Balchem Corporation (NASDAQ: BCPC) today reported for the fourth

quarter 2019 net earnings of $20.4 million, compared to net

earnings of $20.3 million for the fourth quarter 2018. Fourth

quarter adjusted net earnings(a) were $28.4 million, compared to

$25.1 million in the prior year quarter. Fourth quarter

adjusted EBITDA(a) was $40.0 million, compared to $39.6 million in

the prior year quarter. Balchem Corporation also reported for

the full year 2019 net earnings of $79.7 million, compared to net

earnings of $78.6 million for 2018. Full year adjusted net

earnings(a) were $103.7 million, compared to $97.7 million in the

prior year. Full year adjusted EBITDA(a) was $160.0 million,

compared to $159.3 million in the prior year.

Fourth Quarter 2019 Financial Highlights:

- Fourth quarter net sales of $166.5

million, an increase of $3.0 million, or 1.8%, compared to the

prior year quarter.

- Year over year quarterly sales

growth in three of the four segments, with all-time record sales in

Human Nutrition and Health and Animal Nutrition and Health, and

record fourth quarter sales in Specialty Products.

- Fourth quarter GAAP net earnings of

$20.4 million were slightly higher than the prior year. These net

earnings resulted in GAAP earnings per share of $0.63.

- Quarterly adjusted net earnings of

$28.4 million increased $3.3 million or 12.9% from the prior year,

resulting in adjusted earnings per share(a) of $0.88.

- Fourth quarter adjusted EBITDA was

$40.0 million, an increase of $0.4 million, or 1.0%, from the prior

year.

- Quarterly cash flows from

operations were $33.0 million for the fourth quarter 2019 with

quarterly free cash flow(a) of $26.3 million.

Full Year 2019 Financial Highlights:

- Full year net sales of $643.7

million were slightly higher than the prior year.

- Year over year sales growth in

three of the four segments, with all-time record sales in Human

Nutrition and Health, Animal Nutrition and Health, and Specialty

Products, offset by reduced sales in Industrial Products.

- Full year GAAP net earnings were

$79.7 million, an increase of $1.1 million, or 1.4% from the prior

year. These net earnings resulted in GAAP earnings per share of

$2.45.

- Full year adjusted net earnings of

$103.7 million increased $5.9 million or 6.1% from the prior year,

resulting in adjusted earnings per share(a) of $3.19.

- Full year adjusted EBITDA was

$160.0 million, an increase of $0.7 million, or 0.5%, from the

prior year.

- Full year cash flows from

operations were $124.5 million for 2019 with full year free cash

flow(a) of $96.1 million.

Recent Highlights:

- On December 13, 2019, we acquired

Zumbro River Brand, Inc. ("Zumbro"), headquartered in Albert Lea,

MN. Zumbro specializes in developing, marketing, and

manufacturing agglomerated and extruded products for the food and

beverage industry and is a market leader in high protein and

specialty extruded snacks, cereals, and crisps, marketed under the

brands Z-Crisps®, Whey-Os™, Whey-Vs™, and Z-Texx Complete™.

This business will be integrated within Balchem's Human Nutrition

and Health Segment.

- On December 17, 2019, we declared a

$16.9 million dividend on common stock of $0.52 per share, a 10.6%

increase over the prior year cash dividend, representing the tenth

consecutive year of double-digit dividend growth.

Ted Harris, Chairman, CEO, and President of

Balchem said, “Our fourth quarter results saw sales growth in three

of our four segments, record adjusted net earnings, and continued

strong cash conversion. Record quarterly sales for Human Nutrition

and Health and Animal Nutrition and Health, along with record

fourth quarter Specialty Products sales, were partially offset by

significantly lower Industrial Products sales to the oil and gas

fracking market.”

Mr. Harris added, “The Balchem team made

meaningful progress in 2019 on our strategic growth initiatives,

while delivering solid full year financial results. At the same

time, we acquired Chemogas NV in May 2019 and Zumbro in December

2019, enhancing our strategic positioning and strengthening our

customer offerings.”

