Form 8-K - Current report

June 18 2024 - 4:18PM

Edgar (US Regulatory)

false

0001761612

00-0000000

true

0001761612

2024-06-18

2024-06-18

0001761612

us-gaap:CommonStockMember

2024-06-18

2024-06-18

0001761612

bcyc:AmericanDepositarySharesMember

2024-06-18

2024-06-18

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section

13 or 15(d) of the Securities Exchange Act of 1934

June 18, 2024

Date of Report (Date of earliest event reported)

Bicycle Therapeutics plc

(Exact name of registrant as specified in its charter)

| England and Wales |

|

001-38916 |

|

Not applicable |

|

(State or other jurisdiction

of

incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

Blocks

A & B, Portway Building,

Granta

Park Great Abington, Cambridge

United

Kingdom

|

CB21

6GS |

| (Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: +44 1223

261503

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

Trading

Symbol (s) |

Name

of each exchange on which registered |

| Ordinary shares, nominal value £0.01 per share |

n/a |

The Nasdaq Stock Market LLC* |

| American Depositary Shares, each representing one ordinary share, nominal value £0.01 per share |

BCYC |

The Nasdaq Stock Market LLC |

* Not for trading, but only in connection

with the listing of the American Depositary Shares on The Nasdaq Stock Market LLC.

Indicate by check mark whether

the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or

Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

On June 18, 2024, Bicycle

Therapeutics plc (the “Company”) filed a prospectus supplement (the “Prospectus Supplement”)

to its effective registration statement on Form S-3ASR (File No. 333-272248) (the “Registration Statement”)

filed with the U.S. Securities and Exchange Commission, under the Securities Act of 1933, as amended, with respect to the resale by the

selling securityholders named therein of up to 37,656,764 ordinary shares, nominal value £0.01 per share, of the Company (the “Shares”),

with each ordinary share represented by one American Depositary Share.

In connection with the filing

of the Prospectus Supplement, the Company is filing a legal opinion of its counsel, Cooley (UK) LLP, regarding the validity of the Shares

being registered, which opinion is attached as Exhibit 5.1 to this Current Report on Form 8-K.

| Item 9.01. | Financial Statements and Exhibits. |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| Date: June 18, 2024 |

Bicycle Therapeutics plc |

| |

|

| |

By: |

/s/ Alethia Young |

| |

Name: |

Alethia Young |

| |

Title: |

Chief Financial Officer |

Exhibit 5.1

Claire Keast-Butler

+44 (0) 20 7556 4211

ckeastbutler@cooley.com

Bicycle Therapeutics plc

Blocks A & B, Portway Building

Granta Park, Great Abington

Cambridge

United Kingdom

CB21 6GS

18 June 2024

Ladies and Gentlemen:

| Re: | Bicycle Therapeutics plc —

Prospectus Supplement — Exhibit 5.1 |

| 1.1 | We have

acted as English legal advisers to Bicycle Therapeutics plc, a public limited company incorporated

in England and Wales (the “Company”), in connection with the preparation

and filing with the U.S. Securities and Exchange Commission (the “SEC”)

of a prospectus supplement to be filed on or about the date hereof (the “Prospectus

Supplement”), pursuant to the U.S. Securities Act of 1933, as amended (the “Securities

Act”). The Prospectus Supplement supplements a registration statement on Form S-3ASR

that the Company filed with the SEC on 26 May 2023 (the “Registration Statement”).

We have taken instructions solely from the Company. |

| 1.2 | The Prospectus Supplement relates to the resale

by certain securityholders of up to 37,656,764 ordinary shares with a nominal value of £0.01

each in the capital of the Company (“Ordinary Shares”) represented by

up to 37,656,764 American Depositary Shares (“ADSs”), of which 13,781,881

Ordinary Shares are presently in issue and 23,874,883 are Ordinary Shares into which 23,874,883

non-voting ordinary shares of £0.01 each in the capital of the Company may be redesignated. |

| 1.3 | 4,705,882 non-voting ordinary shares of £0.01 each in the

capital of the Company (the “2023 Non-Voting Ordinary Shares”) were offered and sold pursuant to a New York law

governed underwriting agreement dated 12 July 2023 by and among Goldman Sachs & Co. LLC, Jefferies LLC and Leerink

Partners LLC (formerly known as SVB Securities LLC) as representatives of the underwriters and the Company (the

“Underwriting Agreement”) in a registered public offering (the “2023 Offering”). |

| 1.4 | 6,764,705 ADSs (the “2024 PIPE ADSs”), representing 6,764,705 Ordinary Shares

(the “2024 PIPE Ordinary Shares”), and 19,169,001 non-voting ordinary shares of £0.01 each in the capital

of the Company (the “2024 Non-Voting Ordinary Shares” and, together with the 2023 Non-Voting Ordinary Shares, the

“Non-Voting Ordinary Shares”) were sold, and the 2024 PIPE Ordinary Shares and the 2024 Non-Voting Ordinary

