Banner Corporation (NASDAQ GSM: BANR) ("Banner"), the parent

company of Banner Bank and Islanders Bank, today reported net

income of $39.6 million, or $1.15 per diluted share, in the third

quarter of 2019, compared to $39.7 million, or $1.14 per diluted

share, in the preceding quarter and a 5% increase when compared to

$37.8 million, or $1.17 per diluted share, in the third quarter of

2018. Third quarter of 2019 results include $676,000 of

acquisition-related expenses, compared to $301,000 of

acquisition-related expenses in the preceding quarter and $1.0

million in the third quarter of 2018. In the first nine

months of 2019, net income increased 14% to $112.6 million, or

$3.23 per diluted share, compared to $99.0 million, or $3.05 per

diluted share, in the first nine months a year ago. The 2019

results include $3.1 million of acquisition-related expenses

compared to $1.0 million of acquisition-related expenses for the

2018 period.

“Our third quarter 2019 performance continues to

demonstrate the success of our super community bank model which is

based on responsive service that generates client loyalty and

attracts new client relationships," stated Mark J. Grescovich,

President and Chief Executive Officer. “We recently announced

the pending acquisition of AltaPacific Bancorp, the holding company

for AltaPacific Bank. This transaction will increase Banner’s

presence in California by adding attractive core deposits and

new commercial banking relationships within our existing geographic

footprint.”

At September 30, 2019, Banner Corporation had

$12.10 billion in assets, $8.74 billion in net loans and $9.73

billion in deposits. Banner operates 172 branch offices,

including branch offices located in eight of the top 20 largest

western Metropolitan Statistical Areas by population.

Third Quarter 2019

Highlights

- Revenues decreased 1% to $137.5 million, compared to $139.4

million in the preceding quarter and increased 6% compared to

$129.5 million in the third quarter a year ago.

- Net interest income, before the provision for loan losses, was

$116.6 million, compared to $116.7 million in the preceding quarter

and increased 7% from $109.1 million in the third quarter a year

ago.

- Net interest margin was 4.25%, compared to 4.38% in the

preceding quarter and 4.48% in the third quarter a year ago.

- Mortgage banking revenue increased to $6.6 million, compared to

$5.9 million in the preceding quarter and increased 14% compared to

$5.8 million in the third quarter a year ago.

- Return on average assets was 1.31% compared to 1.36% in the

preceding quarter and 1.43% in the third quarter a year ago.

- Net loans receivable increased to $8.74 billion at September

30, 2019, compared to $8.65 billion at June 30, 2019, and increased

13% when compared to $7.73 billion at September 30, 2018.

- Non-performing assets remained low at $18.6 million, or 0.15%

of total assets, at September 30, 2019, compared to $21.0 million,

or 0.18% of total assets three months earlier, and $16.7 million,

or 0.16% of total assets, at September 30, 2018.

- Provision for loan losses was $2.0 million, and the allowance

for loan losses was $97.8 million, or 1.11% of total loans

receivable, as of September 30, 2019.

- Core deposits increased 4% to $8.51 billion at September 30,

2019, compared to $8.22 billion at June 30, 2019 and increased 13%

compared to $7.51 billion a year ago. Core deposits

represented 87% of total deposits at September 30, 2019.

- Quarterly dividends to shareholders were $0.41 per share.

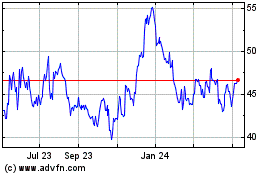

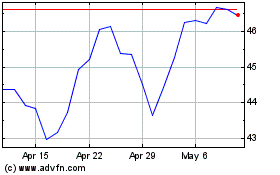

- Common shareholders’ equity per share increased 2% to $44.80 at

September 30, 2019, compared to $43.99 at the preceding quarter end

and an increase of 14% from $39.26 a year ago.

- Tangible common shareholders' equity per share* increased 2% to

$34.10 at September 30, 2019, compared to $33.36 at the preceding

quarter end and an increase of 9% from $31.20 a year ago.

- Repurchased 400,000 shares of common stock at an average cost

of $54.62 per share.

*Tangible common shareholders' equity per share

and the ratio of tangible common equity to tangible assets (both of

which exclude goodwill and other intangible assets, net), and

references to adjusted revenue (which excludes fair value

adjustments and net gain (loss) on the sale of securities from the

total of net interest income before provision for loan losses and

non-interest income) and the adjusted efficiency ratio (which

excludes acquisition-related expenses, amortization of core deposit

intangibles, real estate owned gain (loss) and state/municipal

taxes from non-interest expense divided by adjusted revenue)

represent non-GAAP (Generally Accepted Accounting Principles)

financial measures. Management has presented these non-GAAP

financial measures in this earnings release because it believes

that they provide useful and comparative information to assess

trends in Banner's core operations reflected in the current

quarter's results and facilitate the comparison of our performance

with the performance of our peers. Where applicable,

comparable earnings information using GAAP financial measures is

also presented. See also Non-GAAP Financial Measures

reconciliation tables on the last two pages of this press

release.

Certain reclassifications have been made to the

2018 Consolidated Financial Statements and/or schedules to conform

to the 2019 presentation. These reclassifications have

affected certain line items and ratios for the prior periods but

have not changed net income or shareholders’ equity for those

periods. The effect of these reclassifications is considered

immaterial.

Significant Recent Initiatives and

Events

On July 24, 2019, Banner and AltaPacific Bancorp

("AltaPacific"), the holding company for AltaPacific Bank, entered

into a definitive merger agreement pursuant to which Banner will

acquire AltaPacific in an all-stock transaction, subject to the

terms and conditions set forth therein. Under the merger

agreement, AltaPacific will merge with and into Banner, and

immediately thereafter AltaPacific Bank will merge with and into

Banner Bank. The merger agreement specifies AltaPacific

shareholders will receive 0.2712 shares of Banner common stock in

exchange for each share of AltaPacific common stock, subject to

potential adjustment as provided in the merger agreement. Based on

the closing price of $54.19 per share of Banner common stock on

July 23, 2019, the merger consideration would have an aggregate

value of approximately $87.4 million. The transaction is

expected to close in the fourth quarter of 2019, subject to

customary closing conditions.

AltaPacific Bank is an independent business bank

headquartered in Santa Rosa, California and has additional banking

offices in Glendora, Ontario, Riverside, San Bernardino and

Temecula, California. The bank is focused on meeting the

specialized needs of small to medium-sized businesses and

professionals throughout California. At September 30, 2019,

AltaPacific Bank had assets of $420 million, a loan portfolio of

$334 million, and a deposit base of $297 million. Banner

expects the transaction to be immediately accretive to earnings per

share, excluding one-time transaction expenses. The combined

company will have approximately $12.5 billion in assets.

Income Statement Review

Banner's net interest margin was 4.25% for the

third quarter of 2019, a 13 basis-point decrease compared to 4.38%

in the preceding quarter and a 23 basis-point decrease compared to

4.48% in the third quarter a year ago. The decrease in net

interest margin during the quarter reflects lower yields on average

interest-earning assets largely as a result of two 25 basis point

decreases in the targeted Fed Funds Rate in the third quarter

coupled with a longer term decline in the 10 year treasury

yield. Acquisition accounting adjustments added six basis

points to the net interest margin in the current quarter compared

to seven basis points in the preceding quarter and 12 basis points

in the third quarter a year ago. The total purchase discount

for acquired loans was $21.3 million at September 30, 2019,

compared to $22.6 million at June 30, 2019, and $15.4 million at

September 30, 2018. In the first nine months of the year,

Banner’s net interest margin was 4.33% compared to 4.41% in the

first nine months of 2018.

