Current Report Filing (8-k)

January 11 2021 - 4:02PM

Edgar (US Regulatory)

0001109354

false

0001109354

2021-01-11

2021-01-11

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

January 11, 2021

BRUKER CORPORATION

(Exact name of registrant as specified

in its charter)

|

Delaware

|

|

000-30833

|

|

04-3110160

|

|

(State

or other jurisdiction of

|

|

Commission

File No.

|

|

(I.R.S.

Employer

|

|

Incorporation or organization)

|

|

|

|

Identification

No.)

|

40

Manning Road

Billerica,

MA 01821

(Address

of principal executive offices)(Zip Code)

(978) 663-3660

(Registrant’s telephone number, including

area code)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following

provisions:

¨

Written communications pursuant to Rule 425 under

the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under

the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of

the Act:

|

Title of Each Class

|

|

Trading Symbol(s)

|

|

Name of Each Exchange on Which Registered

|

|

Common Stock, $0.01 par value per share

|

|

BRKR

|

|

The Nasdaq Global Select Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act

of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.02 Results of Operations and Financial Condition.

On January 11, 2021, Bruker Corporation

(the “Company”) stated that it currently expects revenue for the fourth quarter of fiscal year 2020 in the range of

$620-$625 million, including an approximate 4.5% favorable impact from foreign currency translation, during its scheduled presentation

at the 39th Annual J.P. Morgan Healthcare Conference.

Because the Company’s financial statements

for the fiscal year ended December 31, 2020 have not yet been finalized or audited, this preliminary statement regarding the Company’s

current expectations with respect to its fourth quarter 2020 revenue and foreign currency translation effects are subject to change,

and the Company’s actual revenue for this period may differ materially from this preliminary estimate. Accordingly, you should

not place undue reliance on this preliminary estimate.

Item 7.01 Regulation FD Disclosure.

The information set forth in Item 2.02 of

this Current Report is incorporated into this Item 7.01 by reference.

The information furnished in Item 2.02 and

Item 7.01 of this Current Report on Form 8-K shall not be deemed “filed” for purposes of Section 18 of the Securities

Exchange Act of 1934, as amended, and shall not be incorporated by reference into any filing of the Company under the Securities

Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

Forward Looking Statements

Any statements contained in this Current Report on Form 8-K

that do not describe historical facts may constitute forward-looking statements within the meaning of Section 27A of the Securities

Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including statements regarding management’s

current expectations with respect to our fourth quarter 2020 performance, including our revenue. Any forward-looking statements

contained herein are based on current expectations, but are subject to risks and uncertainties that could cause actual results

to differ materially from those indicated, including, but not limited to, risks and uncertainties relating to the preliminary nature

of the Company’s fourth quarter 2020 financial information, which is subject to completion of the Company’s year-end-audit,

and other risk factors discussed from time to time in our filings with the Securities and Exchange Commission, or SEC. These and

other factors are identified and described in more detail in our filings with the SEC, including, without limitation, our annual

report on Form 10-K for the year ended December 31, 2019 and our subsequent quarterly reports on Forms 10-Q. We expressly disclaim

any intent or obligation to update these forward-looking statements other than as required by law.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

BRUKER CORPORATION

(Registrant)

|

|

|

|

|

Date: January 11, 2021

|

By:

|

/s/GERALD N. HERMAN

|

|

|

|

Gerald N. Herman

|

|

|

|

Chief Financial Officer

|

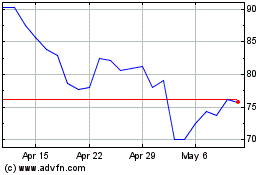

Bruker (NASDAQ:BRKR)

Historical Stock Chart

From Mar 2024 to Apr 2024

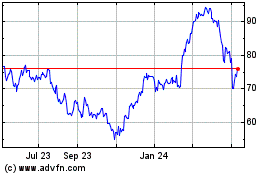

Bruker (NASDAQ:BRKR)

Historical Stock Chart

From Apr 2023 to Apr 2024