Shares were allotted and issued, pursuant to a New York law governed securities purchase agreement between the Company and certain

investors dated 23 May 2024 (the “Securities Purchase Agreement”) in a private placement transaction (the

“2024 Private Placement”). |

| 1.5 | The remaining 7,017,176 ADSs, representing

7,017,176 Ordinary Shares, have been purchased from time to time in open market transactions. Such Ordinary Shares, together

with the 2024 PIPE Ordinary Shares, are referred to in this letter as the “Registered

Ordinary Shares”). |

Cooley (UK) LLP 22 Bishopsgate London EC2N 4BQ

UK

t: +44 (0) 20 7583 4055 f: +44 (0) 20 7785 9355 cooley.com

Cooley (UK) LLP is a limited liability partnership

and is registered in England and Wales with registered number OC395270. Our registered office is at the address above. Cooley (UK) LLP

is authorised and regulated by the Solicitors Regulation Authority (SRA number 617791). A list of the members of Cooley (UK) LLP and

their professional qualifications is open to inspection at its registered office. The word 'partner,' used in relation to Cooley (UK)

LLP, refers to a member of Cooley (UK) LLP or an employee or consultant of Cooley (UK) LLP (or any affiliated firm) of equivalent standing.

Page Two

| 1.6 | We are

rendering this letter at the request of the Company in connection with the Prospectus Supplement. |

| 1.7 | Except

as otherwise defined in this letter, capitalised terms used have the respective meanings

given to them in the Prospectus Supplement and headings are for ease of reference only and

shall not affect interpretation. |

| 1.8 | All references

to legislation in this letter are to the legislation of England unless the contrary is indicated,

and any reference to any provision of any legislation shall include any amendment, modification,

re-enactment or extension thereof, as in force on the date of this letter. |

For the

purpose of issuing this letter, we have reviewed the following documents, as well as such other documentation, opinions and memoranda

as we considered appropriate:

| 2.1 | a PDF

copy of the Prospectus Supplement to be filed by the Company with the SEC on 18 June 2024; |

| 2.2 | a PDF

copy of the Registration Statement; |

| 2.3 | a PDF

executed copy of the Securities Purchase Agreement; |

| 2.4 | a PDF

executed copy of the Underwriting Agreement; |

| 2.5 | a PDF

executed copy of a certificate dated 18 June 2024 signed by the Company’s company

secretary (the “Secretary’s Certificate”) relating to certain factual

matters as at the date of the Secretary’s Certificate and having annexed thereto copies

(certified by the Company’s company secretary as being true, complete, accurate and

up-to-date in each case) of the following documents: |

| (a) | a

PDF copy of the articles of association of the Company adopted on 16 May 2024 (the “Current

Articles”); |

| (b) | a PDF copy of the articles of association

of the Company adopted on 23 May 2019 (the “Prior Articles”); |

| (c) | a

PDF copy of the certificate of incorporation of the Company dated 27 October 2017 and

a PDF copy of the certificate of incorporation on re-registration of the Company as a public

company dated 22 May 2019; |

| (d) | a

PDF executed copy of the written resolutions of the board of directors of the Company (the

“Board” or the “Directors”) passed on 12 July 2023

resolving, inter alia, to: (i) approve the offer, allotment, issue and sale by

the Company of the 2023 Non-Voting Ordinary Shares pursuant to the Underwriting Agreement;

and (ii) authorise the strategic committee of the Board (the “Strategic Committee”)

to fix the number and price of the 2023 Non-Voting Ordinary Shares to be offered in the 2023

Offering (the “2023 Board Written Resolutions”); |

| (e) | a

PDF executed copy of the minutes of a meeting of the Strategic Committee held on 12 July 2023

resolving, inter alia, to: (i) set the final number and price of the 2023 Non-Voting

Ordinary Shares; (ii) authorise the execution and delivery of the Underwriting Agreement;

and (iii) approve the offer, allotment, issue and sale by the Company of the 2023 Non-Voting

Ordinary Shares (the “Strategic Committee Minutes”); |

| (f) | a PDF executed copy of the written resolutions

passed by the Board on 18 May 2024 approving, inter alia: (i) the 2024 Private

Placement in principle; and (ii) the constitution of a pricing committee of the Board

(the “Pricing Committee”) to approve various matters in connection with

the 2024 Private Placement (the “2024 Board Written Resolutions”); |

Page Three

| (g) | a PDF executed copy of the written resolutions

passed by the Board on 22 May 2024 approving, inter alia, an increase in the

aggregate amount potentially raised under the 2024 Private Placement (together with the 2023

Board Written Resolutions and the 2024 Board Written Resolutions, the “Board Written

Resolutions”); |

| (h) | a PDF executed copy of the written resolutions

passed by the Pricing Committee on 23 May 2024 at which it was resolved, inter alia,

to: (i) enter into the Securities Purchase Agreement; and (ii) approve the offering

and sale of the 2024 PIPE ADSs and the 2024 Non-Voting Ordinary Shares and the allotment

and issue of the 2024 PIPE Ordinary Shares and the 2024 Non-Voting Ordinary Shares (the “Pricing

