UNTIED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

|

|

|

|

|

|

|

X

|

|

Filed by Registrant

|

|

|

|

|

|

|

|

Filed by a Party other than the Registrant

|

Check the appropriate box:

|

|

|

|

|

|

|

|

|

Preliminary Proxy Statement

|

|

|

|

|

|

|

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

|

|

|

X

|

|

Definitive Proxy Statement

|

|

|

|

|

|

|

|

Definitive Additional Materials

|

|

|

|

|

|

|

|

Soliciting Material Pursuant to Section 240.14a-12

|

|

|

|

|

|

BOK FINANCIAL CORPORATION

|

|

(Name of Registrant as Specified In Its Charter)

|

|

Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

|

|

X

|

|

No fee required.

|

|

|

|

|

|

|

|

Fee computed on table below per Exchange Act Rules 14-a-6(i)(1) and 0-11.

|

|

|

|

1) Title of each class of securities to which transaction applies:

|

|

|

|

2) Aggregate number of securities to which transaction applies:

|

|

|

|

3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

4) Proposed maximum aggregate value of transaction:

|

|

|

|

5) Total fee paid:

|

|

|

|

|

|

|

|

Fee paid previously with preliminary materials.

|

|

|

|

|

|

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

|

1) Amount Previously Paid:

|

|

|

|

2) Form, Schedule or Registration Statement No.:

|

|

|

|

3) Filing Party:

|

|

|

|

4) Date Filed:

|

March 15, 2019

To Our Shareholders:

The Annual Meeting of Shareholders of BOK Financial Corporation will be held this year on Tuesday,

April 30, 2019

, at 2:30 p.m. Central Time as a virtual meeting of shareholders. You will be able to participate in the meeting, vote, and submit questions during the meeting via live webcast by visiting

www.virtualshareholdermeeting.com/BOKF2019

and entering your secure control number, which can be found on the enclosed proxy card. Details of the business to be conducted at the annual meeting are given in the attached Notice of Annual Meeting and Proxy Statement. Also enclosed is our Annual Report to Shareholders, covering the fiscal year ended

December 31, 2018

.

We hope that you will be able to attend this meeting via live webcast, but all shareholders, whether or not they expect to attend the meeting, are requested to complete, date and sign the enclosed proxy and return it in the enclosed envelope as promptly as possible.

Sincerely,

George B. Kaiser, Chairman of the

Board of Directors

Steven G. Bradshaw, President and

Chief Executive Officer

TABLE OF CONTENTS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Components of Executive Compensation

|

|

|

Compensation Philosophy and Objectives

|

|

|

Change in Control and Termination Benefits

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2018 Pay Ratio Disclosure

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To be held on

April 30, 2019

To Our Shareholders:

Notice is hereby given that the Annual Meeting of Shareholders of BOK Financial Corporation (the “Company” or “BOK Financial”), an Oklahoma corporation, will be held via live webcast at

www.virtualshareholdermeeting.com/BOKF2019

on

April 30, 2019

, at 2:30 p.m. Central Time, for the following purposes:

|

|

|

|

1.

|

To fix the number of directors to be elected at twenty three (23) and to elect twenty three (23) persons as directors for a term of one year or until their successors have been elected and qualified;

|

|

|

|

|

2.

|

To ratify the selection of Ernst & Young LLP as the Company’s independent auditor for the fiscal year ending

December 31, 2019

;

|

|

|

|

|

3.

|

To consider an advisory vote to approve the compensation of the named executive officers; and

|

|

|

|

|

4.

|

To transact such other business as may properly be brought before the Annual Meeting or any adjournment or adjournments thereof.

|

The annual meeting may be adjourned from time to time and, at any reconvened meeting, action with respect to the matters specified in this notice may be taken without further notice to shareholders unless required by the Company’s Bylaws.

The Board recommends that shareholders vote

FOR

(i)

the director nominees named in the accompanying Proxy Statement, (ii) the ratification of Ernst & Young LLP as the Company’s independent auditor for the fiscal year ending

December 31, 2019

, and (iii) the approval of the named executive officers’ compensation.

Only shareholders of record at the close of business on

March 1, 2019

shall be entitled to receive notice of, and to vote at, the annual meeting. A complete list of shareholders entitled to vote will be available for inspection at our offices, Bank of Oklahoma Tower, One Williams Center, Tulsa, OK 74172, and electronically during the annual meeting at

www.virtualshareholdermeeting.com/BOKF2019

.

BY ORDER OF THE BOARD OF DIRECTORS

Frederic Dorwart, Secretary

March 15, 2019

Tulsa, Oklahoma

PROXY STATEMENT FOR ANNUAL MEETING OF SHAREHOLDERS

To be held

April 30, 2019

General

The enclosed proxy is solicited on behalf of the Board of Directors of BOK Financial Corporation for use at our annual meeting of shareholders. The annual meeting will be held on Tuesday,

April 30, 2019

, at 2:30 p.m. local time via live webcast at

www.virtualshareholdermeeting.com/BOKF2019

.

These proxy materials will be mailed on or about

March 15, 2019

to holders of record of common stock as of the close of business on

March 1, 2019

.

Voting by Proxy

If you are the “record holder” of your shares (shares owned in your own name and not through a bank or brokerage firm), you may vote by phone, by mail, over the Internet, or in person (via live webcast) at the annual meeting. We encourage you to vote by phone, mail, or on the Internet in advance of the meeting even if you plan to attend the live webcast of the meeting.

If not revoked, your proxy will be voted at the annual meeting in accordance with your instructions marked on the proxy card. If you fail to mark your proxy with instructions, your proxy will be voted in accordance with the recommendations of the Board of Directors: (1)

FOR

the election of the twenty three (23) nominees for director listed in this Proxy Statement, (2)

FOR

the ratification of Ernst & Young LLP as the Company’s independent auditor for the fiscal year ending

December 31, 2019

, and (3)

FOR

the approval of the named executives’ compensation. If you are voting shares held in the BOK Financial Thrift Plan and you fail to mark your proxy with instructions, your shares will be voted by the Trustee of the Thrift Plan in the same ratio as those shares credited to the account of the Thrift Plan members who do give instructions to the Trustee.

If you hold your shares in “street name” (shares held in the name of a bank or broker on a person’s behalf), you must vote by following the instructions on the form that you receive from your broker or nominee. Without your instructions, your broker or nominee is permitted to use its own discretion and vote your shares on certain routine matters (such as Item 2), but is not permitted to use discretion and vote your shares on non-routine matters (such as Items 1 and 3). We urge you to give voting instructions to your broker on all voting items.

As to any other matter that may properly be brought before the annual meeting, your proxy will be voted as the Board of Directors may recommend. If the Board of Directors makes no recommendation, your proxy will be voted as the proxy holder named in your proxy card deems advisable. The Board of Directors does not know of any other matter that is expected to be presented for consideration at the annual meeting.

Any shareholder executing a proxy retains the right to revoke it any time prior to exercise at the annual meeting. A proxy may be revoked by (i) delivery of written notice of revocation to Frederic Dorwart, Secretary, at 124 East Fourth Street, Tulsa, Oklahoma 74103, (ii) execution and delivery of a later proxy to the address indicated on the proxy card, or (iii) voting the shares electronically at the annual meeting. If not revoked, all shares represented by properly executed proxies will be voted as specified therein.

Voting and Quorum Requirements at the Meeting

Only holders of shares of common stock of the Company at the close of business on

March 1, 2019

(the “record date”) are entitled to notice of and to vote at the annual meeting. On the record date, there were

71,708,000

shares of common stock entitled to vote.

You will have one vote for each share of common stock of the Company held by you on the record date.

