Securities Act covering the resale of those shares, an exemption under Rule 144 under the Securities Act or

another applicable exemption under the Securities Act.

We will be required to file a registration

statement on either Form S-3 or Form S-1 within 30 days of closing of the private placement to provide for the resale of the shares

of common stock and common stock issuable upon the conversion of the Series D Preferred Stock, and will be obligated to use our

reasonable best efforts to keep such registration statement effective until the earlier of (i) the date on which the shares of

common stock and common stock issuable upon conversion of the Series D Preferred Stock may be sold without registration pursuant

to Rule 144 under the Securities Act, and (ii) the date on which all of the shares of common stock and common stock issuable upon

conversion of the Series D Preferred Stock have been sold under the registration statement or pursuant to Rule 144 under the Securities

Act or any other rule of similar effect.

UNDERWRITING

We

entered into an underwriting agreement with Oppenheimer & Co. Inc. on , 2020 as the sole book-running manager of this offering.

The underwriting agreement provides for the purchase of a specific number of shares of common stock and/or pre-funded warrants

by the underwriter. Subject to the terms and conditions of the underwriting agreement, the underwriter has agreed to purchase the

number of shares and pre-funded warrants set forth below:

|

Underwriter

|

|

Number of

Shares of Common

Stock

|

|

Number of

Pre-Funded

Warrants

|

|

Oppenheimer & Co. Inc.

|

|

|

|

|

|

Total

|

|

|

|

|

The

underwriter has agreed to purchase all of the shares of common stock and/or pre-funded warrants offered by this prospectus supplement,

if any are purchased.

The

shares of common stock and/or pre-funded warrants offered hereby are expected to be ready for delivery on or about , 2020 against payment in immediately available funds.

The

underwriter is offering the shares of common stock and/or pre-funded warrants subject to various conditions and may reject all

or part of any order in their sole discretion. The underwriter proposes to initially offer the shares of common stock and/or pre-funded

warrants to purchase shares of common stock to the public at the public offering price set forth on the cover page of this prospectus

supplement and to dealers at a price less a concession not in excess of $ per share. After the shares of common stock and/or pre-funded

warrants are released for sale to the public, the underwriter may change the offering price, the concession, and other selling

terms at various times.

The

following table provides information regarding the amount of the discounts and commissions to be paid to the underwriter by us,

before expenses:

|

|

|

Per Share of Common Stock

|

|

|

Per Pre-Funded Warrant

|

|

Total

|

|

|

Public offering price(1)

|

|

$

|

|

|

|

$

|

|

|

$

|

|

|

|

Underwriting discount (7.0%)

|

|

$

|

|

|

|

$

|

|

|

$

|

|

|

|

Proceeds, before expenses, to us

|

|

$

|

|

|

|

$

|

|

|

$

|

|

|

We estimate that our

total expenses of the offering, excluding the estimated underwriting discounts and commissions, will be approximately $ , which

includes the fees and expenses for which we have agreed to reimburse the representative, provided that any such fees and expenses

in excess of an aggregate of $125,000 will be subject to our prior written approval.

Regulation

M

Rules

of the Securities and Exchange Commission may limit the ability of the underwriters to bid for or purchase shares before the distribution

of the shares is completed. However, the underwriter may engage in the following activities in accordance with the rules:

|

|

·

|

Passive

market making - market makers in the shares who are underwriters or prospective underwriters

may make bids for or purchases of shares, subject to limitations, until the time, if

ever, at which a stabilizing bid is made.

|

Neither

we nor the underwriter make any representation or prediction as to the effect that the transactions described above may have on

the price of the shares. These transactions may occur on The Nasdaq Capital Market or otherwise. If such transactions are commenced,

they may be discontinued without notice at any time.

Electronic

Delivery of Prospectus Supplement

A

prospectus supplement in electronic format may be delivered to potential investors by the underwriter. The prospectus supplement

in electronic format will be identical to the paper version of such prospectus supplement. Other than the prospectus supplement

in electronic format, the information on the underwriter’s website and any information contained in any other website maintained

by an underwriter is not part of this prospectus supplement or the registration statement of which this prospectus supplement forms

a part.

Determination of Offering Price

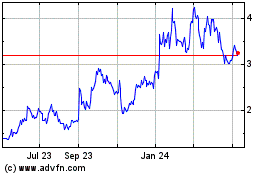

Our common stock is currently traded on

the Nasdaq Capital Market under the symbol “CLRB.” On December 21, 2020, the closing price of our common stock was

$2.66 per share.

The public offering price of the securities

offered by this prospectus supplement will be determined by negotiation between us

and the underwriter. Among the factors considered in determining the public offering price of the shares were:

|

|

·

|

our history and our prospects;

|

|

|

·

|

the industry in which we operate;

|

|

|

·

|

our past and present operating results;

|

|

|

·

|

the previous experience of our executive officers; and

|

|

|

·

|

the general condition of the securities markets at the time of this offering

|

The offering price stated on the

cover page of this prospectus supplement should not be considered an indication

of the actual value of the securities. That price is subject to change as a result of market conditions and other factors,

and we cannot assure you that the securities can be resold at or above the public offering price.

Lock-up Agreements

Our officers and directors have

agreed with the underwriter to be subject to a lock-up period of 90 days following the date of this prospectus supplement. This means

that, during the applicable lock-up period, such persons may not offer for sale, contract to sell, sell, distribute, grant

any option, right or warrant to purchase, pledge, hypothecate or otherwise dispose of, directly or indirectly, any shares of

our common stock or any securities convertible into, or exercisable or exchangeable for, shares of our common stock. Certain

limited transfers are permitted during the lock-up period if the transferee agrees to these lock-up restrictions. We have

also agreed, in the underwriting agreement, to similar lock-up restrictions on the issuance and sale of our securities for 90

days following the closing of this offering, although we will be permitted to issue stock options or stock awards to