Average interest-earning asset yields decreased

12 basis points to 4.79% compared to 4.91% for the preceding

quarter and decreased four basis points compared to 4.83% in the

third quarter a year ago. Average loan yields decreased 13

basis points to 5.20% compared to 5.33% in the preceding quarter

and decreased 11 basis points compared to 5.31% in the third

quarter a year ago. Loan discount accretion added seven basis

points to loan yields in the third quarter of 2019, compared to

nine basis points in the preceding quarter, and 15 basis points in

the third quarter a year ago. Deposit costs were 0.42% in the

third quarter of 2019, a three basis-point increase compared to the

preceding quarter and a 17 basis-point increase compared to the

third quarter a year ago. The total cost of funds was 0.57%

during the third quarter of 2019, a one basis-point increase

compared to the preceding quarter and a 20 basis-point increase

compared to the third quarter a year ago.

Banner recorded a $2.0 million provision for

loan losses in the current quarter, the same as in the prior

quarter and the year ago quarter. The provision is primarily

a result of new loan originations, the renewal of acquired loans

out of the discounted acquired loan portfolio and net

charge-offs.

Total non-interest income was $20.9 million in

the third quarter of 2019, compared to $22.7 million in the second

quarter of 2019 and $20.4 million in the third quarter a year

ago. Deposit fees and other service charges were $10.3

million in the third quarter of 2019, compared to $14.0 million in

the preceding quarter and $12.3 million in the third quarter a year

ago. The decrease in deposit fees and other service charges

is primarily a result of Banner becoming subject to the Durbin

Amendment on July 1, 2019, which reduced the amount of interchange

fees Banner can charge for certain debit card transactions.

Mortgage banking revenues, including gains on one- to four-family

and multifamily loan sales and loan servicing fees, increased to

$6.6 million in the third quarter, compared to $5.9 million in the

preceding quarter and $5.8 million in the third quarter of

2018. The higher mortgage banking revenue reflected an

increase in residential and multifamily mortgage held-for-sale loan

production. The increase in residential held-for-sale loan

production was primarily due to increased refinance activity.

Home purchase activity accounted for 56% of one- to four-family

mortgage loan originations in the third quarter of 2019, compared

to 77% in the prior quarter and 82% in the third quarter of

2018. In the first nine months of 2019, total non-interest

income was $61.7 million, compared to $63.0 million in the first

nine months of 2018.

Banner’s third quarter 2019 results included a

$69,000 net loss for fair value adjustments as a result of changes

in the valuation of financial instruments carried at fair value,

principally comprised of certain investment securities held for

trading and a $2,000 net loss on the sale of securities. In

the preceding quarter, results included an $114,000 net loss for

fair value adjustments and a $28,000 net loss on the sale of

securities. In the third quarter a year ago, results included

a $45,000 net gain for fair value adjustments.

Total revenue was $137.5 million for the third

quarter of 2019, compared to $139.4 million in the preceding

quarter and increased 6% compared to $129.5 million in the third

quarter a year ago. Year-to-date, total revenue increased 9%

to $411.1 million compared to $376.5 million for the same period

one year earlier. Adjusted revenue* (the total of net

interest income before provision for loan losses and non-interest

income revenue excluding the net gain and loss on the sale of

securities and the net change in valuation of financial

instruments) was $137.6 million in the third quarter of 2019,

compared to $139.5 million in the preceding quarter and $129.4

million in the third quarter of 2018. In the first nine

months of the year, adjusted revenue* was $411.3 million, compared

to $372.9 million in the first nine months of 2018.

Banner’s total non-interest expense was $87.3

million in the third quarter of 2019, compared to $86.7 million in

the preceding quarter and $81.6 million in the third quarter of

2018. Acquisition-related expenses were $676,000 for the

third quarter of 2019, compared to $301,000 for the preceding

quarter, and $1.0 million in the third quarter of 2018. Other

non-interest expense items of significance for the third quarter of

2019 include a credit of $2.7 million for previously paid deposit

insurance premiums which resulted in a net deposit insurance

benefit of $1.6 million for the quarter, which came as a result of

the FDIC exceeding its stated Deposit Insurance Fund Reserve

Ratio. This net deposit insurance benefit compares to a

deposit insurance expense of $1.4 million in the preceding quarter

and a deposit insurance expense of $991,000 in the third quarter of

2018. The current quarter also includes a $1.6 million

adjustment to salary and employee benefits expense as a result of

Banner decreasing the discount rate used to calculate its liability

associated with deferred compensation plans. Year-to-date,

total non-interest expense was $264.0 million, compared to $246.0

million in the same period a year earlier. Banner’s

efficiency ratio was 63.50% for the current quarter, compared to

62.22% in the preceding quarter and 63.04% in the year ago

quarter. Banner’s adjusted efficiency ratio* was 60.71% for

the current quarter, compared to 59.56% in the preceding quarter

and 60.21% in the year ago quarter.

For the third quarter of 2019, Banner recorded

$8.6 million in state and federal income tax expense for an

effective tax rate of 17.9%, reflecting a refund of state income

taxes totaling $1.2 million as well as adjustments related to

filing its federal and state income tax returns and the benefits

from tax exempt income sources. Banner’s normal, expected

statutory income tax rate is 23.7%, representing a blend of the

statutory federal income tax rate of 21.0% and apportioned effects

of the state income tax rates.

Balance Sheet Review

Total assets increased to $12.10 billion at

September 30, 2019, compared to $11.85 billion at June 30, 2019,

and $10.51 billion at September 30, 2018. The total of

securities and interest-bearing deposits held at other banks was

$1.87 billion at both September 30, 2019 and June 30, 2019. The

total of securities and interest-bearing deposits held at other

banks was $1.76 billion at September 30, 2018. The average

effective duration of Banner's securities portfolio was

approximately 3.1 years at September 30, 2019, compared to 4.2

years at September 30, 2018.

Net loans receivable increased to $8.74 billion

at September 30, 2019, compared to $8.65 billion at June 30, 2019,

and increased 13% when compared to $7.73 billion at September 30,

2018. The year-over-year increase in net loans included

$631.7 million of portfolio loans acquired in the Skagit

acquisition during the fourth quarter of 2018. Commercial

real estate and multifamily real estate loans were $4.01 billion at

September 30, 2019, compared to $3.95 billion at June 30, 2019, and

increased 14% compared to $3.52 billion a year ago.

Commercial business loans increased modestly to $1.62 billion at

September 30, 2019, compared to $1.60 billion at June 30, 2019, and

increased 19% compared to $1.36 billion a year ago.

Agricultural business loans increased by 3% to $390.5 million at

September 30, 2019, compared to $380.8 million three months earlier

and increased by 9% compared to $360.0 million a year ago.

Total construction, land and land development loans were $1.08

billion at September 30, 2019, unchanged from June 30, 2019, and a

6% increase compared to $1.02 billion a year earlier.

Consumer loans decreased slightly to $779.6 million at September

30, 2019, compared to $790.0 million at June 30, 2019, and

increased 10% compared to $710.5 million a year ago. One- to

four-family loans increased modestly to $947.5 million at September

30, 2019, compared to $944.6 million at June 30, 2019, and

increased 12% compared to $849.9 million a year ago.

Loans held for sale increased substantially to

$244.9 million at September 30, 2019, compared to $170.7 million at

June 30, 2019, and $72.9 million at September 30, 2018. The

volume of one- to four- family residential mortgage loans sold was

$204.6 million in the current quarter, compared to $139.0 million

in the preceding quarter and $134.1 million in the third quarter a

year ago. During the third quarter of 2019, Banner sold $79.4

million in multifamily loans. Banner did not sell any

multifamily loans in the preceding quarter and sold $94.0 million

in the third quarter a year ago.

