UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

Filed by the

Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by

Rule 14a-6(e)(2)) |

| ☐ |

Definitive Proxy Statement |

| ☐ |

Definitive Additional Materials |

| ☒ |

Soliciting Material under §240.14a-12 |

CANOPY GROWTH CORPORATION

(Name of Registrant as Specified in Its Charter)

N/A

(Name of Person(s)

Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☐ |

Fee paid previously with preliminary materials. |

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

Accelerating Entry to The U.S. Cannabis market October 25, 2022

Disclaimers & Cautionary Statements Information Regarding Third Party

Financial Information This presentation contains certain financial information (the “Third Party Information”) relating to Canopy USA, LLC (“Canopy USA”); Acreage Holdings, Inc. (“Acreage”); Mountain High

Products, LLC, Wana Wellness, LLC and The Cima Group, LLC (collectively, “Wana”); Lemurian, Inc. (“Jetty”). The Third Party Information was either obtained from Canopy USA, Acreage, Jetty and Wana (collectively, the

“Third Parties”) (or, in the case of Acreage, also made publicly available by Acreage) or derived from such information. The Third Party Information relates to, among other things, the expected revenue mix of Canopy USA. The Third Party

Information provided by each of Jetty and Wana has not been audited, reviewed, compiled, examined or subject to any procedures by an independent chartered public accountant or the independent registered public accounting firm of Canopy Growth

Corporation (the “Company”), and the Company has not independently verified the financial information provided by each of the Third Parties. In addition, actual results for past periods may not be indicative of future results. Notice

Regarding Forward-Looking Information This presentation contains “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995 and “forward-looking information” within the

meaning of applicable Canadian securities legislation. Often, but not always, forward-looking statements and information can be identified by the use of words such as “plans”, “expects” or “does not expect”,

“is expected”, “estimates”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or state that certain actions, events or

results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved. Forward-looking statements or information involve known and unknown risks, uncertainties and other factors

which may cause the actual results, performance or achievements of the Company or its subsidiaries to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements or information

contained in this presentation. Examples of such statements and uncertainties include statements regarding the expected size of the U.S. cannabis market; statements with respect to our ability to execute on our strategy to accelerate the

Company’s entry into the U.S. cannabis industry, capitalize on the opportunity for growth in the U.S. cannabis sector and the anticipated benefits of such strategy, including the ability to generate revenues and cost synergies; expected

licensed states for Wana; risks associated with completing the proposed transactions that will form Canopy USA and its acquisition of the assets discussed in this presentation; expectations regarding the potential success of, and the costs and

benefits associated with the formation of Canopy USA; the expected revenues of Canopy USA; the expected timing of the transactions and the shareholder votes required to facilitate the transactions; and the expected repayment of certain amounts and

the amendment of certain terms of our loan facility and the expected financial benefits resulting therefrom. Risks, uncertainties and other factors involved with forward-looking information could cause actual events, results, performance, prospects

and opportunities to differ materially from those expressed or implied by such forward- looking information, including the stock exchanges on which we are listed may disagree with our interpretations of their policies, including that financial

consolidation of Canopy USA may be permissible in the event that Canopy USA closes on the acquisition of Wana, Jetty or the Fixed Shares of Acreage; inherent uncertainty associated with projections; the diversion of management time on issues related

to Canopy USA; expectations regarding future investment, growth and expansion of operations; the time required to prepare and mail meeting materials to Acreage shareholders; the ability of the parties to receive, in a timely manner and on

satisfactory terms, the necessary regulatory, court and shareholder approvals; the ability of the parties to satisfy, in a timely manner, the other conditions to the completion of the Floating Share Arrangement; risks related to the value of the

Canopy Shares; regulatory and licensing risks; changes in general economic, business and political conditions, including changes in the financial and stock markets and the impacts of increased rates of inflation; legal and regulatory risks inherent

in the cannabis industry, including the global regulatory landscape and enforcement related to cannabis, political risks and risks relating to regulatory change; risks relating to anti-money laundering laws; compliance with extensive government

regulation and the interpretation of various laws regulations and policies; public opinion and perception of the cannabis industry; and such other risks contained in the public filings of the Company filed with Canadian securities regulators and

available under the Company’s profile on SEDAR at www.sedar.com and with the U.S. Securities and Exchange Commission through EDGAR at www.sec.gov/edgar, including the Company’s annual report on Form 10-K for the year ended March 31,

