UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT

TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES

EXCHANGE ACT OF 1934

For

the month of November 2023

Commission

File Number 001-40517

BON

NATURAL LIFE LIMITED

(Translation

of registrant’s name into English)

Room 601, Block C, Gazelle Valley, No.69,

Jinye Road

High-Tech Zone, Xi’an, Shaanxi, China

People’s

Republic of China

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F: Form 20-F ☒ Form

40-F ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Note:

Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report

to security holders.

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Note:

Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that

the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated,

domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on

which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to

be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the

subject of a Form 6-K submission or other Commission filing on EDGAR.

Effective

November 22, 2023, our Board of Directors adopted the Incentive Compensation Recovery Policy furnished herewith as Exhibit 99.1. The

Policy is intended to comply with Rule 10D-1 under the Exchange Act and Nasdaq Listing Rule 5608.

Exhibits

The

following exhibits are included in this Form 6-K:

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| Date:

November 28, 2023 |

Bon

Natural Life Limited |

| |

|

|

| |

By: |

/s/

Yongwei Hu |

| |

|

Yongwei

Hu |

| |

|

Chairman

and Chief Executive Officer |

Exhibit

99.1

Bon

Natural Life Limited

Incentive

Compensation Recovery Policy

Effective

Date: November 22, 2023

| 1. | Purpose.

The purpose of the Bon Natural Life Limited Incentive Compensation Recovery Policy (this

“Policy”) is to provide for the recovery of certain Incentive-Based Compensation

in the event of an Accounting Restatement. This Policy is intended to comply with, and to

be administered and interpreted consistent with, Section 10D of the Securities Exchange Act

of 1934, as amended (the “Exchange Act”), Rule 10D-1 promulgated under

the Exchange Act (“Rule 10D-1”), and Listing Rule 5608 adopted by the

Nasdaq Stock Market LLC (“Nasdaq”) (the “Listing Standards”).

Unless otherwise defined in this Policy, capitalized terms shall have the meanings set forth

in the Appendix attached hereto. |

| | |

| 2. | Policy

for Recovery of Erroneously Awarded Compensation. In the event of an Accounting Restatement,

it is the Company’s policy to recover reasonably promptly the amount of any Erroneously

Awarded Compensation Received during the Recovery Period. |

| | |

| 3. | Application

of Policy. This Policy applies to Incentive-Based Compensation Received by an Executive

Officer (i) on or after October 2, 2023 and after such individual began service as an Executive

Officer, (ii) if that person served as an Executive Officer at any time during the performance

period for the Incentive-Based Compensation, and (iii) while the Company had a listed class

of securities on a national securities exchange. |

| | |

| 4. | Administration |

| a. | This

Policy shall be administered by the Compensation Committee, except that the Board may determine

to act as the administrator or designate another committee of the Board to act as the administrator

with respect to any portion of this Policy other than Section 4(c) (the “Administrator”).

The Administrator is authorized to interpret and construe this Policy and to make all determinations

necessary, appropriate, or advisable for the administration of this Policy. |

| | | |

| b. | The

Company is authorized to take appropriate steps to implement this Policy and may effect recovery

hereunder by: (i) requiring payment to the Company, (ii) set-off, (iii) reducing compensation,

or (iv) such other means or combination of means as the Administrator determines to be appropriate. |

| | | |

| c. | The

Company need not recover Erroneously Awarded Compensation if and to the extent that the Compensation

Committee or a majority of the independent members of the Board determines that such recovery

is impracticable and not required under Rule 10D-1 and the Listing Standards, including if

the Compensation Committee or a majority of the independent members of the Board determines

that: (i) the direct expense paid to a third party to assist in enforcing this Policy would

exceed the amount to be recovered after making a reasonable attempt to recover, (ii) recovery

would violate home country law adopted prior to November 28, 2022, after obtaining the opinion

of home country counsel, or (iii) recovery would likely cause an otherwise tax-qualified

broad-based retirement plan to fail the requirements of Section 401(a)(13) or Section 411(a)

of the Internal Revenue Code of 1986, as amended, and regulations thereunder. |

| d. | The

Administrator may require each Executive Officer to sign and return to the Company an Acknowledgment

Form substantially in the form attached to this Policy as Exhibit A or in such other

form determined by the Administrator, pursuant to which the Executive Officer agrees to be

bound by, and comply with, the terms of this Policy. |

| | | |

| e. | Any

determinations made by the Administrator under this Policy shall be final and binding on

all affected individuals and need not be uniform among affected individuals. |

| 5. |

Other Recovery Rights; Company Claims. Any right

of recovery pursuant to this Policy is in addition to, and not in lieu of, any other remedies or rights of recovery that may be available

to the Company under applicable law or pursuant to the terms of any compensation recovery policy in any employment agreement, plan or

award agreement, or pursuant to the terms of any other compensation recovery policy of the Company. Nothing contained in this Policy

and no recovery hereunder shall limit any claims, damages, or other legal remedies the Company may have against an individual arising

out of or resulting from any actions or omissions by such individual. |

| |

|

| 6. |

Reporting and Disclosure. The Company shall file

all disclosures with respect to this Policy in accordance with the requirements of federal securities laws. |

| |

|

| 7. |

Indemnification Prohibition. Notwithstanding

the terms of any indemnification or insurance policy or any contractual arrangement that may be interpreted to the contrary, the Company

shall not indemnify any Executive Officer with respect to amount(s) recovered under this Policy or claims relating to the enforcement

of this Policy, including any payment or reimbursement for the cost of third-party insurance purchased by such Executive Officer to fund

potential clawback obligations hereunder. |

| |

|

| 8. |

Amendment; Termination. The Board or the Compensation

Committee may amend or terminate this Policy from time to time in its discretion as it deems appropriate and shall amend this policy

as it deems necessary to comply with applicable law or any rules or standards adopted by a national securities exchange on which the

