Aspen Technology, Inc. ("AspenTech" or the "Company") (NASDAQ:

AZPN), a global leader in industrial software, today announced

financial results for its fourth quarter and fiscal year ended June

30, 2024.

“AspenTech’s fourth quarter results reflected excellent

execution across all areas of our business,” commented Antonio

Pietri, President and Chief Executive Officer of AspenTech. “The

strong performance of our DGM suite in the full year was a great

demonstration of the significant growth opportunities in the

utilities market and the benefit of our diversified end-market

exposure.”

“In fiscal 2025, we are targeting another year of solid ACV

growth, even as we manage through a dynamic macro environment. At

the same time, we are focused on driving toward best-in-class

profitability and plan to continue enhancing our productivity and

efficiency. We believe this attractive combination of top-line

growth and margin expansion can deliver significant value for our

shareholders,” concluded Pietri.

Fiscal Year 2024 and Recent Business Highlights

- Annual Contract Value1 ("ACV") was $968.4 million at the end of

fiscal 2024, increasing 9.4% year over year and 3.5% quarter over

quarter. This amount does not reflect the impact of the write-off

related to the suspension of commercial activities in Russia

described immediately below.

- AspenTech has suspended all commercial activities in Russia

following the recent announcement of expanded sanctions in the

country. In connection with this decision, the Company has

written-off approximately $35.5 million in ACV1 (the “Write-Off”),

effective as of the end of fiscal 2024. Please see Recent

Developments below for additional commentary. ACV1 was $932.9

million as of June 30, 2024, after reflecting the impact of the

Write-Off. ACV1 increased 10.0% year over year in fiscal 2024 when

adjusting to exclude Russia-based ACV1 in both fiscal 2023 and

fiscal 2024.

- Cash flow from operations was $339.9 million in fiscal 2024,

increasing 13.6% year over year. Free cash flow2 was $335.3 million

in fiscal 2024, increasing 14.7% year over year. A reconciliation

of GAAP to non-GAAP results is included in the financial tables

included in this press release.

- AspenTech's Board of Directors has approved a share repurchase

authorization of up to $100.0 million for fiscal 2025. AspenTech

completed its previously announced $300.0 million share repurchase

authorization (the "Fiscal 2024 Share Repurchase Authorization") in

the fourth quarter of fiscal 2024. Please see Recent Developments

below for additional commentary.

Summary of Fourth Quarter and Fiscal Year 2024 Financial

Results

AspenTech’s total revenue was $342.9 million for the fourth

quarter of fiscal 2024 and included the following:

- License and solutions revenue, which represents the

portion of a term license agreement allocated to the initial

license and Digital Grid Management ("DGM") revenue where software,

hardware and professional services are recognized as one

performance obligation, was $231.0 million in the fourth quarter of

fiscal 2024, compared to $222.8 million in the fourth quarter of

fiscal 2023.

- Maintenance revenue, which represents the portion of

customer agreements related to ongoing support and the right to

future product enhancements, was $89.2 million in the fourth

quarter of fiscal 2024, compared to $82.6 million in the fourth

quarter of fiscal 2023.

- Services and other revenue, which represents the portion

of customer agreements related to professional services and

training services, was $22.7 million in the fourth quarter of

fiscal 2024, compared to $15.2 million in the fourth quarter of

fiscal 2023.

Income from operations was $39.2 million in the fourth quarter

of fiscal 2024, compared to $6.0 million in the fourth quarter of

fiscal 2023. Non-GAAP income from operations was $173.4 million in

the fourth quarter of fiscal 2024, compared to $148.9 million in

the fourth quarter of fiscal 2023. The year-over-year improvement

in income from operations was mainly due to lower operating

expenses and stock-based compensation.

Net income was $44.7 million, or $0.70 per diluted share, in the

fourth quarter of fiscal 2024, compared to $27.3 million, or $0.42

per diluted share, in the fourth quarter of fiscal 2023. AspenTech

has increased amortization of intangible assets following the close

of its transaction with Emerson Electric Co. (”Emerson”) in May of

2022. AspenTech expects its amortization of intangible assets to

remain at higher levels for the next several years as the related

asset balance is amortized over the respective expected useful

lives of the intangible assets.