Results for Period Ended December 31,

2019 (unaudited)(Dollars in thousands, except per share

data)

| |

Three Months EndedDecember 31, |

|

Year Ended December 31, |

| |

2019 |

|

2018 |

|

2019 |

|

2018 |

|

Net sales |

$ |

166,527 |

|

|

$ |

163,539 |

|

|

$ |

643,705 |

|

|

$ |

643,679 |

|

| Gross margin |

54,346 |

|

|

51,325 |

|

|

211,367 |

|

|

204,252 |

|

| Operating expenses |

30,705 |

|

|

24,091 |

|

|

108,814 |

|

|

97,152 |

|

| Earnings from operations |

23,641 |

|

|

27,234 |

|

|

102,553 |

|

|

107,100 |

|

| Other expense |

1,273 |

|

|

1,971 |

|

|

6,075 |

|

|

8,070 |

|

| Earnings before income tax

expense |

22,368 |

|

|

25,263 |

|

|

96,478 |

|

|

99,030 |

|

| Income tax expense |

1,985 |

|

|

4,929 |

|

|

16,807 |

|

|

20,457 |

|

| Net earnings |

$ |

20,383 |

|

|

$ |

20,334 |

|

|

$ |

79,671 |

|

|

$ |

78,573 |

|

| |

|

|

|

|

|

|

|

| Diluted net earnings per

common share |

$ |

0.63 |

|

|

$ |

0.63 |

|

|

$ |

2.45 |

|

|

$ |

2.42 |

|

| |

|

|

|

|

|

|

|

| Adjusted EBITDA(a) |

$ |

39,989 |

|

|

$ |

39,577 |

|

|

$ |

160,015 |

|

|

$ |

159,285 |

|

| Adjusted net earnings(a) |

$ |

28,399 |

|

|

$ |

25,146 |

|

|

$ |

103,684 |

|

|

$ |

97,747 |

|

| Adjusted diluted net earnings

per common share(a) |

$ |

0.88 |

|

|

$ |

0.77 |

|

|

$ |

3.19 |

|

|

$ |

3.01 |

|

| |

|

|

|

|

|

|

|

| Shares used in the

calculations of diluted and adjusted net earnings per common

share |

32,448 |

|

|

32,479 |

|

|

32,505 |

|

|

32,445 |

|

|

(a) |

See “Non-GAAP Financial Information” for a reconciliation of GAAP

and non-GAAP financial measures. |

Financial Results for the Fourth Quarter

of 2019:

The Human Nutrition &

Health segment generated fourth quarter sales of $90.3

million, an increase of $3.0 million or 3.4% compared to the prior

year quarter. The increase was primarily driven by higher sales

within our Ingredient Solutions business, partially offset by lower

Cereal Systems volumes. Quarterly earnings from operations for this

segment of $9.2 million decreased $3.1 million or 25.3% compared to

$12.3 million in the prior year quarter, primarily due to certain

manufacturing inefficiencies, higher bad debt expense, and a

non-cash restructuring charge, partially offset by the

aforementioned higher sales. Excluding the effect of non-cash

expense associated with amortization of acquired intangible assets

for the fourth quarter of 2019 and 2018 of $4.8 million and $5.3

million, respectively, adjusted earnings from operations(a) for

this segment were $15.2 million, compared to $17.6 million in the

prior year quarter.

The Animal Nutrition &

Health segment generated quarterly sales of $48.4 million,

an increase of $1.3 million or 2.8% compared to the prior year

quarter. The increase was primarily the result of higher

volumes and improved product mix within both our monogastric and

ruminant species businesses. Fourth quarter earnings from

operations for this segment of $9.4 million were up from the prior

year comparable quarter of $7.0 million, primarily due to the

aforementioned higher sales and certain lower raw material costs,

partially offset by continued competitive pressures on volume and

pricing in the European monogastric business. Excluding the

effect of non-cash expense associated with amortization of acquired

intangible assets of $0.2 million in each of the fourth quarters of

2019 and 2018, adjusted earnings from operations for this segment

were $9.6 million, compared to $7.2 million in the prior year

quarter.