Committee Written Resolutions”); |

| (i) | a

PDF executed copy of the resolutions passed by the shareholders of the Company at the annual

general meeting of the Company held on 28 June 2021 (the “2021 AGM”)

at which it was resolved, inter alia, to authorise the Directors to: (i) allot

shares in the capital of the Company or to grant rights to subscribe for or to convert any

security into shares in the Company, up to a maximum aggregate nominal amount of £250,000

(the “2021 Allotment Authority”); and (ii) allot equity securities

pursuant to the 2021 Allotment Authority as if the statutory pre-emption rights contained

in section 561(1) of the Companies Act 2006 (the “Companies Act”)

did not apply to such allotment (the “2021 AGM Resolutions”); and |

| (j) | a

PDF executed copy of an extract of the resolutions passed at the annual general meeting of

the Company held on 16 May 2024 (the “2024 AGM”) at which it was

resolved, inter alia, to (i) authorise the Board for the purposes of section

551 of the Companies Act to allot shares or to grant rights to subscribe for, or convert

any security into, shares of the Company, up to a maximum aggregate nominal amount of £1,000,000

(the “2024 Allotment Authority”); and (ii) empower the Board to allot

equity securities pursuant to the 2024 Allotment Authority as if the statutory pre-emption

rights contained in section 561(1) of the Companies Act did not apply to such allotment

(the “2024 AGM Resolutions”). |

In addition to examining the documents referred

to in paragraph 2 (Documents), we have carried out the following searches only:

| 3.1 | an

online search at Companies House in England and Wales (“Companies House”)

with respect to the Company, carried out at 9:50 a.m. (London time) on 18 June 2024

(the “Companies House Search”); and |

| 3.2 | an

online enquiry of the Central Registry of Winding-up Petitions at the Insolvency and Companies

List in England and Wales (the “Central Registry”) with respect to the

Company, carried out at 10:02 a.m. (London time) on 18 June 2024 (the

“Central Registry Enquiry” and, together with the Companies House Search,

the “Searches”). |

Subject to the assumptions set out in paragraph

5 (Assumptions), the scope of the opinion set out in paragraph 6 (Scope of Opinion) and the reservations set out in paragraph

7 (Reservations), were are of the opinion that as at the date of this letter:

| 4.1 | the

Registered Ordinary Shares and the Non-Voting Ordinary Shares were validly issued, fully

paid or credited as fully paid and are not subject to any call for payment of further capital

by the Company; and |

| 4.2 | upon

the redesignation of the Non-Voting Ordinary Shares as Ordinary Shares in accordance with

the provisions set out in the Current Articles, such Ordinary Shares will rank pari passu

with the other Ordinary Shares in the capital of the Company. |

Page Four

In giving the opinion in this letter, we have

assumed (without making enquiry or investigation) that:

| 5.1 | all signatures,

stamps and seals on all documents are genuine. All original documents are complete, authentic

and up-to-date, and all documents submitted to us as a copy (whether by email or otherwise)

are complete and accurate and conform to the original documents of which they are copies

and that no amendments (whether oral, in writing or by conduct of the parties) have been

made to any of the documents since they were examined by us; |

| 5.2 | where a document has been examined by us in

draft or specimen form, it will be or has been duly executed in the form of that draft or

specimen; |

| 5.3 | each of the individuals who signs as, or otherwise

claims to be, an officer of the Company is the individual whom they claim to be and holds

the office that they claim to hold; |

| 5.4 | where a document is required to be delivered,

each party to it has delivered the same without it being subject to any escrow or similar

arrangement; |

| 5.5 | all documents,

forms and notices which should have been delivered to Companies House in respect of the Company

have been and will be so delivered; |

| 5.6 | the information

revealed by the Searches is true, accurate, complete and up-to-date in all respects, and

there is no information which should have been disclosed by the Searches that has not been

disclosed for any reason and there has been no alteration in the status or condition of the

Company since the date and time that the Searches were made, and that the results of the

Searches will remain true, complete, accurate and up-to-date as at each date on which the

Non-Voting Ordinary Shares are re-designated as Ordinary Shares and ADSs representing such

Ordinary Shares are issued (each, a “Bring-Down Date”); |

| 5.7 | no notice

has been received by the Company which could lead to the Company being struck off the register

of companies under section 1000 of the Companies Act and no such notice shall have been received

as at the date of this letter and at each Bring-Down Date; |

| 5.8 | the Current Articles remain in full force

and effect and no alteration has been made or will be made to the Current Articles as at

the date of this letter and as at each Bring-Down Date; |

| 5.9 | to

the extent that the obligations of the Company under the Registration Statement, the Prospectus