Non-GAAP net income was $150.7 million, or $2.37 per diluted

share, in the fourth quarter of fiscal 2024, compared to $138.2

million, or $2.13 per diluted share, in the fourth quarter of

fiscal 2023. The year-over-year increase in non-GAAP net income was

mainly due to revenue growth combined with strong operating

leverage.

AspenTech had cash and cash equivalents of $237.0 million as of

June 30, 2024, compared to $241.2 million as of June 30, 2023. The

decrease in cash and cash equivalents during this period was

primarily due to the impact of share repurchase activity under the

Fiscal 2024 Share Repurchase Authorization. Under its revolving

credit facility, AspenTech had no borrowings and $195.1 million

available as of June 30, 2024. Please see Recent Developments below

for updates on the Fiscal 2024 Share Repurchase Authorization and

credit facility.

AspenTech generated $154.9 million in cash flow from operations

and $153.0 million in free cash flow2 in the fourth quarter of

fiscal 2024, compared to $113.6 million in cash flow from

operations and $111.5 million in free cash flow2 in the fourth

quarter of fiscal 2023.

Recent Developments

Russia Business Exit

In June 2024, the United States government announced new

expanded sanctions that will prohibit certain commercial activities

with customers in Russia. These expanded restrictions impact the

sale, service, maintenance, and support (such as bug fixes and

updates) of enterprise management software and design and

manufacturing software in the Russian market. As a result, the

Company recently suspended all commercial activities in Russia.

This includes the discontinuation of the following activities: all

commercial discussions with customers, initiating and/or processing

renewals, providing proposals to customers or selling products or

services to customers.

As a result of the sanctions and the decision to exit Russia,

the Company has written-off certain assets that are related to

operations in Russia and recorded a reduction of $35.5 million in

Russia-based ACV1. ACV1 was $932.9 million as of June 30, 2024,

after including the impact of the Write-Off. The impact of the

additional sanctions was treated as a modification to existing

contracts with customers in Russia in accordance with ASC Topic

606, Revenue from Contracts with Customers. The aggregate impact of

the contract modification resulted in the reversal of $5.5 million

of revenue in the fourth quarter of fiscal 2024. The remaining net

accounts receivable balance associated with customers in Russia as

of June 30, 2024, is not material. The Company also now classifies

cash balances that are both held in Russia and in excess of what is

estimated to be required to wind down operations in Russia in

fiscal 2025 as restricted cash due to current restrictions

impacting the Company’s ability to transfer funds from bank

accounts located in Russia to other countries. As of June 30, 2024,

the Company's restricted cash held in Russia was $11.5 million,

which is included within other non-current assets on the Company's

consolidated balance sheets.

Restructuring Charge

The Company implemented a workforce reduction of approximately

5% in the first quarter of fiscal 2025 as it continues to seek

additional opportunities to streamline expenses and increase

efficiencies. As a result, the Company expects to record

restructuring expenses consisting primarily of severance expenses,

one-time benefits and other contract termination costs during

fiscal 2025. The Company is still assessing the full impact of

these restructuring activities and currently estimates that the

total restructuring expenses for fiscal 2025 for the recent

workforce reductions will be between $7.0 million and $9.0 million.

The Company expects the majority of these expenses to occur in the

first quarter of fiscal 2025.

Share Repurchase Updates

AspenTech repurchased 277,913 shares for $56.9 million under its

Fiscal 2024 Share Repurchase Authorization in the fourth quarter of

fiscal 2024. As of June 30, 2024, the Company had completed its

Fiscal 2024 Share Repurchase Authorization, repurchasing 1,520,993

shares in total in fiscal 2024. AspenTech's Board of Directors has

approved a new share repurchase authorization, pursuant to which an

aggregate amount of up to $100.0 million of its outstanding shares

of common stock may be repurchased by the Company in fiscal

2025.