The Specialty Products segment

generated fourth quarter sales of $24.0 million, an increase of

$6.5 million or 36.8% compared to the prior year quarter, primarily

due to higher sales of ethylene oxide for the medical device

sterilization market due to both the contribution of Chemogas and

higher legacy product sales, partially offset by lower volumes in

the plant nutrition business. Fourth quarter earnings from

operations for this segment were $6.2 million, versus $5.8 million

in the prior year comparable quarter, an increase of $0.5 million

or 8.0%, primarily due to the aforementioned higher sales,

partially offset by mix and higher operating expenses due to the

acquisition of Chemogas. Excluding the effect of non-cash

expense associated with amortization of acquired intangible assets

for the fourth quarters of 2019 and 2018 of $1.7 million and $0.8

million, respectively, adjusted earnings from operations for this

segment were $7.9 million, compared to $6.5 million in the prior

year quarter.

The Industrial Products segment

sales of $3.8 million decreased $7.8 million or 67.3% from the

prior year comparable quarter, primarily due to reduced sales

volumes of choline and choline derivatives used in shale fracking

applications. Earnings from operations for the Industrial

Products segment were $0.3 million, a decrease of $1.8 million or

84.1% compared with the prior year comparable quarter, primarily

due to the aforementioned lower sales volumes.

Consolidated gross margin for the quarter ended

December 31, 2019 of $54.3 million increased by $3.0 million or

5.9%, compared to $51.3 million for the prior year comparable

period. Gross margin as a percentage of sales was 32.6% as

compared to 31.4% in the prior year period, an increase of 125

basis points. The increase was primarily due to mix and

certain lower raw material costs. Operating expenses of $30.7

million for the quarter increased $6.6 million from the prior year

comparable quarter, primarily due to incremental operating expenses

related to the Chemogas and Zumbro acquisitions, increased

transaction and integration costs, higher bad debt expense, and a

non-cash restructuring charge in the Human Nutrition & Health

segment. Excluding non-cash operating expenses associated with

amortization of intangible assets of $6.4 million, operating

expenses were $24.3 million, or 14.6% of sales.

Interest expense was $1.2 million in the fourth

quarter of 2019. Our effective tax rates for the three months ended

December 31, 2019 and 2018 were 8.9% and 19.5%, respectively. The

decrease in the effective tax rate from the prior year is primarily

due to discrete items, particularly related to tax reform

clarifying regulations, incremental R&D tax credits, and

certain lower state taxes.

For the quarter ended December 31, 2019, strong

cash flows provided by operating activities were $33.0 million, and

free cash flow was $26.3 million. The $162.7 million of net working

capital on December 31, 2019 included a cash balance of $65.7

million, which reflects fourth quarter 2019 capital expenditures

and intangible assets acquired of $6.7 million. The Company

continues to invest in projects across all facilities to improve

capabilities and operating efficiencies.

Ted Harris, Chairman, President, and CEO of

Balchem said, “We delivered record fourth quarter sales and

adjusted net earnings, leading to solid overall results for the

full year 2019. Despite significant headwinds in the quarter

and throughout the year, particularly within Industrial Products,

we were able to deliver both top and bottom-line growth,

highlighting the strength and resilience of our business

model.”

Mr. Harris went on to add, “We are well

positioned to continue to drive growth into the future and look

forward to progressing our organic growth initiatives and seeking

value-creating acquisitions in 2020.”

Quarterly Conference Call

A quarterly conference call will be held on

Friday, February 21, 2020, at 11:00 AM Eastern Time (ET) to review

fourth quarter 2019 results. Ted Harris, Chairman of the Board, CEO

and President and Martin Bengtsson, CFO will host the call.

We invite you to listen to the conference by calling toll-free

1-877-407-8290 (local dial-in 1-201-689-8344), five minutes prior

to the scheduled start time of the conference call. The

conference call will be available for replay two hours after the

conclusion of the call through end of day Friday, March 6,

2020. To access the replay of the conference call, dial

1-877-660-6853 (local dial-in 1-201-612-7415), and use conference

ID #13698852.

