Current Report Filing (8-k)

June 22 2021 - 5:17PM

Edgar (US Regulatory)

0001031308

false

0001031308

2021-06-22

2021-06-22

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): June 22, 2021

Bentley

Systems, Incorporated

(Exact name of registrant as specified

in its charter)

|

Delaware

|

001-39548

|

95-3936623

|

|

(State or other jurisdiction

of

incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

685 Stockton Drive

Exton, PA

|

|

19341

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including

area code: (610) 458-5000

Not applicable

(Former name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8−K filing is intended to simultaneously satisfy the filing obligation of the

registrant under any of the following provisions:

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

¨

|

Soliciting material pursuant to Rule 14a−12 under the Exchange Act (17 CFR 240.14a−12)

|

|

|

|

|

¨

|

Pre−commencement communications pursuant to Rule 14d−2(b) under the Exchange Act (17 CFR 240.14d−2(b))

|

|

|

|

|

¨

|

Pre−commencement communications pursuant to Rule 13e−4(c) under the Exchange Act (17 CFR 240.13e−4(c))

|

Securities

registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading

Symbol

|

|

Name of each exchange on which

registered

|

|

Class

B common stock, par value $0.01 per share

|

|

BSY

|

|

The Nasdaq Stock Market LLC

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company x

If an

emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

|

Item 1.01

|

Entry into a Material Definitive Agreement.

|

On

June 22, 2021, the Company entered into a third amendment (the “Third Amendment”) to the Amended and Restated Credit Agreement,

dated as of December 19, 2017, by and among Bentley Systems, PNC Bank National Association, as administrative agent, and the lenders party

thereto (the “Credit Facility”). The Third Amendment amends the Credit Facility to permit the issuance and sale of the Notes

(as defined below) and the capped call transactions described in the offering memorandum related to the Notes Offering (as defined below).

The foregoing description of the Third Amendment is qualified in its entirety by the full text of the Third Amendment, which is filed

herewith as Exhibit 10.1 and is incorporated into this Item 1.01 by reference.

On

June 22, 2021, Bentley Systems, Incorporated (the “Company”) issued a press release announcing that the Company plans to

commence, subject to market conditions and other factors, a private offering (the “Notes Offering”) of $500 million

aggregate principal amount of convertible senior notes due 2027 (the “Notes”) to persons reasonably believed to be

qualified institutional buyers pursuant to Rule 144A under the Securities Act of 1933 (the “Securities Act”). The

Company also expects to grant the initial purchasers of the Notes a 13-day option to purchase up to an additional $75 million

aggregate principal amount of Notes. The Company intends to use the net proceeds from the Notes Offering to repay existing

indebtedness and to pay the cost of anticipated capped call transactions related to the Notes Offering. A copy of the press release

is being furnished as Exhibit 99.1 to this Report and is incorporated herein by reference.

As of March 31, 2021, after giving effect to

the payment of the cash consideration for the acquisition of Seequent Holdings Limited and the Notes Offering and the use of

proceeds therefrom (assuming no exercise of the initial purchasers’ option to purchase additional Notes): (i) the Company

would have had $102 million of secured indebtedness, excluding $0.2 million in outstanding letters of credit, under its Credit

Facility with an additional $748 million of availability thereunder and (ii) approximately $240 million of cash and cash equivalents

(which cash amount does not reflect the intended usage of cash to pay the cost of entering into the capped call transactions).

The information included in this Current Report

on Form 8-K is neither an offer to sell nor a solicitation of an offer to buy any securities.

This

Current Report on Form 8-K contains forward-looking statements. Forward-looking statements include all statements that are not

historical facts. The words “believe,” “may,” “will,” “estimate,” “continue,”

“anticipate,” “intend,” “expect” and similar expressions are intended to identify forward-looking

statements. These forward-looking statements include statements relating to, among other things, risks and uncertainties related to market

conditions, risks that the Notes Offering will not be consummated on the terms or in the amounts contemplated or otherwise, the intended

use of proceeds from the Notes Offering, and the satisfaction of customary closing conditions related to the Notes Offering. These forward-looking

statements are subject to a number of risks, uncertainties and assumptions, including those described under the “Risk Factors”

section of the Company’s Annual Report on Form 10-K for the year ended December 31, 2020. Except as required by law, the Company

has no obligation to update any of these forward-looking statements to conform these statements to actual results or revised expectations.

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits.

|

Exhibit

No.

|

|

Description

|

|

10.1

|

|

Third Amendment, dated as of June 22, 2021, to the Amended and Restated Credit Agreement dated as of December 19, 2017, by and among

the Company, PNC Bank National Association, as administrative agent, and the lenders party thereto

|

|

99.1

|

|

Bentley Systems,

Incorporated Press Release dated June 22, 2021

|

Signatures

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed by the undersigned

hereunto duly authorized.

|

|

Bentley Systems,

Incorporated

|

|

Date: June 22,

2021

|

|

|

|

|

By:

|

/s/

David R. Shaman

|

|

|

Name:

|

David R. Shaman

|

|

|

Title:

|

Chief Legal Officer and Corporate

Secretary

|

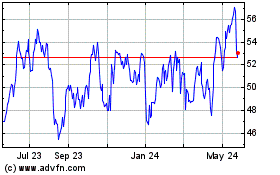

Bentley Systems (NASDAQ:BSY)

Historical Stock Chart

From Jun 2024 to Jul 2024

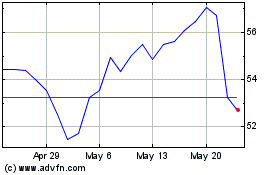

Bentley Systems (NASDAQ:BSY)

Historical Stock Chart

From Jul 2023 to Jul 2024