2022. In respect of the forward-looking statements and information, the Company has provided such statements and information in reliance on certain assumptions that they believe are reasonable at this time. Although the Company believes that the

assumptions and factors used in preparing the forward-looking information or forward-looking statements in this presentation are reasonable, undue reliance should not be placed on such information and no assurance can be given that such events will

occur in the disclosed time frames or at all. Should one or more of the foregoing risks or uncertainties materialize, or should assumptions underlying the forward-looking information prove incorrect, actual results may vary materially from those

described herein as intended, planned, anticipated, believed, estimated or expected. Although the Company has attempted to identify important risks, uncertainties and factors which could cause actual results to differ materially, there may be others

that cause results not to be as anticipated, estimated or intended. The forward-looking information and forward-looking statements included in this presentation are made as of the date of this presentation and the Company does not undertake any

obligation to publicly update such forward-looking information or forward-looking information to reflect new information, 2 subsequent events or otherwise unless required by applicable securities laws.

Participants in the solicitation The Company and its directors and executive

officers may be deemed participants in the solicitation of proxies from the Company’s shareholders with respect to an amendment to the Company’s Articles of Incorporation (the “Amendment”) to facilitate Canopy USA’s

acquisition of the assets discussed in this presentation. A list of the names of those directors and executive officers and a description of their interests in the Company is contained in the Company’s definitive proxy statement on Schedule

14A filed with the SEC on July 29, 2022 and is available free of charge at the SEC’s website at www.sec.gov, or by directing a request to Canopy Growth Corporation, 1 Hershey Drive, Smiths Falls, Ontario, K7A 0A8 or by email to

invest@canopygrowth.com. Additional information regarding the interests of such participants in the transactions contemplated by the Amendment will be contained in the Company’s proxy statement relating to the Amendment when it becomes

available. Investors should read the proxy statement when it becomes available because it will contain important information. 3

Transforming Canopy’s U.S. Strategy 1 2 3 Fast-tracks entry to the

world’s Establishes a leading, premium- Expect compelling financial largest and fastest growing focused U.S. brand powerhouse benefits, including the ability drive cannabis market revenue growth, and realize cost synergies 4

Uniting Iconic brands Under Common Ownership Current State Target STATE 1

Canopy USA 2 2 Direct Ownership through Common Shares Structured Investment utilizing Exchangeable Shares 3 U.S. Hold Co Structure Enables Triggering Full Ownership of U.S. Cannabis Investments 1 Canopy currently holds options to acquire 70% of the

total shares of Acreage at a fixed exchange ratio, and the remaining 30% of Acreage shares on a floating basis; 100% of the membership interests of Wana; and 100% of the shares of Jetty. 2 Canopy currently holds certain exchangeable shares, options,

and warrants in TerrAscend, and will hold a conditional ownership position, assuming conversion of its exchangeable shares, but excluding the exercise of its warrants, of approximately 13.7% in TerrAscend. 3 Canopy USA intends to exercise its

options to acquire 100% of Acreage, Wana, and Jetty, and intends to evaluate all options for its conditional ownership of TerrAscend. 5

Shifting revenue mix towards U.S. cannabis 1 2 CURRENT REVENUE MIX EXPECTED

REVENUE MIX Consumer Products & Other Consumer Products U.S. Canada Rest of World & Other Cannabis Cannabis Cannabis Canada Cannabis Rest of World Cannabis 1 Adjusted to exclude Canadian retail operations and C³ Cannabinoid Compound

Company GmbH per announced divestiture transactions. 2 6 Pro forma results for the trailing twelve-month period ended June 30, 2022.

Unleashing the full power of our U.S. ecosystem Asset-Light Premium Products

National Footprint Business Model • Presence in large-scale markets • Prudent approach to capital • Targeting emerging and fast-growing and rapidly developing adult-use investment with balance of product categories (solventless

vape, markets owned vs. outsourced gummies, flower) production capacity aligned • Significant footprint in California • Wana is a leading edibles brand in with market demand and the Northeast – bringing the North America as gummies

continue best of the West to the East Coast • Focused on leveraging Wana’s to serve as primary entry point for as legalization trends continue licensing expertise to further new customers scale array of brands • Expansion to

additional states • Jetty is #1 solventless vape brand in 1 underway California 1 Based on August 2022 BDSA data for dollars sold. 7

Strategic Rationale 8

Capitalizing on once-in-a-generation opportunity >$50B Projected U.S. THC

market opportunity in 1 2026 21 States where Canopy’s U.S. investments currently have a Presence in large-scale & rapidly presence developing adult-use markets 85% of U.S. market opportunity Deep network of licensing relationships

represented by states Canopy’s U.S. investments 1 currently have a presence Opportunities to bring leading West Coast 20 brands to the Northeast U.S. states currently legal 2 for recreational use Acreage Holdings Jetty Extracts 39 Wana Brands