Segment Information

Balchem Corporation reports four business

segments: Human Nutrition & Health; Animal Nutrition &

Health; Specialty Products; and Industrial Products. The Human

Nutrition & Health segment delivers customized food and

beverage ingredient systems, as well as key nutrients into a

variety of applications across the food, supplement and

pharmaceutical industries. The Animal Nutrition & Health

segment manufactures and supplies products to numerous animal

health markets. Through Specialty Products, Balchem provides

specialty-packaged chemicals for use in healthcare and other

industries, and also provides chelated minerals to the

micronutrient agricultural market. The Industrial Products segment

manufactures and supplies certain derivative products into

industrial applications.

Forward-Looking Statements

This release contains forward-looking

statements, which reflect Balchem’s expectation or belief

concerning future events that involve risks and uncertainties.

Balchem can give no assurance that the expectations reflected in

forward-looking statements will prove correct and various factors

could cause results to differ materially from Balchem’s

expectations, including risks and factors identified in Balchem’s

annual report on Form 10-K for the year ended December 31, 2018.

Forward-looking statements are qualified in their entirety by the

above cautionary statement. Balchem assumes no duty to update its

outlook or other forward-looking statements as of any future

date.

Contact: Mary Ann Brush, Balchem Corporation (Telephone:

845-326-5600)

Selected Financial Data (unaudited) ($

in 000’s)

Business Segment Net Sales:

| |

|

Three Months Ended December

31, |

|

Year Ended December 31, |

| |

|

2019 |

|

2018 |

|

2019 |

|

2018 |

|

Human Nutrition & Health |

|

$ |

90,270 |

|

|

$ |

87,271 |

|

|

$ |

347,433 |

|

|

$ |

341,237 |

|

| Animal Nutrition &

Health |

|

48,430 |

|

|

47,106 |

|

|

177,557 |

|

|

175,693 |

|

| Specialty Products |

|

24,038 |

|

|

17,575 |

|

|

92,257 |

|

|

75,808 |

|

| Industrial Products |

|

3,789 |

|

|

11,587 |

|

|

26,458 |

|

|

50,941 |

|

| Total |

|

$ |

166,527 |

|

|

$ |

163,539 |

|

|

$ |

643,705 |

|

|

$ |

643,679 |

|

Business Segment Earnings Before Income

Taxes:

| |

Three Months Ended December

31, |

|

Year Ended December 31, |

| |

2019 |

|

2018 |

|

2019 |

|

2018 |

|

Human Nutrition & Health |

$ |

9,195 |

|

|

$ |

12,312 |

|

|

$ |

48,429 |

|

|

$ |

48,037 |

|

| Animal Nutrition &

Health |

9,445 |

|

|

7,001 |

|

|

25,868 |

|

|

26,607 |

|

| Specialty Products |

6,238 |

|

|

5,778 |

|

|

28,513 |

|

|

25,254 |

|

| Industrial Products |

340 |

|

|

2,145 |

|

|

3,730 |

|

|

8,988 |

|

| Transaction and integration

costs, ERP implementation costs, and unallocated legal fees |

(1,183 |

) |

|

(2 |

) |

|

(3,436 |

) |

|

(1,786 |

) |

| Unallocated amortization

expense |

(394 |

) |

|

— |

|

|

(551 |

) |

|

— |

|

| Interest and other

expense |

(1,273 |

) |

|

(1,971 |

) |

|

(6,075 |

) |

|

(8,070 |

) |

| Total |

$ |

22,368 |

|

|

$ |

25,263 |

|

|

$ |

96,478 |

|

|

$ |

99,030 |

|

| |

|

|

|

|

|

|

|

| Selected Balance Sheet

Items |

|

December 31, |

|

December 31, |

| |

|

2019 |

|

2018 |

|

Cash and Cash Equivalents |

|

$ |

65,672 |

|

|

$ |

54,268 |

|

| Accounts Receivable, net |

|

93,444 |

|

|

99,545 |

|

| Inventories |

|

83,893 |

|

|

67,187 |

|

| Other Current Assets |

|

11,937 |

|

|

5,314 |

|

| Total Current Assets |

|

254,946 |

|

|

226,314 |

|

| |

|

|

|

|

| Property, Plant &

Equipment, net |

|

216,859 |

|

|

190,919 |

|

| Goodwill |

|

523,998 |

|

|

447,995 |

|

| Intangible Assets with Finite

Lives, net |

|

143,924 |

|

|

109,405 |

|

| Right of Use Assets |

|

7,338 |

|

|

— |

|

| Other Assets |

|

8,617 |

|

|

6,722 |

|

| Total Assets |

|

$ |

1,155,682 |

|

|

$ |

981,355 |

|

| |

|

|

|

|

| Current Liabilities |

|

$ |

92,258 |

|

|

$ |

82,056 |

|

| Revolving Loan |

|

248,569 |

|

|

156,000 |

|

| Deferred Income Taxes |

|

56,431 |

|

|

44,309 |

|

| Derivative Liabilities |

|

2,103 |

|

|

— |

|

| Long-Term Obligations |

|

12,654 |

|

|

7,372 |

|

| Total Liabilities |

|

412,015 |

|

|

289,737 |

|

| |

|

|

|

|

| Stockholders' Equity |

|

743,667 |

|

|

691,618 |

|

| |

|

|

|

|

| Total Liabilities and

Stockholders' Equity |

|

$ |

1,155,682 |

|

|

$ |

981,355 |

|

Balchem

CorporationCondensed Consolidated Statements of

Cash Flows(Dollars in thousands)(unaudited)

| |

|

Year Ended December 31, |

| |

|

2019 |

|

2018 |

| Cash flows from

operating activities: |

|

|

|

|

|

Net earnings |

|

$ |

79,671 |

|

|

$ |

78,573 |

|

|

Adjustments to reconcile net earnings to net cash provided by

operating activities: |

|

|

|

|

|

Depreciation and amortization |

|

45,862 |

|

|

44,666 |

|

|

Stock compensation expense |

|

7,596 |

|

|

6,413 |

|

|

Other adjustments |

|

(3,709 |

) |

|

(6,944 |

) |

|

Changes in assets and liabilities |

|

(4,959 |

) |

|

(4,011 |

) |

|

Net cash provided by operating activities |

|

124,461 |

|

|

118,697 |

|

| |

|

|

|

|

| Cash flows from

investing activities: |

|

|

|

|

|

Cash paid for acquisition, net of cash acquired |

|

(141,062 |

) |

|

(17,399 |

) |

|

Capital expenditures and intangible assets acquired |

|

(28,413 |

) |

|

(19,723 |

) |

|

Proceeds from insurance, sale of assets, and sale of business |

|

14,250 |

|

|

5,131 |

|

|

Purchase of convertible note |

|

(1,000 |

) |

|

— |

|

|

Net cash used in investing activities |

|

(156,225 |

) |

|

(31,991 |

) |

| |

|

|

|

|

| Cash flows from

financing activities: |

|

|

|

|

|

Proceeds from revolving loan |

|

168,569 |

|

|

210,750 |

|

|

Principal payments on long-term and revolving debt |

|

(76,000 |

) |

|

(274,250 |

) |

|

Principal payments on acquired debt |

|

(17,567 |

) |

|

(19 |

) |

|

Proceeds from stock options exercised |

|

4,839 |

|

|

8,272 |

|

|

Dividends paid |

|

(15,135 |

) |

|

(13,432 |

) |

|

Purchase of treasury stock |

|

(21,321 |

) |

|

(1,394 |

) |

|

Other |

|

— |

|

|

(1,374 |

) |

|

Net cash provided by (used in) financing

activities |

|

43,385 |

|

|

(71,447 |

) |

| |

|

|

|

|

|

Effect of exchange rate changes on cash |

|

(217 |

) |

|

(1,407 |

) |

| |

|

|

|

|

| Increase in cash and

cash equivalents |

|

11,404 |

|

|

13,852 |

|

| |

|

|

|

|

| Cash and cash

equivalents, beginning of period |

|

54,268 |

|

|

40,416 |

|

| Cash and cash

equivalents, end of period |

|

$ |

65,672 |

|

|

$ |

54,268 |

|

Non-GAAP Financial Information

In addition to disclosing financial results in

accordance with United States (U.S.) generally accepted accounting

principles (GAAP), this earnings release contains non-GAAP

financial measures that we believe are helpful in understanding and

comparing our past financial performance and our future results.

