0001099160--12-31Q3false10001099160us-gaap:FairValueInputsLevel2Member2022-12-310001099160us-gaap:CorporateMember2023-01-012023-09-300001099160bbgi:FccLicenseMember2022-04-012022-04-300001099160srt:MinimumMemberus-gaap:MeasurementInputLongTermRevenueGrowthRateMember2022-04-012022-06-300001099160bbgi:WilmingtonMemberbbgi:WjbrfmMember2023-10-052023-10-050001099160us-gaap:AllOtherSegmentsMember2023-01-012023-09-300001099160bbgi:AudioAdvertisingMember2023-07-012023-09-300001099160us-gaap:SellingAndMarketingExpenseMember2023-07-012023-09-300001099160srt:MinimumMemberbbgi:BostonMaRadioMarketClusterMemberus-gaap:GoodwillMember2023-01-012023-09-300001099160bbgi:WwnnamMemberbbgi:WestPalmBeachBocaRatonMember2022-04-012022-04-300001099160bbgi:OtherAdvertisingMember2022-01-012022-09-300001099160bbgi:DigitalAdvertisingMember2022-01-012022-09-300001099160us-gaap:CorporateMember2022-12-310001099160srt:MaximumMemberus-gaap:MeasurementInputLongTermRevenueGrowthRateMember2023-07-012023-09-300001099160bbgi:GuaranteeDigitalLLCMember2022-06-222022-06-220001099160bbgi:OtherAdvertisingMember2023-07-012023-09-3000010991602023-09-3000010991602023-01-012023-09-3000010991602022-01-012022-09-300001099160bbgi:AudioMember2022-12-310001099160bbgi:DigitalAdvertisingMember2023-07-012023-09-300001099160us-gaap:SubsequentEventMemberbbgi:PromissoryNoteMember2023-10-012023-10-310001099160bbgi:TwoThousandSevenPlanMember2023-01-012023-09-300001099160srt:MinimumMember2022-04-012022-06-300001099160us-gaap:CorporateMember2022-07-012022-09-300001099160us-gaap:RelatedPartyMember2023-09-300001099160bbgi:AudioMember2023-07-012023-09-300001099160bbgi:OtherAdvertisingMember2022-07-012022-09-300001099160bbgi:TwoThousandSevenPlanMembersrt:MinimumMember2023-01-012023-09-300001099160bbgi:AudioAdvertisingMember2023-01-012023-09-300001099160us-gaap:CommonClassBMember2022-12-310001099160bbgi:PromissoryNoteMember2022-04-012022-06-300001099160us-gaap:GoodwillMemberus-gaap:MeasurementInputDiscountRateMemberbbgi:PhiladelphiaPaMarketClusterMember2023-01-012023-09-300001099160bbgi:TwoThousandSevenPlanMemberus-gaap:CommonClassAMember2023-09-300001099160bbgi:PromissoryNoteMember2022-07-012022-09-3000010991602022-06-3000010991602022-12-3100010991602021-12-3100010991602023-06-300001099160us-gaap:LicenseMember2023-09-300001099160us-gaap:CommonClassAMember2023-10-270001099160us-gaap:CommonClassBMember2023-09-300001099160us-gaap:SellingAndMarketingExpenseMember2022-07-012022-09-300001099160bbgi:FccLicenseMember2023-04-012023-06-300001099160us-gaap:NonrelatedPartyMember2023-09-300001099160us-gaap:AllOtherSegmentsMember2022-01-012022-09-300001099160us-gaap:GeneralAndAdministrativeExpenseMember2022-07-012022-09-300001099160bbgi:TwoThousandSevenPlanMember2023-09-300001099160bbgi:BbgiGuaranteeDigitalLLCMember2023-09-300001099160bbgi:DigitalMember2023-07-012023-09-300001099160us-gaap:LicensingAgreementsMember2023-07-012023-09-300001099160us-gaap:StockCompensationPlanMember2023-01-012023-09-300001099160srt:MinimumMember2023-07-012023-09-300001099160srt:MaximumMemberus-gaap:MeasurementInputLongTermRevenueGrowthRateMemberus-gaap:GoodwillMemberbbgi:PhiladelphiaPaMarketClusterMember2023-01-012023-09-300001099160bbgi:DigitalMember2022-12-310001099160srt:MaximumMember2023-07-012023-09-300001099160us-gaap:MeasurementInputDiscountRateMember2022-04-012022-06-3000010991602022-07-012022-09-300001099160bbgi:DigitalMember2022-07-012022-09-300001099160bbgi:PhiladelphiaPaMarketClusterMember2023-01-012023-09-300001099160us-gaap:SellingAndMarketingExpenseMember2022-01-012022-09-300001099160bbgi:TwoThousandSevenPlanMembersrt:MaximumMember2023-01-012023-09-300001099160us-gaap:CommonClassAMember2022-12-310001099160bbgi:DigitalAdvertisingMember2022-07-012022-09-300001099160us-gaap:AllOtherSegmentsMember2023-09-300001099160bbgi:SecuredNotesMember2023-09-300001099160bbgi:AudioMember2022-01-012022-09-300001099160us-gaap:AllOtherSegmentsMember2022-07-012022-09-300001099160bbgi:AudioAdvertisingMember2022-01-012022-09-300001099160us-gaap:CommonClassBMember2023-10-270001099160bbgi:AudioMember2023-01-012023-09-300001099160bbgi:AtlantaGAMemberbbgi:WWWEAMMember2023-09-112023-09-110001099160bbgi:TwoThousandSevenPlanMemberus-gaap:RestrictedStockUnitsRSUMember2023-07-012023-09-300001099160us-gaap:GoodwillMemberbbgi:PhiladelphiaPaMarketClusterMember2023-01-012023-09-300001099160bbgi:AudioMember2022-07-012022-09-300001099160bbgi:DigitalMember2023-01-012023-09-300001099160bbgi:BostonMaRadioMarketClusterMember2023-01-012023-09-300001099160us-gaap:StockCompensationPlanMember2022-01-012022-09-300001099160us-gaap:GeneralAndAdministrativeExpenseMember2022-01-012022-09-300001099160bbgi:AudioMember2023-09-300001099160us-gaap:AllOtherSegmentsMember2023-07-012023-09-3000010991602023-07-012023-09-300001099160us-gaap:PropertyPlantAndEquipmentMember2023-09-300001099160bbgi:FortMayersNaplesFlLasvegasLvAndWilmingtonMemberus-gaap:LicensingAgreementsMember2022-04-012022-06-300001099160srt:MinimumMemberus-gaap:MeasurementInputLongTermRevenueGrowthRateMemberus-gaap:GoodwillMemberbbgi:PhiladelphiaPaMarketClusterMember2023-01-012023-09-300001099160srt:MinimumMemberus-gaap:MeasurementInputLongTermRevenueGrowthRateMember2023-07-012023-09-300001099160bbgi:OtherAdvertisingMember2023-01-012023-09-300001099160us-gaap:SellingAndMarketingExpenseMember2023-01-012023-09-300001099160bbgi:AudioAdvertisingMember2022-07-012022-09-300001099160us-gaap:CommonClassAMember2023-09-300001099160bbgi:EightPointSixTwoFivePercentSeniorSecuredNotesDue2026Member2021-02-020001099160bbgi:BostonMaRadioMarketClusterMemberus-gaap:MeasurementInputDiscountRateMemberus-gaap:GoodwillMember2023-01-012023-09-300001099160srt:MaximumMemberbbgi:BostonMaRadioMarketClusterMemberus-gaap:MeasurementInputLongTermRevenueGrowthRateMemberus-gaap:GoodwillMember2023-01-012023-09-300001099160srt:MaximumMemberus-gaap:MeasurementInputLongTermRevenueGrowthRateMember2022-04-012022-06-300001099160bbgi:PromissoryNoteMember2023-04-012023-06-300001099160us-gaap:RelatedPartyMember2022-12-310001099160us-gaap:GeneralAndAdministrativeExpenseMember2023-01-012023-09-300001099160us-gaap:NonrelatedPartyMember2022-12-310001099160us-gaap:FairValueInputsLevel2Member2023-09-300001099160srt:MaximumMember2022-04-012022-06-300001099160us-gaap:CorporateMember2023-09-300001099160bbgi:TwoThousandSevenPlanMemberus-gaap:RestrictedStockUnitsRSUMember2023-09-300001099160bbgi:PhiladelphiaPaMarketClusterMember2023-07-012023-09-300001099160bbgi:DigitalMember2023-09-300001099160bbgi:FortMayersNaplesFlLasvegasLvAndWilmingtonMember2023-01-012023-09-300001099160us-gaap:CorporateMember2022-01-012022-09-3000010991602022-09-300001099160us-gaap:AllOtherSegmentsMember2022-12-310001099160bbgi:BostonMaRadioMarketClusterMember2022-04-012022-06-300001099160bbgi:DigitalAdvertisingMember2023-01-012023-09-300001099160us-gaap:StockCompensationPlanMember2023-07-012023-09-300001099160bbgi:DigitalMember2022-01-012022-09-300001099160us-gaap:GeneralAndAdministrativeExpenseMember2023-07-012023-09-300001099160us-gaap:MeasurementInputDiscountRateMember2023-07-012023-09-300001099160bbgi:TwoThousandSevenPlanMemberus-gaap:RestrictedStockUnitsRSUMember2023-06-300001099160us-gaap:CorporateMember2023-07-012023-09-300001099160srt:MaximumMemberbbgi:BostonMaRadioMarketClusterMemberus-gaap:GoodwillMember2023-01-012023-09-300001099160bbgi:SecuredNotesMember2022-12-310001099160srt:MinimumMemberbbgi:BostonMaRadioMarketClusterMemberus-gaap:MeasurementInputLongTermRevenueGrowthRateMemberus-gaap:GoodwillMember2023-01-012023-09-30xbrli:purexbrli:sharesiso4217:USD