Total deposits increased 5% to $9.73 billion at

September 30, 2019, compared to $9.29 billion at June 30, 2019, and

increased 12% when compared to $8.69 billion a year ago.

Non-interest-bearing account balances increased 6% to $3.89 billion

at September 30, 2019, compared to $3.67 billion at June

30, 2019, and increased 12% compared to $3.47 billion a year

ago. Core deposits (non-interest-bearing and interest-bearing

transaction and savings accounts) increased 4% from the prior

quarter and increased 13% compared to a year ago. Core

deposits represented 87% of total deposits at September 30, 2019,

compared to 88% of total deposits at June 30, 2019, and 86% of

total deposits a year earlier. Certificates of deposit

increased 14% to $1.22 billion at September 30, 2019, compared to

$1.07 billion at June 30, 2019, and increased 3% compared to $1.18

billion a year earlier. The increase in certificates of

deposit primarily reflects the increase in brokered deposits to

$299.5 million at September 30, 2019, compared to $138.4 million at

June 30, 2019 and were $352.2 million a year ago. The

increase in brokered deposits reflects the decision to fund a

smaller portion of the balance sheet with FHLB borrowings.

FHLB borrowings were reduced to $382.0 million at September 30,

2019 compared to $606.0 million at June 30, 2019 and were $221.2

million a year earlier.

At September 30, 2019, total common

shareholders' equity was $1.53 billion, or 12.65% of assets,

compared to $1.52 billion or 12.84% of assets at June 30, 2019, and

$1.27 billion or 12.10% of assets a year ago. At September

30, 2019, tangible common shareholders' equity*, which excludes

goodwill and other intangible assets, net, was $1.17 billion, or

9.93% of tangible assets*, compared to $1.15 billion, or 10.05% of

tangible assets, at June 30, 2019, and $1.01 billion, or 9.86% of

tangible assets, a year ago. Banner's tangible book value per

share* increased to $34.10 at September 30, 2019, compared to

$31.20 per share a year ago.

Banner repurchased 400,000 shares of its common

stock in the third quarter of 2019 at an average cost of $54.62 per

share. In the second quarter of 2019, Banner repurchased

600,000 shares of its common stock at an average cost of $53.46 per

share. Banner and its subsidiary banks continue to maintain

capital levels in excess of the requirements to be categorized as

“well-capitalized” under the Basel III and Dodd Frank Act

regulatory standards. At September 30, 2019, Banner's common

equity Tier 1 capital ratio was 10.86%, its Tier 1 leverage capital

to average assets ratio was 10.70%, and its total capital to

risk-weighted assets ratio was 13.20%.

Credit Quality

The allowance for loan losses was $97.8 million

at September 30, 2019, or 1.11% of total loans receivable

outstanding and 536% of non-performing loans compared to $98.3

million at June 30, 2019, or 1.12% of total loans receivable

outstanding and 534% of non-performing loans, and $95.3 million at

September 30, 2018, or 1.22% of total loans receivable outstanding

and 603% of non-performing loans. Net loan charge-offs

totaled $2.5 million in the third quarter, compared to net loan

charge-offs of $1.1 million in the preceding quarter and net loan

charge-offs of $612,000 in the third quarter a year ago.

Primarily as a result of the origination of new loans, the renewal

of acquired loans out of the discounted acquired loan portfolio and

net charge-offs, Banner recorded a $2.0 million provision for loan

losses in the current quarter, which was the same amount as

recorded in the prior quarter and in the year ago quarter.

Non-performing loans were $18.3 million at September 30, 2019,

compared to $18.4 million at June 30, 2019, and $15.8 million a

year ago. Real estate owned and other repossessed assets were

$343,000 at September 30, 2019, compared to $2.6 million at June

30, 2019, and $937,000 a year ago.

In accordance with acquisition accounting, loans

acquired from acquisitions were recorded at their estimated fair

value, which resulted in a net discount to the loans’ contractual

amounts, a portion of which reflects a discount for possible credit

losses. Credit discounts are included in the determination of

fair value, and as a result, no allowance for loan losses is

recorded for acquired loans at the acquisition date. At

September 30, 2019, the total purchase discount for acquired loans

was $21.3 million.

Banner's total non-performing assets were $18.6

million, or 0.15% of total assets, at September 30, 2019, compared

to $21.0 million, or 0.18% of total assets, at June 30, 2019, and

$16.7 million, or 0.16% of total assets, a year ago. In

addition to non-performing assets, there were $12.6 million of

purchased credit-impaired loans at September 30, 2019, compared to

$12.9 million at both June 30, 2019 and September 30, 2018.

Conference Call

Banner will host a conference call on Thursday,

October 24, 2019, at 8:00 a.m. PDT, to discuss its third quarter

results. To listen to the call on-line, go to

www.bannerbank.com. Investment professionals are invited to

dial (866) 235-9915 to participate in the call. A replay will

be available for one week at (877) 344-7529 using access code

10135112, or at www.bannerbank.com.

About the Company

Banner Corporation is a $12.10 billion bank

holding company operating two commercial banks in four Western

states through a network of branches offering a full range of

deposit services and business, commercial real estate,

construction, residential, agricultural and consumer loans.

Visit Banner Bank on the Web at www.bannerbank.com.

Forward-Looking Statements

When used in this press release and in other

documents filed with or furnished to the Securities and Exchange

Commission (the “SEC”), in press releases or other public

stockholder communications, or in oral statements made with the

approval of an authorized executive officer, the words or phrases

"may," “believe,” “will,” “will likely result,” “are expected to,”

“will continue,” “is anticipated,” “estimate,” “project,” “plans,”

"potential," or similar expressions are intended to identify

“forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995. You are cautioned

not to place undue reliance on any forward-looking statements,

which speak only as of the date such statements are made and based

only on information then actually known to Banner. Banner

does not undertake and specifically disclaims any obligation to

revise any forward-looking statements to reflect the occurrence of

anticipated or unanticipated events or circumstances after the date

of such statements. These statements may relate to future

financial performance, strategic plans or objectives, revenues or

earnings projections, or other financial information. By

their nature, these statements are subject to numerous

uncertainties that could cause actual results to differ materially

from those anticipated in the statements and could negatively

affect Banner's operating and stock price performance.

Important factors that could cause actual

results to differ materially from the results anticipated or

projected include, but are not limited to, the following: (1)

expected revenues, cost savings, synergies and other benefits from

the proposed merger of Banner and AltaPacific might not be

realized within the expected time frames or at all and costs or

difficulties relating to integration matters, including but not

limited to customer and employee retention, might be greater than

expected; (2) the requisite regulatory approvals for the proposed

merger of Banner and AltaPacific may be delayed or may not be

obtained (or may result in the imposition of conditions that could

adversely affect the combined company or the expected benefits of

the proposed merger); (3) the requisite approval of AltaPacific

shareholders may be delayed or may not be obtained, the other

closing conditions to the merger may be delayed or may not be

obtained, or the merger agreement may be terminated; (4) business

disruption may occur following or in connection with the proposed

merger of Banner and AltaPacific; (5) Banner’s or AltaPacific’s

businesses may experience disruptions due to transaction-related

uncertainty or other factors making it more difficult to maintain

relationships with employees, customers, other business partners or

governmental entities; (6) the possibility that the proposed merger

is more expensive to complete than anticipated, including as a

result of unexpected factors or events; diversion of managements’

attention from ongoing business operations and opportunities as a

result of the proposed merger or otherwise; (7) the credit risks of

lending activities, including changes in the level and direction of

loan delinquencies and write-offs and changes in estimates of the

adequacy of the allowance for loan losses, which could necessitate

additional provisions for loan losses, resulting both from loans

originated and loans acquired from other financial institutions;