In order to have a meeting it is necessary that a quorum be present. The presence in person or by proxy of the holders of a majority of the outstanding shares of common stock is necessary to constitute a quorum at the annual meeting. Abstentions and broker non-votes will be counted for purposes of determining the presence or absence of a quorum. Abstentions and broker non-votes will not be counted as having voted either for or against a proposal.

The affirmative vote of the holders of shares representing a majority of the voting power of the shareholders present or represented at the meeting in which a quorum is present and entitled to vote is required for approval of all matters other than election of directors. Directors are elected by the affirmative vote of the holders of shares representing a majority of the voting power of the shareholders present or represented at the meeting in which a quorum is present and entitled to vote for the election of directors, but if the number of nominees exceeds the number of directors to be elected (i.e. a contested election), the shareholders shall instead elect the directors by plurality vote of the shares present in person or by proxy.

George B. Kaiser currently owns approximately 53.6% of the outstanding common stock and plans to vote all of his shares.

Solicitation of Proxies

We are paying for all our costs incurred in soliciting proxies for the annual meeting. In addition to solicitation by mail, we may use our directors, officers and regular employees to solicit proxies by telephone or otherwise. These personnel will not be specifically compensated for these services. We will pay persons holding shares of common stock for the benefit of others, such as nominees, brokerage houses, banks, and other fiduciaries, for the expense of forwarding solicitation materials to the beneficial owner.

Annual Report

Our Annual Report to Shareholders, covering the fiscal year ended

December 31, 2018

, including audited financial statements, is enclosed. No parts of the Annual Report are incorporated in this Proxy Statement or are deemed to be a part of the material for the solicitation of proxies.

Principal Shareholders of the Company

To the extent known to the Board of Directors of the Company, as of

March 1, 2019

, the only shareholder of the Company having beneficial ownership of more than 5% of the shares of common stock of the Company is set forth below:

|

|

|

|

|

|

|

|

|

Name & Address of Beneficial Owner

|

Beneficial Ownership

|

Class

|

|

|

George B. Kaiser

P.O. Box 21468, Tulsa, Oklahoma 74121-1468

|

38,427,249

|

53.6%

|

|

|

|

|

Security Ownership of Certain Beneficial Owners and Management

As of

March 1, 2019

, there were

71,708,000

shares of common stock issued and outstanding. The following table sets forth, as of

March 1, 2019

, the beneficial ownership of common stock of BOK Financial by those persons who were, at

December 31, 2018

, (i) the Chief Executive Officer (Steven G. Bradshaw), (ii) the Chief Financial Officer (Steven E. Nell), and (iii) the three other most highly compensated executive officers of the Company who were serving as executive officers at the end of

2018

(the “named executives”); each director and nominee; and, as a group, all such persons and other executive officers not named in the table.

|

|

|

|

|

|

|

|

|

Name of Beneficial Owner

|

Amount & Nature of Beneficial Ownership

(1)

|

|

Percent of Class

(2)

|

|

Alan S. Armstrong

|

1,725

|

|

|

*

|

|

Norman P. Bagwell

|

45,688

|

|

(3)

|

*

|

|

C. Fred Ball, Jr.

|

8,483

|

|

(4)

|

*

|

|

Steven Bangert

|

232,824

|

|

(5)

|

*

|

|

Peter C. Boylan, III

|

6,570

|

|

(6)

|

*

|

|

Steven G. Bradshaw

|

207,655

|

|

(7)

|

*

|

|

Chester E. Cadieux, III

|

3,250

|

|

|

*

|

|

Gerard P. Clancy

|

411

|

|

(8)

|

*

|

|

John W. Coffey

|

3,300

|

|

|

*

|

|

Joseph W. Craft, III

|

2,759

|

|

|

*

|

|

Jack E. Finley

|

525

|

|

|

*

|

|

Scott B. Grauer

|

55,721

|

|

(9)

|

*

|

|

David F. Griffin

|

42,341

|

|

(10)

|

*

|

|

V. Burns Hargis

|

17,730

|

|

(11)

|

*

|

|

Douglas D. Hawthorne

|

4,364

|

|

(12)

|

*

|

|

Kimberley D. Henry

|

1,350

|

|

|

*

|

|

E. Carey Joullian, IV

|

5,977

|

|

(13)

|

*

|

|

George B. Kaiser

|

38,427,249

|

|

(14)

|

53.6%

|

|

Stacy C. Kymes

|

53,118

|

|

(15)

|

*

|

|

Stanley A. Lybarger

|

32,859

|

|

(16)

|

*

|

|

Steven J. Malcolm

|

3,742

|

|

(17)

|

*

|

|

Steven E. Nell

|

70,536

|

|

(18)

|

*

|

|

E. C. Richards

|

4,792

|

|

(19)

|

*

|

|

Claudia San Pedro

|

150

|

|

(20)

|

*

|

|

Michael C. Turpen

|

2,238

|

|

|

*

|

|

R. A. Walker

|

3,670

|

|

|

*

|

|

All directors, nominees, and executive officers listed on page 26 (35 persons)

|

|

54.9%

|

* Less than one percent (1%)

(1) Except as otherwise indicated, all shares are beneficially owned and the sole investment and voting power is held by the person named. Certain shares included here (i.e. options exercisable within 60 days and unvested restricted stock granted as of March 1, 2019) do not count towards an executive’s stock ownership for purposes of the BOKF Executive Stock Ownership Guidelines discussed on page 30.

(2) All percentages are rounded to the nearest tenth, and are based upon the number of shares outstanding as of the date set forth above. For purposes of computing the percentages of the outstanding shares owned by the persons in the table, any shares such persons are deemed to own by having a right to acquire such shares by exercise of an option are included, but shares acquirable by other persons by the exercise of stock options are not included.

(3) Includes 22,824 shares of restricted stock and 8,565.447 shares held in the BOK Thrift Plan.

(4) Includes 5,267 shares owned by C. Fred Ball, Jr. IRA.

(5) Includes 41,067 shares indirectly owned by Bangert Family Investments, LLLP, 22,950 shares indirectly owned by Remount Financial, LLC, and 11,041 shares owned by Mr. Bangert's wife.

(6) Includes 2,000 shares indirectly owned by Boylan Capital Partners, LP and 4,570 shares indirectly owned by the Peter C. Boylan III Revocable Trust.

(7) Includes 106,360 shares indirectly owned by the Steven G. Bradshaw Revocable Trust. Also includes 101,295 shares of restricted stock.

(8) Includes 30 shares owned by IRA.

(9) Includes options to purchase 6,233 shares of BOK Financial common stock immediately exercisable or becoming exercisable within 60 days. Also includes 25,383 shares of restricted stock and 9,212.3527 shares held in the BOK Thrift Plan.

(10) Includes 38,903 shares indirectly owned by Doppler Investments, LP and 3,438 shares indirectly owned by the David F. Griffin Revocable Trust.

(11) Includes 15,805 shares indirectly owned by Devonshire Holdings, LLC.

(12) Includes 450 shares indirectly owned by Mr. Hawthorne’s wife’s partnership Tomahawk Springs, Ltd.

(13) Includes 1,869 shares indirectly owned by JCAP, LLC.

(14) Includes 3,000 shares owned by Mr. Kaiser's wife. 24,289,575 shares have been pledged as collateral.

(15) Includes options to purchase 903 shares of BOK Financial common stock immediately exercisable or becoming exercisable within 60 days. Also includes 25,234 shares of restricted stock and 6,528.8109 shares held in the BOK Thrift Plan.

(16) Includes 32,859 shares indirectly owned by the Stanley A. Lybarger Revocable Trust.

(17) Includes 3,742 shares indirectly owned by the Steven J. Malcolm Revocable Trust.