The non-GAAP financial measures disclosed by the company exclude

certain business combination accounting adjustments and certain

other items related to acquisitions, certain unallocated equity

compensation, and certain one-time or unusual transactions. These

non-GAAP financial measures should not be considered a substitute

for, or superior to, financial measures calculated in accordance

with GAAP, and the financial results calculated in accordance with

GAAP and reconciliations from these results should be carefully

evaluated. Management believes that these non-GAAP measures provide

useful information about the Company's core operating results and

thus are appropriate to enhance the overall understanding of the

Company's past financial performance and its prospects for the

future. The non-GAAP financial measures in this press release

include adjusted gross margin, adjusted earnings from operations,

adjusted net earnings and the related adjusted per diluted share

amounts, EBITDA, adjusted EBITDA, adjusted income tax expense, and

free cash flow. EBITDA is defined as earnings before interest,

other expense/income, taxes, depreciation and amortization.

Adjusted EBITDA is defined as earnings before interest, other

expense/income, taxes, depreciation, amortization, stock-based

compensation, transaction and integration costs, indemnification

settlements, legal settlements, ERP implementation costs,

unallocated legal fees, the fair valuation of acquired inventory,

and restructuring costs. Adjusted income tax expense is

defined as income tax expense adjusted for the impact of ASU

2016-09. Free cash flow is defined as net cash provided by

operating activities less capital expenditures and capitalized ERP

implementation costs.

Set forth below are reconciliations of the

non-GAAP financial measures to the most directly comparable GAAP

financial measures.

Table 1

Reconciliation of Non-GAAP Measures to

GAAP(Dollars in thousands, except per share

data)(unaudited)