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_______________

FORM 10-Q

|

|

[X] |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Quarterly Period Ended September 30, 2023

OR

|

|

[ ] |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 000-29253

BEASLEY BROADCAST GROUP, INC.

(Exact Name of Registrant as Specified in Its Charter)

|

|

Delaware |

65-0960915 |

(State or other jurisdiction of |

(I.R.S. Employer |

incorporation or organization) |

Identification No.) |

3033 Riviera Drive, Suite 200

Naples, Florida 34103

(Address of Principal Executive Offices and Zip Code)

(239) 263-5000

(Registrant's Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of Each Class |

Trading Symbol |

Name of Each Exchange on which Registered |

Class A Common Stock, par value $0.001 per share |

BBGI |

Nasdaq Global Market |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

Large accelerated filer |

|

Accelerated filer |

Non-accelerated filer |

|

Smaller reporting company |

Emerging growth company |

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes No

Indicate the number of shares outstanding of each of the issuer's classes of common stock, as of the latest practicable date.

Class A Common Stock, $0.001 par value, 13,303,369 Shares Outstanding as of October 27, 2023

Class B Common Stock, $0.001 par value, 16,662,743 Shares Outstanding as of October 27, 2023

INDEX

BEASLEY BROADCAST GROUP, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED)

|

|

|

|

|

|

|

|

|

|

|

December 31, |

|

|

September 30, |

|

|

|

2022 |

|

|

2023 |

|

ASSETS |

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

39,534,653 |

|

|

$ |

29,665,464 |

|

Accounts receivable, less allowance for credit losses of $1,876,751 in 2022 and

$1,803,068 in 2023 |

|

|

56,683,526 |

|

|

|

47,686,751 |

|

Prepaid expenses |

|

|

5,078,231 |

|

|

|

10,636,324 |

|

Other current assets |

|

|

4,364,120 |

|

|

|

3,331,191 |

|

Total current assets |

|

|

105,660,530 |

|

|

|

91,319,730 |

|

Property and equipment, net |

|

|

55,807,047 |

|

|

|

52,479,386 |

|

Operating lease right-of-use assets |

|

|

38,478,756 |

|

|

|

36,629,732 |

|

Finance lease right-of-use assets |

|

|

306,667 |

|

|

|

296,667 |

|

FCC licenses |

|

|

487,249,798 |

|

|

|

393,976,500 |

|

Goodwill |

|

|

13,265,460 |

|

|

|

2,683,100 |

|

Other intangibles, net |

|

|

8,219,939 |

|

|

|

7,493,876 |

|

Assets held for sale |

|

|

- |

|

|

|

4,827,864 |

|

Other assets |

|

|

5,955,158 |

|

|

|

4,674,332 |

|

Total assets |

|

$ |

714,943,355 |

|

|

$ |

594,381,187 |

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

19,344,621 |

|

|

$ |

15,379,755 |

|

Operating lease liabilities |

|

|

8,166,394 |

|

|

|

8,342,355 |

|

Other current liabilities |

|

|

29,183,630 |

|

|

|

24,624,951 |

|

Total current liabilities |

|

|

56,694,645 |

|

|

|

48,347,061 |

|

Due to related parties |

|

|

85,731 |

|

|

|

62,697 |

|

Long-term debt, net of unamortized debt issuance costs |

|

|

285,472,107 |

|

|

|

283,612,363 |

|

Operating lease liabilities |

|

|

37,485,602 |

|

|

|

35,180,442 |

|

Deferred tax liabilities |

|

|

98,068,981 |

|

|

|

71,090,989 |

|

Other long-term liabilities |

|

|

13,647,481 |

|

|

|

13,639,276 |

|

Total liabilities |

|

|

491,454,547 |

|

|

|

451,932,828 |

|

Commitments and contingencies |

|

|

|

|

|

|

Stockholders' equity: |

|

|

|

|

|

|

Preferred stock, $0.001 par value; 10,000,000 shares authorized; none issued |

|

|

- |

|

|

|

- |

|

Class A common stock, $0.001 par value; 150,000,000 shares authorized; 16,763,227

issued and 13,113,659 outstanding in 2022; 17,025,209 issued and 13,303,369

outstanding in 2023 |

|

|

16,761 |

|

|

|

17,023 |

|

Class B common stock, $0.001 par value; 75,000,000 shares authorized; 16,662,743

issued and outstanding in 2022 and 2023 |

|

|

16,662 |

|

|

|

16,662 |

|

Additional paid-in capital |

|

|

151,948,310 |

|

|

|

152,481,469 |

|

Treasury stock, Class A common stock; 3,649,568 shares in 2022; 3,721,840 shares

in 2023 |

|

|

(29,155,300 |

) |

|

|

(29,225,138 |

) |

Retained earnings |

|

|

100,163,064 |

|

|

|

18,659,032 |

|

Accumulated other comprehensive income |

|

|

499,311 |

|

|

|

499,311 |

|

Total stockholders' equity |

|

|

223,488,808 |

|

|

|

142,448,359 |

|

Total liabilities and stockholders' equity |

|

$ |

714,943,355 |

|

|

$ |

594,381,187 |

|

3

BEASLEY BROADCAST GROUP, INC.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS) (UNAUDITED)