(18) Includes 34.70 shares held by 401(k) plan. Includes options to purchase 5,096 shares of BOK Financial common stock immediately exercisable or becoming exercisable within 60 days. Also includes 28,184 shares of restricted stock.

(19) Includes 3,927 shares indirectly owned by the Emmet C. Richards Revocable Trust and 865 shares owned by Core Investment Capital, LLC.

(20) Includes 150 shares indirectly owned by the San Pedro-Sund Joint Revocable Trust.

PROPOSAL ONE - ELECTION OF DIRECTORS

RECOMMENDATION

|

|

|

|

|

|

|

|

|

ü

|

The Board of Directors recommends that you vote

FOR

the 23 nominees.

|

Nominees and Vote Required to Elect Nominees

A board of twenty three (23) directors is to be elected at the annual meeting. The nominees for director who receive a majority of shares voting “FOR” their election shall be elected as directors. You may vote the number of shares of common stock you own for up to twenty three (23) persons. Unless you otherwise instruct by marking your proxy card, the proxy holders will vote the proxies received by them FOR the election of each of the twenty three (23) nominees named below, unless you hold your shares in street name, in which case your broker is not permitted to use its discretion and those votes will constitute broker non-votes.

If at the time of the annual meeting any of the nominees is unwilling or unable to serve, all proxies received will be voted in favor of the remainder of those nominated and for such substitute nominees, if any, as shall be designated by the Board and nominated by any of the proxies named in the enclosed proxy form. We have no reason to believe that any of the nominees will be unable or unwilling to serve if elected.

Term of Office

The term of office of each person elected as a director will continue until the next annual meeting of shareholders or until his or her successor has been elected and qualified.

Family Relationships

There are no family relationships by blood, marriage or adoption between any director or executive officer of the company and any other director or executive officer of the company.

Information about Nominees

Certain information concerning the nominees to the Board of Directors of the company is set forth below based on information supplied by the nominees. All information is as of

March 1, 2019

. All references in this Proxy Statement to “BOKF” shall mean BOKF, National Association, the banking subsidiary of BOK Financial Corporation, which operates through the following regional divisions: Bank of Albuquerque, Bank of Arizona, Bank of Arkansas, Bank of Oklahoma (“BOK”), Bank of Texas (“BOT”), Colorado State Bank and Trust, and Mobank. BOK Financial Securities, Inc., a registered broker/dealer and registered investment adviser, is a wholly-owned subsidiary of BOK Financial Corporation. No other corporation or organization listed below is a parent, subsidiary, or other affiliate of BOK Financial Corporation unless otherwise indicated.

BOARD OF DIRECTORS NOMINEES

|

|

|

|

|

|

|

|

Name

|

Age

|

Principal Occupation and Business

Experience During Last 5 Years and

Directorships of Other Public Companies

|

First Year Became a Director

|

|

Alan S. Armstrong

|

56

|

Chief Executive Officer, President, and a Director of The Williams Companies, Inc. (energy holding company) since January 2011. Mr. Armstrong's qualifications to sit on our Board of Directors include his energy sector and management expertise, civic leadership experience, and his knowledge of our head office area, gained in part as the 2015 Board Chair of the Tulsa Regional Chamber's Boards of Directors.

|

2013

|

|

C. Fred Ball, Jr.

|

74

|

Chief Operating Officer of Spyglass Trading, LP (purchase, sale and brokerage of securities). Retired as Senior Chairman of BOT in January 2015, and formerly its Chairman, Chief Executive Officer, and President. Before joining BOT in 1997, Mr. Ball was Executive Vice President of Comerica Bank-Texas and later President of Comerica Securities, Inc. He is a director of Mid-Con Energy Partners, LP and serves on its audit committee. Mr. Ball’s qualifications to sit on our Board of Directors include his almost four decades of experience in the banking industry and his involvement with the Texas market.

|

1999

|

|

Steven Bangert

|

62

|

Vice-Chairman of Colorado-BOKF, NA. Mr. Bangert served as Chairman of the Board of Directors and Chief Executive Officer of CoBiz Financial, Inc. from September 1994 to September 2018 when it was acquired by BOK Financial Corporation. From August 1992 to March 1999, Mr. Bangert served as President and a director of Western Capital Holdings, Inc., formerly the bank holding company for River Valley Bank-Texas. From March 1992 to July 1998, Mr. Bangert also served as Chairman of the Board of River Valley Bank-Texas, and from April 1988 to July 1994, he served as Vice Chairman of the Board and Chief Executive Officer of River Valley Savings Bank-Illinois. From February 1994 to July 1998, Mr. Bangert served as a director and member of the Executive Committee of Lafayette American Bank. The Company believes Mr. Bangert's qualifications to serve as a director include his financial services industry experience, his merger and acquisition experience, his extensive board experience in the for-profit and not-for-profit world and his years of experience as a director of CoBiz Financial. In conjunction with the acquisition of CoBiz Financial, BOK Financial agreed to cause Mr. Bangert to be included in the slate of directors to be elected at the next annual shareholders meeting.

|

2018

|

|

|

|

|

|

|

|

|

Peter C. Boylan, III

|

55

|

Co-Founder, Chairman, Director, President, and Chief Executive Officer of Cypress Energy Holdings, LLC (a pipeline inspection and integrity company serving the energy sector) since 2012. Mr. Boylan is also Chairman and Chief Executive Officer of Cypress Energy Partners, GP, LLC, that controls Cypress Energy Partners, L.P. (NYSE-traded master limited partnership). From 1994 through 2004, Mr. Boylan served in a variety of senior executive management positions of various public and private companies controlled by Liberty Media Corporation. Mr. Boylan’s qualifications to sit on our Board of Directors include his substantial public company board and senior executive management and leadership experience, and industry-specific expertise across a variety of industries (including energy, technology, banking, and media).

|

2005

|

|

Steven G. Bradshaw

|

59

|

President and Chief Executive Officer of BOK Financial and BOKF, NA. Mr. Bradshaw became the chief executive at BOK Financial in January 2014 after previously serving in a number of roles at the Company since joining BOKF in 1991. Most recently he served as Senior Executive Vice President and was responsible for all aspects of consumer banking, corporate marketing, mortgage banking, investment securities, trust activities, treasury services, international banking, community development and Community Reinvestment Act responsibilities for all seven banking divisions within the Company. He also served as chairman of BOK Financial’s broker-dealer subsidiary, BOK Financial Securities, Inc. and had executive responsibility for Colorado State Bank and Trust and Mobank. Mr. Bradshaw’s qualifications to sit on our Board of Directors include his position and years of leadership at BOKF, and extensive knowledge of all aspects of our business.

|

2014

|

|

Chester E. Cadieux, III

|

52

|

Chairman and Chief Executive Officer of QuikTrip Corporation (a gasoline and retail convenience chain) since 2002. Mr. Cadieux previously served as Vice President of Sales at QuikTrip Corporation. Mr. Cadieux’s qualifications to sit on our Board of Directors include his knowledge of finance and accounting, his management experience, and his knowledge of all of our geographic markets.

|

2005

|

|

Gerard P. Clancy

|

57

|

President, University of Tulsa, since November 2016. Prior to becoming President, Mr. Clancy served as Vice President for Health Affairs, Dean of the Oxley College of Health Services and held the Oxley Foundation Chair in Community Medicine, all at the University of Tulsa. Mr. Clancy's qualification to sit on our Board of Directors include his thirty years of leadership as a physician, twenty years of leadership as an academic and his understanding of the local community.