Credit Agreement Renewal

On June 27, 2024 (the "Closing Date"), AspenTech entered into a

Second Amended and Restated Credit Agreement (the “Credit

Agreement”), with the lenders and issuing banks party thereto from

time to time and JPMorgan Chase Bank, N.A., as administrative

agent. The Credit Agreement provides for a new revolving credit

facility (the “Credit Facility”) with initial commitments in an

aggregate principal amount of $200.0 million, which includes a

$40.0 million sub-facility for letters of credit, to replace the

Company’s previous revolving credit facility. The proceeds of the

Credit Facility may be used for working capital and general

corporate purposes. The Credit Facility is scheduled to terminate

on June 27, 2029.

On the Closing Date, in connection with the entry into the

Credit Agreement as described above, the Company terminated the

then-existing Amended and Restated Credit Agreement, dated as of

December 23, 2019 (as amended, restated, amended and restated,

supplemented or otherwise modified prior to the Closing Date) with

the lenders party thereto, the initial issuing banks party thereto

and JPMorgan Chase Bank, N.A., as administrative agent.

Fiscal Year 2025 Business Outlook

Based on information as of today, August 6, 2024, AspenTech is

issuing the following guidance for fiscal 2025. Please note that

the Company’s fiscal 2025 ACV1 guidance is based on an ACV1 balance

of $932.9 million as of June 30, 2024, which reflects the impact of

the Write-Off.

- ACV1 growth of ~9.0% year-over-year

- GAAP operating cash flow of ~$357 million

- Free cash flow2 of ~$340 million

- Total bookings of ~$1.17 billion

- Total revenue of ~$1.19 billion

- GAAP total expense of ~$1.21 billion

- Non-GAAP total expense of ~$675 million

- GAAP operating loss of ~$24 million

- Non-GAAP operating income of ~$514 million

- GAAP net income of ~$52 million

- Non-GAAP net income of ~$478 million

- GAAP net income per share of ~$0.81

- Non-GAAP net income per share of ~$7.47

These statements are forward-looking and actual results may

differ materially. Refer to the Forward-Looking Statements safe

harbor below for information on the factors that could cause

AspenTech’s actual results to differ materially from these

forward-looking statements.

Conference Call and Webcast

AspenTech will host a conference call and webcast presentation

on Tuesday, August 6, 2024, at 4:30 p.m. ET to discuss its

financial results, business outlook, and related corporate and

financial matters. A live webcast of the call will be available on

AspenTech’s Investor Relations website, http://ir.aspentech.com,

via its “Webcasts” page. To access the call by phone, please use

the registration link. To avoid delays, participants are encouraged

to dial into the conference call fifteen minutes ahead of the

scheduled start time. A replay of the webcast also will be

available for a limited time at http://ir.aspentech.com/.

AspenTech has provided an earnings presentation for its fourth

quarter of fiscal 2024. AspenTech asks that shareholders refer to

this presentation in conjunction with the conference call, which

can be found at ir.aspentech.com.

Footnotes

- AspenTech defines ACV as the estimate of the annual value of

portfolio of term license and software maintenance and support

("SMS") contracts, the annual value of SMS agreements purchased

with perpetual licenses and the annual value of standalone SMS

agreements purchased with certain legacy term license agreements,

which have become an immaterial part of the Company's

business.

- Free cash flow is a non-GAAP metric that is calculated as net

cash provided by operating activities adjusted for the net impact

of purchases of property, equipment and leasehold improvements and

payments for capitalized computer software development costs.

Effective January 1, 2023, AspenTech no longer excludes acquisition

and integration planning related payments from its computation of

free cash flow. Free cash flow for all prior periods presented has

been revised to the current period computation.

About AspenTech

Aspen Technology, Inc. (NASDAQ: AZPN) is a global software

leader helping industries at the forefront of the world’s dual

challenge meet the increasing demand for resources from a rapidly

growing population in a profitable and sustainable manner.