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

|

2022 |

|

|

2023 |

|

Net revenue |

|

$ |

63,823,288 |

|

|

$ |

60,119,757 |

|

Operating expenses: |

|

|

|

|

|

|

Operating expenses (including stock-based compensation of $60,892 in 2022

and $37,041 in 2023 and excluding depreciation and amortization shown

separately below) |

|

|

51,511,699 |

|

|

|

50,117,044 |

|

Corporate expenses (including stock-based compensation of $209,202 in 2022

and $140,773 in 2023) |

|

|

5,132,362 |

|

|

|

4,493,277 |

|

Depreciation and amortization |

|

|

2,456,646 |

|

|

|

2,201,664 |

|

FCC licenses impairment losses |

|

|

- |

|

|

|

78,204,065 |

|

Goodwill impairment loss |

|

|

- |

|

|

|

10,582,360 |

|

Total operating expenses |

|

|

59,100,707 |

|

|

|

145,598,410 |

|

Operating income (loss) |

|

|

4,722,581 |

|

|

|

(85,478,653 |

) |

Non-operating income (expense): |

|

|

|

|

|

|

Interest expense |

|

|

(6,621,540 |

) |

|

|

(6,445,746 |

) |

Other income, net |

|

|

1,166,430 |

|

|

|

1,106,918 |

|

Loss before income taxes |

|

|

(732,529 |

) |

|

|

(90,817,481 |

) |

Income tax benefit |

|

|

(1,252,669 |

) |

|

|

(23,299,388 |

) |

Income (loss) before equity in earnings of unconsolidated affiliates |

|

|

520,140 |

|

|

|

(67,518,093 |

) |

Equity in earnings of unconsolidated affiliates, net of tax |

|

|

(22,072 |

) |

|

|

(18,744 |

) |

Net income (loss) |

|

|

498,068 |

|

|

|

(67,536,837 |

) |

Net income (loss) per Class A and Class B common share: |

|

|

|

|

|

|

Basic and diluted |

|

$ |

0.02 |

|

|

$ |

(2.25 |

) |

Weighted average shares outstanding: |

|

|

|

|

|

|

Basic |

|

|

29,546,324 |

|

|

|

29,962,613 |

|

Diluted |

|

|

29,715,361 |

|

|

|

29,962,613 |

|

4

BEASLEY BROADCAST GROUP, INC.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS (UNAUDITED)

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended September 30, |

|

|

|

2022 |

|

|

2023 |

|

Net revenue |

|

$ |

184,354,006 |

|

|

$ |

181,360,600 |

|

Operating expenses: |

|

|

|

|

|

|

Operating expenses (including stock-based compensation of $214,483 in 2022

and $109,261 in 2023 and excluding depreciation and amortization shown

separately below) |

|

|

155,147,840 |

|

|

|

152,098,261 |

|

Corporate expenses (including stock-based compensation of $661,691 in 2022

and $424,160 in 2023) |

|

|

13,933,292 |

|

|

|

13,381,403 |

|

Depreciation and amortization |

|

|

7,423,648 |

|

|

|

6,626,974 |

|

FCC licenses impairment losses |

|

|

4,619,772 |

|

|

|

88,245,065 |

|

Goodwill impairment losses |

|

|

5,856,551 |

|

|

|

10,582,360 |

|

Total operating expenses |

|

|

186,981,103 |

|

|

|

270,934,063 |

|

Operating loss |

|

|

(2,627,097 |

) |

|

|

(89,573,463 |

) |

Non-operating income (expense): |

|

|

|

|

|

|

Interest expense |

|

|

(20,293,794 |

) |

|

|

(19,764,067 |

) |

Other income, net |

|

|

1,357,512 |

|

|

|

1,684,168 |

|

Loss before income taxes |

|

|

(21,563,379 |

) |

|

|

(107,653,362 |

) |

Income tax benefit |

|

|

(3,874,646 |

) |

|

|

(26,285,207 |

) |

Loss before equity in earnings of unconsolidated affiliates |

|

|

(17,688,733 |

) |

|

|

(81,368,155 |

) |

Equity in earnings of unconsolidated affiliates, net of tax |

|

|

141,154 |

|

|

|

(135,877 |

) |

Net loss |

|

|

(17,547,579 |

) |

|

|

(81,504,032 |

) |

|

|

|

|

|

|

|

Net loss per Class A and Class B common share: |

|

|

|

|

|

|

Basic and diluted |

|

$ |

(0.60 |

) |

|

$ |

(2.73 |

) |

Weighted average shares outstanding: |

|

|

|

|

|

|

Basic and diluted |

|

|

29,445,998 |

|

|

|

29,867,820 |

|

5

BEASLEY BROADCAST GROUP, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended September 30, |

|

|

|

2022 |

|

|

2023 |

|

Cash flows from operating activities: |

|

|

|

|

|

|

Net loss |

|

$ |

(17,547,579 |

) |

|

$ |

(81,504,032 |

) |

Adjustments to reconcile net loss to net cash provided by (used in) operating activities: |