(8) results of examinations by regulatory authorities, including

the possibility that any such regulatory authority may, among other

things, require increases in the allowance for loan losses or

writing down of assets or impose restrictions or penalties with

respect to Banner's activities; (9) competitive pressures among

depository institutions; (10) interest rate movements and their

impact on customer behavior and net interest margin; (11) the

impact of repricing and competitors' pricing initiatives on loan

and deposit products; (12) fluctuations in real estate values; (13)

the ability to adapt successfully to technological changes to meet

customers' needs and developments in the market place; (14) the

ability to access cost-effective funding; (15) changes in financial

markets; (16) changes in economic conditions in general and in

Washington, Idaho, Oregon and California in particular; (17) the

costs, effects and outcomes of litigation; (18) legislation or

regulatory changes, including but not limited to the impact of the

Dodd-Frank Act and regulations adopted thereunder, changes in

regulatory capital requirements pursuant to the implementation of

the Basel III capital standards, other governmental initiatives

affecting the financial services industry and changes in federal

and/or state tax laws or interpretations thereof by taxing

authorities; (19) changes in accounting principles, policies or

guidelines; (20) future acquisitions by Banner of other depository

institutions or lines of business; (21) future goodwill impairment

due to changes in Banner\'s business, changes in market conditions,

or other factors; and (22) other economic, competitive,

governmental, regulatory, and technological factors affecting our

operations, pricing, products and services; and other risks

detailed from time to time in our filings with the Securities and

Exchange Commission including our Quarterly Reports on Form 10-Q

and our Annual Reports on Form 10-K.