U.S. states currently legal 3 Wana licensed asset-light for medical use 1 MJBiz market forecast of total U.S. cannabis market by 2026 9 2 Including Washington D.C. 3 Map does not include Puerto Rico where Wana also has a presence

Leading Premium-Focused Brand Powerhouse Diversified Gummies Extracts

Vertical integration from cultivation to Top 10 cannabis brand and top 6 A leading edibles brand in North retail in multiple strategic states 1 vape brand in California America Authentic vape experience and award- Industry-leading quality, Strong

regional footholds through winning technology consistency, and potency portfolio of premium brands Strong growth and margins in highly Personalized experience through Award-winning national retail store competitive California market selection forms

and recipes brand “The Botanist” 1 Based on March 2022 BDSA data for dollars sold for all product categories. 10

Compelling financial benefits Ability to highlight the value of U.S.

investments by fully consolidating Canopy USA’s operating results into 1 Canopy’s financials Integration of U.S. assets to drive material revenue growth opportunities Expected expense reductions, such as elimination of Acreage public

company costs, expected to benefit financial performance over time 1 Financial results of assets wholly owned by Canopy USA (Acreage, Jetty, and Wana) will be consolidated in Canopy USA’s operating results. TerrAscend will not be consolidated

in Canopy USA’s financial results. 11

Structured Process 12

Highly structured plan to execute strategy Process Outcome • Canopy

has created a new holding company, Canopy USA, under which its U.S. cannabis assets will sit ü Enables rapid entry to U.S. market ahead of New U.S. Holding • Canopy holds non-voting shares in Canopy USA, which are exchangeable federal THC

permissibility into common shares Company • Canopy and Canopy USA have entered into a protection agreement to ü Ensures fast start for Canopy as legalization preserve the value of non-voting shares trends continue momentum • Canopy

to hold a shareholder vote to create a new class of exchangeable ü Protective layer in place for Canopy’s core Exchangeable shares in Canopy • Exchangeable shares are not entitled to any voting rights, dividends, or business

operations Shares other rights associated with common share ownership ü Allows all Canopy shareholders to realize greater participation in the U.S. cannabis • Expect Constellation to convert its common shares into exchangeable market

Constellation shares • Upon conversion by Constellation, existing investor rights agreement Relationship between Canopy and Constellation would terminate ü Constellation remains vested in Canopy’s success as a shareholder •

Canopy USA expected to acquire fixed shares of Acreage through share exchange, per terms of amended plan of arrangement ü Positioned to benefit from positive regulatory • Canopy USA entered into agreement to acquire floating shares

Acreage Agreement developments in the US while creating value • Acreage expects to hold a shareholder vote in early 2023 to approve the agreement for Canopy USA to acquire the floating shares, paving the way in the near-term for it to own 100%

of Acreage 13

Creating financial flexibility for future growth • Agreement with

certain lenders to repay US$187.5M existing term loan at discounted price • Amendment to minimum liquidity covenant under existing term ~27% loan to US$100M $26M Reduction to Reduction in overall debt • Intention to negotiate exchange

agreement with affiliates of annualized position Constellation to exchange up to CAD$100 million of senior notes interest expense due July 2023 in into Exchangeable Shares (in USD) ü Strengthen Balance ü Improve Cash Burn ü Unlock

Capacity for Growth Sheet Investments 14

Projected Timeline FY 2023 FY 2024 Q4 h1 H2 Canopy Shareholder Vote To

approve creation of new class of exchangeable shares CBI Conversion Following Canopy shareholder vote, CBI expected to convert ownership to Exchangeable shares & terminate IRA Acreage Shareholder Vote Acreage Close (TBC) Acreage, Jetty, and Wana

Following receipt of all regulatory To approve acquisition of the Trigger and shareholder approvals floating shares of Acreage To acquire 100% of Jetty and Wana as well as Acreage fixed and floating shares, Jetty Close (TBC) subject to regulatory

Following receipt of all regulatory approvals and shareholder approvals vote Wana Close (TBC) Following receipt of all regulatory approvals 15

THANK YOU 16

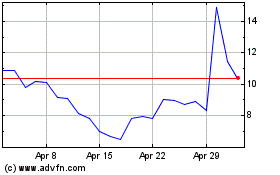

Canopy Growth (NASDAQ:CGC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Canopy Growth (NASDAQ:CGC)

Historical Stock Chart

From Apr 2023 to Apr 2024