Supplement, the Underwriting Agreement and the Securities Purchase Agreement (each

a “Relevant Agreement” and together, the “Relevant Agreements”)

may be dependent upon such matters, each of the parties to such Relevant Agreement: |

| (a) | is

duly organised, validly existing and in good standing (where such concept is legally relevant)

under the laws of its jurisdiction of incorporation; |

| (b) | is

in compliance, generally, with all applicable laws, rules and regulations to which it

is subject, its constitutional documents and any judicial or administrative judgments, awards,

injunctions or orders binding upon it or its property; |

| (c) | has

the capacity, power and authority to execute, deliver and perform the Relevant Agreements; |

| (d) | is

duly qualified to engage in the activities contemplated by the Relevant Agreements and will

not be in breach of any of its respective obligations under any document, contract, instrument

or agreement as a result of its entry into and performance of its obligations under the Relevant

Agreements; |

| (e) | is

authorised under all applicable laws of its jurisdiction and domicile to submit to the jurisdiction

of the relevant courts or arbitral tribunal specified in such Relevant Agreement and has

validly submitted to such jurisdiction; and |

| (f) | has validly authorised, executed

and delivered all relevant documents; |

and that each of the foregoing remains the case as at each

Bring-Down Date;

Page Five

| 5.10 | each

Relevant Agreement (and any other documents referred to therein) constitutes legal,

valid and binding obligations of each of the parties thereto enforceable under all applicable

laws and that each Relevant Agreement will remain in full force and effect as at the date

of this letter and each Bring-Down Date; |

| 5.11 | each of the Relevant Agreements remains accurate

and complete and has not been amended, modified, terminated or otherwise discharged as at

the date of this letter and each Bring-Down Date; |

| 5.12 | each of the persons who executed each of

the Relevant Agreements on behalf of the relevant parties thereto executed an identical final

version of each such document, in each case in the form reviewed by us; |

| 5.13 | there

is an absence of fraud or mutual mistake of fact or law or any other arrangements, agreements,

understandings or course of conduct or prior or subsequent dealings amending, rescinding

or modifying or suspending any of the terms of any of the Relevant Agreements or which would

result in the inclusion of additional terms therein, and that the parties have acted in accordance

with the terms of each of the Relevant Agreements; |

| 5.14 | in

relation to the Relevant Agreements and the transactions contemplated thereby and

the allotment and issue of the Registered Ordinary Shares and the Non-Voting Ordinary Shares

(and, where applicable, the ADSs), the Directors have acted and will act in the manner required

by section 172 of the Companies Act and that the allotment and issue of the Registered Ordinary

Shares and the Non-Voting Ordinary Shares (and, where applicable, the ADSs) was made in good

faith and on bona fide commercial terms and on arms’ length terms and for the purposes

of carrying on the business of the Company; |

| 5.15 | the

Company is, and the Company and each party to the Relevant Agreements will at all

relevant times remain, in compliance with all applicable anti-corruption, anti-money laundering,

anti-terrorism, sanctions and human rights laws and regulations; |

| 5.16 | the Registration Statement has become effective

under the Securities Act and such effectiveness shall not have been terminated or rescinded

prior to each Bring-Down Date, and the Prospectus Supplement has been filed with the SEC; |

| 5.17 | the

Strategic Committee Minutes referred to in paragraph 2.5 (Documents) are a true record

of the proceedings described therein, and that the meeting recorded in such minutes was duly

conducted as described therein, duly constituted and convened and all constitutional, statutory

and other formalities were duly observed (including, if applicable, those relating to the

declaration of Directors’ interests or the power of interested Directors to vote),

a quorum was present throughout, the requisite majority of Directors voted in favour of approving

the resolutions and the resolutions passed at that meeting of the Strategic Committee were

duly adopted, have not been revoked or varied and remain in full force and effect as at the

date of this letter and each Bring-Down Date; |

| 5.18 | the

resolutions set out in the Board Written Resolutions and the Pricing Committee Written Resolutions

referred to in paragraph 2.5 (Documents) were validly passed on the respective dates

as written resolutions of the Board or the Pricing Committee, as applicable, in accordance

with the Current Articles or the Prior Articles, as applicable, that all eligible Directors

(being all the Directors or members of the Pricing Committee, as applicable, who would have

been entitled to vote on the matter had it been proposed as a resolution at a Directors’

meeting or meeting of the Pricing Committee, as applicable, but excluding any Director whose

vote is not to be counted in respect of a particular matter) have signed one or more copies

of the Board Written Resolutions or the Pricing Committee Written Resolutions, that all relevant

provisions of the Companies Act and the Current Articles or the Prior Articles, as applicable,

were complied with and the Current Articles or the Prior Articles, as applicable, were duly

observed (including, if applicable, those relating to the declaration of Directors’

interests or the power of interested Directors to vote) and such resolutions were duly adopted,

and have not been revoked or varied and remain in full force and effect as at the date of

this letter and each Bring-Down Date; |

Page Six

| 5.19 | the 2021 AGM was duly convened and held on

28 June 2021 at which all constitutional, statutory and other formalities were duly

observed, a quorum of shareholders was present throughout and the 2021 AGM Resolutions were

duly passed and have not been revoked or varied and remained in full force and effect until

the date of the 2024 AGM, and that all filings required to be made with Companies House in

connection therewith were made within the relevant time limits; |

| 5.20 | the 2024 AGM was duly convened and held on

16 May 2024 at which all constitutional, statutory and other formalities were duly observed,

a quorum of shareholders was present throughout and the 2024 AGM Resolutions were duly passed

and have not been revoked or varied and remain in full force and effect as at the date of

this letter and each Bring-Down Date, and that all filings required to be made with Companies