AspenTech solutions address complex environments where it is

critical to optimize the asset design, operation and maintenance

lifecycle. Through AspenTech's unique combination of deep domain

expertise and innovation, customers in asset-intensive industries

can run their assets safer, greener, longer and faster to improve

their operational excellence. To learn more, visit

AspenTech.com.

Forward-Looking Statements

Statements in this press release that are not strictly

historical may be “forward-looking” statements for purposes of the

safe harbor provisions of the Private Securities Litigation Reform

Act of 1995, which involve risks and uncertainties, and AspenTech

undertakes no obligation to update any such statements to reflect

later developments. These forward-looking statements include, but

are not limited to, AspenTech's guidance for fiscal 2025,

expectations regarding cash collections, and completion of the new

share repurchase authorization announced for fiscal 2025. In some

cases, you can identify forward-looking statements by the following

words: “may,” “will,” “could,” “would,” “should,” “expect,”

“intend,” “plan,” “strategy,” “anticipate,” “believe,” “estimate,”

“predict,” “project,” “potential,” “continue,” “ongoing,”

“opportunity” or the negative of these terms or other comparable

terminology, although not all forward-looking statements contain

these words. These risks and uncertainties include, without

limitation: the failure to realize the anticipated benefits of the

transaction with Emerson; risks resulting from the Company's status

as a controlled company; the suspension of commercial activities in

Russia and the scope, duration and ultimate impact of the

Israeli-Hamas conflict; as well as economic and currency

conditions, market demand (including adverse changes in the process

or other capital-intensive industries, such as materially reduced

spending budgets due to oil and gas price declines and volatility),

pricing, protection of intellectual property, cybersecurity,

natural disasters, tariffs, sanctions, competitive and

technological factors, and inflation; and others, as set forth in

AspenTech’s most recent Annual Report on Form 10-K and subsequent

reports filed with the U.S. Securities and Exchange Commission (the

“SEC”). The outlook contained herein represents AspenTech’s

expectation for its consolidated results, other than as noted

herein.

© 2024 Aspen Technology, Inc. AspenTech, aspenONE, asset

optimization and the Aspen leaf logo are trademarks of Aspen

Technology, Inc. All rights reserved. All other trademarks not

owned by AspenTech are property of their respective owners.

Use of Non-GAAP Financial Measures

This press release contains “non-GAAP financial measures” under

the rules of the SEC. Non-GAAP financial measures are not based on

a comprehensive set of accounting rules or principles. This

non-GAAP information supplements, and is not intended to represent

a measure of performance in accordance with, disclosures required

by generally accepted accounting principles, or GAAP. Non-GAAP

financial measures should be considered in addition to, not as a

substitute for or superior to, financial measures determined in

accordance with GAAP. A reconciliation of GAAP to non-GAAP results

is included in the financial tables included in this press

release.

Management considers both GAAP and non-GAAP financial results in

managing AspenTech’s business. As the result of adoption of new

licensing models, management believes that a number of AspenTech’s

performance indicators based on GAAP, including revenue, gross

profit, operating income and net income, should be viewed in

conjunction with certain non-GAAP and other business measures in

assessing AspenTech’s performance, growth and financial condition.

Accordingly, management utilizes a number of non-GAAP and other

business metrics, including the non-GAAP metrics set forth in this

press release, to track AspenTech’s business performance.