|

|

|

|

|

|

Stock-based compensation |

|

|

876,174 |

|

|

|

533,421 |

|

Provision for credit losses |

|

|

853,938 |

|

|

|

1,006,830 |

|

Depreciation and amortization |

|

|

7,423,648 |

|

|

|

6,626,974 |

|

FCC licenses impairment losses |

|

|

4,619,772 |

|

|

|

88,245,065 |

|

Goodwill impairment losses |

|

|

5,856,551 |

|

|

|

10,582,360 |

|

Amortization of loan fees |

|

|

1,123,935 |

|

|

|

1,097,214 |

|

Gain on debt purchases |

|

|

(1,131,346 |

) |

|

|

(973,208 |

) |

Deferred income taxes |

|

|

(4,232,949 |

) |

|

|

(26,977,992 |

) |

Equity in earnings of unconsolidated affiliates |

|

|

(141,154 |

) |

|

|

135,877 |

|

Change in operating assets and liabilities: |

|

|

|

|

|

|

Accounts receivable |

|

|

5,827,751 |

|

|

|

7,989,945 |

|

Prepaid expenses |

|

|

(5,925,056 |

) |

|

|

(5,558,093 |

) |

Other assets |

|

|

(1,890,763 |

) |

|

|

2,572,946 |

|

Accounts payable |

|

|

5,822,312 |

|

|

|

(3,964,866 |

) |

Other liabilities |

|

|

808,125 |

|

|

|

(4,887,810 |

) |

Other operating activities |

|

|

(51,972 |

) |

|

|

70,484 |

|

Net cash provided by (used in) operating activities |

|

|

2,291,387 |

|

|

|

(5,004,885 |

) |

Cash flows from investing activities: |

|

|

|

|

|

|

Payment for acquisition |

|

|

(2,000,000 |

) |

|

|

- |

|

Capital expenditures |

|

|

(11,218,937 |

) |

|

|

(3,060,716 |

) |

Proceeds from dispositions |

|

|

1,185,312 |

|

|

|

250,000 |

|

Net cash used in investing activities |

|

|

(12,033,625 |

) |

|

|

(2,810,716 |

) |

Cash flows from financing activities: |

|

|

|

|

|

|

Payments on debt |

|

|

(8,677,500 |

) |

|

|

(1,983,750 |

) |

Reduction of finance lease liabilities |

|

|

(1,945 |

) |

|

|

- |

|

Purchase of treasury stock |

|

|

(108,091 |

) |

|

|

(69,838 |

) |

Net cash used in financing activities |

|

|

(8,787,536 |

) |

|

|

(2,053,588 |

) |

Net decrease in cash and cash equivalents |

|

|

(18,529,774 |

) |

|

|

(9,869,189 |

) |

Cash and cash equivalents at beginning of period |

|

|

51,378,642 |

|

|

|

39,534,653 |

|

Cash and cash equivalents at end of period |

|

$ |

32,848,868 |

|

|

$ |

29,665,464 |

|

Cash paid for interest |

|

$ |

25,564,611 |

|

|

$ |

24,946,655 |

|

Cash paid for income taxes |

|

$ |

1,547,500 |

|

|

$ |

1,353,057 |

|

6

BEASLEY BROADCAST GROUP, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

(1)Interim Financial Statements

The accompanying unaudited condensed consolidated financial statements should be read in conjunction with the consolidated financial statements of Beasley Broadcast Group, Inc. and its subsidiaries (the “Company”) included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022. These financial statements have been prepared in accordance with U.S. generally accepted accounting principles (“GAAP”) for interim financial information and with the instructions to Form 10-Q and Article 10 of Regulation S-X. Accordingly, they do not include all of the information and footnotes required by GAAP for complete financial statements. In the opinion of management, the financial statements reflect all adjustments necessary for a fair statement of the financial position and results of operations for the interim periods presented, and all such adjustments are of a normal and recurring nature. The Company’s results are subject to seasonal fluctuations; therefore, the results shown on an interim basis are not necessarily indicative of results for the full year.

(2)Summary of Significant Accounting Policies

Use of Estimates

Preparing financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the period. Such estimates include: (i) the amount of allowance for credit losses; (ii) future cash flows used for testing recoverability of property and equipment; (iii) fair values used for testing Federal Communications Commission (“FCC”) licenses, goodwill and other intangibles for impairment; (iv) estimates used to determine the incremental borrowing rate to record lease liabilities and related right-of-use assets; (v) the realization of deferred tax assets; and (vi) actuarial assumptions related to the Supplemental Employee Retirement Plan. Actual results and outcomes may differ from management’s estimates and assumptions.

Accounts Receivable

Accounts receivable consist primarily of uncollected amounts due from advertisers for the sale of advertising airtime. The amounts are net of advertising agency commissions and an allowance for credit losses. The allowance for credit losses reflects management’s estimate of expected losses in accounts receivable from local advertisers and national agencies. Management determines the allowance based on historical information, relative improvements or deteriorations in the age of the accounts receivable and changes in current economic conditions and reasonable and supportable forecasts of future economic conditions. Interest is not accrued on accounts receivable.

The changes in allowance for credit losses on accounts receivable are as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended September 30, |

|

|

Nine months ended September 30, |

|

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

Beginning balance |

|

$ |

1,648,342 |

|

|

$ |

1,848,595 |

|

|

$ |

1,720,477 |

|

|

$ |

1,876,751 |

|

Provision for credit losses |

|

|

265,187 |

|

|

|

481,016 |

|

|

|

853,938 |

|

|

|

1,006,830 |

|

Deductions |

|

|

(274,559 |

) |

|

|

(526,543 |

) |

|

|

(935,445 |

) |

|

|

(1,080,513 |

) |

Ending balance |

|

$ |

1,638,970 |

|

|

$ |

1,803,068 |

|

|

$ |

1,638,970 |

|

|

$ |

1,803,068 |

|

Recent Accounting Pronouncements

In June 2016, the Financial Accounting Standards Board (“FASB”) issued guidance that will require the measurement of all expected credit losses for financial assets, including accounts receivable, held at the reporting date based on historical experience, current conditions, and reasonable and supportable forecasts. The guidance was initially effective for the Company for annual reporting periods beginning after December 15, 2019, and interim periods within those fiscal years. In November 2019, the FASB issued additional guidance that included a deferral of the effective date for smaller reporting companies as defined by the Securities and Exchange Commission to fiscal years beginning after December 15, 2022, and interim periods within those years. The Company

7

BEASLEY BROADCAST GROUP, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

adopted the guidance on January 1, 2023, and the adoption did not have a material impact on the Company’s condensed consolidated financial statements.

(3)Acquisition and Dispositions

On October 5, 2023, the Company completed the sale of substantially all of the assets used in the operations of WJBR-FM in Wilmington, DE to a third party for $5.0 million in cash. During the second quarter of 2023, due to the potential sale of these assets, the Company recorded an impairment loss of $10.0 million related to the FCC license. The Company no longer has operations in the Wilmington, DE market after completion of the disposition. However, management determined that the disposition did not represent a strategic shift that would have a significant effect on the Company’s operation and financial results, therefore the operations in the Wilmington, DE market have not been reported as discontinued operations. A summary of assets held for sale as of September 30, 2023 is as follows:

|

|

|

|

|

Property and equipment, net |

|

$ |

77,064 |

|

FCC licenses |

|

|

4,750,800 |

|

|

|

$ |

4,827,864 |

|

On September 11, 2023, the Company completed the sale of substantially all of the assets used in the operations of WWWE-AM in Atlanta, GA to a third party for $250,000 in cash.

On June 22, 2022, the Company completed the acquisition of Guarantee Digital, LLC (“Guarantee”), a digital marketing agency, for $2.0 million in cash. The acquisition was accounted for as a business combination. The purchase price allocation is summarized as follows:

|

|

|

|

|

Property and equipment |

|

$ |

3,000 |

|

Goodwill |

|

|

922,000 |

|

Other intangibles |

|

|

1,075,000 |

|

|

|

$ |

2,000,000 |

|

Goodwill was equal to the amount the purchase price exceeded the values allocated to the tangible and identifiable intangible assets and includes the value of the assembled workforce. The goodwill was allocated to the Digital segment. The $0.9 million allocated to goodwill is deductible for tax purposes. Revenue and earnings for Guarantee are not material for all reporting periods presented in the accompanying condensed consolidated financial statements.

On April 1, 2022, the Company completed the sale of substantially all of the assets used in the operations of WWNN-AM in West Palm Beach-Boca Raton, FL to a third party for $1.25 million in cash. As a result of the sale, the Company recorded an impairment loss of $1.9 million related to the FCC license during the first quarter of 2022.

Changes in the carrying amount of FCC licenses for the nine months ended September 30, 2023 are as follows:

|

|

|

|

|

Balance as of January 1, 2023 |

|

$ |

487,249,798 |

|

Impairment losses (see below and also Note 3) |

|

|

(88,245,065 |

) |

Radio station disposition (see Note 3) |

|

|

(277,433 |

) |

Assets held for sale reclassification |

|

|

(4,750,800 |

) |

Balance as of September 30, 2023 |

|

$ |

393,976,500 |

|

FCC licenses are tested for impairment on an annual basis, or more frequently if events or changes in circumstances indicate that the FCC licenses might be impaired. The Company assesses qualitative factors to determine whether it is more likely than not that its FCC licenses are impaired. If the Company determines it is more likely than not that its FCC licenses are impaired, then the Company is required to perform the quantitative impairment test. The quantitative impairment test compares the fair value of the FCC licenses with the carrying amounts of such licenses. If the carrying amounts of the FCC licenses exceed the fair value, an impairment loss is recognized in an amount equal to that excess. For the purpose of testing FCC licenses for impairment, the Company combines its

8

BEASLEY BROADCAST GROUP, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

licenses into reporting units based on its market clusters. The FCC license valuations are Level 3 non-recurring fair value measurements.