| |

Three Months Ended December

31, |

|

Year Ended December 31, |

| |

2019 |

|

2018 |

|

2019 |

|

2018 |

| Reconciliation of

adjusted gross margin |

|

|

|

|

|

|

|

|

GAAP gross margin |

$ |

54,346 |

|

|

$ |

51,325 |

|

|

$ |

211,367 |

|

|

$ |

204,252 |

|

| Inventory valuation adjustment

(1) |

147 |

|

|

— |

|

|

147 |

|

|

— |

|

| Amortization of intangible

assets (2) |

633 |

|

|

735 |

|

|

2,644 |

|

|

3,097 |

|

| Adjusted gross margin |

$ |

55,126 |

|

|

$ |

52,060 |

|

|

$ |

214,158 |

|

|

$ |

207,349 |

|

| |

|

|

|

|

|

|

|

| Reconciliation of

adjusted earnings from operations |

|

|

|

|

|

|

|

| GAAP earnings from

operations |

$ |

23,641 |

|

|

$ |

27,234 |

|

|

$ |

102,553 |

|

|

$ |

107,100 |

|

| Inventory valuation adjustment

(1) |

147 |

|

|

— |

|

|

147 |

|

|

— |

|

| Amortization of intangible

assets (2) |

7,065 |

|

|

6,308 |

|

|

25,788 |

|

|

24,988 |

|

| Transaction and integration

costs, ERP implementation costs, and unallocated legal fees

(3) |

1,183 |

|

|

2 |

|

|

3,436 |

|

|

1,786 |

|

| Restructuring costs (4) |

1,026 |

|

|

— |

|

|

1,026 |

|

|

— |

|

| Adjusted earnings from

operations |

$ |

33,062 |

|

|

$ |

33,544 |

|

|

$ |

132,950 |

|

|

$ |

133,874 |

|

| |

|

|

|

|

|

|

|

| Reconciliation of

adjusted net earnings |

|

|

|

|

|

|

|

| GAAP net earnings |

$ |

20,383 |

|

|

$ |

20,334 |

|

|

$ |

79,671 |

|

|

$ |

78,573 |

|

| Inventory valuation adjustment

(1) |

147 |

|

|

— |

|

|

147 |

|

|

— |

|

| Amortization of intangible

assets (2) |

7,136 |

|

|

6,378 |

|

|

26,071 |

|

|

25,668 |

|

| Transaction and integration

costs, ERP implementation costs, and unallocated legal fees

(3) |

1,183 |

|

|

2 |

|

|

3,436 |

|

|

1,786 |

|

| Restructuring costs (4) |

1,026 |

|

|

— |

|

|

1,026 |

|

|

— |

|

| Income tax adjustment (5) |

(1,476 |

) |

|

(1,568 |

) |

|

(6,667 |

) |

|

(8,280 |

) |

| Adjusted net earnings |

$ |

28,399 |

|

|

$ |

25,146 |

|

|

$ |

103,684 |

|

|

$ |

97,747 |

|

| |

|

|

|

|

|

|

|

| Adjusted net earnings per

common share - diluted |

$ |

0.88 |

|

|

$ |

0.77 |

|

|

$ |

3.19 |

|

|

$ |

3.01 |

|

| (1)

Inventory valuation adjustment: Business combination accounting

principles require us to measure acquired inventory at fair value.

The fair value of inventory reflects the acquired company’s cost of

manufacturing plus a portion of the expected profit margin. The

non-GAAP adjustment to our cost of sales excludes the expected

profit margin component that is recorded under business combination

accounting principles. We believe the adjustment is useful to

investors as an additional means to reflect cost of sales and gross

margin trends of our business. |

| (2)

Amortization of intangible assets: Amortization of intangible

assets consists of amortization of customer relationships,

trademarks and trade names, developed technology, regulatory

registration costs, patents and trade secrets, capitalized loan

issuance costs, and other intangibles acquired primarily in

connection with business combinations. We record expense relating

to the amortization of these intangibles in our GAAP financial

statements. Amortization expenses for our intangible assets are

inconsistent in amount and are significantly impacted by the timing

and valuation of an acquisition. Consequently, our non-GAAP

adjustments exclude these expenses to facilitate an evaluation of

our current operating performance and comparisons to our past

operating performance. |

| (3)

Transaction and integration costs, ERP implementation costs and

unallocated legal fees: Transaction and integration costs related

to acquisitions and divestitures are expensed in our GAAP financial

statements. ERP implementation costs related to a company-wide ERP

system implementation are expensed in our GAAP financial

statements. Unallocated legal fees for transaction-related

non-compete agreement disputes are expensed in our GAAP financial

statements. Management excludes these items for the purposes of

calculating Adjusted EBITDA and other non-GAAP financial measures.

We believe that excluding these items from our non-GAAP financial

measures is useful to investors because these are items associated

with each transaction and are inconsistent in amount and frequency

causing comparison of current and historical financial results to

be difficult. |

| (4) Restructuring costs:

Expenses related to a reorganization of the business. |

|

(5) Income tax adjustment: For purposes of calculating adjusted net

earnings and adjusted diluted earnings per share, we adjust the

provision for (benefit from) income taxes to tax effect the taxable

and deductible non-GAAP adjustments described above as they have a

significant impact on our income tax (benefit) provision.

Additionally, the income tax adjustment is adjusted for the impact

of adopting ASU 2016-09, “Improvements to Employee Share-Based

Payment Accounting” and uses our non-GAAP effective rate applied to

both our GAAP earnings before income tax expense and non-GAAP

adjustments described above. See Table 3 for the calculation of our

non-GAAP effective tax rate. |

The following table sets forth a reconciliation

of Net Income calculated using amounts determined in accordance

with GAAP to EBITDA and to Adjusted EBITDA for the three and twelve

months ended December 31, 2019 and 2018.

Table 2 (unaudited)