|

2018

|

|

|

|

|

|

|

|

|

John W. Coffey

|

56

|

Private investor and Chartered Financial Analyst. Mr. Coffey retired from the position of Managing Director, Wellington Management Company, LLP, (a private, investment management company) which he held from September 2007 until June 2017. Mr. Coffey's qualifications to sit on our Board of Directors include his extensive financial services expertise, understanding of business value, business risk and strategic decision making and experience with finance, accounting, securities markets, corporate governance, mergers and acquisitions, risk assessment and government relations.

|

2018

|

|

Joseph W. Craft, III

|

68

|

President, Chief Executive Officer and Director of Alliance Resource Partners, L.P. (a diversified coal producer and marketer) since 1999. Mr. Craft served as Chairman, President, Director and Chief Executive Officer of Alliance Holdings GP, L.P. from 2006-2018. Previously, he served as President of MAPCO Coal Inc. since 1986. Mr. Craft’s qualifications to sit on our Board of Directors include his extensive experience in corporate leadership, as well as his public company experience.

|

2007

|

|

Jack E. Finley

|

71

|

Self-employed certified public accountant. Mr. Finley was a partner with Grant Thornton LLP from 2011 to 2015. Previously, he served as National Practice Director at Hudson Financial Solutions and as an audit partner at KPMG. Mr. Finley's qualifications to sit on our Board of Directors include his four decades of experience as a certified public accountant and partner at two international accounting firms, predominately focused on banking and other financial services.

|

2017

|

|

David F. Griffin

|

53

|

Chairman and Chief Executive Officer of Griffin Capital, L.L.C. President and Chief Executive Officer, Griffin Communications, L.L.C. (owns and operates CBS- and CW-affiliated television stations plus associated websites, billboards, and radio stations in Oklahoma). Mr. Griffin was formerly President and General Manager, KWTV-9 (Oklahoma City). Mr. Griffin’s qualifications to sit on our Board of Directors include his significant expertise, experience, and background in corporate management and his involvement with both the Oklahoma City and Tulsa markets.

|

2003

|

|

V. Burns Hargis

|

73

|

President, Oklahoma State University. Prior to becoming OSU President, Mr. Hargis served as Vice Chairman, BOK Financial and BOK and Director of BOK Financial Securities, Inc. since 1993. Mr. Hargis was formerly Attorney and Shareholder of the law firm of McAfee & Taft (Oklahoma City, Oklahoma). Mr. Hargis’ qualifications to sit on our Board of Directors include his nearly three decades practicing law with a focus on financial reporting and litigation, including representing financial institutions and their boards, as well as having served for many years as our Vice Chairman.

|

1993

|

|

|

|

|

|

|

|

|

Douglas D. Hawthorne

|

71

|

Founding Chief Executive Officer Emeritus, Texas Health Resources. Prior to helping create Texas Health Resources in 1997, Mr. Hawthorne was Chief Executive Officer of Presbyterian Healthcare System. Mr. Hawthorne’s qualifications to sit on our Board of Directors include his knowledge of the healthcare sector and of the Texas market.

|

2013

|

|

Kimberley D. Henry

|

54

|

Executive director of Sarkeys Foundation, a private, charitable foundation that provides grants and gifts to Oklahoma’s non-profit organizations. Ms. Henry is the former First Lady of Oklahoma. Ms. Henry’s qualifications to sit on our Board of Directors include her knowledge of our geographic market, her leadership skills, and her extensive civic involvement, including participation on numerous boards of non-profit organizations.

|

2015

|

|

E. Carey Joullian, IV

|

58

|

Chairman, President and Chief Executive Officer of Mustang Fuel Corporation and subsidiaries; President and Manager, Joullian & Co., L.L.C.; Manager, JCAP, L.L.C. Mr. Joullian’s qualifications to sit on our Board of Directors include his significant experience and expertise in the oil and gas industry and his expertise in accounting.

|

1995

|

|

George B. Kaiser

|

76

|

Chairman of the Board and majority shareholder of BOK Financial and BOKF, NA; President, Chief Executive Officer, and principal owner of GBK Corporation, parent of Kaiser-Francis Oil Company (independent oil and gas exploration and production company); founder of Excelerate Energy and Argonaut Private Equity. Mr. Kaiser’s qualifications to sit on our Board of Directors include his four decades of executive leadership in the oil and gas industry, his broad perspective gained from involvement in diverse industries, his knowledge of our business, and his interest as the majority owner of our company.

|

1990

|

|

Stanley A. Lybarger

|

69

|

Former President and Chief Executive Officer of BOK Financial and BOKF. Mr. Lybarger was previously President of BOK Oklahoma City Regional Office and Executive Vice President of BOK with responsibility for corporate banking. He is a director and chairman of the audit committee of Cypress Energy Partners GP, LLC. Mr. Lybarger’s qualifications to sit on our Board of Directors include his prior role as our Chief Executive Officer, his three decades of leadership positions with BOKF, and his extensive knowledge of all facets of the banking industry.

|

1991

|

|

|

|

|

|

|

|

|

Steven J. Malcolm

|

70

|

Retired Chairman, President and Chief Executive Officer of The Williams Companies, Inc. (energy holding company) and Williams Partners L.P. Mr. Malcolm was previously President and Chief Executive Officer of Williams Energy Services after serving as senior vice president and general manager of Midstream Gas and Liquids for Williams Energy Services. In December 2011, Mr. Malcolm became a director of ONEOK, Inc. and ONEOK Partners. Mr. Malcolm’s qualifications to sit on our Board of Directors include his experience in the energy sector as well as his public company and executive management expertise.

|

2002

|

|

Steven E. Nell

|

57

|

Executive Vice President and Chief Financial Officer for BOK Financial and BOKF, NA. Mr. Nell is responsible for all accounting and financial reporting, corporate tax, capital markets, mergers and acquisitions, and investor relations. Mr. Nell joined BOK Financial in 1992 as manager of management accounting. He was named controller of management accounting in 1996 and corporate controller in 1999. He became Chief Financial Officer in 2001. Before joining BOK Financial in 1992, Mr. Nell was with Ernst & Young LLP for eight years auditing public and private companies. Mr. Nell’s qualifications to sit on our Board of Directors include his position and years of leadership at BOKF, and extensive knowledge of all aspects of our business.

|

2018

|

|

E.C. Richards

|

69

|

Managing Member of Core Investment Capital, LLC. Prior to September 1999, Mr. Richards served as Executive Vice President and Chief Operating Officer for Sooner Pipe Corporation (distributor of tubular products worldwide with domestic and international operations), a subsidiary of Oil States International. Mr. Richards previously served on the BOK Financial Board of Directors from 1997 through 2001. Mr. Richards’ qualifications to sit on our Board of Directors include his diverse background in the private equity and distribution industries and his civic involvement.

|

2008

|

|

|

|

|

|

|

|

|

Claudia San Pedro

|

49

|

President of SONIC, part of the Inspire Brands, Inc. family of restaurants. San Pedro assumed her role at SONIC in January 2018. She joined SONIC in 2006 as vice president of investor relations and treasurer. Ms. San Pedro was promoted to executive vice president and chief financial officer in 2015, and was responsible for SONIC’s financial planning practices, as well as the brand’s relationship with lending institutions, shareholders, and the financial community. Prior to joining SONIC, she served as the director for the Oklahoma Office of State Finance, appointed by Governor Brad Henry in 2005. Ms. San Pedro's qualifications to sit on our Board of Directors include her knowledge in finance and accounting, public company executive management experience and knowledge of retail marketing across our geographic markets.

|

Nominee

|

|

Michael C. Turpen

|

69

|

Partner at the law firm of Riggs, Abney, Neal, Turpen, Orbinson & Lewis in Oklahoma City, Oklahoma. Mr. Turpen previously served at Attorney General for the State of Oklahoma. He is serving his second 9-year term as a Regent for Oklahoma State Regents for Higher Education. Mr. Turpen's qualifications to sit on our Board of Directors include his legal expertise, his public services experience and leadership skills demonstrated through extensive involvement with non-profit boards and organizations.