House in connection therewith have been made within the relevant time limits; |

| 5.21 | all

of the 2023 Non-Voting Ordinary Shares were allotted and issued pursuant to the authority

and power granted to the Directors pursuant to section 551 and section 570 of the Companies

Act, respectively, under resolutions 8 and 9, respectively, of the 2021 AGM Resolutions,

and that at the time of such allotment and issue that authority and that power remained unutilised

to a sufficient extent to enable the allotment and issue of the 2023 Non-Voting Ordinary

Shares; |

| 5.22 | all of the 2024 PIPE Ordinary Shares and

the 2024 Non-Voting Ordinary Shares were allotted and issued pursuant to the authority and

power granted to the Directors pursuant to section 551 and section 570 of the Companies Act,

respectively, under resolutions 9 and 10, respectively, of the 2024 AGM Resolutions, and

that at the time of such allotment and issue that authority and that power remained unutilised

to a sufficient extent to enable the allotment and issue of the 2024 PIPE Ordinary Shares

and the 2024 Non-Voting Ordinary Shares; |

| 5.23 | all

of the 2023 Non-Voting Ordinary Shares were duly allotted by the Strategic Committee in accordance

with the Prior Articles and the requirements of all applicable laws; |

| 5.24 | all of the 2024 PIPE Ordinary Shares and

the 2024 Non-Voting Ordinary Shares were duly allotted by the Pricing Committee in accordance

with the Current Articles and the requirements of all applicable laws; |

| 5.25 | the

remaining 7,017,176 Registered Ordinary Shares were duly allotted by the Board or a duly

authorised committee thereof pursuant to a valid authorisation of the directors to

allot shares pursuant to section 551 of the Companies Act and a valid disapplication of pre-emption

rights pursuant to section 570 or 571 of the Companies Act in accordance with the articles

of association in effect at the time of such allotment and the requirements of all applicable

laws; |

| 5.26 | any redesignation of the Non-Voting Ordinary

Shares as Ordinary Shares will be carried out in accordance with the provisions of the Current

Articles and approved by either the Board or a duly authorised committee or representative

thereof; |

| 5.27 | the Registered Ordinary Shares and the Non-Voting

Ordinary Shares were not allotted or issued at a discount to their nominal value (whether

in dollars or equivalent in any other currency); |

| 5.28 | at the time of allotment and issue of the

Registered Ordinary Shares and the Non-Voting Ordinary Shares, the Company received payment

in full for such shares in an amount of “cash consideration” (as defined in section

583(3) of the Companies Act) equal to the aggregate subscription price for such shares,

such amount not being less than the aggregate nominal value for such shares, and the Company

entered the holder or holders thereof in the register of members of the Company showing that

all such shares had been fully paid up as to their nominal value and any premium thereon

as at the date of each such allotment; |

| 5.29 | the

persons authorised and appointed by the Pricing Committee and the Strategic Committee to

execute the Securities Purchase Agreement and the Underwriting Agreement, respectively,

on behalf of the Company (the “Authorised Signatories”) were so appointed

and authorised; |

| 5.30 | the

persons executing the Securities Purchase Agreement and the Underwriting Agreement,

respectively, on behalf of the Company were the Authorised Signatories and their authority

had not been revoked; |

Page Seven

| 5.31 | there was at the time of the allotment and

issue of the Registered Ordinary Shares and the Non-Voting Ordinary Shares, and there remains,

no fact or matter (such as bad faith, coercion, duress, undue influence or a mistake or misrepresentation

before or at the time any agreement or instrument is entered into, a subsequent breach, release,

waiver or variation of any right or provision, an entitlement to rectification or circumstances

giving rise to an estoppel) which might affect the allotment and issue of the Registered