Due to an increase in interest rates in the U.S. economy and a decrease in projected revenues, the Company tested its FCC licenses for impairment during the third quarter of 2023. As a result of the quantitative impairment tests performed as of September 30, 2023, the Company recorded impairment losses of $78.2 million related to the FCC licenses in each of its market clusters. The impairment losses were primarily due to an increase in the discount rate due to certain risks associated with the U.S. economy and a decrease in the projected revenues in each market cluster used in the discounted cash flow analyses to estimate the fair values of the FCC licenses.

The fair values of the FCC licenses in each of the market clusters were estimated using an income approach. The income approach is based upon discounted cash flow analyses incorporating variables such as projected radio market revenues, projected growth rate for radio market revenues, projected radio market revenue shares, projected radio station operating income margins, and a discount rate appropriate for the radio broadcasting industry. The key assumptions used in the discounted cash flow analyses are as follows:

|

|

|

Revenue growth rates |

|

(1.2)% - 1.8% |

Market revenue shares at maturity |

|

0.4% - 44.7% |

Operating income margins at maturity |

|

19.7% - 30.4% |

Discount rate |

|

10.0% |

Due to an increase in interest rates in the U.S. economy, the Company tested its FCC licenses for impairment during the second quarter of 2022. As a result of the quantitative impairment tests performed as of June 30, 2022, the Company recorded impairment losses of $2.8 million related to the FCC licenses in its Fort Myers-Naples, FL, Las Vegas, NV, and Wilmington, DE market clusters. The impairment losses were primarily due to an increase in the discount rate used in the discounted cash flow analyses to estimate the fair values of the FCC licenses due to certain risks associated with the U.S. economy.

The fair values of the FCC licenses in the Fort Myers-Naples, FL, Las Vegas, NV, and Wilmington, DE market clusters were estimated using an income approach. The income approach is based upon discounted cash flow analyses incorporating variables such as projected radio market revenues, projected growth rate for radio market revenues, projected radio market revenue shares, projected radio station operating income margins, and a discount rate appropriate for the radio broadcasting industry. The key assumptions used in the discounted cash flow analyses are as follows:

|

|

|

Revenue growth rates |

|

(1.9)% - 15.9% |

Market revenue shares at maturity |

|

0.6% - 44.0% |

Operating income margins at maturity |

|

19.2% - 32.6% |

Discount rate |

|

9.5% |

Changes in the carrying amount of goodwill for the nine months ended September 30, 2023 are as follows:

|

|

|

|

|

Balance as of January 1, 2023 |

|

$ |

13,265,460 |

|

Impairment losses (see below) |

|

|

(10,582,360 |

) |

Balance as of September 30, 2023 |

|

$ |

2,683,100 |

|

Goodwill is tested for impairment on an annual basis, or more frequently if events or changes in circumstances indicate that the Company’s goodwill might be impaired. The Company assesses qualitative factors to determine whether it is necessary to perform a quantitative assessment for each reporting unit. If the quantitative assessment is necessary, the Company will determine the fair value of each reporting unit. If the fair value of any reporting unit is less than the carrying amount, the Company will recognize an impairment charge for the amount by which the carrying amount exceeds the reporting unit’s fair value. The loss recognized will not exceed the total amount of goodwill allocated to the reporting unit. For the purpose of testing goodwill for impairment, the Company has identified its radio market clusters and esports as its reporting units. The goodwill valuation is a Level 3 non-recurring fair value measurement.

Due to an increase in interest rates in the U.S. economy and a decrease in projected revenues, the Company tested its goodwill for impairment during the third quarter of 2023. As a result of the quantitative impairment test performed as of September 30, 2023, the

9

BEASLEY BROADCAST GROUP, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

Company recorded an impairment loss of $10.6 million related to the goodwill in its Philadelphia, PA market cluster. The impairment loss was primarily due to an increase in the discount rate due to certain risks associated with the U.S. economy and a decrease in the projected revenues used in the discounted cash flow analysis to estimate the fair value of the goodwill.

The fair value of the goodwill in the Philadelphia, PA market cluster was estimated using an income approach. The income approach is based upon a discounted cash flow analysis incorporating variables such as projected radio market revenues, projected growth rate for radio market revenues, projected radio market revenue shares, projected radio station operating income margins, and a discount rate appropriate for the radio broadcasting industry. The key assumptions used in the discounted cash flow analysis are as follows:

|

|

|

Revenue growth rates |

|

(9.3)% - 1.4% |

Operating income margin |

|

27.9% |

Discount rate |

|

10.0% |

Due to an increase in interest rates in the U.S. economy, the Company tested its goodwill for impairment during the second quarter of 2022. As a result of the quantitative impairment test performed as of June 30, 2022, the Company recorded impairment losses of $5.9 million related to the goodwill in its Boston, MA, Charlotte, NC, Fayetteville, NC, Fort Myers-Naples, FL and Tampa-Saint Petersburg, FL market clusters. The impairment losses were primarily due to an increase in the discount rate used in the discounted cash flow analyses to estimate the fair value of goodwill due to certain risks associated with the U.S. economy.

The fair values of goodwill in the Boston, MA, Charlotte, NC, Fayetteville, NC, Fort Myers-Naples, FL, and Tampa-Saint Petersburg, FL market clusters were estimated using an income approach. The income approach is based upon discounted cash flow analyses incorporating variables such as projected radio market revenues, projected growth rate for radio market revenues, projected radio market revenue shares, projected radio station operating income margins, and a discount rate appropriate for the radio broadcasting industry. The key assumptions used in the discounted cash flow analyses are as follows:

|

|

|

Revenue growth rates |

|

(1.9)% - 11.1% |

Operating income margins |

|

5.4% - 29.8% |

Discount rate |

|

9.5% |

Long-term debt is comprised of the following:

|

|

|

|

|

|

|

|

|

|

|

December 31, |

|

|

September 30, |

|

|

|

2022 |

|

|

2023 |

|

Secured notes |

|

$ |

290,000,000 |

|

|

$ |

287,000,000 |

|

Less unamortized debt issuance costs |

|

|

(4,527,893 |

) |

|

|

(3,387,637 |

) |

|

|

$ |

285,472,107 |

|

|

$ |

283,612,363 |

|

On February 2, 2021, the Company issued $300.0 million aggregate principal amount of 8.625% senior secured notes due on February 1, 2026 (the “Notes”) under an indenture dated February 2, 2021 (the “Indenture”). Interest on the Notes accrues at the rate of 8.625% per annum and is payable semiannually in arrears on February 1 and August 1 of each year. The Notes are secured on a first-lien priority basis by substantially all assets of the Company and its majority-owned subsidiaries and are guaranteed jointly and severally by the Company and its majority-owned subsidiaries. The Indenture contains restrictive covenants that limit the ability of the Company and its subsidiaries to, among other things, incur additional indebtedness, guarantee indebtedness or issue disqualified stock or, in the case of such subsidiaries, preferred stock; pay dividends on, repurchase or make distributions in respect of our capital stock or make other restricted payments; make certain investments or acquisitions; sell, transfer or otherwise convey certain assets; create liens; enter into agreements restricting certain subsidiaries’ ability to pay dividends or make other intercompany transfers; consolidate, merge, sell or otherwise dispose of all or substantially all of its assets; enter into transactions with affiliates; prepay certain kinds of indebtedness; and issue or sell stock of its subsidiaries. Prior to February 1, 2025, the Company will be subject to certain premiums, as defined in the Indenture, for optional or mandatory (upon certain contingent events) redemption of some or all of the Notes.