|

2011

|

|

R. A. Walker

|

62

|

Chairman and Chief Executive Officer of Anadarko Petroleum Corporation. Mr. Walker was named Chairman in May 2013, having been named Chief Executive Officer in May 2012 and President in February 2010. He previously served as Chief Operating Officer from March 2009, and was Senior Vice President - Finance and Chief Financial Officer from 2005 until his appointment as Chief Operating Officer. Prior to joining Anadarko, he worked in the oil and gas industry, investment and commercial banking, and as an institutional investor. Mr. Walker was a director of CenterPoint Energy, Inc. and Temple-Inland, Inc., as well as Western Gas Equity Holdings, LLC and Western Gas Holdings, LLC, both of which are subsidiaries of Anadarko. Mr. Walker’s qualifications to sit on our Board of Directors include his knowledge of the energy sector and his public company expertise.

|

2013

|

PROPOSAL TWO - RATIFICATION OF SELECTION OF AUDITOR

RECOMMENDATION

|

|

|

|

|

|

|

|

|

ü

|

The Board of Directors recommends that you vote

FOR

the ratification of the selection of Ernst & Young LLP as the independent auditor of BOK Financial and its subsidiaries for the fiscal year ending December 31, 2019.

|

At least annually, the Audit Committee reviews the Company's independent public accounting firm to decide whether to retain such firm on behalf of the Company. Ernst & Young LLP ("EY") began serving as the Company’s independent auditor since its inception on October 24, 1990. The Audit Committee has selected EY as our independent auditor for the fiscal year ending

December 31, 2019

.

When conducting its latest review of EY, the Audit Committee considered, among other factors:

|

|

|

|

•

|

the professional qualifications of EY and that of the lead audit partner and other key engagement members relative to the current and ongoing needs of the Company;

|

|

|

|

|

•

|

EY's historical and recent performance on the Company's audits, including the extent and quality of EY's communications with the Audit Committee thereto;

|

|

|

|

|

•

|

the appropriateness of EY's fees relative to both efficiency and audit quality;

|

|

|

|

|

•

|

EY's independence policies and processes for maintaining its independence;

|

|

|

|

|

•

|

EY's tenure as the Company's independent public accounting firm and its related depth of understanding of the Company's business, operations and systems and the Company's accounting policies and practices; and

|

|

|

|

|

•

|

EY's capability, expertise and efficiency in handling the breadth and complexity of the Company's operations.

|

While we are not required to do so, the Company is submitting the selection of EY to serve as our independent auditor for the fiscal year ending

December 31, 2019

for ratification, in order to ascertain the views of our shareholders on this appointment. If the selection is not ratified, the Audit Committee will reconsider its selection. Representatives of EY are expected to participate in the annual meeting, will be available to answer shareholder questions and will have the opportunity to make a statement if they desire to do so.

PROPOSAL THREE - ADVISORY VOTE TO APPROVE THE

COMPENSATION OF NAMED EXECUTIVE OFFICERS

RECOMMENDATION

|

|

|

|

|

|

|

|

|

ü

|

The Board of Directors recommends that you vote

FOR

the approval of the compensation of the Company’s named executive officers as disclosed in this Proxy Statement.

|

Pursuant to Section 951 of the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”), which added a new section 14A to the Securities Exchange Act, shareholders can vote to approve, not less frequently than once every three years, the compensation of the Company’s named executive officers disclosed in the Proxy Statement. This is commonly known as a “say on pay” vote. This allows our shareholders the opportunity to communicate annually to the Board of Directors their views on the compensation of our named executive officers through the following resolution:

“RESOLVED, that the compensation paid to the company’s named executive officers, as disclosed in this Proxy Statement pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the Compensation Discussion and Analysis, compensation tables and narrative discussion, is hereby APPROVED.”

We are asking you to vote for the above resolution approving the compensation of our named executive officers. This vote is advisory in nature and non-binding; however, the Board of Directors will consider the shareholder vote when making future decisions regarding executive compensation. Our “say on pay” vote is included in our Proxy Statement every year, and the vote on the frequency of the “say on pay” proposal is held every six years.

The affirmative vote of the holders of a majority of the shares of common stock, present in person or by proxy, voted at the meeting, is required for the advisory approval of this resolution.

CORPORATE GOVERNANCE

Director Compensation

All non-officer directors of BOK Financial and BOKF receive a retainer of 75 shares per quarter, in accordance with the BOK Financial Directors Stock Compensation Plan, whether serving on one or both of the Boards of Directors. Director compensation shares are issued to each director on or before the 15

th

day following the end of each calendar quarter during which such director served as a member of the Board of Directors of BOK Financial or BOKF. All non-officer directors are also paid $1,250 in cash for each Board of Directors meeting attended, $750 in cash for each committee meeting attended (provided only one fee is paid when two or more committees meet contemporaneously), and $2,750 in cash for each committee meeting chaired. The Chairman of the Risk Committee and the Audit Committee receive $500 for each quarterly earnings release conference. Non-Oklahoma resident directors receive an additional $500 for attendance in person per meeting day. Non-officer Company directors were paid the following in

2018

:

|

|

|

|

|

|

|

|

Name

(1)

|

Fees Earned or Paid in Cash

($)

|

Stock Awards

(2)

($)

|

Total

($)

|

|

Alan S. Armstrong

|

9,500

|

29,058

|

38,558

|

|

C. Fred Ball, Jr.

|

12,000

|

29,058

|

41,058

|

|

Steven Bangert

|

3,250

|

—

|

3,250

|

|

Peter C. Boylan, III

|

14,750

|

29,058

|

43,808

|

|

Chester Cadieux, III

|

6,500

|

29,058

|

35,558

|

|

Gerard P. Clancy

|

8,750

|

29,058

|

37,808

|

|

John W. Coffey

|

8,750

|

22,105

|

30,855

|

|

Joseph W. Craft

|

16,250

|

29,058

|

45,308

|

|

Jack E. Finley

|

21,000

|

29,058

|

50,058

|

|

David F. Griffin

|

22,250

|

29,058

|

51,308

|

|

V. Burns Hargis

|

12,000

|

29,058

|

41,058

|

|

Douglas D. Hawthorne

|

11,500

|

29,058

|

40,558

|

|

Kimberley D. Henry

|

8,750

|

29,058

|

37,808

|

|

E. Carey Joullian, IV

|

25,000

|

29,058

|

54,058

|

|

Robert J. LaFortune

(3)

|

4,750

|

14,308

|

19,058

|

|

Stanley A. Lybarger

|

21,250

|

29,058

|

50,308

|

|

Steven J. Malcolm

|

10,000

|

29,058

|

39,058

|

|

E.C. Richards

|

13,000

|

29,058

|

42,058

|

|

Terry K. Spencer

(4)

|

5,250

|

7,356

|

12,606

|

|

Michael C. Turpen

|

10,750

|

29,058

|

39,808

|

|

R. A. Walker

|

15,750

|

29,058

|

44,808

|

|

|

|

|

(1)

|

George B. Kaiser, a non-officer director, is not listed as he does not receive payment for serving as a director.

