0001346830

false

0001346830

2023-08-07

2023-08-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

August 7, 2023

CARA THERAPEUTICS, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-36279 |

|

75-3175693 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

| |

|

|

|

|

|

4 Stamford Plaza

107 Elm Street, 9th Floor

Stamford, Connecticut |

|

|

|

06902 |

| (Address of principal executive offices) |

|

|

|

(Zip Code) |

| |

|

|

|

|

| Registrant's telephone number, including area code (203) 406-3700 |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class |

Trading

Symbol |

Name

of each exchange on which registered |

| Common Stock, par value $0.001 per share |

CARA |

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by

check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨.

| Item 2.02. |

Results of Operations and Financial Condition. |

On August 7, 2023, Cara Therapeutics, Inc. (the “Company”)

issued a press release announcing its financial results for the second quarter ended June 30, 2023. A copy of the press release

is being furnished to the Securities and Exchange Commission as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated

by reference to this Item 2.02.

The information furnished pursuant to this Item 2.02, including Exhibit 99.1,

shall not be deemed to be "filed" for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange

Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference into any of

the Company’s filings with the Securities and Exchange Commission under the Exchange Act or the Securities Act of 1933, as amended,

whether made before or after the date hereof, regardless of any general incorporation language in such a filing.

| Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

CARA THERAPEUTICS, INC. |

| |

|

| |

By: |

/s/

RYAN MAYNARD |

| |

|

Ryan Maynard |

| |

|

Chief Financial Officer |

| |

|

(Principal Financial and Accounting Officer) |

Date: August 7, 2023

Exhibit 99.1

Cara Therapeutics Reports Second Quarter 2023

Financial Results

– 2Q23 total revenue of $6.9M including

collaborative revenue of $5.4M from the Company’s share of profit of KORSUVA® (difelikefalin) injection –

– Demand for KORSUVA injection accelerating

with 46% increase in vial orders quarter to quarter –

– 2024 ESRD PPS proposed rule suggests

additional funding for TDAPA-designated products in existing functional category; final rule expected in 4Q23 –

– Three late-stage oral difelikefalin

clinical programs tracking to plan; Internal readout of Part A of KIND 1 atopic dermatitis trial expected in 4Q23 –

– Conference call today at 4:30 p.m. EDT

–

STAMFORD, Conn., August 7, 2023 – Cara

Therapeutics, Inc. (Nasdaq: CARA), a commercial-stage biopharmaceutical company leading a new treatment paradigm to improve

the lives of patients suffering from pruritus, today announced financial results and operational highlights for the second quarter ended

June 30, 2023.

“In the second quarter of 2023, the commercialization

of KORSUVA® (difelikefalin) injection in the U.S. and Kapruvia® in countries around the world continued

to make meaningful progress. We believe the increased vial shipments and reorder rates in the U.S., as well as the positive feedback from

providers and patients globally, confirm the significant need for an anti-pruritic treatment for chronic kidney disease (CKD) patients,”

said Christopher Posner, President and Chief Executive Officer of Cara Therapeutics. “In June, CMS issued the CY2024 ESRD PPS proposed

rule, providing clarity around the reimbursement of KORSUVA injection post its TDAPA period. While we were pleased that CMS included additional

funding outside the bundle rate in the proposed rule, we will continue to work with CMS on refining the reimbursement methodology ahead

of the release of the final rule, which is expected in the fourth quarter of 2023.”

Mr. Posner continued, “On the development

front, we are pleased with the progress of our late-stage oral difelikefalin programs for pruritus associated with atopic dermatitis (AD),

advanced CKD and notalgia paresthetica (NP). All three trials are enrolling patients and the internal readout from Part A of our

KIND Phase 3 program in AD is expected in the fourth quarter of 2023. As the key driver of our long-term value, we are focused on advancing

the development of oral difelikefalin in our nephrology and medical dermatology franchises and remain steadfast in our commitment to establishing

Cara Therapeutics as the leader in the treatment of chronic pruritus.”

2Q23 and Recent Highlights

| · | England’s National Institute for Health

and Care Excellence (NICE) recommended Kapruvia® for the treatment of moderate-to-severe chronic kidney disease-associated

pruritus (CKD-aP) in adult patients on hemodialysis |

| · | Enrollment continued in the KIND Phase 3 program

in AD with the internal readout from Part A expected in 4Q23 and final topline results for the program expected in 1H25 |

| · | Enrollment continued in the KICK Phase 3 program

in advanced CKD with topline results expected in 2H24 |

| · | KOURAGE Phase 2/3 program of oral difelikefalin

for the treatment of moderate-to-severe pruritus in patients with NP is ongoing; internal readout from Part A is expected in 2H24

with final topline results for the program expected in 1H26 |

KORSUVA Injection Launch Update: 2Q23

United States

In the second quarter of 2023, KORSUVA injection

generated net sales of $11.4 million and the Company recorded collaborative revenue of $5.4 million, which represented the Company’s

share of the profit from sales of KORSUVA injection.