In October 2023, the Company purchased $10.0 million principal amount of the Notes for a price equal to 63% of the principal amount and recorded a gain of $3.6 million as a result of the purchase. In the second quarter of 2023, the Company purchased $3.0

10

BEASLEY BROADCAST GROUP, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

million principal amount of the Notes for a price equal to 66% of the principal amount and recorded a gain of $1.0 million as a result of the purchase.

In the third quarter of 2022, the Company purchased $5.0 million aggregate principal amount of the Notes for an aggregate price equal to 77% of the principal amount and recorded an aggregate gain of $1.0 million as a result of the purchases. In the second quarter of 2022, the Company purchased $5.0 million aggregate principal amount of the Notes for an aggregate price equal to 96% of the principal amount and recorded an aggregate gain of $0.1 million as a result of the purchases.

The changes in stockholders’ equity are as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended September 30, |

|

|

Nine months ended September 30, |

|

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

Beginning balance |

|

$ |

245,537,024 |

|

|

$ |

209,809,453 |

|

|

$ |

263,082,298 |

|

|

$ |

223,488,808 |

|

Stock-based compensation |

|

|

270,094 |

|

|

|

177,814 |

|

|

|

876,174 |

|

|

|

533,421 |

|

Adjustment from related party transaction |

|

|

(6,573 |

) |

|

|

- |

|

|

|

(6,573 |

) |

|

|

- |

|

Purchase of treasury stock |

|

|

(2,384 |

) |

|

|

(2,071 |

) |

|

|

(108,091 |

) |

|

|

(69,838 |

) |

Net income (loss) |

|

|

498,068 |

|

|

|

(67,536,837 |

) |

|

|

(17,547,579 |

) |

|

|

(81,504,032 |

) |

Other comprehensive loss |

|

|

(12,442 |

) |

|

|

- |

|

|

|

(12,442 |

) |

|

|

- |

|

Ending balance |

|

$ |

246,283,787 |

|

|

$ |

142,448,359 |

|

|

$ |

246,283,787 |

|

|

$ |

142,448,359 |

|

Net revenue is comprised of the following:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended September 30, |

|

|

Nine months ended September 30, |

|

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

Audio |

|

$ |

52,995,670 |

|

|

$ |

48,332,715 |

|

|

$ |

153,778,711 |

|

|

$ |

146,198,774 |

|

Digital |

|

|

10,241,671 |

|

|

|

11,177,881 |

|

|

|

28,769,331 |

|

|

|

33,455,935 |

|

Other |

|

|

585,947 |

|

|

|

609,161 |

|

|

|

1,805,964 |

|

|

|

1,705,891 |

|

|

|

$ |

63,823,288 |

|

|

$ |

60,119,757 |

|

|

$ |

184,354,006 |

|

|

$ |

181,360,600 |

|

The Company recognizes revenue when it satisfies a performance obligation under a contract with an advertiser. The transaction price is allocated to performance obligations based on executed contracts which represent relative standalone selling prices. Payment is generally due within 30 days, although certain advertisers are required to pay in advance. Revenues are reported at the amount the Company expects to be entitled to receive under the contract. The Company has elected to use the practical expedient to expense sales commissions as incurred. Payments received from advertisers before the performance obligation is satisfied are recorded as deferred revenue in the balance sheets. Substantially all deferred revenue is recognized within 12 months of the payment date.

|

|

|

|

|

|

|

|

|

|

|

December 31, |

|

|

September 30, |

|

|

|

2022 |

|

|

2023 |

|

Deferred revenue |

|

$ |

4,696,989 |

|

|

$ |

5,356,521 |

|

Audio revenue includes revenue from the sale or trade of aired commercial spots to advertisers directly or through advertising agencies. Each commercial spot is considered a performance obligation. Revenue is recognized when the commercial spots have aired. Trade sales are recorded at the estimated fair value of the goods or services received. If commercial spots are aired before the goods or services are received, then a trade sales receivable is recorded. If goods or services are received before the commercial spots are aired, then a trade sales payable is recorded. Other revenue includes revenue from concerts, promotional events, talent fees and other miscellaneous items. Such revenue is generally recognized when the concert, promotional event, or talent services are completed.

11

BEASLEY BROADCAST GROUP, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

|

|

|

|

|

|

|

|

|

|

|

December 31, |

|

|

September 30, |

|

|

|

2022 |

|

|

2023 |

|

Trade sales receivable |

|

$ |

1,564,054 |

|

|

$ |

2,032,871 |

|

Trade sales payable |

|

|

806,162 |

|

|

|

823,879 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended September 30, |

|

|

Nine months ended September 30, |

|

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

Trade sales revenue |

|

$ |

1,481,948 |

|

|

$ |

1,441,228 |

|

|

$ |

4,358,626 |

|

|

$ |

4,288,722 |

|

Digital revenue includes revenue from the sale of streamed commercial spots, station-owned assets and third-party products. Each streamed commercial spot, station-owned asset and third-party product is considered a performance obligation. Revenue is recognized when the commercial spots have streamed. Station-owned assets are generally scheduled over a period of time and revenue is recognized over time as the digital items are used for advertising content, except for streamed commercial spots. Third-party products are generally scheduled over a period of time with an impression target each month. Revenue from the sale of third-party products is recognized over time as the digital items are used for advertising content and impression targets are met each month.

(9)Stock-Based Compensation

The Beasley Broadcast Group, Inc. 2007 Equity Incentive Award Plan (the “2007 Plan”) permits the Company to issue up to 7.5 million shares of Class A common stock. The 2007 Plan allows for eligible employees, directors and certain consultants of the Company to receive restricted stock units, shares of restricted stock, stock options or other stock-based awards. The restricted stock units that have been granted under the 2007 Plan generally vest over one to five years of service.

A summary of restricted stock unit activity is presented below:

|

|

|

|

|

|

|

|

|

|

|

Units |

|

|

Weighted-Average Grant-Date Fair Value |

|

Unvested as of July 1, 2023 |

|

|

878,850 |

|

|

$ |

1.63 |

|

Granted |

|

|

- |

|

|

|

- |

|

Vested |

|

|

(8,333 |

) |

|

|

2.01 |

|

Forfeited |

|

|

- |

|

|

|

- |

|

Unvested as of September 30, 2023 |

|

|

870,517 |

|

|

$ |

1.62 |

|

As of September 30, 2023, there was $0.9 million of total unrecognized compensation cost for restricted stock units granted under the 2007 Plan. That cost is expected to be recognized over a weighted-average period of 2.1 years.