ASPEN TECHNOLOGY, INC. AND

SUBSIDIARIES

CONSOLIDATED AND COMBINED

STATEMENTS OF OPERATIONS

(Unaudited)

Three Months Ended June

30,

Year Ended June

30,

2024

2023

2024

2023

(Dollars and Shares in

Thousands, Except per Share Data)

Revenue:

License and solutions

$

230,996

$

222,825

$

701,574

$

669,185

Maintenance

89,171

82,634

345,451

316,911

Services and other

22,738

15,184

80,457

58,082

Total revenue

342,905

320,643

1,127,482

1,044,178

Cost of revenue:

License and solutions

65,838

70,238

270,291

279,564

Maintenance

11,003

8,846

40,195

36,650

Services and other

19,800

16,478

72,090

57,375

Total cost of revenue

96,641

95,562

382,576

373,589

Gross profit

246,264

225,081

744,906

670,589

Operating expenses:

Selling and marketing

124,846

126,396

490,767

482,656

Research and development

49,959

55,606

206,114

209,347

General and administrative

32,250

37,094

137,565

161,651

Total operating expenses

207,055

219,096

834,446

853,654

Income (loss) from operations

39,209

5,985

(89,540

)

(183,065

)

Other (expense) income, net

(461

)

3,850

(8,478

)

(29,418

)

Interest income, net

14,127

12,807

54,183

31,917

Income (loss) before provision (benefit)

for income taxes

52,875

22,642

(43,835

)

(180,566

)

Provision (benefit) for income taxes

8,177

(4,674

)

(34,064

)

(72,806

)

Net income (loss)

$

44,698

$

27,316

$

(9,771

)

$

(107,760

)

Net income (loss) per common

share:

Basic

$

0.71

$

0.42

$

(0.15

)

$

(1.67

)

Diluted

$

0.70

$

0.42

$

(0.15

)

$

(1.67

)

Weighted average shares

outstanding:

Basic

63,308

64,614

63,711

64,621

Diluted

63,619

64,943

63,711

64,621

ASPEN TECHNOLOGY, INC. AND

SUBSIDIARIES

CONSOLIDATED AND COMBINED

BALANCE SHEETS

(Unaudited)

June 30,

2024

2023

(Dollars in Thousands, Except

Share Data)

ASSETS

Current assets:

Cash and cash equivalents

$

236,970

$

241,209

Accounts receivable, net

115,533

122,789

Current contract assets, net

409,177

367,539

Prepaid expenses and other current

assets

27,441

27,728

Receivables from related parties

78,483

62,375

Prepaid income taxes

8,462

11,424

Total current assets

876,066

833,064

Property, equipment and leasehold

improvements, net

17,389

18,670

Goodwill

8,328,201

8,330,811

Intangible assets, net

4,184,750

4,659,657

Non-current contract assets, net

515,106

536,104

Contract costs

24,903

15,992

Operating lease right-of-use assets

96,034

67,642

Deferred income tax assets

6,989

10,638

Other non-current assets

22,269

13,474

Total assets

$

14,071,707

$

14,486,052

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current liabilities:

Accounts payable

$

8,099

$

20,299

Accrued expenses and other current

liabilities

100,167

99,526

Due to related parties

47,449

22,019

Current operating lease liabilities

13,125

12,928

Income taxes payable

44,249

46,205

Current contract liabilities

124,312

151,450

Total current liabilities

337,401

352,427

Non-current contract liabilities

27,512

30,103

Deferred income tax liabilities

790,687

957,911

Non-current operating lease

liabilities

84,875

55,442

Other non-current liabilities

18,377

19,240

Stockholders’ equity:

Common stock, $0.0001 par

value—Authorized—600,000,000 shares

Issued— 65,367,159 and 64,952,868

shares

Outstanding— 63,251,495 and 64,465,242

shares

7

6

Additional paid-in capital

13,277,851

13,194,028

Accumulated deficit

(51,162

)

(41,391

)

Accumulated other comprehensive (loss)

income

(7,261

)

2,436

Treasury stock, at cost- 2,115,664 and

487,626 shares of common stock

(406,580

)

(84,150

)

Total stockholders’ equity

12,812,855

13,070,929

Total liabilities and stockholders’

equity

$

14,071,707

$

14,486,052

ASPEN TECHNOLOGY, INC. AND

SUBSIDIARIES

CONSOLIDATED AND COMBINED

STATEMENTS OF CASH FLOWS

(Unaudited)