Wholesalers shipped 66,852 vials to dialysis centers,

the majority of which were Fresenius clinics, during the second quarter of 2023. Vial orders increased 46% quarter to quarter, indicating

an acceleration in patient demand.

In June 2023, the Centers for Medicare &

Medicaid Services (CMS) issued a proposed rule for the End Stage Renal Disease Prospective Payment System (ESRD PPS) for calendar

year 2024, which addresses the reimbursement of KORSUVA injection after its Transitional Drug Add-On Payment Adjustment (TDAPA) period.

The final rule is expected in the fourth quarter of 2023.

International

In the second quarter of 2023, Kapruvia generated

$1.2 million in net sales and the Company recorded $123,000 in royalty revenue associated with Kapruvia sales in Europe.

Seven EU countries have launched Kapruvia to date,

and the Company expects additional launches to commence over the coming months. In May 2023, England’s NICE recommended Kapruvia

for the treatment of moderate-to-severe CKD-aP in adult patients on hemodialysis.

The Company continues to expect its licensing

partner Maruishi Pharmaceutical Co., Ltd. to receive a regulatory decision from the Pharmaceuticals and Medical Devices Agency (PMDA)

in Japan in the second half of 2023.

Upcoming Meeting Activities

The Company expects to present at the following

upcoming investor conferences:

| · | Canaccord Genuity 43rd Annual Growth

Conference, August 7-10 |

| · | Stifel Biotech Summer Summit, August 14-15 |

| · | H.C. Wainwright Global Investment Conference,

September 11-13 |

Second Quarter 2023 Financial Results

Cash, cash equivalents and marketable securities

at June 30, 2023 totaled $101.7 million compared to $156.7 million at December 31, 2022. The decrease in the balance primarily

resulted from $55.1 million of cash used in operating activities.

For the second quarter of 2023, net loss was $31.5

million, or $(0.58) per basic and diluted share, compared to net loss of $4.2 million, or $(0.08) per basic and diluted share, for the

same period in 2022.

Revenues: Total revenue was $6.9 million

and $23.0 million for the three months ended June 30, 2023 and 2022, respectively. Revenue primarily consisted of:

| · | $5.4

million and $8.0 million of collaborative revenue related to our share of the profit from

CSL Vifor’s sales of KORSUVA injection to third parties during the three months ended

June 30, 2023 and 2022, respectively; |

| · | $1.4

million of commercial supply revenue related to sales of KORSUVA injection to CSL Vifor during

the three months ended June 30, 2023. There was no commercial supply revenue during

the three months ended June 30, 2022; |

| · | Approximately

$123,000 of royalty revenue related to our royalties on the net sales of Kapruvia in Europe

during the three months ended June 30, 2023. There was no royalty revenue during the

three months ended June 30, 2022; and |

| · | There

was no license and milestone revenue during the three months ended June 30, 2023. We

recorded $15.0 million in milestone revenue related to the approval of Kapruvia by the European

Commission in April 2022 during the three months ended June 30, 2022. |

Cost of Goods Sold: Cost of goods

sold was $1.4 million during the three months ended June 30, 2023, related to commercial supply revenue for KORSUVA injection

sales to CSL Vifor. There was no associated cost of goods sold during the three months ended June 30, 2022 as there was no

commercial supply revenue from CSL Vifor.

Research and Development (R&D) Expenses:

R&D expenses were $30.3 million for the three months ended June 30, 2023 compared to $19.9 million in the same period of

2022. The higher R&D expenses in 2023 were primarily due to increases in clinical trial costs related to our three late-stage development

programs partially offset by a decrease in stock-based compensation expense.

General and Administrative (G&A) Expenses:

G&A expenses were essentially flat at $7.5 million for the three months ended June 30, 2023 compared to $7.6 million in the same

period of 2022.

Other Income, net: Other income, net was

approximately $861,000 for the three months ended June 30, 2023 compared to approximately $266,000 in the same period of 2022. The

increase in other income, net was primarily due to an increase in interest income resulting from a higher yield on our portfolio of investments

during the three months ended June 30, 2023.