Company’s securities are listed; provided, however, that no amendment or termination of this Policy shall be effective to the extent

it would cause the Company to violate any federal securities laws, Securities and Exchange Commission rule or the rules or standards

of any national securities exchange on which the Company’s securities are listed. |

| |

|

| 9. |

Successors. This Policy shall be binding and

enforceable against all individuals who are or were Executive Officers and their beneficiaries, heirs, executors, administrators, or

other legal representatives. |

| |

|

| 10. |

Effective Date. This Policy was approved on November

22, 2023 and is effective only for Incentive-Based Compensation Received on or after October 2, 2023. |

APPENDIX

Definitions:

For purposes of this Policy, the following terms shall have the meanings set forth below:

“Accounting

Restatement” means an accounting restatement of the Company’s financial statements due to the Company’s material

noncompliance with any financial reporting requirement under the securities laws, including any accounting restatement required to correct

an error in previously issued financial statements that is material to the previously issued financial statements, or that would result

in a material misstatement if the error were corrected in the current period or left uncorrected in the current period.

“Administrator”

has the meaning set forth in Section 4(a) hereof.

“Board”

means the Company’s Board of Directors.

“Company”

means Bon Natural Life Limited an exempted company incorporated under the laws of Cayman Islands, and its affiliates.

“Compensation

Committee” means the Compensation Committee of the Board.

“Erroneously

Awarded Compensation” means the amount, as determined by the Administrator, of Incentive-Based Compensation received by an

Executive Officer that exceeds the amount of Incentive-Based Compensation that would have been received by the Executive Officer had

it been determined based on the restated amounts. For Incentive-Based Compensation based on stock price or total shareholder return (“TSR”)

the Administrator will determine the amount based on a reasonable estimate of the effect of the Accounting Restatement on the stock price

or TSR upon which the Incentive-Based Compensation was received, and the Company will maintain documentation of the determination of

that reasonable estimate and provide the documentation to Nasdaq. In all cases, the amount to be recovered will be calculated without

regard to any taxes paid by the Executive Officer with respect of the Erroneously Awarded Compensation.

“Executive

Officers” means the Company’s current and former executive officers as determined by the Administrator in accordance

with Rule 10D-1 and the Listing Standards. Generally, Executive Officers include any executive officer designated by the Board as an

“officer” under Rule 16a-1(f) under the Exchange Act.

“Financial

Reporting Measure” means (i) any measure that is determined and presented in accordance with the accounting principles used

in preparing the Company’s financial statements and any measure derived wholly or in part from such a measure, and (ii) any measure

based wholly or in part on the Company’s stock price or total shareholder return. A Financial Reporting Measure need not be presented

within the Company’s financial statements or included in a filing with the Securities and Exchange Commission.

“Incentive-Based

Compensation” means any compensation granted, earned, or vested based in whole or in part on the Company’s attainment

of a Financial Reporting Measure. Incentive-Based Compensation is deemed to be “Received” for purposes of this Policy

in the fiscal period during which the Financial Reporting Measure specified in the Incentive-Based Compensation award is attained, even

if the payment or grant of such Incentive-Based Compensation occurs after the end of that period.

“Recovery

Period” means the three completed fiscal years immediately preceding the date that the Company is required to prepare the applicable

Accounting Restatement and any “transition period” as described under Rule 10D-1 and the Listing Standards. For purposes

of this Policy, the “date that the Company is required to prepare the applicable Accounting Restatement” is the earlier

to occur of (i) the date the Board, a committee of the Board, or the officer or officers of the Company authorized to take such action

if Board action is not required, concludes, or reasonably should have concluded, that the Company is required to prepare an Accounting

Restatement, or (ii) the date a court, regulator, or other legally authorized body directs the Company to prepare an Accounting Restatement.

Exhibit

A

Bon

Natural Life Limited

Incentive Compensation Recovery Policy

ACKNOWLEDGEMENT

FORM

I,

the undersigned, acknowledge and affirm that I have received and reviewed a copy of the Bon Natural Life Limited Incentive Compensation

Recovery Policy, and agree that: (i) I am and will continue to be subject to the Bon Natural Life Limited Incentive Compensation Recovery

Policy, as amended from time to time (the “Policy”), (ii) the Policy will apply to me both during and after my employment

with the Company, and (iii) I will abide by the terms of the Policy, including, without limitation, by promptly returning any Erroneously

Awarded Compensation to the Company to the extent required by, and in a manner determined by the Administrator and permitted by, the

Policy. In the event of any inconsistency between the Policy and the terms of any employment agreement or offer letter to which I am

a party, or the terms of any compensation plan, program, or agreement under which any compensation has been granted, awarded, earned

or paid, the terms of the Policy shall govern.

Capitalized

terms used but not otherwise defined in this Acknowledgement Form shall have the meanings ascribed to such terms in the Policy.

| |

|

| |

Signature |

| |

|

| |

|

| |

Print

Name |

| |

|

| |

|

| |

Date |

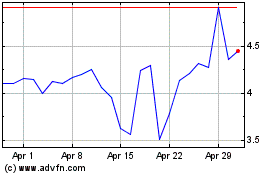

Bon Natural Life (NASDAQ:BON)

Historical Stock Chart

From Apr 2024 to May 2024

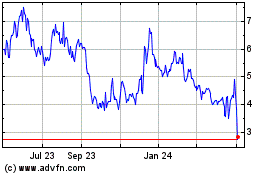

Bon Natural Life (NASDAQ:BON)

Historical Stock Chart

From May 2023 to May 2024