UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

(Rule

14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☒ | Soliciting Material Under § 240.14a-12 |

AMERISERV FINANCIAL, INC.

|

(Name of Registrant as Specified In Its Charter)

|

| |

DRIVER MANAGEMENT COMPANY LLC

DRIVER OPPORTUNITY PARTNERS I LP

J. ABBOTT R. COOPER

KEITH R. MESTRICH

|

(Name of Persons(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check all boxes that apply):

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Driver Management Company

LLC (“Driver Management”), together with the other participants named herein (collectively, “Driver”), intends

to nominate, and to file a preliminary proxy statement and accompanying proxy card with the Securities and Exchange Commission to be used

to solicit votes for the election of, director nominees at the 2024 annual meeting of shareholders of AmeriServ Financial, Inc., a Pennsylvania

corporation (the “Company”).

On December 12, 2023, Driver

sent the following letter to J. Michael Adams, Chairman of the board of directors of the Company:

December 12, 2023

Mr. J. Michael Adams

Chairman of the Board

AmeriServ Financial, Inc.

216 Franklin Street

Johnstown, PA 15901

Via email to jmadams@ameriserv.com

and blayton@ameriserv.com

Mr. Adams,

A Form 10-Q must include the information

required by Item 103 of Regulation S-K, which requires a registrant to:

Describe briefly any material

pending legal proceedings, other than ordinary routine litigation incidental to the business, to which the registrant or any of its subsidiaries

is a party or of which any of their property is the subject. Include the name of the court or agency in which the proceedings are

pending, the date instituted, the principal parties thereto, a description of the factual basis alleged to underlie the proceedings and

the relief sought.

Both the Company’s Form 10-Q

for the perioded ended June 30, 2023 (the “2Q23 10-Q”) and the Company’s Form 10-Q for the period ended September

30, 2023 (the “3Q23 10-Q”) contain the following disclosure:

There are no material proceedings

to which the Company or any of our subsidiaries are a party or by which, to the Company’s knowledge, we, or any of our subsidiaries,

are threatened. All legal proceedings presently pending or threatened against the Company or our subsidiaries involve routine litigation

incidental to our business or that of the subsidiary involved and are not material in respect to the amount in controversy.

However, the 2Q23 10-Q provides:

…..NON-INTEREST EXPENSE…..Non-interest

expense for the second quarter of 2023 totaled $13.2 million and increased by $1.1 million, or 8.8%, from the prior year’s second

quarter. Factors contributing to the higher level of non-interest expense for the quarter included:

● a

$1.1 million, or 127.6%, rise in professional fees due primarily to increased legal and professional fees related to the Company’s

recent annual meeting proxy contest and defense against an activist investor. The Company is still involved in ongoing litigation with

an activist investor.

Similarly, the 3Q23 10-Q provides:

…..NON-INTEREST EXPENSE…..Non-interest

expense for the first nine months of 2023 totaled $37.2 million and increased by $1.9 million, or 5.4%, from the prior year’s first

nine months. Factors contributing to the higher level of non-interest expense for the nine-month period included:

● a

$1.9 million, or 80.5%, rise in professional fees due primarily to increased legal and professional fees related to the defense against

an activist investor and a proxy contest at the 2023 annual meeting. These costs amounted to $2.0 million for the first nine months of

2023. As expected, costs related to the activist shareholder issue declined meaningfully between the second and third quarters of 2023

by $828,000. However, given a recent increase in activity by the activist investor, the Company cannot determine at this time whether

these costs will remain at a lower level in the fourth quarter of 2023;

In addition, on June 6, 2023, AmeriServ

Financial Inc. (“AmeriServ” or the “Company”) filed a complaint (the “Complaint”)

in the United States District Court for the Western District of Pennsylvania against Jack Babich, the Company’s former Senior Vice

President for Human Resources initiated legal proceedings referred to as the “Babich Litigation.”

The Complaint states, in pertinent

part:

Plaintiff AmeriServ Financial,

Inc. brings this action against its former Senior Vice President for Human Resources, Jack Babich, for breach of his severance agreement

for divulging confidential Company information, including sensitive and private personnel information about another former AmeriServ

employee, which information was largely inaccurate, to AmeriServ shareholder Driver Opportunity Partners I, LP (“Driver”)

in connection with Driver’s efforts to obtain Company books and records and wage a proxy solicitation contest against the Company

for board of director seats.

Based on the above, it would appear

that the Company is party to several material legal proceedings as to which insufficient or non-existent disclosure has been made in

periodic reports filed by the Company with the Securities and Exchange Commission. The Company’s failure to comply with its reporting

requirements raises obvious questions regarding the Company’s internal controls. More to the point, however, the Company’s

failure to comply with disclosure requirements regarding litigation suggests that the Company, more specifically its board of directors

(the “Board”), is trying to conceal from shareholders the vast sums and efforts being spent by the Company to further

entrench a Board that has overseen decades of poor performance and mismanagement.

Please advise when corrective disclosures

will be made.

CERTAIN INFORMATION CONCERNING THE PARTICIPANTS

Driver Management Company LLC (“Driver

Management”), together with the other participants named herein (collectively, “Driver”), intends to nominate, and to

file a preliminary proxy statement and accompanying proxy card with the Securities and Exchange Commission to be used to solicit votes

for the election of, director nominees at the 2024 annual meeting of shareholders of AmeriServ Financial, Inc., a Pennsylvania corporation

(the “Company”).

DRIVER STRONGLY ADVISES ALL SHAREHOLDERS OF

THE COMPANY TO READ ANY PROXY MATERIALS AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. SUCH PROXY MATERIALS

WILL BE AVAILABLE AT NO CHARGE ON THE SEC’S WEB SITE AT HTTP://WWW.SEC.GOV. IN ADDITION,

THE PARTICIPANTS IN THIS PROXY SOLICITATION WILL PROVIDE COPIES OF PROXY MATERIALS WITHOUT CHARGE, WHEN AVAILABLE, UPON REQUEST.

The participants in the proxy solicitation

are currently anticipated to be Driver Management, Driver Opportunity Partners I LP (“Driver Opportunity”), J. Abbott R. Cooper

and Keith R. Mestrich.

As of the date hereof, the participants in

the proxy solicitation beneficially own in the aggregate 426,503 shares of Common Stock, par value $0.01 per share, of the Company (the

“Common Stock”). As of the date hereof, Driver Opportunity directly beneficially owns 426,503 shares of Common Stock, including

1,000 shares held in record name. Driver Management, as the general partner of Driver Opportunity, may be deemed to beneficially own the

426,503 shares of Common Stock directly beneficially owned by Driver Opportunity. Mr. Cooper, as the managing member of Driver Management,

may be deemed to beneficially own the 426,503 shares of Common Stock directly beneficially owned by Driver Opportunity. As of the date

hereof, Mr. Mestrich does not beneficially own any securities of the Company.

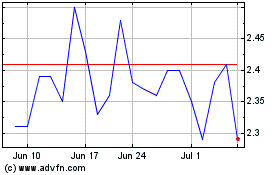

AmeriServ Financial (NASDAQ:ASRV)

Historical Stock Chart

From Mar 2024 to Apr 2024

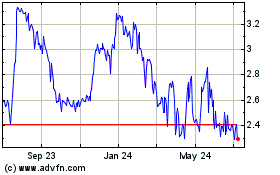

AmeriServ Financial (NASDAQ:ASRV)

Historical Stock Chart

From Apr 2023 to Apr 2024