Financial Guidance

We expect that our current unrestricted cash and

cash equivalents and available-for-sale marketable securities, including collaborative revenue from our share of the profit from KORSUVA

injection, will be sufficient to fund our currently anticipated operating plan for at least the next 12 months.

About Cara Therapeutics

Cara Therapeutics is

a commercial-stage biopharmaceutical company leading a new treatment paradigm to improve the lives of patients suffering from pruritus.

The Company’s KORSUVA® (difelikefalin) injection is the first and only FDA-approved treatment for moderate-to-severe pruritus

associated with chronic kidney disease in adults undergoing hemodialysis. The Company is developing an oral formulation of difelikefalin

and has Phase 3 programs ongoing for the treatment of pruritus in patients with advanced chronic kidney disease and atopic dermatitis.

In addition, the Company has initiated a Phase 2/3 program of oral difelikefalin for the treatment of moderate-to-severe pruritus in

patients with notalgia paresthetica. For more information, visit www.CaraTherapeutics.com and follow the company on Twitter,

LinkedIn and Instagram.

Forward-looking Statements

Statements contained in this press release regarding matters that are

not historical facts are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of

1995. Examples of these forward-looking statements include statements concerning the Company’s and its partners’ ongoing commercialization

of and ability to successfully commercialize KORSUVA injection and Kapruvia, future revenue and profit share from sales of KORSUVA and

Kapruvia, planned future regulatory submissions and potential future regulatory approvals, potential for post-TDAPA reimbursement of KORSUVA

and timing of final rules related thereto, future product launches, the performance of the Company’s commercial partners, including

CSL Vifor, expected timing of the initiation, enrollment and data readouts from the Company’s planned and ongoing clinical trials,

the potential results of ongoing clinical trials, timing of future regulatory and development milestones for the Company’s product

candidates, the potential for the Company’s product candidates to be alternatives in the therapeutic areas investigated and the

potential for oral difelikefalin to address additional pruritic indications, the size and growth of the potential markets for pruritus

management, the Company’s participation in certain conferences and the Company’s expected cash reach. Because such statements

are subject to risks and uncertainties, actual results may differ materially from those expressed or implied by such forward-looking statements.

These risks and uncertainties include the risks inherent in the launch of new products, including that our commercial partners, including

CSL Vifor, may not perform as expected, risks inherent in the clinical and regulatory development of pharmaceutical products, and the

risks described more fully in Cara Therapeutics’ filings with the Securities and Exchange Commission, including the “Risk

Factors” section of the Company’s Annual Report on Form 10-K for the year ending December 31, 2022 and its other

documents subsequently filed with or furnished to the Securities and Exchange Commission, including its Form 10-Q for the quarter

ended March 31, 2023. All forward-looking statements contained in this press release speak only as of the date on which they were

made. Cara Therapeutics undertakes no obligation to update such statements to reflect events that occur or circumstances that exist after

the date on which they were made, except as required by law.

Financial tables follow

| CARA THERAPEUTICS, INC. |

| CONDENSED BALANCE SHEETS |

| (in thousands) |

| (unaudited) |

| | |

| | |

| |

| | |

June 30, | | |

December 31, | |

| | |

2023 | | |

2022 | |

| Assets | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 58,249 | | |

$ | 63,741 | |

| Marketable securities | |

| 36,442 | | |

| 81,658 | |

| Accounts receivable, net - related party | |

| 10,124 | | |

| 3,260 | |

| Inventory, net | |

| 3,420 | | |

| 2,383 | |

| Income tax receivable | |

| 697 | | |

| 697 | |

| Other receivables | |

| 420 | | |

| 496 | |

| Prepaid expenses | |

| 14,976 | | |

| 16,267 | |

| Restricted cash | |

| 408 | | |

| 408 | |

| Total current assets | |

| 124,736 | | |

| 168,910 | |

| Operating lease right-of-use assets | |

| 792 | | |

| 1,551 | |

| Marketable securities, non-current | |

| 7,053 | | |

| 11,350 | |

| Property and equipment, net | |

| 308 | | |

| 426 | |

| Restricted cash, non-current | |

| 1,500 | | |

| - | |

| Total assets | |

$ | 134,389 | | |

$ | 182,237 | |

| | |

| | | |

| | |

| Liabilities and stockholders’ equity | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable and accrued expenses | |

