Current Report Filing (8-k)

March 31 2022 - 6:17AM

Edgar (US Regulatory)

0001781755

false

0001781755

2022-03-28

2022-03-28

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

_____________________________________________________________________________________________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________________

FORM 8-K

______________________________

CURRENT REPORT

Pursuant to Section

13 or 15(d)

of the Securities

Exchange Act of 1934

Date of Report

(Date of earliest event reported): March 28, 2022

______________________________

BRP Group, Inc.

(Exact name of registrant as specified in its

charter)

______________________________

| Delaware |

001-39095 |

61-1937225 |

|

(State or other jurisdiction of

incorporation or organization)

|

(Commission

File No.)

|

(I.R.S. Employer

Identification No.)

|

4211 W. Boy Scout Blvd., Suite 800, Tampa, Florida,

33607

(Address of principal executive offices) (Zip

Code)

(Registrant’s telephone number, including

area code): (866) 279-0698

Not Applicable

(Former Name, former address and former fiscal

year, if changed since last report)

______________________________

Check the appropriate box below if the form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2 (b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

Title

of each class |

Trading

Symbol(s) |

Name

of each exchange on which registered |

| Class A Common Stock, par value $0.01 per share |

BRP |

The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

On March 28, 2022, Baldwin Risk Partners, LLC (“BRP LLC”),

a subsidiary of BRP Group, Inc., as borrower, entered into an Amendment No. 5 to the Credit Agreement (as defined below) (the “Amendment”)

with JPMorgan Chase Bank, N.A., as administrative agent (the “Agent”), certain material subsidiaries of BRP LLC (together

with BRP LLC, the “Loan Parties”), as guarantors, and the several banks, financial institutions, institutional investors and

other entities party thereto as lenders and letter of credit issuers. The Amendment, among other things, (1) increases the aggregate principal

amount of the Revolving Commitments (as defined in the Credit Agreement) from $475.0 million to $600.0 million, (2) changes the interest

rate on the Revolving Loans (as defined in the Credit Agreement) to the Secured Overnight Financing Rate (SOFR), plus a credit spread

adjustment of 10 basis points (“bps”), plus an amount between 200 bps and 300 bps, depending on BRP LLC's total net leverage

ratio, (3) increases the total net leverage ratio covenant to 7.0x consolidated EBITDA and (4) extends the maturity of Revolving Loans

to April 1, 2027. The proceeds from Revolving Commitments will be used for general corporate purposes of BRP LLC and certain of its subsidiaries

(including acquisitions and other investments permitted under the Credit Agreement). JPMorgan Chase Bank, N.A., Capital One, National

Association, Wells Fargo Bank, National Association, Bank of America, N.A., Morgan Stanley Senior Funding, Inc., Raymond James Bank, Cadence

Bank, N.A., Lake Forest Bank & Trust Company, N.A., and South State Bank, N.A. served as joint lead arrangers and joint bookrunners

with respect to the Amendment.

Except as otherwise described above, the incremental Revolving Commitments

and any incremental Revolving Loans are subject to substantially the same terms to which the existing Revolving Commitments and any existing

Revolving Loans are subject under the Credit Agreement.

The term “Credit Agreement” means that certain Credit Agreement,

dated as of October 14, 2020, among the Loan Parties, the Agent and the several banks, financial institutions, institutional investors

and other entities from time to time party thereto as lenders and letter of credit issuers, as amended by that certain Amendment No. 1,

dated as of May 7, 2021, that certain Amendment No. 2, dated as of June 2, 2021, that certain Amendment No. 3, dated as of August 6, 2021,

and that certain Amendment No. 4, dated as of December 16, 2021.

The foregoing description of the terms of the Amendment is not a complete

description thereof and is qualified in its entirety by the full text of such agreement which is filed as Exhibit 10.1 hereto and incorporated

herein by reference.

Item 2.03. Creation of a Direct Financial Obligation or an Obligation

under an Off-Balance Sheet Arrangement of a Registrant.

The disclosure required by this item is included in Item 1.01 of this

Current Report on Form 8-K and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| |

|

|

|

Exhibit

No. |

|

Description |

| |

|

| 10.1 |

|

Amendment No. 5 to Credit Agreement, dated as of March 28, 2022, by and among Baldwin Risk Partners, LLC, a Delaware limited liability company, JPMorgan Chase Bank, N.A., as the Administrative Agent, the Guarantors party thereto, the Lenders party thereto and the Issuing Lenders party thereto |

| 104 |

|

Cover Page Interactive Data File (embedded within the inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

|

BRP GROUP, INC. |

| |

|

|

|

| Date: March 30, 2022 |

By: |

/s/ Bradford Hale |

| |

|

Name: |

Bradford Hale |

| |

|

Title: |

Chief Financial Officer |

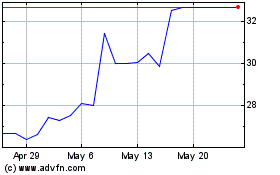

Baldwin Insurance (NASDAQ:BRP)

Historical Stock Chart

From May 2024 to Jun 2024

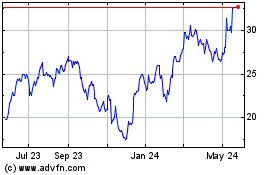

Baldwin Insurance (NASDAQ:BRP)

Historical Stock Chart

From Jun 2023 to Jun 2024