|

|

|

|

|

(2)

|

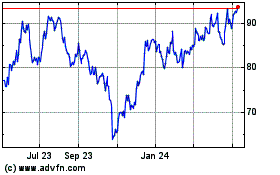

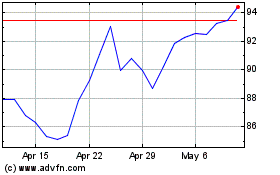

The BOK Financial Directors Stock Compensation Plan provides that the issuance price for the director compensation shares is the average of the mid-points between the highest price and the lowest price at which trades occurred on NASDAQ on the five trading days immediately preceding the end of the calendar quarter. Director shares were granted in 2018 at the following prices: first quarter, $92.70; second quarter, $98.08; third quarter, $95.19; and fourth quarter, $101.48. The Stock Awards column reflects actual payments made to the directors in 2018 for service in the fourth quarter of 2017 and the first three quarters of 2018. The total BOK Financial common stock owned by each director and nominee as of March 1, 2019 may be found in the Security Ownership of Certain Beneficial Owners and Management table on page 7.

|

|

|

|

|

(3)

|

Robert J. LaFortune resigned March 27, 2018.

|

|

|

|

|

(4)

|

Terry K. Spencer resigned June 21, 2018.

|

Attendance of Meetings

The entire Board of Directors of BOK Financial met four times during

2018

. All directors of BOK Financial attended at least 75% of all meetings of the Board of Directors and committees on which they served. Although BOK Financial does not have a policy with respect to attendance by the directors at the Annual Meeting of Shareholders, directors are encouraged to attend. Twenty-two of the twenty-two members of the Board of Directors attended the

2018

Annual Meeting of Shareholders. The Board of Directors intends to meet at least four times in

2019

.

Director Nominations

While the Board of Directors does not have a standing nomination committee, director candidates identified by management and members of the Board of Directors are discussed regularly at Board of Directors meetings. The Board has adopted a written policy on qualifications of directors, which states that directors will have all of the following characteristics: (i) impeccable integrity, (ii) strong sense of professionalism, and (iii) capability of serving the interests of stockholders, along with several of the following characteristics: (i) prominence in the community, (ii) ability to represent the views of under-represented constituencies in the Company’s market areas, (iii) financial analytical skill and expertise, and (iv) vision for social trends.

While the policy on director qualifications does not formally require diversity on the Board and the Company does not have a diversity policy, the policy states that the Board should encompass a diverse range of skill and expertise sufficient to provide prudent guidance to the Company, and have the right mix of characteristics and talents for the optimal functioning of the Board in its oversight of the Company. In considering a particular nominee, the Board will consider, in addition to the qualifications and characteristics described above, whether the potential director assists in achieving a mix of Board members that represents a diversity of background, perspective, and experience, including with respect to age, gender, race, place of residence, and specialized expertise.

The Board of Directors will consider director candidates recommended by stockholders if provided with the following: (i) evidence in accordance with Rule 14a-8 of compliance with stockholder eligibility requirements, (ii) the written consent of the candidate(s) for nomination as a director and verification as to the accuracy of the biographical and other information submitted in support of the candidate, (iii) a resume or other written statement of the qualifications of the candidate(s) for nomination as a director, and (iv) all information regarding the candidate(s) and the submitting stockholder that would be required to be disclosed in a proxy statement filed with the SEC if the candidate(s) were nominated for election to the Board of Directors. Any recommendations received from stockholders will be evaluated in the same manner that potential nominees suggested by Board members, management or other parties are evaluated. The Board of Directors encourages stockholder director candidate recommendations.

Any stockholder that wishes to present a director candidate for consideration should submit the information identified above pursuant to the procedures set forth below under “Communication with the Board of Directors”.

Director Independence

The Board of Directors has determined that BOK Financial is a “controlled company,” as defined in Rule 5615(c)(1) of the NASDAQ listing standards, based on Mr. Kaiser's beneficial ownership of approximately 53.6% of the outstanding common stock. Accordingly, BOK Financial is exempt from certain requirements of the NASDAQ listing standards, including the requirement to maintain a majority of independent directors on the Company's Board of Directors and the requirements regarding the determination of compensation of executive officers and the nomination of directors by independent directors. Nevertheless, the Company maintains a substantial majority of independent directors, determines upper level management compensation through an independent board committee, and nominates new board members through board consensus. Further, the Audit Committee is comprised solely of independent board members. Further discussion regarding determination of independence may be found in the sections entitled “Audit Committee” and “Independent Compensation Committee”.

Compensation Committee Interlocks and Insider Participation

No voting member of the Compensation Committee has served as an officer of the Company, including its affiliates, at any time. None of our executive officers serve as a member of the Compensation Committee of any other company that has an executive officer serving as a member of the Company’s Board of Directors. None of our executive officers serve as a member of the board of directors of any other company that has an executive officer serving as a member of our Board’s Compensation Committee.

Committees of the Board of Directors

The Risk Committee, Audit Committee, Independent Compensation Committee, and Credit Committee are described below.

Risk Committee

The Risk Committee assists the Board in its oversight of the Company’s risk management strategies, policies, and practices that identify, assess, monitor and manage the Company’s risks. The Risk Committee held four meetings in fiscal

2018

.

|

|

|

|

|

|

Members

|

Responsibilities include oversight of

|

|

Walker (Chairman)

Boylan

Cadieux

Clancy

Coffey

Finley

Henry

Malcolm

|

• Enterprise-wide risk management

• Capital planning and adequacy, including stress testing

• Market risk including rate, price, and liquidity

• Corporate-wide policy management framework

• Risk transfer program

• Mergers and acquisitions

• Alternative investments

• Operating risks including cybersecurity and information technology

• Counterparty risk

• Third party risk

• Compliance with laws and regulations

• Reports of examinations from regulators

|

Audit Committee

All of the Audit Committee members are “independent” as defined in Rule 5605(a)(2) of the NASDAQ listing standards. Director independence is determined through the procedures described under “Related Party Transaction Review and Approval Policy”. The Report of the Audit Committee is on page 24 of this Proxy Statement. The Audit Committee held twelve meetings in fiscal

2018

. The Audit Committee has a charter, which is available on the Company’s website at www.bokf.com.

|

|

|

|

|

|

Members

|

Responsibilities include oversight of

|

|

Joullian (Chairman)

(1)

Finley

Hawthorne

Lybarger

|

• Accounting and financial reporting policies of the Company

• Internal controls over financial reporting

• Selection and reporting of the Company’s independent auditors

• Audits of the financial statements of the Company

• Related party reporting (other than related party credit transactions overseen by the Credit Committee)

• Reports of internal audits

• Review whistleblower complaints

|

|

|

|

|

(1)

|

The Board of Directors designated Mr. Joullian as its "audit committee financial expert," as defined in Item 407(d) of Regulation S-K.

|

Independent Compensation Committee

The Independent Compensation Committee administers a performance-based compensation plan for the Chief Executive Officer, direct reports of the Chief Executive Officer and other designated senior executives. The Independent Compensation Committee has a charter, which is available on the Company’s website at www.bokf.com.

The Committee does not delegate its authority. Compensation for all other officers is, in practice, determined by the Chief Executive Officer and Mr. Kaiser, the Chairman of the Board. The Independent Compensation Committee Report on Executive Compensation and the Compensation Discussion and Analysis may be found on pages 40 and 29 respectively. The Committee held two meetings in fiscal

2018

.

|

|

|

|

|

|

Members

|

Responsibilities include approval of

|

|

Craft (Chairman)

Cadieux

(1)

Griffin

(1)

Kaiser

(1)

Malcolm

Richards

|

• Compensation of the Chief Executive Officer

• Compensation of direct reports to the Chief Executive Officer

• Compensation of other officers participating in the Company’s

Executive Incentive Plan

|

|

|

|

|

(1)

|

Members are non-voting on matters pertaining to 162(m) of the Internal Revenue Code.

|

Credit Committee

The Credit Committee oversees the credit and lending strategies and objectives of BOKF, including overseeing credit risk management and the quality and performance of BOKF's credit portfolio. The Credit Committee met nine times during

2018

.

|

|

|

|

|

|

Members

|

Responsibilities include oversight of

|

|

Griffin (Chairman)

Armstrong

Ball

Bangert

Boylan

Bradshaw

Craft

Hargis

Kaiser

Lybarger

Richards

Turpen

|

• Quality of the Company’s credit portfolio and trends affecting the credit

portfolio (and reporting to the Board regarding such quality and trends)

• Extension of credit exceeding amounts as determined from time to

time by the Board

• Effectiveness and administration of credit-related policies and related

party credit transactions

• Appropriateness of the allowance for loan losses and accrual for

off-balance sheet credit losses

|

Independent Director Meetings

The Board of Directors has adopted a policy of regularly scheduled executive sessions where independent directors meet separately from management. The independent directors plan to meet in executive session after all regularly scheduled Board of Directors meetings. The independent directors held four executive sessions during

2018

. The presiding director at the executive sessions is Mr. Kaiser. Stockholders of the Company may communicate their concerns to the non-management directors in accordance with the procedures described below under “Communication with the Board of Directors.”