Ordinary Shares and the Non-Voting Ordinary Shares (or, where applicable, the ADSs); |

| 5.32 | the contents of the Secretary’s Certificate

were true and not misleading when given and remain true and not misleading as at the date

of this letter and will remain so as at each Bring-Down Date, and there is no fact or matter

not referred to in the Secretary’s Certificate which would make any of the information

in the Secretary’s Certificate inaccurate or misleading; |

| 5.33 | as at the date of this letter and each Bring-Down

Date, none of the parties to the Relevant Agreements has taken any corporate or other action

nor have any steps taken or legal proceedings been started against any such party for the

liquidation, winding-up, dissolution, reorganisation or bankruptcy of, or for the appointment

of a liquidator, receiver, trustee, administrator, administrative receiver or similar officer

of, any such party (including the Company) or all or any of its or their assets (or any analogous

proceedings in any jurisdiction) and none of the parties to the Relevant Agreements (including

the Company) is unable to pay its debts as they fall due within the meaning of section 123

of the Insolvency Act 1986, as amended (the “Insolvency Act”) or becomes

unable to pay its debts within the meaning of that section as a result of any of the transactions

contemplated in this letter, is insolvent or has been dissolved or declared bankrupt; |

| 5.34 | all agreements and documents examined by

us that are governed by the laws of any jurisdiction other than England are on the date of

this letter legal, valid and binding under the laws by which they are (or are expected to

be) governed and will remain so on each Bring-Down Date; |

| 5.35 | there are no provisions of the laws of any

jurisdiction outside England that would have any implication for the opinion which we express

in this letter and that, insofar as the laws of any jurisdiction outside England may be relevant

to this letter, such laws have been and will be complied with; |

| 5.36 | all statements of fact and representations

and warranties as to matters of fact (except as to matters expressly set out in the opinion

given in this letter) contained in or made in connection with any of the documents examined

by us were true and correct as at the date given and are true and correct at today’s

date and no fact was omitted therefrom which would have made any of such facts, representations

or warranties incorrect or misleading; |

| 5.37 | all consents, licences, approvals, authorisations,

notices, filings and registrations that are necessary under any applicable laws or regulations

in connection with the transactions contemplated by the Registration Statement and the Prospectus

Supplement have been or will be duly made or obtained and are, or will be, in full force

and effect; |

| 5.38 | we

note that the Securities Purchase Agreement and the Underwriting Agreement provide

that they are to be governed by and construed in accordance with New York law. We express

no opinion as to any matters governed by New York law. As lawyers not qualified in the State

of New York, we are not qualified or able to assess the true meaning or import of the terms

of the Securities Purchase Agreement and the Underwriting Agreement under New York law, and

we have made no investigation of such meaning or import. Therefore, our review of the Securities

Purchase Agreement and the Underwriting Agreement has been limited to its terms as they appear

to us on their face. We have assumed that the choice of New York law in the Securities Purchase

Agreement and the Underwriting Agreement are valid as a matter of New York law and the Securities

Purchase Agreement and the Underwriting Agreement and each of their provisions is valid,

binding and enforceable under New York law and the law of any other jurisdiction whose law

applies, other than law covered expressly in an opinion included in this letter. We have

also assumed that, under New York law, any court named in the forum selection clauses of

the Securities Purchase Agreement and the Underwriting Agreement will have jurisdiction over

the parties and the subject matter of any action brought in that court under the Securities

Purchase Agreement and the Underwriting Agreement; |

Page Eight

| 5.39 | except

to the extent expressly set out in the opinion given in this letter, no consents, approvals,

authorisations, orders, licences, registrations, filings or similar formalities are required

from any governmental or regulatory authority in connection with the execution, delivery

and performance of the Relevant Agreements by any of the parties thereto or if such

consents, approvals, authorisations, orders, licences, registrations, filings or similar

formalities are required, these have been made or will be made within the prescribed time

limits; |

| 5.40 | each

person involved in or dealing with the Company in connection with the 2024 Private Placement

or the 2023 Offering or otherwise in relation to the allotment and issue of the Registered

Ordinary Shares and the Non-Voting Ordinary Shares (and, where applicable, the ADSs) which

is carrying on, or purporting to carry on, a regulated activity (within the meaning of section

19 (The general prohibition) of Financial Services and Markets Act 2000, as amended

(the “FSMA”)) is an authorised person or exempt person under the FSMA; |

| 5.41 | no ADSs,

Ordinary Shares or Non-Voting Ordinary Shares have been or shall be offered to the public

in the United Kingdom except in circumstances which do not require the publication of a prospectus

pursuant to EU Prospectus Regulation (Regulation (EU) 2017/1129) as it forms part of domestic

law in the United Kingdom by virtue of the European Union (Withdrawal) Act 2018 (the “UK

Prospectus Regulation”), Part VI of the FSMA or of any other United Kingdom

laws or regulations concerning offers of securities to the public; |

| 5.42 | no communication

has been or shall be made in relation to the Registered Ordinary Shares, or the ADSs representing

such Registered Ordinary Shares, or the Non-Voting Ordinary Shares in breach of section 21

(Restrictions on financial promotion) of the FSMA or any other United Kingdom laws

or regulations relating to offers or invitations to subscribe for, or to acquire rights to

subscribe for or otherwise acquire, shares or other securities; in particular, any invitation

or inducement to engage in investment activity (within the meaning of section 21 of the FSMA)

in connection with the offer and issue of the Registered Ordinary Shares, or the ADSs representing

such Registered Ordinary Shares, and the Non-Voting Ordinary Shares has only been communicated

or caused to be communicated in circumstances in which there has been no breach of section