The Company’s effective tax rate was (171)% and (26)% for the three months ended September 30, 2022 and 2023, respectively, and (18)% and (24)% for the nine months ended September 30, 2022 and 2023, respectively. These rates differ from the federal statutory rate of 21% due to the effect of state income taxes and certain expenses that are not deductible for tax purposes.

12

BEASLEY BROADCAST GROUP, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

Earnings per share calculation information is as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended September 30, |

|

|

Nine months ended September 30, |

|

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

Net income (loss) attributable to BBGI stockholders |

|

$ |

498,068 |

|

|

$ |

(67,536,837 |

) |

|

$ |

(17,547,579 |

) |

|

$ |

(81,504,032 |

) |

Weighted-average shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

29,546,324 |

|

|

|

29,962,613 |

|

|

|

29,445,998 |

|

|

|

29,867,820 |

|

Effect of dilutive restricted stock units and restricted stock |

|

|

169,037 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

Diluted |

|

|

29,715,361 |

|

|

|

29,962,613 |

|

|

|

29,445,998 |

|

|

|

29,867,820 |

|

Net income (loss) attributable to BBGI stockholders per

Class A and Class B common share – basic and diluted |

|

$ |

0.02 |

|

|

$ |

(2.25 |

) |

|

$ |

(0.60 |

) |

|

$ |

(2.73 |

) |

The Company excluded the effect of restrictive stock units and restricted stock under the treasury stock method when reporting a net loss as the addition of shares was anti-dilutive. As a result, the Company excluded 76,147 shares for the three months ended September 30, 2023, and 219,222 shares and 83,315 shares for the nine months ended September 30, 2022 and 2023, respectively.

(12)Financial Instruments

The carrying amount of the Company’s financial instruments, including cash and cash equivalents, accounts receivable and accounts payable, approximates fair value due to the short-term nature of these financial instruments.

The estimated fair value of the Notes, based on available market information, was $174.0 million and $180.1 million as of December 31, 2022 and September 30, 2023, respectively. The Company used Level 2 measurements under the fair value measurement hierarchy to determine the estimated fair value of the Notes.

The Company currently operates three operating segments (Audio, Digital, esports) and two reportable segments (Audio, Digital). The identification of segments is consistent with how the segments report to and are managed by the Company’s Chief Executive Officer (the Company’s Chief Operating Decision Maker). The Audio segment generates revenue primarily from the sale of commercial advertising to customers of the Company’s stations in the following markets: Atlanta, GA, Augusta, GA, Boston, MA, Charlotte, NC, Detroit, MI, Fayetteville, NC, Fort Myers-Naples, FL, Las Vegas, NV, Middlesex, NJ, Monmouth, NJ, Morristown, NJ, Philadelphia, PA, and Tampa-Saint Petersburg, FL. The Digital segment generates revenue primarily from the sale of digital advertising to customers of the Company’s stations and other advertisers throughout the United States. Corporate includes general and administrative expenses and certain other income and expense items not allocated to the operating segments. Non-operating corporate items including interest expense and income taxes, are reported in the accompanying condensed consolidated statements of comprehensive income (loss).

Reportable segment information for the three months ended September 30, 2023 is as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Audio |

|

|

Digital |

|

|

Other |

|

|

Corporate |

|

|

Total |

|

Net revenue |

|

$ |

48,332,715 |

|

|

$ |

11,177,881 |

|

|

$ |

609,161 |

|

|

$ |

- |

|

|

$ |

60,119,757 |

|

Operating expenses |

|

|

38,932,340 |

|

|

|

10,110,593 |

|

|

|

1,074,111 |

|

|

|

- |

|

|

|

50,117,044 |

|

Corporate expenses |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

4,493,277 |

|

|

|

4,493,277 |

|

Depreciation and amortization |

|

|

1,741,376 |

|

|

|

47,397 |

|

|

|

199,979 |

|

|

|

212,912 |

|

|

|

2,201,664 |

|

FCC licenses impairment losses |

|

|

78,204,065 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

78,204,065 |

|

Goodwill impairment loss |

|

|

10,582,360 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

10,582,360 |

|

Operating income (loss) |

|

$ |

(81,127,426 |

) |

|

$ |

1,019,891 |

|

|

$ |

(664,929 |

) |

|

$ |

(4,706,189 |

) |

|

$ |

(85,478,653 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Audio |

|

|

Digital |

|

|

Other |

|

|

Corporate |

|

|

Total |

|

Capital expenditures |

|

$ |

1,026,120 |

|

|

$ |

1,594 |

|

|

$ |

- |

|

|

$ |

16,817 |

|

|

$ |

1,044,531 |

|

13

BEASLEY BROADCAST GROUP, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

Reportable segment information for the three months ended September 30, 2022 is as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Audio |

|

|

Digital |

|

|

Other |

|

|

Corporate |

|

|

Total |

|

Net revenue |

|

$ |

52,995,670 |

|

|

$ |

10,241,671 |

|

|

$ |

585,947 |

|

|

$ |

- |

|

|

$ |

63,823,288 |

|

Operating expenses |

|

|

42,456,844 |

|

|

|

8,237,262 |

|

|

|

817,593 |

|

|

|

- |

|

|

|

51,511,699 |

|

Corporate expenses |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

5,132,362 |

|

|

|

5,132,362 |

|

Depreciation and amortization |

|

|

1,520,168 |

|

|

|

47,882 |

|

|

|

699,969 |

|

|

|

188,627 |

|

|

|

2,456,646 |

|

Operating income (loss) |

|

$ |

9,018,658 |

|

|

$ |

1,956,527 |

|

|

$ |

(931,615 |

) |

|

$ |

(5,320,989 |

) |

|

$ |

4,722,581 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Audio |

|

|

Digital |

|

|

Other |

|

|

Corporate |

|

|

Total |

|

Capital expenditures |

|

$ |

4,517,127 |

|

|

$ |

25,959 |

|

|

$ |

- |

|

|

$ |

191,949 |

|

|

$ |

4,735,035 |

|

Reportable segment information for the nine months ended September 30, 2023 is as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Audio |

|

|

Digital |

|

|

Other |

|

|

Corporate |

|

|

Total |

|

Net revenue |

|

$ |

146,198,774 |

|

|

$ |

33,455,935 |

|

|

$ |

1,705,891 |

|

|

$ |

- |

|

|

$ |

181,360,600 |

|

Operating expenses |

|

|

118,200,967 |

|

|

|

30,804,774 |

|

|

|

3,092,520 |

|

|

|

- |

|

|

|

152,098,261 |

|

Corporate expenses |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

13,381,403 |

|

|

|

13,381,403 |

|

Depreciation and amortization |

|

|

5,253,581 |

|

|

|

141,364 |

|

|

|

595,746 |

|

|

|

636,283 |

|

|

|

6,626,974 |

|

FCC licenses impairment losses |

|

|

88,245,065 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

88,245,065 |

|

Goodwill impairment loss |

|

|

10,582,360 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

10,582,360 |

|

Operating income (loss) |

|

$ |

(76,083,199 |

) |

|

$ |

2,509,797 |

|

|

$ |

(1,982,375 |

) |

|

$ |

(14,017,686 |

) |

|

$ |

(89,573,463 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Audio |

|

|

Digital |

|

|

Other |

|

|

Corporate |

|

|

Total |

|

Capital expenditures |

|

$ |

2,975,897 |

|

|

$ |

13,184 |

|

|

$ |

25,534 |

|

|

$ |

46,101 |

|

|

$ |

3,060,716 |

|

Reportable segment information for the nine months ended September 30, 2022 is as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Audio |