Communication with the Board of Directors

The Board of Directors of BOK Financial believes that it is important for stockholders to have a process to send communications to the Board. Accordingly, stockholders who wish to communicate with the Board of Directors, or a particular director, may do so by sending a letter to the Director of Investor Relations of BOK Financial at P.O. Box 2300, Tulsa, Oklahoma 74192. The mailing envelope should contain a clear notation indicating that the enclosed letter is a “Stockholder-Board Communication” or “Stockholder-Director Communication.” Such letters should identify the author as a stockholder and state whether the intended recipients are all members of the Board of Directors or certain specified individual directors. The Director of Investor Relations and the General Counsel will independently review the content of the letters. Communications which are constructive suggestions for the conduct of the business or policies of the Company will be promptly delivered to the identified director or directors. Communications which are complaints about specific incidents involving banking or brokerage service will be directed to the appropriate business unit for review. Director nominations will be reviewed for compliance with the requirements identified in the section of this proxy entitled “Director Nominations,” and if meeting such requirements, promptly forwarded to the director(s) identified in the communication.

Report of the Audit Committee

In

2018

, the Audit Committee (the “Committee”) oversaw the Company’s financial reporting process on behalf of the Board of Directors. The Company’s management has the primary responsibility for the financial statements, for maintaining effective internal control over financial reporting, and for assessing the effectiveness of internal control over financial reporting. In fulfilling its oversight responsibilities, the Committee discussed and reviewed the audited consolidated financial statements included in the Annual Report with management, including a discussion of the quality, not just the acceptability, of the accounting policies, reasonableness of significant judgments, and the clarity of disclosures in the financial statements.

The Committee reviewed the Ernst & Young LLP opinion on the conformity of the audited consolidated financial statements with U.S. generally accepted accounting principles with Ernst & Young LLP, the independent registered public accounting firm. This discussion included their judgments as to the quality, not just the acceptability, of the Company's accounting policies, and other matters as required to be discussed with the Committee by the standards of the Public Company Accounting Oversight Board ("PCAOB"), including PCAOB Auditing Standard No. 1301,

Communications with Audit Committees

, the rules of the Securities and Exchange Commission and other applicable regulations. In addition, the Committee has discussed with Ernst & Young LLP the firm’s independence from the Company, including matters in the firm’s independence letter required by the PCAOB, and considered the compatibility of any non-audit services with the firm’s independence.

The Committee also reviewed and discussed with management and Ernst & Young LLP the results of management’s assessment of the effectiveness of the Company’s internal control over financial reporting, and the firm’s audit of internal control over financial reporting. The Committee meets at least quarterly with the Company's internal auditors and Ernst & Young LLP, with and without management present, regarding the overall scope and plans for their respective audits and the results of those audits, including their evaluations of internal control over financial reporting and the overall quality of the Company’s financial reporting.

The Committee is governed by a charter which is available for review at www.bokf.com. Each of the members of the Committee qualifies as an “independent” Director under the current NASDAQ listing standards and Rule 10A-3 of the Securities Exchange Act of 1934. The Board of Directors has appointed E. Carey Joullian IV as the “audit committee financial expert”.

In reliance on the reviews and discussions referred to above, the Committee recommended to the Board of Directors, and the Board has approved, that the audited consolidated financial statements and management’s assessment of the effectiveness of the Company’s internal control over financial reporting be included in the Annual Report on Form 10-K for the year ended December 31, 2018, filed with the Securities and Exchange Commission.

The Committee and the Board have also recommended, subject to shareholder approval, the selection of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending

December 31, 2019

.

AUDIT COMMITTEE

E. Carey Joullian IV, Audit Committee Chairman

Jack E. Finley

Douglas D. Hawthorne

Stanley A. Lybarger

Principal Accountant Fees and Services

Audit Fees

.

Fees paid to Ernst & Young LLP (“EY”) for the audit of the annual consolidated financial statements included in BOK Financial’s Annual Report on Form 10-K, for the review of the consolidated financial statements included in BOK Financial’s Forms 10-Q for the quarters included in the years ended

December 31, 2018

and

2017

and various subsidiary audits were $2,201,225 and $2,076,375 respectively.

Audit-Related Fees

.

Fees paid to EY for SOC 1 reports and other audit-related functions were $506,325 and $296,575 respectively, for the years ended December 31, 2018 and 2017.

Tax Fees

.

Fees paid to EY associated with tax consultation and planning were $42,088 and $23,292 respectively, for the years ended December 31, 2018 and 2017.

All Other Fees

.

Fees paid to EY for other services, including trust tax return preparation that is reimbursed by our clients, were $1,057,151 and $1,008,334 respectively, for the years ended December 31, 2018 and 2017.

The Audit Committee has a policy on auditor independence requiring the approval by the Committee of all professional services rendered by BOK Financial’s independent auditor prior to the commencement of the specified services. 100% of the services described in ”Audit Fees”, “Audit-Related Fees”, “Tax Fees” and “All Other Fees” were approved by the Audit Committee in accordance with BOK Financial’s policy on auditor independence and approval of fees.

Board Leadership Structure

The positions of Chief Executive Officer and Chairman of the Board are not held by the same person. Mr. Bradshaw, the President and Chief Executive Officer, brings Company-specific experience and expertise to the role, while Mr. Kaiser, the Chairman of the Board, brings experience, oversight, and expertise from outside the Company and industry. Mr. Kaiser is also the majority shareholder of BOK Financial, giving him additional incentive to ensure the success of the Company. Keeping the positions of Chief Executive Officer and Chairman separate allows the Chief Executive Officer to focus on our day-to-day business, while allowing the Chairman to lead the Board in its fundamental role of providing advice to, and independent oversight of, management. The Board believes that having separate Chief Executive Officer and Chairman positions and having an outside director serve as Chairman is the appropriate leadership structure for the Company at this time, given the characteristics and circumstances of the Company, and demonstrates our commitment to good corporate governance. It provides the appropriate balance between strategy development and independent oversight of management.

Board Role in Oversight of Risk

The Board has an active role, as a whole and also at the committee level (as disclosed in the descriptions of the committees in this Proxy Statement), in overseeing management of the Company’s risks. The full Board maintains responsibility for general oversight of strategic risks, and regularly reviews information regarding the Company’s credit, liquidity and operations, as well as the risks associated with each. The Company’s Independent Compensation Committee is responsible for overseeing the management of risks relating to the Company’s compensation policies and programs. The Risk Committee manages enterprise-wide risk management programs including capital planning, liquidity, interest rate, and operations risk as well as compliance with legal and regulatory requirements. The Audit Committee manages risks associated with accounting and financial reporting and internal controls. The Credit Committee manages risks associated with the Company’s credit portfolio and credit-related policies. While each committee is responsible for evaluating certain risks and overseeing the management of such risks, the entire Board of Directors oversees overall strategic and reputational risks, and is regularly informed through committee reports and reports directly from officers responsible for oversight of various risks within the Company.