| |

Three Months Ended December

31, |

|

Year Ended December 31, |

|

2019 |

|

2018 |

|

2019 |

|

2018 |

|

Net income - as reported |

$ |

20,383 |

|

|

$ |

20,334 |

|

|

$ |

79,671 |

|

|

$ |

78,573 |

|

| Add back: |

|

|

|

|

|

|

|

| Provision for income

taxes |

1,985 |

|

|

4,929 |

|

|

16,807 |

|

|

20,457 |

|

| Other expense |

1,273 |

|

|

1,971 |

|

|

6,075 |

|

|

8,070 |

|

| Depreciation and

amortization |

12,307 |

|

|

11,136 |

|

|

45,580 |

|

|

43,986 |

|

| EBITDA |

35,948 |

|

|

38,370 |

|

|

148,133 |

|

|

151,086 |

|

| Add back certain items: |

|

|

|

|

|

|

|

| Non-cash compensation expense

related to equity awards |

1,685 |

|

|

1,205 |

|

|

7,273 |

|

|

6,413 |

|

| Inventory valuation

adjustment |

147 |

|

|

— |

|

|

147 |

|

|

— |

|

| Transaction and integration

costs, ERP implementation costs, and unallocated legal fees |

1,183 |

|

|

2 |

|

|

3,436 |

|

|

1,786 |

|

| Restructuring costs |

1,026 |

|

|

— |

|

|

1,026 |

|

|

— |

|

| Adjusted EBITDA |

$ |

39,989 |

|

|

$ |

39,577 |

|

|

$ |

160,015 |

|

|

$ |

159,285 |

|

The following table sets forth a reconciliation

of our GAAP effective income tax rate to our non-GAAP effective

income tax rate for the three and twelve months ended December 31,

2019 and 2018.

Table 3(unaudited)

| |

|

Three Months Ended December

31, |

| |

2019 |

|

Effective Tax Rate |

|

2018 |

|

Effective Tax Rate |

|

GAAP Income Tax Expense |

|

$ |

1,985 |

|

|

8.9 |

% |

|

$ |

4,929 |

|

|

19.5 |

% |

| Impact of ASU 2016-09(6) |

|

263 |

|

|

|

|

273 |

|

|

|

| Adjusted Income Tax

Expense |

|

$ |

2,248 |

|

|

10.1 |

% |

|

$ |

5,202 |

|

|

20.6 |

% |

| |

|

Year Ended December 31, |

| |

2019 |

|

Effective Tax Rate |

|

2018 |

|

Effective Tax Rate |

|

GAAP Income Tax Expense |

|

$ |

16,807 |

|

|

17.4 |

% |

|

$ |

20,457 |

|

|

20.7 |

% |

| Impact of ASU 2016-09(6) |

|

1,004 |

|

|

|

|

2,043 |

|

|

|

| Adjusted Income Tax

Expense |

|

$ |

17,811 |

|

|

18.5 |

% |

|

$ |

22,500 |

|

|

22.7 |

% |

| (6)

Impact of ASU 2016-09: The primary impact of ASU No. 2016-09,

"Improvements to Employee Share-Based Payment Accounting" ("ASU

2016-09"), was the recognition during the three and twelve months

ended December 31, 2019 and 2018, of excess tax benefits as a

reduction to the provision for income taxes and the classification

of these excess tax benefits in operating activities in the

consolidated statement of cash flows instead of financing

activities. |

The following table sets forth a reconciliation

of net cash provided by operating activities to free cash flow for

the three and twelve months ended December 31, 2019 and 2018.

Table 4(unaudited)

| |

Three Months Ended December

31, |

|

Year Ended December 31, |

| |

2019 |

|

2018 |

|

2019 |

|

2018 |

|

Net cash provided by operating activities |

$ |

32,967 |

|

|

$ |

39,512 |

|

|

$ |

124,461 |

|

|

$ |

118,697 |

|

| Capital expenditures and

capitalized ERP implementation costs |

(6,700 |

) |

|

(5,917 |

) |

|

(28,315 |

) |

|

(19,170 |

) |

| Free cash flow |

$ |

26,267 |

|

|

$ |

33,595 |

|

|

$ |

96,146 |

|

|

$ |

99,527 |

|

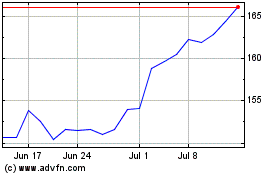

Balchem (NASDAQ:BCPC)

Historical Stock Chart

From Mar 2024 to Apr 2024

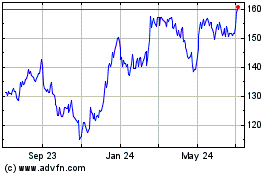

Balchem (NASDAQ:BCPC)

Historical Stock Chart

From Apr 2023 to Apr 2024