Bon Natural Life Limited (Nasdaq: BON) (“BON” or the “Company”),

one of the leading bio-ingredient solutions providers in the

natural, health and personal care industries, today announced its

half-year financial results for the six months ended March 31,

2023.

1H-2023 Financial

Highlights

- Revenue - Total

revenues were $14.1 million, representing a 3.4% increase from

US$13.7 million for the same period in 2022.

- Income from

operation – for the six months ended March 31, 2023 was

$2,985,234 increase of $196,875 or 7.1% as compared to $2,788,359

in the same period of 2022.

- Net income attributable to

BON Natural Life Limited - for the six months ended March

31, 2023 was $2,119,760 as compared to $2,548,678 in the same

period of 2022.

- Earnings per share

– Basic earnings per share was $0.24 for the six months

ended March 31, 2023 as compared to $0.31 in the same period of

2022. Diluted earnings per share was $0.24 for the six months ended

March 31, 2023 as compared to $0.30 in the same period of

2022.

1H-2023 Product Categories Summary:

Growth vs. Prior Year

|

|

Revenues increase (decrease) |

Gross Profits increase (decrease) |

|

Fragrance Compounds |

(8.4%) |

12.3% |

|

Health Supplements (Powder Drinks) |

37.2% |

21.0% |

|

Bioactive Food Ingredients |

(5.2%) |

20.0% |

Fragrance Compounds

Revenues from sales of fragrance compound

products decreased by 8.4% to US$6.8 million in the six months

ended March 31, 2023 from US$7.4 million for the same period in

2022. The decrease was primarily attributable to a 10.1% decrease

in average selling price and a 9.5% negative impact from currency

exchange, partially offset by an increase of 1.8% in sales

volume.

Gross profit from fragrance compound products

increased by 12.3% to US$2.0 million from US$1.8 million for the

same period in 2022. The increase was primarily attributable to a

16.6% decrease in cost of products due to our ability to negotiate

better price from suppliers and an increase of 1.8% in sales

volume, partially offset by a 9.5% negative impact from currency

exchange.

Health Supplements (Powder

Drinks)

Revenues from sales of health supplement (powder

drinks) products increased by 37.2% to US$4.6 million in the six

months ended March 31, 2023 from US$3.3 million for the same period

in 2022. The increase was primarily attributable to an increase of

50% in sales volume and partially offset by a 9.5% negative impact

from currency exchange.

Gross profit from health supplement (powder

drinks) products increased by 21.0% to US$1.4 million from US$1.2

million for the same period in 2022. The increase was primarily

attributable to the above referenced factors.

Bioactive Food Ingredients

Revenues from sales of bioactive food ingredient

products decreased by 5.2% to US$2.8 million in the six months

ended March 31, 2023 from US$2.9 million for the same period in

2022. The decrease was primarily attributable to a 7.5% decrease in

average price and a 9.5% negative impact from currency exchange,

partially offset by a 2.4% increase in sales volume due to strong

customer demand and sales effort.

Gross profit from bioactive food ingredient

products increased by 20.0% to US$1.3 million from US$1.1 million

for the same period in 2022. The increase was mainly due to a 2.4%

increase in sales volume and a decrease of 21.7% in cost of

products due to the decreased raw materials purchase price,

partially offset by a 9.5% negative impact from currency

exchange.

General and administrative

expenses increased by $467,012, or approximately 46.8%,

from $998,943 in the six months ended March 31, 2022, to $1,465,955

in the same period of 2023, mainly attributable to an increase of

44.2% in staff payroll due to the increase in staff headcount, a

234.8% increase in rent expenses and a 42.7% increase in expenses

such as professional service and consulting fees and investor

relation expenses, etc. as we become a public company since we

completed the IPO in July 2021.

Research and development (“R&D”)

expenses decreased by $34,680, or approximately 21.1%,

from $164,675 in the six months ended March 31, 2022, to $129,995

in the same period of 2023. The decrease was mainly due to a 79.3%

decrease in staff payroll and a 34.4% decrease in outsourcing

R&D activities to external consulting firms.

Government subsidies received

in the form of provincial-level export credit insurance subsidy and

unemployment insurance expansion grant totaled $11,916 in the six

months ended March 31, 2023.

Net income decreased from $2.5

million in the six months ended March 31, 2022 to $2.1 million in

the same period of 2023.