Three Months Ended June

30,

Year Ended June

30,

2024

2023

2024

2023

(Dollars and Shares in

Thousands, Except per Share Data)

Cash flows from operating

activities:

Net income (loss)

$

44,698

$

27,316

$

(9,771

)

$

(107,760

)

Adjustments to reconcile net income (loss)

to net cash provided by operating activities:

Depreciation and amortization

123,215

123,153

493,009

491,419

Reduction in the carrying amount of

right-of-use assets

4,761

3,406

16,073

13,869

Net foreign currency losses

904

368

9,142

4,079

Net realized loss on settlement of foreign

currency forward contracts

—

36,997

—

26,176

Stock-based compensation

11,494

20,830

57,311

84,850

Deferred income taxes

(28,872

)

(36,880

)

(167,342

)

(192,926

)

Provision for uncollectible

receivables

(3,031

)

3,883

6,238

7,827

Other non-cash operating activities

32

(1,336

)

837

(228

)

Changes in assets and

liabilities:

Accounts receivable

27,841

(14,478

)

4,918

(25,538

)

Contract assets

(19,442

)

(10,986

)

(22,344

)

(21,658

)

Contract costs

(3,982

)

(4,808

)

(9,186

)

(10,165

)

Lease liabilities

(4,214

)

(3,352

)

(15,495

)

(13,655

)

Prepaid expenses, prepaid income taxes,

and other assets

(22,865

)

(20,016

)

(40,309

)

7,625

Liability from foreign currency forward

contract

—

(40,454

)

—

—

Accounts payable, accrued expenses, income

taxes payable and other liabilities

40,504

30,353

46,476

18,315

Contract liabilities

(16,107

)

(437

)

(29,671

)

16,979

Net cash provided by operating

activities

154,936

113,559

339,886

299,209

Cash flows from investing

activities:

Purchase of property, equipment and

leasehold improvements

(1,853

)

(2,062

)

(4,432

)

(6,577

)

Net payments for settlement of foreign

currency forward contracts

—

(36,997

)

—

(26,176

)

Payments for business acquisitions, net of

cash acquired

—

—

(8,273

)

(72,498

)

Payments for equity method investments

(46

)

(24

)

(318

)

(700

)

Payments for capitalized computer software

development costs

(52

)

(19

)

(183

)

(366

)

Payments for asset acquisitions

—

—

(12,500

)

—

Purchase of other assets

—

—

—

(1,000

)

Net cash used in investing activities

(1,951

)

(39,102

)

(25,706

)

(107,317

)

Cash flows from financing

activities:

Issuance of shares of common stock

10,593

5,194

25,807

36,736

Repurchases of common stock

(56,934

)

(100,000

)

(300,000

)

(100,000

)

Payment of tax withholding obligations

related to restricted stock

(3,370

)

(6,430

)

(20,380

)

(20,836

)

Deferred business acquisition payments

—

—

—

(1,363

)

Repayments of amounts borrowed under term

loan

—

—

—

(276,000

)

Net transfers (to) from Parent Company

(30,550

)

(14,184

)

2,008

(19,933

)

Payments of debt issuance costs

(1,708

)

—

(1,708

)

(2,375

)

Net cash used in financing activities

(81,969

)

(115,420

)

(294,273

)

(383,771

)

Effect of exchange rate changes on cash

and cash equivalents and

(140

)

(4,564

)

(12,648

)

(16,637

)

Increase (decrease) in cash and cash

equivalents

70,876

(45,527

)

7,259

(208,516

)

Cash, cash equivalents and restricted

cash, beginning of period

177,592

286,736

241,209

449,725

Cash, cash equivalents and restricted

cash, end of period

$

248,468

$

241,209

$

248,468

$

241,209

Reconciliation of cash, cash equivalents

and restricted cash:

Cash and cash equivalents

$

236,970

$

241,209

$

236,970

$

241,209

Restricted cash in other non-current

assets

11,498

—

11,498

—

Total cash, cash equivalents and

restricted cash

$

248,468

$

241,209

$

248,468

$

241,209

ASPEN TECHNOLOGY, INC. AND

SUBSIDIARIES

Reconciliation of GAAP to

Non-GAAP Results of Operations and Cash Flows

(Unaudited)