| RESULTS OF

OPERATIONS |

|

Quarters Ended |

|

Nine Months Ended |

| (in thousands except shares and

per share data) |

|

Sep 30, 2019 |

|

Jun 30, 2019 |

|

Sep 30, 2018 |

|

Sep 30, 2019 |

|

Sep 30, 2018 |

| |

|

|

|

|

|

|

|

|

|

|

| INTEREST

INCOME: |

|

|

|

|

|

|

|

|

|

|

|

Loans receivable |

|

$ |

118,096 |

|

|

$ |

117,007 |

|

|

$ |

104,868 |

|

|

$ |

350,558 |

|

|

$ |

298,743 |

|

|

Mortgage-backed securities |

|

9,415 |

|

|

9,794 |

|

|

8,915 |

|

|

29,716 |

|

|

25,145 |

|

|

Securities and cash equivalents |

|

3,925 |

|

|

4,037 |

|

|

3,865 |

|

|

11,996 |

|

|

11,003 |

|

| |

|

131,436 |

|

|

130,838 |

|

|

117,648 |

|

|

392,270 |

|

|

334,891 |

|

| INTEREST

EXPENSE: |

|

|

|

|

|

|

|

|

|

|

|

Deposits |

|

10,014 |

|

|

9,023 |

|

|

5,517 |

|

|

27,680 |

|

|

13,139 |

|

|

Federal Home Loan Bank advances |

|

3,107 |

|

|

3,370 |

|

|

1,388 |

|

|

9,953 |

|

|

3,564 |

|

|

Other borrowings |

|

82 |

|

|

67 |

|

|

60 |

|

|

209 |

|

|

179 |

|

|

Junior subordinated debentures |

|

1,612 |

|

|

1,683 |

|

|

1,605 |

|

|

5,008 |

|

|

4,495 |

|

| |

|

14,815 |

|

|

14,143 |

|

|

8,570 |

|

|

42,850 |

|

|

21,377 |

|

|

Net interest income before provision for loan losses |

|

116,621 |

|

|

116,695 |

|

|

109,078 |

|

|

349,420 |

|

|

313,514 |

|

| PROVISION FOR LOAN

LOSSES |

|

2,000 |

|

|

2,000 |

|

|

2,000 |

|

|

6,000 |

|

|

6,000 |

|

|

Net interest income |

|

114,621 |

|

|

114,695 |

|

|

107,078 |

|

|

343,420 |

|

|

307,514 |

|

| NON-INTEREST

INCOME: |

|

|

|

|

|

|

|

|

|

|

|

Deposit fees and other service charges |

|

10,331 |

|

|

14,046 |

|

|

12,255 |

|

|

36,995 |

|

|

35,535 |

|

|

Mortgage banking operations |

|

6,616 |

|

|

5,936 |

|

|

5,816 |

|

|

15,967 |

|

|

15,324 |

|

|

Bank-owned life insurance |

|

1,076 |

|

|

1,123 |

|

|

1,726 |

|

|

3,475 |

|

|

3,511 |

|

|

Miscellaneous |

|

2,914 |

|

|

1,713 |

|

|

569 |

|

|

5,431 |

|

|

4,995 |

|

| |

|

20,937 |

|

|

22,818 |

|

|

20,366 |

|

|

61,868 |

|

|

59,365 |

|

|

Net (loss) gain on sale of securities |

|

(2 |

) |

|

(28 |

) |

|

— |

|

|

(29 |

) |

|

48 |

|

|

Net change in valuation of financial instruments carried at fair

value |

|

(69 |

) |

|

(114 |

) |

|

45 |

|

|

(172 |

) |

|

3,577 |

|

|

Total non-interest income |

|

20,866 |

|

|

22,676 |

|

|

20,411 |

|

|

61,667 |

|

|

62,990 |

|

| NON-INTEREST

EXPENSE: |

|

|

|

|

|

|

|

|

|

|

|

Salary and employee benefits |

|

59,090 |

|

|

55,629 |

|

|

48,930 |

|

|

169,359 |

|

|

150,491 |

|

|

Less capitalized loan origination costs |

|

(7,889 |

) |

|

(7,399 |

) |

|

(4,318 |

) |

|

(20,137 |

) |

|

(13,062 |

) |

|

Occupancy and equipment |

|

12,566 |

|

|

12,681 |

|

|

12,385 |

|

|

39,013 |

|

|

35,725 |

|

|

Information / computer data services |

|

5,657 |

|

|

5,273 |

|

|

4,766 |

|

|

16,256 |

|

|

13,711 |

|

|

Payment and card processing services |

|

4,330 |

|

|

4,041 |

|

|

3,748 |

|

|

12,355 |

|

|

11,179 |

|

|

Professional and legal expenses |

|

2,704 |

|

|

2,336 |

|

|

3,010 |

|

|

7,474 |

|

|

11,276 |

|

|

Advertising and marketing |

|

2,221 |

|

|

2,065 |

|

|

1,786 |

|

|

5,815 |

|

|

5,758 |

|

|

Deposit insurance (benefit) expense |

|

(1,604 |

) |

|

1,418 |

|

|

991 |

|

|

1,232 |

|

|

3,353 |

|

|

State/municipal business and use taxes |

|

1,011 |

|

|

1,007 |

|

|

902 |

|

|

2,963 |

|

|

2,430 |

|

|

Real estate operations |

|

126 |

|

|

260 |

|

|

433 |

|

|

263 |

|

|

553 |

|

|

Amortization of core deposit intangibles |

|

1,985 |

|

|

2,053 |

|

|

1,348 |

|

|

6,090 |

|

|

4,112 |

|

|

Miscellaneous |

|

6,435 |

|

|

7,051 |

|

|

6,646 |

|

|

20,230 |

|

|

19,444 |

|

|

|

|

86,632 |

|

|

86,415 |

|

|

80,627 |

|

|

260,913 |

|

|

244,970 |

|

|

Acquisition-related expenses |

|

676 |

|

|

301 |

|

|

1,005 |

|

|

3,125 |

|

|

1,005 |

|

|

Total non-interest expense |

|

87,308 |

|

|

86,716 |

|

|

81,632 |

|

|

264,038 |

|

|

245,975 |

|

|

Income before provision for income taxes |

|

48,179 |

|

|

50,655 |

|

|

45,857 |

|

|

141,049 |

|

|

124,529 |

|

| PROVISION

FOR INCOME TAXES |

|

8,602 |

|

|

10,955 |

|

|

8,084 |

|

|

28,426 |

|

|

25,542 |

|

| NET

INCOME |

|

$ |

39,577 |

|

|

$ |

39,700 |

|

|

$ |

37,773 |

|

|

$ |

112,623 |

|

|

$ |

98,987 |

|

| Earnings per share available

to common shareholders: |

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

1.15 |

|

|

$ |

1.14 |

|

|

$ |

1.17 |

|

|

$ |

3.24 |

|

|

$ |

3.06 |

|

|

Diluted |

|

$ |

1.15 |

|

|

$ |

1.14 |

|

|

$ |

1.17 |

|

|

$ |

3.23 |

|

|

$ |

3.05 |

|

| Cumulative dividends declared

per common share |

|

$ |

0.41 |

|

|

$ |

0.41 |

|

|

$ |

0.38 |

|

|

$ |

1.23 |

|

|

$ |

1.58 |

|

| Weighted average common shares

outstanding: |

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

34,407,462 |

|

|

34,831,047 |

|

|

32,256,789 |

|

|

34,760,607 |

|

|

32,300,688 |

|

|

Diluted |

|

34,497,994 |

|

|

34,882,359 |

|

|

32,376,623 |

|

|

34,850,006 |

|

|

32,406,414 |

|

| Decrease in common shares

outstanding |

|

(400,286 |

) |

|

(579,103 |

) |

|

(2,939 |

) |

|

(1,009,415 |

) |

|

(323,728 |

) |

|

FINANCIAL CONDITION |

|

|

|

|

|

|

|

|

|

Percentage Change |

| (in thousands except shares and

per share data) |

|

Sep 30, 2019 |

|

Jun 30, 2019 |

|

Dec 31, 2018 |

|

Sep 30, 2018 |

|

Prior Qtr |

|

Prior Yr Qtr |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and due from banks |

|

$ |

250,671 |

|

|

$ |

187,043 |

|

|

$ |

231,029 |

|

|

$ |

184,417 |

|

|

34.0 |

% |

|

35.9 |

% |

| Interest-bearing deposits |

|

73,785 |

|

|

59,753 |

|

|

41,167 |

|

|

64,244 |

|

|

23.5 |

% |

|

14.9 |

% |

|

Total cash and cash equivalents |

|

324,456 |

|

|

246,796 |

|

|

272,196 |

|

|

248,661 |

|

|

31.5 |

% |

|

30.5 |

% |

| Securities - trading |

|

25,672 |

|

|

25,741 |

|

|

25,896 |

|

|

25,764 |

|

|

(0.3 |

)% |

|

(0.4 |

)% |

| Securities - available for

sale |

|

1,539,908 |

|

|

1,561,009 |

|

|

1,636,223 |

|

|

1,412,273 |

|

|

(1.4 |

)% |

|

9.0 |

% |

| Securities - held to

maturity |

|

230,056 |

|

|

203,222 |

|

|

234,220 |

|

|

258,699 |

|

|

13.2 |

% |

|

(11.1 |

)% |

|

Total securities |

|

1,795,636 |

|

|

1,789,972 |

|

|

1,896,339 |

|

|

1,696,736 |

|

|

0.3 |

% |

|

5.8 |

% |

| Federal Home Loan Bank

stock |

|

25,623 |

|

|

34,583 |

|

|

31,955 |

|

|

19,196 |

|

|

(25.9 |

)% |

|

33.5 |

% |

| Loans held for sale |

|

244,889 |

|

|

170,744 |

|

|

171,031 |

|

|

72,850 |

|

|

43.4 |

% |

|

236.2 |

% |

| Loans receivable |

|

8,835,368 |

|

|

8,746,550 |

|

|

8,684,595 |

|

|

7,822,519 |

|

|

1.0 |

% |

|

12.9 |

% |

| Allowance for loan losses |

|

(97,801 |

) |

|

(98,254 |

) |

|

(96,485 |

) |

|

(95,263 |

) |

|

(0.5 |

)% |

|

2.7 |

% |

|

Net loans receivable |

|

8,737,567 |

|

|

8,648,296 |

|

|

8,588,110 |

|

|

7,727,256 |

|

|

1.0 |

% |

|

13.1 |

% |

| Accrued interest

receivable |

|

40,033 |

|

|

40,238 |

|

|

38,593 |

|

|

37,676 |

|

|

(0.5 |

)% |

|

6.3 |

% |

| Real estate owned held for

sale, net |

|

228 |

|

|

2,513 |

|

|

2,611 |

|

|

364 |

|

|

(90.9 |

)% |

|

(37.4 |

)% |

| Property and equipment,

net |

|

171,279 |

|

|

171,233 |

|

|

171,809 |

|

|

151,212 |

|

|

— |

% |

|

13.3 |

% |

| Goodwill |

|

339,154 |

|

|

339,154 |

|

|

339,154 |

|

|

242,659 |

|

|

— |

% |

|

39.8 |

% |

| Other intangibles, net |

|

26,610 |

|

|

28,595 |

|

|

32,924 |

|

|

18,499 |

|

|

(6.9 |

)% |

|

43.8 |

% |

| Bank-owned life insurance |

|

179,076 |

|

|

178,922 |

|

|

177,467 |

|

|

163,265 |

|

|

0.1 |

% |

|

9.7 |

% |

| Other assets |

|

213,291 |

|

|

196,328 |

|

|

149,128 |

|

|

135,929 |

|

|

8.6 |

% |

|

56.9 |

% |

|

Total assets |

|

$ |

12,097,842 |

|

|

$ |

11,847,374 |

|

|

$ |

11,871,317 |

|

|

$ |

10,514,303 |

|

|

2.1 |

% |

|

15.1 |

% |

|

LIABILITIES |

|

|

|

|

|

|

|

|

|

|

|

|

| Deposits: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-interest-bearing |

|

$ |

3,885,210 |

|

|

$ |

3,671,995 |

|

|

$ |

3,657,817 |

|

|

$ |

3,469,294 |

|

|

5.8 |

% |

|

12.0 |

% |

|

Interest-bearing transaction and savings accounts |

|

4,624,970 |

|

|

4,546,202 |

|

|

4,498,966 |

|

|

4,035,856 |

|

|

1.7 |

% |

|

14.6 |

% |

|

Interest-bearing certificates |

|

1,218,591 |

|

|

1,070,770 |

|

|

1,320,265 |

|

|

1,180,674 |

|

|

13.8 |

% |

|

3.2 |

% |

|

Total deposits |

|

9,728,771 |

|

|

9,288,967 |

|

|

9,477,048 |

|

|

8,685,824 |

|

|

4.7 |

% |

|

12.0 |

% |

| Advances from Federal Home

Loan Bank |

|

382,000 |

|

|

606,000 |

|

|

540,189 |

|

|

221,184 |

|

|

(37.0 |

)% |

|

72.7 |

% |

| Customer repurchase agreements

and other borrowings |

|

120,014 |

|

|

118,370 |

|

|

118,995 |

|

|

98,979 |

|

|

1.4 |

% |

|

21.3 |

% |

| Junior subordinated debentures

at fair value |

|

113,417 |

|

|

113,621 |

|

|

114,091 |

|

|

113,110 |

|

|

(0.2 |

)% |

|

0.3 |

% |

| Accrued expenses and other

liabilities |

|

181,351 |

|

|

159,131 |

|

|

102,061 |

|

|

82,530 |

|

|

14.0 |

% |

|

119.7 |

% |

| Deferred compensation |

|

41,354 |

|

|

40,230 |

|

|

40,338 |

|

|

40,478 |

|

|

2.8 |

% |

|

2.2 |

% |

|

Total liabilities |

|

10,566,907 |

|

|

10,326,319 |

|

|

10,392,722 |

|

|

9,242,105 |

|

|

2.3 |

% |

|

14.3 |

% |

| SHAREHOLDERS'

EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

| Common stock |

|

1,286,711 |

|

|

1,306,888 |

|

|

1,337,436 |

|

|

1,175,250 |

|

|

(1.5 |

)% |

|

9.5 |

% |

| Retained earnings |

|

203,704 |

|

|

178,257 |

|

|

134,055 |

|

|

109,942 |

|

|

14.3 |

% |

|

85.3 |

% |

| Other components of

shareholders' equity |

|

40,520 |

|

|

35,910 |

|

|

7,104 |

|

|

(12,994 |

) |

|

12.8 |

% |

|

nm |

|

|

Total shareholders' equity |

|

1,530,935 |

|

|

1,521,055 |

|

|

1,478,595 |

|

|

1,272,198 |

|

|

0.6 |

% |

|

20.3 |

% |

|

Total liabilities and shareholders' equity |

|

$ |

12,097,842 |

|

|

$ |

11,847,374 |

|

|

$ |

11,871,317 |

|

|

$ |

10,514,303 |

|

|

2.1 |

% |

|

15.1 |

% |

| Common Shares

Issued: |

|

|

|

|

|

|

|

|

|

|

|

|

| Shares outstanding at end of

period |

|

34,173,357 |

|

|

34,573,643 |

|

|

35,182,772 |

|

|

32,402,757 |

|

|

|

|

|

| Common shareholders' equity

per share (1) |

|

$ |

44.80 |

|

|

$ |

43.99 |

|

|

$ |

42.03 |

|

|

$ |

39.26 |

|

|

|

|

|

| Common shareholders' tangible

equity per share (1) (2) |

|

$ |

34.10 |

|

|

$ |

33.36 |

|

|

$ |

31.45 |

|

|

$ |

31.20 |

|

|

|

|

|

| Common shareholders' tangible

equity to tangible assets (2) |

|

9.93 |

% |

|

10.05 |

% |

|

9.62 |

% |

|

9.86 |

% |

|

|

|

|

| Consolidated Tier 1 leverage

capital ratio |

|

10.70 |

% |

|

10.83 |

% |

|

10.98 |

% |

|

11.04 |

% |

|

|

|

|

| |

|

(1) Calculation is based on number of common shares

outstanding at the end of the period rather than weighted average

shares outstanding. |

| (2) Common

shareholders' tangible equity excludes goodwill and other

intangible assets. Tangible assets exclude goodwill and other

intangible assets. These ratios represent non-GAAP financial

measures. See also Non-GAAP Financial Measures reconciliation

tables on the final two pages of the press release tables. |

| |

| ADDITIONAL FINANCIAL

INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

| (dollars in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Percentage Change |

| LOANS |

|

Sep 30, 2019 |

|

Jun 30, 2019 |

|

Dec 31, 2018 |

|

Sep 30, 2018 |

|

Prior Qtr |

|

Prior Yr Qtr |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Commercial real estate: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Owner occupied |

|

$ |

1,463,303 |

|

|

$ |

1,433,995 |

|

|

$ |

1,430,097 |

|

|

$ |

1,271,363 |

|

|

2.0 |

% |

|

15.1 |

% |

|

Investment properties |

|

2,150,938 |

|

|

2,116,306 |

|

|

2,131,059 |

|

|

1,943,793 |

|

|

1.6 |

% |

|

10.7 |

% |

| Multifamily real estate |

|

399,814 |

|

|

402,241 |

|

|

368,836 |

|

|

309,809 |

|

|

(0.6 |

)% |

|

29.1 |

% |

| Commercial construction |

|

190,532 |

|

|

172,931 |

|

|

172,410 |

|

|

154,071 |

|

|

10.2 |

% |

|

23.7 |

% |

| Multifamily construction |

|

214,878 |

|

|

189,160 |

|

|

184,630 |

|

|

172,433 |

|

|

13.6 |

% |

|

24.6 |

% |

| One- to four-family

construction |

|

488,945 |

|

|

503,061 |

|

|

534,678 |

|

|

498,549 |

|

|

(2.8 |

)% |

|

(1.9 |

)% |

| Land and land

development: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Residential |

|

163,829 |

|

|

187,180 |

|

|

188,508 |

|

|

171,610 |

|

|

(12.5 |

)% |

|

(4.5 |

)% |

|

Commercial |

|

26,119 |

|

|

27,470 |

|

|

27,278 |

|

|

22,382 |

|

|

(4.9 |

)% |

|

16.7 |

% |

| Commercial business |

|

1,619,391 |

|

|

1,598,788 |

|

|

1,483,614 |

|

|

1,358,149 |

|

|

1.3 |

% |

|

19.2 |

% |

| Agricultural business

including secured by farmland |

|

390,505 |

|

|

380,805 |

|

|

404,873 |

|

|

359,966 |

|

|

2.5 |

% |

|

8.5 |

% |

| One- to four-family real

estate |

|

947,475 |

|

|

944,617 |

|

|

973,616 |

|

|

849,928 |

|

|

0.3 |

% |

|

11.5 |

% |

| Consumer: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Consumer secured by one- to four-family real estate |

|

566,792 |

|

|

575,658 |

|

|

568,979 |

|

|

539,143 |

|

|

(1.5 |

)% |

|

5.1 |

% |

|

Consumer-other |

|

212,847 |

|

|

214,338 |

|

|

216,017 |

|

|

171,323 |

|

|

(0.7 |

)% |

|

24.2 |

% |

|

Total loans receivable |

|

$ |

8,835,368 |

|

|

$ |

8,746,550 |

|

|

$ |

8,684,595 |

|

|

$ |

7,822,519 |

|

|

1.0 |

% |

|

12.9 |

% |

| Restructured loans performing

under their restructured terms |

|

$ |

6,721 |

|

|

$ |

6,594 |

|

|

$ |

13,422 |

|

|

$ |

13,328 |

|

|

|

|

|

| Loans 30 - 89 days past due

and on accrual (1) |

|

$ |

11,496 |

|

|

$ |

17,923 |

|

|

$ |

25,108 |

|

|

$ |

8,688 |

|

|

|

|

|

| Total delinquent loans

(including loans on non-accrual), net (2) |

|

$ |

26,830 |

|

|

$ |

34,479 |

|

|

$ |

38,721 |

|

|

$ |

21,191 |

|

|

|

|

|

| Total delinquent

loans / Total loans receivable |

|

0.30 |

% |

|

0.40 |

% |

|

0.45 |

% |

|

0.27 |

% |

|

|

|

|

| |

| (1)

Includes $112,000 of purchased credit-impaired loans at September

30, 2019 compared to $3,000 at December 31, 2018 and $5,000 at

September 30, 2018. |

| (2)