Net cash used in operating

activities during the six months ended March 31, 2023 was

$2,177,992 compared to net cash used in operating activities of

$130,577 in the same period of 2022.

Diluted earnings per share

("EPS") was $0.24, compared

to $0.30 for the same period in 2022.

Investors are encouraged to review the Company’s

complete financial statements and related disclosures for

additional information. These materials are available

at https://www.sec.gov/edgar/browse/?CIK=1816815&owner=exclude

About Bon Natural Life

Limited

The Company focuses on the manufacturing of

personal care ingredients, such as plant extracted fragrance

compounds for perfume and fragrance manufacturers, natural health

supplements such as powder drinks and bioactive food ingredient

products mostly used as food additives and nutritional supplements

by their customers. For additional information, please visit the

Company’s website at www.bnlus.com.

Safe Harbor Statement

This press release contains forward-looking

statements as defined by the Private Securities Litigation Reform

Act of 1995. Forward-looking statements include statements

concerning plans, objectives, goals, strategies, future events or

performance, and underlying assumptions and other statements that

are other than statements of historical facts. When the Company

uses words such as "may, "will, "intend," "should," "believe,"

"expect," "anticipate," "project," "estimate" or similar

expressions that do not relate solely to historical matters, it is

making forward-looking statements. Forward-looking statements are

not guarantees of future performance and involve risks and

uncertainties that may cause the actual results to differ

materially from the Company's expectations discussed in the

forward-looking statements. These statements are subject to

uncertainties and risks including, but not limited to, the

following: the Company's goals and strategies; the Company's future

business development; product and service demand and acceptance;

changes in technology; economic conditions; the growth of the

natural, health and personal care market in China and the

other international markets the Company plans to serve; reputation

and brand; the impact of competition and pricing; government

regulations; fluctuations in general economic and business

conditions in China and the international markets the

Company plans to serve and assumptions underlying or related to any

of the foregoing and other risks contained in reports filed by the

Company with the SEC. For these reasons, among others, investors

are cautioned not to place undue reliance upon any forward-looking

statements in this press release. Additional factors are discussed

in the Company's filings with the SEC, which are available for

review at www.sec.gov. The Company undertakes no obligation to

publicly revise these forward–looking statements to reflect events

or circumstances that arise after the date hereof.

For more information, please

contact:

Bon Natural LifeCindy Liu |

IREmail: bonnatural@appchem.cn

|

BON NATURAL LIFE LIMITED AND

SUBSIDIARIESCONDENSED CONSOLIDATED BALANCE

SHEETS(UNAUDITED) |

|

|

|

As of |

|

|

|

|

March 31, 2023 |

|

|

September 30, 2022 |

|

|

ASSETS |

|

|

|

|

|

|

|

CURRENT ASSETS |

|

|

|

|

|

|

|

|

|

Cash |

|

$ |

542,272 |

|

|

$ |

840,861 |

|

|

Accounts receivable, net |

|

|

9,260,407 |

|

|

|

6,784,307 |

|

|

Inventories, net |

|

|

1,803,374 |

|

|

|

1,722,120 |

|

|

Advance to suppliers, net |

|

|

7,644,920 |

|

|

|

4,091,990 |

|

|

Acquisition deposit |

|

|

1,000,000 |

|

|

|

1,000,000 |

|

|

Prepaid expenses and other current assets |

|

|

3,967,756 |

|

|

|

277,509 |

|

|

TOTAL CURRENT ASSETS |

|

|

24,218,729 |

|

|

|

14,716,787 |

|

|

|

|

|

|

|

|

|

|

|

|

Property, plant and equipment, net |

|

|

22,135,274 |

|

|

|

21,624,437 |

|

|

Intangible assets, net |

|

|

373,751 |

|

|

|

366,167 |

|

|

Right-of-use lease assets, net |

|

|

450,282 |

|

|

|

546,690 |

|

|

Deferred tax assets, net |

|

|

29,023 |

|

|

|

2,768 |

|

|

TOTAL ASSETS |

|

$ |

47,207,059 |

|

|

$ |

37,256,849 |

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND EQUITY |

|

|

|

|

|

|

|

|

|

CURRENT LIABILITIES |

|

|

|

|

|

|

|

|

|

Short-term loans |

|

$ |

2,666,457 |

|

|

$ |

2,424,587 |

|

|

Current portion of long-term loans |

|

|

1,934,411 |

|

|

|

2,135,979 |

|

|

Accounts payable |

|

|

324,240 |

|

|

|

214,585 |

|

|

Due to related parties |

|

|

120,203 |

|

|

|

72,836 |

|

|

Taxes payable |

|

|

1,676,714 |

|

|

|

1,239,708 |

|

|

Deferred revenue |

|

|

989,027 |

|

|

|

188,745 |

|

|

Accrued expenses and other current liabilities |

|

|

3,503,550 |

|

|

|

114,431 |

|

|

Finance lease liabilities, current |

|

|

- |

|

|

|

26,285 |

|

|

Operating lease liability, current |

|

|

247,397 |

|

|

|

230,182 |

|

|

TOTAL CURRENT LIABILITIES |

|

|

11,461,999 |

|

|

|

6,647,338 |

|

|

|

|

|

|

|

|

|

|

|

|

Long-term loans |

|

|

30,336 |

|

|

|

189,813 |

|

|

Operating lease liability, noncurrent |

|

|

212,955 |

|

|

|

327,202 |

|

|

TOTAL LIABILITIES |

|

$ |

11,705,290 |

|

|

$ |

7,164,353 |

|

|

|

|

|

|

|

|

|

|

|

|

COMMITMENTS AND CONTINGENCIES |

|

|

|

|

|

|

|

|

|

EQUITY |

|

|

|

|

|

|

|

|

|

Ordinary shares, $0.0001 par value, 500,000,000 shares authorized,

11,146,226 and 8,396,226 shares issued and outstanding as of March

31, 2023 and September 30, 2022, respectively |

|

|

1,115 |

|

|

|

840 |

|

|

Additional paid in capital |

|

|

17,946,174 |

|

|

|

15,711,450 |

|

|

Statutory reserve |

|

|

1,804,116 |

|

|

|

1,804,116 |

|

|

Retained earnings |

|

|

16,796,529 |

|

|

|

14,676,769 |

|

|

Accumulated other comprehensive income |

|

|

(1,559,550 |

) |

|

|

(2,631,171 |

) |

|

TOTAL BON NATURAL LIFE LIMITED SHAREHOLDERS’