$ | 24,475 | | |

$ | 21,540 | |

| Operating lease liabilities, current | |

| 982 | | |

| 1,918 | |

| Total current liabilities | |

| 25,457 | | |

| 23,458 | |

| | |

| | | |

| | |

| Commitments and contingencies | |

| - | | |

| - | |

| | |

| | | |

| | |

| Stockholders’ equity: | |

| | | |

| | |

| Preferred stock | |

| - | | |

| - | |

| Common stock | |

| 54 | | |

| 53 | |

| Additional paid-in capital | |

| 733,984 | | |

| 726,630 | |

| Accumulated deficit | |

| (624,376 | ) | |

| (566,232 | ) |

| Accumulated other comprehensive loss | |

| (730 | ) | |

| (1,672 | ) |

| Total stockholders’ equity | |

| 108,932 | | |

| 158,779 | |

| Total liabilities and stockholders’ equity | |

$ | 134,389 | | |

$ | 182,237 | |

| CARA THERAPEUTICS, INC. |

| CONDENSED STATEMENTS OF OPERATIONS |

| (amounts in thousands, except share and per share data) |

| (unaudited) |

| |

| | |

Three Months Ended June 30, | | |

Six Months Ended June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Revenue: | |

| | | |

| | | |

| | | |

| | |

| Collaborative revenue | |

$ | 5,410 | | |

$ | 8,003 | | |

$ | 8,160 | | |

$ | 8,003 | |

| Commercial supply revenue | |

| 1,400 | | |

| - | | |

| 4,591 | | |

| 4,790 | |

| Royalty revenue | |

| 123 | | |

| - | | |

| 248 | | |

| - | |

| License and milestone fees | |

| - | | |

| 15,000 | | |

| - | | |

| 15,000 | |

| Clinical compound revenue | |

| - | | |

| - | | |

| 99 | | |

| - | |

| Total revenue | |

| 6,933 | | |

| 23,003 | | |

| 13,098 | | |

| 27,793 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Cost of goods sold | |

| 1,418 | | |

| - | | |

| 4,008 | | |

| 2,081 | |

| Research and development | |

| 30,310 | | |

| 19,905 | | |

| 54,644 | | |

| 41,178 | |

| General and administrative | |

| 7,545 | | |

| 7,570 | | |

| 14,436 | | |

| 16,917 | |

| Total operating expenses | |

| 39,273 | | |

| 27,475 | | |

| 73,088 | | |

| 60,176 | |

| Operating loss | |

| (32,340 | ) | |

| (4,472 | ) | |

| (59,990 | ) | |

| (32,383 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other income, net | |

| 861 | | |

| 266 | | |

| 1,846 | | |

| 428 | |

| Net loss | |

| (31,479 | ) | |

| (4,206 | ) | |

| (58,144 | ) | |

| (31,955 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss per share: | |

| | | |

| | | |

| | | |

| | |

| Basic and Diluted | |

$ | (0.58 | ) | |

$ | (0.08 | ) | |

$ | (1.08 | ) | |

$ | (0.60 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average shares: | |

| | | |

| | | |

| | | |

| | |

| Basic and Diluted | |

| 54,002,988 | | |

| 53,614,668 | | |

| 53,937,875 | | |

| 53,561,161 | |

MEDIA CONTACT:

Annie Spinetta

6 Degrees

973-768-2170

aspinetta@6degreespr.com

INVESTOR CONTACT:

Iris Francesconi, Ph.D.

Cara Therapeutics

203-406-3700

investor@caratherapeutics.com

v3.23.2

Cover

|

Aug. 07, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 07, 2023

|

| Entity File Number |

001-36279

|

| Entity Registrant Name |

CARA THERAPEUTICS, INC.

|

| Entity Central Index Key |

0001346830

|

| Entity Tax Identification Number |

75-3175693

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

4 Stamford Plaza

|

| Entity Address, Address Line Two |

107 Elm Street

|

| Entity Address, Address Line Three |

9th Floor

|

| Entity Address, City or Town |

Stamford

|

| Entity Address, State or Province |

CT

|

| Entity Address, Postal Zip Code |

06902

|

| City Area Code |

203

|

| Local Phone Number |

406-3700

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

CARA

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

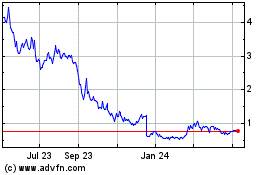

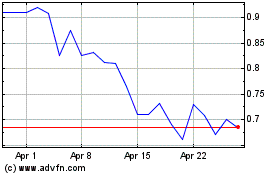

Cara Therapeutics (NASDAQ:CARA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cara Therapeutics (NASDAQ:CARA)

Historical Stock Chart

From Apr 2023 to Apr 2024