UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

___________

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

___________

Date of Report (date of earliest event reported):

September 17, 2019

AWARE, INC.

(Exact name of registrant as specified in

its charter)

|

Massachusetts

|

000-21129

|

04-2911026

|

|

(State or other jurisdiction

|

(Commission

|

(IRS Employer

|

|

of incorporation)

|

File Number)

|

Identification No.)

|

40 Middlesex Turnpike, Bedford, MA, 01730

(Address of principal executive offices,

including zip code)

Registrant's telephone number, including

area code: (781) 276-4000

Not Applicable

(Former Name or Former Address, if Changed

Since Last Report)

Securities registered or to be registered pursuant to Section

12(b) of the Act:

|

Title

of Each Class

|

Trading Symbol

|

Name

of Each Exchange on Which Registered

|

|

Common Stock, par value $.01 per share

|

AWRE

|

The Nasdaq Global Market

|

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

|

Item 5.02.

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

Robert A. Eckel

On September 17, 2019, the Board of Directors of Aware, Inc.

(“Aware”) appointed Robert A. Eckel to serve as Chief Executive Officer and President of Aware and as a Class III member

of the Board of Directors of Aware and to serve as a member of the Board’s Executive Committee, effective September 19, 2019

(the “Effective Date”). Mr. Eckel, age 61, currently serves as a strategic advisory board member of Evolv Technology

and as a consultant for Digimarc Corporation. Mr. Eckel previously served as an advisor to Sonavation, Inc. from March 2019 to

September 2019 and Columbia Tech from February 2019 to September 2019. Mr. Eckel also served as a consultant to Aware from May

2019 to September 2019. Prior to his advisory and consulting work, Mr. Eckel served as the Regional President, Chief Executive

Officer of NORAM Identity & Security, Idemia (OT-Morpho) from 2017 to 2018. Prior to Idemia, Mr. Eckel served as President

and Chief Executive Officer of MorphoTrust USA LLC from 2011 to 2017. Prior to MorphoTrust USA LLC, Mr. Eckel served in the Secure

Credentialing Division of L-1 Identity Solutions Company as President from 2010 to 2011 and as Executive Vice President from 2008

to 2010. Prior to L-1 Identity Solutions Company, Mr. Eckel served as President of the Identity Systems division of Digimarc Corporation

from 2005 to 2008. Mr. Eckel received his Master’s degree in Electrical Engineering from the University of California Los

Angeles and his bachelor’s degree in Electrical Engineering from the University of Connecticut. The Aware Board believes

that Mr. Eckel’s extensive industry and leadership experience will be of benefit to Aware’s Board and shareholders.

On September 17, 2019, Aware and Mr. Eckel entered into an Employment

Agreement (the “Eckel Employment Agreement”). Pursuant to the Eckel Employment Agreement, Mr. Eckel will receive the

following compensation: (a) an annual base salary of $300,000, (b) annual cash incentive compensation as determined by the Board

or the Compensation Committee with an initial target annual incentive compensation up to 50% of his base salary and tied to Company

performance targets as determined by the Compensation Committee, (c) a performance share award of 20,000 shares of Aware’s

common stock, which shares shall be issued to Mr. Eckel on September 19, 2019 and will be forfeitable if Mr. Eckel is not serving

as a director, officer or employee of Aware or any subsidiary of Aware on the six month anniversary of the Effective Date, (d)

an unrestricted stock award of 80,000 shares of Aware’s common stock, which shares shall be issued and vested to Mr. Eckel

in four (4) equal installments on each of the first, second, third and fourth anniversaries of the Effective Date provided Mr.

Eckel is serving as a director, officer or employee of Aware or any subsidiary of Aware on such date, (e) an unrestricted stock

award of 15,000 shares of Aware’s common stock, which shares shall be issued to Mr. Eckel on December 31, 2019 provided Mr.

Eckel is serving as a director, officer or employee of Aware or any subsidiary of Aware on such date, (f) a stock option for 50,000

shares of Aware’s common stock with an exercise price per share equal to the greater of (i) the fair market value of a share

of Aware’s common stock on the date of grant or (ii) $4.50 (such exercise price referred to as the “Base Exercise Price”)

and vesting over four years; (g) a stock option for 50,000 shares of Aware’s common stock with an exercise price per share

equal to the Base Exercise Price plus $1.00 and vesting over four years; (h) a stock option for 50,000 shares of Aware’s

common stock with an exercise price per share equal to the Base Exercise Price plus $2.00 and vesting over four years; and (i)

a stock option for 50,000 shares of Aware’s common stock with an exercise price per share equal to the Base Exercise Price

plus $3.00 and vesting over four years. All stock options must be exercised within 60 days of Mr. Eckel ceasing to be an employee

of, or paid consultant to, Aware.

