Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

February 10 2021 - 12:51PM

Edgar (US Regulatory)

FILED PURSUANT TO RULE 433 UNDER THE

SECURITIES ACT OF 1933

ISSUER FREE WRITING PROSPECTUS DATED

FEBRUARY 10, 2021

REGISTRATION STATEMENT NO. 333-252890

|

Ballard Power Systems Inc.

|

|

|

|

Treasury Offering

of Common Shares

|

|

February 10, 2021

|

An amended and restated preliminary

short form prospectus containing important information relating to the securities described in this document has not yet been

filed with the securities regulatory authorities in each of the provinces and territories of Canada (excluding Quebec). A copy

of the amended and restated preliminary short form prospectus is required to be delivered to any investor that received this document

and expressed an interest in acquiring the securities.

There will not be any sale or any acceptance

of an offer to buy the securities until a receipt for the final short form prospectus has been issued.

This document does not provide full

disclosure of all material facts relating to the securities offered. Investors should read the amended and restated preliminary

short form prospectus, final short form prospectus and any amendment, for disclosure of those facts, especially risk factors relating

to the securities offered, before making an investment decision.

This communication shall not constitute

an offer to sell or the solicitation of an offer to buy nor shall there be any sale of these securities in any jurisdiction in

which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any

such jurisdiction.

|

|

Revised Terms & Conditions

|

|

|

|

|

Issuer:

|

Ballard Power Systems Inc. (the “Company”)

|

|

|

|

|

Issue:

|

14,870,000 common

shares of the Company (the “Shares”).

|

|

|

|

|

Amount:

|

US$550,190,000

|

|

|

|

|

Issue Price:

|

US$37.00

per Share.

|

|

|

|

|

Over-Allotment Option:

|

The Company has granted the Underwriters an option, exercisable at the Issue Price at any time up to 30 days following the closing of the offering, to purchase up to an additional 15% of the offering to cover over-allotments, if any.

|

|

|

|

|

Use of Proceeds:

|

The Company plans to use the net proceeds of the offering to further strengthen the balance sheet, thereby providing additional flexibility to fund its growth strategy, including through activities such as product innovation, investments in production capacity expansion and localization, future acquisitions and strategic partnerships and investments.

|

|

|

|

|

Listing:

|

The existing common shares of the Company trade on the Toronto Stock Exchange and NASDAQ under the symbol “BLDP”.

|

|

|

|

|

Form of Offering:

|

Public offering in all provinces and territories of Canada (excluding Quebec) by way of a short form prospectus and in the United States pursuant to a registration statement under the Multijurisdictional Disclosure System.

|

|

|

|

|

Form of Underwriting:

|

Bought deal, subject to a mutually acceptable underwriting agreement containing “disaster out”, “regulatory out” and “material adverse change out” clauses running to Closing.

|

|

|

|

|

Eligibility:

|

Eligible for RRSPs, RRIFs, RESPs, TFSAs, RDSPs and DPSPs.

|

|

|

|

|

Bookrunners:

|

TD Securities Inc. and National Bank Financial Inc.

|

|

|

|

|

Underwriting Fee:

|

4.00%

|

|

|

|

|

Closing:

|

February 23, 2021

|

FILED PURSUANT TO RULE 433 UNDER THE

SECURITIES ACT OF 1933

ISSUER FREE WRITING PROSPECTUS DATED

FEBRUARY 10, 2021

REGISTRATION STATEMENT NO. 333-252890

|

Ballard Power Systems Inc.

|

|

|

|

Treasury Offering

of Common Shares

|

|

February 10, 2021

|

The

offering will be made in the United States pursuant to the Multijurisdictional Disclosure System. A registration statement on

Form F-10 relating to these securities has been filed with the U.S. Securities and Exchange Commission but has not yet become

effective. These securities may not be sold nor may offers to buy be accepted prior to the time the registration statement becomes

effective. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has

filed with the SEC for more complete information about the issuer and this offering. You may get these documents for free by visiting

EDGAR on the SEC Website at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering

will arrange to send you the prospectus or you may request it from TD Securities Inc. in Canada, Attention: Symcor, NPM (tel:

289-360-2009, email: sdcconfirms@td.com), 1625 Tech Avenue, Mississauga ON L4W 5P5; or you may request it from TD Securities (USA)

LLC in the U.S. (tel: 212-827-7392), 31 W 52nd Street, New York NY 10019 or from National Bank Financial Inc. by phone

at (416)-869-6534 or email at ECM-Origination@nbc.ca

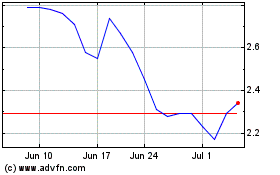

Ballard Power Systems (NASDAQ:BLDP)

Historical Stock Chart

From Mar 2024 to Apr 2024

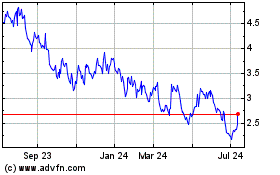

Ballard Power Systems (NASDAQ:BLDP)

Historical Stock Chart

From Apr 2023 to Apr 2024