Executive Officers

Certain information concerning the executive officers of BOK Financial and its subsidiaries is set forth below;

|

|

|

|

|

|

Norman P. Bagwell

|

|

Executive Vice President, Regional Banks

|

|

Chairman and Chief Executive Officer, Bank of Texas

|

|

|

|

Norman P. Bagwell, age 56, is Executive Vice President, Regional Banks of BOK Financial and Chief Executive Officer and Chairman of Bank of Texas, with responsibility for the six regional markets and the Oklahoma City market, which includes all lines of business, with an emphasis on commercial banking, business banking, and treasury services. Mr. Bagwell has almost three decades of banking experience in Texas. Prior to joining Bank of Texas in 2008, he served as President of the Dallas Region for JPMorgan Chase, and previously served as President of the Dallas Region for Bank One.

|

|

|

|

Steven G. Bradshaw

|

|

President and Chief Executive Officer

|

|

|

|

Steven G. Bradshaw, age 59, is President and Chief Executive Officer of BOK Financial and BOKF, NA. Mr. Bradshaw became the chief executive at BOK Financial in January 2014 after previously serving in a number of roles at the Company since joining BOKF in 1991. Most recently he served as Senior Executive Vice President and was responsible for all aspects of consumer banking, corporate marketing, mortgage banking, investment securities, trust activities, treasury services, international banking, community development and Community Reinvestment Act responsibilities for all seven banking divisions within the Company. He also served as chairman of BOK Financial’s broker-dealer subsidiary, BOK Financial Securities, Inc. and had executive responsibility for Colorado State Bank and Trust and Mobank.

|

|

|

|

Joseph A. Gottron, II

|

|

Executive Vice President, Chief Information Officer

|

|

|

|

Joseph A. Gottron, II, age 55, is Executive Vice President and Chief Information Officer of BOK Financial. Mr. Gottron was named Chief Information Officer in September 2017. In his role, Mr. Gottron leads the Operations and Technology division, which enables and supports almost every facet of the Company. Prior to joining BOK Financial in November 2016 as Chief Technology Officer, Mr. Gottron served as Chief Administrative Officer of Heartland Bank in Gahanna, Ohio. Prior leadership roles included eight years at Cardinal Health, where he held the position of Chief Information Officer of the Pharmaceutical Segment and six years at Huntington Bancshares, where he led the technology team as the Chief Information Officer. He started his career at IBM holding a variety of roles over the course of 16 years.

|

|

|

|

Scott B. Grauer

|

|

Executive Vice President, Wealth Management

|

|

Chief Executive Officer of BOK Financial Securities, Inc.

|

|

|

|

Scott B. Grauer, age 54, is Executive Vice President, Wealth Management of BOK Financial and Chief Executive Officer and Chairman of the Company’s broker-dealer subsidiary, BOK Financial Securities, Inc. In his current role, Mr. Grauer is responsible for the Company’s wealth management business lines in all markets, including Institutional Wealth, The Private Bank, and International Banking. He also serves as chairman of both of the Company’s registered investment advisers, Cavanal Hill Investment Management and The Milestone Group. Mr. Grauer joined BOK Financial in 1991 as part of the company’s acquisition of an independent retail brokerage operation and was named manager of BOK Financial Securities, Inc. retail in 1996. In late 1999, he was named president and Chief Executive Officer of the firm and assumed responsibilities for retail, institutional and investment banking activities when BOK Financial first combined these units under one organization.

|

|

|

|

|

|

|

|

|

Martin E. Grunst

|

|

Executive Vice President and Chief Risk Officer

|

|

|

|

Martin E. Grunst, age 52, is Executive Vice President and Chief Risk Officer of BOK Financial. As Chief Risk Officer, Mr. Grunst is responsible for enterprise-wide risk management, information security, and ensuring the company’s compliance with government regulations. Mr. Grunst served as treasurer of BOK Financial from 2009-2016. Before joining BOK Financial as treasurer in 2009, he served as treasurer for Citizens Bank and Citizens Republic Bancorp in Michigan for six years, where he had the additional responsibility of managing corporate finance. Previously, Mr. Grunst was with Bank One (now JPMorgan Chase) in Columbus, Ohio, where he worked in treasury, corporate finance, and line of business finance roles, including asset liability manager and finance manager for Banc One Ohio Corporation, manager of acquisition planning for the credit card line of business, finance manager for commercial real estate lending, asset liability manager for the retail line of business, and finance manager for consumer lending.

|

|

|

|

Rebecca D. Keesling

|

|

Executive Vice President and Chief Auditor

|

|

|

|

Rebecca D. Keesling, age 46, is Executive Vice President and Chief Auditor of BOK Financial, responsible for ensuring the Company’s internal controls are designed properly and operating effectively and performing independent assessments of the Company’s compliance with various laws and regulations. Previously, Ms. Keesling was Senior Vice President and Manager of Loan Portfolio Reporting, where she managed a team responsible for financial reporting as it pertained to the loan portfolio and allowance for credit losses. Ms. Keesling joined BOK Financial in 2004 as Vice President and Corporate Audit Manager. Prior to joining BOK Financial, Ms. Keesling spent 10 years in the public accounting industry primarily with Ernst & Young LLP auditing private and publicly owned companies.

|

|

|

|

Stacy C. Kymes

|

|

Executive Vice President, Corporate Banking

|

|

|

|

Stacy C. Kymes, age 48, is Executive Vice President, Corporate Banking of BOK Financial. Mr. Kymes oversees all the specialized banking areas within the Commercial Banking division, including energy, commercial real estate, healthcare and commercial strategies. He also has oversight for TransFund, the eighth largest ATM network in the US. Prior to his appointment to his current position in 2015, Mr. Kymes served as Chief Credit Officer and was responsible for all aspects of credit administration for BOK Financial, including credit approval, policy administration, loan portfolio reporting, loan and appraisal review, and loan workouts. Mr. Kymes joined BOK Financial in 1996 and has held a number of positions in various areas of the company’s finance and credit divisions including Chief Auditor, Controller, Director of Corporate Development and Treasurer.

|

|

|

|

Derek S. Martin

|

|

Executive Vice President, Consumer Banking Services

|

|

|

|

Derek S. Martin, age 48, is Executive Vice President - Consumer Banking of BOK Financial. Mr. Martin oversees all consumer, small business and mortgage banking functions operating under seven brands across eight states. He is also responsible for BOK Financial’s Corporate Marketing division. He joined BOK Financial in 1994 and has held a variety of roles across the consumer bank. Prior to his current position, he was the head of Strategic Services, which was responsible for strategy, digital banking and origination, business intelligence and analytics, operations, contact center, small business, credit delivery and various product lines.

|

|

|

|

|

|

|

|

|

Marc C. Maun

|

|

Executive Vice President and Chief Credit Officer

|

|

|

|

Marc C. Maun, age 60, is Executive Vice President, and Chief Credit Officer of BOK Financial. Most recently, Mr. Maun served BOK Financial for two years as the Chairman and Chief Executive Officer of Bank of Oklahoma, Oklahoma City. Since joining BOK Financial in 1985, Mr. Maun has overseen significant business divisions such as Treasury, International Banking, Mergers and Acquisitions, Corporate Banking and Correspondent Banking. Before moving to Oklahoma City in 2013, Mr. Maun was chairman and Chief Executive Officer of Mobank.

|

|

|

|

John C. Morrow

|

|

Senior Vice President and Chief Accounting Officer

|

|

|

|