Current Report Filing (8-k)

June 04 2021 - 8:11AM

Edgar (US Regulatory)

false000107553100010755312021-06-042021-06-040001075531us-gaap:CommonStockMember2021-06-042021-06-040001075531bkng:A0.8SeniorNotesDueMarch2022Member2021-06-042021-06-040001075531bkng:A2.15SeniorNotesDueNovember2022Member2021-06-042021-06-040001075531bkng:A2.375SeniorNotesDueSeptember2024MemberMember2021-06-042021-06-040001075531bkng:A0100SeniorNotesDue2025Member2021-06-042021-06-040001075531bkng:A1.8SeniorNotesDueMarch2027Member2021-06-042021-06-040001075531bkng:A05SeniorNotesDueMarch2028Member2021-06-042021-06-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) June 4, 2021

Booking Holdings Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

1-36691

|

|

06-1528493

|

(State or other Jurisdiction of

Incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

800 Connecticut Avenue

|

Norwalk

|

Connecticut

|

|

06854

|

|

(Address of principal office)

|

|

(zip code)

|

Registrant's telephone number, including area code: (203) 299-8000

N/A

(Former name or former address, if changed since last report)

Securities Registered Pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of Each Class:

|

|

Trading Symbol

|

|

Name of Each Exchange on which Registered:

|

|

Common Stock par value $0.008 per share

|

|

BKNG

|

|

The NASDAQ Global Select Market

|

|

0.800% Senior Notes Due 2022

|

|

BKNG 22A

|

|

The NASDAQ Stock Market LLC

|

|

2.150% Senior Notes Due 2022

|

|

BKNG 22

|

|

The NASDAQ Stock Market LLC

|

|

2.375% Senior Notes Due 2024

|

|

BKNG 24

|

|

The NASDAQ Stock Market LLC

|

|

0.100% Senior Notes Due 2025

|

|

BKNG 25

|

|

The NASDAQ Stock Market LLC

|

|

1.800% Senior Notes Due 2027

|

|

BKNG 27

|

|

The NASDAQ Stock Market LLC

|

|

0.500% Senior Notes Due 2028

|

|

BKNG 28

|

|

The NASDAQ Stock Market LLC

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4c under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01. Other Events.

On June 4, 2021, Glenn Fogel, the President and Chief Executive Officer of Booking Holdings Inc. and Booking.com BV announced to employees that Booking Holdings Inc. and its subsidiaries (the “Company”) intend to return government assistance received through the Netherlands’ wage subsidy program and the various other government aid programs outside the Netherlands in which the Company participated as a result of the impact of the COVID-19 pandemic on the Company’s business. While the decision to accept this assistance was made during a period when the Company’s business was severely impacted and the timing and pace of the recovery of the travel industry was very uncertain, the Company is now encouraged by the improving booking trends in certain countries in recent months that the Company discussed on its most recent earnings call on May 5, 2021. The Company estimates that the amount to be returned to various governments is approximately $110 million and the amount of government aid that was previously recorded in the income statements for the year ended December 31, 2020 and the three months ended March 31, 2021 (principally as a reduction of personnel expenses) that is expected to be reversed in Q2 2021 is approximately $140 million (pre-tax). This reversal was not included in the commentary the Company provided about Q2 2021 financial results on May 5, 2021.

This Current Report on Form 8-K contains forward-looking statements. These forward-looking statements reflect our views regarding current expectations and projections about future events and conditions and are based on currently available information. These forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties and assumptions that are difficult to predict, including the Risk Factors identified in our most recently filed quarterly report on Form 10-Q and annual report on Form 10-K; therefore, our actual results could differ materially from those expressed, implied or forecast in any such forward-looking statements. Expressions of future goals and expectations and similar expressions, including “may,” “will,” “should,” “could,” “aims,” “seeks,” “expects,” “plans,” “anticipates,” “intends,” “believes,” “estimates,” “predicts,” “potential,” “targets,” and “continue,” reflecting something other than historical fact are intended to identify forward-looking statements. Unless required by law, we undertake no obligation to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise. However, readers should carefully review the reports and documents we file or furnish from time to time with the Securities and Exchange Commission, particularly our annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BOOKING HOLDINGS INC.

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ David I. Goulden

|

|

|

|

Name:

|

David I. Goulden

|

|

|

|

Title:

|

Executive Vice President and Chief Financial Officer

|

Date: June 4, 2021

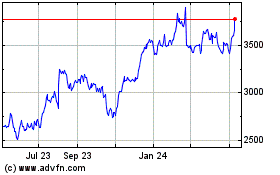

Booking (NASDAQ:BKNG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Booking (NASDAQ:BKNG)

Historical Stock Chart

From Apr 2023 to Apr 2024