Three Months Ended June

30,

Year Ended June

30,

2024

2023

2024

2023

(Dollars and Shares in

Thousands, Except per Share Data)

Total

expenses

GAAP total expenses (a)

$

303,696

$

314,658

$

1,217,022

$

1,227,243

Less:

Stock-based compensation (b)

(11,494

)

(20,830

)

(57,311

)

(84,850

)

Amortization of intangibles (c)

(121,589

)

(121,526

)

(486,490

)

(485,486

)

Acquisition and integration planning

related fees

(1,131

)

(526

)

(1,947

)

(7,556

)

Non-GAAP total expenses

$

169,482

$

171,776

$

671,274

$

649,351

Income (loss)

from operations

GAAP income (loss) from operations

$

39,209

$

5,985

$

(89,540

)

$

(183,065

)

Plus:

Stock-based compensation (b)

11,494

20,830

57,311

84,850

Amortization of intangibles (c)

121,589

121,526

486,490

485,486

Acquisition and integration planning

related fees

1,131

526

1,947

7,556

Non-GAAP income from operations

$

173,423

$

148,867

$

456,208

$

394,827

Net income

(loss)

GAAP net income (loss)

$

44,698

$

27,316

$

(9,771

)

$

(107,760

)

Plus:

Stock-based compensation (b)

11,494

20,830

57,311

84,850

Amortization of intangibles (c)

121,589

121,526

486,490

485,486

Acquisition and integration planning

related fees

1,131

526

1,947

7,556

Realized loss on foreign currency forward

contract

—

36,997

—

26,176

Less:

Income tax effect on Non-GAAP items

(d)

(28,243

)

(28,565

)

(113,923

)

(124,231

)

Unrealized gain on foreign currency

forward contract

—

(40,454

)

—

—

Non-GAAP net income

$

150,669

$

138,176

$

422,054

$

372,077

Diluted income

(loss) per share

GAAP diluted income (loss) per share

$

0.70

$

0.42

$

(0.15

)

$

(1.67

)

Plus:

Stock-based compensation (b)

0.18

0.32

0.89

1.30

Amortization of intangibles (c)

1.91

1.87

7.59

7.46

Acquisition and integration planning

related fees

0.02

0.01

0.03

0.12

Realized loss on foreign currency forward

contract

—

0.57

—

0.40

Impact of diluted shares

—

—

0.01

0.02

Less:

Income tax effect on Non-GAAP items

(d)

(0.44

)

(0.44

)

(1.78

)

(1.91

)

Unrealized gain on foreign currency

forward contract

—

(0.62

)

—

—

Non-GAAP diluted income per share

$

2.37

$

2.13

$

6.59

$

5.72

Shares used in computing diluted income

per share

63,619

64,943

64,060

65,094

Three Months Ended June

30,

Year Ended June

30,

2024

2023

2024

2023

(Dollars in Thousands)

Free Cash

Flow (2)

Net cash provided by operating activities

(GAAP)

$

154,936

$

113,559

$

339,886

$

299,209

Purchases of property, equipment and

leasehold improvements

(1,853

)

(2,062

)

(4,432

)

(6,577

)

Payments for capitalized computer software

development costs

(52

)

(19

)

(183

)

(366

)

Free cash flow (2) (non-GAAP)

$

153,031

$

111,478

$

335,271

$

292,266

(a) GAAP total expenses

Three Months Ended June

30,

Year Ended June

30,

2024

2023

2024

2023

(Dollars in Thousands)

Total costs of revenue

$

96,641

$

95,562

$

382,576

$

373,589

Total operating expenses

207,055

219,096

834,446

853,654

GAAP total expenses

$

303,696

$

314,658

$

1,217,022

$

1,227,243

(b) Stock-based compensation expense was

as follows:

Three Months Ended June

30,

Year Ended June

30,

2024

2023

2024

2023

(Dollars in Thousands)

Cost of license and solutions

$

312

$

813

$

2,116

$

3,565

Cost of maintenance

642

431

2,526

1,893

Cost of services and other

856

538

2,445

1,995

Selling and marketing

2,256

5,316

10,368

16,202

Research and development

2,574

7,959

14,189

21,790

General and administrative

4,854

5,773

25,667

39,405

Total stock-based compensation

$

11,494

$

20,830

$

57,311

$

84,850

(c) Amortization of intangible assets was

as follows:

Three Months Ended June

30,

Year Ended June

30,

2024

2023

2024

2023

(Dollars in Thousands)

Cost of license and solutions

$

48,202

$

48,035

$

192,586

$

191,412

Selling and marketing

73,387

73,491

293,904

294,074

Total amortization of intangible

assets

$

121,589

$

121,526

$

486,490

$

485,486

(d) The income tax effect on non-GAAP

items is calculated utilizing the Company's combined US federal and

state statutory tax rate as follows:

Three Months Ended June

30,

Year Ended June 30,

Nine Months Ended June

30,

2024

2023

2024

2023

U.S. statutory rate

21.79

%

21.79

%

21.79

%

21.79

%

ASPEN TECHNOLOGY, INC. AND

SUBSIDIARIES

Reconciliation of

Forward-Looking Guidance

(Unaudited)

Twelve Months Ended June 30,

2025 (3)

(Dollars in Thousands, Except

Share Data)

Guidance - Total expenses

GAAP expectation - total expenses

$

1,213,000

Less:

Stock-based compensation

(56,000

)

Amortization of intangibles

(474,000

)

Restructuring (4)

(8,000

)

Non-GAAP expectation - total expenses

$

675,000

Guidance - Income from

operations

GAAP expectation - loss from

operations

$

(24,000

)

Plus:

Stock-based compensation

56,000

Amortization of intangibles

474,000

Restructuring (4)

8,000

Non-GAAP expectation - income from

operations

$

514,000

Guidance - Net income and diluted

income per share

GAAP expectation - net income and diluted

income per share

$

52,000

$

0.81

Plus:

Stock-based compensation

56,000

Amortization of intangibles

474,000

Restructuring (4)

8,000

Less:

Income tax effect on Non-GAAP items

(5)

(112,000

)

Non-GAAP expectation - net income and

diluted income per share

$

478,000

$

7.47

Shares used in computing guidance for

diluted income per share

64,000

Guidance - Free Cash Flow (2)

GAAP expectation - Net cash provided by

operating activities

$

357,000

Less:

Purchases of property, equipment and

leasehold improvements

(17,000

)

Free cash flow expectation (non-GAAP)

$

340,000

(3) Rounded amounts used, except per share

data.

(4) The Company uses the midpoint of its

estimated fiscal 2025 total restructuring expense range to

reconcile its fiscal 2025 guidance.

(5) The income tax effect on non-GAAP

items for the twelve months ended June 30, 2025 is calculated

utilizing the Company’s statutory tax rate of 21.79 percent.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240806640135/en/

Media Contact Len Dieterle Aspen Technology +1

781-221-4291 len.dieterle@aspentech.com

Investor Contact William Dyke Aspen Technology +1

781-221-5571 ir@aspentech.com

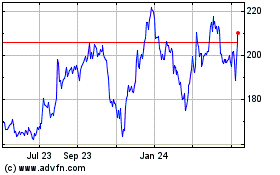

Aspen Technology (NASDAQ:AZPN)

Historical Stock Chart

From Oct 2024 to Nov 2024

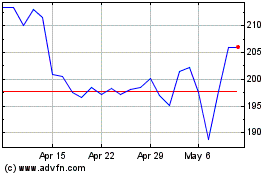

Aspen Technology (NASDAQ:AZPN)

Historical Stock Chart

From Nov 2023 to Nov 2024