21(1) of the FSMA; |

| 5.43 | in issuing the Registered Ordinary Shares,

and the ADSs representing such Registered Ordinary Shares, and the Non-Voting Ordinary Shares,

the Company was not carrying on a regulated activity for the purposes of section 19 of the

FSMA; |

| 5.44 | all

applicable provisions of the EU Market Abuse Regulation (Regulation (EU) No 596/2014)

as it forms part of domestic law in the United Kingdom by virtue of the European Union (Withdrawal)

Act 2018 (“UK MAR”), the UK Prospectus Regulation, the FSMA, the Financial

Services Act 2012 (the “FS Act”), and all rules and regulations made

pursuant to UK MAR, the UK Prospectus Regulation, the FSMA and the FS Act, have been and

will be complied with as regards anything done in relation to the Registered Ordinary Shares,

and the ADSs representing such Registered Ordinary Shares, and the Non-Voting Ordinary Shares

in, from or otherwise involving England (including, without limitation, articles 14 (Prohibition

of insider dealing and of unlawful disclosure of inside information) and 15 (Prohibition

of market manipulation) of UK MAR, sections 19 (The general prohibition) and 21

(Restrictions on financial promotion) of the FSMA and sections 89 (Misleading statements),

90 (Misleading impressions) and 91 (Misleading statements etc. in relation to benchmarks)

of the FS Act); and |

| 5.45 | no application has been or will be made for

any ADSs, Ordinary Shares or Non-Voting Ordinary Shares to be listed or admitted to trading

on a regulated market, multilateral trading facility or organised trading facility situated

or operating in the United Kingdom. |

| 6.1 | The

opinion given in this letter is limited to English law as it would be applied by English

courts on the date of this letter. |

| 6.2 | We

express no opinion in this letter on the laws of any other jurisdiction. We have not

investigated the laws of any country other than England and we assume that no foreign law

affects any of the opinion stated in paragraph 4 (Opinion). |

Page Nine

| 6.3 | We express no opinion as to any agreement,

instrument or other document other than as specified in this letter. For the purposes of

giving the opinion in paragraph 4 (Opinion), we have only examined and relied on those

documents set out in paragraph 2 (Documents) and made those searches and enquiries

set out in paragraph 3 (Searches), respectively. We have made no further enquiries

concerning the Company or any other matter in connection with the giving of the opinion in

paragraph 4 (Opinion). |

| 6.4 | No opinion

is expressed with respect to taxation in the United Kingdom or otherwise in this letter. |

| 6.5 | We have not been responsible for investigating

or verifying the accuracy of the facts or the reasonableness of any statement of opinion

or intention, contained in or relevant to any document referred to in this letter, or that

no material facts have been omitted therefrom. |

| 6.6 | The

opinion given in this letter is given on the basis of each of the assumptions set

out in paragraph 5 (Assumptions) and is subject to each of the reservations set out

in paragraph 7 (Reservations) to this letter. The opinion given in this letter is

strictly limited to the matters stated in paragraph 4 (Opinion) and does not extend,

and should not be read as extending, by implication or otherwise, to any other matters. |

| 6.7 | This

letter only applies to those facts and circumstances which exist as at today’s

date and we assume no obligation or responsibility to update or supplement this letter to

reflect any facts or circumstances which may subsequently come to our attention, any changes

in laws which may occur after today, or to inform the addressee of any change in circumstances

happening after the date of this letter which would alter the opinion given in this letter. |

| 6.8 | We have not been responsible for investigation

or verification of statements of fact (including statements as to foreign law) or the reasonableness

of any statements of opinion in the Registration Statement or the Prospectus Supplement,

or that no material facts have been omitted therefrom. |

| 6.9 | This letter is given by Cooley (UK) LLP and

no partner or employee assumes any personal responsibility for it nor shall owe any duty

of care in respect of it. |

| 6.10 | This

letter, the opinion given in it, and any non-contractual obligations arising out of or in

connection with this letter and/or the opinion given in it, are governed by and shall be

construed in accordance with English law as at the date of this letter. |

| 7.1 | The Companies House Search described at paragraph

3.1 (Searches) is not capable of revealing conclusively whether or not: |

| (a) | a winding-up order has been made or a

resolution passed for the winding-up of a company; |

| (b) | an administration order has been made;

or |

| (c) | a receiver, administrative receiver, administrator

or liquidator has been appointed, |

since notice of these matters may not

be filed with the Registrar of Companies in England and Wales immediately and, when filed, may not be entered on the public database

or recorded on the public microfiches of the relevant company immediately.