Subject to Mr. Eckel signing and delivering to Aware a noncompetition

agreement and a release of claims, Mr. Eckel will also be eligible to receive compensation upon termination of Mr. Eckel’s

employment by Aware without “Cause” or by Mr. Eckel for ”Good Reason” as follows: (a) an amount equal to

Mr. Eckel’s base salary paid during the twelve (12) months immediately preceding the termination of Mr. Eckel’s employment

with Aware, divided by the number of days employed during the twelve (12) months immediately preceding the termination of Mr. Eckel’s

employment with Aware and multiplied by 365, (b) all time-based stock options and other time-based stock-based awards held by Mr.

Eckel in which such stock option or other stock-based award would have vested if Mr. Eckel had remained employed for an additional

twelve (12) months following the date of termination shall vest and become exercisable or nonforfeitable as of the date of termination,

and (c) Aware paying the difference between the cost of COBRA continuation coverage, should Mr. Eckel elect to receive it, for

Mr. Eckel and any dependent who received health insurance coverage prior to termination of Mr. Eckel’s employment with Aware,

and any premium contribution amount applicable to Mr. Eckel as of such termination, for a period of twelve (12) months following

the date of termination of Mr. Eckel’s employment with Aware.

Pursuant to the change in control provisions in the Eckel Employment

Agreement, if Mr. Eckel’s employment is terminated during the eighteen (18) month period following a “Change of Control”

(a) by Aware without “Cause” or (b) by Mr. Eckel for “Good Reason”, subject to Mr. Eckel signing and delivering

to Aware a noncompetition agreement and a release of claims, Mr. Eckel will receive from Aware: (i) a lump-sum amount equal to

(A) 1.5 times (B) Mr. Eckel’s base annual salary paid during the

twelve (12) months immediately preceding the termination of Mr. Eckel’s employment with Aware, divided by the number of days

employed during the twelve (12) months immediately preceding the termination of Mr. Eckel’s employment with Aware and multiplied

by 365, (ii) if a Change of Control occurs on or before the one year anniversary of the Effective Date, all time-based stock options

and other time-based stock-based awards held by Mr. Eckel in which such stock option or other stock-based award would have vested

if Mr. Eckel had remained employed for an additional eighteen (18) months following the date of termination shall vest and become

exercisable or nonforfeitable as of the date of termination; (c) if

a Change of Control occurs after the one year anniversary of the Effective Date, all time-based stock options and other time-based

stock-based awards held by Mr. Eckel as of the occurrence of such Change of Control shall immediately accelerate and become fully

exercisable or nonforfeitable as of the date of termination; and (d) the difference between the cost of COBRA continuation coverage,

should Mr. Eckel elect to receive it, for Mr. Eckel and any dependent who received health insurance coverage prior to termination

of Mr. Eckel’s employment with Aware, and any premium contribution amount applicable to Mr. Eckel as of such termination,

for a period of eighteen (18) months following the date of termination of Mr. Eckel’s employment with Aware.

A copy of the Eckel Employment Agreement is attached as Exhibit

10.1 to this Report. The foregoing summary of the Eckel Employment Agreement is qualified in its entirety by reference to the Eckel

Employment Agreement.

As described above, on September 19, 2019 Aware and Mr. Eckel

entered into a Performance Share Award Agreement (the “Share Award Agreement”). Pursuant to the Share Award Agreement,

Mr. Eckel will receive a stock award of 20,000 shares of Aware’s common stock, which shares shall be issued to Mr. Eckel

on September 19, 2019 and will be forfeitable if Mr. Eckel is not serving as a director, officer or employee of Aware or any subsidiary

of Aware on the six month anniversary of the Effective Date.

A copy of the Share Award Agreement is attached as Exhibit 10.2

to this Report. The foregoing summary of the Share Award Agreement is qualified in its entirety by reference to the Share Award

Agreement.

Kevin T. Russell

On September 17, 2019, the Board of Directors of Aware appointed

Kevin T. Russell, Aware’s Chief Executive Officer and President, General Counsel and a member of the Board of Directors of

Aware to serve as Chief Legal and Administrative Officer of Aware, effective September 19, 2019. Mr. Russell will continue to serve

as a member of the Board of Directors of Aware. Mr. Russell, age 57, has been with Aware since April 2000 and has served as Aware’s

Chief Executive Officer and President, General Counsel since March 2017.

On September 19, 2019, Aware and Mr. Russell entered into an

Employment Agreement (the “Russell Employment Agreement”). The Russell Employment Agreement supersedes and replaces

the Change in Control Retention Agreement dated as of March 26, 2015 between Aware and Mr. Russell.