Delinquent loans include $412,000 of delinquent purchased

credit-impaired loans at September 30, 2019 compared to $519,000 at

December 31, 2018 and $568,000 at September 30, 2018. |

| |

| LOANS BY GEOGRAPHIC

LOCATION |

|

|

|

|

|

|

|

|

|

|

|

Percentage Change |

| |

|

Sep 30, 2019 |

|

Jun 30, 2019 |

|

Dec 31, 2018 |

|

Sep 30, 2018 |

|

Prior Qtr |

|

Prior Yr Qtr |

| |

|

Amount |

|

Percentage |

|

Amount |

|

Amount |

|

Amount |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Washington |

|

$ |

4,313,972 |

|

|

48.8 |

% |

|

$ |

4,293,854 |

|

|

$ |

4,324,588 |

|

|

$ |

3,640,209 |

|

|

0.5 |

% |

|

18.5 |

% |

| Oregon |

|

1,615,192 |

|

|

18.3 |

% |

|

1,628,102 |

|

|

1,636,152 |

|

|

1,628,703 |

|

|

(0.8 |

)% |

|

(0.8 |

)% |

| California |

|

1,729,208 |

|

|

19.5 |

% |

|

1,659,326 |

|

|

1,596,604 |

|

|

1,496,817 |

|

|

4.2 |

% |

|

15.5 |

% |

| Idaho |

|

552,523 |

|

|

6.3 |

% |

|

548,189 |

|

|

521,026 |

|

|

504,297 |

|

|

0.8 |

% |

|

9.6 |

% |

| Utah |

|

62,197 |

|

|

0.7 |

% |

|

62,944 |

|

|

57,318 |

|

|

63,053 |

|

|

(1.2 |

)% |

|

(1.4 |

)% |

| Other |

|

562,276 |

|

|

6.4 |

% |

|

554,135 |

|

|

548,907 |

|

|

489,440 |

|

|

1.5 |

% |

|

14.9 |

% |

| Total loans receivable |

|

$ |

8,835,368 |

|

|

100.0 |

% |

|

$ |

8,746,550 |

|

|

$ |

8,684,595 |

|

|

$ |

7,822,519 |

|

|

1.0 |

% |

|

12.9 |

% |

| |

ADDITIONAL FINANCIAL INFORMATION(dollars in

thousands)

The following table shows loan originations (excluding loans

held for sale) activity for the quarters ending September 30, 2019,

June 30, 2019, and September 30, 2018 and the nine months ending

September 30, 2019 and September 30, 2018 (in thousands):