In addition, such a company search

is not capable of revealing, prior to the making of the relevant order, whether or not a winding-up petition or a petition for an administration

order has been presented.

| 7.2 | The

Central Registry Enquiry described at paragraph 3.2 (Searches) relates only

to a compulsory winding-up and is not capable of revealing conclusively whether or not a

winding-up petition in respect of a compulsory winding-up has been presented, since details

of the petition may not have been entered on the records of the Central Registry immediately

or, in the case of a petition presented to a District Registry and/or County Court in England

and Wales, may not have been notified to the Central Registry and entered on such records

at all, and the response to an enquiry only relates to the period since approximately 2016

for petitions presented in London and since approximately 2019 for petitions presented to

a District Registry and/or County Court in England and Wales. We have not made enquiries

of any District Registry or County Court in England and Wales. |

Page Ten

| 7.3 | The opinion

set out in this letter is subject to: (i) any limitations arising from applicable laws

relating to insolvency, bankruptcy, administration, reorganisation, liquidation, moratoria,

schemes or analogous circumstances; and (ii) an English court exercising its discretion

under section 426 of the Insolvency Act (co-operation between courts exercising jurisdiction

in relation to insolvency) to assist the courts having the corresponding jurisdiction

in any part of the United Kingdom or any relevant country or territory. |

| 7.4 | We express

no opinion as to matters of fact. |

| 7.5 | Save

for the matters set out in the Secretary’s Certificate, we have made no enquiries of

any individual connected with the Company. We have relied entirely on the facts, statements

and confirmations contained in the Secretary’s Certificate and we have not undertaken

any independent investigation or verification of the matters referred to in the Secretary’s

Certificate. |

| 7.6 | If (a) a

party to any Relevant Agreement is the target of economic or financial sanctions or other

restrictive measures imposed in any jurisdiction (“Sanctions”) or is owned

or controlled (directly or indirectly) by or is acting on behalf of or at the direction of

or is otherwise connected with a person who is a target of Sanctions or (b) a party

to any Relevant Agreement is incorporated or resident in or operating from a country or territory

that is a target of Sanctions or (c) the rights or obligations of a party to any Relevant

Agreement is otherwise affected by Sanctions, then the rights and obligations of such person

under such Relevant Agreement may be void and/or unenforceable. |

| 7.7 | We express

no opinion in this letter on the application or potential application of the National Security

and Investment Act 2021 in relation to any Relevant Agreement or any transaction contemplated

thereby or otherwise in respect of the allotment and issue of the Registered Ordinary Shares

and the Non-Voting Ordinary Shares (and, where applicable, the ADSs). |

| 8. | DISCLOSURE

AND RELIANCE |

| 8.1 | This

letter is addressed to you solely for your benefit in connection with the Prospectus Supplement

and the transactions contemplated thereunder. We consent to the filing of this letter as

an exhibit to the current report on Form 8-K to be filed with the SEC in relation to

the Prospectus Supplement. In giving such consent, we do not thereby admit that we are in

the category of persons whose consent is required under section 7 of the Securities Act or

the rules and regulations thereunder. |

| 8.2 | This

letter may not be relied upon by you for any other purpose, or furnished to, assigned to,

quoted to, or relied upon by any other person, firm or other entity for any purpose, without

our prior written consent, which may be granted or withheld at our sole discretion. |

Yours faithfully

/s/ Cooley (UK) LLP

Cooley (UK) LLP

v3.24.1.1.u2

Cover

|

Jun. 18, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jun. 18, 2024

|

| Entity File Number |

001-38916

|

| Entity Registrant Name |

Bicycle Therapeutics plc

|

| Entity Central Index Key |

0001761612

|

| Entity Tax Identification Number |

00-0000000

|

| Entity Incorporation, State or Country Code |

X0

|

| Entity Address, Address Line One |

Blocks

A & B, Portway Building

|

| Entity Address, Address Line Two |

Granta

Park Great Abington

|

| Entity Address, City or Town |

Cambridge

|

| Entity Address, Country |

GB

|

| Entity Address, Postal Zip Code |

CB21

6GS

|

| City Area Code |

+44

|

| Local Phone Number |

1223

261503

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Ordinary shares, nominal value £0.01 per share

|

| No Trading Symbol Flag |

true

|

| Security Exchange Name |

NASDAQ

|

| American Depositary Shares [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

American Depositary Shares, each representing one ordinary share, nominal value £0.01 per share

|

| Trading Symbol |

BCYC

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a security having no trading symbol.

| Name: |

dei_NoTradingSymbolFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:trueItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=bcyc_AmericanDepositarySharesMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

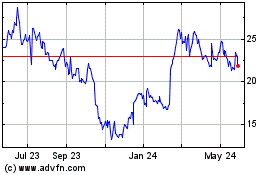

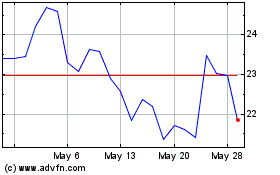

Bicycle Therapeutics (NASDAQ:BCYC)

Historical Stock Chart

From May 2024 to Jun 2024

Bicycle Therapeutics (NASDAQ:BCYC)

Historical Stock Chart

From Jun 2023 to Jun 2024