EQUITY |

|

|

34,988,384 |

|

|

|

29,562,004 |

|

|

Non-controlling interest |

|

|

513,387 |

|

|

|

530,492 |

|

|

TOTAL SHAREHOLDERS’ EQUITY |

|

|

35,501,771 |

|

|

|

30,092,496 |

|

|

TOTAL LIABILITIES AND EQUITY |

|

$ |

47,207,059 |

|

|

$ |

37,256,849 |

|

|

BON NATURAL LIFE LIMITED AND

SUBSIDIARIESCONDENSED CONSOLIDATED STATEMENTS OF

INCOME AND COMPREHENSIVE

INCOME(UNAUDITED) |

|

|

|

For the six months endedMarch

31, |

|

|

|

|

2023 |

|

|

2022 |

|

|

REVENUE |

|

$ |

14,149,967 |

|

|

$ |

13,688,400 |

|

|

COST OF REVENUE |

|

|

(9,432,619 |

) |

|

|

(9,652,453 |

) |

|

GROSS PROFIT |

|

|

4,717,348 |

|

|

|

4,035,947 |

|

|

|

|

|

|

|

|

|

|

|

|

OPERATING EXPENSES |

|

|

|

|

|

|

|

|

|

Selling expenses |

|

|

(136,164 |

) |

|

|

(83,970 |

) |

|

General and administrative expenses |

|

|

(1,465,955 |

) |

|

|

(998,943 |

) |

|

Research and development expenses |

|

|

(129,995 |

) |

|

|

(164,675 |

) |

|

Total operating expenses |

|

|

(1,732,114 |

) |

|

|

(1,247,588 |

) |

|

|

|

|

|

|

|

|

|

|

|

INCOME FROM OPERATIONS |

|

|

2,985,234 |

|

|

|

2,788,359 |

|

|

|

|

|

|

|

|

|

|

|

|

OTHER INCOME (EXPENSES) |

|

|

|

|

|

|

|

|

|

Interest income |

|

|

8,732 |

|

|

|

589 |

|

|

Interest expense |

|

|

(178,557 |

) |

|

|

(277,764 |

) |

|

Unrealized foreign transaction exchange loss |

|

|

8,452 |

|

|

|

(16,994 |

) |

|

Government subsidies |

|

|

11,916 |

|

|

|

542,256 |

|

|

Income from short-term investments |

|

|

- |

|

|

|

12,419 |

|

|

Other income |

|

|

(223,043 |

) |

|

|

43,532 |

|

|

Total other income, net |

|

|

(372,501 |

) |

|

|

304,038 |

|

|

|

|

|

|

|

|

|

|

|

|

INCOME BEFORE INCOME TAX PROVISION |

|

|

2,617,733 |

|

|

|

3,092,397 |

|

|

|

|

|

|

|

|

|

|

|

|

INCOME TAX PROVISION |

|

|

(510,077 |

) |

|

|

(562,737 |

) |

|

|

|

|

|

|

|

|

|

|

|

NET INCOME |

|

|

2,102,656 |

|

|

|

2,529,660 |

|

|

Less: net loss attributable to non-controlling interest |

|

|

(17,104 |

) |

|

|

(19,018 |

) |

|

NET INCOME ATTRIBUTABLE TO BON NATURAL LIFE

LIMITED |

|

$ |

2,119,760 |

|

|

$ |

2,548,678 |

|

|

|

|

|

|

|

|

|

|

|

|

NET INCOME |

|

|

2,102,656 |

|

|

|

2,529,660 |

|

|

|

|

|

|

|

|

|

|

|

|

OTHER COMPREHENSIVE INCOME |

|

|

|

|

|

|

|

|

|

Total foreign currency translation adjustment |

|

|

1,071,621 |

|

|

|

485,503 |

|

|

TOTAL COMPREHENSIVE INCOME |

|

|

3,174,277 |

|

|

|

3,015,163 |

|

|

Less: comprehensive loss attributable to non-controlling

interest |

|

|

(17,104 |

) |

|

|

(21,314 |

) |

|

COMPREHENSIVE INCOME ATTRIBUTABLE TO BON NATURAL LIFE

LIMITED |

|

$ |

3,191,381 |

|

|

$ |

3,036,477 |

|

|

|

|

|

|

|

|

|

|

|

|

EARNINGS PER SHARE |

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.24 |

|

|

$ |

0.31 |

|

|

Diluted |

|

$ |

0.24 |

|

|

$ |

0.30 |

|

|

|

|

|

|

|

|

|

|

|

|

WEIGHTED AVERAGE NUMBER OF SHARES OUTSTANDING |

|

|

|

|

|

|

|

|

|

Basic |

|

|

8,918,309 |

|

|

|

8,350,381 |

|

|

Diluted |

|

|

8,979,243 |

|

|

|

8,386,306 |

|

|

BON NATURAL LIFE LIMITED AND

SUBSIDIARIESCONDENSED CONSOLIDATED STATEMENTS OF

CASH

FLOWS(UNAUDITED) |

|

|

|

For the six months endedMarch

31, |

|

|

|

|

2023 |

|

|

2022 |

|

|

Cash flows from operating activities |

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

2,102,656 |

|

|

$ |

2,529,660 |

|

|

Adjustments to reconcile net income to cash provided by operating

activities |

|

|

|

|

|

|

|

|

|

Allowance for doubtful accounts |

|

|

- |

|

|

|

187 |

|

|

Depreciation and amortization |

|

|

282,888 |

|

|

|

112,945 |

|

|

Inventory reserve |