Pursuant to the Russell Employment Agreement, Mr. Russell will

receive the following compensation: (a) an annual base salary of $275,000, (b) annual cash incentive compensation as determined

by the Board or the Compensation Committee with an initial target annual incentive compensation up to $100,000 and tied to Company

performance targets as determined by the Compensation Committee, (c) a stock option for 15,000 shares of Aware’s common stock

with an exercise price per share equal to the greater of (i) the fair market value of a share of Aware’s common stock on

the date of grant or (ii) $4.50 (such exercise price referred to as the “Base Exercise Price”) and vesting over four

years; (d) a stock option for 15,000 shares of Aware’s common stock with an exercise price per share equal to the Base Exercise

Price plus $1.00 and vesting over four years; (e) a stock option for 15,000 shares of Aware’s common stock with an exercise

price per share equal to the Base Exercise Price plus $2.00 and vesting over four years; and (f) a stock option for 15,000 shares

of Aware’s common stock with an exercise price per share equal to the Base Exercise Price plus $3.00 and vesting over four

years. All stock options must be exercised within 60 days of Mr. Russell ceasing to be an employee of, or paid consultant to, Aware.

Subject to Mr. Russell signing and delivering to Aware a noncompetition

agreement and a release of claims, Mr. Russell will also be eligible to receive compensation upon termination of Mr. Russell’s

employment by Aware without “Cause” or by Mr. Russell for ”Good Reason” as follows: (a) an amount equal

to Mr. Russell’s base salary paid during the twelve (12) months immediately preceding the termination of Mr. Russell’s

employment with Aware, divided by the number of days employed during the twelve (12) months immediately preceding the termination

of Mr. Russell’s employment with Aware and multiplied by 365, (b) all time-based stock options and other time-based stock-based

awards held by Mr. Russell in which such stock option or other stock-based award would have vested if Mr. Russell had remained

employed for an additional twelve (12) months following the date of termination shall vest and become exercisable or nonforfeitable

as of the date of termination, and (c) Aware paying the difference between the cost of COBRA continuation coverage, should Mr.

Russell elect to receive it, for Mr. Russell and any dependent who received health insurance coverage prior to termination of Mr.

Russell’s employment with Aware, and any premium contribution amount applicable to Mr. Russell as of such termination, for

a period of twelve (12) months following the date of termination of Mr. Russell’s employment with Aware.

Pursuant to the change in control provisions in the Russell

Employment Agreement, if Mr. Russell’s employment is terminated during the eighteen (18) month period following a “Change

of Control” (a) by Aware without “Cause” or (b) by Mr. Russell for “Good Reason”, subject to Mr.

Russell signing and delivering to Aware a noncompetition agreement and a release of claims, Mr. Russell will receive from Aware:

(i) a lump-sum amount equal to (A) 1.5 times (B) Mr. Russell’s base

annual salary paid during the twelve (12) months immediately preceding the termination of Mr. Russell’s employment with Aware,

divided by the number of days employed during the twelve (12) months immediately preceding the termination of Mr. Russell’s

employment with Aware and multiplied by 365, (ii) all time-based stock options and other time-based stock-based awards held

by Mr. Russell as of the occurrence of such Change of Control shall immediately accelerate and become fully exercisable or nonforfeitable

as of the date of termination and (iii) the difference between the cost

of COBRA continuation coverage, should Mr. Russell elect to receive it, for Mr. Russell and any dependent who received health insurance

coverage prior to termination of Mr. Russell’s employment with Aware, and any premium contribution amount applicable to Mr.

Russell as of such termination, for a period of eighteen (18) months following the date of termination of Mr. Russell’s employment

with Aware.

A copy of the Russell Employment Agreement is attached as Exhibit

10.3 to this Report. The foregoing summary of the Russell Employment Agreement is qualified in its entirety by reference to the

Russell Employment Agreement.

Executive Committee

On September 17, 2019, the Board of Directors approved the following

directors to serve as members of the Board’s Executive Committee effective September 19, 2019: Robert A. Eckel, Brent P.

Johnstone, Richard P. Moberg, Kevin T. Russell and John S. Stafford, III.

Press Release

On September 19, 2019, Aware issued a press release, attached

to this Form 8-K as Exhibit 99.1, announcing that Mr. Eckel had become Chief Executive Officer and President of Aware and that

Mr. Russell had become Chief Legal and Administrative Officer of Aware.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

No financial statements are required to be filed as part of

this Report. The following exhibit is filed as part of this Report:

*Management contract or compensatory plan

Signature(s)

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly

authorized.

|

|

AWARE,

INC.

|

|

|

|

|

|

By:

|

/s/

Kevin T. Russell

|

|

|

Kevin

T. Russell

|

|

|

Chief

Legal and Administrative Officer

|

Date: September 19, 2019

Exhibit Index

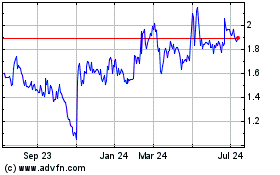

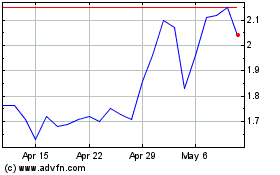

Aware (NASDAQ:AWRE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Aware (NASDAQ:AWRE)

Historical Stock Chart

From Apr 2023 to Apr 2024