|

|

Digital |

|

|

Other |

|

|

Corporate |

|

|

Total |

|

Net revenue |

|

$ |

153,778,711 |

|

|

$ |

28,769,331 |

|

|

$ |

1,805,964 |

|

|

$ |

- |

|

|

$ |

184,354,006 |

|

Operating expenses |

|

|

126,507,373 |

|

|

|

25,810,560 |

|

|

|

2,829,907 |

|

|

|

- |

|

|

|

155,147,840 |

|

Corporate expenses |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

13,933,292 |

|

|

|

13,933,292 |

|

Depreciation and amortization |

|

|

4,706,333 |

|

|

|

56,959 |

|

|

|

2,096,270 |

|

|

|

564,086 |

|

|

|

7,423,648 |

|

FCC licenses impairment losses |

|

|

4,619,772 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

4,619,772 |

|

Goodwill impairment losses |

|

|

5,856,551 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

5,856,551 |

|

Operating income (loss) |

|

$ |

12,088,682 |

|

|

$ |

2,901,812 |

|

|

$ |

(3,120,213 |

) |

|

$ |

(14,497,378 |

) |

|

$ |

(2,627,097 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Audio |

|

|

Digital |

|

|

Other |

|

|

Corporate |

|

|

Total |

|

Capital expenditures |

|

$ |

10,738,350 |

|

|

$ |

36,785 |

|

|

$ |

59,084 |

|

|

$ |

398,693 |

|

|

$ |

11,232,912 |

|

Reportable segment information as of September 30, 2023 is as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Audio |

|

|

Digital |

|

|

Other |

|

|

Corporate |

|

|

Total |

|

Property and equipment, net |

|

$ |

49,202,607 |

|

|

$ |

102,950 |

|

|

$ |

79,095 |

|

|

$ |

3,094,734 |

|

|

$ |

52,479,386 |

|

FCC licenses |

|

|

393,976,500 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

393,976,500 |

|

Goodwill |

|

|

- |

|

|

|

922,000 |

|

|

|

1,761,100 |

|

|

|

- |

|

|

|

2,683,100 |

|

Other intangibles, net |

|

|

1,741,182 |

|

|

|

874,315 |

|

|

|

4,698,716 |

|

|

|

179,663 |

|

|

|

7,493,876 |

|

Assets held for sale |

|

|

4,827,864 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

4,827,864 |

|

14

BEASLEY BROADCAST GROUP, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

Reportable segment information as of December 31, 2022 is as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Audio |

|

|

Digital |

|

|

Other |

|

|

Corporate |

|

|

Total |

|

Property and equipment, net |

|

$ |

51,941,687 |

|

|

$ |

112,693 |

|

|

$ |

67,751 |

|

|

$ |

3,684,916 |

|

|

$ |

55,807,047 |

|

FCC licenses |

|

|

487,249,798 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

487,249,798 |

|

Goodwill |

|

|

10,582,360 |

|

|

|

922,000 |

|

|

|

1,761,100 |

|

|

|

- |

|

|

|

13,265,460 |

|

Other intangibles, net |

|

|

1,841,001 |

|

|

|

992,752 |

|

|

|

5,206,523 |

|

|

|

179,663 |

|

|

|

8,219,939 |

|

15

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

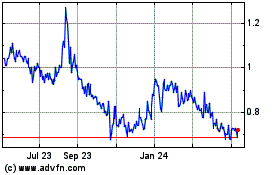

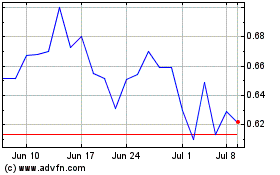

General

We are a multi-platform media company whose primary business is operating radio stations throughout the United States. We offer local and national advertisers integrated marketing solutions across audio, digital and event platforms. We own and operate stations in the following markets: Atlanta, GA, Augusta, GA, Boston, MA, Charlotte, NC, Detroit, MI, Fayetteville, NC, Fort Myers-Naples, FL, Las Vegas, NV, Middlesex, NJ, Monmouth, NJ, Morristown, NJ, Philadelphia, PA, and Tampa-Saint Petersburg, FL. We refer to each group of stations in each market as a market cluster. Unless the context otherwise requires, all references in this report to the “Company,” “we,” “us” or “our” are to Beasley Broadcast Group, Inc. and its subsidiaries.

Cautionary Note Regarding Forward-Looking Statements

This report contains “forward-looking statements” about the Company within the meaning of the Private Securities Litigation Reform Act of 1995, which relate to future, not past, events. All statements other than statements of historical fact included in this document are forward-looking statements. These forward-looking statements are based on the current beliefs and expectations of the Company’s management and are subject to known and unknown risks and uncertainties. Forward-looking statements, which address the Company’s expected business and financial performance and financial condition, among other matters, contain words such as: “expects,” “anticipates,” “intends,” “plans,” “believes,” “estimates,” “may,” “will,” “plans,” “projects,” “could,” “should,” “would,” “seek,” “forecast,” or other similar expressions.

Forward-looking statements, by their nature, address matters that are, to different degrees, uncertain. Although the Company believes the expectations reflected in such forward-looking statements are based upon reasonable assumptions, it can give no assurance that the expectations will be attained or that any deviation will not be material. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they are made. The Company undertakes no obligation to update or revise any forward-looking statements.

Forward-looking statements involve a number of risks and uncertainties, and actual results or events may differ materially from those projected or implied in those statements. Factors that could cause actual results or events to differ materially from these forward-looking statements include, but are not limited to:

•external economic forces and conditions that could have a material adverse impact on the Company’s advertising revenues and results of operations;

•the ability of the Company’s stations to compete effectively in their respective markets for advertising revenues;

•the ability of the Company to develop compelling and differentiated digital content, products and services;

•audience acceptance of the Company’s content, particularly its audio programs;

•the ability of the Company to respond to changes in technology, standards and services that affect the audio industry;

•the Company’s dependence on federally issued licenses subject to extensive federal regulation;

•actions by the FCC or new legislation affecting the audio industry;

•increases to royalties the Company pays to copyright owners or the adoption of legislation requiring royalties to be paid to record labels and recording artists;

•the Company’s dependence on selected market clusters of stations for a material portion of its net revenue;

•credit risk on the Company’s accounts receivable;

•the risk that the Company’s FCC licenses and/or goodwill could become impaired;

16

•the Company’s substantial debt levels and the potential effect of restrictive debt covenants on the Company’s operational flexibility and ability to pay dividends;

•the potential effects of hurricanes on the Company’s corporate offices and stations;

•the failure or destruction of the internet, satellite systems and transmitter facilities that the Company depends upon to distribute its programming;

•disruptions or security breaches of the Company’s information technology infrastructure and information systems;

•the loss of key personnel;

•the Company’s ability to integrate acquired businesses and achieve fully the strategic and financial objectives related thereto and their impact on the Company’s financial condition and results of operations;

•the fact that the Company is controlled by the Beasley family, which creates difficulties for any attempt to gain control of the Company;

•the Company's ability to comply with the continued listing standards of the Nasdaq Global Market; and

•other economic, business, competitive, and regulatory factors affecting the businesses of the Company, including those set forth in the Company’s filings with the SEC.