|

|

105,314 |

|

|

|

- |

|

|

Deferred income tax |

|

|

(25,749 |

) |

|

|

(28 |

) |

|

Amortization of operating lease right-of-use assets |

|

|

114,179 |

|

|

|

33,122 |

|

|

Amortization of stock options |

|

|

35,000 |

|

|

|

89,820 |

|

|

Unrealized foreign currency exchange loss |

|

|

(8,452 |

) |

|

|

16,994 |

|

|

Gain on disposal of property and equipment |

|

|

- |

|

|

|

(745 |

) |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

(2,198,450 |

) |

|

|

(1,265,109 |

) |

|

Inventories |

|

|

(124,601 |

) |

|

|

(515,690 |

) |

|

Advance to suppliers, net |

|

|

(3,353,433 |

) |

|

|

977,033 |

|

|

Prepaid expenses and other current assets |

|

|

(3,595,458 |

) |

|

|

(38,795 |

) |

|

Accounts payable |

|

|

100,386 |

|

|

|

165,741 |

|

|

Operating lease liabilities |

|

|

(115,170 |

) |

|

|

(30,589 |

) |

|

Taxes payable |

|

|

386,510 |

|

|

|

(1,806,543 |

) |

|

Deferred revenue |

|

|

781,183 |

|

|

|

(440,032 |

) |

|

Accrued expenses and other current liabilities |

|

|

3,335,205 |

|

|

|

41,452 |

|

|

Net cash used in operating activities |

|

|

(2,177,992 |

) |

|

|

(130,577 |

) |

|

|

|

|

|

|

|

|

|

|

|

Cash flows from investing activities |

|

|

|

|

|

|

|

|

|

Purchase of short-term investments |

|

|

- |

|

|

|

(3,678,199 |

) |

|

Proceeds upon redemption of short-term investments |

|

|

- |

|

|

|

5,273,186 |

|

|

Purchase of property and equipment |

|

|

(15,131 |

) |

|

|

(10,231 |

) |

|

Proceeds from sales of property and equipment |

|

|

- |

|

|

|

1,659 |

|

|

Capital expenditures on construction-in-progress |

|

|

(2,970 |

) |

|

|

(3,577,995 |

) |

|

Net cash used in investing activities |

|

|

(18,101 |

) |

|

|

(1,991,580 |

) |

|

|

|

|

|

|

|

|

|

|

|

Cash flows from financing activities |

|

|

|

|

|

|

|

|

|

Net proceeds from issuance of Ordinary Shares in initial public

offerings |

|

|

2,200,000 |

|

|

|

- |

|

|

Proceeds from short-term loans |

|

|

259,767 |

|

|

|

1,608,378 |

|

|

Proceeds from long-term loans |

|

|

- |

|

|

|

594,864 |

|

|

Repayment of short-term loans |

|

|

(79,165 |

) |

|

|

(41,945 |

) |

|

Repayment of long-term loans |

|

|

(437,412 |

) |

|

|

(393,343 |

) |

|

Proceeds from (repayment of) borrowings from related parties |

|

|

(1,038 |

) |

|

|

91,965 |

|

|

Principal repayment of capital lease |

|

|

(27,236 |

) |

|

|

(89,465 |

) |

|

Net cash provided by financing activities |

|

|

1,914,916 |

|

|

|

1,824,454 |

|

|

|

|

|

|

|

|

|

|

|

|

Effect of changes of foreign exchange rates on

cash |

|

|

(17,412 |

) |

|

|

2,915 |

|

|

Net decrease in cash |

|

|

(298,589 |

) |

|

|

(294,788 |

) |

|

Cash, beginning of period |

|

|

840,861 |

|

|

|

1,903,867 |

|

|

Cash, end of period |

|

$ |

542,272 |

|

|

$ |

1,609,079 |

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental disclosure of cash flow

information |

|

|

|

|

|

|

|

|

|

Cash paid for interest expense |

|

$ |

178,557 |

|

|

$ |

277,764 |

|

|

Cash paid for income tax |

|

$ |

500,251 |

|

|

$ |

785,853 |

|

|

Supplemental disclosure of non-cash investing and financing

activities |

|

|

|

|

|

|

|

|

|

Amortization of share-based compensation for initial public

offering services |

|

$ |

35,000 |

|

|

$ |

89,820 |

|

|

Right-of-use assets obtained in exchange for operating lease

obligations |

|

$ |

458,181 |

|

|

$ |

- |

|

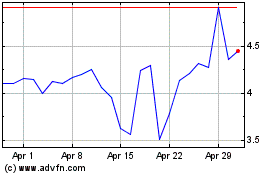

Bon Natural Life (NASDAQ:BON)

Historical Stock Chart

From Apr 2024 to May 2024

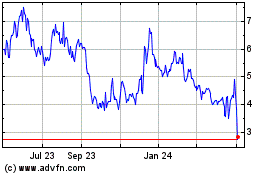

Bon Natural Life (NASDAQ:BON)

Historical Stock Chart

From May 2023 to May 2024