| LOAN

ORIGINATIONS |

Quarters Ended |

|

Nine Months Ended |

| |

Sep 30, 2019 |

|

Jun 30, 2019 |

|

Sep 30, 2018 |

|

Sep 30, 2019 |

|

Sep 30, 2018 |

| Commercial real estate |

$ |

114,528 |

|

|

$ |

81,361 |

|

|

$ |

142,393 |

|

|

$ |

290,085 |

|

|

$ |

363,899 |

|

| Multifamily real estate |

29,645 |

|

|

21,651 |

|

|

2,215 |

|

|

58,913 |

|

|

9,040 |

|

| Construction and land |

303,151 |

|

|

368,224 |

|

|

370,484 |

|

|

904,869 |

|

|

1,062,834 |

|

| Commercial business |

194,606 |

|

|

241,134 |

|

|

303,472 |

|

|

561,652 |

|

|

632,368 |

|

| Agricultural business |

12,363 |

|

|

20,702 |

|

|

36,747 |

|

|

65,124 |

|

|

104,801 |

|

| One-to four-family

residential |

27,734 |

|

|

26,210 |

|

|

51,459 |

|

|

85,733 |

|

|

95,810 |

|

| Consumer |

101,613 |

|

|

119,970 |

|

|

74,339 |

|

|

285,357 |

|

|

259,161 |

|

| Total loan originations

(excluding loans held for sale) |

$ |

783,640 |

|

|

$ |

879,252 |

|

|

$ |

981,109 |

|

|

$ |

2,251,733 |

|

|

$ |

2,527,913 |

|

| ADDITIONAL FINANCIAL

INFORMATION |

|

|

|

|

|

|

|

|

|

|

| (dollars in thousands) |

|

|

|

|

|

|

|

|

|

|

| |

|

Quarters Ended |

|

Nine Months Ended |

| CHANGE IN

THE |

|

Sep 30, 2019 |

|

Jun 30, 2019 |

|

Sep 30, 2018 |

|

Sep 30, 2019 |

|

Sep 30, 2018 |

| ALLOWANCE FOR LOAN

LOSSES |

|

|

|

|

|

|

|

|

|

|

|

Balance, beginning of period |

|

$ |

98,254 |

|

|

$ |

97,308 |

|

|

$ |

93,875 |

|

|

$ |

96,485 |

|

|

$ |

89,028 |

|

| Provision for loan losses |

|

2,000 |

|

|

2,000 |

|

|

2,000 |

|

|

6,000 |

|

|

6,000 |

|

| Recoveries of loans previously

charged off: |

|

|

|

|

|

|

|

|

|

|

|

Commercial real estate |

|

107 |

|

|

149 |

|

|

12 |

|

|

277 |

|

|

1,580 |

|

|

Construction and land |

|

156 |

|

|

30 |

|

|

5 |

|

|

208 |

|

|

190 |

|

|

One- to four-family real estate |

|

129 |

|

|

230 |

|

|

86 |

|

|

402 |

|

|

732 |

|

|

Commercial business |

|

162 |

|

|

215 |

|

|

586 |

|

|

400 |

|

|

856 |

|

|

Agricultural business, including secured by farmland |

|

2 |

|

|

35 |

|

|

— |

|

|

37 |

|

|

41 |

|

|

Consumer |

|

154 |

|

|

223 |

|

|

46 |

|

|

487 |

|

|

264 |

|

| |

|

710 |

|

|

882 |

|

|

735 |

|

|

1,811 |

|

|

3,663 |

|

| Loans charged off: |

|

|

|

|

|

|

|

|

|

|

|

Commercial real estate |

|

(314 |

) |

|

(393 |

) |

|

(102 |

) |

|

(1,138 |

) |

|

(401 |

) |

|

Construction and land |

|

— |

|

|

— |

|

|

(479 |

) |

|

— |

|

|

(479 |

) |

|

One- to four-family real estate |

|

(86 |

) |

|

— |

|

|

(27 |

) |

|

(86 |

) |

|

(43 |

) |

|

Commercial business |

|

(1,599 |

) |

|

(802 |

) |

|

(473 |

) |

|

(2,991 |

) |

|

(1,367 |

) |

|

Agricultural business, including secured by farmland |

|

(741 |

) |

|

(162 |

) |

|

(5 |

) |

|

(907 |

) |

|

(341 |

) |

|

Consumer |

|

(423 |

) |

|

(579 |

) |

|

(261 |

) |

|

(1,373 |

) |

|

(797 |

) |

| |

|

(3,163 |

) |

|

(1,936 |

) |

|

(1,347 |

) |

|

(6,495 |

) |

|

(3,428 |

) |

|

Net (charge-offs) recoveries |

|

(2,453 |

) |

|

(1,054 |

) |

|

(612 |

) |

|

(4,684 |

) |

|

235 |

|

| Balance, end of period |

|

$ |

97,801 |

|

|

$ |

98,254 |

|

|

$ |

95,263 |

|

|

$ |

97,801 |

|

|

$ |

95,263 |

|

| Net (charge-offs) recoveries /

Average loans receivable |

|

(0.027 |

)% |

|

(0.012 |

)% |

|

(0.008 |

)% |

|

(0.053 |

)% |

|

0.003 |

% |

| ALLOCATION

OF |

|

|

|

|

|

|

|

|

| ALLOWANCE FOR LOAN

LOSSES |

|

Sep 30, 2019 |

|

Jun 30, 2019 |

|

Dec 31, 2018 |

|

Sep 30, 2018 |

| Specific or allocated loss

allowance: |

|

|

|

|

|

|

|

|

|

Commercial real estate |

|

$ |

28,515 |

|

|

$ |

26,730 |

|

|

$ |

27,132 |

|

|

$ |

25,147 |

|

|

Multifamily real estate |

|

4,283 |

|

|

4,344 |

|

|

3,818 |

|

|

3,745 |

|

|

Construction and land |

|

22,569 |

|

|

23,554 |

|

|

24,442 |

|

|

24,564 |

|

|

One- to four-family real estate |

|

4,569 |

|

|

4,701 |

|

|

4,714 |

|

|

4,423 |

|

|

Commercial business |

|

21,147 |

|

|

19,557 |

|

|

19,438 |

|

|

17,948 |

|

|

Agricultural business, including secured by farmland |

|

3,895 |

|

|

3,691 |

|

|

3,778 |

|

|

3,505 |

|

|

Consumer |

|

8,441 |

|

|

8,452 |

|

|

7,972 |

|

|

8,110 |

|

|

Total allocated |

|

93,419 |

|

|

91,029 |

|

|

91,294 |

|

|

87,442 |

|

| Unallocated |

|

4,382 |

|

|

7,225 |

|

|

5,191 |

|

|

7,821 |

|

|

Total allowance for loan losses |

|

$ |

97,801 |

|

|

$ |

98,254 |

|

|

$ |

96,485 |

|

|

$ |

95,263 |

|

| Allowance for loan losses /

Total loans receivable |

|

1.11 |

% |

|

1.12 |

% |

|

1.11 |

% |

|

1.22 |

% |

| Allowance for loan losses /

Non-performing loans |

|

536 |

% |

|

534 |

% |

|

616 |

% |

|

603 |

% |

| |

|

|

|

|

|

|

|

| ADDITIONAL FINANCIAL

INFORMATION |

|

|

|

|

|

|

|

| (dollars in thousands) |

|

|

|

|

|

|

|

| |

Sep 30, 2019 |

|

Jun 30, 2019 |

|

Dec 31, 2018 |

|

Sep 30, 2018 |

| NON-PERFORMING

ASSETS |

|

|

|

|

|

|

|

| Loans on non-accrual

status: |

|

|

|

|

|

|

|

|

Secured by real estate: |

|

|

|

|

|

|

|

|

Commercial |

$ |

5,092 |

|

|

$ |

4,603 |

|

|

$ |

4,088 |

|

|

$ |

3,728 |

|

|

Multifamily |

87 |

|

|

— |

|

|

— |

|

|

— |

|

|

Construction and land |

1,318 |

|

|

2,214 |

|

|

3,188 |

|

|

2,095 |

|

|

One- to four-family |

3,007 |

|

|

2,665 |

|

|

1,544 |

|

|

1,827 |

|

|

Commercial business |

3,035 |

|

|

2,983 |

|

|

2,936 |

|

|

2,921 |

|

|

Agricultural business, including secured by farmland |

757 |

|

|

1,359 |

|

|

1,751 |

|

|

1,645 |

|

|

Consumer |

2,473 |

|

|

3,230 |

|

|

1,241 |

|

|

1,703 |

|

| |

15,769 |

|

|

17,054 |

|

|

14,748 |

|

|

13,919 |

|

| Loans more than 90 days

delinquent, still on accrual: |

|

|

|

|

|

|

|

|

Secured by real estate: |

|

|

|

|

|

|

|

|

Commercial |

89 |

|

|

— |

|

|

— |

|

|

428 |

|

|

Construction and land |

1,141 |

|

|

262 |

|

|

— |

|

|

— |

|

|

One- to four-family |

652 |

|

|

995 |

|

|

658 |

|

|

1,076 |

|

|

Commercial business |

358 |

|

|

1 |

|

|

1 |

|

|

87 |

|

|

Consumer |

247 |

|

|

97 |

|

|

247 |

|

|

296 |

|

| |

2,487 |

|

|

1,355 |

|

|

906 |

|

|

1,887 |

|

| Total non-performing

loans |

18,256 |

|

|

18,409 |

|

|

15,654 |

|

|

15,806 |

|

| Real estate owned (REO) |

228 |

|

|

2,513 |

|

|

2,611 |

|

|

364 |

|

| Other repossessed assets |

115 |

|

|

112 |

|

|

592 |

|

|

573 |

|

|

Total non-performing assets |

$ |

18,599 |

|

|

$ |

21,034 |

|

|

$ |

18,857 |

|

|

$ |

16,743 |

|

| Total non-performing

assets to total assets |

0.15 |

% |

|

0.18 |

% |

|

0.16 |

% |

|

0.16 |

% |

| Purchased credit-impaired

loans, net |

$ |

12,575 |

|

|

$ |

12,945 |

|

|

$ |

14,413 |

|

|

$ |

12,944 |

|

| |

|

|

|

| |

Quarters Ended |

|

Nine Months Ended |

| REAL ESTATE

OWNED |

Sep 30, 2019 |

|

Jun 30, 2019 |

|

Sep 30, 2018 |

|

Sep 30, 2019 |

|

Sep 30, 2018 |

|

Balance, beginning of period |

$ |

2,513 |

|

|

$ |

2,611 |

|

|

$ |

473 |

|

|

$ |

2,611 |

|

|

$ |

360 |

|

|

Additions from loan foreclosures |

48 |

|

|

61 |

|

|

— |

|

|

109 |

|

|

502 |

|

|

Proceeds from dispositions of REO |

(2,333 |

) |

|

(150 |

) |

|

(90 |

) |

|

(2,483 |

) |

|

(385 |

) |

|

(Loss) gain on sale of REO |

— |

|

|

(9 |

) |

|

8 |

|

|

(9 |

) |

|

74 |

|

|

Valuation adjustments in the period |

— |

|

|

— |

|

|

(27 |

) |

|

— |

|

|

(187 |

) |

| Balance, end of period |

$ |

228 |

|

|

$ |

2,513 |

|

|

$ |

364 |

|

|

$ |

228 |

|

|

$ |

364 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| ADDITIONAL FINANCIAL

INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

| (dollars in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| DEPOSIT

COMPOSITION |

|

|

|

|

|

|

|

|

|

Percentage Change |

| |

|

Sep 30, 2019 |

|

Jun 30, 2019 |

|

Dec 31, 2018 |

|

Sep 30, 2018 |

|

Prior Qtr |

|

Prior Yr Qtr |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-interest-bearing |

|

$ |

3,885,210 |

|

|

$ |

3,671,995 |

|

|

$ |

3,657,817 |

|

|

$ |

3,469,294 |

|

|

5.8 |

% |

|

12.0 |

% |

| Interest-bearing checking |

|

1,209,826 |

|

|

1,187,035 |

|

|

1,191,016 |

|

|

1,034,678 |

|

|

1.9 |

% |

|

16.9 |

% |

| Regular savings accounts |

|

1,863,839 |

|

|

1,848,048 |

|

|

1,842,581 |

|

|

1,627,560 |

|

|

0.9 |

% |

|

14.5 |

% |

| Money market accounts |

|

1,551,305 |

|

|

1,511,119 |

|

|

1,465,369 |

|

|

1,373,618 |

|

|

2.7 |

% |

|

12.9 |

% |

|